Indian Economy

Concerns Over Cess and Surcharges in India

For Prelims: 16th Finance Commission, cess, surcharge, income tax, Consolidated Fund of India, Goods and Services Tax, Divisible Pool of Taxes, State List

For Mains: Indian Taxation System, Fiscal Federalism, Challenges in Government Revenue Collection

Why in News?

Arvind Panagariya, Chairman of the 16th Finance Commission, recently called the issue of the Centre's increasing reliance on cesses and surcharges a "complicated issue."

What are Cess and Surcharges?

- Cess: A cess is a form of tax that is levied for a specific purpose. It is a tax on tax, imposed in addition to an existing tax like excise or income tax, and the revenue is earmarked for a particular use.

- Cesses are typically charged for a specific time period, or until the government has gathered enough funds for the designated purpose.

- The 80th Amendment formally amended Article 270, explicitly excluding cesses and surcharges from the divisible pool (revenue from cesses is not shared with states).

- Cesses are recognized in the Constitution under Article 277 and Article 270 (which outlines the revenue-sharing framework between the Union and States).

- Examples: Education Cess (for financing primary education), Swachh Bharat Cess (for cleanliness initiatives), and Fuel Cess (for road development).

- Surcharge: A surcharge is an additional tax or levy imposed on existing duties or taxes. It is essentially a "tax on tax" and is discussed under Articles 270 and 271 of the Indian Constitution.

- Surcharges are often applied to individuals, companies, and other taxpayers who fall within income brackets. The rate of surcharge can vary based on income level.

- They are designed to be progressive, ensuring that higher earners contribute more, promoting social equity and addressing income disparity.

- Surcharge increases the total tax liability of individuals or entities who are already subject to tax, particularly higher-income earners or certain sectors.

- The funds collected from surcharges go into the government’s general fund and can be used for a variety of purposes, such as financing infrastructure projects, social welfare programs, and other governmental activities.

- 13th and 14th Finance Commissions upheld exclusion of surcharges from the divisible pool; recommended reducing Centre's reliance on these levies.

- Surcharges are often applied to individuals, companies, and other taxpayers who fall within income brackets. The rate of surcharge can vary based on income level.

- Cess vs. Surcharge: Cess and surcharge both go to the Consolidated Fund of India (CFI) but differ in usage. Surcharge is spent like other taxes, while cess must be allocated separately and used only for its specific purpose.

What are the Concerns Regarding Cess and Surcharges?

- Centre's Fiscal Constraints: The increase in the share of states in the divisible tax pool from 32% under the 13th Finance Commission to 42% under the 14th and 41% under the 15th Finance Commission has reduced the Centre's fiscal space.

- To counterbalance this, the Centre increasingly relies on cesses and surcharges, which are not shared with the States.

- Originally envisioned as a temporary measure, surcharges and cesses have become a permanent fixture in India’s tax system, which has raised concerns about their long-term impact on fiscal federalism.

- State Concerns: Cesses and surcharges increased from 10.4% in 2011-12 to 20% in 2021-22. This trend effectively shrinks the pool of taxes that are shared with States, limiting their fiscal flexibility and undermining the spirit of fiscal federalism.

- States have consistently demanded a cap on cesses and surcharges, and the inclusion of any excess collections into the divisible pool to ensure fairer revenue distribution.

- This issue underscores the challenge of balancing power and financial autonomy between the Centre and States, potentially impacting states' ability to fund critical programs and achieve developmental goals.

- Lack of Transparency and Vagueness: Since cesses are collected for specific purposes, they reduce transparency in the allocation and distribution of tax revenues.

- States argue that this method of taxation bypasses the principles of equitable revenue sharing.

- Many cesses, like the Swachh Bharat and Krishi Kalyan Cess, are broadly defined. They aren't subject to the same parliamentary oversight as general taxes.

- There are discrepancies in how cess proceeds are used. For example, the Research and Development Cess was partly used to finance the Union’s revenue deficit rather than its intended purpose.

- Inequitable Taxation: Cesses and surcharges tend to disproportionately affect the wealthier segments of society, as they are the primary contributors.

- Critics argue that this creates fairness issues and may drive wealthy individuals and businesses to relocate to more tax-friendly countries.

What is the Divisible Pool of Taxes?

- About: The Divisible Pool of Taxes refers to the portion of the total tax revenue collected by the Union government that is shared with the States in India.

- It is a key component of fiscal federalism, ensuring that both the Centre and the States have access to resources for their respective functions.

- Key Features:

- Taxes: The divisible pool includes taxes that are collected by the Union government such as Corporation Tax, Personal Income Tax, Central and Goods and Services Tax (GST).

- Finance Commission: The distribution of the divisible pool is based on the recommendations of the Finance Commission, which is constituted every five years.

- The Commission suggests the percentage share for both the Union and the States.

