Indian History

76th Republic Day

For Prelims: Republic Day, Padma Awards, Gallantry awards, Central Armed Police Forces, Indian Coast Guard, President’s Medal for Gallantry, Jeevan Raksha Padak Awards, Arjun Main Battle Tank, Tejas MKII fighter aircraft, Etikoppaka Bommalu

For Mains: India's democratic values and Constitution, Indian National Movement

Why in News?

India celebrated its 76th Republic Day (26th January 2025), with the theme 'Swarnim Bharat: Virasat aur Vikas,' highlighting military strength, development, and cultural diversity, with Indonesian President Prabowo Subianto as the chief guest.

- Republic Day in India is a national observance that commemorates the adoption of the Indian Constitution on 26thJanuary 1950, which established India as a republic, reflecting its democratic values and rich heritage.

What are the Key Highlights of the 2025 Republic Day Tableaux?

- Tri-Services Tableau: For the first time, a Tri-Services Tableau was featured, underlining the synergy between the Army, Navy, and Air Force.

- The theme ‘Shashakt aur Surakshit Bharat’ (Strong and Secure India) was exemplified by a display of integrated operations across land, water, and air.

- The tableau included representations of indigenous defense technologies like the Arjun Main Battle Tank, Tejas MKII fighter aircraft, Advanced Light Helicopter, and INS Visakhapatnam destroyer.

- DRDO Tableau: Themed ‘Raksha Kavach–Multi-layer Protection against Multi-domain Threats’, displayed cutting-edge innovations for national security.

- The Tableau showcased key technologies like the Quick Reaction Surface-to-Air Missile, Medium Power Radar - Arudhra, Drone Detection System, Advanced Lightweight Torpedo, Dharashakti Electronic Warfare System, and Indigenous Unmanned Aerial Systems, highlighting India's focus on indigenously developed defense technologies for national security.

- States Tableaux:

|

States/UTs |

Theme |

|

Andhra Pradesh |

“ Etikoppaka Bommalu - Eco-Friendly Wooden Toys” |

|

Bihar |

“Swarnim Bharat: Virasat Aur Vikas (Nalanda Vishwavidyalya)”

|

|

Chandigarh |

“Chandigarh: A Harmonious Blend of Heritage, Innovation and Sustainability”

|

|

Dadra Nagar Haveli and Daman and Diu |

“Daman Aviary Bird Park along with Kukri Memorial - A tribute to the valiant sailors of the Indian Navy” |

|

Delhi |

“Quality Education” |

|

Goa |

“Cultural Heritage of Goa”

|

|

Gujarat |

“Swarnim Bharat: Virasat Aur Vikas”

|

|

Haryana |

Showcasing Bhagwad Gita and Krishna’s teachings |

|

Karnataka |

Lakkundi: Cradle of Stone craft.

|

|

Madhya Pradesh |

“Madhya Pradesh’s Glory: Kuno National park- The land of Cheetahs” |

|

Punjab |

“Punjab as the land of knowledge and wisdom” |

|

Tripura |

“ Eternal Reverence: The worship of 14 Deities in Tripura - Kharchi Puja” |

|

Uttar Pradesh |

“Mahakumbh 2025 - Swarnim Bharat Virasat aur Vikas”

|

|

Uttarakhand |

“Uttarakhand: Cultural Heritage and Adventure Sports” |

|

West Bengal |

“ The ‘Lakshmir Bhandar’ & ‘Lok Prasar Prakalpa’ - Empowering Lives and Fostering Self-Reliance in Bengal” |

What are the Key Highlights of the 76th Republic Day?

- Padma Awards: 139 Padma Awards have been conferred on 76th Republic Day. These include Padma Vibhushan, Padma Bhushan, and Padma Shri.

- Padma Vibhushan’ is awarded for exceptional and distinguished service.

- Padma Bhushan for distinguished service of high order and ‘Padma Shri’ for distinguished service in any field.

- Padma Vibhushan is the highest, followed by Padma Bhushan and Padma Shri in the Padma Awards hierarchy. The awards are announced on the occasion of Republic Day every year.

- Gallantry Awards and Defence Decorations: President conferred Gallantry awards for 93 Armed Forces and Central Armed Police Forces (CAPF) personnel.

- These include Kirti Chakras, Shaurya Chakras, Bar to Sena Medal, Sena Medals, Nao Sena Medals, and Vayu Sena Medals.

- Gallantry awards are announced twice a year, on Republic Day and Independence Day.

- Gallantry Awards:

- Wartime Awards: These awards honor bravery in the face of the enemy, primarily for armed forces personnel.

- Notable awards include the Param Vir Chakra, Mahavir Chakra, and Vir Chakra.

- Peacetime Awards: These awards recognize bravery in non-wartime situations and include the Ashoka Chakra, Kirti Chakra, and Shaurya Chakra.

- These can be awarded to armed forces, paramilitary forces, police, and civilians.

- Other Gallentry Awards: The Sena Medal (Gallentry) honors distinguished service in the Indian Army, with a Bar to Sena Medal (Gallentry) for subsequent acts of bravery.

- Wartime Awards: These awards honor bravery in the face of the enemy, primarily for armed forces personnel.

- Defence Decorations: The President conferred 305 defence decorations, including Param Vishisht Seva Medals, Uttam Yudh Seva Medals, Ati Vishisht Seva Medals, Yudh Seva Medals, Bar to Sena Medal, Sena Medals (Devotion to Duty), Nao Sena Medals, Vayu Sena Medals, Bar to Vishisht Seva Medals, and Vishisht Seva Medals.

- Param Vishisht Seva Medals: Recognize distinguished service of exceptional order.

- Uttam Yudh Seva Medals: Awarded for distinguished service during war or conflict.

- Ati Vishisht Seva Medals: Recognize distinguished service of exceptional order.

- Yudh Seva Medals: Awarded for distinguished service during war or hostilities.

- Bar to Sena Medal (Devotion to Duty): Awarded to recipients of Sena Medal for further acts of devotion.

- Vishisht Seva Medal: High-order service, with a Bar for subsequent awards.

- PTM and TM Medal: President conferred the President’s Tatrakshak Medal (PTM) and Tatrakshak Medal (TM) for Indian Coast Guard personnel on 76th Republic Day.

- These awards recognise their acts of conspicuous gallantry, exceptional devotion to duty, and distinguished/meritorious service.

- Services Personnel: A total of 942 personnel from Police, Fire Services, Home Guard & Civil Defence (HG&CD), and Correctional Services have been awarded Gallantry and Service Medals.

- Police Gallantry Medals: Announced twice a year, these medals acknowledge bravery and exemplary conduct by police personnel.

- The President’s Medal for Gallantry is awarded for exceptional courage in saving lives or preventing crime, while the Police Medal for Gallantry recognizes acts of bravery during duty.

- President’s Medal for Distinguished Service (PSM): Awarded for special distinguished service records.

