Governance

Anna Chakra and SCAN for Reforming PDS System

For Prelims: India's Public Distribution System, National Food Security Act (NFSA) of 2013 , Fair Price Shops, Pradhan Mantri Garib Kalyan Anna Yojana, Food Corporation of India, Minimum support prices, One Nation One Ration Card

For Mains: Reforms in PDS System in India, Challenges Related to India’s Public Distribution System in India, Measures can be Adopted to Enhance the Effectiveness of the PDS System.

Why in News?

Recently, the Union Minister of Consumer Affairs, Food and Public Distribution and New & Renewable Energy, launched “Anna Chakra” and the SCAN (Subsidy Claim Application for NFSA) portal with the aim to modernize India's Public Distribution System (PDS).

- This will enhance the efficiency of the PDS supply chain and streamline the subsidy claim process, benefiting millions of citizens reliant on food security programs.

What is Anna Chakra and the SCAN System?

- About Anna Chakra::

- Anna Chakra is a pioneering tool for optimizing the supply chain of the PDS in India.

- It has been developed in collaboration with the World Food Programme (WFP) and the Foundation for Innovation and Technology Transfer (FITT) at IIT-Delhi.

- This initiative employs advanced algorithms to identify optimal routes for the transportation of food grains.

- Key Features:

- Enhanced Efficiency and Cost Savings: Optimizes the PDS logistics network to ensure timely delivery of essentials while achieving annual savings of Rs 250 crores through reduced fuel consumption, time, and logistics costs.

- Environmental Sustainability: Minimizes transportation-related emissions by reducing transportation distance by 15-50% and contributing to a reduced carbon footprint.

- Wide Coverage: Optimization assessment spans 30 states, benefiting approximately 4.37 lakh Fair Price Shops (FPS) and 6,700 warehouses within the PDS supply chain.

- Seamless Integration: Linked with the Railways' Freight Operations Information System (FOIS) via the Unified Logistics Interface Platform (ULIP) and integrated with the PM Gati Shakti platform, enabling geo-location mapping of FPS and warehouses.

- About SCAN System:

- The SCAN portal is designed to streamline the subsidy claim process for states under the National Food Security Act (NFSA) 2013.

- It modernizes PDS operations for better fund utilization, aligns with government tech initiatives to reduce leakages, and enhances food security for 80 crore people with environmental and economic benefits.

- Key Features:

- Unified Platform: Provides a single-window system for states to submit food subsidy claims, streamlining the process for all stakeholders.

- Automated Workflow: Ensures end-to-end automation for the release and settlement of subsidies, enhancing efficiency and transparency.

- Rule-Based Mechanism: Utilizes rule-based processing for claim scrutiny and approval by the Department of Food and Public Distribution (DFPD), expediting settlements.

What is PDS?

- About:

- The PDS is an Indian food Security System established to address food scarcity by providing foodgrains at affordable prices

- It operates under the National Food Security Act (NFSA), 2013, ensuring food security for nearly two-thirds of India’s population based on Census 2011 data.

- Nodal Ministry:

- Ministry of Consumer Affairs, Food, and Public Distribution.

- Evolution of PDS:

- The Public Distribution System (PDS) in India originated during World War II as a wartime rationing measure and evolved through several phases.

- In the 1960s, PDS expanded in response to food shortages, with the establishment of the Agriculture Prices Commission and the FCI to ensure domestic procurement and storage.

- By the 1970s, PDS became a universal scheme, and in 1992, the Revamped Public Distribution System (RPDS) aimed to strengthen and expand PDS reach in remote areas.

- The Targeted Public Distribution System (TPDS), launched in 1997, focused on the poor by categorizing beneficiaries into Below Poverty Line (BPL) and Above Poverty Line (APL) households.

- The Antyodaya Anna Yojana (AAY), launched in 2000, further targeted the poorest families.

- Management:

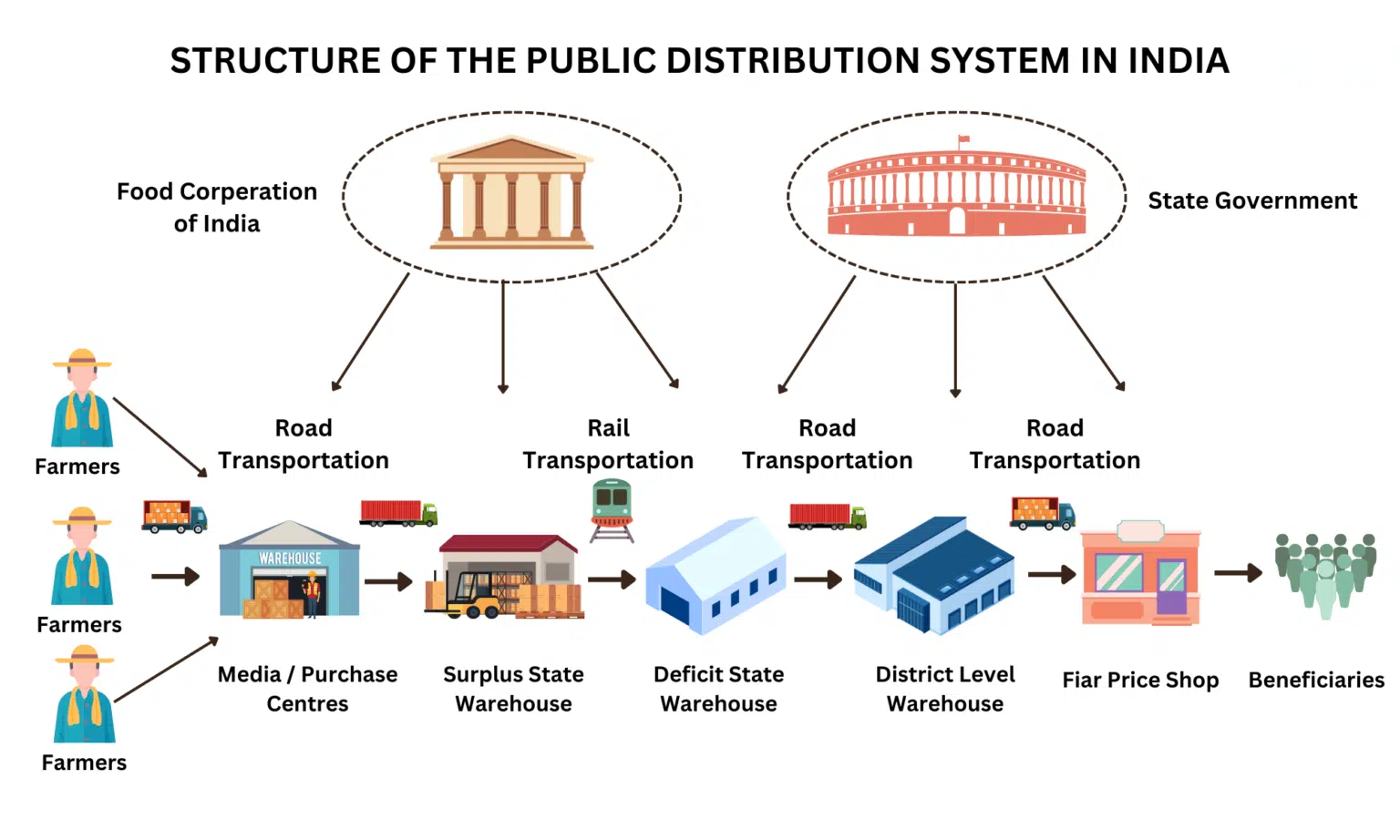

- It is jointly managed by the Central and State/UT Governments, with distinct responsibilities.

- The Central Government, via the Food Corporation of India (FCI), handles procurement, storage, transportation, and bulk allocation of foodgrains.

- State Governments manage local distribution, identify eligible households, issue ration cards, and supervise Fair Price Shops (FPSs).

- Commodities Distributed:

- PDS primarily provides wheat, rice, sugar, and kerosene. Some states also distribute items like pulses, edible oils, and salt.

National Food Security Act (NFSA), 2013

- Enacted: NFSA was enacted on 12th September 2013

- Objective: The NFSA aims to ensure food and nutritional security through a human life cycle approach, providing access to adequate quantities of quality food at affordable prices, enabling individuals to live with dignity.

- Coverage: It covers 75% of the rural population and up to 50% of the urban population under the Targeted Public Distribution System (TPDS), benefiting 67% of India’s total population.

- Eligibility:

- Priority households as per state government guidelines under TPDS.

- Households under the existing Antyodaya Anna Yojana (AAY).

- Provisions:

- 5 kg of foodgrains per person per month at subsidized rates of Rs. 3/2/1 per kg for rice/wheat/coarse grains.

- AAY households continue to receive 35 kg of foodgrains per month.

- Meal and maternity benefits of at least Rs. 6,000 for pregnant women and lactating mothers.

- Meals for children up to 14 years of age.

