Indian Economy

Household Consumption Expenditure Survey 2022-23

For Prelims: Household Consumption Expenditure Survey, National Statistical Office, Gross Domestic Product, Consumer Price Index, NITI Aayog, Monthly Per Capita Consumer Expenditure, C. Rangarajan Committee.

For Mains: Highlights of the Recent Household Consumption Expenditure Survey

Why in News?

Recently, the detailed report of Household Consumption Expenditure Survey (HCES) 2022-23 was released by Ministry of Statistics and Programme Implementation (MoSPI).

- It provided valuable insights into the spending habits of rural and urban households across different states.

What is the Household Consumption Expenditure Survey?

- About:

- The HCES is conducted by the National Statistical Office (NSO) every 5 years.

- It is designed to collect information on the consumption of goods and services by households.

- The data collected in HCES is also utilised for deriving various other macroeconomic indicators such as Gross Domestic Product (GDP), poverty rates, and Consumer Price Index (CPI).

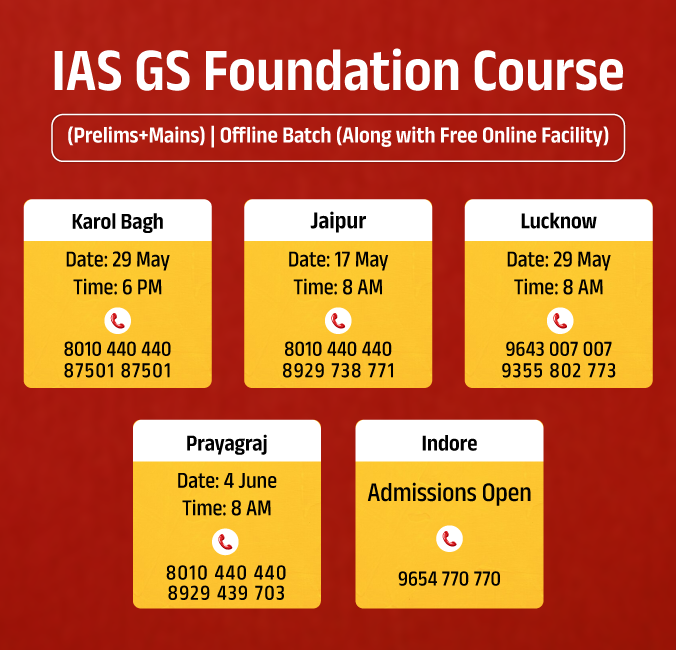

- The average MPCE has been calculated at 2011-12 prices.

- The survey covered the whole of the Indian Union except a few inaccessible villages in the Andaman and Nicobar Islands.

- The findings of the last HCES, conducted in 2017-18 were not released after the government cited “data quality” issues.

- Information Generated:

- Provides information on the typical spending on both goods (including food and non-food items) and services.

- Additionally, assists in calculating estimates for household Monthly Per Capita Consumer Expenditure (MPCE) and analysing the distribution of households and individuals across different MPCE categories.

What are the Highlights of the Recent Household Consumption Expenditure Survey?

- Food Expenditure Preferences:

- Beverages, Refreshments, and Processed Food: This category was the most significant part of the food expenditure across many states, particularly noticeable in Tamil Nadu with the highest spending percentages both in rural (28.4%) and urban (33.7%) areas.

- Milk and Milk Products: Predominantly favoured in rural and urban households of northern states like Haryana (rural 41.7%, urban 33.1%) and Rajasthan (urban 33.2%).

- Egg, Fish, and Meat: Kerala households showed the highest expenditure in this category, both in rural (23.5%) and urban (19.8%) setups.

- Overall Food vs. Non-Food Expenditure:

- Food Expenditure: In rural India, food constitutes about 46% of total household consumption expenditure, whereas in urban areas, it is around 39%.

- Non-Food Expenditure: There has been a significant shift towards higher spending on non-food items, with rural spending on non-food items rising from 40.6% in 1999 to 53.62% in 2022-23 and urban spending from 51.94% to 60.83% in the same period.

- Major Non-Food Expenditure Categories:

- Conveyance: Remained the top non-food expenditure in both rural and urban settings, with the highest percentages in Kerala.

- Medical Expenses: Particularly high in Kerala, West Bengal, and Andhra Pradesh for rural areas and West Bengal, Kerala, and Punjab for urban areas.

- Durable Goods: The highest expenditure on durable goods was noted in Kerala in both rural and urban areas.

- Fuel and Light: West Bengal and Odisha showed significant spending in rural and urban settings, respectively.

- Regional Variations:

- Different states showed varying preferences for spending on specific food and non-food items, reflecting cultural and regional economic differences.

- Growth in Consumption Expenditure:

- The survey indicates a substantial increase in consumption expenditure over the past decade. Rural monthly consumption per person increased by 164% from 2011-12 to 2022-23, while urban monthly consumption per person grew by 146%.

- The rural monthly per capita consumption has seen a faster growth when compared to the urban sector in India.

- The difference between the urban and rural MPCE has seen a decrease over the years, with the differential reducing from 90 percent in 2009-10 to 75 percent in 2022-23.

National Statistical Office

- About: Formed in 2019 by merging the Central Statistical Office (CSO) and the National Sample Survey Office (NSSO).

- C. Rangarajan Committee first suggested the establishment of NSO as the nodal body for all core statistical activities.

- It currently works under the Ministry of Statistics and Programme Implementation (MoSPI).

- Function: Collects, compiles, and disseminates reliable, objective, and relevant statistical data.

|

Drishti Mains Question: Q. In the light of, Household Consumption Expenditure Survey (HCES) 2022-23 examine the potential implications of changing consumption patterns on India's economic planning and development strategies. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. As per the NSSO 70th Round “Situation Assessment Survey of Agricultural Households”, consider the following statements: (2018)

- Rajasthan has the highest percentage share of agricultural households among its rural households.

