Governance

Delhi Excise Policy Case

- 26 Mar 2024

- 13 min read

For Prelims: Delhi Excise Policy 2021-22, Enforcement Directorate’s (ED’s), Covid-19 pandemic, Article 361 of the Constitution, Representation of the People Act, 1951.

For Mains: Delhi Excise Policy 2021-22, Enforcement Director, its functions and Related Issues.

Why in News?

Recently, a Magistrate Court in Delhi has sent the Chief Minister of Delhi to the Enforcement Directorate’s (ED’s) custody in connection with the Excise Policy Case.

- The CM of Delhi is accused by the ED of being the "kingpin and key conspirator" of the Delhi excise scam.

What is the Delhi Excise Policy Case?

- About:

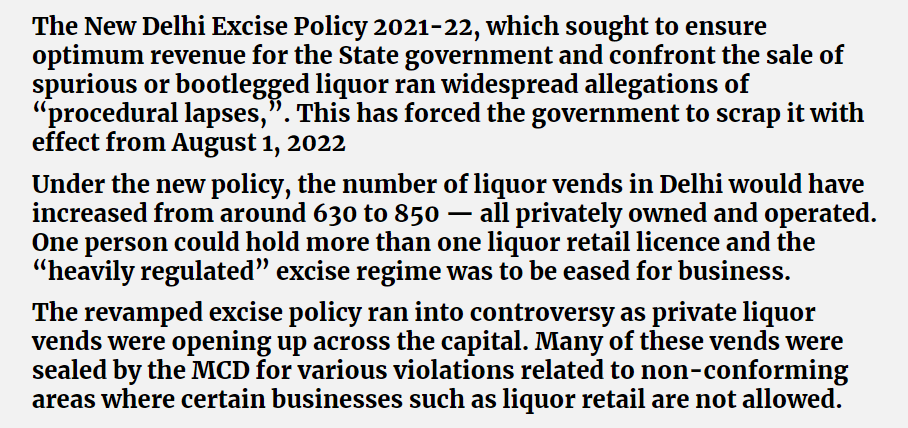

- The Delhi Excise Policy Case refers to a case surrounding the formulation and implementation of the Delhi Excise Policy 2021-22.

- This policy, which came into effect in November 2021, was subsequently scrapped in July 2022 due to allegations of procedural lapses, corruption, and financial losses to the exchequer.

- Key Allegations:

- Arbitrary Decisions: The Delhi Chief Secretary's report highlighted arbitrary and unilateral decisions made by Delhi's Deputy Chief Minister and Excise Minister, which allegedly led to financial losses estimated at over Rs 580 crore.

- Conspiracy and Kickbacks: The Enforcement Directorate (ED) has alleged that the new excise policy was implemented as part of a conspiracy to provide a 12% profit margin to certain private companies in the alcohol business.

- It's alleged that a 6% kickback was involved in this arrangement.

- A Kickback refers to a form of bribery or corrupt payment made to someone, typically a public official or businessperson, in return for facilitating or influencing a transaction or decision in favour of the person providing the kickback.

- Cartel Formation and Preferential Treatment: The ED alleges that the policy was designed with deliberate loopholes to promote cartel formations and benefit leaders of the Aam Aadmi Party (AAP).

- Preferential treatment, such as discounts, extensions in license fees, waiver of penalties, and relief due to disruptions caused by the Covid-19 pandemic, were granted to alcohol business owners and operators in exchange for kickbacks.

- Influence on Elections: It's alleged that the kickbacks received through this scheme were used to influence Assembly elections in Punjab and Goa in early 2022.

Can an Incumbent Chief Minister Govern the State/UT Administration from Jail?

- Constitutional Morality and Good Governance:

- The Indian Constitution doesn't explicitly address the issue of whether a Chief Minister (CM) can run the government from jail.

- However, judgments by various courts have emphasised the importance of constitutional morality, good governance, and public trust in holding public office.

- CM Not Immune as President or Governor:

- President of India and Governors of states are the only constitutional post holders who are immune from civil and criminal proceedings until his/her term ends, as per the law.

- Article 361 of the Constitution says that the President of India and Governors of states are not answerable to any court of law for “any act done in discharge of their official duties".

- The Administrator or Lt. Governor (LG) of a Union Territory is not immune under Article 361, unlike the Governor and President who have immunity.

- But the immunity doesn't cover the Prime Ministers or Chief Ministers who are treated as equals in front of the Constitution that advocates the Right to Equality before the law.

- Yet, they are not disqualified just by an arrest.

- Legal Framework:

- As per the law, a Chief Minister can only be disqualified or removed from office when he is convicted in any case.

- In the case of Arvind Kejriwal, he has not been convicted yet.

- The Representation of the People Act, 1951 has disqualification provisions for certain offences but a conviction of anyone holding the office is mandatory.

- The Chief Minister can lose the top job under only two conditions - loss of majority support in the assembly or through a successful No-Confidence Motion against the government in power that the Chief Minister leads.

- As per the law, a Chief Minister can only be disqualified or removed from office when he is convicted in any case.

- Basic Norms for Holding Public Office:

- As mentioned by the Supreme Court in Manoj Narula versus Union of India Case, 2014, the basic norms for holding a public office include constitutional morality, good governance, and constitutional trust.

