Governance

CSS and Fiscal Federalism

For Prelims: Centrally Sponsored Schemes (CSS), Fiscal Federalism, Article 282, Articles 270 & 275, Finance Commission, Appropriation Act, Consolidated Fund of India, Planning Commission, NITI Aayog, Seventh Schedule, Inter-State Council.

For Mains: Centrally sponsored schemes (CSS) and issues arising from their implementation.

Why in News?

The Centre cut the 2025-26 centrally sponsored schemes (CSS) outlay to states by Rs 91,000 crore (18% of the budget estimate for the schemes) after finding Rs 1.6 lakh crore in unspent funds from past transfers.

- Many states have termed this decision as contrary to fiscal federalism and raised questions on the viability of Article 282.

What is Article 282?

- About Article 282: It allows both the Union and States to make grants for any public purpose, even if the purpose is outside their legislative jurisdiction.

- Unlike tax devolution (Articles 270 & 275), grants under Article 282 are discretionary and not bound by Finance Commission (FC) recommendations.

- Initially intended for unanticipated contingencies, successive central governments have used it to introduce CSSs.

- Articles 270 and 275 mandate that the FC determines the States' share in Union tax revenues.

- Judicial Stand: In the Bhim Singh Case, 2010, the Supreme Court (SC) upheld the Union’s power to provide discretionary grants under Article 282, even beyond FC recommendations (Article 275).

- Grants can be made even for subjects beyond Parliament's legislative competence, provided they serve a public purpose.

- Citing Ram Jawaya Kapur Case, 1955, the SC ruled that Appropriation Acts, authorizing expenditure from the Consolidated Fund of India (CFI), legally justify grants under Article 282.

How CSS Pose Challenge to Fiscal Federalism?

- Discretionary CSS Funding: Grants under Article 282 the Union or a State can grant funds for any public purpose, even if it lacks legislative authority over it.

- The NITI Aayog 2015 (like earlier Planning Commission which guided grants though they lacked constitutional status), continues to influence CSS design.

- Erosion of States’ Fiscal Autonomy: CSSs have strict fund utilization conditions, limiting states' flexibility to adapt them to local needs.

- E.g., under the Poshan Abhiyaan, States cannot modify target groups or key nutrition indicators.

- Resource-Expenditure Asymmetry: The 15th Finance Commission (2021-26) highlighted the Union holds 63% of resources but spends 38%, while states get 37% but bear 62% of expenditure.

- It makes states reliant on CSS funds and limit state-specific initiatives.

- Prioritization Issues: CSS funds require states to provide matching grants, diverting their resources from state-priority sectors.

- Threat to Cooperative Federalism: During Constitutional debates, Dr. BR Ambedkar emphasized a co-equal partnership between the Union and states but over-reliance on discretionary CSS grants undermines the constitutional intent of cooperative federalism.

- E.g., CSS guidelines mandate “branding” to highlight central leadership, reinforcing central control.

- Pushing Union’ Policies: CSSs have increasingly been used as political instruments to control states.

- E.g., the Ministry of Finance’s 2022 guidelines included a Rs 50,000 crore interest-free loan for states willing to disinvest public sector enterprises, a move opposed by several states.

- Proliferation of CSS Funding: CSS fund releases rose from 7.5% of total transfers in 2014-15 to 47% in 2022-23, reducing FC recommended transfers.

- As opposed to the Seventh Schedule of the Constitution, many CSSs operate in areas under the State List, leading to Central encroachment into State jurisdictions.

What is CSS?

- About: CSSs are jointly funded by the Centre and states, implemented by states, and cover sectors under the State and Concurrent Lists of the Constitution.

- They supplement the efforts of State Governments, as the Central Government has greater financial resources.

- All transfers to States for CSSs are being routed through the Consolidated Fund of the State.

- Types: CSS is divided into three main categories:

- Core of the Core Schemes: These schemes are the most crucial for social inclusion and protection. E.g., MGNREGA.

- Core Schemes: These schemes focus on various developmental sectors such as agriculture, infrastructure, education, health, and rural development.

- E.g., Mid-Day Meal Scheme (School Nutrition Programme), Pradhan Mantri Gram Sadak Yojana (Rural Roads) etc.

- Optional Schemes: States are free to choose the ones they wish to implement.

- Eg: Border Area Development Programme etc.