- Medal for Meritorious Service (MSM): Given for valuable service characterized by dedication and devotion to duty.

- Police Gallantry Medals: Announced twice a year, these medals acknowledge bravery and exemplary conduct by police personnel.

- Jeevan Raksha Padak Awards: On the 76th Republic Day, 49 Jeevan Raksha Padak Awards were conferred, recognizing civilian bravery in saving lives.

- The awards are given in three categories: Sarvottam, Uttam, and Jeevan Raksha Padak.

- Sarvottam Jeevan Raksha Padak: For conspicuous courage in saving a life under very dangerous circumstances.

- Uttam Jeevan Raksha Padak: For courage and prompt action in saving a life under great danger.

- Jeevan Raksha Padak: For courage and prompt action in saving a life under conditions involving grave bodily injury.

Note: Raman Rajamannan, Kerala’s tribal king of the Mannan community, attended the 76th Republic Day celebrations at Kartavya Path, marking the first time a Mannan king participated.

- The Mannan community consists of approximately 3,000 members, spread across 46 settlements mainly in Idukki district, Kerala.

- The community originated in Tamil Nadu, where their ancestors fled during the Chola-Pandya war and sought refuge in Idukki’s forests, forming a small kingdom.

- The Mannan community is governed by a traditional system, with the Mannan king at the top, supported by a council of ministers (kaanis) and deputies (upa rajas).

- The Mannan tribe follows a matrilineal system, with lineage and inheritance passing through the mother. It has 36 sub-castes, and members often marry outside the community (exogamy).

What is the Significance of Republic Day?

- Republic Day: 26th January 1950, India’s Constitution came into force, marking the country’s transition to a sovereign democratic republic.

- The Constitution was adopted by the Constituent Assembly on 26th November 1949.

- The day honors the democratic values enshrined in the Constitution, with 26th January specifically chosen to commemorate the Indian National Congress (INC)'s declaration of Purna Swaraj on 26th January 1930.

- Purna Swaraj Declaration (1930): On 19th December 1929, the INC passed the 'Purna Swaraj' (total independence) resolution at its Lahore session.

- A public declaration was made on 26th January 1930, which the INC urged Indians to celebrate as Independence Day.

- From 1930 to 1947, January 26 was celebrated as Independence Day or Poorna Swaraj Day to mark the pursuit of full sovereignty.

- Unfurling: On Republic Day, the President of India 'unfurls' the national flag, symbolizing the country's shift from a British colony to a sovereign republic.

- The flag is rolled and attached to the top of the pole, and the President unveils it as a commitment to democratic values.

- In contrast, on Independence Day, the Prime Minister 'hoists' the flag from the bottom to the top, symbolizing the rise of a new nation, freedom, and patriotism after colonial rule.

- These actions, though similar, represent different historical and symbolic contexts.

|

Drishti Mains Question: Analyze how the adjective 'Republic' in the Preamble influences India's governance structure and its impact on national polices. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. What was the exact constitutional status of India on 26th January 1950? (2021)

(a) A Democratic Republic

(b) A Sovereign Democratic Republic

(c) A Sovereign Secular Democratic Republic

(d) A Sovereign Socialist Secular Democratic Republic

Ans: (b)

Mains

Q. Discuss each adjective attached to the word ‘Republic’ in the ‘Preamble’. Are they defendable in the present circumstances? (2013)

Indian Economy

India's Fiscal Consolidation

For Prelims: Fiscal Deficit, GDP, Fiscal Consolidation, Fiscal Responsibility and Budget Management (FRBM) Act, 2003, Tax Evasion, Inflation, Currency Exchange Rate, Revenue Deficit, Medium Term Fiscal Policy Statement, Macroeconomic Framework Statement, Fiscal Policy Strategy Statement, Effective Revenue Deficit, NK Singh Committee, Fiscal Council, Primary deficit, MSMEs, Production Linked Incentive (PLI) Scheme, Reserve Bank of India (RBI).

For Mains: Importance of fiscal consolidation in an economy, India’s performance in fiscal consolidation and related concerns.

Why in News?

India has significantly reduced its fiscal deficit from a pandemic high of 9.2% of GDP in FY 2020-21 to an estimated 5.6% in FY 2023-24, with a target of 4.9% for FY 2024-25.

- Through targeted spending and enhanced revenue collection, the country has made substantial progress in fiscal consolidation under the Fiscal Responsibility and Budget Management (FRBM) Act, 2003.

What is Fiscal Consolidation?

- About: Fiscal consolidation refers to the prudent management of government finances to ensure long-term economic stability.

- It focuses on balancing government revenue (taxes and non-tax receipts) with expenditure, aiming to minimize fiscal deficits, control public debt, and support sustainable economic growth.

- Key Features:

- Prudent Spending: Focus on essential, efficient, and productive areas like infrastructure, health, and education.

- Revenue Optimization: Maximize tax collection, reduce tax evasion, and broaden the tax base.

- Deficit Control: Limit fiscal deficits to avoid excessive borrowing.

- Debt Management: Keep public debt sustainable to prevent economic crises.

- Accountability: Ensure transparency through audits and compliance with regulations.

- Significance:

- Macro-Economic Stability: It controls inflation by lowering government borrowing (low money circulation), stabilizes currency exchange rates (reducing volatility in exchange rates), and ensures stable economic growth.

- Reduced Debt Burden: Prevents unsustainable borrowing, thereby reducing the burden on future generations.

- Investor Confidence: Signals sound economic management, attracting domestic and foreign investments.

- Efficient Resource Utilization: Prevents wasteful expenditure and ensures resources are directed toward development priorities.

How Does Fiscal Consolidation Impact Economic Stability and Growth?

- Inflation Control: Under the FRBM Act, 2003, the fiscal deficit was reduced from 4.5% of GDP in FY 2013-14 to 3.4% by FY 2018-19 reducing government borrowing.

- By curbing excessive borrowing and government spending, fiscal consolidation helps keep prices stable and inflation in control.

- Increased Capex: During the Covid-19 pandemic, India focused financial relief on sectors like MSMEs and displaced individuals, while prioritizing capital expenditure (capex) which increased from 1.6% of GDP in FY 2014-15 to 3.2% in FY 2023-24.

- It helped cushion the negative economic impact on vulnerable sectors and laid the foundation for long-term economic growth by improving critical infrastructure

- Revenue Mobilization: The digitization of the tax system led to greater efficiency in tax collection, with tax receipts rising from 10% of GDP in FY 2014-15 to 11.8% in FY 2023-24.

- Increased tax revenues enhanced the government’s ability to invest in public services.

- Long-Term Structural Reforms: India launched the Production Linked Incentive (PLI) scheme to boost domestic manufacturing.

- It helped mitigate the effects of global trade disruptions and geopolitical tensions, ensuring steady growth despite global uncertainties.

- Capacity Building: As the fiscal deficit narrowed, India became more competitive in exports, reduced its reliance on imports, and improved its trade balance.