- Public officials are expected to act in a manner consistent with these principles.

- Court has recognised that citizens expect persons in power to uphold high standards of moral conduct.

- This expectation is particularly high for positions like Chief Minister, which are seen as the repository of public faith.

- Practical Difficulties of Functioning from Jail:

- The practical challenges of a Chief Minister running the government from jail are significant.

- For example, they may face restrictions on accessing official documents or communicating with government officials.

- There may also be questions about whether they can effectively fulfill their duties while in custody.

- The practical challenges of a Chief Minister running the government from jail are significant.

- Precedents and Case Law:

- In S. Ramachandran versus V. Senthil Balaji Case, 2023, the Madras High Court considered whether a Minister accused of a financial scandal had forfeited their right to hold office.

- The Madras HC judgment highlighted the practical difficulties of being a Minister while in custody.

- Even if it's technically possible for a Chief Minister to run the government from jail, there may be concerns about the legitimacy and effectiveness of their leadership under such circumstances.

- The High Court raised a question, whether an individual should receive a salary from the public exchequer while occupying a public office without performing any associated duties.

- President’s Rule:

- Since it is impractical for any CM to run a government from the jail, the Lt. Governor can cite 'failure of constitutional machinery in the state,' a strong reason for the President's rule in Delhi under Article 239AB of the Constitution and pave the way for the CM to resign.

- The President's rule will bring that national capital under the Union government's direct control.

- Since it is impractical for any CM to run a government from the jail, the Lt. Governor can cite 'failure of constitutional machinery in the state,' a strong reason for the President's rule in Delhi under Article 239AB of the Constitution and pave the way for the CM to resign.

What is the ED?

- About:

- The ED is a multi-disciplinary organisation mandated with investigation of offences of money laundering and violations of foreign exchange laws.

- It functions under the Department of Revenue of the Ministry of Finance.

- As a premier financial investigation agency of the Government of India, the ED functions in strict compliance with the Constitution and Laws of India.

- The ED is a multi-disciplinary organisation mandated with investigation of offences of money laundering and violations of foreign exchange laws.

- Structure:

- Headquarters: ED with its headquarters at New Delhi, is headed by the Director of Enforcement.

- There are five regional offices at Mumbai, Chennai, Chandigarh, Kolkata and Delhi headed by Special Directors of Enforcement.

- Recruitment: Recruitment of the officers is done directly and by drawing officers from other investigation agencies.

- It comprises officers of IRS (Indian Revenue Services), IPS (Indian Police Services) and IAS (Indian Administrative Services) such as Income Tax officer, Excise officer, Customs officer, and police.

- Tenure: Two years, but directors’ tenure can be extended from two to five years by giving three annual extensions.

- The Delhi Special Police Establishment (DSPE) Act, 1946 (for ED) and the Central Vigilance Commission (CVC) Act, 2003 (for CV Commissioners) have been amended to give the government the power to keep the two chiefs in their posts for one year after they have completed their two-year terms.

- Headquarters: ED with its headquarters at New Delhi, is headed by the Director of Enforcement.

- Functions:

- COFEPOSA: Under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 (COFEPOSA), Directorate is empowered to sponsor cases of preventive detention with regard to contraventions of FEMA.

- Foreign Exchange Management Act, 1999 (FEMA): It is a civil law enacted to consolidate and amend the laws relating to facilitate external trade and payments and to promote the orderly development and maintenance of foreign exchange market in India.

- ED has been given the responsibility to conduct investigation into suspected contraventions of foreign exchange laws and regulations, to adjudicate and impose penalties on those adjudged to have contravened the law.

- Prevention of Money Laundering Act, 2002 (PMLA): Following the recommendations of the Financial Action Task Force (FATF) India enacted PMLA.

- The ED has been entrusted with the responsibility of executing the provisions of PMLA by conducting investigation to trace the assets derived from proceeds of crime, to provisionally attach the property and to ensure prosecution of the offenders and confiscation of the property by the Special court.

- Fugitive Economic Offenders Act, 2018 (FEOA): With the increase in the number of cases relating to economic offenders taking shelter in foreign countries, the Government of India introduced the Fugitive Economic Offenders Act, 2018 (FEOA) and ED is entrusted with its enforcement.

- This law was enacted to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts.

- Under this law, the ED is mandated to attach the properties of the fugitive economic offenders who have escaped from India warranting arrest and provide for the confiscation of their properties to the Central Government.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. Which one of the following groups of items is included in India’s foreign-exchange reserves? (2013)

(a) Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries

(b) Foreign-currency assets, gold holdings of the RBI and SDRs

(c) Foreign-currency assets, loans from the World Bank and SDRs

(d) Foreign-currency assets, gold holdings of the RBI and loans from the World Bank

Ans: (b)

Explanation:

- Foreign Exchange Reserves are assets kept in reserve by a central bank in foreign currencies.

- According to RBI, Foreign Exchange Reserve in India includes:

- Foreign Currency Assets

- Gold

- SDRs

- Reserve Tranche Position with IMF

- Therefore, option (b) is the correct answer.

Mains:

Q. Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (2021)