- Funding Pattern: The Centre allocates about 12% of its budget to CSS, with funding shared in varying Centre-State ratios:

- 60:40 (Majority of Schemes)

- 80:20 (Some Schemes)

- 90:10 (For North-Eastern & Special Category States)

- Difference Between CSS and Central Sector Schemes:

|

Feature |

Centrally Sponsored Schemes (CSS) |

Central Sector Schemes |

|

Implementation |

By State Governments |

By Central Government |

|

Funding Source |

Shared funding (Centre & State) |

Fully funded by Centre |

|

Examples |

MGNREGA, PMAY, Swachh Bharat Mission |

Way Forward

- Judicial Clarity on Article 282: The SC should evaluate whether CSS affects federal balance and establish the special circumstances under which discretionary grants can be used.

- Rationalisation of CSS: Merge similar CSS into effective Umbrella Schemes and conduct regular impact assessments to eliminate ineffective ones.

- Review Funding Mechanism: Revise the fund-sharing pattern to ease states' financial burden, especially for general category states, and restore support for backward regions after Backward Regions Grant Fund (BRGF) discontinuation.

- Strengthening Cooperative Federalism: Establish regular Centre-State consultations via the Inter-State Council and NITI Aayog, and grant states more flexibility in adapting CSS to local needs.

|

Drishti Mains Question: Discuss the impact of Centrally Sponsored Schemes (CSS) on fiscal federalism in India. How do discretionary grants under Article 282 affect states' financial autonomy? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following statements is/are correct regarding Smart India Hackathon 2017? (2017)

- It is a centrally sponsored scheme for developing every city of our country into Smart Cities in a decade.

- It is an initiative to identify new digital technology innovations for solving the many problems faced by our country.

- It is a programme aimed at making all the financial transactions in our country completely digital in a decade.

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 2 only

(c) 3 only

(d) 2 and 3 only

Ans: (b)

Q. Consider the following statements: (2011)

In India, a Metropolitan Planning Committee

- is constituted under the provisions of the Constitution of India.

- prepares the draft development plans for the metropolitan area.

- has the sole responsibility for implementing Government sponsored schemes in the metropolitan area.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

Q. How have the recommendations of the 14th Finance Commission of India enabled the States to improve their fiscal position? (2021)

Q. The concept of cooperative federalism has been increasingly emphasized in recent years. Highlight the drawbacks in the existing structure and the extent to which cooperative federalism would answer the shortcomings. (2015)

Sports & Affairs

SC Slams Politicisation of Sports Administration

For Prelims: Amateur Kabaddi Federation of India, Supreme Court of India, Indian Olympic Association, State subject, National Sports Code of India

For Mains: Judicial Oversight in Sports Administration, Politicization in Indian Sports Federations, Sports Governance

Why in News?

The Supreme Court of India has directed the Ministry of Youth Affairs and Sports to ensure Indian kabaddi players participate in the Asian Kabaddi Championship 2025.

- The directive comes amid Amateur Kabaddi Federation of India (AKFI’s) suspension by the International Kabaddi Federation (IKF), with the court slamming political interference and bureaucratic control in sports administration.

Why was the AKFI Suspended by IKF?

- About: The AKFI is the apex governing body for Kabaddi in India. It regulates all forms of Kabaddi, including National, Indoor, Beach, and Circle Style, and plays a key role in organizing tournaments, selecting teams, and overseeing the sport’s development.

- Headquarters: Jaipur, Rajasthan

- Affiliations: Indian Olympic Association (IOA), Asian Kabaddi Federation (AKF), and International Kabaddi Federation (IKF). AKFI follows guidelines received from the IKF and AKF.

- Recognition: Officially recognized by the Ministry of Youth Affairs and Sports, Government of India.

- Concerns Regarding AKFI: AKFI faces allegations of opaque elections, mismanagement, and monopolization by politicians, raising concerns over nepotism and fair representation.

- Delhi HC Intervention: Amid AKFI management concerns, the Delhi High Court appointed Justice (Retd) S.P. Garg as administrator to oversee its affairs.

- AKFI Suspension: IKF suspended AKFI over governance issues, citing the absence of an elected body, jeopardizing India's international Kabaddi participation.

- IKF assured AKFI’s affiliation restoration and India’s participation at the Iran championship if an elected body replaced the administrator.

Note: The IKF, founded in 2004 and headquartered in Jaipur, is the global governing body of Kabaddi, with 24 affiliated countries (including India).

What Did the Supreme Court Order?

- The Supreme Court instructed Justice (Retd.) S.P. Garg, to hand over charge to the newly elected body from the December 2023 elections.

- The Court stressed urgency due to the upcoming Asian Kabaddi Championship 2025, directing AKFI's Governing Body to immediately select teams and arrange training camps, and ensure India's participation in the tournament.

- The Court also clarified that the transfer of authority does not imply endorsement of the AKFI elections and that related issues remain open for adjudication.

What are the SC’s Concerns Regarding Sports Administration?