- The 15th Finance Commission recommended that states receive 41% of the divisible pool of central taxes for the period 2021–2026

- Vertical and Horizontal Devolution:

- Vertical Devolution: Refers to the proportion of the divisible pool allocated between the Union and the States.

- Horizontal Devolution: Refers to how the States' share of the divisible pool is distributed among the individual States, based on factors such as population, income disparity, and tax efforts.

- Exclusion of Cesses and Surcharges: Cesses and surcharges levied by the Union are excluded from the divisible pool.

International Practices on Cess and Surcharges

- Surcharges:

- Germany: The solidarity surcharge was introduced in 1991 to fund German reunification and Gulf War expenses. Initially temporary, it was reintroduced in 1995 and continues today.

- France: Surcharges are imposed temporarily to address fiscal challenges.

- Cess Taxes:

- United States: States like Alabama earmark substantial tax revenue for specific purposes.

- Australia: Medicare Levy (introduced in 1984) is a personal income tax to fund Medicare. Other temporary taxes, like the gun buyback and Ansett ticket levies, have been short-lived and contribute minimally to total revenue.

- Australia's constitutional structure limits consistent use of earmarked taxes.

What Can be Done to Address Concerns Regarding Cess and Surcharges?

- For Cesses:

- Imposition: The Union Government should refrain from levying cesses for issues under the State List, such as health and education, as it undermines federal principles.

- Set a ceiling on cess collection and avoid exceeding it.

- Transparency: Ensure clear allocation of funds and transparency in cess collection. A structured, periodic review process should be instituted to evaluate the effectiveness and necessity of cesses.

- If misuse occurs, shift cess funds to a general tax, allowing states a share based on Finance Commission recommendations.

- Abolition: Cesses that generate very minimal revenue can be abolished, as they are economically inefficient and add to tax complexity.

- Impose cesses for a maximum of 5 years, with one possible extension, after which they should be abolished. Include sunset clauses in cess legislation to limit indefinite continuation.

- Imposition: The Union Government should refrain from levying cesses for issues under the State List, such as health and education, as it undermines federal principles.

- For Surcharges:

- Rationalization of Income Tax: Surcharges often act as a proxy for progressive income tax. This can be addressed by rationalizing the income tax structure itself, rather than adding surcharges, especially on higher income slabs.

- Temporary Nature of Surcharges: Surcharges can be made temporary, used only during financial distress, with sunset clauses to prevent their perpetual use and become permanent tax instruments.

Conclusion

The reliance on cesses and surcharges in India has raised efficiency, and transparency concerns. Clear guidelines, periodic reviews, are needed to limit their use and prevent permanence. Surcharges should be used only in exceptional circumstances. Accountability must be enhanced to ensure they serve their intended purposes.

|

Drishti Mains Question: Discuss the increasing reliance on cesses and surcharges by the Centre and its implications for fiscal federalism in India. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following: (2023)

- Demographic performance

- Forest and ecology

- Governance reforms

- Stable government

- Tax and fiscal efforts

For the horizontal tax devolution, the Fifteenth Finance Commission used how many of the above as criteria other than population area and income distance?

(a) Only two

(b) Only three

(c) Only four

(d) All five

Ans: (b)

Mains

Q. Discuss the recommendations of the 13th Finance Commission which have been a departure from the previous commissions for strengthening the local government finances. (2013)

Q. What is the meaning of the term ‘tax expenditure’? Taking the housing sector as an example, discuss how it influences the budgetary policies of the government. (2013)

Indian Polity

Impeachment Process and Judicial Accountability in India

Prelims: Article 124(4), Article 218, Judges Inquiry Act 1968, Bangalore Principles of Judicial Conduct 2002, Restatement of Values of Judicial Life 1997, Supreme Court, High Court, Parliament

Mains: Judicial Accountability in India, Ethical Standards for Judges, Independence of Judiciary and Accountability

Why in News?

Recently, an impeachment motion is being considered against a sitting judge of the Allahabad High Court following his controversial remarks at an event organized by a religious organisation. The remarks, deemed by many as communally charged, have raised concerns about judicial propriety and impartiality.

What is the Impeachment Process for Judges in India?

- About:

- Impeachment, though not explicitly mentioned in the Constitution, refers colloquially to the process by which a judge can be removed from office by Parliament.

- The impeachment process for judges in India serves as a crucial mechanism to uphold judicial accountability while preserving the independence of the judiciary.

- Constitutional Safeguards and Grounds for Impeachment:

- Article 124(4): The article outlines the removal process for Supreme Court judges, which is applicable to High Court judges as per Article 218. The grounds for impeachment are explicitly limited to “proved misbehaviour” and “incapacity”.

- Proved Misbehavior: Actions or conduct by a judge that breaches the ethical and professional standards of the judiciary.

- Incapacity: A judge's inability to perform judicial duties due to physical or mental infirmity.