- A food security allowance for beneficiaries in case of non-supply of entitled foodgrains or meals.

- Grievance redressal mechanisms at the district and state levels.

What Initiatives Have Been Taken to Reform the PDS System in India?

- One Nation One Ration Card (ONORC):

- ONORC enables portability of ration cards across the country. It allows beneficiaries to access subsidized food from any FPS nationwide, benefiting migrant workers and seasonal laborers.

- It enhances inclusivity, transparency, and efficiency through biometric authentication and digital payments.

- Universal PDS:

- Tamil Nadu has implemented a Universal PDS, where every household is entitled to subsidized food grains, ensuring comprehensive coverage across the state.

- Technology Related PDS Reforms:

- SMART-PDS Scheme: In 2023, the Government of India approved the SMART-PDS scheme for the period 2023-2026.

- It aims to maintain and upgrade the technology used in the End-to-End Computerization and Integrated Management of PDS (ImPDS).

- Computerized Fair Price Shops (FPS): Many FPS have been computerized through the installation of Point of Sale (POS) machines, which authenticate beneficiaries and record the quantity of subsidized grains issued. This automation reduces the scope for fraud and ensures transparency in distribution.

- Aadhaar and Direct Benefit Transfer (DBT): Aadhaar integration in TPDS has enhanced beneficiary identification, reducing errors and eliminating duplicates.

- DBT ensured cash transfers to beneficiaries, offering flexibility to purchase food grains from the open market while reducing reliance on ration shops.

- GPS and SMS Monitoring: GPS tracking has been used to ensure that food grain trucks reach designated FPS without diversion, while SMS alerts notify citizens about the dispatch and arrival of TPDS commodities, promoting transparency and public participation.

- SMART-PDS Scheme: In 2023, the Government of India approved the SMART-PDS scheme for the period 2023-2026.

Note: The Supreme Court appointed Wadhwa Committee in 2006 found that states like Tamil Nadu, Chhattisgarh, and Madhya Pradesh had implemented computerization and other technological measures to streamline the PDS.

- These reforms have helped reduce leakages and improve the delivery of food grains.

What are the Challenges Related to PDS?

- Identification of Beneficiaries: There are significant inclusion and exclusion errors in identifying beneficiaries. Many eligible households are left out, while non-eligible households receive benefits.

- Studies have shown that the PDS suffers from nearly 61% error of exclusion and 25% error of inclusion.

- Corruption and Leakages: Corruption and leakages are widespread, with food grains being diverted to the open market or sold at higher prices. This undermines the effectiveness of the system.

- A recent study by International Food Policy Research Institute (IFPRI) and the Indian Council for Research on International Economic Relations (ICRIER) highlights that approximately 28% of subsidized grains meant for the poor in India are lost to leakage, resulting in an estimated financial loss of Rs 69,108 crore to the government.

- Storage and Distribution: There is a lack of adequate storage facilities, leading to wastage and spoilage of food grains. Additionally, the distribution network is inefficient, causing delays and losses.

- Quality of Food Grains: The PDS often distributes inconsistent and poor-quality food grains, and its focus on free rice and wheat fails to meet the diverse nutritional needs, particularly of children under five.

Way Forward

- End-to-End Digitalization & Monitoring: There is a need to use blockchain and IoT to track the supply chain and implement real-time stock updates. AI analytics can help detect irregularities and prevent theft.

- Upgrade FPS with biometric authentication, electronic weighing scales, and digital payment systems, also there is a need to implement QR codes for quality certification and create a public monitoring dashboard.

- Portable Benefits & Migration Support: Strengthen One Nation One Ration Card (ONORC) with better interstate coordination and real-time tracking. Facilitate temporary ration card registration for seasonal migrants.

- Storage Infrastructure Modernization: Upgrade to modern silos with IoT-based quality monitoring. Develop decentralized, tech-enabled storage and promote public-private partnerships for infrastructure.

- Establish disaster response protocols with prepositioned stocks and mobile PDS units.

- Nutritional Security: Turn select FPS into nutrition hubs with pulses, oils, and fortified items. Introduce E-Rupee nutrition vouchers for vulnerable groups and include millets in PDS, as in Karnataka and Odisha.

|

Drishti Mains Question: What is the Public Distribution System (PDS)? Why is it essential for India, and what reforms have been implemented to enhance its efficiency? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q.1 In the context of India’s preparation for Climate-Smart Agriculture, consider the following statements: (2021)

- The ‘Climate-Smart Village’ approach in India is a part of a project led by the Climate Change, Agriculture and Food Security (CCAFS), an international research programme.

- The project of CCAFS is carried out under Consultative Group on International Agricultural Research (CGIAR) headquartered in France.

- The International Crops Research Institute for the Semi-Arid Tropics (ICRISAT) in India is one of the CGIAR’s research centers.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q.2 With reference to the provisions made under the National Food Security Act, 2013, consider the following statements: (2018)

- The families coming under the category of ‘below poverty line (BPL)’ only are eligible to receive subsidized food grains.

- The eldest woman in a household, of age 18 years or above, shall be the head of the household for the purpose of issuance of a ration card.

- Pregnant women and lactating mothers are entitled to a ‘take-home ration’ of 1600 calories per day during pregnancy and for six months thereafter.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 3 only

Ans: (b)

Mains

Q.1 In what way could replacement of price subsidy with Direct Benefit Transfer (DBT) change the scenario of subsidies in India? Discuss. (2015)

Geography

Including Non-Mineralised Areas in Mining Leases

For Prelims: Mining Leases, Mines and Minerals (Development and Regulation) Act, 1957, Supreme Court, Waste management, Indian Bureau of Mines (IBM), Illegal Mineral Extraction, District Mineral Foundation (DMF), National Mineral Exploration Trust (NMET), The Mines and Minerals (Development and Regulation) Amendment Act, 2023, Critical Minerals, Foreign Direct Investment, Net-Zero Emissions By 2070.

For Mains: Significance of India's Mineral Policy, Economic Governance, Sustainable Resource Management, And Environmental Regulations.

Why in News?

Recently, the Centre has allowed state governments to include non-mineralised areas within existing mining leases for dumping mine waste and overburden, streamlining operations and addressing industry challenges.

- The Ministry of Mines clarified that under the Mines and Minerals (Development and Regulation) Act, 1957, non-mineralized areas for ancillary activities like waste disposal can be included within a mining lease.

- This interpretation is supported by the Mines Act, 1952, and Rule 57 of the Mineral Concession Rules, 2016, which allow ancillary zones to be included in the lease area.

What are the Supreme Court Rulings for Regulating Mining and Minerals?

- Centre’s Primary Authority: In 1989, a seven-judge Bench in India Cement Ltd. v. the state of Tamil Nadu case ruled that mining regulation falls primarily under the Centre’s authority via the Mines and Minerals (Development and Regulation) Act, 1957, and Entry 54 of the Union List.

- State Authority on Taxes: In State of Orissa v. M.A. Tulloch & Co. Case, it was held that states could only collect royalties, not impose additional taxes, as royalties were classified as taxes.

- A 2004 judgment in State of West Bengal v. Kesoram Industries Ltd. Case questioned this classification, leading to a nine-judge review.

- Overturning 1989 Verdict: In July 2024, the Court ruled in favor of states (overturned 1989 judgement), asserting their power to tax mineral rights under Entry 50 of List II (State List) while limiting Parliament to imposing constraints to ensure mineral development isn’t hindered.

- However, some judges expressed concerns that unchecked state taxation could disrupt federal uniformity in mineral pricing and development, urging Parliament to intervene for consistency.

Goa Foundation v. Union of India Case, 2014: Against Dumping Outside Valid Lease Areas

- Prohibition of External Dumping: The Supreme Court ruled that dumping mine waste or overburden outside the boundaries of valid mining leases is prohibited to prevent environmental and legal violations.

- Protection of Non-Lease Areas: The ruling emphasized that non-lease areas must not be used for mining-related activities, ensuring their preservation and proper regulation.

- Alignment with Mining Laws: The Court’s decision reinforced compliance with the Mines and Minerals (Development and Regulation) Act, 1957, and related laws that restrict unauthorized use of land.

- Impact on Mining Practices: Mining operations were required to include waste management within leased areas, prompting changes in planning and land allocation.

What are the Implications of the Recent Inclusion of Non-Mineralised Areas?

- Streamlined Operations: Including non-mineralised areas in mining leases ensures safe and efficient management of overburden and waste, addressing industry operational challenges.

- Overburden, consisting of rocks, soil, and materials removed to access minerals, must be properly managed for safe mining.

- Non-mineralized areas, lacking significant mineral deposits, can be allocated by state governments for overburden disposal and added to mining leases without auction if they are contiguous.

- Aligned with 2014 Ruling: The move aligns with the Supreme Court’s 2014 ruling against dumping outside valid lease areas.

