SC to Examine Use of Money Bills in Legislation

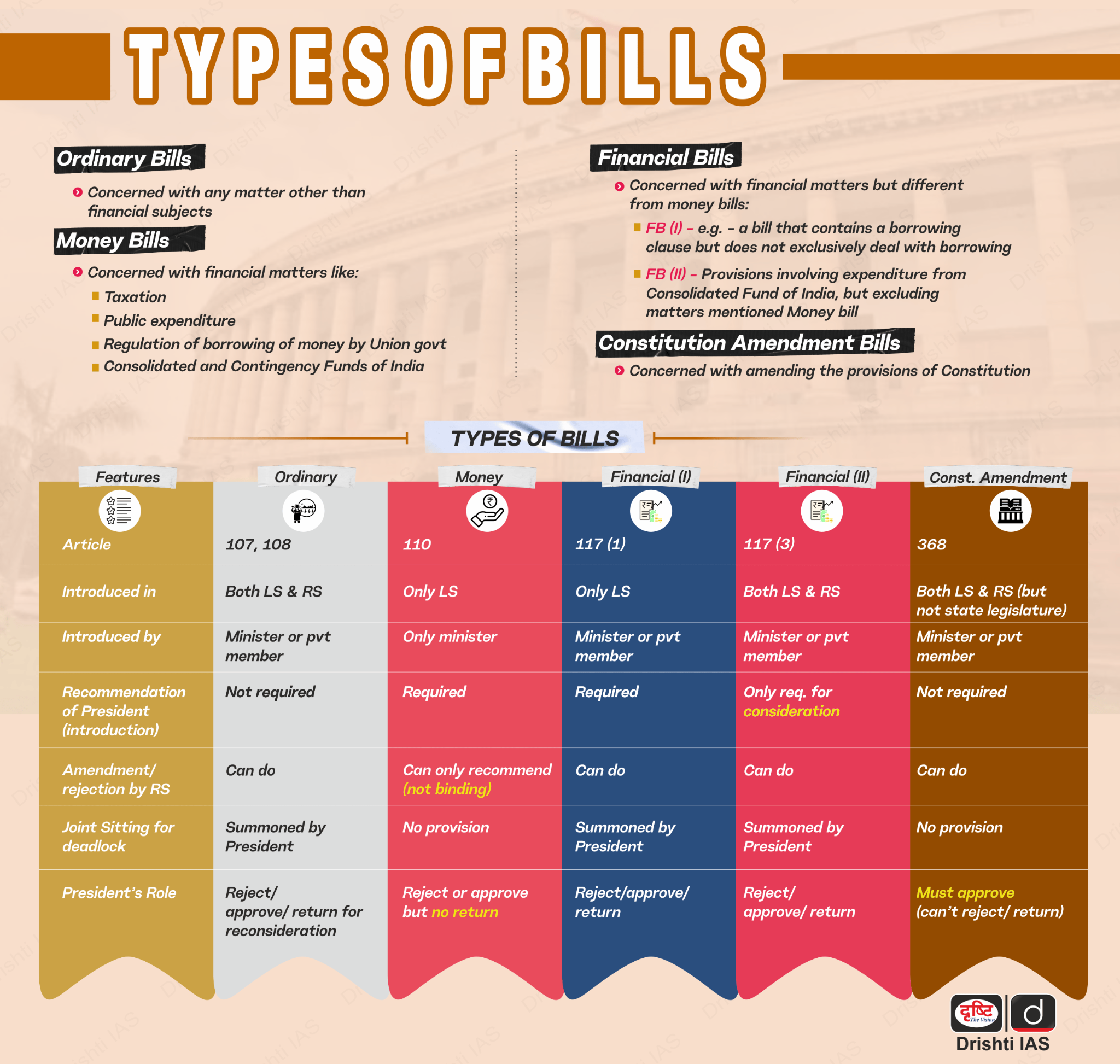

For Prelims: Chief Justice of India, Money Bill, Parliament, Rajya Sabha, Article 110, Judicial review, Supreme Court, Consolidated Fund

For Mains: Indian Constitution, Features, Amendments, Significant Provisions, Judicial Review

Why in News?

Recently, Chief Justice of India (CJI) has agreed to list petitions challenging the government's use of the Money Bill route to pass contentious amendments in the Parliament.

- This issue is crucial as it concerns the circumvention of the Rajya Sabha and potential violations of Article 110 of the Constitution.

What are the Concerns Regarding the Money Bill?

- Circumventing the Rajya Sabha: One of the primary concerns is that passing contentious amendments as a Money Bill allows the government to circumvent the Rajya Sabha, undermining the bicameral nature of Parliament.

- The classification of a bill as a money bill limits the Rajya Sabha to only recommending changes, without the power to amend or reject the bill.

- The Rajya Sabha, as the Upper House, provides additional scrutiny to legislation. Bypassing it reduces the opportunity for comprehensive debate and oversight.

- Violation of Article 110: It specifies what constitutes a Money Bill. There are concerns that certain amendments labelled as Money Bills do not strictly adhere to these provisions.

- Speaker's Certification: The Speaker of the Lok Sabha has the authority to certify a bill as a money bill under Article 110 of the Constitution, a decision that is not subject to judicial review.

- This raises concerns about the potential misuse of this power, allowing for circumvention of legislative processes.

- Specific Cases Highlighting Concerns:

-

Aadhaar Act: The Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 was classified as a Money Bill under Article 110(1), which led to widespread controversy.

-

In 2018, the Supreme Court upheld the constitutionality of the Aadhaar law, with the majority ruling that the Act's main aim was to provide subsidies and benefits, which involves expenditure from the Consolidated Fund, and therefore qualified it to be passed as a Money Bill.

-

However, Justice D.Y. Chandrachud (who was not the CJI at the time) dissented, observing that the use of the Money Bill route in this case was an "abuse of the constitutional process".

-

-

Finance Act, 2017: The Finance Act, 2017 included amendments to a number of Acts, including empowering the government to notify rules regarding the service conditions of members of Tribunals.

-

A host of petitioners argued that the Finance Act, 2017 must be struck down in its entirety as it contained provisions that had no connection with the subjects listed in Article 110.

-

In 2019, in the case Rojer Mathew vs South Indian Bank Ltd, a five-judge Bench referred the Money Bill aspect to a larger seven-judge Bench.

-

-

Prevention of Money Laundering Act (PMLA) Amendments: Amendments to the PMLA, passed as Money Bills from 2015 onwards, gave the Enforcement Directorate extensive powers, including arrest and raids.

- Although the Supreme Court upheld the legality of these amendments, it left the question of whether they should have been passed as Money Bills to the seven-judge Bench.

- The broad powers granted through these amendments raised concerns about potential misuse and the bypassing of legislative scrutiny.

-

Developments Following the 2019 Ruling

- The seven-judge Bench (mentioned earlier) has yet to address key questions about what constitutes a valid Money Bill, impacting subsequent legislation.

- The court has avoided resolving the Money Bill question in cases related to the Enforcement Directorate's powers and electoral laws, awaiting the larger Bench’s decision.

What are the Potential Consequences of Misclassifying Money Bills?

- Legal Challenges: Misclassifying bills as money bills can lead to prolonged legal battles, adding uncertainty to the legislative process.

-

Legislative Precedents: If upheld by the judiciary, the use of money bills inappropriately could set a precedent for future governments to bypass the Rajya Sabha.