- Article 124(4): The article outlines the removal process for Supreme Court judges, which is applicable to High Court judges as per Article 218. The grounds for impeachment are explicitly limited to “proved misbehaviour” and “incapacity”.

- Steps in the Impeachment Process:

- Initiation of Motion:

- A motion for impeachment must be supported by at least 100 members in the Lok Sabha or 50 members in the Rajya Sabha.

- The Speaker or Chairman may review relevant materials and consult individuals before deciding whether to admit or reject the motion.

- For example in 2018, the motion against Chief Justice Dipak Misra was rejected after due consideration.

- This ensures that the process cannot be initiated casually or without significant support from elected representatives.

- Formation of an Inquiry Committee:

- Upon admission of the motion, the Speaker of the Lok Sabha or the Chairman of the Rajya Sabha constitutes a three-member committee comprising:

- The Chief Justice of India or a Supreme Court judge.

- The Chief Justice of a High Court.

- A distinguished jurist.

- The committee conducts a thorough inquiry into the allegations, gathering evidence and examining witnesses to determine the validity of the charges.

- Upon admission of the motion, the Speaker of the Lok Sabha or the Chairman of the Rajya Sabha constitutes a three-member committee comprising:

- Committee Report and Parliamentary Debate:

- The committee submits its findings to the presiding officer of the House where the motion was introduced. If the judge is found guilty of the alleged misconduct or incapacity, the report is debated in Parliament.

- Both Houses of Parliament must approve the motion with a special majority, requiring:

- A majority of the total membership of the House.

- At least two-thirds of the members present and vote.

- Final Removal by the President:

- Once the motion is adopted in both Houses it shall be presented to the President in the same session in which the motion has been adopted.

- Initiation of Motion:

- Checks and Balances:

- High Thresholds for Impeachment: The stringent requirements for initiating and approving an impeachment motion protect against misuse of the process.

- Objective Inquiry by Experts: The inclusion of judicial and legal experts in the inquiry committee ensures a fair and impartial investigation.

- Parliamentary Oversight: By involving both Houses of Parliament, the process ensures accountability through democratic scrutiny.

- Instances of Impeachment Attempts:

- India has witnessed a few attempts at impeachment, with notable cases like those of Justice V. Ramaswami (1993) and Justice Soumitra Sen (2011).

- While none have resulted in a complete removal, these instances highlight the process's rigor and its role in upholding accountability.

- India has witnessed a few attempts at impeachment, with notable cases like those of Justice V. Ramaswami (1993) and Justice Soumitra Sen (2011).

What Guidelines Regulate Judges’ Public Statements?

- Freedom of Expression with Responsibility: Judges, like all citizens, are entitled to freedom of speech and expression under Article 19(1)(a) of the Constitution. However, this right is subject to reasonable restrictions to maintain public order, morality, and the integrity of their office.

- Public statements by judges must be measured and avoid any hint of bias or partiality, ensuring that they uphold the dignity of their judicial office.

- Bangalore Principles of Judicial Conduct (2002)

- Restatement of Values of Judicial Life (1997)

- In-House Mechanisms for Judicial Conduct: The judiciary has internal protocols to address instances where judges’ public statements may be seen as inappropriate or controversial.

- Specific Guidelines on Judicial Restraint:

- Non-Interference in Political Matters: Judges are expected to abstain from commenting on political events or policies to avoid being perceived as partisan.

- Refraining from Prejudging Cases: Judges must avoid making statements about ongoing cases or legal issues that could be interpreted as prejudgment or bias.

- No Participation in Controversial Events: Judges should avoid participating in events or forums that could appear to compromise their independence or align them with a specific ideology or group.

- Supreme Court Observations:

- In Justice C.S. Karnan’s case (2017), the court highlighted the damage caused by a judge’s public statements undermining the judiciary’s integrity.

- Challenges in Implementation Guidelines:

- Lack of Codified Rules: Some aspects of judicial behavior, such as public statements, rely on conventions rather than statutory regulations.

- Gray Areas in Freedom of Speech: Balancing a judge’s right to free expression with their responsibility to maintain judicial propriety is often subjective.

How can the Judiciary Uphold Impartiality in a Diverse Society?

- Adherence to Constitutional Values: The Constitution enshrines principles of equality, justice, and secularism, which serve as the judiciary's guiding framework.

- Judges must interpret and apply these principles without prejudice or favor.

- Ensuring Representation in the Judiciary:

- Inclusive Recruitment: Ensuring that judges from varied backgrounds, including underrepresented communities, are appointed to the bench.

- Gender Balance: Encouraging greater representation of women in the judiciary to address gender biases in legal interpretation.

- Awareness of Marginalized Groups: Judges must be trained to recognize the challenges faced by minorities and marginalized communities.