- As the fiscal deficit narrowed and the economy became more stable, India’s competitiveness in exports improved.

What is FRBM Act, 2003?

- About: The FRBM Act was enacted in 2003 to establish financial consolidation in the government to reduce fiscal deficits and promote fiscal responsibility.

- Key Features: Union and States to reduce the Fiscal Deficit to 3% of GDP (Union) and 3% of GSDP (States), and eliminate the Revenue Deficit by 2008.

- Present the Medium Term Fiscal Policy, Macroeconomic Framework, and Fiscal Policy Strategy Statements with the Union Budget.

- Escape Clause: Under Section 4(2) of the FRBM Act, 2003, the government can exceed its fiscal deficit target by up to 0.5% of GDP in times of severe economic stress in situations such as national security/act of war, national calamity, etc.

- Amendments: It was amended in 2012 to remove the requirement for a 0% Revenue Deficit, instead mandating a 0% Effective Revenue Deficit by 2015.

- Effective revenue deficit implies revenue deficit minus grants to states for capital assets creation.

- In 2016, NK Singh Committee was set up to suggest improvements to the Act due to the perceived rigidity of its targets.

N.K. Singh Committee Recommendations

- Deviations: Both Union and State governments may exceed the fiscal deficit target by up to 0.5% of GDP.

- Primary deficit target of 0% shifted to 2022-23 (earlier 2020-21).

- Primary deficit is the difference between the government's fiscal deficit and its interest payments on existing public debt.

- Primary deficit target of 0% shifted to 2022-23 (earlier 2020-21).

- Debt as Primary Target: Focus on debt reduction rather than rigid fiscal deficit targets.

- Fiscal Council: Creation of an autonomous Fiscal Council with independent members to oversee fiscal policy.

- Borrowings: Restrictions on borrowing from RBI, allowing it only in specific cases:

- Meeting temporary shortfalls in receipts.

- RBI purchases government securities for deviations from targets.

- RBI subscription to government securities in certain conditions.

What are Challenges in India's Fiscal Consolidation?

- Compromising Welfare: Critics argue that focusing too much on reducing the fiscal deficit may limit essential spending for economic growth and harm public welfare programs, with the 3% GDP target being too ambitious.

- Geopolitical Tensions: Shifting trade dynamics, with tighter regulations and tariffs, can impact India’s external trade, fiscal health, and increase pressure on government spending to support domestic industries and self-sufficiency. E.g., Trump’s tariff threats.

- Volatile Capital Flows: Capital flows into India have become volatile due to increase in interest rates in developed economies. Unexpected outflows could lead to fiscal deficits or put pressure on currency stability.

- Rising State Deficits: Many states are struggling with rising fiscal deficits, which exceed the recommended 3% of GSDP. E.g., Himachal Pradesh (4.7%), Andhra Pradesh (4.2%).

- Also, many states are witnessing a rise in their debt-to-GDP ratios.

- Sustaining Capital Expenditure: Sustaining 3.2% of Capex investment without further escalating the fiscal deficit is a challenge due to higher borrowing costs, low tax compliance and collections etc.

Way Forward

- Tax Reforms and Mobilization: Improving the tax base, particularly in the informal sector by higher tax collection without needing to raise tax rates, and addressing leakages will be essential to meet fiscal targets without overburdening the economy.

- State governments need to implement fiscal reforms tailored to their specific challenges and reduce wasteful expenditures.

- Investment vs. Deficit Control: Maintaining fiscal consolidation is crucial, but India must balance it with the need for long-term growth, as overly strict measures could hinder essential investments.

- E.g., The 14th Finance Commission (2013-2014), recommended more flexibility in fiscal management to support growth and development while ensuring long-term sustainability.

- Monetary and Fiscal Coordination: The Reserve Bank of India (RBI) and the government must coordinate effectively to manage volatility in the currency markets and keep inflation in check.

|

Drishti Mains Question: Analyze the importance of fiscal consolidation in ensuring India's macroeconomic stability. What steps have been taken to reduce the fiscal deficit, and what challenges remain? |

UPSC Civil Services, Previous Year Questions (PYQ)

Prelims

Q. Which one of the following is likely to be the most inflationary in its effect?

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

Ans: (d)

Q. In the context of governance, consider the following: (2010)

- Encouraging Foreign Direct Investment inflows

- Privatization of higher educational Institutions

- Down-sizing of bureaucracy

- Selling/offloading the shares of Public Sector Undertakings

Which of the above can be used as measures to control the fiscal deficit in India?

(a) 1, 2 and 3

(b) 2, 3 and 4

(c) 1, 2 and 4

(d) 3 and 4 only

Ans: (d)

Mains

Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)

Q. Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (2019)