-

Public Trust: Controversies surrounding money bills can erode public trust in the legislative process and the integrity of parliamentary procedures.

-

Broader Implications for Indian Democracy:

- The ongoing debates and judicial reviews surrounding money bills underscore the importance of maintaining a balance of power between the Lok Sabha and the Rajya Sabha.

- Ensuring that the passage of significant legislation involves adequate scrutiny and debate is crucial for legislative transparency and accountability.

- Upholding the constitutional provisions and preventing their misuse is essential for the integrity of India's democratic processes.

What is a Money Bill?

- About: Article 110 of the Constitution of India outlines the definition of a Money Bill, stating that a bill is considered a Money Bill if it contains only provisions dealing with specific financial matters. These include:

-

Taxation Matters: Imposition, abolition, remission, alteration, or regulation of any tax.

-

Borrowing Regulation: Regulation of the borrowing of money by the Union government.

-

Custody of Funds: Management of the Consolidated Fund of India(revenue received by the government through taxes and expenses incurred in the form of borrowings and loans) or the contingency fund(money to meet unforeseen expenditure).

-

Appropriation of Funds: Appropriation of money out of the Consolidated Fund.

-

Expenditure Declaration: Declaration of any expenditure charged on the Consolidated Fund.

-

Receipt of Money: Receipt of money related to the Consolidated Fund or public accounts.

-

Other Matters: Any matters incidental to the above provisions.

-

-

Speaker's Certification: The decision on whether a bill is a Money Bill rests with the Speaker of the Lok Sabha. This decision is final and cannot be questioned in any court or by either House of Parliament, nor can it be contested by the President.

- Upon certification, the Speaker endorses the bill as a Money Bill when it is transmitted to the Rajya Sabha for recommendations.

- Legislative Procedure: Money Bills can only be introduced in the Lok Sabha and must be recommended by the President. They are treated as government bills and can only be introduced by a minister.

- After passing in the Lok Sabha, the bill is sent to the Rajya Sabha, which has limited powers: It cannot reject or amend a Money Bill, it can only make recommendations and must return the bill within 14 days, regardless of whether it makes recommendations or not.

- The Lok Sabha can accept or reject the Rajya Sabha's recommendations. If the Lok Sabha accepts any recommendations, the bill is deemed passed in the modified form; if it rejects them, it passes in its original form.

- Presidential Assent: Once a Money Bill is presented to the President, he can either give assent or withhold it but cannot return it for reconsideration.

- Generally, the President gives assent to Money Bills as they are introduced with his prior permission.

Note: A bill cannot be classified as a Money Bill simply because it involves Imposition of fines or pecuniary penalties, demand or payment of fees for licences or services, and taxation by local authorities for local purposes.

|

Drishti Mains Question: Q. Evaluate the concerns associated with the government's use of the Money Bill route to pass contentious amendments. How do these provisions ensure or undermine legislative accountability? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. Regarding the Money Bill, which of the following statements is not correct? (2018)

(a) A bill shall be deemed to be a Money Bill if it contains only provisions relating to the imposition, abolition, remission, alteration or regulation of any tax.

(b) A Money Bill has provisions for the custody of the Consolidated Fund of India or the Contingency Fund of India.

(c) A Money Bill is concerned with the appropriation of money out of the Contingency Fund of India.

(d) A Money Bill deals with the regulation of borrowing of money or giving of any guarantee by the Government of India.

Ans: (c)

Q2. What will follow if a Money Bill is substantially amended by the Rajya Sabha? (2013)

(a) The Lok Sabha may still proceed with the Bill, accepting or not accepting the recommendations of the Rajya Sabha.

(b) The Lok Sabha cannot consider the Bill further.

(c) The Lok Sabha may send the Bill to the Rajya Sabha for reconsideration.

(d) The President may call a joint sitting for passing the Bill.

Ans: (a)

China Plus One

For Prelims: China Plus One Strategy, PLI (Production Linked Incentive), Inflation, GDP, India’s trade agreements, GST, Foreign Direct Investment (FDI).

For Mains: China’s Economic Slowdown and Opportunities for India, Steps taken by India present itself as an alternative to China.

Why in News?

India has the opportunity to capitalise on the China Plus One strategy and attract global manufacturing investments.

- While China's exports remain strong, India's large domestic market, low-cost talent, and potential for growth make it an appealing alternative.

What is the China+1 Strategy?

- About:

- It refers to the global trend where companies diversify their manufacturing and supply chains by establishing operations in countries other than China.

- This approach aims to mitigate risks associated with over-reliance on a single country, especially in light of geopolitical tensions and supply chain disruptions.

- China's Dominance in Global Supply Chains:

- China has been the centre of global supply chains for the past few decades, earning the title of "World's Factory". This was due to favourable factors of production and a strong business ecosystem.

- Shift to China in the 1990s:

- In the 1990s, large manufacturing entities from the US and Europe shifted their production to China, attracted by the low manufacturing costs and access to a vast domestic market.

- Disruptions During the Pandemic:

- The Covid-19 pandemic led to significant disruptions in many economies. As the large economies emerged from the pandemic, there was a sudden surge in demand. However, China's zero-Covid policy resulted in industrial lockdowns, leading to inconsistent supply chain performance and container shortages.

- Evolution of the China+1 Strategy:

- The confluence of factors, including China's zero-Covid policy, supply chain disruptions, high freight rates, and longer lead times, has led many global companies to adopt a "China-Plus-One" strategy.

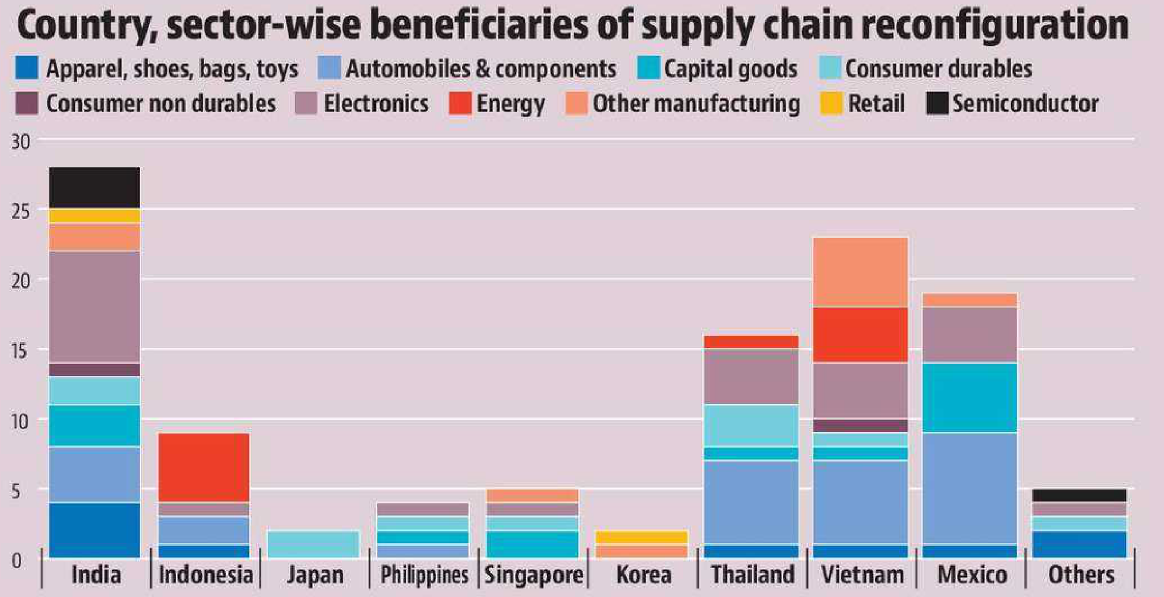

- This involves exploring alternative manufacturing locations in other developing Asian countries, such as India, Vietnam, Thailand, Bangladesh, and Malaysia, to diversify their supply chain dependencies.