- Education and Sensitisation of Judges:

- Training on Diversity and Equality: Judicial academies should regularly conduct programs on cultural competence, implicit bias, and sensitivity towards social diversity.

- Awareness of Historical Disparities: Judges must understand the systemic inequities that exist within society and how these affect individuals’ access to justice.

- Objective Decision-Making:

- Judicial decisions must be based solely on facts, evidence, and applicable laws, without being influenced by the identities of the parties involved.

- Judges must provide well-reasoned judgments that demonstrate their neutrality and adherence to the rule of law.

- Addressing Systemic Biases in the Judiciary:

- Review of Precedents: Courts should critically examine past judgments to identify and address instances where biases may have influenced decisions.

- Equitable Interpretation of Laws: Judges must ensure that laws are applied in a manner that promotes equality and justice, particularly for disadvantaged groups.

- Proactive Measures to Protect Vulnerable Groups:

- Social Justice Bench: Special benches, such as the one established by the Supreme Court in 2014, focus on addressing issues affecting marginalized communities.

- Legal Aid and Pro Bono Services: Ensuring legal assistance for economically weaker sections enhances inclusivity and impartiality.

- The Role of Civil Society and Media:

- An informed civil society and vigilant media can act as watchdogs, ensuring that judicial impartiality is maintained.

- Constructive criticism and scrutiny of judicial actions help reinforce accountability without compromising independence.

Conclusion

Maintaining impartiality and public trust is vital for the judiciary in a diverse democracy like India. Instances of controversial conduct underscore the need for balancing judicial accountability with independence. Robust impeachment mechanisms, adherence to constitutional values, and proactive measures like training and inclusive representation are essential to uphold the judiciary's integrity and reinforce its role as a guardian of justice and equality.

|

Drishti Mains Question: Judicial accountability is essential to uphold the credibility and impartiality of the judiciary, especially in a diverse society like India. Comment. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q1. Explain the reasons for the growth of public interest litigation in India. As a result, has the Indian Supreme Court emerged as the world's most powerful judiciary? (2024)

Q2. Discuss the desirability of greater representation to women in the higher judiciary to ensure diversity, equity and inclusiveness. (2021)

Q3. Critically examine the Supreme Court’s judgement on ‘National Judicial Appointments Commission Act, 2014’ with reference to appointment of judges of higher judiciary in India. (2017)

Indian Economy

Dispute Between Government and RBI

For Prelims: Reserve Bank of India (RBI), RBI Governor, Repo Rate, Reverse Repo Rate, CRR

For Mains: Working of RBI, Key Reasons for Tussle between RBI and Central Government

Why in News?

Recently, the tenure of Reserve Bank of India (RBI) Governor Shaktikanta Das concluded in December 2024, characterized by some friction with the government towards the end of his second term.

- The disagreement between the RBI and the government arose from the central bank's decision to refrain from cutting policy rates, despite the economic slowdown and the government's appeal for steps to boost GDP growth.

Note: The Appointments Committee of the Cabinet has approved the appointment of 56-year-old Sanjay Malhotra, currently serving as Revenue Secretary in the Finance Ministry, as the 26th Governor of the Reserve Bank of India.

What are the Key Issues Between RBI and the Central Government?

- Easing Norms of Prompt Corrective Action (PCA): The government urged RBI to exempt power companies and ease lending rules under PCA to boost credit for MSMEs, but the RBI has often opposed such measures.

- Arguing that relaxing norms under PCA could undermine the efforts to address the Non-Performing Asset (NPA) crisis, which had become a significant challenge for the Indian banking system.

- Section 7 of RBI Act, 1934: The government, under Section 7 of the RBI Act, can direct the RBI in public interest, but its rare invocation has raised concerns about undermining RBI's autonomy.

- While the government prioritizes short-term growth through measures like lowering interest rates, the RBI focuses on inflation control, price stability, and long-term financial stability, leading to occasional policy tensions.

- RBI Surpluses: RBI earns income from bonds and retains part of the surplus for buffers like the Contingency Fund and Asset Reserve.

- It is seen that the government often demands higher dividends, arguing excess reserves, while the RBI warns of inflation risks and threats to macroeconomic stability.

- Surpluses also act as a safeguard against currency value fluctuations and gold depreciation.

- Regulatory Authority and Institutional Turf: The creation of bodies like the Financial Stability and Development Council (FSDC) has raised concerns within the RBI about its diminishing role in financial regulation.

- Moreover, there is conflict over the issue of government influence in the appointment of key RBI officials, with the central bank expressing concerns that such interference challenges its independence.

- Issue over Forex: The RBI has resisted the government’s calls to use foreign exchange reserves for fiscal deficits or loan write-offs, fearing it could undermine financial stability and weaken the rupee, leading to disagreements on reserve management.

- RBI opposes this demand by citing risks to financial stability and the rupee's strength. Additionally, the government's push for financial inclusion and priority sector lending often conflicts with RBI’s focus on maintaining overall financial stability.