- Out of the total agricultural households in the country, a little over 60 percent belong to OBCs.

- In Kerala, a little over 60 percent of agricultural households reported to have received maximum income from sources other than agricultural activities.

Which of the statements given above is/are correct?

(a) 2 and 3 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: c

Q. In a given year in India, official poverty lines are higher in some States than in others because (2019)

(a) poverty rates vary from State to State

(b) price levels vary from State to State

(c) Gross State Product varies from State to State

(d) quality of public distribution varies from State to State

Ans: (b)

Indian Economy

Financing of Large Infrastructure Projects

For Prelims: Reserve Bank of India (RBI), provisioning, fiscal deficits, Public-Private Partnerships (PPP), CARE Ratings, corporate bond market

For Mains: National Infrastructure Pipeline (NIP), National Bank for Financing Infrastructure and Development (NaBFID), National Investment and Infrastructure Fund (NIIF), Financing issues faced by the large infrastructure projects in India.

Why in News?

Recently, the Reserve Bank of India (RBI) has proposed a new framework to improve the regulation of financing for long-term projects in infrastructure, non-infrastructure, and commercial real estate sectors.

- This is in response to the challenges these projects often face, such as delays and cost overruns.

What are the Key Provisions Proposed by RBI for Project Financing?

- Mitigating Credit Events: The framework prioritises preventing credit events such as loan defaults, extensions of the project's commercial operation start date (DCCO), additional debt requirements, or a decrease in the project's Net Present Value (NPV).

-

Increased Provisioning: To build a buffer against potential losses, the framework proposes a significant increase in provisioning (setting aside funds) by banks.

- Provisioning is raised from the existing 0.4% to 5% of the loan amount during the construction stage (before the project launch).

- The 5% provisioning will be implemented gradually with 2% in FY25, 3.5% in FY26, and reaching 5% by FY27.

- The additional provisioning requirements are estimated to be 0.5-3% of banks’ net worth and could impact the CET1 (Common Equity Tier 1) ratio.

- Reduced Provisioning During Operations: If a project demonstrates a positive net operating cash flow (enough income to cover repayments) and reduces its total debt by 20% after starting commercial operations, provisioning can be lowered.

-

Potential Impacts of the Proposed Framework:

- Impact on banks:

- Higher provisioning requirements could impact bank profitability in the short term. Additionally, loan pricing might increase slightly to reflect the perceived higher risk.

- State-owned banks are cautiously optimistic, suggesting the impact on pricing might be moderate.

- Impact on borrowers:

- Borrowers might face stricter financing terms and potentially higher interest rates. However, the framework aims to improve project viability and reduce overall risk in the long run.

- Rating agencies predict a potential rise in funding costs by 20-40 basis points.

Classification of Bank Capital

- According to Basel-III norms banks' regulatory capital is divided into Tier 1 and Tier 2, while Tier 1 is subdivided into Common Equity Tier-1 (CET-1) and Additional Tier-1 (AT-1) capital.

- Common Equity Tier 1 capital includes equity instruments where returns are linked to the banks’ performance and therefore the performance of the share price. They have no maturity.

- Additional Tier-1 capital are perpetual bonds that carry a fixed coupon payable annually from past or present profits of the bank. They have no maturity, and their dividends can be cancelled at any time.

- Tier 2 capital consists of unsecured subordinated debt with an original maturity of at least five years.

Provisioning Coverage Ratio (PCR)

- Under provisioning, banks have to set aside or provide funds to a prescribed percentage of their bad assets.

- It is essentially the ratio of provisioning to gross non-performing assets and indicates the extent of funds a bank has kept aside to cover loan losses.

What are the Financing Issues Faced by the Large Infrastructure Projects in India?

- Fiscal Burden on Government: Traditionally, the government has been the primary source of funding for infrastructure projects, leading to high fiscal deficits. This limits spending on other social programs like education and healthcare.

- In 2022, the government's infrastructure spending was around 3.3% of GDP, a positive step but still below the desired level.

- Asset-Liability Mismatch of Commercial Banks: Commercial banks, a key source of infrastructure financing, prioritise short-term loans with quicker returns. Long-term infrastructure projects with slow returns become less attractive.

- Many infrastructure projects experience delays and cost overruns, leading to financial stress for banks that provide loans. This discourages further lending for large projects.

- Subdued Investments in Public-Private Partnerships (PPP) Projects: Private sector participation through PPPs hasn't met expectations. Uncertain regulatory environment, complex project structures, and land acquisition issues deter private investors.

- A 2023 report by CARE Ratings, an Indian credit rating agency, states that private sector investment in infrastructure projects has been around 5% of the total requirement.

- Inefficient and Underdeveloped Corporate Bond Market: India's corporate bond market, a potential source of long-term financing for infrastructure, is still relatively small and lacks liquidity. This makes it difficult for infrastructure companies to raise funds through bond issuance.

- In 2023, the size of India's corporate bond market was approximately USD1.8 trillion, which is significant but still smaller compared to developed economies like the US at USD51 trillion.

- Investment Obligations of Insurance and Pension Funds: Regulations often require insurance and pension funds to invest a significant portion of their funds in government securities. This limits their ability to invest in riskier infrastructure projects, which could offer higher returns.

- According to the World Bank, only around 2% of Indian pension funds' assets are invested in infrastructure projects, compared to a global average of 5-10%.

What are the Government initiatives Related to Financing Large Infrastructure Projects in India?

- National Infrastructure Pipeline (NIP)

-

National Bank for Financing Infrastructure and Development (NaBFID)

-

Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs)

-

Public-Private Partnerships (PPP) Model Reforms: The government measures like reducing legal complexities, simplifying the approval process and streamlining dispute resolution processes.

- Example: The Ministry of Finance has established a dedicated PPP cell and model concession agreements to address the concerns of private investors and facilitate faster project clearances.