- The confluence of factors, including China's zero-Covid policy, supply chain disruptions, high freight rates, and longer lead times, has led many global companies to adopt a "China-Plus-One" strategy.

What are the Opportunities for India to Attract the Foreign Investment?

- Demographic Dividend and Consumption Power:

-

India's youthful demographic, with 28.4% of the population under 30 in 2023, according to the World Bank's data, compared to China's 20.4%, is driving the workforce and consumer market. This boosts consumption, savings, and investments, positioning India as a potential multi-trillion dollar economy and attractive market for global companies.

-

-

Cost Competitiveness and Infrastructure Advantage:

-

India's lower labour and capital costs compared to competitors like Vietnam make its production sector highly competitive.

- A 2023 study by Deloitte stated that India's average manufacturing wage is 47% lower than China's.

- Additionally, the government's heavy investment in infrastructure through the National Infrastructure Pipeline (NIP) aims to reduce manufacturing costs and improve logistics by 20%, further enhancing India's attractiveness.

-

-

Business Environment and Policy Initiatives:

-

Recent policy interventions like the Production Linked Incentive (PLI) scheme, tax reforms, and relaxed FDI norms have created a conducive business environment.

-

The Make in India initiative, coupled with efforts to promote ease of doing business, is attracting foreign investments.

-

-

Digital Skilling and Technological Edge:

- As of January 2024, India has 870 million internet users, representing 61% of its population. This, combined with access to global tech giants like Google and Facebook, unavailable in China, gives Indian youth a digital advantage.

- Strategic Economic Partnerships:

-

India's focus on sub-regional partnerships and control over China's influence through initiatives like the CEPA trade agreement with the UAE demonstrates its strategic approach.

-

This diversification is expected to increase bilateral trade by 200% within 5 years, ensuring access to new markets while protecting domestic interests.

-

- Dynamic Diplomacy and Global Influence:

- India's active participation in groupings like QUAD and I2U2, along with bilateral agreements with key countries, strengthens its economic ties and opens doors for technology transfer, finance, and market access.

-

As India assumes leadership roles in G20 and SCO, it can leverage its position to shape global trade trends.

-

Large Domestic Market:

-

India's massive domestic market of 1.3 billion people with rising incomes offers a compelling alternative to China.

- India's GDP per capita has grown at an average of 6.9% between 2018 and 2023 leading to a vast consumer base that provides a strong foundation for sustained economic growth and increased global trade.

-

Which Sectors will Benefit from the China+1 Strategy in India?

- Information Technology/Information Technology Enabled Services (IT/ITeS): In a 2024 NASSCOM report, India is recognized as a key player in IT services exports, bolstered by initiatives like "Make in India," which aims to establish the country as a manufacturing hub for IT hardware. This effort has attracted major global technology firms.

- Pharmaceuticals: India's pharmaceutical industry, valued at Rs 3.5 lakh crore in 2024, is the world's third-largest by volume.

- India has emerged as a "pharmacy of the world," supplying nearly 70% of WHO's vaccine needs and offering 33% lower manufacturing costs than the US.

- Metals and Steel: India's rich natural resources and the PLI scheme for specialty steel, expected to attract Rs 40,000 crore in investments by 2029, position it as a major steel exporter. China's withdrawal of export rebates and imposition of duties on processed steel products enhance India's attractiveness.

What is India's Performance in the C+1 Landscape?

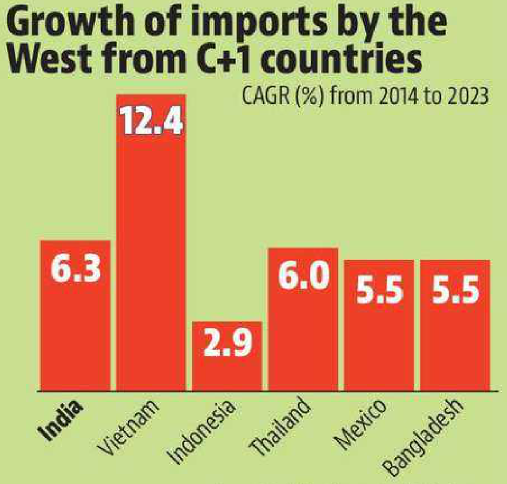

- Import Growth:

- India’s imports from Western countries have shown the second-highest growth among analysed countries, with a compound annual growth rate (CAGR) of 6.3% from 2014 to 2023.

- Vietnam and Thailand have outperformed India, with a CAGR of 12.4% in imports by the US, UK, and EU.

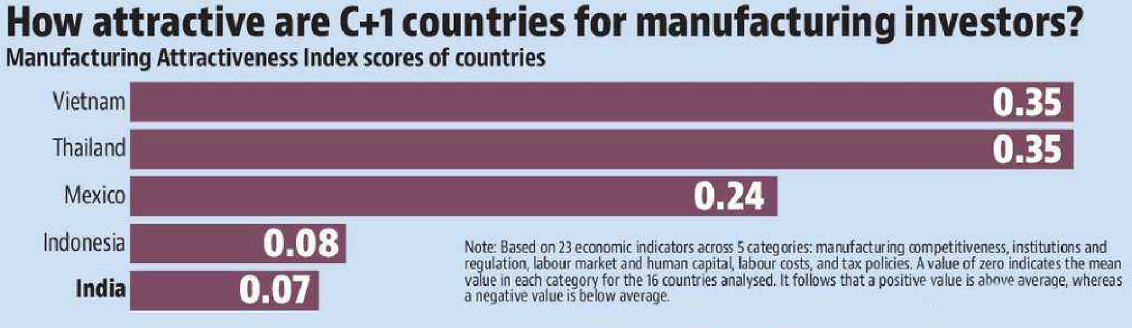

- Business Perception:

- Despite having abundant resources and strategic planning, India has struggled to create a positive impression among businesses relocating from China.

- Vietnam and Thailand have emerged as more attractive destinations.

-

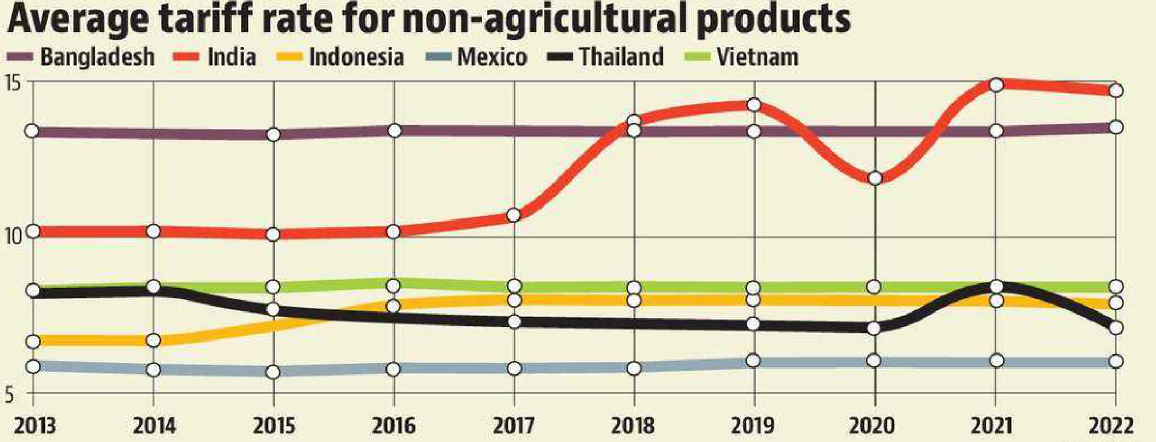

Tariff Rates:

- India's higher tariff rates, averaging 14.7% for non-agricultural products, have deterred Western investors. This is the highest among the countries analysed.