Indian Polity

Ad hoc Judges in High Court

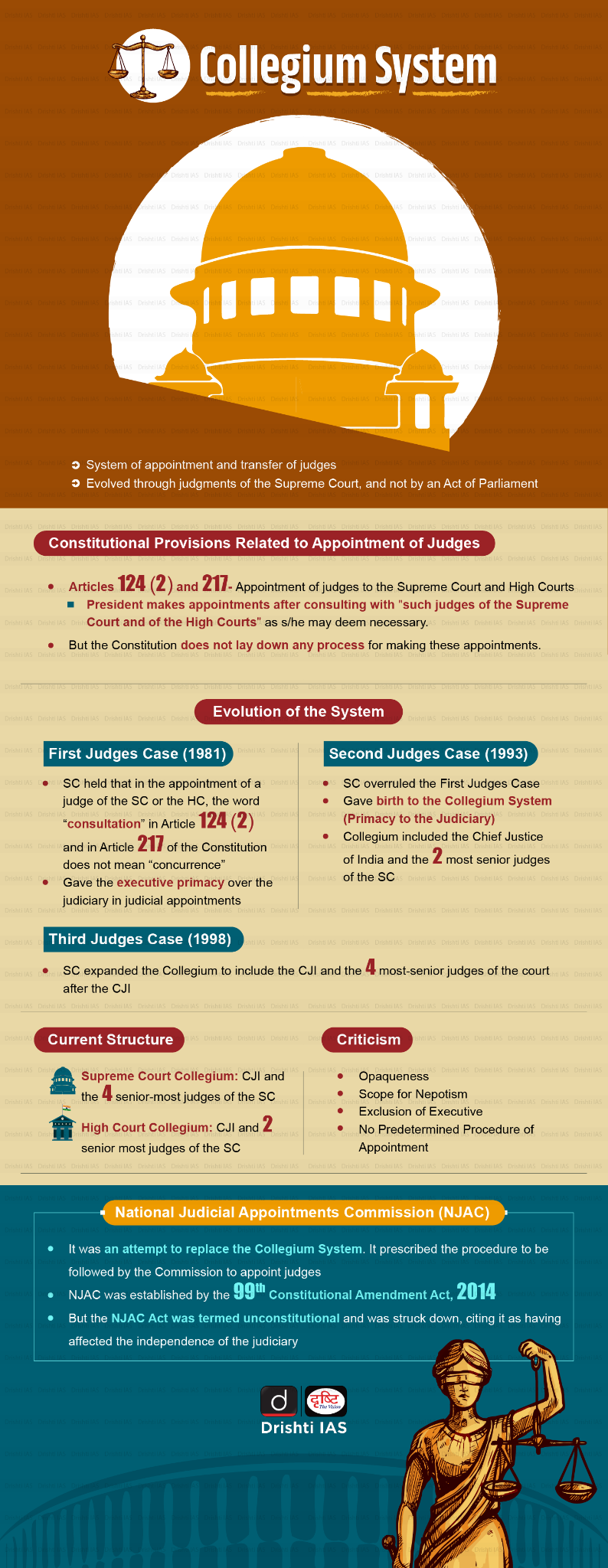

For Prelims: Supreme Court (SC), High Court, Article 224A, President, Chief Minister, Chief Justice of India, Collegium System, NITI Aayog, District Courts, Wide Area Network (WAN), Alternate Dispute Resolution (ADR), Arbitration, Mediation, Lok Adalats, Mediation Act, 2023, Arbitration and Conciliation (Amendment) Act, 2015, Special Leave Petitions (SLPs), Malimath Committee, National Judicial Infrastructure Authority of India (NJIAI).

For Mains: Role of ad hoc judges in addressing pending cases before judiciary, Reasons behind pendency and Way Forward to reduce pendency of cases.

Why in News?

The Supreme Court (SC) suggested temporarily appointing retired judges on an ad hoc (as required) basis to address the growing backlog of pending criminal cases before several High Courts.

- The SC suggested revising its 2021 ruling limiting ad hoc judge appointments to specific cases.

What are Key Points Regarding Ad hoc Judges in HC?

- About: Ad hoc judges are temporary judges appointed to a court, typically to address specific needs such as reducing case backlogs or filling gaps when permanent judges are unavailable.

- Constitutional Basis: Article 224A of the Indian Constitution allows the Chief Justice of a High Court, with the President's approval (along with the consent of the retired judge), to appoint retired High Court judges to serve temporarily.

- Procedure: The procedure is outlined in the Memorandum of Procedure (MOP) 1998, created after the collegium system for appointing High Court judges.

- The MOP states that after the retired judge has consented to the appointment, the Chief Justice must forward her name and details on the duration of the appointment to the state’s Chief Minister (CM).

- The CM will pass this recommendation to the Union Law Minister, who will consult the Chief Justice of India (CJI) before forwarding the recommendation and the CJI’s advice to the Prime Minister of India.

- The PM will advise the President on whether to give her approval.

- In the Lok Prahari v. Union of India case, 2021, the Supreme Court ruled that recommendations for appointing retired judges must go through the Supreme Court's collegium.

- Under the collegium system, for appointment of high court judges, the CJI should consult a collegium of two senior-most judges of the Supreme Court.

- Initiation of Process: In the Lok Prahari v. Union of India case, 2021, the SC laid down the following requirements to initiate the appointment process.

- Vacancy Thresholds: More than 20% of the sanctioned strength of judges is vacant.

- Pending Cases: More than 10% of the backlog of pending cases is over 5 years old.

- Regular Appointments First: Ad hoc appointment process can only be initiated after the process for regular judicial appointments has been triggered.

- Process for Selection: Each High Court's Chief Justice should create a panel of retired or soon-to-retire judges for ad hoc appointments.

- The appointment process can bypass the Intelligence Bureau check since the nominees are former judges, shortening the process.

- Tenure: Ad-hoc judges typically serve for two to three years, with the number ranging from two to five based on the backlog and vacancies in the High Court.

- Role and Duties: Ad-hoc judges may hear cases over five years old and are prohibited from other legal work, such as advisory, arbitration, or client representation.

- Emoluments and Allowances: Ad-hoc judges will receive emoluments and allowances equivalent to a permanent judge of that High Court, excluding pension.

- Previous Appointments: Only three ad hoc judges have been appointed under Article 224A, with the Supreme Court calling it a "dormant provision."

- Justice Suraj Bhan to Madhya Pradesh HC in 1972 for one year to hear election petitions,

- Justice P. Venugopal to Madras HC in 1982, with a one-year renewal in 1983,

- Justice O.P. Srivastava went to Allahabad HC in 2007 to hear the Ayodhya title suit.

Ad hoc Judge in SC (Article 127)

- When there is a lack of quorum of the permanent judges to hold or continue any session of the Supreme Court, the Chief Justice of India can appoint a judge of a High Court as an ad hoc judge of the Supreme Court for a temporary period.

- He can do so only after consultation with the chief justice of the High Court concerned and with the previous consent of the president.

- The judge so appointed should be qualified for appointment as a judge of the Supreme Court.

- It is the duty of the judge so appointed to attend the sittings of the Supreme Court, in priority to other duties of his office.

- While attending, he enjoys all the jurisdiction, powers and privileges (and discharges the duties) of a judge of the Supreme Court.

What is the Status of Pendency of Cases in India?

- Pending Cases: As of 2024, there are over 51 million (5.1 crore) pending cases across various courts in India, including both district and high courts.

- This backlog includes over 169,000 cases that have been pending for more than 30 years.

- The majority of the cases (approximately 87%, or 4.5 crore) are in district courts.

- Rate of Disposal: A 2018 NITI Aayog report projected it would take over 324 years to clear the pending cases, which then stood at 29 million.

- Judicial delays cost the economy an estimated 1.5% to 2% of India's GDP.

- Impacts: Delays in the judicial system deny timely justice and erode public confidence in the judicial system.

- India ranks 111th in civil justice and 93rd in criminal justice in the Rule of Law Index, 2023 highlighting global concerns about its delayed judicial processes.

- Causes of Case Pendency:

- Shortage of Judges: As of January 2024, India's 25 High Courts have 783 out of 1,114 sanctioned judges, and over 5,000 district-level vacancies remain as of early 2023.

- Infrastructure Gaps: A study of 20 district courts in 10 states found that only 45% of judicial officers have electronic display facilities, and 32.7% lack video conferencing in court complexes.

- Lack of Judicial Accountability: The impeachment process for removing judges is rarely used and inadequate provisions for addressing minor issues not amounting to impeachment.

- Alleged corruption and post-retirement appointment controversies have increased calls for transparency in the judiciary.

- Access to Justice Barriers: By 2022, 76% of India's prison population were undertrials, largely from disadvantaged communities, due to high costs, complex procedures, and language barriers.

What Initiatives have been Taken to Reduce Pendency of Cases?

- National Mission for Justice Delivery and Legal Reforms: Launched in August 2011, the initiative aims to reduce judicial delays and arrears by improving infrastructure and leveraging technology.