- Politicization: Former politicians and bureaucrats dominate sports bodies, sidelining athletes.

- SC acknowledges that sports associations improve when sportspersons take charge rather than political or bureaucratic appointees.

- Mismanagement: Allegations of opaque election processes, financial irregularities, and monopolization by certain individuals have surfaced.

- Federations like AKFI operate without properly elected governing bodies, violating sports norms not aligning with the National Sports Code of India 2011.

- No Checks and Balances: With no clear oversight or accountability, sports bodies operate without transparency, as evident in the 2010 Commonwealth Games, where the Central Vigilance Commission (CVC) reported financial irregularities in 14 projects.

- Impact on Athletes: Delays in team selection, training, and tournament participation due to administrative inefficiencies harm athletes.

- Athletes face sexual harassment, but weak complaint systems and delayed action leave them vulnerable, demanding urgent reforms.

- Sports Infrastructure: As sports is a State subject, there is no uniform approach to infrastructure development across India.

What is the National Sports Code of India 2011?

Click Here to Read: National Sports Code of India 2011

Way Forward

- Auditing: Engaging diplomatic channels to resolve sports federation recognition issues and ensuring Central Bureau of Investigation (CBI) and INTERPOL investigations to eliminate corruption and vested interests at national and international levels.

- A central regulatory body with clear statutes and democratic principles is needed to govern all sports federations, ensuring transparent governance and strict oversight for fair and accountable administration.

- Empowering Athletes: Athletes must have active roles in decision-making for transparency and accountability.

- Follow the Olympic Charter, which mandates athlete representatives in National Olympic Committees (e.g., IOA in India).

Increasing Women’s Representation: Ensure gender equality, establish quotas, and create a safe, inclusive environment to encourage women in sports administration careers.

|

Drishti Mains Question: Examine the impact of political interference and bureaucratic control in Indian sports federations. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q. An athlete participates in the Olympics for personal triumph and nation’s glory; victors are showered with cash incentives by various agencies, on their return. Discuss the merit of state sponsored talent hunt and its cultivation as against the rationale of a reward mechanism as encouragement. (2014)

Governance

Balancing Freebies and Welfare

For Prelims: Subsidies, RBI, Health Insurance, Purchasing Power, Public Distribution System (PDS), Directive Principles of State Policy (DPSP), Fiscal Responsibility and Budget Management (FRBM) Act, 2003, Off-budget Borrowings.

For Mains: Debate over freebies and welfare and their impact on the economy.

Why in News?

There is a rising trend among the political parties to promise a barrage of freebies or subsidies to lure the electorate as seen in the Delhi Assembly elections 2025.

- Electoral freebies (or "revdi culture") are debated—some see them as harmful to development, while others view them as essential for socio-economic progress.

- The RBI defines ‘freebies’ as “a public welfare measure that is provided free of charge.”

How Freebies Help in Socio-economic Progress?

- Women Empowerment: Cash transfers to women boost financial independence, decision-making, and reduce dependency on family members for immediate needs.

- Enhancing Human Capabilities: Welfare schemes like free food and health insurance align with Amartya Sen’s “capability approach,” enhancing dignity, immunity, and reducing healthcare burdens.

- Boosting Consumer Spending: Direct cash transfers boost demand, enhance purchasing power, and stimulate local economies through increased spending.

- Poverty Alleviation: Food security schemes, like the Public Distribution System (PDS) and Mid-Day Meal, ensure basic sustenance, preventing extreme poverty.

- Targeted welfare measures help bridge the gap between rich and poor, fostering inclusive growth.

- Long-Term Benefits: Poor health causes personal suffering and strains public resources by raising healthcare demand. Early investment in nutrition brings long-term benefits for individuals and society.

How Can Freebies Be Harmful to Development?

- Rising Revenue Deficit: Freebie-driven spending increases the fiscal burden, leading to a decline in the revenue surplus of States.

- E.g., Delhi’s revenue surplus dropped by 35% between 2022-23 and 2024-25.

- Higher Subsidy Expenditure: RBI warns that unchecked subsidies divert funds from infrastructure, healthcare, and education, with annual costs rising by Rs 10,000- 12,000 crore due to new freebies.

- Increased Tax Burden: Governments may raise taxes to cover rising government expenditure, potentially reducing disposable income and hurting middle-class consumption.

- Crowding Out Investments: Excessive expenditure on freebies could crowd out the resources available and hamper states’ capacity to build critical social and economic infrastructure.

- Potential Credit Default Risks: Worsening fiscal health affects states’ ability to borrow and higher debt servicing costs may increase credit default risks.