- The inverted duty structure in India, where taxes on imported raw materials are higher than those on final products, reduces the competitiveness of Indian exports.

- India's higher tariff rates, averaging 14.7% for non-agricultural products, have deterred Western investors. This is the highest among the countries analysed.

- Promising Future Prospects:

- As per analysis, India has emerged as the most favoured destination for companies planning to relocate production or invest in new facilities in Asia, with 28 companies showing interest, compared to 23 for Vietnam.

- Notably, a significant portion of these interested firms (8 out of 28) are from the electronics sector, an area where India has previously lagged behind Vietnam.

What are the Factors Hindering India's Competitiveness?

- Ease of Doing Business: India's regulatory environment is complex, characterized by bureaucratic hurdles and inconsistent policy implementation, which deter both domestic and foreign investors.

- Manufacturing Competitiveness: India faces significant challenges in manufacturing competitiveness due to high input costs, inadequate infrastructure, and a shortage of skilled labour.

- The CME Group's ranking highlights this issue, placing India behind several Southeast Asian nations.

- Infrastructure Deficiencies: Poor transportation, logistics, and energy infrastructure increase operational costs and reduce business efficiency.

- Labour Market Rigidities: Restrictive labour laws hinder flexibility and job creation, particularly in the organised sector.

- Tax Structure: The complex tax regime, including multiple indirect taxes, adds to the cost of doing business.

- Land Acquisition Challenges: The cumbersome process of land acquisition for industrial projects delays investments and raises costs.

- Skill Mismatch: The education system often fails to produce graduates with the skills demanded by the modern economy.

- Corruption: The prevalence of corruption erodes investor confidence and increases transaction costs.

Way Forward

- Targeted Incentives and Subsidies: India should offer attractive incentives and subsidies, particularly in sectors like electronics, automotive, and pharmaceuticals, to set up manufacturing facilities in India, including tax benefits, land subsidies, and infrastructure support.

- Improve Ease of Doing Business: The focus should be made on streamlining regulatory processes, reducing bureaucratic hurdles, simplifying labour laws, land acquisition procedures, and environmental clearances to enhance the overall ease of doing business in India.

-

Develop Specialised Industrial Clusters: There is a need to create dedicated industrial clusters or manufacturing hubs for specific sectors with world-class infrastructure and support services, including plug-and-play facilities, common testing and certification centres, and shared logistics infrastructure.

-

Invest in Skill Development: India should also focus on strengthening vocational training programs and collaborate with industry to develop a skilled workforce aligned with the needs of the manufacturing sector, promote STEM education, and upskill the existing workforce to meet the demands of high-tech manufacturing.

- Enhance Infrastructure and Logistics: Invest in modern, efficient, and well-connected transportation networks, including roads, railways, ports, and airports, and improve the reliability and availability of power supply, water, and other essential utilities.

- Streamline Trade Policies and Agreements: Negotiate and sign free trade agreements (FTAs) with key trading partners to improve market access for Indian exports, simplify import-export procedures and reduce tariffs to enhance global competitiveness.

-

Promote Research and Innovation: The government should encourage public-private partnerships in research and development (R&D) to foster innovation in manufacturing technologies and processes and provide incentives for companies to establish R&D centres and collaborate with academic institutions in India.

Conclusion

The C+1 opportunity presents a crucial chance for India to address its longstanding manufacturing sector challenges and emerge as a global manufacturing powerhouse. By addressing the key bottlenecks and implementing a comprehensive strategy, India can leverage this trend to drive sustainable economic growth and job creation. The time is ripe for India to seize the C+1 opportunity and cement its position as a preferred manufacturing destination.

|

Drishti Mains Question: What is the China Plus One Strategy? Discuss the challenges and opportunities for India to fully utilise this strategy. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. What is the importance of developing Chabahar Port by India? (2017)

(a) India’s trade with African countries will enormously increase.

(b) India’s relations with oil-producing Arab countries will be strengthened.

(c) India will not depend on Pakistan for access to Afghanistan and Central Asia.

(d) Pakistan will facilitate and protect the installation of a gas pipeline between Iraq and India.

Ans: (c)

Mains

Q. A number of outside powers have entrenched themselves in Central Asia, which is a zone of interest to India. Discuss the implications, in this context, of India’s joining the Ashgabat Agreement. (2018)

Lack of Authority of States in Altering SC List

For Prelims: Criterion for SC Status, Constitution (Scheduled Castes) Order of 1950, Registrar General of India.

For Mains: Criterion for SC Status and Arguments for and against the Inclusion of Dalit Cristians and Muslims.

Why in News?

Recently, the Supreme Court (SC) ruled that states are not empowered to make changes to the Scheduled Caste (SC) list as published under Article 341 of the Constitution.

- This decision came as the Court quashed a 2015 Bihar government notification that sought to categorise the Tanti-Tantwa community as Scheduled Caste (SC), highlighting the importance of adhering strictly to the constitutional provisions governing such classifications.

Note:

- Tanti-Tantwa is a Hindu caste belonging to a weaving and cloth merchant community in India. The community has a significant presence in states like Gujarat, Maharashtra, Jharkhand, Bihar, Uttar Pradesh, West Bengal, Assam, and Odisha.

What is the Background of the Case and Supreme Court’s Judgment?

- Background of Case:

- The Tanti-Tantwa community had been earlier categorised as an Extremely Backward Class (EBC) under the Bihar Reservation of Vacancies in Posts and Services (for Scheduled Castes, Scheduled Tribes, and other Backward Classes) Act, 1991.

- On 1st July 2015, the Bihar government issued a resolution to merge the Tanti-Tantwa community into the SC list based on a recommendation from the State Commission for Backward Classes (SCBC).

- This decision aimed to extend SC benefits to the Tanti-Tantwa community and was upheld by the Patna High Court in 2017, but later challenged in the Supreme Court.

- Supreme Court’s Judgment:

-

The court held that the state government has no authority to change the SC list published under Article 341 of the Constitution.

- Article 341(1) of the Indian Constitution vests the power to specify SC in various states and union territories with the President of India.

- Article 341(2) empowers Parliament to modify this list. Thus, any change in the SC list necessitates an amendment to the Constitution.

- The court observed that the Bihar government had not followed the due process and consultation with the Registrar General of India, who had not supported the proposal to include Tanti-Tantwa in the SC list.

- The court termed the state government's notification as "mala fide" and an unpardonable "mischief", depriving the genuine SC members of their rightful benefits.

- While the court quashed the resolution, it took a balanced approach regarding those who had already benefited from the resolution. It directed that such individuals should be accommodated under their original EBC category and that the SC quota posts they occupied should be returned to the SC category.