- e-Courts Mission Mode Project: It leverages Information and Communication Technology (ICT) to enable court processes and enhance transparency. Key components include:

- Wide Area Network (WAN) connectivity in court complexes

- Establishment of virtual courts etc.

- Tele-Law Programme: Launched in 2017, the program aims to provide legal advice to disadvantaged communities through video conferencing, phone, and mobile apps.

- ADR Mechanisms: The Government has strengthened Alternate Dispute Resolution (ADR) mechanisms such as Arbitration, Mediation, and Lok Adalats.

- Fast Track Courts: They were established to speed up trials for specific cases, including heinous crimes, crimes against women and children, and offenses involving MPs/MLAs.

Way Forward

- National Court of Appeal for SLPs: In the case of Bihar Legal Support Society v. Chief Justice of India (1986), the Supreme Court suggested the establishment of a National Court of Appeal to hear Special Leave Petitions (SLPs).

- This would limit the SC to hearing only constitutional and public law-related issues, significantly reducing the Court's workload and addressing the backlog more efficiently.

- Constitutional and Legal Divisions: The Tenth Law Commission 1981 of India proposed dividing the SC into two divisions: a Constitutional Division for constitutional matters and a Legal Division for other legal issues.

- It would streamline the judicial process by assigning constitutional issues to a specialized bench, ensuring faster disposal of these cases.

- Increasing the Number of Workdays: The Malimath Committee recommended the Supreme Court work for 206 days and reduce vacation by 21 days to address case pendency.

- The 2009 Law Commission's 230th report recommended reducing court vacations by 10-15 days at all judicial levels to help reduce case backlogs.

- Dedicated Authority for Judicial Infrastructure: Former Chief Justice of India NV Ramanna proposed the establishment of a National Judicial Infrastructure Authority of India (NJIAI) to address the critical infrastructure gaps in India’s judicial system.

|

Drishti Mains Question: Examine the causes behind the massive pendency of cases in India. Discuss key reforms needed to address the pendency of cases. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the Indian judiciary, consider the following statements:

- Any retired judge of the Supreme Court of India can be called back to sit and act as a Supreme Court judge by the Chief Justice of India with the prior permission of the President of India.

- A High Court in India has the power to review its own judgement as the Supreme Court does.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither I nor 2

Ans: (a)

Mains

Q. Critically examine the Supreme Court’s judgement on ‘National Judicial Appointments Commission Act, 2014’ with reference to the appointment of judges of higher judiciary in India. (2017)

Governance

Underutilization of Funds Under the BOCW Act, 1996

For Prelims: Right to Information, International Labour Organisation, Cess, Chief Labour Commissioner, Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM), Pradhan Mantri Suraksha Bima Yojana (PM-SBY), Ayushman Bharat

For Mains: Welfare of construction workers in India, Labor laws and their effectiveness, Social Security and Welfare Programs in India

Why in News?

A Right to Information (RTI) query has revealed that welfare boards across various states have failed to utilize Rs 70,744 crore of the total cess collected under the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) (BOCW) Act, 1996.

What is the BOCW Act, 1996?

- About: BOCW Act, 1996, is a legislative framework aimed at safeguarding the rights, welfare, and working conditions of building and construction workers in India.

- It provides for their safety, health, and welfare measures and addresses employment regulations, ensuring better working conditions for one of the most vulnerable labor sectors.

- The Act was framed in accordance with the principles of the International Labour Organisation (ILO), particularly aligning with ILO Convention No. 167 on construction safety and health.

- Key Features:

- Welfare Measures: Empowers state governments to collect a cess of 1% to 2% from employers for the welfare of construction workers.

- The collected funds are intended to provide benefits such as health, education, and social security, including temporary accommodation, drinking water, and latrines.

- Encourages State/Union Territories (UT) Welfare Boards to implement welfare schemes using cess funds effectively.

- Safety Provisions: The Act mandates the preparation of an emergency action plan for sites employing more than 500 workers.

- Applicability: The Act applies to establishments employing 10 or more construction workers, except for private residential construction projects costing less than Rs 10 lakh.

- Employers are mandated to register their establishments under this Act within 60 days of its applicability.

- Enforcement Mechanism: The Chief Labour Commissioner (Central) and its field offices enforce the provisions of the Act, conducting regular inspections to ensure compliance with safety and welfare measures.

- Additionally, State and UT BOCW Welfare Boards implement welfare schemes and utilize cess funds collected under the Act.

- Welfare Measures: Empowers state governments to collect a cess of 1% to 2% from employers for the welfare of construction workers.

Note: ILO Convention No. 167 adopted in 1988 (India ratified) aims to ensure the safety and health of workers in the construction industry by establishing standards for improving working conditions in construction sites.

What are the Concerns Regarding the BOCW Act, 1996?

- Underutilisation of Collected Cess: A major concern is the underutilisation of Rs 70,744 crore in collected cess, highlighting a significant gap between the funds raised and the benefits allocated to workers.

- Maharashtra, Karnataka, and Uttar Pradesh spent Rs 13,683.18 crore, Rs 7,921.42 crore, and Rs 7,826.66 crore from the cess, leaving balances of Rs 9,731.83 crore, Rs 7,547.23 crore, and Rs 6,506.04 crore.

- The large cess balances in these states raise concerns about their commitment to utilizing the funds for workers' welfare.

- Except for Kerala, most state governments and UT administrations are not enforcing the Building and Other Construction Workers Act.

- Maharashtra, Karnataka, and Uttar Pradesh spent Rs 13,683.18 crore, Rs 7,921.42 crore, and Rs 7,826.66 crore from the cess, leaving balances of Rs 9,731.83 crore, Rs 7,547.23 crore, and Rs 6,506.04 crore.

- Cess Evasion and Misreporting: Concerns about large-scale cess evasion by employers and builders persist, with Maharashtra's reported cess collection seeming inconsistent with its construction activity.

- Additionally, there is a lack of transparency in details on the actual cost of approved construction projects.

- Delayed Welfare Measures: The Act's provisions for workers' accommodation, water, and sanitation were poorly enforced, especially during the Covid-19 lockdowns, leaving workers without support.

- Additionally, promised welfare benefits, including financial aid during crises, remain unmet, highlighting the Act's ineffectiveness..

- Implementation Concerns: Except Kerala, most states and UTs are not implementing the BOCW Act, 1996, limiting stipulated benefits.

- Many states are also avoiding reconstituting welfare boards, and concerns exist that unspent welfare funds could be diverted to state exchequers.

- Impact of the Code on Social Security: The proposed Code on Social Security (CSS), 2020 may dilute cess collection, as it allows employers to self-assess the cess and reduces the cess rate and interest.

- It also reduces workers' entitlements, making essential benefits like accommodation optional rather than guaranteed.

Other Schemes Related to Construction Workers

Way Forward

- Enhanced Monitoring: Implement independent audits and transparent reporting mechanisms to track cess fund usage and ensure accountability.

- Create real-time online platforms for workers through initiatives like e-shram to track cess collection, allocation, and utilization.