- Distort Decision Making: Some argue that freebies amount to bribery and discourage voters from making informed choices.

What is the Judicial Stand on Freebies?

- S. Subramaniam Balaji Case, 2013: The Supreme Court ruled that freebies fall within legislative policy and are beyond judicial scrutiny. It emphasized that certain freebies align with the Directive Principles of State Policy (DPSP).

- While hearing a PIL in 2025, the Supreme Court condemned pre-election freebies, warning free ration and money discourage work and create a "class of parasites".

How Freebies Differ From Welfare Schemes?

|

Criteria |

Freebies |

Welfare Schemes |

|

Conceptual Distinction |

Goods or services provided free of charge, often for political gain. |

Government initiatives for social and economic upliftment. |

|

Merit vs. Non-Merit Goods |

Non-merit goods like TVs, laptops, mixer grinders, and cash handouts. |

Merit goods like education, healthcare, food security, and rural employment. |

|

Socio-Economic Impact |

Provides short-term benefits but lacks structural economic improvements. |

Reduces poverty, improves living standards, and enhances productivity. |

|

Fiscal Sustainability |

Can lead to excessive borrowing and revenue deficits. |

Budgeted with policy backing for economic inclusion. |

|

Political Motivations |

Often distributed before elections to influence voters. |

Aimed at structural development with long-term policy planning. |

|

Implementation Challenges |

Distributed indiscriminately, sometimes benefiting non-needy sections. |

Essential for addressing inequalities. |

|

Accountability and Governance |

Lacks transparency, leading to financial mismanagement. |

Subject to fiscal planning, coordination, and oversight. |

Note:

- Merit goods are goods and services that have positive externalities, meaning they benefit not just individuals but society as a whole. Education, Healthcare, Food Security etc.

- Demerit goods are goods and services whose consumption leaves a negative impact on its consumer and on others in the society. E.g., alcohol.

Way Forward

- Fiscal Reforms: Strengthen the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 to prevent reckless fiscal spending.

- Implement time-bound and well-targeted subsidies to ensure sustainable social welfare.

- Defining Welfare and Freebies: Define policy guidelines to differentiate essential welfare from electoral freebies, using social utility, long-term impact, and fiscal sustainability as criteria.

- Strengthening Institutional Mechanisms: Strengthen financial regulators to monitor public spending and improve tracking of off-budget borrowings and hidden subsidies (e.g., Underpricing of electricity).

- Balancing Welfare and Fiscal Prudence: Focus on education, healthcare, and job creation for economic stability, ensuring subsidies and social schemes promote capacity-building over dependency.

|

Drishti Mains Question: Discuss the socio-economic impact of electoral freebies in India. How do they differ from welfare schemes? |

Important Facts For Prelims

Swavalambini

Why in News?

The Ministry of Skill Development and Entrepreneurship (MSDE), in collaboration with NITI Aayog launched “Swavalambini” in Assam, Meghalaya and Mizoram.

What is Swavalambini?

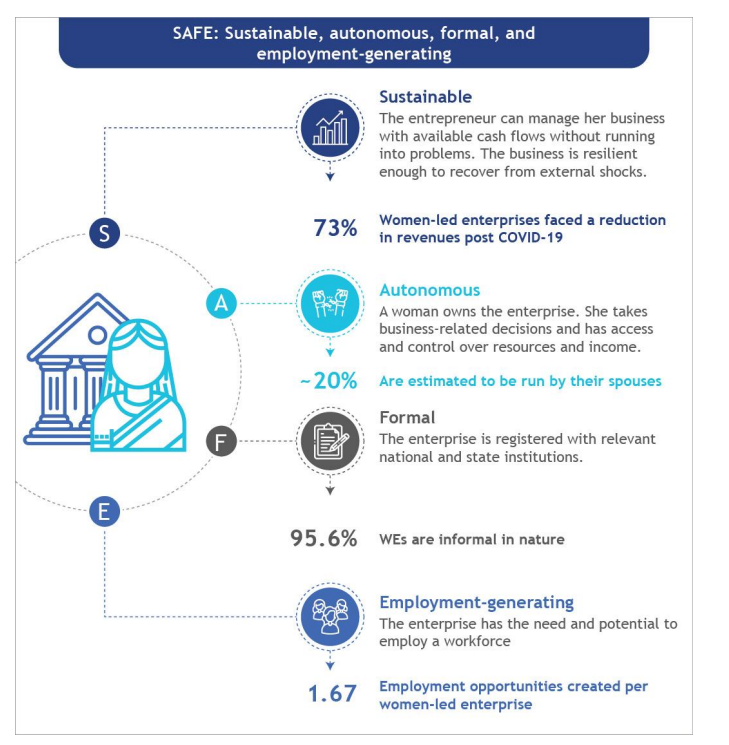

- About: Swavalambini is a women entrepreneurship program that aims to empower females in Northeast Higher Education Institutions (HEIs) with an entrepreneurial mindset, resources, and mentorship for business success.