-

- Implications of Supreme Court Judgment:

-

The judgement reaffirms the constitutional scheme where only the Parliament can make changes to the SC list, and state governments cannot unilaterally tinker with it.

- The judgement safeguards the interests of the genuine SC members by ensuring that the benefits meant for them are not diverted to other communities.

- The judgement upholds the separation of power by clearly delineating the powers of the Legislature and Executive with respect to the SC list.

- It can serve as a precedent for other states attempting to make unauthorised changes to the SC/ST lists, which is a common issue across the country.

-

What is the Procedure to Amend/Alter the SC List?

- Process of Amending/Altering the SC List:

-

Initiation and Scrutiny: A state government proposes the inclusion or exclusion of a community from the SC list, which is scrutinised by the Ministry of Social Justice and Empowerment.

-

Then the proposal undergoes evaluation based on socio-economic factors and historical data, with inputs from the Registrar General of India.

-

-

Expert Consultation and Cabinet Approval: The National Commission for Scheduled Castes (NCSC) provides expert recommendations on the proposal.

-

The Cabinet then reviews the proposal, considering NCSC recommendations and other factors, and grants approval for amendments.

-

-

Parliamentary Process: A Constitutional Amendment Bill is introduced in Parliament, detailing the proposed changes to the SC list.

-

The Bill requires a special majority i.e. majority of 2/3rd of the members present and voting and more than 50% of the total strength of the house.

-

-

Presidential Assent and Implementation: Upon passage by both Houses, the Bill is sent to the President for assent. Once the President gives assent, the amendments to the SC list are officially enacted.

-

-

Criteria for Inclusion in SC List:

- Extreme social, educational and economic backwardness arising out of traditional practice of untouchability.

Registrar General of India

- The Registrar General of India was founded in 1961 by the Government of India under the Ministry of Home Affairs.

- It arranges, conducts, and analyses the results of the demographic surveys of India including the Census of India and Linguistic Survey of India.

- The position of Registrar is usually held by a civil servant holding the rank of Joint Secretary.

What are the Constitutional Provisions Related to Upliftment of SC?

- Article 15(4) mandates special provisions for the advancement of SCs.

- Article 16(4A) allows for reservation in promotions to posts in the state services for SCs/STs who are underrepresented.

- Article 17 abolishes Untouchability.

- Article 46 directs the State to promote the educational and economic interests of SCs and STs, protecting them from social injustice and exploitation.

- Article 330 and Article 332 provides for reservation seats in Lok Sabha and state legislative assemblies respectively for SCs and STs.

- Article 335 ensures that while making appointments to government services, the claims of SCs and STs are considered without compromising administrative efficiency.

- Part IX (Panchayats) and Part IXA (Municipalities) provide for reservations for SCs and STs in local governance bodies.

- Article 243D(4): This provision mandates the reservation of seats for SCs in Panchayats (local self-government institutions) in proportion to their population in the area.

- Article 243T(4): This provision ensures the reservation of seats for SCs in Municipalities (urban local bodies) in proportion to their population in the area.

|

Drishti Mains Question: What are the constitutional safeguards and schemes available for the socio-economic upliftment of Scheduled Castes, Scheduled Tribes and Other Backward Classes in India? |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q1. If a particular area is brought under the Fifth Schedule of the Constitution of India, which one of the following statements best reflects the consequence of it? (2022)

(a) This would prevent the transfer of land of tribal people to non-tribal people.

(b) This would create a local self-governing body in that area.

(c) This would convert that area into a Union Territory.

(d) The State having such areas would be declared a Special Category State.

Ans: (a)

Q2. Under which Schedule of the Constitution of India can the transfer of tribal land to private parties for mining be declared null and void? (2019)

(a) Third Schedule

(b) Fifth Schedule

(c) Ninth Schedule

(d) Twelfth Schedule

Ans: (b)

Mains:

Q. Whether the National Commission for Scheduled Castes (NCSC) can enforce the implementation of constitutional reservation for the Scheduled Castes in the religious minority institutions? Examine. (2018)

Q. In 2001, RGI stated that Dalits who converted to Islam or Christianity are not a single ethnic group as they belong to different caste groups. Therefore, they cannot be included in the list of Scheduled Castes (SC) as per Clause (2) of Article 341, which requires a single ethnic group for inclusion. (2014)

India's Space Launch Vehicle Supply and Demand Challenges

For Prelims: Indian Space Research Organisation, ISRO’s launch vehicle, SpaceX’s Falcon 9, geostationary transfer orbit

For Mains: Space Technology, India’s space launch services, Market for satellite-based services

Why in News?

Recently, the Chairman of the Indian Space Research Organisation (ISRO), stated that ISRO’s launch vehicle capability was three times the demand.

- This statement has sparked discussions among experts regarding the challenges facing India's space launch sector, as it appears to be struggling to create sufficient demand for its services.

What is India's Current Launch Vehicle Landscape?