- Sovereign Wealth Funds (SWFs):

- The Indian government is actively engaging with countries like UAE, Norway etc. with large SWFs to facilitate their investment in Indian market.

- SWFs can provide a stable source of long-term funding for infrastructure projects and help mitigate the risk burden on the government's budget.

- The Indian government is actively engaging with countries like UAE, Norway etc. with large SWFs to facilitate their investment in Indian market.

What Measures can be taken to Improve Financing of Large Infrastructure Projects in India?

- Enhancing Project Preparation and Risk Mitigation: Conducting extensive feasibility studies that accurately assess project viability, costs, and potential risks is crucial to attracting investors.

- Ensuring a fair and transparent risk allocation framework that balances the interests of both the public and private sectors.

- Attract Private Sector Participation: The government can provide grants or subsidies to bridge the gap between project costs and what private investors are willing to pay (Viability Gap Funding), making projects more attractive.

- Diversifying Funding Sources: Encouraging the creation of more Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs) to attract investments from pension funds, insurance companies, and other institutional investors.

- Creating a sovereign wealth fund in India to leverage the country's foreign exchange reserves for long-term infrastructure financing.

- Streamline Approvals and Clearances: Streamlining land acquisition procedures to ensure timely availability of land for project development, a major bottleneck currently.

- Developing a more efficient system for environmental impact assessments and clearances, balancing environmental protection with project timelines.

- Improve Project Execution and Efficiency: Encourage the use of new technologies like prefabrication and modular construction to improve project efficiency and reduce costs.

- Implementing stricter performance monitoring and accountability measures to ensure the timely completion of large projects and avoid cost overruns.

|

Drishti Mains Question: Q. Discuss the key issues related to the financing of large infrastructure projects in India. What government initiatives have been taken to ease facilitation of large infrastructure projects in India. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)? (2017)

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: A

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do? (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: B

Mains

Q. The product diversification of financial institutions and insurance companies, resulting in overlapping of products and services strengthens the case for the merger of the two regulatory agencies, namely SEBI and IRDA. Justify. (2013)

International Relations

United Nations Global Supply Chain Forum

For Prelims: UN Trade and Development (UNCTAD), Greenhouse gas emissions, Climate change, Covid-19, Zero-emission fuels, Blockchain-enabled traceability, World Bank, Active Pharmaceutical Ingredients, Supply Chain Resilience Initiative (SCRI), Indo-Pacific Economic Framework for Prosperity (IPEF), G-7 Summit, Public-Private partnership, Free Trade Agreement (FTA), Trade and Economic Partnership Agreement (TEPA), Critical mineral, PM Gati Shakti National Master Plan, National Logistics Policy (2022), Atmanirbhar Bharat initiative, PLI schemes, Liberalized FDI policy, Ease of doing business

For Mains: Challenges in Global Supply Chain, Initiatives for strengthening Global supply chains

Why in News?

Recently the inaugural United Nations Global Supply Chain Forum (UNGSCF) hosted by UN Trade and Development (UNCTAD) and the Government of Barbados highlighted several critical issues and initiatives to address escalating global supply chain disruptions.

What are the Key Issues Highlighted at the UNGSCF?

- It emphasized the volatility in global trade and the urgency of making supply chains more inclusive, sustainable, and resilient.

- The global disruptions are causing increased sea time for ships and higher greenhouse gas emissions.

- It focused on the compounded effects of climate change, geopolitical tensions, and the Covid-19 pandemic on global supply chains.

- Ports were highlighted as crucial for maintaining global value chains through technology and sustainable practices.

- The Port of Bridgetown in Barbados was showcased as a model for other Small Island Developing States (SIDS).

- The forum explored the challenges of reducing carbon emissions in global shipping, especially for developing countries that have renewable energy resources.

- The "Manifesto for Intermodal, Low-Carbon, Efficient and Resilient Freight Transport and Logistics" was launched, advocating for zero-emission fuels, optimized logistics, and sustainable value chains to keep global warming below 1.5°C.

- SIDS faces heightened risks from climate change impacts on transport infrastructure. Improvements in multimodal transport networks and customs procedures should be prioritised.

- Ministers from SIDS called for international financial institutions and donor countries to fund projects promoting resilience and sustainability in their transport and logistics sectors.

- Blockchain-enabled traceability and advanced customs automation were highlighted as crucial for optimising trade facilitation and enhancing transparency.

- UN Trade and Development presented guidelines for an electronic single window for trade to streamline processes.

- A new Trade-and-Transport Dataset developed with the World Bank was launched, covering data on over 100 commodities and various transport modes. This free, comprehensive dataset aims to enhance the understanding and optimization of global trade flows.

UNCTAD

- United Nations Conference on Trade and Development (UNCTAD) is a permanent intergovernmental body of the United Nations.

- It was established in 1964 and is headquartered in Geneva, Switzerland.

- It aims to promote sustainable development, particularly in developing countries, through international trade, investment, finance, and technology transfer.

- UNCTAD's work focuses on four main areas:

- Trade and development

- Investment and Enterprise

- Technology and innovation

- Macroeconomics and development policies.

What is the Need for Supply Chain Resilience for India?

- About:

- Supply Chain Resilience: In the context of international trade, supply chain resilience is an approach that helps a country to ensure that it has diversified its supply risk across a clutch of supplying nations instead of being dependent on just one or a few.

- Unexpected events, whether natural disasters like volcanic eruptions, tsunamis, earthquakes, or pandemics; or human-caused issues like armed conflicts, can disrupt or stop trade from a specific country. This could negatively affect the economy of the country that relies on those supplies.

- Supply Chain Resilience: In the context of international trade, supply chain resilience is an approach that helps a country to ensure that it has diversified its supply risk across a clutch of supplying nations instead of being dependent on just one or a few.

- Need:

- Covid-19 Realisation: With the spread of Covid-19 globally, it has been realised that dependence on a single nation is not good for both the global economy and national economies.