- Program Structure: MSDE, in collaboration with Indian Institute of Entrepreneurship (IIE), Guwahati and NITI Aayog, launched a stage-wise entrepreneurial process including Entrepreneurship Awareness Programme (EAP), Women Entrepreneurship Development Programme (EDP), Faculty Development Programme (FDP), and funding.

- Successful ventures will be recognized and awarded, inspiring others and establishing a clear framework to scale women-led enterprises in India.

- Expected Outcomes: 10% of EDP trainees expected to launch successful businesses.

- Strengthens entrepreneurial culture in HEIs, making business creation a viable career path for women. Promotes women-led enterprises as a key driver of India’s economic transformation.

How Does Swavalambini Align with National Policies?

- National Education Policy (NEP) 2020: Promotes skill integration, industry collaboration, and entrepreneurship-driven education.

- Swavalambini builds on this by ensuring financial and mentorship support for women entrepreneurs.

- Women Entrepreneurship Schemes: Swavalambini strengthens initiatives like Start-Up India, Stand-Up India, PM Mudra Yojana, and Women Entrepreneurship Platform.

- Swavalambini aligns with the Union Budget 2025, which introduced a Rs 10,000 crore start-up fund and extended the 100% tax exemption on start-up profits for the first five years, providing crucial financial support for emerging women-led enterprises.

Women Entrepreneurship Landscape in India

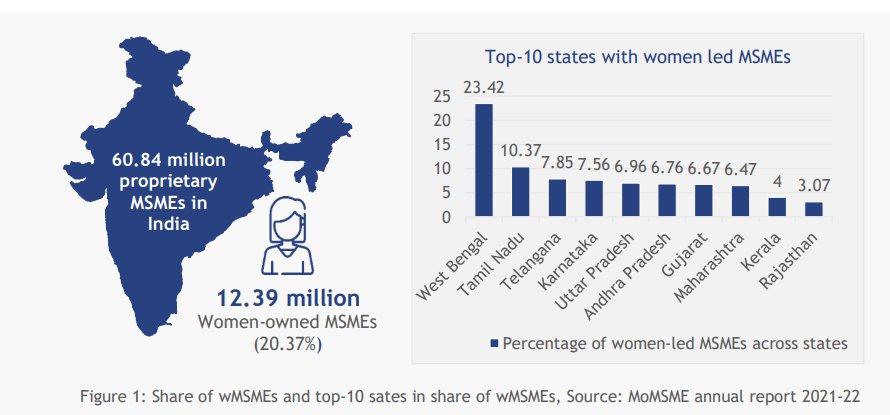

- Total MSMEs in India: Over 63 million, Women-Owned MSME 20% (12.39 million).

- Employment Contribution: Women-led MSMEs employ 22-27 million people.

- India’s Rank in Women Entrepreneurship: India currently ranks 57th out of 65 nations, in the Mastercard Index on Women Entrepreneurship (MIWE) 2021.

- India ranks 70th among 77 nations in the Global Female Entrepreneurship Index (FEI) as estimated by the Global Entrepreneurship and Development Institute.

- Top States with the Highest Share of Women-Led MSMEs: West Bengal (23.42%), Tamil Nadu (10.37%), Telangana (7.85%), Karnataka (7.56%), and Andhra Pradesh (6.76%).

UPSC Civil Services Examination, Previous Year Questions (PYQs):

Q. What does venture capital mean? (2014)

(a) A short-term capital provided to industries

(b) A long-term start-up capital provided to new entrepreneurs

(c) Funds provided to industries at times of incurring losses

(d) Funds provided for replacement and renovation of industries

Ans: (b)

Q. With reference to ‘Stand Up India Scheme’, which of the following statements is/are correct? (2016)

- Its purpose is to promote entrepreneurship among SC/ST and women entrepreneurs.

- It provides for refinance through SIDBI.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (C)

Q. Pradhan Mantri MUDRA Yojana is aimed at (2016)

(a) bringing the small entrepreneurs into formal financial system

(b) providing loans to poor farmers for cultivating particular crops

(c) providing pensions to old and destitute persons

(d) funding the voluntary organisations involved in the promotion of skill development and employment generation

Ans: (a)

Important Facts For Prelims

US Agency for International Development

Why in News?

The US President Donald Trump has imposed a 90-day freeze on foreign aid, halting US Agency for International Development (USAID) programs worldwide.