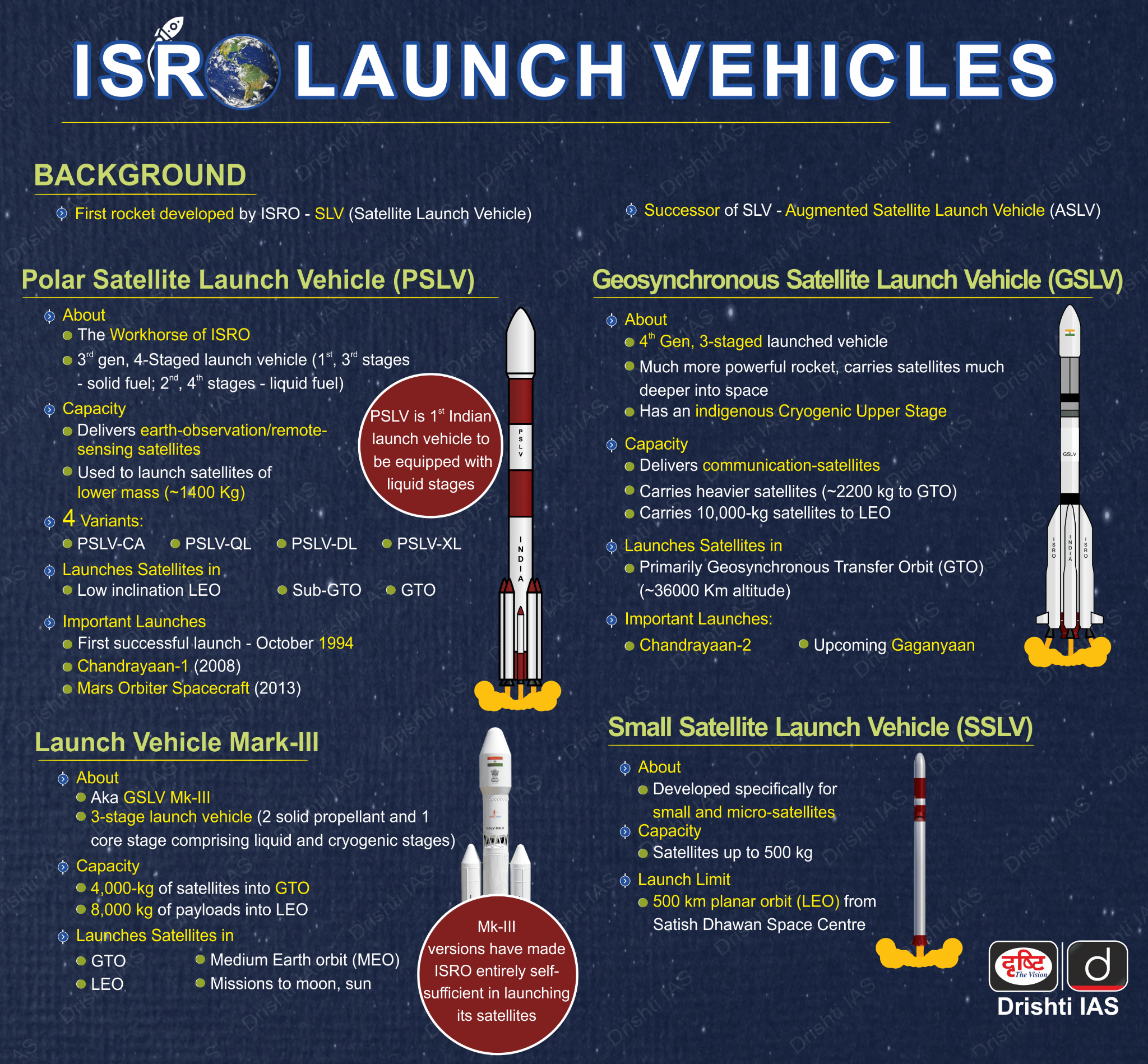

- Current Launch Vehicles:

- Small Satellite Launch Vehicle (SSLV): Designed for launching small payloads.

- Polar Satellite Launch Vehicle (PSLV): Versatile for launching Earth Observation, Geo-stationary, and Navigation payloads.

- Known for its high success rate; considered the workhorse of ISRO.

- Geosynchronous Satellite Launch Vehicle (GSLV): Used for heavier payloads, particularly communication satellites weighing up to 2 tonnes.

- Launch Vehicle Mark-III (LVM-3): Capable of launching payloads up to 4-tonne class communication satellites and 10-tonne class payloads to Low Earth Orbits (LEOs).

- Limitations of Current Launch Vehicles:

-

Low Payload Capacity: India’s LVM-3 has less than one-third the capacity of China’s Long March 5. India’s current vehicles face limitations for more ambitious missions like Chandrayaan 4, necessitating upgrades and new vehicle developments.

- The country currently has a fleet of satellites for various applications such as communications, remote sensing, positioning, navigation and timing (PNT), meteorology, disaster management, space-based internet, scientific missions, and experimental missions. Additionally, it requires launch vehicles for upcoming space missions.

-

- Future Upgrades Needed: ISRO plans to upgrade the LVM-3 with a semi-cryogenic engine to increase its payload capacity to six tonnes to geostationary transfer orbit (GTO).

-

They also intend to develop a new launch vehicle called the Next Generation Launch Vehicle (NGLV), or Project Soorya, to carry 10 tonnes to GTO.

-

Currently, ISRO has only submitted a funding proposal for this project.

-

Additionally, the SSLV requires one more successful flight to build confidence for commercial launches of smaller satellites.

-

- Reliance on Foreign Launch Vehicles: For heavier payloads, India relies on international providers like Ariane V and SpaceX’s Falcon 9.

Why is there a Disconnect Between Supply and Demand?

- Historical Context: Previously, ISRO operated on a supply-driven model, launching satellites first and then seeking customers. This approach shifted post-2019 to a demand-driven model, which has led to an oversupply of launch vehicles relative to actual needs.

- The transition has led to a situation where demand for satellite services needs to precede satellite construction and launch.

- Challenges in Creating Demand:

-

Economic Factors: Launch vehicles are needed for satellites, with heavier ones used for national goals like lunar exploration and smaller ones for technology demonstration.

-

Satellites have finite operational lifespans, necessitating replacements that can create additional demand for launch vehicles. However, technological advancements have extended these lifetimes, creating uncertainty in the demand for launch vehicles.

-

Launch vehicles are also improving, with the ability to deliver multiple satellites in one launch, reusable rocket stages, and efforts to replace toxic fuels with greener alternatives.

-

ISRO is also investing in reusable rocket technology, which can reduce costs and improve profitability in the long term.

-

-

- Market Saturation: In some sectors, like internet services, existing options (e.g., affordable fibre and mobile internet) may overshadow the perceived need for space-based solutions. This reduces the urgency in developing satellite capabilities.

- Dependency on Government Initiatives: The Indian government wants the private sector to stimulate demand, build and launch satellites, provide customer services, generate revenue from launch services, and upskill workers.

- Private companies prefer the government to be their customer and to provide reliable regulations, aiming for a long-term source of revenue.

- Without proactive government initiatives to educate and stimulate demand among potential users, the gap between supply and demand is likely to persist.

-

Way Forward

- Educating Stakeholders: The key to creating demand is educating potential users (government entities, industries, and even ordinary citizens) about the benefits and applications of satellite services.

- The responsibility lies in both ISRO and the private sector to foster awareness and create a market for satellite-based services.

- Complex Customer Base: The demand for satellite services must be cultivated across diverse sectors, including agriculture, finance, and defence. Each sector has unique requirements and levels of awareness, complicating demand generation efforts.

- Cost-Effectiveness: Maintain India's edge as a cost-competitive launch service provider, attracting global customers seeking affordable access to space.

- Maintain ISRO's proven record of successful launches, fostering trust and confidence among potential clients.

- Government Push: The government can support private space ventures by providing seed funding, offering guaranteed launch slots for satellites, and increasing public awareness of the benefits of space-based applications.

- Collaboration: Foster collaboration with other space agencies for joint missions, technology exchange, and knowledge sharing. Encourage increased private sector involvement in satellite development and launch by creating a supportive regulatory environment.

Read more: Space Missions in 2024

|

Drishti Mains Question: Q. Discuss the current challenges facing India's space launch sector and suggest measures to bridge the gap between supply and demand. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. With reference to India’s satellite launch vehicles, consider the following statements: (2018)

- PSLVs launch the satellites useful for Earth resources monitoring whereas GSLVs are designed mainly to launch communication satellites.

- Satellites launched by PSLV appear to remain permanently fixed in the same position in the sky, as viewed from a particular location on Earth.

- GSLV Mk III is a four-staged launch vehicle with the first and third stages using solid rocket motors, and the second and fourth stages using liquid rocket engines.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3

(c) 1 and 2

(d) 3 only

Ans: (a)

