Economy

Paradox of Savings

- 03 May 2024

- 7 min read

For Prelims: Paradox of Savings, Paradox of Thrift, Savings Rates, John Maynard Keynes, Microfinance, Reserve Bank of India, Sagarmala, Bharatmala

For Mains: Application of Paradox of Savings in Context of India

Why in News?

Recently, the paradox of savings, or the paradox of thrift, has been a topic of interest in economic discussions due to its implications on how personal savings behaviors might negatively affect broader economic growth.

- This counterintuitive economic concept has resurfaced in news and analyses, particularly in times of economic downturns, where the balance between saving and spending becomes crucial to policy debates on how best to stimulate recovery and sustain economic stability.

What is the Concept of the Paradox of Savings?

- About:

- The paradox of savings, also known as the paradox of thrift, suggests that while individual savings are ostensibly good, an increase in overall savings rates across an economy may lead to a decrease in total economic savings.

- This theory contrasts with the intuitive belief that higher personal savings directly contribute to increased economic savings.

- Origins and Development of the Theory:

- Key Historical Insights: The idea was notably popularised by John Maynard Keynes in his influential 1936 book, The General Theory of Employment, Interest, and Money.

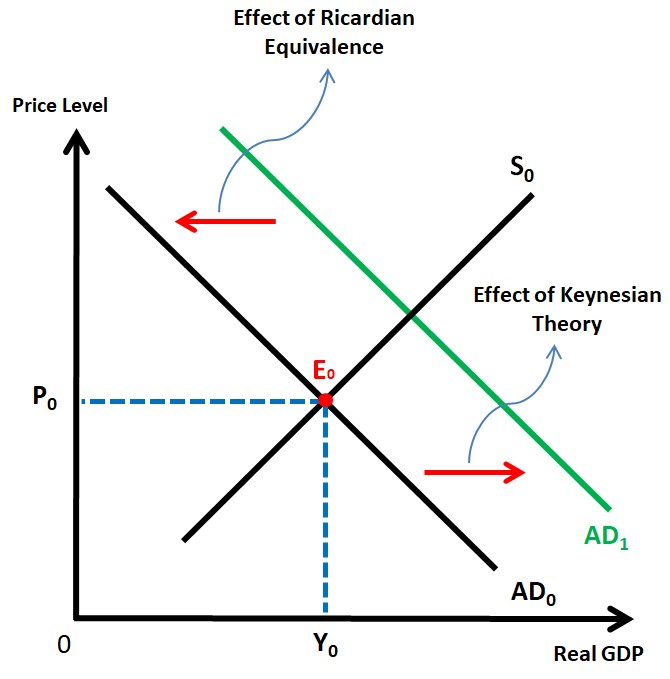

- Keynesian Perspective: Keynesian economists argue that an increase in savings reduces consumer spending on final goods and services, which in turn decreases overall savings and investment.

- They contend that consumer spending drives economic growth and that savings are channelized into investments aimed at producing goods for consumer markets.

- Insufficient consumer spending can lead to a reduction in these investments, thus harming economic growth.

- Governmental Role:

- Keynesians advocate for active governmental intervention, particularly in times of economic downturns.

- Measures could include increasing government spending to boost consumer purchasing power and stimulate demand.

- Keynesians advocate for active governmental intervention, particularly in times of economic downturns.

- Counter Arguments:

- Critics of the paradox argue that savings contribute to a pool of capital that can be used for investment, potentially leading to economic growth even in the context of reduced consumer spending.

- A decrease in consumer demand shifts investment from short-term, consumer-driven production to long-term projects, potentially making previously unviable projects viable.

How the Paradox of Thrift Plays Out in Indian Context?

- The Indian Context:

- Indian's high savings rate, beneficial for long-term security, may hinder economic growth in slowdowns.

- A sizable informal sector with limited savings complicates matters; policies promoting formalisation can boost savings and enhance credit access.

- Low demand may deter businesses from investing in new projects, shrinking the overall investment pool, a critical concern for India's infrastructure and job creation needs.

- Mitigating Factors:

- An efficient banking system can channel savings into productive investments.

- During economic downturns, the government can increase spending on infrastructure and social programs, stimulating demand and creating jobs.

- Principles from behavioral economics can be used to encourage consumption during economic downturns.

How Does the Ricardian Equivalence Proposition Plays Out in India?

- The Crowding-Out Effect: The economic survey (2021) discusses the crowding-out effect, where increased government spending potentially reduces private investment by causing higher interest rates.

- This effect is linked to the Ricardian Equivalence Proposition (REP), which assumes perfect capital markets and suggests that consumers save in anticipation of future taxes, thus neutralising government spending’s impact.

- However, the strict assumptions of REP may not hold true in complex and developing economies like India.

- India’s Economic Landscape: Unlike the fixed savings supply assumed in the crowding-out theory, India, as an emerging economy, sees an expanding savings supply with income growth.

- Government spending can boost demand and employment, leading to increased savings and stimulating private investment.

- Public expenditures that support the private sector’s saving and investment capacities can actually foster private investment, especially when directed towards infrastructure and development.

- Economic Survey Insights: The Economic Survey of India (2020-21) acknowledges potential short-term crowding-out effects but emphasises the long-term benefits where public investments stimulate private investments.

- It highlights the growth in credit to the MSME sector and increased capital expenditure by the government as vital economic growth drivers.

- The survey suggests that in India, public spending complements private investment, aiding the country’s overall economic progress.

Conclusion

- The paradox of savings presents a significant theoretical challenge to conventional economic wisdom that favours savings unequivocally.

- While Keynesian economists highlight potential negative impacts of increased savings rates on economic activity, critics offer a different perspective that sees savings as a flexible tool for adjusting economic production and investment across time, potentially leading to more sustainable long-term growth.

|

Drishti Mains Questions: Q. Discuss the relevance of the paradox of thrift in the context of the Indian economy. How does individual saving behaviour impact overall economic growth and aggregate demand? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. In India, the interest rate on savings accounts in all the nationalized commercial banks is fixed by (2010)

(a) Union Ministry of Finance

(b) Union Finance Commission

(c) Indian Banks’ Association

(d) None of the above

Ans: (d)

Q. If the interest rate is decreased in an economy, it will (2014)

(a) decrease the consumption expenditure in the economy

(b) increase the tax collection of the Government

(c) increase the investment expenditure in the economy

(d) increase the total savings in the economy

Ans: (c)

Mains:

Q. Among several factors for India’s potential growth, savings rate is the most effective one. Do you agree? What are the other factors available for growth potential?