- Assembly lines are heavily dependent on supplies from one country (China).

- The impact on importing nations could be crippling if the source stops production for involuntary reasons, or even as a conscious measure of economic coercion.

- USA-China Trade Tensions: The problems for the global supply chain can escalate when the United States and China both apply tariff sanctions on each other due to trade disputes.

- India as an Emerging Supply Hub: The businesses have started seeing India as a “hub for supply chains”, so there is a need for robust supply chian.

- Chinese Import to India:

- As per the Confederation of Indian Industry, China’s share of imports into India in 2018 (considering the top 20 items supplied by China) stood at 14.5%.

- In areas such as Active Pharmaceutical Ingredients for medicines such as paracetamol, India is largely dependent on China.

- In electronics, China accounts for 45% of India’s imports.

- Covid-19 Realisation: With the spread of Covid-19 globally, it has been realised that dependence on a single nation is not good for both the global economy and national economies.

- Initiatives:

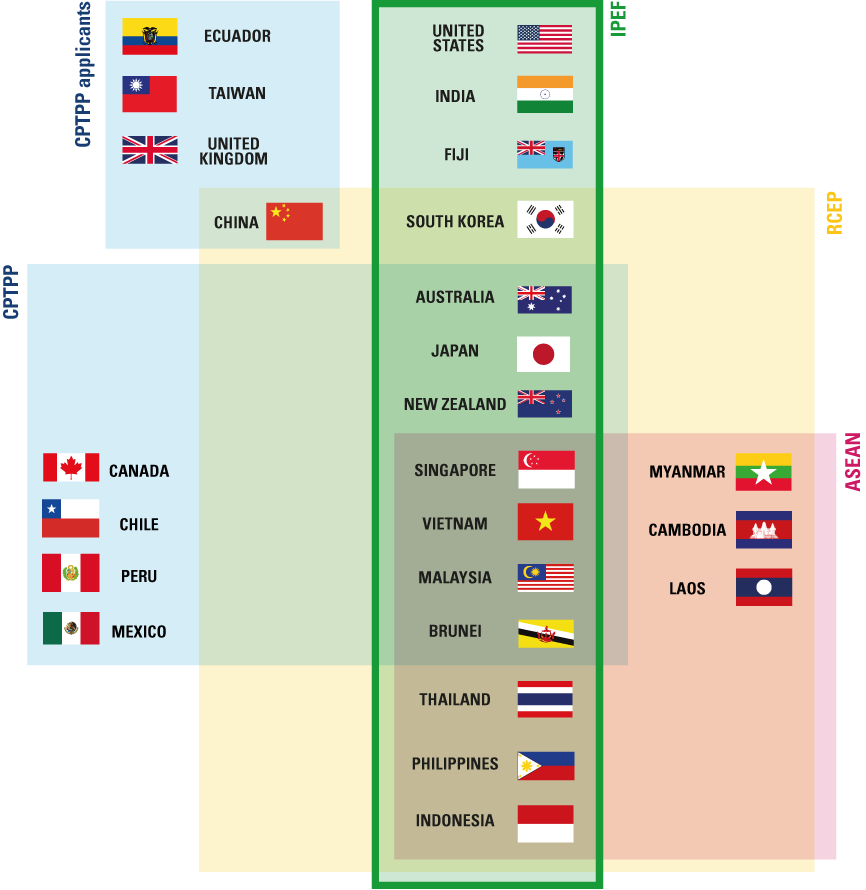

- Indo-Pacific Economic Framework for Prosperity (IPEF)

- Supply Chain Resilience Initiative (SCRI): The SCRI aims to create a virtuous cycle of enhancing supply chain resilience to eventually attain strong, sustainable, balanced, and inclusive growth in the Indo-Pacific region.

- Since, India is looking to establish itself as a reliable presence in the semiconductor supply chain the Union Cabinet has approved a Memorandum of Cooperation (MoC) between India and Japan on developing a semiconductor supply chain partnership.

- In the 2023 G-7 Summit, India made an important intervention on the topic of Enhancing Supply Chain Resilience and gave several suggestions on the issue.

- India with an aim to ensure a stable and reliable supply of critical minerals is stepping up its critical mineral acquisition plans in Africa, challenging China's dominant position in the region.

- Other Initiatives:

- PM Gati Shakti National Master Plan

- National Logistics Policy (2022)

What are Suggestions for India for Improving Supply Chain Resilience?

- Diversification of Suppliers and Manufacturing Base: Reduce over-dependence on a single source for raw materials, components, or finished goods. For instance, over 60% of electronic components are imported, primarily from East Asia.

-

Encouraging domestic manufacturing and diversifying import sources across multiple countries to mitigate risks from geopolitical tensions or natural disasters. This aligns with the Atmanirbhar Bharat (Self-reliant India) initiative.

-

- Integration of MSME in GVCs: The integration of Indian MSMEs with Global Value Chains (GVCs) by building and strengthening regional innovation systems and by establishing a multipurpose science and technology commission in the clusters of SMEs.

- Increase Share of Indian Fleet: The Indian fleet is just 1.2% of the world's fleet in terms of capacity and carries only 7.8% (for 2018-19) of India’s EXIM trade (Economic Survey 2021-2022). Efforts should be made to increase Indian fleet.

- Share in Global Trade: As per OECD, India’s share in world exports of goods and services rose from 0.5% in the early 1990s to 2.1% in 2018. However, to be a part of global supply chain India needs to increase it’s share gradually.

-

Investment in Logistics Infrastructure: India's logistics costs are estimated to be around 13-14% of GDP, compared to 8-11% in developed economies.

-

Therefore there is a need to upgrade transportation networks, including roads, railways, waterways, and ports.

-

-

Boosting Domestic Production of Critical Inputs: Identifying and prioritising critical raw materials and components currently heavily imported like APIs.

-

Providing incentives and support for domestic production of these items to reduce vulnerability to external disruptions through mechanisms like PLI Scheme.