- State Government Accountability: Hold states accountable for proper implementation of BOCW Act, 1996 and effective use of cess funds.

- Introduce performance-based incentives, prioritizing states that effectively utilize funds, while withholding additional fund allocations for underperforming states.

- Reviewing CSS 2020: The proposed CSS, 2020 should be revised to maintain mandatory worker entitlements, such as health coverage.

- Worker Education and Awareness: Mandate corporates and construction companies to educate workers on their rights under the BOCW Act, promote skill development, and collaborate with Non-governmental Organizations (NGOs) for better safety and wages.

|

Drishti Mains Question: Analyze the effectiveness of the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996, in ensuring workers’ welfare. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the guilds (Shreni) of ancient India that played a very important role in the country’s economy, which of the following statements is/are correct? (2012)

- Every guild was registered with the central authority of the State and the king was the chief administrative authority on them.

- The wages, rules of work, standards and prices were fixed by the guild.

- The guild had judicial powers over its own members.

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains

Q.Why indentured labour was taken by the British from India to other colonies? Have they been able to preserve their cultural identity over there? (2018)

Q.Discuss the changes in the trends of labour migration within and outside India in the last four decades. (2015)

Important Facts For Prelims

Landmark Rulings Safeguarding Freedom of Press in India

Why in News?

The Romesh Thapar v. State of Madras (1950) case set a landmark precedent for protecting free speech under Article 19(1)(a), curbing arbitrary state powers, and shaping the interpretation of the freedom of press and fundamental rights in India.

What are Key Facts Regarding Romesh Thapar v. State of Madras, 1950 Case?

- Background:

- In 1950, the Madras government banned the weekly magazine CrossRoads under the Madras Maintenance of Public Order Act for reporting police violence that caused 22 Communist deaths, a ban later challenged in the Supreme Court.

- Supreme Court Verdict:

- In May 1950, the SC declared the Madras Maintenance of Public Order Act unconstitutional, stating that restrictions on free speech must be narrowly defined and linked to "security of the state."

- The court clarified that "public order" cannot be equated with "state security," limiting arbitrary state censorship.

- In May 1950, the SC declared the Madras Maintenance of Public Order Act unconstitutional, stating that restrictions on free speech must be narrowly defined and linked to "security of the state."

Note:

- In response to Romesh Thapar v. State of Madras, 1950 case, the government introduced the First Constitutional Amendment Act in 1951, adding “reasonable restrictions” to Article 19(1)(a) in free speech, including grounds like public order, incitement to an offense, and friendly relations with foreign states.

What are the Other Landmark Cases Related to Freedom of Press in India?

- Brij Bhushan v. State of Delhi, 1950: In Brij Bhushan Case, the SC invalidated a provision requiring prior censorship of a newspaper, imposed on the Organiser magazine, asserting that such censorship was a violation of freedom of speech and expression.

- The SC held that restrictions on the fundamental right should only happen if there is a clear danger to public order or if there is incitement to violence.

- The ruling reinforced the principle that any prior restraint on publication is unconstitutional.

- Sakal Papers Ltd vs Union of India, 1961: The SC struck down the Newspaper (Price and Page) Act, 1956, which imposed restrictions on newspaper pricing, advertisement space, and supplements.

- The Court ruled that these restrictions violated the fundamental right to freedom of speech under Article 19(1)(a), as they unreasonably interfered with press freedom.

- Bennett Coleman & Co. v. Union of India, 1973: The SC invalidated the Newsprint Control Order, which imposed restrictions on the number of pages a newspaper could publish.

- The SC held that such restrictions were not reasonable under Article 19(2) and violated the right to freedom of speech

- Indian Express Newspapers v. Union of India, 1985: In 1981, the Indian government imposed a steep hike in customs duties on newsprint, affecting smaller newspapers and regional publications.

- This was seen as an indirect attempt to curb press freedom by making it financially difficult for newspapers to operate.

- The SC ruled that freedom of the press is an essential aspect of freedom of speech and struck down excessive taxation on newspapers as a means to curtail free expression emphasizing that any restrictions must be justified under Article 19(2).

- Shreya Singhal vs Union of India , 2015 : In Shreya Singhal Case, the SC struck down Section 66A of the IT Act,, deeming it unconstitutional for being vague and overly broad, thereby violating the right to free speech under Article 19(1)(a).

UPSC Civil Services Examination, Previous Year Question

Q. The Ninth Schedule was introduced in the Constitution of India during the prime ministership of (2019)

(a) Jawaharlal Nehru

(b) Lal Bahadur Shastri

(c) Indira Gandhi

(d) Morarji Desai

Important Facts For Prelims

Party Whip

Why in News?

The Vice President of India has expressed concerns regarding the use of party whips in Parliament, questioning their impact on limiting the independent judgment of elected representatives.

What is a Party Whip?

- About:

- A whip in Parliament is a directive issued by a political party to its members in the legislature, instructing them on how to vote during discussions and decisions on specific bills, motions, or resolutions.

- Also, the whip is also the designated party member responsible for ensuring attendance and adherence to these directives.

- Objective:

- The primary objective of a whip is to maintain party discipline, ensure uniformity in decision-making, and avoid defections or dissent within the party ranks.

- The term "whip" originates from England's hunting fields, where a whipper-in kept stray hounds within the pack.

- The primary objective of a whip is to maintain party discipline, ensure uniformity in decision-making, and avoid defections or dissent within the party ranks.

- Constitutional Status:

- It is not mentioned in the Constitution, Rules of the House, or any parliamentary statute, and is based on parliamentary conventions.

- Types of Whips:

- One-Line Whip: Informs members about an important vote, allowing abstention without penalty.

- Two-Line Whip: This mandates the presence of members during a vote but does not explicitly require them to vote in a particular manner.

- Three-Line Whip: The strictest form, requiring members to attend the vote and align their vote with the party’s directive.

- Functions:

- Ensures Attendance: Responsible for ensuring the presence of party members and maintaining quorum in the House.

- Secures Support: Works to garner support for or against specific issues.

- Maintains Discipline: Ensures party members adhere to party guidelines and maintain stable democratic institutions.

- Identifies Discontent: Monitors signs of discontent among MPs and reports them to party leaders.

- Internal Party Coordination: Acts as a unifying force, maintaining party cohesion within the Parliament.

- Violation of Whip:

- If an Members of Parliament (MPs)/ Members of Legislative Assemblies (MLAs) defies the party's whip, they may face expulsion under the Anti-Defection Law, unless more than two-third of the legislators dissent, leading to a split within the party.

Quorum:

- The quorum in the Parliament is the minimum number of members required to be present for a session to be considered valid.

- It is specified in Article 100 of the Constitution of India.

- It is one-tenth of the total number of members in a house of Parliament. (Lok Sabha: 55 and Rajya Sabha: 25).