- Additionally, the US has announced that it will not attend the 2025 G20 Foreign Ministers’ meeting in Johannesburg, South Africa.

What is the US Agency for International Development?

- About: USAID is the primary US agency for global humanitarian and development aid.

- Support: In 2024, USAID was allocated USD 44.2 billion, just 0.4% of the total US federal budget, but accounted for 42% of all humanitarian aid tracked by the United Nations.

- USAID funds healthcare, food aid, disaster relief, and policy advocacy worldwide.

- Top aid recipients Include Ukraine, Ethiopia, Jordan, Somalia, and Afghanistan.

- USAID and India: India's association with USAID began in 1951 with the India Emergency Food Aid Act, evolving over decades from food aid to infrastructure, capacity building, and economic reforms.

- The agency has been supporting education, immunization, polio eradication, and HIV (human immunodeficiency virus) /Tuberculosis (TB) prevention.

- In the last decade, India is said to have received around USD 1.5 billion from USAID (about 0.2 % to 0.4 % of USAID’s total global funding).

What are the Implications for India?

- India’s Role in the Global South: India has positioned itself as a bridge between the Global North and the Global South, benefiting from its rising status within the G20.

- China and Russia: If the US reduces its role in G20, China and Russia could expand their influence, potentially shifting global economic dynamics and weakening India's position amid China's rising power.

- Healthcare: Although direct financial aid to India has decreased, USAID contributions exceeded USD 50 million in 2024.

- A permanent funding cut could impact India's vaccination programs, infectious disease control, and medical infrastructure.

- India may need to redirect domestic funds to sustain health, environment, and governance projects.

UPSC Civil Services Examination Previous Year’s Questions (PYQs)

Prelims:

Q. In which one of the following groups are all the four countries members of G20? (2020)

(a) Argentina, Mexico, South Africa and Turkey

(b) Australia, Canada, Malaysia and New Zealand

(c) Brazil, Iran, Saudi Arabia and Vietnam

(d) Indonesia, Japan, Singapore and South Korea

Ans: (a)

Rapid Fire

Taranaki Maunga Mountain Gains Legal Personhood

Taranaki Maunga (New Zealand’s 2nd-highest mountain in North Island) was granted legal personhood becoming the third natural feature (after Te Urewera park in 2014 and Whanganui River in 2017) in the country to receive this status.

- It will now be officially recognized by its Māori name, replacing the colonial name Mount Egmont.

- Māori are the indigenous tribes (Iwi) of New Zealand.

About Mount Taranaki:

- Type: Stratovolcano (composite cone) with a symmetrical shape.

- Formation: Result of Pacific Plate subducting beneath the Australian Plate.

- Status: Snow-capped dormant volcano.

- Aoraki/Mount Cook (3724 m), located in the Southern Alps is the highest mountain in New Zealand, while Mount Tasman is second-highest (3,497m).

Legal Rights to Natural Entities in India:

- Uttarakhand HC (2017 & 2018): Granted legal personhood to Ganga & Yamuna rivers, Gangotri & Yamunotri glaciers, and later extended equal rights to all animals. The Supreme Court stayed the river ruling.

- Punjab & Haryana HC (2020): Declared Sukhna Lake, Chandigarh, a living entity for environmental protection.

- The Doctrine of Parens Patriae empowers the state (judiciary) to act as a guardian for those unable to protect themselves, including natural entities like rivers, forests, and wildlife.

Read More: Human Rights and Environment

Rapid Fire

Eurasian Otters in Kashmir Valley

Eurasian otters have been spotted in Gurez Valley (Kashmir) with the first live documentation in 25 years.

- It was spotted feasting on fish in the Kishanganga River (Originating from Krishansar lake, Ganderbal district (J&K).

- The river flows northwards through the Tulail and Gurez Valleys of Kashmir before entering PoK.

- About Eurasian Otters:

- About: Otters are members of the mammalian family called Mustelidae and inhabit both marine and freshwater.

- In J&K, they are locally known as Vodur and help maintain aquatic ecosystem health.

- Otters are mainly active around dawn and dusk (crepuscular).

- Habitat: Found in the Himalayas, northeast India, and Western Ghats.

- Carnivorous Diet: Feeds on fish, crustaceans, amphibians, and sometimes reptiles, birds, eggs, insects, and worms.

- Conservation Status: Near threatened (IUCN), Schedule I (Wildlife Protection Act, 1972), Appendix I (CITES).

- Other Otter Species in India: Smooth-coated Otter (throughout India), and Small-clawed Otter (Himalayas and southern India).

