Disaster Management

The Disaster Management (Amendment) Bill 2024

For Prelims: Disaster Management Act, 2005, National Disaster Management Authority, State Disaster Management Authorities, National Crisis Management Committee,National Disaster Response Fund, Heatwaves,Indian Meteorological Department

For Mains: Disaster Management (Amendment) Bill, 2024, Challenges Related to Disaster Management Act, 2005

Why in News?

Recently, the central government introduced the Disaster Management (Amendment) Bill, 2024 in the Lok Sabha, to amend the existing Disaster Management Act, 2005.

- However, the proposed amendments have sparked debate over the increasing centralisation of disaster management processes and their implications for effective disaster response.

What are the Key Provisions of Disaster Management (Amendment) Bill, 2024?

- Preparation of Disaster Management Plans: Under the 2005 Act, the National Executive Committee (NEC) and State Executive Committees (SECs) were responsible for assisting the National Disaster Management Authority (NDMA) and State Disaster Management Authorities (SDMAs) in preparing disaster management plans.

- The Bill proposes that NDMA and SDMA directly prepare their respective national and state disaster management plans, bypassing the NEC and SECs.

- The NDMA’s responsibilities will be expanded to include periodic assessments of disaster risks.

- National and State Disaster Database: The Bill mandates the creation of a comprehensive disaster database at both national and State levels.

- This database will cover aspects such as disaster assessment, fund allocation, expenditure, preparedness plans, and risk registers.

- Appointments to NDMA: Currently, the central government appoints officers and employees to NDMA.

- The Bill allows NDMA to specify its own staffing needs and appoint experts with central government approval.

- Urban Disaster Management Authority: The Bill introduces Urban Disaster Management Authorities (UDMA) for state capitals and large cities, except for the National Capital Territory of Delhi and Union territory of Chandigarh.

- These authorities will be led by municipal commissioners and district collectors, focusing on urban disaster management planning and implementation.

- State Disaster Response Force: The 2005 Act provides for a National Disaster Response Force (NDRF) for specialised disaster response.

- The Bill empowers state governments to create State Disaster Response Forces (SDRFs) with defined functions and terms of service, enhancing local response capabilities.

- Statutory Status to Existing Committees: The Bill grants statutory status to the National Crisis Management Committee (NCMC) and the High-Level Committee (HLC), which will handle major disasters and financial assistance respectively.

- The NCMC will be led by the Cabinet Secretary, and the HLC by the Minister overseeing disaster management.

- Penalties and Directives: The Bill seeks to insert a new Section 60A to empower the Central and State governments to direct any person to take any action or refrain from taking any action for reducing the impact of a disaster and to impose a penalty not exceeding Rs 10,000.

What are the Concerns Regarding the Disaster Management (Amendment) Bill, 2024?

- Centralisation of Power: The Bill further centralises an already heavily-centralised Disaster Management Act, 2005, creating more authorities and committees at various levels, complicating the chain of action and leading to delayed disaster response, contrary to the Act's intent.

- The Bill dilutes the National Disaster Response Fund (NDRF) by removing specific usage guidelines, exacerbating concerns about centralisation in disaster response.

- The centralisation has previously led to delays, as seen with the slow disbursement of funds to Tamil Nadu and Karnataka.

- The Bill dilutes the National Disaster Response Fund (NDRF) by removing specific usage guidelines, exacerbating concerns about centralisation in disaster response.

- Inadequate Local Resources: The Bill does not address the potential lack of resources and funding at the local level for setting up and maintaining UDMAs.

- This gap could undermine the effectiveness of these new entities in disaster management.

- Ensuring Disaster Relief as a Legal Right: The Bill does not address the need to make disaster relief a justiciable right (can be enforced in court if they are violated), despite the moral obligation of the state to provide relief.

- Relief measures vary significantly across states and even within states for similar disasters.

- Integrating Climate Change: The Bill lacks provisions to fully integrate climate change impacts into disaster risk management. Despite international agreements like the Sendai Framework and Paris Agreement 2015, the Bill falls short in addressing climate-induced risks.