What Were the Previous Conflicts Between RBI Governors and the Government?

- RBI governor YV Reddy (2003-2008): He had differences with the then Finance Minister (FM) over rate cuts and financial market development. He opposed proposals for writing off farmer loans and using foreign exchange reserves without guarantees.

- D Subbarao (2008-2013): His tenure saw conflicts over anti-inflation policies, with government officials pushing for lower rates despite high inflation.

- Raghuram Rajan (2013-2016): He also faced challenges when the government sought to regulate money markets through the Securities and Exchange Board of India (SEBI) without consulting the RBI. He raised concerns about the potential costs and benefits of demonetization, which the government pursued without his endorsement.

- Urjit Patel (2016-2018): His tenure was marked by significant disagreements over surplus transfers and lending norms. The government invoked Section 7 of the RBI Act to engage in discussions about the RBI's policies.

- He resigned amid escalating tensions, particularly regarding the government’s attempts to access the RBI's capital reserves.

Way Forward

- Strengthening RBI-Government Dynamics: Independent oversight mechanisms can ensure merit-based appointments and shield RBI from undue political influence.

- A clear delineation of roles is essential, with the government focusing on fiscal policies and growth, while RBI prioritizes monetary policy and financial stability.

- Strengthening the RBI’s Autonomy: The government should build consensus with the RBI to implement short-term measures that compromise long-term financial stability.

- Clear legal and institutional frameworks can reinforce the RBI’s autonomy, ensuring it can carry out its mandate without external interference.

- Enhancing Transparency and Accountability: Greater transparency in decision-making by both the RBI and the government is needed to reduce misunderstandings and build mutual trust. Instances like demonetization (2016), PCA norms, surplus transfer disagreements, and monetary policy conflicts highlight the need for transparent decision-making to align RBI-government priorities and build mutual trust.

- Clear Fiscal-Monetary Policy Coordination: The government should aim for better coordination between fiscal and monetary policies, acknowledging the limits of fiscal expansion and the RBI’s concerns regarding inflation control.

- This could involve formal mechanisms for policy alignment, ensuring that both institutions work towards a common economic goal.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)? (2017)

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: A

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do? (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: B

Indian Economy

Natural Pearl Farming in India

For Prelims: Pearl Farming, Mollusks

For Mains: Government Initiatives for Natural Pearl Production in India, Challenges in Pearl Production and Way Forward

Why in News?

The Ministry of Fisheries, Animal Husbandry and Dairying in collaboration with the State Governments, Research Institutes, and other concerned agencies has taken several initiatives to promote natural pearl farming in India.

What is Pearl Farming?

- About: Pearl farming is the process of cultivating pearls within freshwater or saltwater oysters in a controlled environment.

- It involves the process of cultivating pearls by inserting an irritant (nucleus) into the body of a mollusk, which then secretes layers of nacre around it. Over time, these layers form a pearl.

- Nacre (the mother of pearl) is an organic-inorganic composite system, produced by some mollusks as an inner shell layer. The material is strong, resilient, and iridescent, and this is what the pearls are composed of.

- This scientific and commercial practice leverages the natural biological process of mollusks to produce high-quality pearls in controlled conditions.

- Mollusks are soft-bodied invertebrates that inhabit marine, freshwater, brackish waters, or land environments such as snails, octopi, oysters.

- It involves the process of cultivating pearls by inserting an irritant (nucleus) into the body of a mollusk, which then secretes layers of nacre around it. Over time, these layers form a pearl.

- Procedure: Farming practice of the freshwater pearl culture operation involves six major steps sequentially:

- Collection of mussels

- Pre-operative conditioning (keeping mussels in crowded condition in captivity)

- Implantation (Inserting nuclei or graft tissues into mussels)

- Post-operative care (antibiotic treatment)

- Pond culture (12-18 months)

- Harvesting of pearls

- Pearl Production:

- Global – China leads global pearl production, focusing on freshwater pearls, followed by Japan, Australia, Indonesia, and the Philippines.

- India – Pearl culture practices are present in Gujarat, Maharashtra, Bihar, Odisha, Kerala, Rajasthan, Jharkhand, Goa, and Tripura.

- In 2022, India was the 19th largest exporter of pearls in the world, exporting USD 3.79 million worth of pearls.

- Challenges in Pearl Farming in India:

- Limited freshwater pearl farmers and absence of an organized sector.

- Lack of standardized protocols for broodstock management, breeding, and water quality tailored to diverse agro-climatic zones.

- Scattered availability of mussel broodstock (reproductively mature adults that breed and produce more individuals) and inadequate research support.

- Poor extension networks to disseminate existing technologies.

What are the Government Initiatives for Natural Pearl Production in India?