- About: Otters are members of the mammalian family called Mustelidae and inhabit both marine and freshwater.

Read More: Fishing Cat and Otters

Rapid Fire

100 GW Solar Power Capacity

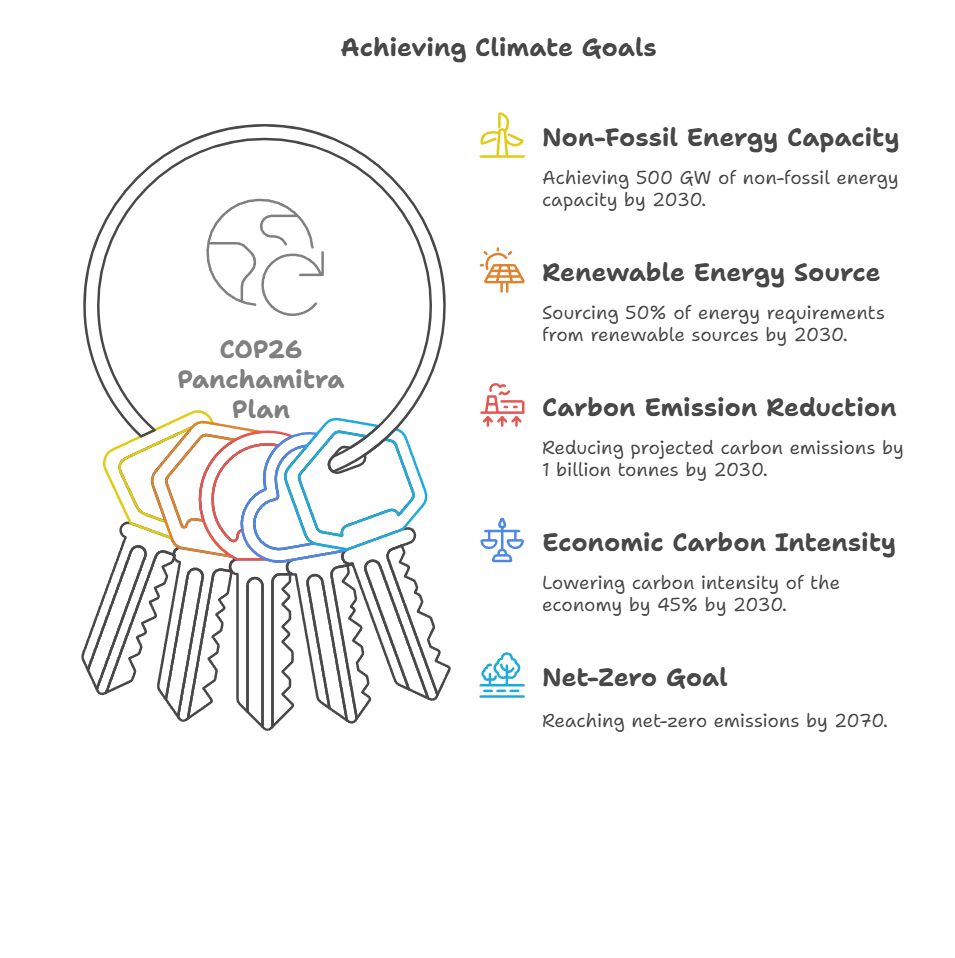

India has crossed 100 GW of installed solar capacity, marking a key milestone toward its 500 GW non-fossil energy goal by 2030.

- Growth in Solar Capacity: It surged over 35 times in the last decade, rising from 2.82 GW in 2014 to 100 GW in 2025.

- The grand total of solar and hybrid projects stands at 296.59 GW.

- PM Surya Ghar: Muft Bijli Yojana enabled 9 lakh rooftop solar installations across households.

- Solar Contribution to Climate Goals: Solar power contributes 47% of India’s total renewable energy capacity.

- Top Solar States: Rajasthan, Gujarat, Tamil Nadu, Maharashtra, and Madhya Pradesh.

- Growth in Manufacturing: Solar module production capacity surged from 2 GW in 2014 to 60 GW in 2024.