- Integration Issues: The transition of responsibilities from the National Executive Committee and State Executive Committees to the NDMA and SDMAs could face integration issues, particularly in aligning new roles with existing frameworks.

- In the proposed bill there is no clear mechanism for effective collaboration among various stakeholders, including government agencies, Non-governmental Organizations (NGOs), private sectors, and the general public.

- Recent disasters highlight the need for better governance and coordination to handle complex and emerging risks.

- Restricted Definition of ‘Disaster’: The government currently does not plan to classify heatwaves as a notified disaster under the Disaster Management Act, 2005, despite the increasing frequency and impact of heatwaves in India.

- The definition of "disaster" in the Act remains restricted and static, failing to adequately address climate-induced disasters like heatwaves, which display regional variability and gradation.

- Impact on Federal Dynamics: The Bill may exacerbate tensions between central and State governments by centralising decision-making and financial management.

- States may become overly dependent on the central government for funds and decision-making, limiting their autonomy in disaster management and response.

What are the Shortcomings of the Disaster Management Act, 2005?

- Institutional Shortcomings: The position of Vice-Chairperson of the NDMA has been vacant for about a decade. This absence has deprived the NDMA of necessary leadership and political influence.

- The NDMA lacks independent administrative and financial powers, requiring all decisions to be routed through the Ministry of Home Affairs, which leads to inefficiencies and delays.

- Bureaucratic Inefficiencies: The Act suffers from excessive bureaucracy, creating a top-down approach where decision-making is centralised and local authorities are sidelined.

- This has led to delayed responses during disasters, as seen with the incidents like the 2018 Kerala floods and 2013 Kedarnath floods.

- Vagueness: The Act includes vague definitions of key terms like "disaster" and "calamity." For example, it initially defined disasters as any "catastrophe, mishap, calamity or grave occurrence" from natural or man-made causes, but it did not clearly differentiate between types of disasters or specify their scope, leading to confusion.

- Funding: Allocated funds are often insufficient for addressing the needs during large-scale disasters, leading to delays in response and recovery.

Disaster Management Act, 2005

- The DM Act, 2005 was enacted in the aftermath of the devastating 2004 tsunami the idea for such legislation was in the works at least since the 1998 Odisha super cyclone.

- The Act led to the creation of the NDMA, SDMAs at the state level, a National Disaster Response Force (NDRF), and a National Institute of Disaster Management (NIDM) (an institute meant for disaster-related research, training, awareness, and capacity building).

- The Act was followed by a National Disaster Management Policy in 2009 and a National Disaster Management Plan in 2016.

- This institutional framework has served India in dealing with natural disasters. Over the years, it has saved thousands of lives, and provided relief, rescue and rehabilitation services.

- Growing incidents of natural disasters, exacerbated by climate change, have made agencies such as NDMA more important than ever, requiring the assignment of greater responsibilities and resources.

Way Forward

- Integrating Disaster Risk Reduction into Development Plans: Ensure that disaster risk reduction is embedded in national and state development policies, especially in infrastructure, urban planning, and agriculture.

- Strengthening Early Warning Systems: In disaster management policy designing, Early Warning Systems should be prioritized by incorporating the upgradation of early warning systems.

- Leveraging advanced technology from Indian Space Research Organisation (ISRO), Indian Meteorological Department, and National Remote Sensing Agency (NRSA) can enhance accuracy and make these systems more accessible at the community level, ensuring timely and effective disaster response.

- Develop Rapid Response Mechanisms: Establish a national disaster response framework that ensures rapid and coordinated action during emergencies, with a clear command structure and resource allocation.

- Implement a 72-hour critical response plan, as practiced in countries like Japan, ensuring timely rescue operations and efficient coordination.

- Enhance NDMA's Authority: Enhance NDMA's Authority by filling vacant positions and empowering the agency with the necessary powers.

- This will ensure better coordination between central and state agencies, leading to a more cohesive and effective disaster management framework.

- Decentralization of Disaster Management: It is crucial to enhance responsiveness and effectiveness. Empowering state and local authorities with greater autonomy and resources can ensure quicker and more context-specific responses.