-

-

Strengthening Digital Integration: Promote digitalisation across the supply chain to improve transparency, visibility, and risk management.

-

This includes implementing robust cyber security measures and fostering collaboration through shared data platforms.

-

|

Drishti Mains Question: Q. Discuss the key challenges that India faces in ensuring supply chain resilience in the context of global trade. How can India address these challenges to emerge as a reliable supply chain hub? (250 words) |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. In which one of the following groups are all the four countries members of G20? (2020)

(a) Argentina, Mexico, South Africa and Turkey

(b) Australia, Canada, Malaysia and New Zealand

(c) Brazil, Iran, Saudi Arabia and Vietnam

(d) Indonesia, Japan, Singapore and South Korea

Ans: (a)

Q. Recently, there has been a concern over the short supply of a group of elements called ‘rare earth metals’. Why? (2012)

- China, which is the largest producer of these elements, has imposed some restrictions on their export.

- Other than China, Australia, Canada and Chile, these elements are not found in any country.

- Rare earth metals are essential for the manufacture of various kinds of electronic items and there is a growing demand for these elements.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains:

Q. Quadrilateral Security Dialogue (Quad) is transforming itself into a trade bloc from a military alliance, in present times Discuss. (2020)

Indian Polity

CIC Jurisdiction over MPLADS Funds

For Prelims: Right to Information Act (RTI Act), Central Information Commission (CIC), State Information Commission (SIC), MPLADS Scheme.

For Mains: Jurisdiction and powers of Central and State Information Commission, Reforms in CEC, Impact of ineffective Right to Information Act, 2005 on good governance and transparency and accountability in the country.

Why in News?

Recently, the Delhi High Court has ruled that the Central Information Commission (CIC) has no jurisdiction to comment on the utilisation of funds under the Members of Parliament Local Area Development Scheme (MPLADS).

What is the Background of the Court's Ruling?

- Key Events:

- In 2018, an order by the Central Information Commission (CIC) raised concerns about some MPs strategically saving their MPLADS funds until the last year of their term. The CIC suspected this tactic was used to gain an unfair advantage during elections.

- It had suggested to the Ministry of Statistics and Programme Implementation (MoSPI) that this “abuse” of the funds be prevented and guidelines be implemented for distributing the money equally for each year of the five-year term.

- The Ministry of Statistics and Programme Implementation (MoSPI) then filed a legal challenge in the Delhi High Court against a ruling by the CIC on a Right to Information (RTI) application.

- Court’s Ruling:

- Delhi High Court held that the CIC has no jurisdiction to comment upon the utilisation of funds by the MPs under the MPLADS.

- The scope of the RTI Act is limited to providing access to information under the control of public authorities.

- Court said that as per Section 18 of the RTI Act, the CIC can “only deal with issues relating to the information sought for under the RTI Act or any other issue which leads to dissipation of information as sought for by the applicant”

- The Court however retained the portion of the order of CIC where it has instructed the public authority to publish details of the funds MP-wise, Constituency-wise, and work-wise under the RTI Act.

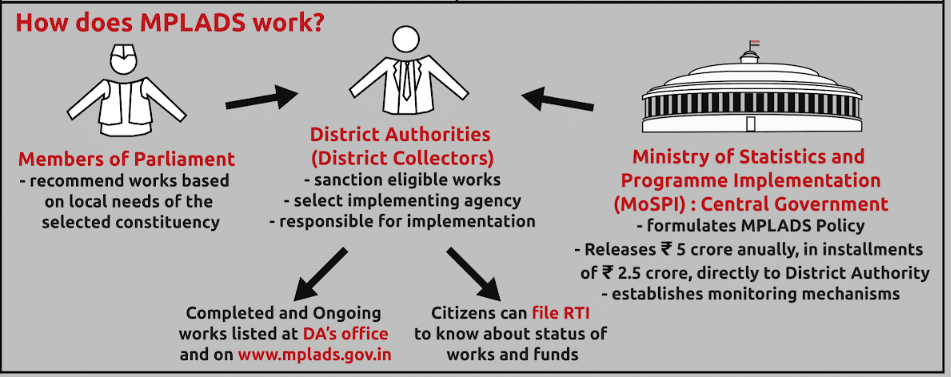

What is the MPLADS Scheme?

- About:

- It is a Central Sector Scheme announced in 1993.

- Objective:

- It enables Members of Parliaments (MPs) to recommend works of a developmental nature with a focus on the creation of durable community assets in the areas of drinking water, primary education, public health, sanitation and roads, etc. primarily in their Constituencies.

- Since June 2016, the MPLAD funds can also be used for implementation of the schemes such as Swachh Bharat Abhiyan, Accessible India Campaign (Sugamya Bharat Abhiyan), conservation of water through rainwater harvesting and Sansad Aadarsh Gram Yojana, etc.

- It enables Members of Parliaments (MPs) to recommend works of a developmental nature with a focus on the creation of durable community assets in the areas of drinking water, primary education, public health, sanitation and roads, etc. primarily in their Constituencies.

- Implementation:

- The process under MPLADS starts with the MPs recommending works to the Nodal District Authority.

- The Nodal District Authority concerned is responsible for implementing the eligible works recommended by the Members of Parliament and maintaining the details of individual works executed and the amount spent under the Scheme.

- Functioning:

- Each year, MPs receive Rs. 5 crore in two instalments of Rs. 2.5 crore each. Funds under MPLADS are non-lapsable.

- Lok Sabha MPs have to recommend the district authorities projects in their Lok Sabha constituencies, while Rajya Sabha MPs have to spend it in the state that has elected them to the House.

- Nominated Members of both the Rajya Sabha and Lok Sabha can recommend works anywhere in the country.

- Concerns:

- Breach of Federalism: The MPLADS encroaches upon the domain of local self-governing institutions, thereby violating the principles laid out in Part IX and IX-A of the Constitution.