- Efficient Land Utilisation: Allowing waste disposal within lease areas ensures optimal use of non-mineralised zones without necessitating separate auctions for such purposes.

- Industry Growth: Eases operational hurdles, encouraging sustainable mineral extraction and fostering growth in the mining sector.

- States can allocate contiguous or non-contiguous non-mineralised areas for waste management if it benefits mineral development, providing operational flexibility.

- Safeguards Against Misuse: States must ensure non-mineralised areas are verified, consult the Indian Bureau of Mines (IBM) for extent determination, and notify IBM about supplementary leases, preventing illegal mineral extraction.

What is the Mines and Minerals (Development and Regulation) Act, 1957?

- Pivotal Legislation: This Act governs India’s mining sector, aiming to develop the industry, conserve minerals, and ensure transparency and efficiency in exploitation.

- Initial Objectives: Focused on promoting mining, conserving resources, and regulating concessions.

- 2015 Amendment: The 2015 Amendment introduced key reforms, including the Auction Method for transparency, the establishment of District Mineral Foundation (DMF) for mining-affected areas, National Mineral Exploration Trust (NMET) to boost exploration, and stringent penalties for illegal mining.

- 2021 Amendment: Captive mines are operated by companies to extract minerals for their own use, with up to 50% of their annual production allowed for sale in the open market after fulfilling the requirements of the end-use plant.

- Merchant mines are operated to produce minerals for sale in the open market, with the extracted minerals sold to various buyers, including industries without their own mines.

- Auction-only concessions ensure that all private-sector mineral concessions are granted through auctions.

- 2023 Amendment: The Mines and Minerals (Development and Regulation) Amendment Act, 2023 aims to enhance the exploration and extraction of critical minerals vital for India's economic growth and national security.

- Key changes include removing six minerals from the list of 12 atomic minerals reserved for state agency exploration and allowing the government to exclusively auction concessions for critical minerals.

- Exploration licenses have been introduced to attract foreign direct investment and engage junior mining companies in exploring deep-seated and critical minerals.

- The amendments focus on reducing import dependence and encouraging private sector participation to accelerate the mining of essential minerals like lithium, graphite, cobalt, titanium, and rare earth elements, supporting India's energy transition and commitment to net-zero emissions by 2070.

|

Drishti Mains Questions: Evaluate the role of the Mines and Minerals (Development and Regulation) Act, 1957 in regulating India’s mining sector and its amendments. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. What is/are the purpose/purposes of ‘District Mineral Foundations’ in India? (2016)

- Promoting mineral exploration activities in mineral-rich districts

- Protecting the interests of the persons affected by mining operations

- Authorizing State Governments to issue licences for mineral exploration

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. What are the consequences of Illegal mining? Discuss the Ministry of Environment and Forests’concept of GO AND NO GO zones for coal mining sector. (2013)

Governance

Bharatiya Vayuyan Vidheyak Bill 2024

For Prelims: Parliament, Directorate General of Civil Aviation, Bureau of Civil Aviation Security, Article 14 of the Constitution, Ude Desh Ka Aam Naagrik, Foreign Direct Investment, Digi Yatra

For Mains: Bharatiya Vayuyan Vidheyak Bill, 2024, Sustainability in Aviation, India's aviation sector

Why in News?

Recently, the Parliament passed the Bharatiya Vayuyan Vidheyak (BVV) Bill, 2024, which seeks to replace the Aircraft Act, 1934 (last amended in 2020), and bring major reforms to the aviation sector.

What are the Key Features of the Bharatiya Vayuyan Vidheyak Bill, 2024?

- Aircraft Act 1934: The Bill retains the provisions from the Aircraft Act, 1934, which established the DGCA (Directorate General of Civil Aviation), BCAS (Bureau of Civil Aviation Security), and AAIB (Aircraft Accidents Investigation Bureau).

- These bodies will continue to oversee safety, security, and accident investigations, respectively.

- The Bill provides a mechanism for appeals against the orders of DGCA or BCAS to the central government, which will be the final authority.

- Single Window Clearance: The BVV Bill, 2024, moves the responsibility for managing Radio Telephone Operator Restricted (RTR) certifications from the Department of Telecom (DoT) to the DGCA.

- This change aims to streamline the licensing process for aviation personnel and address corruption in the DoT's RTR exams, ensuring more transparency under the DGCA's oversight.

- RTR certification, or RTR (A) for aeronautical purposes, is a license certifying a person's qualification to use radio communication equipment on an aircraft, primarily for air traffic control communication. It is mandatory for pilots in India.

- This change aims to streamline the licensing process for aviation personnel and address corruption in the DoT's RTR exams, ensuring more transparency under the DGCA's oversight.

- Regulation of Aircraft Design: The Bill empowers the DGCA to regulate not only the manufacture, repair, and maintenance of aircraft but also the design and locations where aircraft are being designed.

- With these new powers, the DGCA can ensure more comprehensive and efficient oversight of the aviation sector in India.

- Arbitrator Appointment: The Bill allows the Central government to unilaterally appoint an arbitrator (a person who is or has been qualified for appointment as a Judge of a High Court) to resolve compensation disputes related to land acquisition near airports.

What are the Concerns Regarding the BVV Bill, 2024?

- Lack of Independence of DGCA: The Bill keeps the DGCA under direct government control, unlike independent regulators, and the Bill does not specify the qualifications or tenure of the DGCA head, which could result in potential conflicts of interest and influence from the central government.

- Arbitration Process Issues: The unilateral appointment of an arbitrator for compensation disputes may violate the right to equality under Article 14 of the Constitution, as it undermines the impartiality and independence of the arbitration process.

- The Supreme Court stated that such appointments could violate the right to equality due to concerns about impartiality.

- By exempting the Bill from the Arbitration and Conciliation Act, 1996, the government risks bypassing standardised arbitration processes, leading to potential inconsistencies in adjudication.

- Penalty Framework: The Bill allows the central government to set penalties for aviation offenses, raising concerns about potential inconsistency and fairness due to executive discretion rather than fixed legal guidelines.

Arbitration and Conciliation Act, 1996

- Arbitration is a method of resolving disputes between parties outside of the court system. It's an alternative dispute resolution (ADR) method, along with conciliation and mediation.

- Arbitration in India is governed and regulated by the Arbitration and Conciliation Act 1996 (which is amended in 2015, 2019 and 2021).

- The 2019 Amendment Act aims to establish the Arbitration Council of India (ACI) for grading arbitral institutions and accrediting arbitrators. However, ACI has not yet been formally established and operationalized.

What are the Implications of BVV Bill, 2024 for the Aviation Sector?

- Streamlined Licensing: Bringing RTR certification under DGCA control aims to reduce corruption and delays in the certification process.

- Improved Oversight: Expanded powers to regulate aircraft design and enforce penalties could enhance safety and compliance.

- Regulatory Challenges: Concerns over the lack of independence for DGCA and government centralization may affect fairness and transparency.

- Regulatory Burden on Private Airlines: Imposes severe penalties for offenses like dangerous flying, with fines up to one crore rupees and imprisonment, though the discretionary power for penalties raises concerns.

- New compliance requirements may increase costs for private operators.

What is the Scenario of India’s Aviation Industry?