UPSC Civil Services Exam, Previous Year Questions (PYQ)

Prelims

Q. Consider the following statements: (2013)

- The Chairman and the Deputy Chairman of the Rajya Sabha are not the members of that House.

- While the nominated members of the two Houses of the Parliament have no voting right in the presidential election, they have the right to vote in the election of the Vice President.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Rapid Fire

Statehood Day of Himachal Pradesh

The Prime Minister greeted the people of Himachal Pradesh (HP) on the occasion of Statehood Day (25th January).

- Key Facts RegardingHimachal Pradesh:

- The Chief Commissioner’s province of HP came into being on 15th April 1948.

- HP became a part C state on 26th January 1950 with the implementation of the Constitution of India.

- Part C states included former Chief Commissioner’s provinces and some erstwhile princely states of British India.

- After recommendation of the State Reorganisation Commission, HP became a Union Territory on 1st November 1956.

- Kangra and most of the other hill areas of Punjab were merged with HP on 1st November 1966 though it remained a Union Territory.

- On 18th December 1970 the State of HP Act was passed by Parliament and the new state came into being on 25th January 1971. HP emerged as the 18th state of the Indian Union.

Read More: Reorganisation of States in India

Rapid Fire

Oligarchy

In his farewell address, the US President cautioned about the rising influence of an oligarchy in the US, where a small group of billionaires are increasingly shaping public policy.

- Oligarchy: A government dominated by a small, influential group. Power may or may not be distributed equitably.

- It differs from democracy as only a few individuals make decisions.

Other Different Types of Government:

|

Monarchy |

It is a government ruled by a hereditary leader, such as a king or queen. It can be:

|

|

Theocracy |

It is a system where the government is run by divine guidance or by officials (priests) who are considered divinely guided. Eg: Vatican City |

|

Democratic and Republic |

|

|

Anarchy |

It means "no rule," or a state of lawlessness, where no governing authority exists. Eg: As of 2025, no countries are recognized as true anarchist states. Historically, Somalia experienced a period from 1991 to 2006. |

|

Dictatorship |

A government led by a single ruler with complete control, often without regard for laws or constitutions. Eg: North Korea. |

Read More: Constitutional Monarchy, Forms of Government, Commonwealth of Nations.

Rapid Fire

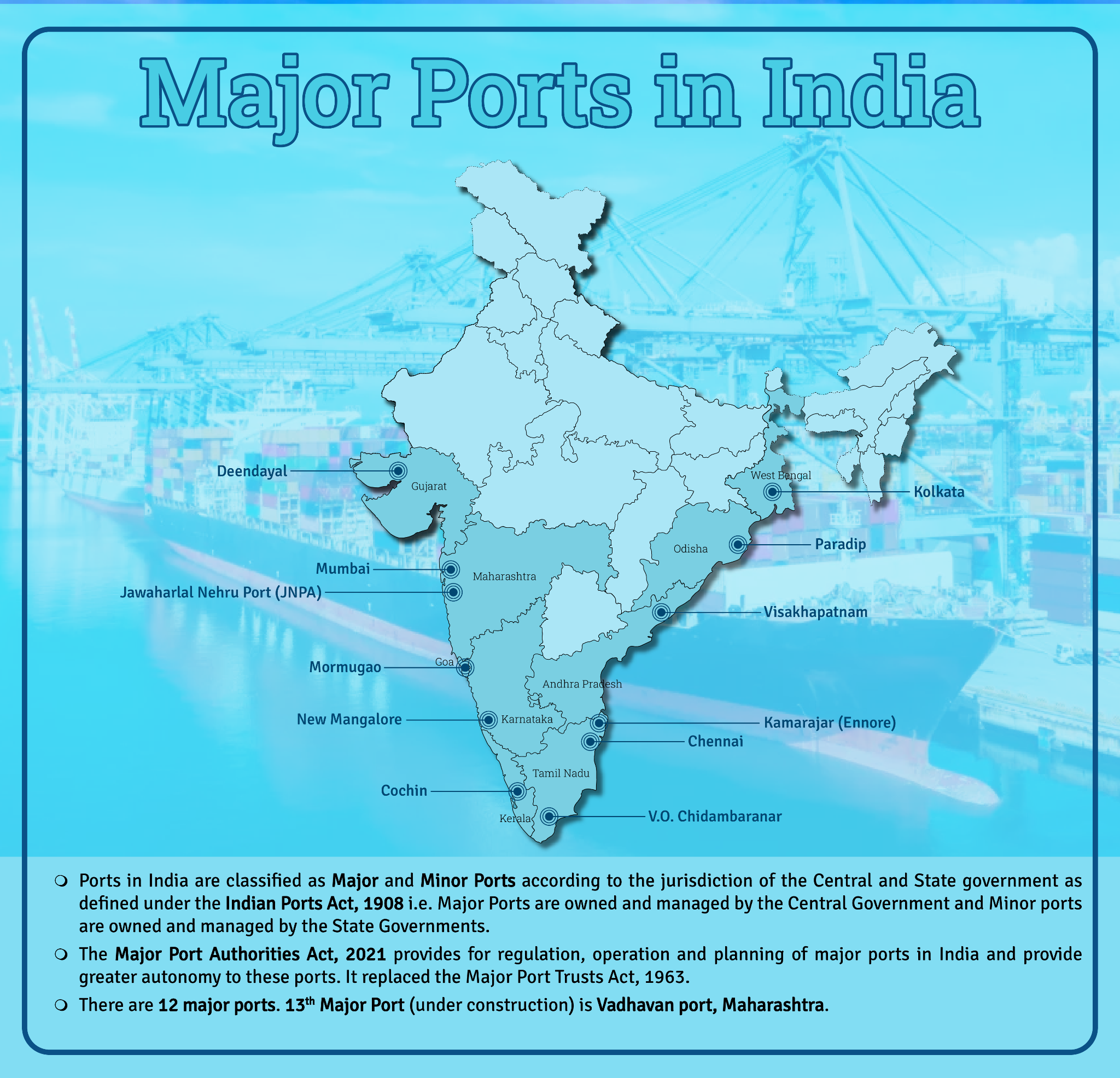

Jawaharlal Nehru Port

The Jawaharlal Nehru Port Authority (JNPA) or Nhava Sheva Port is set to become India’s first port to achieve a global ranking by handling 10 million TEUs (Twenty-Foot Equivalent Units) per year by 2027.

- In 2024, JNPA handled a record 7.05 million TEUs, operating at over 90% capacity, with an 11% year-on-year growth.

Jawaharlal Nehru Port (JNP):

- Located in Navi Mumbai, Maharashtra and was commissioned in 1989.

- Key Features:

- India’s First Landlord Major Port: Fully adopts the landlord port model.

- Container Terminals: Operates 5 container terminals, including Bharat Mumbai Container Terminals (BMCT), Nhava Sheva International Container Terminal (NSICT), and Gateway Terminals India Pvt (GTIPL).