- Implementation Lapses: The MPLAD Scheme allows MPs to utilise funds as a source of patronage, which they can dispense at their discretion.

- The Comptroller and Auditor General (CAG) has highlighted instances of financial mismanagement and artificial inflation of expenditure.

- The scheme is also criticised for fostering a nexus between MPs and private firms, leading to the misuse of funds for private projects, allocation to ineligible agencies, and diversion of funds to private trusts.

- No Statutory Backing: The MPLAD Scheme is not governed by any statutory law, making it susceptible to arbitrary changes by the government of the day.

- Criticism: Both the National Commission to Review the Working of the Constitution (2002) and the 2nd Administrative Reforms Commission (2007) recommended its termination.

- Their argument centres on the scheme's incompatibility with the division of power between the central and state governments.

- Way Forward:

- Enhancing Transparency and Accountability: A robust online tracking system for project proposals, sanctions, and fund utilisation should be implemented. Regular audits and public reports should be done.

- Empowering Citizen Participation: By fostering participatory budgeting mechanisms, involving community forums where citizens can identify and prioritise development needs within the constituency.

- Promoting Evidence-Based Decision Making: Encouraging MPs to conduct needs assessments and use data to identify the most impactful projects for their constituencies.

- Enhancing Convergence: The process for converging MPLADS funds with other central and state government schemes should be streamlined which can help create larger, more sustainable projects.

- The capacity of local implementing agencies should be strengthened to ensure efficient project execution.

- Addressing Lapsing Funds: Alternative approaches to lapsable funds should be considered. Funds could be rolled over to the next year or directed to a national pool for distribution in constituencies with greater needs.

What is the Central Information Commission (CIC)?

- It was established in 2005 under the Right to Information Act.

- It is a non-constitutional body overseeing access to information held by central government agencies.

- It comprises a CIC and up to 10 Information Commissioners (ICs), serving terms set by the central government (with a maximum age limit of 65) and ineligible for reappointment.

- The CIC's key functions include:

- Receiving and investigating complaints regarding information requests submitted under the RTI Act.

- Launching inquiries into relevant matters based on reasonable grounds (suo moto power).

- Exercising powers similar to a civil court to summon individuals and request documents during investigations.

- Each state in India has a State Information Commission (SIC) with a similar structure.

Right to Information (RTI) Act 2005

- Under the RTI Act of 2005, Public Authorities are required to make suo moto disclosures on various aspects of their structure and functioning. This includes:

- The disclosure of their organisation, functions, and structure.

- The powers and duties of its officers and employees.

- The financial information.

- The intent of such disclosures is that the public should need minimum recourse through the Act to obtain such information.

- If such information is not made available, citizens have the right to request it from the Authorities.

- The intent behind the enactment of the Act is to promote transparency and accountability in the working of Public Authorities.

Meaning of the Term ‘Public Authorities’:

- ‘Public Authorities’ include bodies of self-government established under the Constitution, or under any law or government notification, such as Union Ministries, Public Sector Undertakings, and Regulators.

- It also includes any entities owned, controlled or substantially financed and non-government organisations substantially financed directly or indirectly by funds provided by the government (this was pronounced by the Supreme Court in its judgement in D.A.V. College Trust and Management Society v. Director of Public Instructions Case, 2019.

What are the Concerns Related to Autonomy of CIC?

- Appointment Process:

- The CIC and Information Commissioners (ICs) are appointed by a committee comprising politicians, which potentially allows political considerations to influence the selection, thereby compromising the CIC's impartiality

- Tenure and Removal:

- The RTI Act originally guaranteed a fixed 5-year term for Information Commissioners. However, the RTI (Amendment) Act, 2019 removed this, giving the central government control over their terms.

- This has raised concerns that the government might influence these officials, impacting their independence.

- The RTI Act originally guaranteed a fixed 5-year term for Information Commissioners. However, the RTI (Amendment) Act, 2019 removed this, giving the central government control over their terms.

- Salaries, Wages and Allowances to CEC:

- The RTI Act (2005) linked the salaries of the CIC and ICs to those of the Chief Election Commissioner and Election Commissioners.

- However, the 2019 amendment removed this link, giving the central government the power to decide their pay and benefits. This shift raises concerns about potential government influence.

- The RTI Act (2005) linked the salaries of the CIC and ICs to those of the Chief Election Commissioner and Election Commissioners.

- Funding and Resources:

- The CIC relies on the central government for its budgetary allocations and administrative support, which can limit the CIC's autonomy and effectiveness.

- Enforcement Powers:

- The CIC has the power to order the disclosure of information and impose penalties on non-compliant officials, but the lack of a robust enforcement mechanism hampers the effectiveness of these powers, making it difficult to ensure compliance.

What are the Reforms Proposed to Strengthen the Central Information Commission?

- Establishment of an Independent Selection Committee:

- The selection committee should include representatives from the judiciary, civil society, and other independent bodies, which will help reduce political influence and ensure that competent and unbiased individuals lead the CIC.

- Fixed and Non-Renewable Tenures:

- A fixed term (e.g., 5 years) without the possibility of renewal should be proposed. Also, there should be robust safeguards against premature removal, ensuring that CIC officials can function independently.

- Financial and Administrative Autonomy:

- CIC should be provided with financial autonomy by allocating a separate budget for it and ensuring its timely disbursement.

- They should also be empowered to manage its administrative affairs, including staff recruitment and infrastructure.

- Enhanced Enforcement Powers:

- They can be provided with contempt powers to hold individuals or organisations in contempt for non-compliance, the power to impose fines on public authorities that fail to comply with CIC orders and an execution mechanism to enforce its decision effectively.

|

Drishti Mains Question Discuss the relevance of the Member of Parliament Local Area Development Scheme in present times. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. With reference to the funds under the Members of Parliament Local Area Development Scheme (MPLADS), which of the following statements are correct? (2020)

- MPLADS funds must be used to create durable assets like physical infrastructure for health, education, etc.