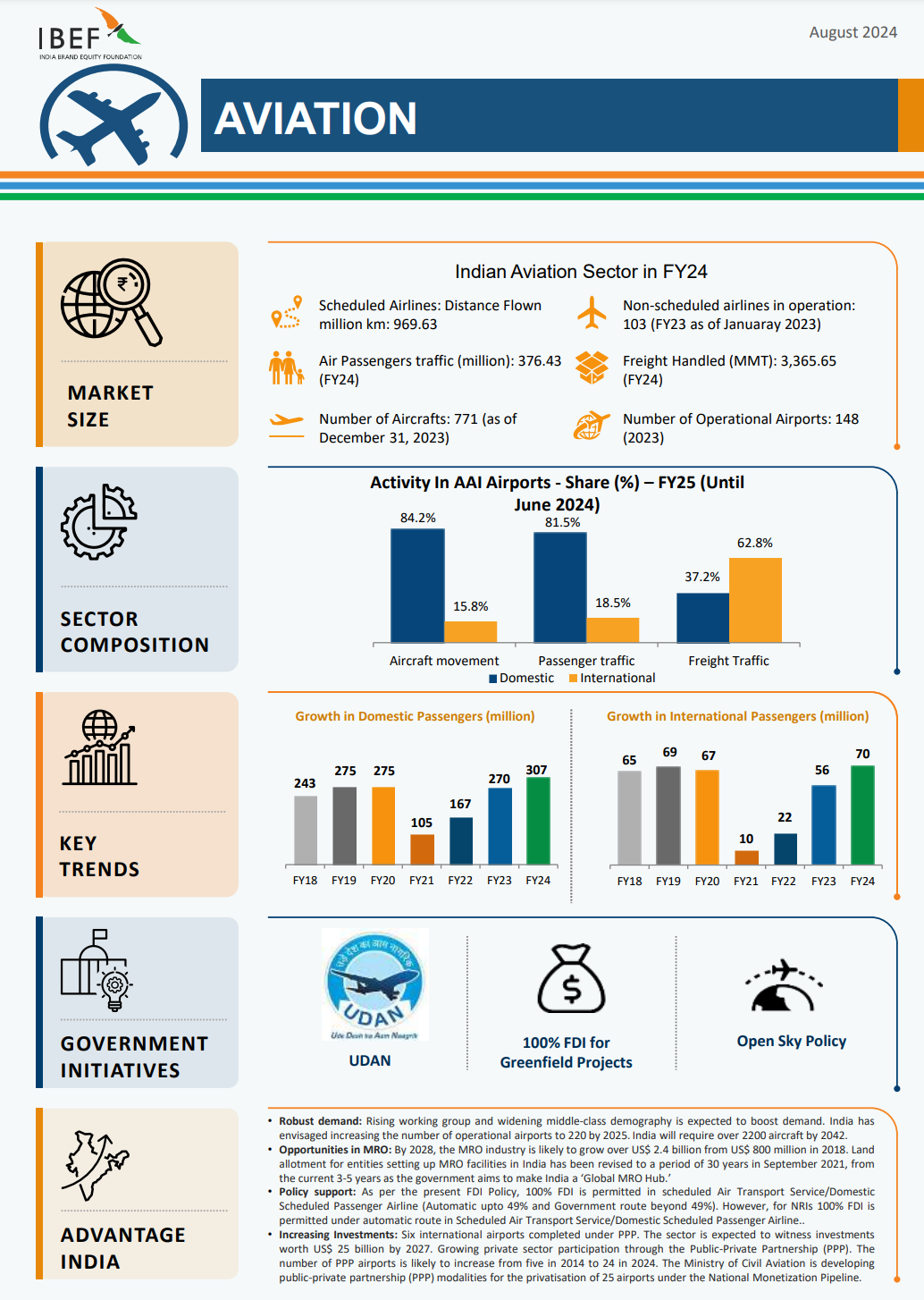

- Rapid Growth in Passenger Traffic: Domestic air traffic in FY23 reached 306.79 million passengers, a 13.5% YoY growth, while international traffic rose 22.3% to 69.64 million passengers.

- India is the third-largest domestic aviation market after the US and China.

- Expanding Infrastructure: Operational airports increased from 74 in 2014 to 157 in 2024, with a goal of 350-400 by 2047.

- Fleet Expansion: Indian carriers added 112 new aircraft in 2023, bringing the total to 771 planes, with plans to reach 1,100 by 2027.

- Market and Revenue Growth: India’s aviation revenue is expected to grow by 15-20% in FY24 and 10-15% in FY25.

- Freight traffic showed steady growth, with domestic freight at 1.32 million tonnes and international freight at 2.04 million tonnes in FY24.

What are India's Initiatives Related to the Aviation Industry?

- Policy Interventions:

- National Civil Aviation Policy 2016: The NCAP 2016 aims to make flying accessible to the masses by enhancing affordability and connectivity, promoting ease of doing business, deregulation, simplified procedures, and e-governance.

- The Regional Connectivity Scheme-Ude Desh Ka Aam Naagrik (UDAN), is a key component of NCAP 2016.

- UDAN-RCS Scheme: Aims to improve regional air connectivity; operationalized 519 routes and benefited over 13 million passengers.

- FDI Policy: The Centre allows 100% Foreign Direct Investment(FDI) in aviation sectors like air transport and Maintenance, Repair, and Overhaul (MRO).

- National Civil Aviation Policy 2016: The NCAP 2016 aims to make flying accessible to the masses by enhancing affordability and connectivity, promoting ease of doing business, deregulation, simplified procedures, and e-governance.

- Infrastructure Modernization: Initiatives like Digi Yatra and NABH Nirman enhance operational efficiency and passenger experience.

- 21 Greenfield Airport projects have been approved, with 11 operationalized by 2023 (Donyi Polo Airport, Itanagar, Arunachal Pradesh is the first greenfield airport in India).

- Greenfield airports are aviation facilities built from scratch on undeveloped land, designed with eco-friendly features to minimize environmental impact.

- 21 Greenfield Airport projects have been approved, with 11 operationalized by 2023 (Donyi Polo Airport, Itanagar, Arunachal Pradesh is the first greenfield airport in India).

- Sustainability Efforts: Airports like Delhi and Mumbai achieved Level 4+ Carbon Accreditation.

- 73 airports fully use green energy, with solar energy, and new greenfield airports prioritize net-zero emissions.

Way Forward

- Transparent Arbitration Framework: Introduce independent third-party oversight for compensation disputes to uphold the constitutional right to equality under Article 14.

- Strengthening Regulatory Independence: Consider restructuring the DGCA to function as an autonomous regulatory body to enhance impartiality and credibility.

- Consistent Penalty Framework: Develop a clear and consistent framework for penalties related to aviation offenses, reducing the scope for executive discretion and ensuring fairness.

- Inclusive Consultation Process: Engage with stakeholders, including airlines, aviation personnel, and the public, to gather feedback and address concerns. This can help build consensus and ensure the Bill's provisions are practical and effective.

|

Drishti Mains Question: Discuss the significance of the Bharatiya Vayuyan Vidheyak, Bill 2024, and its implications for India’s aviation sector. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q. Examine the development of Airports in India through joint ventures under Public–Private Partnership (PPP) model. What are the challenges faced by the authorities in this regard? (2017)

Economy

India Lags In Leveraging China+1 Strategy

For Prelims: China Plus One Strategy, PLI (Production Linked Incentive), Inflation, GDP, India’s trade agreements, GST, Foreign Direct Investment (FDI).

For Mains: Opportunities and Challenges for India in Leveraging China+1 strategy, Steps taken by India present itself as an alternative to China.

Why in News?

The recently released NITI Aayog’s Trade Watch report highlights India’s trade prospects, challenges, and growth potential, especially in light of the US-China trade conflict and the 'China Plus One' strategy.

- It stated that India has had "limited success so far" in capitalizing on the 'China Plus One' strategy adopted by multinational companies to diversify and de-risk their supply chains.

Why Has India Seen "Limited Success" in China+1 Strategy?

- Competitive Disadvantages and Regulatory Challenges:

- Countries like Vietnam, Thailand, Cambodia, and Malaysia have leveraged cheaper labor, simplified tax laws, and lower tariffs to attract multinational corporations looking to diversify away from China.

- India's complex regulations, bureaucratic hurdles, inconsistent policies and higher labor costs deter investment, with slow administration and unpredictable reforms reducing business competitiveness.

- Additionally, corruption has eroded investor confidence, increased transaction costs, and undermined India's appeal as an investment destination, despite ongoing anti-corruption efforts.

- Free Trade Agreements (FTAs):

- South-Asian countries like Vietnam, Thailand, Cambodia, and Malaysia have been more proactive in signing Free Trade Agreements (FTAs), which has helped them expand their export shares.

- India's slower pace in negotiating and finalizing FTAs has put it at a disadvantage.

- Geopolitical Tensions and Limited Market Share:

- India’s limited share in global trade (less than 1% in 70% of global trade) highlights untapped potential.

- While geopolitical tensions, like the US-China trade conflict, offer opportunities for India to emerge as a neutral alternative, they also create uncertainty, complicating trade strategies and hindering market expansion.

- Supply Chain Disruptions:

- US export controls and tariffs on China have fragmented supply chains, offering India an opportunity. However, poor infrastructure, inefficient ports, and high logistics costs have limited India's ability to attract foreign investment.

- Carbon Tax Risks and Land Acquisition Issues:

- The EU's Carbon Border Adjustment Mechanism (CBAM) risks raising costs for India's iron and steel exports, reducing competitiveness.

- Additionally, India's complex tax regime and slow land acquisition processes increase business costs, delaying industrial projects and hindering growth.

What is the 'China Plus One' Strategy?

- About:

- The China Plus One (or China+1) strategy refers to the global trend of companies diversifying their manufacturing and supply chains by setting up operations in countries beyond China.

- This strategy aims to reduce risks from over-dependence on a single country, particularly due to geopolitical tensions and supply chain disruptions.

- Background of China+1 Strategy:

- China as "World's Factory":

- For decades, China has been the hub of global supply chains, earning the title of "World's Factory" due to its favorable production factors and strong business ecosystem.

- In the 1990s, companies from the US and Europe shifted production to China, attracted by low manufacturing costs and access to its large domestic market.

- Disruptions During the Pandemic:

- However, the Covid-19 pandemic caused significant disruptions, with China's zero-Covid policy leading to industrial lockdowns, inconsistent supply chain performance, and container shortages.

- Evolution of the China+1 Strategy:

- The confluence of factors, including China's zero-Covid policy, supply chain disruptions, high freight rates, and longer lead times, has led many global companies to adopt a "China-Plus-One" strategy.