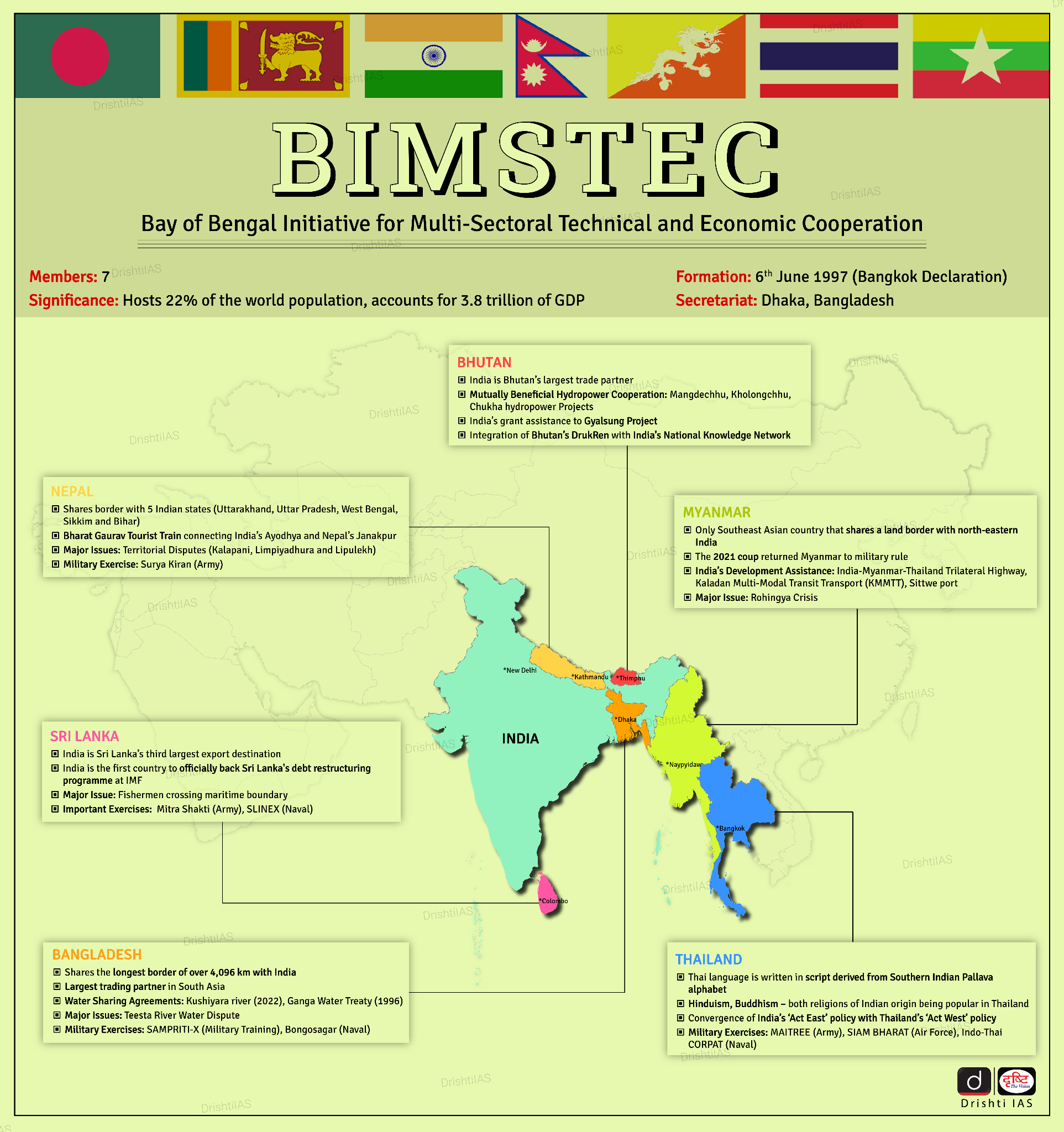

2nd Retreat of the Foreign Ministers of the BIMSTEC

Why in News?

The 2nd Retreat of the Foreign Ministers of the Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) was held in New Delhi, taking on added significance amid escalating tensions and major developments in Myanmar.

- External Affairs Minister of India emphasised the need for BIMSTEC to address regional challenges internally, especially in light of recent setbacks faced by Myanmar’s military junta against various Ethnic Armed Organisations (EAOs).

Note: This retreat is the first major event since the BIMSTEC Charter came into effect in 2024, marking a significant milestone in the organisation’s evolution. The 1st edition of the BIMSTEC Foreign Ministers' Retreat was held in Bangkok, Thailand in 2023.

What are the Key Highlights of the BIMSTEC Foreign Ministers’ Retreat?

- Global and Regional Developments: The meeting underscored the urgency of addressing long-standing goals like capacity building and economic cooperation due to current global and regional challenges.

- Myanmar Crisis: Discussions centred on the impact of the Myanmar crisis on regional stability and developmental projects. The instability in Myanmar is a major concern for BIMSTEC as it has affected various developmental and connectivity projects aimed at strengthening ties among Nepal, Bhutan, India, Bangladesh, Myanmar, and Thailand.

- Humanitarian Assistance Discussions: Conversations included the potential for humanitarian aid, though India’s current assistance has been limited to displaced populations and military personnel who have taken refuge in Mizoram.

- India Stance on Myanmar Crisis: India maintains a cautious stance, particularly since Ethnic Armed Organizations (EAOs) have gained control over crucial trade routes and territories near international borders.

- India continues to cooperate on countering transnational crimes such as cybercrime, narcotics, and illegal arms.

Myanmar Crisis

Myanmar's military (the Tatmadaw) junta, overthrew the democratically elected government in February 2021. This led to widespread protests and a civil disobedience movement demanding the restoration of democracy.

- In response to the junta’s crackdown, opposition groups, including Ethnic Armed Organizations (EAOs), formed the People's Defence Forces (PDFs) to resist military rule, aligning with the National Unity Government (NUG) established by ousted lawmakers. Since October 2023, fighting between the military and armed opposition groups has intensified, causing widespread displacement and humanitarian crisis.

- Almost 2.6 million people have fled their homes, and 18.6 million people, roughly 1/3 of the total population, need humanitarian assistance. Inflation and conflict have driven up the price of food and other basic necessities, leading to hunger and potential illness for 1/4 of the population.

- India maintains a balanced stance, expressing concern over the disruption of democracy while engaging with the junta to safeguard its interests. Notably, anti-junta forces have captured strategic towns near the India-Myanmar border, impacting crucial connectivity projects like the India-Myanmar-Thailand trilateral highway.

Read more: BIMSTEC Charter

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following pairs: (2016)

| Community sometimes mentioned in the news | In the affairs of | |

| 1. | Kurd | Bangladesh |

| 2. | Madhesi | Nepal |

| 3. | Rohingya | Myanmar |

Which of the pairs given above is/are correctly matched?

(a) 1 and 2

(b) 2 only

(c) 2 and 3

(d) 3 only

Ans- (c)

Forest Advisory Committee (FAC)

Why in News?

Recently, the Forest Advisory Committee (FAC) of the Ministry of Environment Forest and Climate Change reprimanded the Odisha government for building walls, without approval, in forest land that will be part of the proposed Shree Jagannath International Airport in Puri.

What is the Forest Advisory Committee (FAC)?

- About:

-

It is a statutory body which was constituted by the Forest (Conservation) Act 1980.

- It comes under the Ministry of Environment, Forests & Climate Change (MoEF&CC).

- The FAC evaluates industrial projects which require forest land for their activities.

- The committee may or may not approve a project and can give an approval for forest land to be diverted, after imposing certain conditions.

- In the recent case, satellite pictures showed that the agency tasked with the project had already built a wall without waiting for approval by the FAC.

-

What is the Forest Conservation Act, 1980?

- About: The Forest Conservation Act of 1980 was enacted to streamline forest-related laws, regulate deforestation, oversee the transportation of forest products, and levy duties on timber and other forest produce.

- Under the provisions of this Act, prior approval of the Central Government is required for diversion of forest land for non-forest purposes.

- It primarily applied to forest lands recognized by the Indian Forest Act, 1927, or State records since 1980.

- Under the provisions of this Act, prior approval of the Central Government is required for diversion of forest land for non-forest purposes.

- Supreme Court’s Interpretation: The Godavarman judgement, 1996 by the Supreme Court mandated the protection of forests regardless of classification or ownership.