- Planned Satellite port at Vadhavan port and dry ports at Jalna and Wardha to enhance connectivity and trade efficiency.

Ports in India:

- India has 12 major ports (13th major port under construction is Vadhvan port, Mumbai) and over 200 minor and intermediate ports.

- India's maritime sector handles 95% of trade by volume and 70% by value.

Read More: Jawaharlal Nehru Port

Rapid Fire

India to Ratify Cape Town Convention

The Union Cabinet has approved the Protection and Enforcement of Interests in Aircraft Objects Bill to strengthen India's aviation framework and align it with global standards.

- It aims to ratify and enforce the provisions of the Convention on International Interests in Mobile Equipment (Cape Town Convention), and Protocol on Matters Specific to Aircraft Equipment (Cape Town Protocol).

Cape Town Convention (CTC):

- About:

- The CTC is an international treaty that allows creditors, such as lessors, lenders, and financiers, to repossess high-value mobile assets like aircraft, engines, and helicopters if the airline defaults on lease payments.

- It was adopted in Cape Town, South Africa, in 2001.

- Key Features:

- International Registry: Establishes a global registry to record interests in mobile equipment, ensuring transparency and prioritizing registered creditors' claims.

- Default Remedies: Provides clear remedies for creditors, including the deregistration and export of aircraft without lengthy local legal procedures.

- Cape Town Protocol: It complements CTC and sets out specific rules for aircraft financing and leasing.

India's Status:

- India signed the CTC in 2008 but has not yet ratified it, thus the convention's provisions are not legally binding in India.

- India is the world's third-largest domestic aviation market after the US and China.

Read More: India's Aviation Industry

Rapid Fire

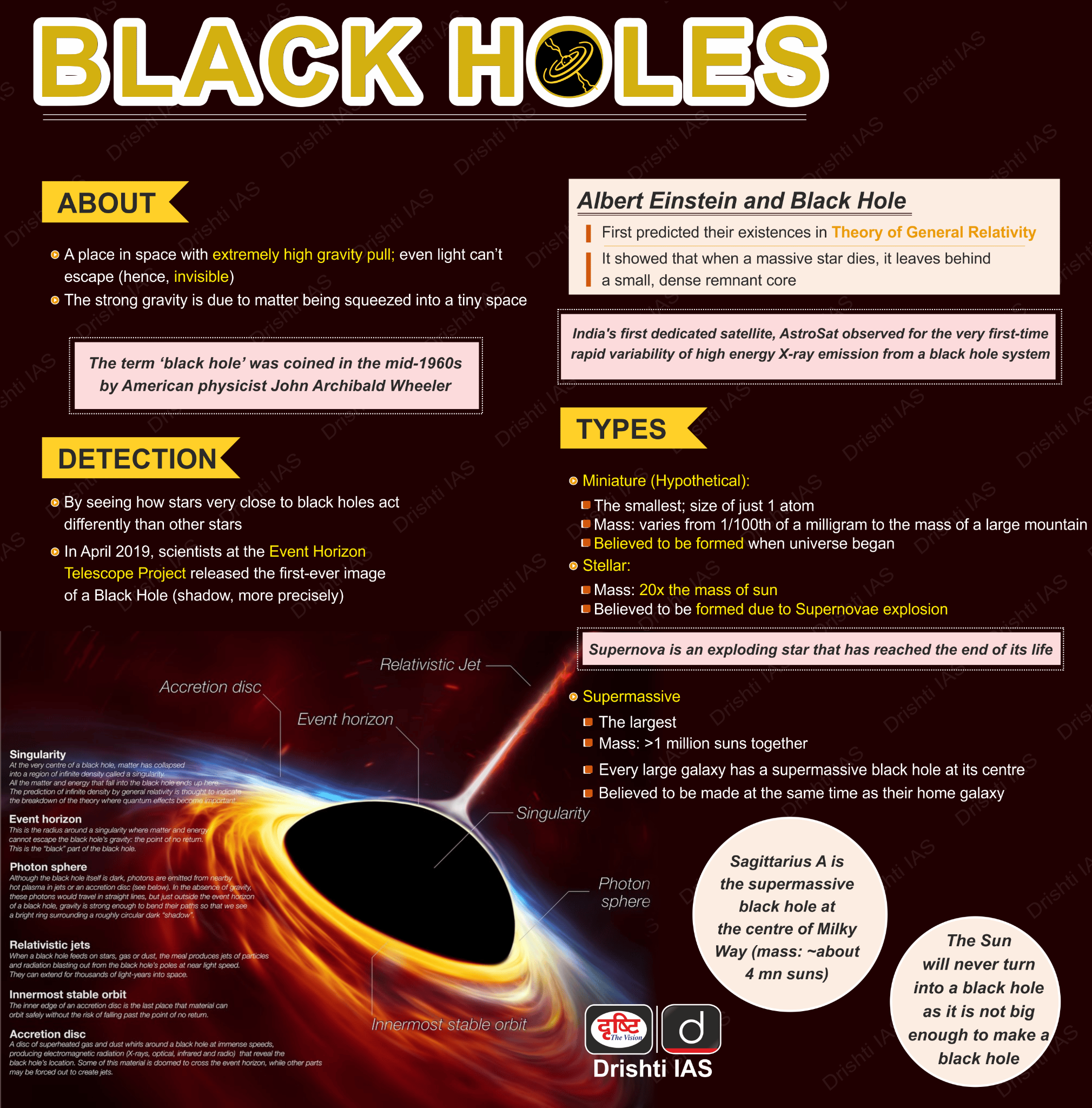

LID 568 Black Hole

Astronomers, using NASA’s James Webb Space Telescope (JWST) and the Chandra X-ray Observatory, have discovered a low-mass supermassive black hole LID 568.

LID-568 Black Hole:

- About:

- LID-568 is a low-mass supermassive black hole that existed 1.5 billion years after the Big Bang.

- It was discovered through X-ray and infrared observations and is located in a galaxy with minimal star formation, likely due to the black hole’s powerful outflows.

- Key Features:

- Super-Eddington Accretion: It feeds at a rate 40 times the Eddington limit, which is the maximum rate at which a black hole or star can accrete matter without radiation pressure pushing matter away.

- Eddington Limit represents the balance between gravitational pull and outward radiation pressure, preventing further accretion if exceeded.

- Galaxy Effects: The black hole’s outflows prevent the accumulation of matter needed for star formation in its galaxy.

- Super-Eddington Accretion: It feeds at a rate 40 times the Eddington limit, which is the maximum rate at which a black hole or star can accrete matter without radiation pressure pushing matter away.

- Significance:

- Challenges Current Models: LID-568’s rapid growth contradicts theories requiring sustained accretion for supermassive black hole formation.

- Insights into the Early Universe: It suggests that short bursts of intense feeding could explain the formation of large black holes in the early universe.

- Future Research: Opens avenues for studying black hole accretion processes and their impact on galaxy evolution.

Read More: Black Hole Gaia BH3