- This involves relocating manufacturing to alternative countries such as India, Vietnam, Thailand, Bangladesh, and Malaysia to mitigate dependency on China.

- The confluence of factors, including China's zero-Covid policy, supply chain disruptions, high freight rates, and longer lead times, has led many global companies to adopt a "China-Plus-One" strategy.

- China as "World's Factory":

What are the Key Growth Drivers for India under the China+1 Strategy?

- Large Domestic Market and Demographic Advantage:

- India's 1.3 billion population, with a youthful demographic and rising incomes, creates a growing consumer base and a strong workforce.

- With India's real GDP is projected to grow between 6.5-7% in 2024-25 and around half of the population under 30, India is poised for sustained economic growth, positioning it as a key driver of global trade and an attractive investment destination.

- Cost Competitiveness and Infrastructure Advantage:

- India's production sector benefits from lower labour and capital costs compared to competitors like Vietnam, with manufacturing wages 47% lower than China's.

- The government's infrastructure initiatives, such as the National Infrastructure Pipeline (NIP), aim to reduce manufacturing costs and improve logistics by 20%, enhancing India's global competitiveness.

- Business Environment and Policy Initiatives:

- Recent reforms, including the Production Linked Incentive (PLI) scheme, tax changes, and relaxed FDI norms, have improved India’s business climate.

- The Make in India initiative and simplified business processes further attract foreign investments through incentives for global companies.

- Strategic Economic Partnerships:

- India’s focus on strategic partnerships, such as the India-UAE Comprehensive Economic Partnership Agreement (CEPA), enhances its global trade position. These agreements are projected to boost bilateral trade by 200% in five years, opening new markets while reducing dependence on any single economy.

- Dynamic Diplomacy and Global Influence:

- India’s active role in forums like QUAD, I2U2, G20, and Shanghai Cooperation Organisation strengthens its diplomatic and economic ties. By leading global discussions, India influences trade trends, attracts investments, and facilitates technology transfer and financial cooperation.

Potential Indian Sector Having Advantage Under the China+1 Strategy

- Pharmaceuticals: With a valuation of Rs 3.5 lakh crore in 2024, India is the world's third-largest pharmaceutical producer, supplying 70% of WHO’s vaccine needs and offering 33% lower manufacturing costs than the US.

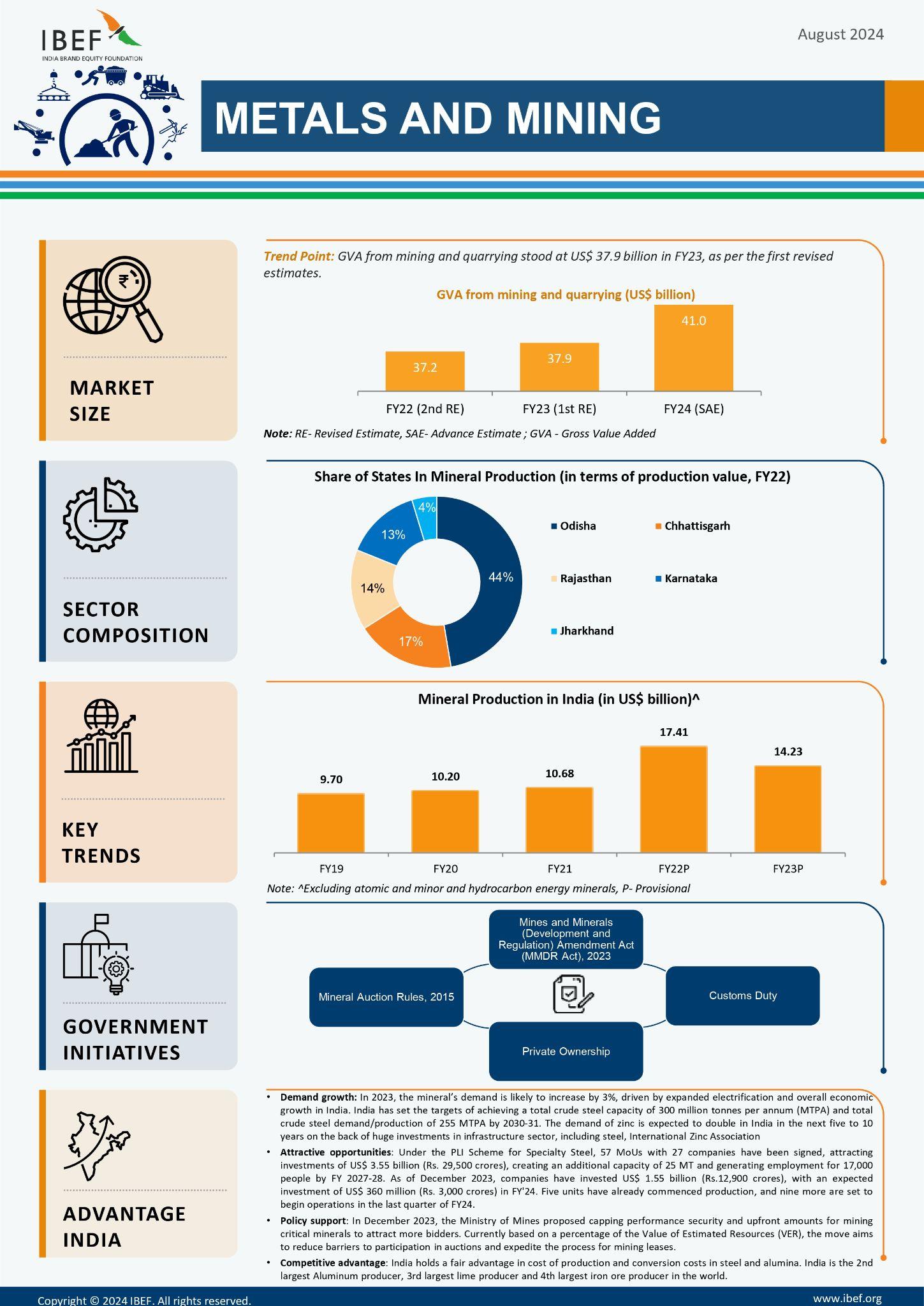

- Metals and Steel: India’s natural resource wealth and the PLI scheme for specialty steel, expected to draw Rs 40,000 crore by 2029, strengthen its position as a major steel exporter, further boosted by China's export policy changes.

- Information Technology (IT/ITeS): India is a key player in IT services exports, supported by initiatives like "Make in India" and a focus on manufacturing IT hardware, attracting global technology firms.

Way Forward

- Structural Reforms: Streamline regulations, improve ease of doing business, and enhance logistics efficiency to reduce the high costs of road transport, which currently handles 60% of freight.

- Adopt strategies used by countries like Vietnam and Malaysia, such as offering cheaper labor, simplified tax laws, and redistributed land for industrial development.

- Specialized Industrial Clusters: Develop dedicated manufacturing hubs with world-class infrastructure, plug-and-play facilities, and shared services to enhance sectoral competitiveness.

- Skill Development: Strengthen vocational training, promote STEM education, and upskill the workforce to meet the demands of high-tech manufacturing.

- Sectoral Manufacturing Boost: Provide long-term tax incentives and support growth in emerging sectors like mobile phones and defense, while leveraging strengths in textiles, leather, auto components, and pharmaceuticals.

Conclusion

India's journey to capture the 'China Plus One' opportunity has been marked by challenges, including competitive disadvantages, regulatory hurdles, and sector-specific issues. However, with strategic investments in infrastructure, regulatory reforms, and a focus on innovation, India can position itself as a viable alternative in the global supply chain landscape. The potential for economic growth is significant, but it requires proactive measures to turn challenges into opportunities.

|

Drishti Mains Questions: What is the 'China Plus One' strategy, and what are the opportunities and challenges it presents for India? |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. What is the importance of developing Chabahar Port by India? (2017)

(a) India’s trade with African countries will increase enormously.

(b) India’s relations with oil-producing Arab countries will be strengthened.

(c) India will not depend on Pakistan for access to Afghanistan and Central Asia.

(d) Pakistan will facilitate and protect the installation of a gas pipeline between Iraq and India.