- Pradhan Mantri Matsya Sampada Yojana (PMMSY):

- Under the PMMSY, the government has approved the establishment of bivalve cultivation units, encompassing mussels, clams, and pearls, with a total investment of Rs 461 lakh across various States and Union Territories.

- Additionally, a Standard Operating Procedure (SOP) has been circulated to guide the development of fisheries and aquaculture clusters, including specialized pearl farming clusters.

- Pearl Farming Clusters:

- Establishment of the first pearl farming cluster in Hazaribagh, Jharkhand. TRIFED (Tribal Cooperative Marketing Development Federation of India) has also inked an agreement with the Jharkhand-based Purty Agrotech for the promotion of pearl farming in tribal areas.

- Support Under Blue Revolution:

- The Department of Fisheries has included a sub-component for pearl culture in the Blue Revolution scheme for encouraging the sector.

- Training and Capacity Building:

- Training of over 1900 participants by Indian Council of Agricultural Research (ICAR) institutions on both freshwater pearl farming and marine pearl farming.

Way Forward

- To advance pearl farming in India, there is a need to enhance government support and infrastructure by strengthening subsidies, improving broodstock management, and standardizing breeding and water quality protocols.

- Establishing organized sectors and cooperatives will streamline operations and improve market linkages. Promoting research through institutions like ICAR-CIFA and building farmer capacity with innovative techniques and training programs is essential.

|

Drishti Mains Question: Discuss the potential of pearl farming as a sustainable livelihood option in India. Highlight the challenges faced by the sector and suggest measures to overcome them. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which one of the following is a filter feeder? (2021)

(a) Catfish

(b) Octopus

(c) Oyster

(d) Pelican

Ans: (c)

Q. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes? (2020)

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Post-harvest expenses

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Important Facts For Prelims

Birth Anniversary of C. Rajagopalachari

Why in News?

The Prime Minister of India, paid tribute to Shri Chakravarti Rajagopalachari (popularly known as Rajaji) on his birth anniversary (10th December), remembering his invaluable contributions to India’s freedom struggle, governance, and social empowerment.

Who Was C. Rajagopalachari?

- Early Life and Education: C. Rajagopalachari was born on 10th December 1878 in Salem, Madras Province (now Tamil Nadu). Became a Bachelor of Law in 1899 and began his legal practice in Salem.

- Politics and Social Reforms: Rajagopalachari was deeply affected by Lord Curzon’s decision to partition Bengal on communal lines and was inspired by Lokmanya Bal Gangadhar Tilak’s call for complete independence.

- Joined the Indian National Congress (INC) and actively participated in India’s freedom struggle.

- In 1917, Rajagopalachari became Chairman of Salem Municipality, focused on social welfare of backward classes, and in 1925, he established an Ashram in Madras Province for social upliftment.

- The Ashram published two magazines, Vimochanam (Tamil) and Prohibition (English).

- Freedom Struggle: During the anti-Rowlatt agitation, Rajaji hosted Mahatma Gandhi in Chennai, Tamil Nadu.

- In 1930, during the Dandi March, Rajagopalachari led the Salt March in Madras Province from Tiruchi to Vedaranyam (also known as Vedaranyam Satyagraha).

- His arrest during Vedaranyam Satyagraha gained him national recognition as a leader in the independence movement.

- After the Quit India movement, Rajagopalachari's pamphlet "The Way Out" outlined the C. R. Formula to resolve the constitutional deadlock between the Muslim League and the INC regarding a separate Muslim state.

- In 1930, during the Dandi March, Rajagopalachari led the Salt March in Madras Province from Tiruchi to Vedaranyam (also known as Vedaranyam Satyagraha).

- Prime Minister of Madras Province: In 1937, Rajagopalachari became the Prime Minister of Madras Province.

- Implemented social and economic reforms, including the promotion of Khadi, the abolition of Zamindari, and the introduction of Hindi in schools.

- Focused on raising the standard of living for Dalits and promoting social equity.

- Post-Independence Contributions: Rajagopalachari was appointed the Governor of West Bengal and later the first Indian Governor-General of Independent India in 1947 (the office was permanently abolished in 1950).

- Worked to integrate Muslims into the national mainstream and maintain India’s secular fabric.

- Served as Union Home Minister after Sardar Patel's death and played a significant role in key national issues, including the preparation of the First Five-Year Plan.

- In 1959, Rajagopalachari founded the Swatantra Party, advocating for a market economy and less government control.

- In 1962, Rajaji led a Gandhi Peace Foundation delegation to the US, urging a ban on nuclear tests.

- Rajagopalachari wrote a Tamil translation of the Ramayana, titled Chakravarthi Thirumagan, which won the Sahitya Akademi Award in 1958.

- Legacy: Shri C. Rajagopalachari was awarded ‘Bharat Ratna’ in 1954. He was the first to receive the highest civilian award.