Read More: India's Quest for Solar Dominance

Rapid Fire

BIMSTEC Youth Summit 2025

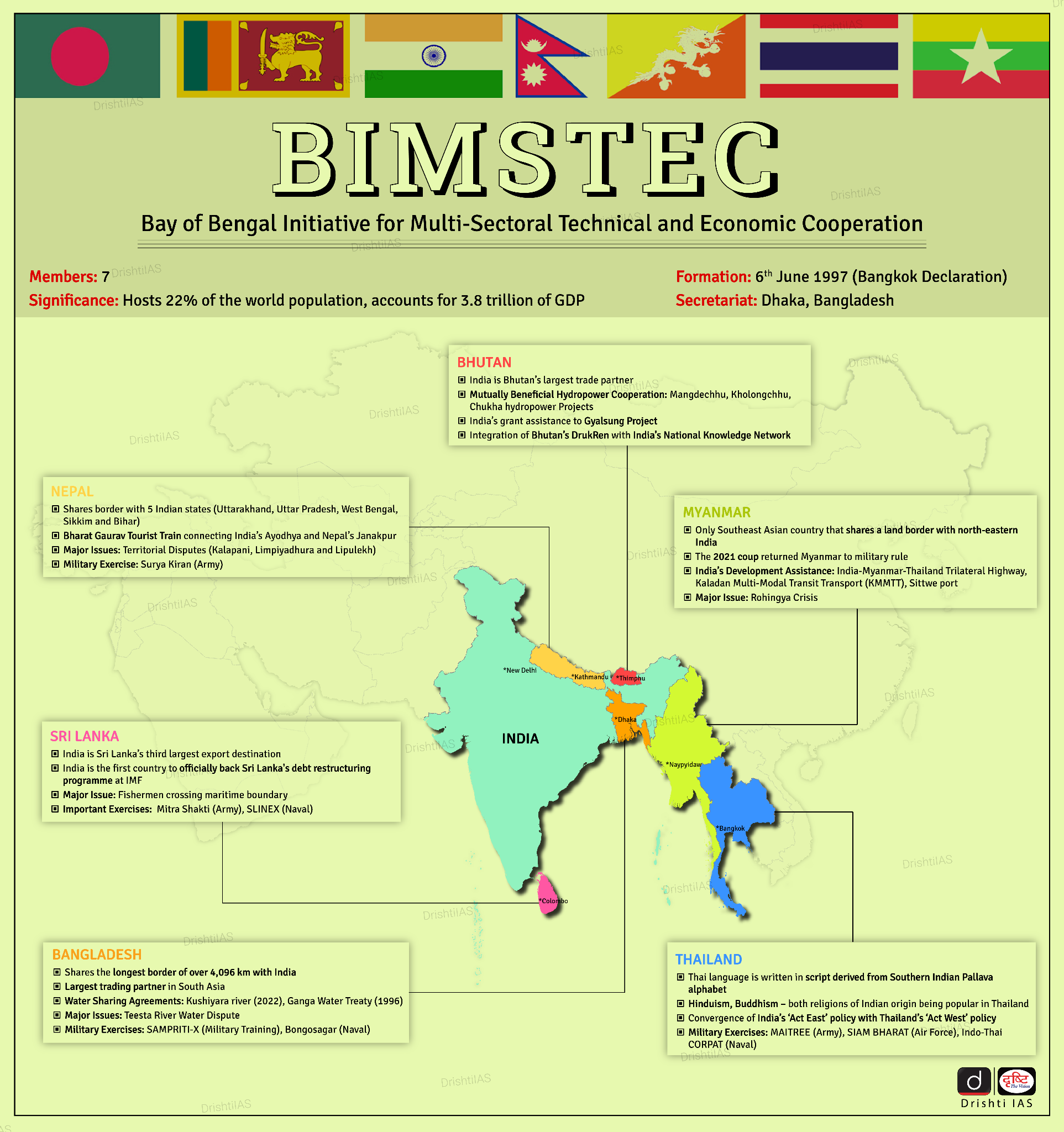

The first-ever Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) Youth Summit 2025 was inaugurated in Gandhinagar, Gujarat, the event emphasized skill development, entrepreneurship, and regional cooperation.

- Key Highlights of Summit:

- Theme: "Youth as a Bridge for Intra-BIMSTEC Exchange."

- Youth-Centric Focus: The summit highlighted that over 60% of BIMSTEC’s 1.8 billion population comprises youth, underlining their role in regional growth.

- Highlighted India's goal of becoming a developed nation by 2047, stressing youth participation.

- Startup Network: India proposed a BIMSTEC-wide startup network to boost innovation and entrepreneurship.

- BIMSTEC: The BIMSTEC is a regional organization comprising India, Bangladesh, Myanmar, Sri Lanka, Thailand, Nepal, and Bhutan.

- It tackles climate change, poverty, and sustainability while strengthening cooperation in the Bay of Bengal region.

- India’s Commitment to Youth Empowerment: India’s Skill India Mission, National Education Policy (NEP) 2020, and PM Internship Scheme have trained 15 million youth in AI, robotics, and digital technologies.

- India’s startup ecosystem is the world’s third-largest, with 157,000 startups, nearly half women-led.

Read more: BIMSTEC Charter