- A specified portion of each MP’s fund must benefit SC/ST populations.

- MPLADS funds are sanctioned on a yearly basis and the unused funds cannot be carried forward to the next year.

- The district authority must inspect at least 10% of all works under implementation every year.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 3 and 4 only

(c) 1, 2 and 3 only

(d) 1, 2 and 4 only

Mains:

Q. The Right to Information Act is not all about citizens’ empowerment alone, it essentially redefines the concept of accountability.” Discuss. (2018)

Important Facts For Prelims

National Testing Agency

Why in News?

Recently, the National Testing Agency (NTA) released the NEET UG results, drawing attention to the unusually high number of candidates scoring a perfect 720/720 and the controversial near-perfect scores of 718 or 719.

- The National Medical Commission (NMC) is responsible for laying down policies for maintaining high quality and high standards in medical education and making necessary regulations on this behalf.

What is the National Testing Agency?

- About:

- The National Testing Agency (NTA) was established as a Society registered under the Indian Societies Registration Act, of 1860.

- It is an autonomous and self-sustained testing organisation to conduct entrance examinations for admission in higher educational institutions.

- Governance:

- NTA is chaired by an eminent educationist appointed by the Ministry of Human Resource Development.

- The Chief Executive Officer (CEO) will be the Director-General to be appointed by the Government.

- There will be a Board of Governors comprising members from user institutions.

- Functions:

- To identify partner institutions with adequate infrastructure from the existing schools and higher education institutions that would facilitate the conduct of online examinations without adversely impacting their academic routine.

- To create a question bank for all subjects using modern techniques.

- To establish a strong R&D culture as well as a pool of experts in different aspects of testing.

- To collaborate with international organisations like ETS (Educational Testing Services).

- To undertake any other examination that is entrusted to it by the Ministries/Departments of Government of India/State Governments.

National Medical Commission (NMC)

- NMC is the apex regulatory body for medical education and practice in India.

- NMC was established in 2020 by the National Medical Commission Act, 2019, replacing the Medical Council of India (MCI).

- NMC consists of four autonomous boards: the Undergraduate Medical Education Board, the Post-Graduate Medical Education Board, the Medical Assessment and Rating Board, and the Ethics and Medical Registration Board.

- NMC also has a Medical Advisory Council, which advises the commission on matters related to medical education and practice.

- NMC also regulates the standards and quality of medical education and training, the registration and ethics of medical practitioners, and the assessment and rating of medical institutions.

- NMC has also achieved the prestigious World Federation for Medical Education (WFME) recognition, which means that the medical degrees awarded by the NMC are recognized globally.

Read more: State of Medical Education in India

Important Facts For Prelims

IPEF Ministerial Meeting 2024

Why in News?

Recently, India participated in the Indo-Pacific Economic Framework for Prosperity (IPEF) Ministerial Meeting, held in Singapore on 6th June 024, showcasing the significant strides made in fostering economic engagement among partner countries in the Indo-Pacific region.

What are the Key Highlights of the Meeting?

- IPEF members signed 3 agreements focused on the Clean Economy, Fair Economy, and the overarching IPEF Agreement.

- India did not formally sign these agreements as the domestic approval process is still underway.

- Clean Economy Agreement:

-

It aims to accelerate efforts towards energy security, climate resilience, and reducing GHG emissions.

-

India has taken a leading role in launching a new collaborative effort called a "Cooperative Work Programme" (CWP) that is focused on recovering valuable resources from electronic waste, also known as e-waste urban mining.

-

-

IPEF Catalytic Capital Fund:

-

The fund was launched to support clean economy infrastructure projects in IPEF emerging and upper-middle-income economies.

- The founding supporters such as Australia, Japan, Korea, and the US have provided USD 33 million as an initial grant funding to catalyse USD 3.3 billion in private investment.

-

- Fair Economy Agreement:

-

It aims to create a more transparent and predictable business environment, promote fair competition, and enhance efforts against corruption.

- India highlighted a training program in Digital Forensics & System-Driven Risk Analysis that it will offer to other IPEF partners.

-

- IPEF Upskilling Initiative:

- It provides digital skills training, primarily to women and girls, in IPEF partner countries.

- In the last 2 years, it has provided 10.9 million upskilling opportunities, of which 4 million were in India.

What is IPEF?

- About:

- IPEF was launched on 23rd May 2022 at Tokyo, Japan, comprising 14 countries The IPEF seeks to strengthen economic engagement and cooperation among partner countries with the goal of advancing growth, economic stability and prosperity in the region.

- Members:

- Australia, Brunei, Fiji, India, Indonesia, Japan, South Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, United States, and Vietnam.

- These 14 IPEF partners represent 40% of global GDP and 28% of global goods and services trade.

- Pillars:

- The IPEF is built on 4 main pillars: (I) fair and resilient trade, (II)supply chain resilience, (III) clean economy (renewable energy and reduction of carbon emissions), and (IV) fair economy (tax and anti-corruption policies).

- India has joined Pillars II to IV of IPEF while it has an observer status in Pillar I.

- Fair and Resilient Trade (Pillar I): Aims to promote economic growth, peace, and prosperity in the region.

- Supply-Chain Resilience (Pillar II): Seeks to make supply chains more resilient, robust, and well-integrated.

- Focuses on improving logistics, connectivity, and investments in critical sectors.

- Aims to enhance worker roles through upskilling and reskilling initiatives.

- Clean Economy (Pillar III): Aims to advance cooperation on clean energy and climate-friendly technologies.

- Focuses on research, development, commercialisation, and deployment of clean energy.

- Encourages investment in climate-related projects in the Indo-Pacific region.

- Fair Economy (Pillar IV): Focuses on implementing effective anti-corruption and tax measures.

- Highlights India's strong steps in improving legislative and administrative frameworks to combat corruption.