Ans: (c)

Mains

Q. A number of outside powers have entrenched themselves in Central Asia, which is a zone of interest to India. Discuss the implications, in this context, of India’s joining the Ashgabat Agreement. (2018)

Important Facts For Prelims

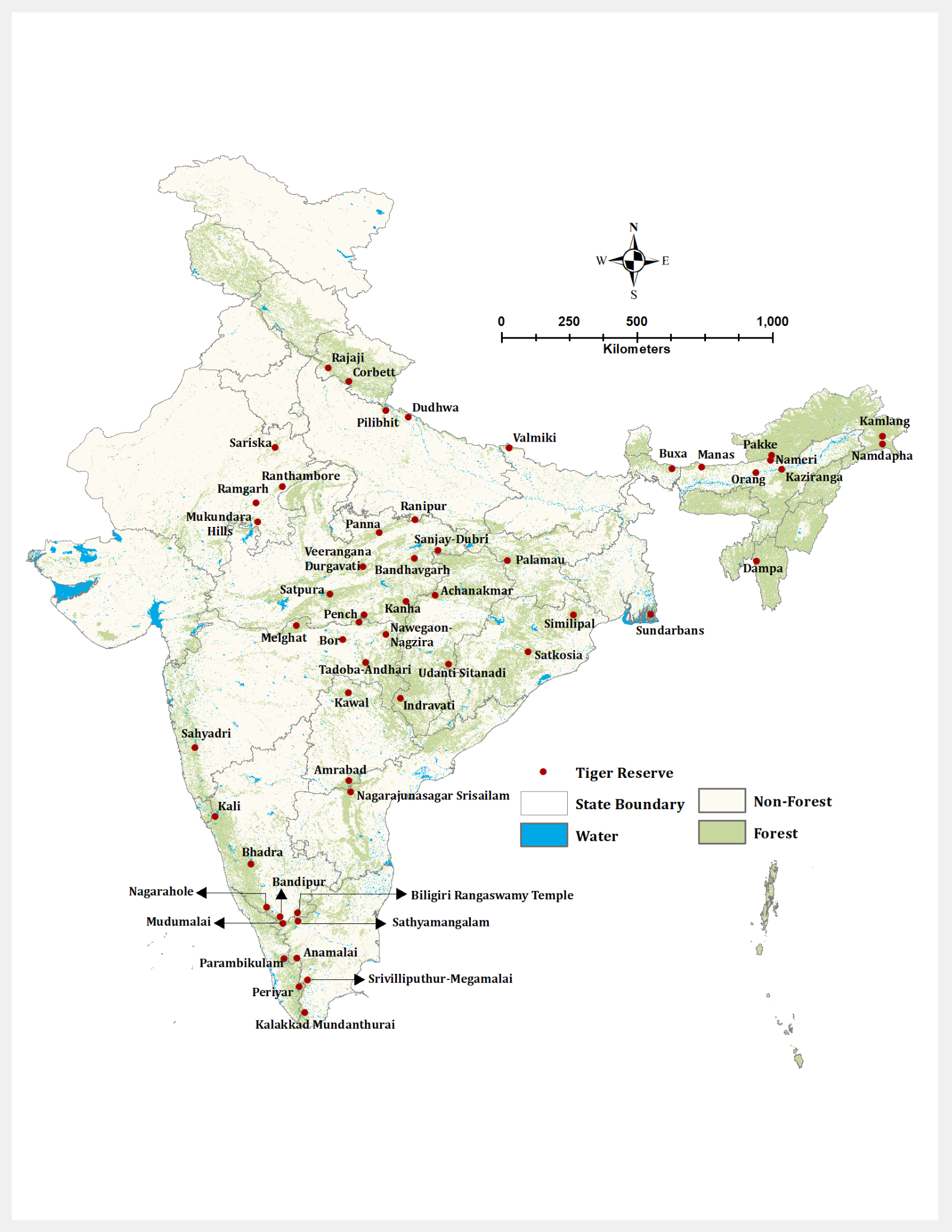

Ratapani Tiger Reserve

Why in News?

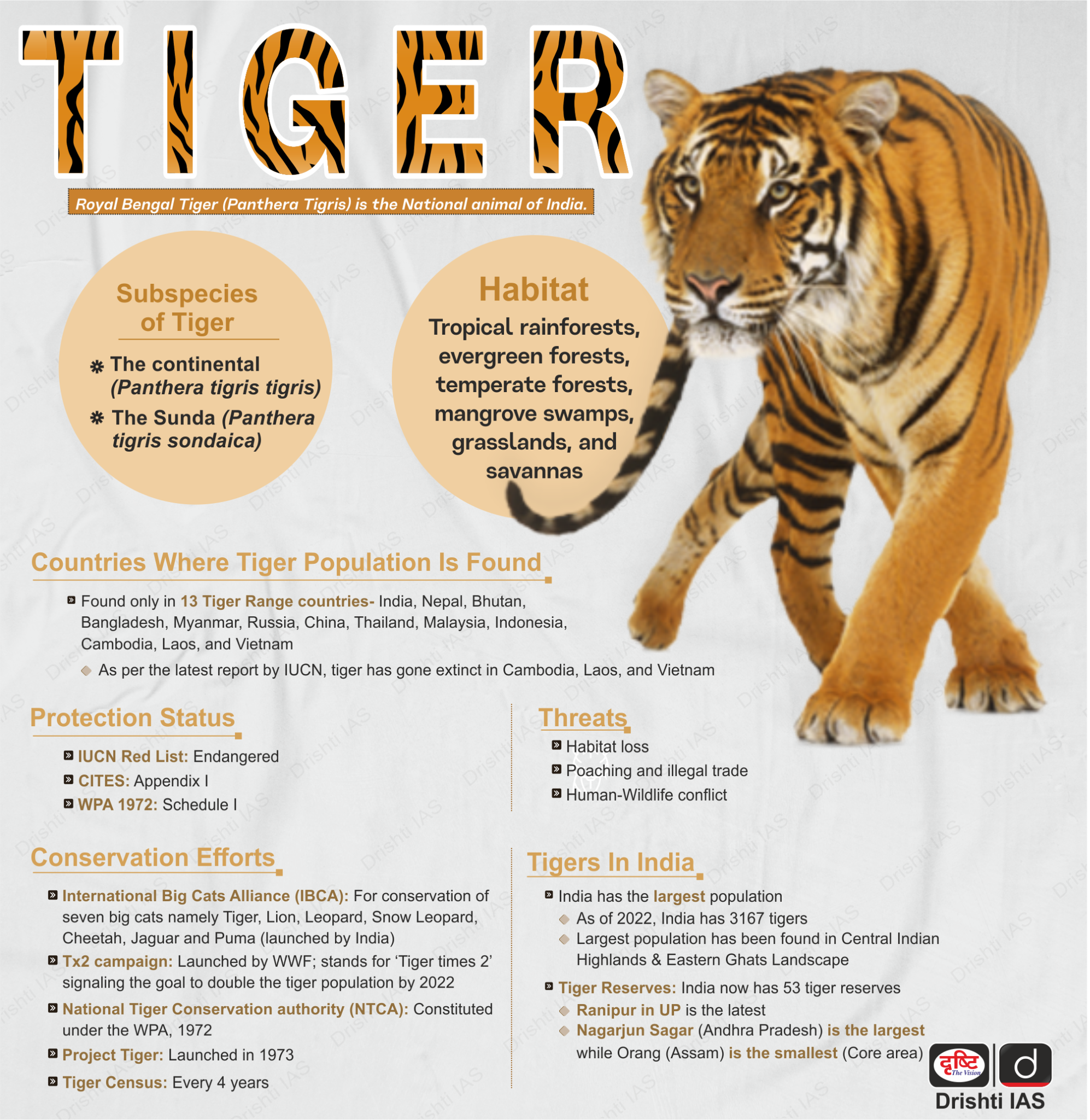

Recently, the Ratapani Wildlife Sanctuary has been officially declared a tiger reserve, becoming the 8th such reserve in Madhya Pradesh and 57th tiger reserve in India.

- It was approved by the Ministry of Environment, Forest, and Climate Change (MoEF&CC) through the National Tiger Conservation Authority (NTCA).

What are Some Key Facts About Ratapani Tiger Reserve?

- It is situated near the Vindhya hills, the sanctuary encompasses the Bhimbetka Rock Shelters, a UNESCO World Heritage Site.

- The Ratapani Tiger Reserve encompasses a total area of 1,271.4 square kilometers, with a core area of 763.8 square kilometers and a buffer area of 507.6 square kilometers.

- Flora and Fauna:

- Dry and moist deciduous, with teak (Tectona grandis) covering 55% of the area.

- Bamboo and evergreen Saja forests, enhancing tourist appeal.

- The sanctuary is home to more than 35 species of mammals, 33 species of reptiles, 14 species of fishes and 10 species of amphibians and over 40 Tigers.

What is the Procedure to Designate Tiger Reserve in India?

- Initial Proposal: The state government proposes a wildlife sanctuary or national park for designation as a tiger reserve, assessing ecological significance and tiger presence.

- A comprehensive plan is prepared, outlining management strategies and habitat requirements to support a viable tiger population.

- Approval from NTCA: The proposal and conservation plan are submitted to the National Tiger Conservation Authority (NTCA) for review and evaluation.

- In-Principle Approval: The NTCA grants in-principle approval, recognizing the area as critical for tiger conservation and eligible for funding.

- Official Notification: The state government issues an official notification declaring the area as a tiger reserve under Section 38V the Wildlife (Protection) Act, 1972, delineating core and buffer zones.