- This introduced the concept of deemed forests or forest-like tracts referring to areas resembling forests but not officially classified as such in government or revenue records.

- Concern Regarding Varying Definitions of Forests: States in India interpret 'forests' differently based on surveys and expert reports, leading to diverse definitions.

- For example, Chhattisgarh and Madhya Pradesh base their definitions on size, tree density, and natural growth, while Goa relies on forest species coverage.

- Varying definitions result in estimates of deemed forest ranging from 1% to 28% of India's official forest area.

- Recent Amendment to Forest Conservation Act:

- The recent Forest (Conservation) Amendment Act, 2023 aimed to bring clarity and address concerns surrounding deemed forests.

- It focused on defining the scope of forest land under the Act's purview, exempting certain categories of land from its provisions.

- It exempts up to 0.10 hectares of forest land for connectivity purposes along roads and railways, up to 10 hectares for security-related infrastructure, and up to 5 hectares in Left Wing Extremism Affected Districts for public utility projects.

- It focused on defining the scope of forest land under the Act's purview, exempting certain categories of land from its provisions.

- However, the Supreme Court's interim directive maintains the traditional approach to forest governance, unaffected by the recent amendment enacted by the Centre.

- Also, the Supreme Court ruled that the creation of zoos or safaris by any government or authority must receive final approval from the court.

- The recent Forest (Conservation) Amendment Act, 2023 aimed to bring clarity and address concerns surrounding deemed forests.

Initiatives for Forest Conservation

Read More: Environment vs. Development - An Ethical Debate

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Consider the following statements: (2023)

Once the Central Government notifies an area as a 'Community Reserve'

- the Chief Wildlife Warden of the State becomes the governing authority of such forest

- hunting is not allowed in such area

- people of such area are allowed to collect non-timber forest produce

- people of such area are allowed traditional agricultural practices

How many of the above statements are correct?

(a) Only one

(b) Only two

(c) Only three

(d) All four

Ans: (b)

Q. The "Miyawaki method" is well known for the: (2022)

(a) Promotion of commercial farming in arid and semi-arid areas

(b) Development of gardens using genetically modified flora

(c) Creation of mini forests in urban areas

(d) Harvesting wind energy on coastal areas and on sea surfaces

Ans: (c)

Q. On which one of the following rivers is the Tehri Hydropower Complex located? (2008)

(a) Alaknanda

(b) Bhagirathi

(c) Dhauliganga

(d) Mandakini

Ans: (b)

Q. Where are Tapovan and Vishnugarh Hydroelectric Projects located? (2008)

(a) Madhya Pradesh

(b) Uttar Pradesh

(c) Uttarakhand

(d) Rajasthan

Ans: (c)

States Oppose PM-SHRI

As per a report published by Indian Express, The Education Ministry has stopped funds under the Samagra Shiksha Abhiyan (SSA), to Delhi, Punjab and West Bengal because of their reluctance to participate in the Pradhan Mantri Schools for Rising India (PM-SHRI) scheme.

- The scheme includes a provision for establishing over 14,500 PM SHRI Schools (PM Schools for Rising India) by enhancing existing schools managed by the Central government, State/UT governments, and local bodies to showcase the implementation of the National Education Policy (NEP) 2020.

- The Centre will cover 60% of the financial burden and states will cover 40% and the States must confirm their participation by signing a Memorandum of Understanding (MoU) with the Education Ministry.

- Five states - Tamil Nadu, Kerala, Delhi, Punjab, and West Bengal have not signed the MoU.

- Tamil Nadu and Kerala have shown willingness, while Delhi, Punjab, and West Bengal have refused, leading to the Centre stopping their SSA funds.

- Samagra Shiksha is an integrated scheme for school education extending from pre-school to class XII to ensure inclusive and equitable quality education at all levels of school education.

- It subsumes the three Schemes of Sarva Shiksha Abhiyan (SSA), Rashtriya Madhyamik Shiksha Abhiyan (RMSA) and Teacher Education (TE).

- The main emphasis of the Scheme is on improving the quality of school education by focussing on the two T’s – Teacher and Technology.

- It subsumes the three Schemes of Sarva Shiksha Abhiyan (SSA), Rashtriya Madhyamik Shiksha Abhiyan (RMSA) and Teacher Education (TE).

Read More: PM SHRI Schools

Public Sector Lenders Raise MCLR

Public sector lenders like State Bank of India and Bank of Baroda have raised their Marginal Cost of funds based Lending Rates (MCLR). This will lead to higher Equated Monthly Instalments (EMIs) for borrowers.

- The Marginal Cost of Fund based Lending Rate refers to the minimum interest rate a bank must charge for lending. The bank cannot grant any loan below that rate, except in certain cases permitted by the Reserve Bank of India (RBI).

- MCLR is an "internal benchmark" which varies from bank to bank. It is calculated based on the marginal cost of funds.

- Main components of MCLR:

- Marginal cost of funds

- Negative carry on account of CRR

- Operating costs

- Tenor premium

- If the cost of funds goes up, the MCLR increases, and the loans linked to any MCLR tenor get more expensive. Similarly, if the MCLR comes down, loans get cheaper.

- In 2019, the Reserve Bank of India (RBI) introduced the External Benchmark Based Lending Rate (EBLR), to replace the MCLR regime.

- Consequently, all retail loans and floating-rate loans to Micro, Small, and Medium Enterprises (MSMEs) are now linked to the EBLR.

Read More: External Benchmarks Lending Rate

World Day for International Justice

Every year on 17th July, the World Day for International Justice is observed to promote international criminal justice and honour the fight against impunity for serious crimes affecting the global community.

- Historical Significance: Originated on 17th July 1998, with the adoption of the Rome Statute, establishing the International Criminal Court (ICC).

- The ICC is not part of the United Nations system and has a separate agreement governing its relationship with the UN. Currently, 124 countries are States Parties to the Rome Statute of the ICC, India is not a party to the Rome Statute/ICC.

- The ICC is the first permanent international court and has jurisdiction over crimes under international law including genocide, war crimes, crimes against humanity and crimes of aggression committed on or after 1st July 2002.

- The Rome Statute marks a significant step in the fight against impunity for grave crimes, ensuring accountability for perpetrators.

- The day raises awareness about international justice mechanisms and their role in addressing impunity, and promoting global peace and security.

Read more: International Criminal Court (ICC)

Project PARI

Recently, the Ministry of Culture initiated Project PARI (Public Art of India) during the 46th Session of the World Heritage Committee Meeting in New Delhi.

- It aims to bring forth public art that draws inspiration from India's artistic heritage (lok kala/lok sanskriti) while incorporating modern themes and techniques.

- Over 150 visual artists from across the country will create various artworks including wall paintings, murals, sculptures, and installations for the beautification of public spaces in Delhi.

- The sculptures will pay tribute to nature, ideas from the Natyashastra, Gandhi, toys of India, ancient knowledge, Naad or Primeval Sound, Harmony of life, and the Kalpataru (divine tree).

World Heritage Committee (WHC):

- It decides on the inscription of new sites into the UNESCO World Heritage List.

- India will be hosting the meeting for the first time in July 2024.

- India has 42 UNESCO World Heritage Sites, with the ‘Sacred Ensembles of the Hoysala’ added recently. These include 34 (cultural sites), 7 (natural) and 1 (mixed).

Read More: World Heritage Sites in India