Rapid Fire

World Wealth Report 2024

India's high net-worth individuals (HNWIs) increased by 12.2% in 2023 as compared to 2022, according to the Capgemini World Wealth Report. There are now 3.589 million HNWIs in the country.

- The financial wealth of India's HNWIs increased by 12.4% in 2023 to USD 1,445.7 billion, up from USD 1,286.7 billion in 2022.

- Globally, HNWI wealth and population rose by 4.7% and 5.1% in 2023.

- In 2023, India's:

- Unemployment rate dropped from 7% in 2022 to 3.1% in 2023, alongside a 7.3% economic growth.

- Market capitalisation surged by 29.0%, compared to a 6% increase in 2022.

- National savings as a percentage of GDP rose from 29.9% in 2022 to 33.4% in 2023.

- HNWI are individuals with investable assets of USD 1 million or more, excluding their primary residence, collectables, consumables, and consumer durables.

Rapid Fire

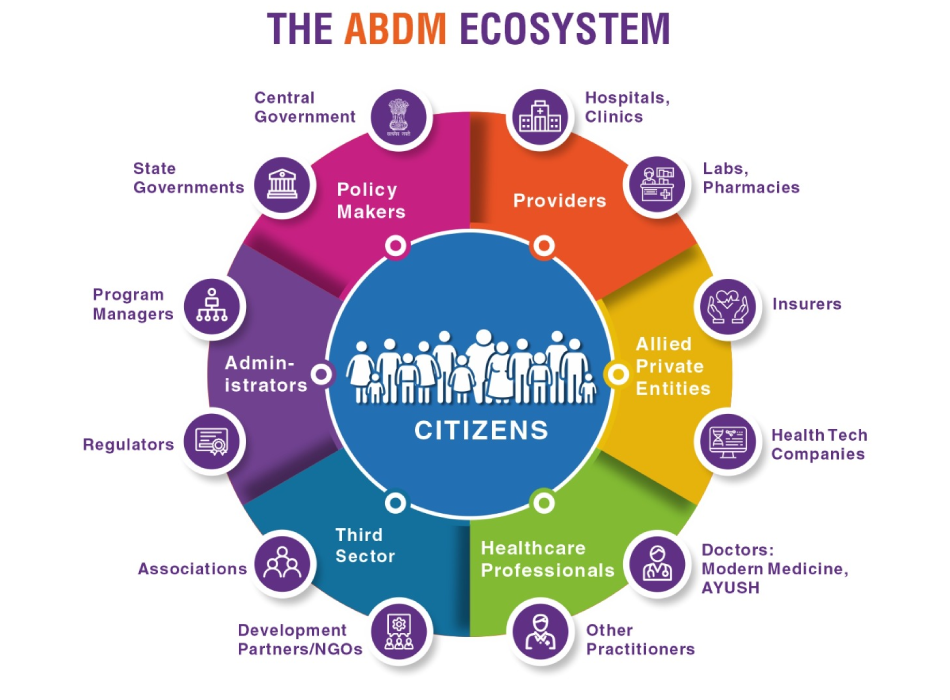

ABHA-Based Scan and Share Service

Recently, the National Health Authority (NHA) has achieved a milestone of generating over 3 crore tokens for Out-Patient Department (OPD) registrations through the ABHA-based Scan and Share service.

- It enables patients to conveniently register for OPD appointments by scanning a QR code displayed at the OPD registration counter.

- It has eliminated the need to wait in long queues for appointments, benefiting vulnerable groups such as the elderly, pregnant women, and those with mobility challenges.

- Uttar Pradesh has generated the maximum tokens followed by Andhra Pradesh, Karnataka and Jammu and Kashmir.

- This service was launched under the Ayushman Bharat Digital Mission (ABDM) in 2022.

- ABHA is a unique 14-digit number used to link all the health records of a person, which intends to create a digital health ecosystem & aims to promote the digitisation of healthcare.

Place In News

Jolfa

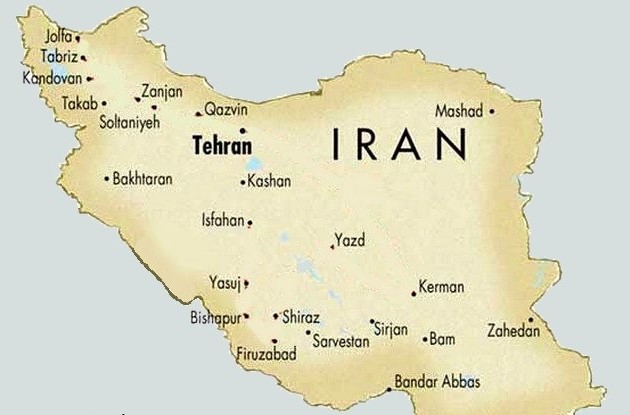

Recently, Iran’s President and Foreign Minister died, following a helicopter crash in the Jolfa, East Azerbaijan province of Iran.

- The helicopter was a US-made Bell-212 helicopter, known for its reliability despite its age.

Jolfa:

- Jolfa is a city in the Central District of Jolfa County, East Azerbaijan province, Iran.

- It serves as the capital of both the county and the district.

- Jolfa is separated by the Aras River from the town of Julfa on the Azerbaijan side of the border.

Rapid Fire

Australia Opens Armed Forces to Non-Citizens

Australia will allow non-citizen permanent residents who have been living in Australia for at least 12 months to join the Australian armed forces starting in July 2024.

- This is due to Australia struggling to meet recruitment targets for its military.

- Citizens from the Five Eyes countries will be favoured to join.

- The Five Eyes is an intelligence alliance comprising Australia, Canada, New Zealand, the United Kingdom and the US.

- These countries are parties to the multilateral UK-USA Agreement.

- Australia is bolstering its military by ramping up recruitment in response to a perceived growing threat from China and a current defence personnel count of around 90,000.

Read more: India-Australia Relations