- Initiatives are launched to benefit local communities and promote sustainable livelihoods while managing the tiger reserve effectively.

- Monitoring and Evaluation: Continuous monitoring by NTCA and state authorities assesses conservation effectiveness and adapts management strategies as needed.

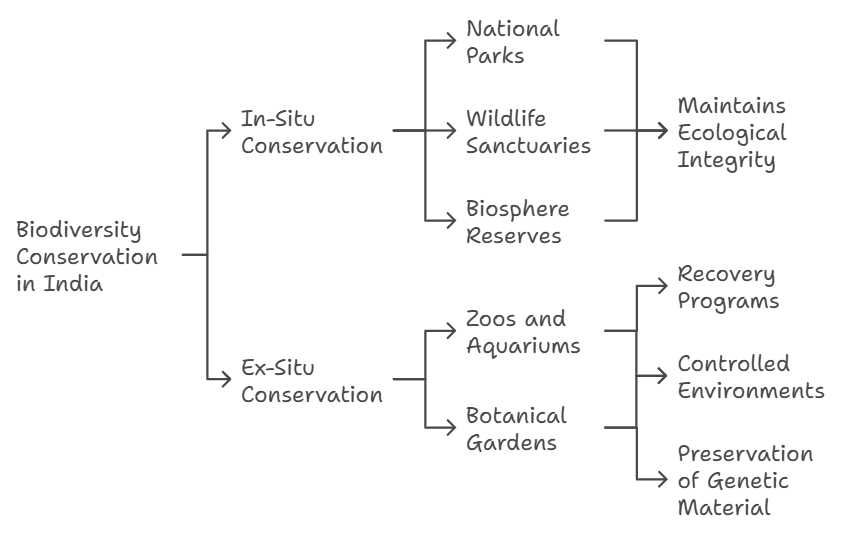

Different Types of Conservation Methods

Difference Between Wildlife Sanctuary, Tiger Reserve and Biosphere Reserve

|

Feature |

Wildlife Sanctuary |

Tiger Reserve |

Biosphere Reserve |

|

Definition |

An area dedicated to the protection of specific species of flora and fauna, and their habitats owned by the government or private entities. |

A protected area specifically designated for the conservation of tigers and their habitats. |

A designated area for the conservation of biodiversity, and sustainable development, including flora, fauna, and cultural heritage. |

|

Management Authority |

Managed by state governments or private organizations. |

Managed by the National Tiger Conservation Authority (NTCA) under MoEF&CC. |

Managed by the MoEF&CC in collaboration with local communities. |

|

Public Access |

Generally open to visitors with some restrictions on activities. |

Access is regulated to minimize human disturbance; tourism is allowed in designated areas. |

Limited public access; primarily for research and education purposes. |

|

Legal Framework |

Governed by the Wildlife Protection Act, 1972. |

Established under the Wildlife Protection Act, 1972 with specific provisions for tiger conservation. |

Recognized under UNESCO's Man and Biosphere Programme; governed by national laws for conservation. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. At the national level, which ministry is the nodal agency to ensure effective implementation of the Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act, 2006? (2021)

(a) Ministry of Environment, Forest and Climate Change

(b) Ministry of Panchayati Raj

(c) Ministry of Rural Development

(d) Ministry of Tribal Affairs

Ans: (d)

Q2. Consider the following statements: (2018)

- The definition of “Critical Wildlife Habitat” is incorporated in the Forest Rights Act, 2006.

- For the first time in India, Baigas have been given Habitat Rights.

- Union Ministry of Environment, Forest and Climate Change officially decides and declares Habitat Rights for Primitive and Vulnerable Tribal Groups in any part of India.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Important Facts For Prelims

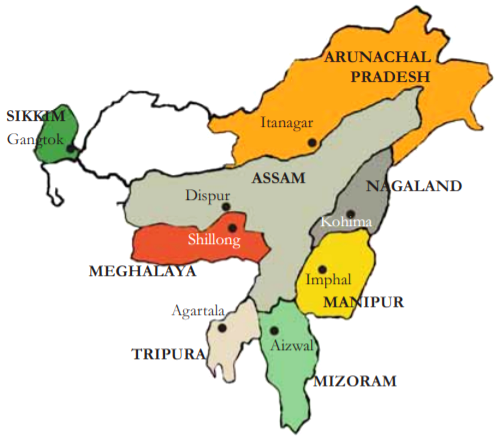

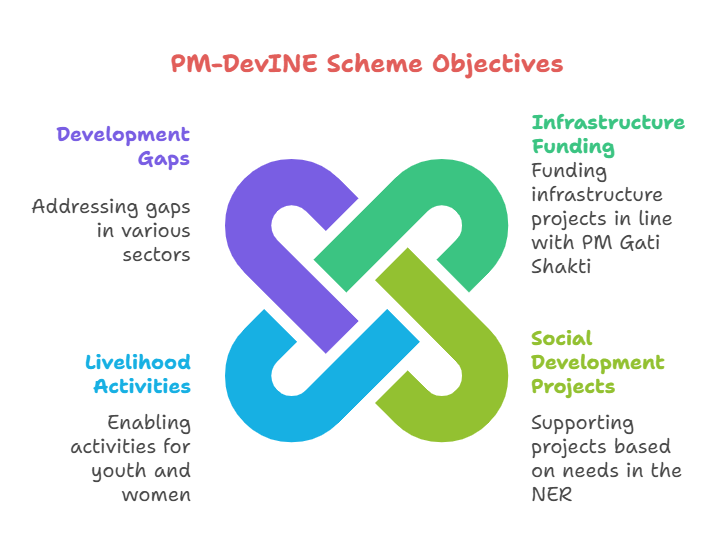

PM’s Development Initiative for North East Region (PM-DevINE)

Why in News?

Recently, in a written reply to a question in the Rajya Sabha, it was informed that 35 projects worth Rs. 4857.11 crore, including seven announced in Union Budget 2022-23, have been sanctioned under PM-DevINE.

What is PM-DevINE Scheme?

- About: PM-DevINE, is a Central Sector Scheme introduced in the Union Budget 2022-23 with the aim of promoting rapid and holistic development in the North East Region (NER).

- The scheme was approved by the Cabinet on 12th October 2022, with a total financial outlay of Rs 6600 crore for the period from 2022-23 to 2025-26.

- Implementation: The scheme is implemented by the Ministry of Development of the North Eastern Region (MDoNER) to address region-specific developmental needs, ensuring efficient utilisation of resources and coordinated project execution.

- Infrastructure Development: In line with the scheme's objectives, a total of 17 projects worth Rs. 2806.65 crore have been approved for NER.

- It aligns with PM GatiShakti, focusing on cohesive funding of infrastructure projects to ensure seamless connectivity and accessibility across NER.

- Prioritises funding for projects that tackle critical social issues and improve the quality of life for residents in NER.

- Emphasizes creating sustainable livelihood opportunities specifically for youth and women, fostering greater participation in the region’s growth.

- Focuses on bridging developmental disparities in sectors not covered by other schemes, enhancing regional balance.

- Achievements under PM-DevINE:

- 35 projects worth Rs 4857.11 crore include initiatives such as cancer care facilities, university infrastructure upgrades, and radiation oncology centers.

- Road connectivity projects have developed new roads, connecting remote villages, reducing travel time, and boosting local economies.

- Smart water supply projects providing integrated drinking water systems have directly benefited over 1 lakh residents.

- Ineligible Projects: Excludes projects involving Direct Benefit Transfers (DBT) or those providing long-term individual benefits.

- Projects related to administrative buildings, government offices, or sectors already addressed by existing MDoNER schemes or listed in the Negative List are ineligible.

What are Various Development Initiatives and Their Achievements in the North East?

- Infrastructure Initiatives:

- Bharatmala Pariyojana, Kaladan Multi-Modal Transit Project, and the India-Myanmar-Thailand Trilateral Highway enhance regional and international connectivity, fostering trade and economic growth for the Northeast Region.

- The Regional Connectivity Scheme under UDAN works towards making air travel more affordable and accessible and linking remote areas.

- Industrial Development:

- The North East Industrial Development Scheme (NEIDS) (2017-2022) provided incentives for MSMEs to stimulate regional employment and industrial growth.

- The UNNATI Scheme (2024) was introduced to enhance industrialization, offering incentives such as capital investment support, interest subventions, and service-linked benefits.

- Agricultural and Environmental Focus:

- The National Bamboo Mission promotes sustainable bamboo development, while the North Eastern Region Agri-Commodity e-Connect (NE-RACE) connects farmers to global markets, enhancing agricultural income.

- Digital and Scientific Innovation:

- The Digital North East Vision 2022 aims to transform lives through digital technologies, while the North East Science and Technology Cluster (NEST) promotes grassroots innovations and eco-friendly technological growth.

- Tourism, Cultural, Entrepreneurial Growth:

- The Swadesh Darshan Scheme develops tourism circuits to highlight the region's natural beauty and cultural heritage, promoting eco-tourism.