- Rajagopalachari passed away on 25th December 1972.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. After Quit India Movement, C. Rajagopalachari issued a pamphlet entitled “The Way Out”. Which one of the following was a proposal in this pamphlet? (2010)

(a) The establishment of a “War Advisory Council” composed of representatives of British India and the Indian States

(b) Reconstitution of the Central Executive Council in such a way that all its members, except the Governor General and the Commander-in-Chief should be Indian leaders

(c) Fresh elections to the Central and Provincial Legislatures to be held at the end of 1945 and the Constitution making body to be convened as soon as possible

(d) A solution for the constitutional deadlock

Ans: (d)

Important Facts For Prelims

SFBs to Offer UPI-Based Credit Lines

Why in News?

Recently, the Reserve Bank of India (RBI) has decided to permit Small Finance Banks (SFBs) to extend pre-sanctioned credit (loan) lines through the Unified Payments Interface (UPI).

- It aims to deepen financial inclusion and enhance formal credit, particularly for ‘new to credit’ customers.

Note: In September 2023, the scope of UPI was expanded by enabling pre-sanctioned credit lines to be linked through UPI and used as a funding account by Scheduled Commercial Banks.

- However, it excluded Payments Banks, Small Finance Banks (SFBs) and Regional Rural Banks.

What are Small Finance Banks (SFBs)?

- About: SFBs are specialized financial institutions regulated by RBI under the Banking Regulation Act, 1949.

- It was announced in the Union Budget 2014-15 to enhance credit supply using high-technology and low-cost operations.

- It was set up based upon recommendations of the Nachiket Mor Committee.

- Registrations: SFBs are registered as a public limited company under the Companies Act, 2013.

- Objective: Its primary objective is to promote financial inclusion in underserved and unserved sections of society.

- It caters to small business units, small and marginal farmers, micro and small industries, and other unorganized sector entities.

- SFB’s Mandate: They must allocate 75% of their Adjusted Net Bank Credit (ANBC) to priority sectors, including agriculture, MSMEs, and weaker sections.

- At least 25% of SFB branches must be located in unbanked rural areas to improve rural banking access.

- Capital Requirement: To set up an SFB bank, the minimum capital required is Rs 200 crores.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. What is the purpose of setting up of Small Finance Banks (SFBs) in India? (2017)

- To supply credit to small business units

- To supply credit to small and marginal farmers

- To encourage young entrepreneurs to set up business particularly in rural areas.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Rapid Fire

INS Tushil

INS Tushil (F70), India’s advanced multi-role stealth-guided missile frigate, was commissioned into the Indian Navy in Russia, marking a significant milestone in India-Russia defense cooperation and maritime strength.

- About: INS Tushil is an upgraded Krivak III-class frigate of Project 1135.6 (Talwar Class). It is the 7th in the series after three Talwar-class and three Teg-class frigates.

- INS Tushil, is the first of two upgraded frigates under a 2016 contract between the Indian Government and JSC Rosoboronexport (a Russian company).

- A frigate is a versatile warship used for escorting, patrolling, and combat operations, crucial in modern navies.

- The name Tushil means "protector shield," reflects the Indian Navy’s commitment to protecting maritime frontiers.

- INS Tushil, is the first of two upgraded frigates under a 2016 contract between the Indian Government and JSC Rosoboronexport (a Russian company).

- Advanced Weaponry: INS Tushil is equipped with BrahMos supersonic cruise missiles, Shtil Surface-to-Air Missiles, anti-submarine torpedoes, and electronic warfare systems.

- Operational Versatility: Designed for blue-water operations across air, surface, underwater, and electromagnetic dimensions, aligning with India’s SAGAR (Security and Growth for All in the Region), ensuring stability in the Indian Ocean Region (IOR).

- India - Russia Defense Cooperation:

- Agreement on Military Technical Cooperation (2021-2031)

- India-Russia 2+2 Dialogue.

- Bilateral Projects: T-90 tanks, Su-30-MKI aircraft, MiG-29-K aircraft

- Military Exercises: INDRA(Tri-Services), Avia Indra( Air Force), and Ex Vostok ( Army ).