- Major festivals like Hornbill Festival and Pang Lhabsol, along with the Ashtalakshmi Mahotsav, promote regional traditions, handicrafts, and tourism.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q With reference to ‘National Investment and Infrastructure Fund’, which of the following statements is/are correct? (2017)

- It is an organ of NITI Aayog.

- It has a corpus of `4,00,000 crore at present.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Mains:

Q. “Investment in infrastructure is essential for more rapid and inclusive economic growth.” Discuss in the light of India’s experience. (2021).

Rapid Fire

Birth Anniversary of Dr. Rajendra Prasad

The President of India, paid tributes to Dr. Rajendra Prasad, the first President of India on his birth anniversary (3rd December).

- Birth and Early Life: Rajendra Prasad was born on 3rd December 1884, in Zeradei, Siwan, Bihar.

- He was influenced by Gandhi's views on caste and untouchability, and led a simple life.

- Role in the Freedom Struggle: Prasad gave up his legal career to join the independence movement in 1920 and was imprisoned during the Salt Satyagraha in 1931 and the Quit India movement in 1942.

- Presided over the Bombay session of the Indian National Congress in 1934 and became Congress President after Subhash Chandra Bose's resignation in 1939.

- Role in Constitutional Making: He was appointed President of the Constituent Assembly in 1946.

- Led committees on National Flag, Rules of Procedure, and Finance and Staff.

- Literary Works: Satyagraha at Champaran (1922), India Divided (1946), Atmakatha (1946), and Bapu ke Kadmon Mein (1954).

- Presidency and Legacy: Elected as India's first President in 1950, serving for over 12 years. Only President to be re-elected unanimously in 1952 and 1957. Rajendra Prasad was awarded with the Bharat Ratna in 1962.

Read more: Dr. Rajendra Prasad

Rapid Fire

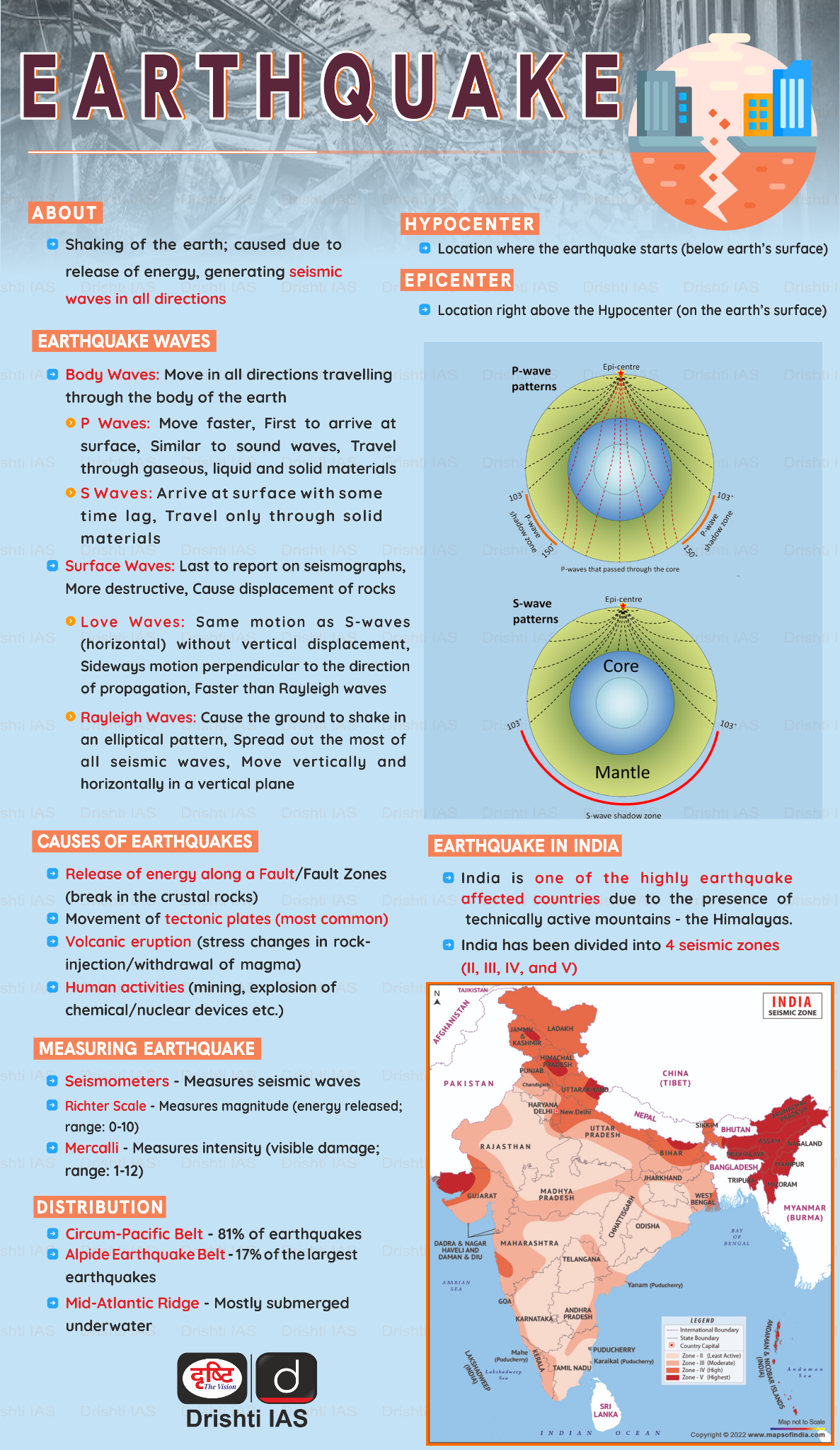

5.3 Magnitude Earthquake Strikes Telangana

A magnitude 5.3 earthquake struck the Eturnagaram forest area in Telangana, originating from a depth of 40 km. This quake was associated with the historically seismic Godavari fault system.

- Tremors were reported across several regions, including Warangal, Bhadrachalam, Khammam, and Vijayawada.

- India's seismic activity is categorized into four zones namely, Zone II, Zone III, Zone IV, and Zone V.

- Zone V has the highest seismic risk, while Zone II has the lowest. Telangana is in Zone II, indicating low seismic activity.

- In India, approximately 59% of the landmass is susceptible to earthquakes of varying intensities.

Read More: Types of Earthquake and Causes

Read More: Types of Earthquake and Causes

Rapid Fire

Google Safety Engineering Centre in Hyderabad

Hyderabad has been chosen as the site for India's first Google Safety Engineering Centre (GSEC), marking a significant milestone in the country's cybersecurity landscape.

- GSEC, Hyderabad will be the first of its kind in the Asia-Pacific region, and only the 5th globally, following similar facilities in Dublin, Munich, and Malaga.

- GSEC will specialise in advanced research, Artificial Intelligence (AI)-driven security solutions, and skill development while addressing India’s unique cybersecurity challenges.

- The project is expected to bring thousands of direct and indirect employment opportunities to Hyderabad and Telangana.

- Google and the Telangana state government are exploring collaborations in education, startups, and smart city initiatives.

- Hyderabad is already home to five major tech companies: Alphabet (Google), Microsoft, Apple, Amazon, and Meta.

- Telangana registered over 1,800 startups during 2022-23 and has supported over 550 startups through incubation.

- T-Hub, along with initiatives like T Works (India's largest prototyping centre in Hyderabad), has catalyzed growth in deep tech and manufacturing startups, positioning Hyderabad as a key player in India’s startup landscape.

Read more: Startup Surge: Fueling India's Growth

Rapid Fire

World's Largest Grain Storage Plan in Cooperative Sector

Recently, the Ministry of Cooperation highlighted the progress of World’s Largest Grain Storage Plan in the Cooperative Sector, focusing on the construction of godowns at Primary Agricultural Credit Societies (PACS) across India.

- The plan aims to empower PACS by establishing decentralized storage facilities, processing units, and custom hiring centres.

- Warehouses and other infrastructure will be developed at PACS in 24 States/Union Territories, improving storage and reducing food wastage.

- Under the Pilot Project of the Grain Storage Plan, grain storage godowns were constructed at 11 PACS across Maharashtra, Uttar Pradesh, Tamil Nadu, Karnataka, Gujarat, Madhya Pradesh, Uttarakhand, Assam, Telangana, Tripura, and Rajasthan.

- The Pilot Project has been extended, with over 500 additional PACS identified for the construction of godowns.

- Subsidies and interest subvention are provided to PACS through the Agriculture Infrastructure Fund (AIF) and Agricultural Marketing Infrastructure Scheme (AMI).

- PACS are village level cooperative credit societies that serve as the last link in a three-tier cooperative credit structure headed by the State Cooperative Banks (SCB) at the state level.

Read more: Grain Storage Plan in Cooperative Sector