Rapid Fire

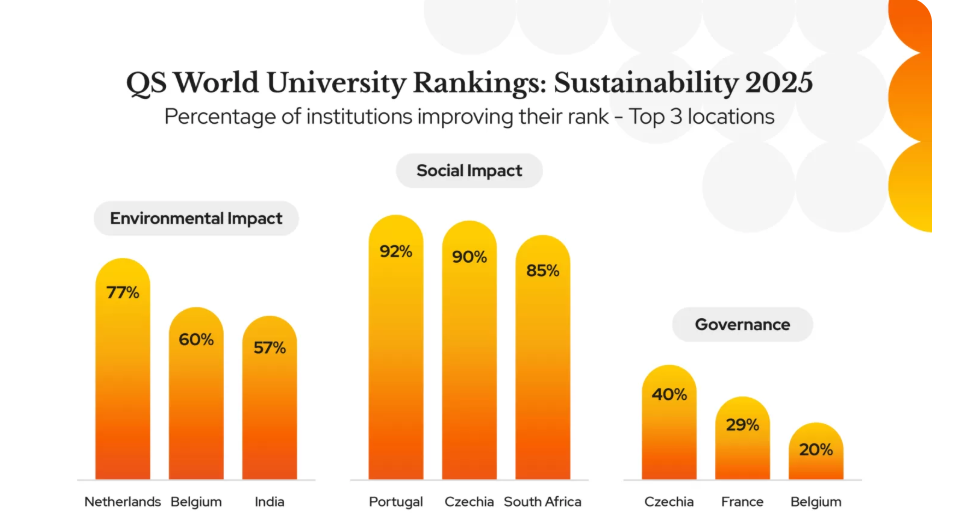

QS World University Rankings: Sustainability 2025

The Quacquarelli Symonds (QS) World University Rankings: Sustainability 2025, in its third edition, evaluates global institutions' progress in tackling environmental and social challenges through education and research.

- These rankings assess universities' contributions to sustainability, focusing on three pivotal pillars: Environmental Impact, Social Impact, and Governance. 78 Indian universities are featured in the 2025 rankings.

- Top Performers in India:

- IIT Delhi: Ranked 1st in India and 171st globally.

- IIT Kharagpur: Ranked 2nd in India and 202nd globally.

- IIT Bombay: Ranked 3rd in India and 234th globally.

- IIT Kanpur: Ranked 4th in India and 245th globally.

- IIT Madras: Ranked 5th in India and 277th globally.

- Notable Performances:

- Environmental Impact: IIT Delhi (55) and IIT Kanpur (87) ranked in the global top 100.

- Environmental Sustainability: IIT Bombay is at top in India (ranks globally at 38th).

- Environmental Education: IISc is placed 32nd worldwide.

- Governance and Equality: Manipal Academy of Higher Education (MAHE) leads India in the Governance category and ranks highest in India for Equality (ranks globally at 390th).

- Social Impact: IIT Delhi ranked 362nd globally, with top performance in India in Employability and Outcomes (ranks globally at 116th).

- Knowledge Exchange: DU is at top in India (ranks globally at 121st).

- However, Indian universities need to improve in Health and Wellbeing and Impact of Education, where no Indian institute has featured in the top 350.

- Environmental Impact: IIT Delhi (55) and IIT Kanpur (87) ranked in the global top 100.

- QS is a London-based global higher education analyst best known for its widely recognized QS World University Rankings.

Read More: QS World University Rankings 2025

Rapid Fire

Ghost Guns and 3D Printing

Ghost guns are untraceable firearms assembled at home, often using kits or 3D-printed parts.

- These weapons lack serial numbers, making them difficult for law enforcement to track.

- Printing Enable Ghost Guns: In the context of firearms, 3D printers can produce components like receivers, barrels, or grips using materials such as plastic or metal.

- These parts, when combined with other easily sourced components, create a functional firearm.

- Ghost guns pose serious safety risks, with advocacy groups labeling them the "fastest-growing gun safety problem.”

- 3D Printing: 3D printing, or additive manufacturing, creates objects layer by layer from digital designs. Key Features of 3D Printing are:

- Customization: Precise designs tailored to specific needs.

- Accessibility: Affordable printers and open-source designs make it easy for individuals to experiment.

- Rapid Prototyping: Quickly turns digital designs into physical objects.

Read More: 3D Printing and Its Applications

Rapid Fire

Laysan Albatross

Wisdom, a 74-year-old Laysan albatross (Phoebastria immutabilis), laid an egg at the Midway Atoll National Wildlife Refuge, her first in four years. She was initially banded there in 1956.

- Laysan albatross is a large, abundant seabird whose breeding range is centered in Hawai‘. Like all albatrosses, they are accomplished fliers using dynamic soaring to cover great distances. They mainly feed at night and often far from breeding colonies.

- According to the National Oceanic and Atmospheric Administration, the average lifespan of a Laysan albatross is typically around 68 years.

- Note: Snowy Albatross or Wandering Albatross (Diomedea exulans) is the largest flying seabird in terms of wingspan.

- Laysan albatross matures slowly, starting to breed at three or four years old, but typically achieving successful breeding only at eight or nine years of age.

- They nest in colonies, have long-term pair bonds and high site fidelity. They lay only one egg per season and the egg is incubated by both the parents in turn.

- Conservation Status – IUCN Red list:

- Laysan Albatross: Near Threatened

- Snowy Albatross (Wandering Albatross): Vulnerable

- Waved Albatross: Critically Endangered

- Tristan Albatross: Critically Endangered

Read More: Wandering Albatross