- Support for R&D in Disaster Management: Allocate resources for research in disaster risk management, focusing on innovative technologies like Artificial Intelligence, remote sensing, and big data analytics.

- Psychological Rehabilitation: There is a need for integrating psychological rehabilitation programs into disaster management policies to support the mental health of individuals who have lost loved ones and property in disasters.

- Dynamic Policy Adaptation: Regularly update disaster management policies based on evolving risks, technological advancements, and lessons learned from past disasters.

- Shift the focus from reactive to proactive strategies, emphasizing disaster preparedness, mitigation, and building resilience.

|

Drishti Mains Question: Q. Discuss the key provisions of the Disaster Management (Amendment) Bill, 2024, and analyse their potential impact on disaster management processes in India. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q. Discuss the recent measures initiated in disaster management by the Government of India departing from the earlier reactive approach. (2020)

Q. With reference to National Disaster Management Authority (NDMA) guidelines, discuss the measures to be adopted to mitigate the impact of the recent incidents of cloudbursts in many places of Uttarakhand. (2016)

Indian Economy

Evolving Household Savings in India

For Prelims: Reserve Bank of India, Gross Domestic Product, Monetary policy, Public provident fund, Household Savings, Sukanya Samriddhi Account Scheme,

For Mains: Household savings in India, Economic growth of India, Banking Sector

Why in News?

Recently, the Reserve Bank of India (RBI) Deputy Governor at the Financing 3.0 Summit of the Confederation of Indian Industry (CII) highlighted that Indian households are rebuilding financial savings post-pandemic, with significant implications for the broader economy and financial system.

Note: The CII is a non-government, not-for-profit, industry-led and industry-managed organisation that works to create and sustain an environment conducive to the development of India, partnering Industry, Government and civil society.

What is the Current Trend in Household Savings?

- Recovery of Household Savings: The net financial savings of households nearly halved from 2020-21 levels due to the unwinding of pandemic-era careful savings and a shift to physical assets like housing instead of savings.

- Households have now begun to restore their financial savings driven by rising incomes after a decline during the Covid pandemic.

- Financial assets have increased from 10.6% of Gross Domestic Product (GDP) (2011-17) to 11.5% (2017-23, excluding the pandemic year).

- Physical savings have increased to over 12% of GDP in the post-pandemic years and could continue to rise. However, this is still lower than the 16% of GDP recorded in 2010-11.

- Future Prospects: As incomes continue to rise, households are expected to rebuild financial assets to levels similar to the early 2000s, potentially reaching around 15% of GDP.

- Impact of Household Savings on the Economy:

- Interest Rates: Changes in household savings behaviour can influence monetary policy, including interest rates. Lower financial savings might prompt demands for higher interest rates to encourage savings, and vice versa.

- Enhanced Lending Capacity: As households regain financial strength, they are likely to become the primary net lenders in the economy, providing crucial funding for other sectors, especially as corporate borrowing needs rise.

- Corporate Sector Borrowing: The corporate sector has decreased net borrowings. However, anticipated increases in capital expenditure (capex) may lead to higher borrowing needs.

- With a projected rise in corporate borrowing, households are expected to fill the financing gap, supporting economic growth and investment.

- Economic Stability: Higher physical savings contribute to economic stability by diversifying investment portfolios and potentially increasing long-term wealth, though it might also limit liquidity.

- Implications for External Financing: As domestic savings rise, the need for external financing may decrease, though external debt sustainability will remain a priority.

- Changes in external financing composition could occur as the economy’s capacity to absorb foreign resources evolves.

- The public sector’s net dissaving has moderated but remains a net borrower, reflecting the need for continued fiscal policy support.

What are Household Savings?

- About: Household (HH) savings in India consist of two parts, net financial savings (NFS) and physical savings.

- HH NFS is arrived at after deducting financial liabilities (known as annual borrowing) from gross financial savings (GFS).

- GFS includes seven key areas: Currencies; deposits (bank and non-bank); insurance; provident and pension funds (P&PF), including the public provident fund (PPF); shares and debentures (S&D); claims on government (small savings); and others.

- HH physical savings primarily constitute residential real estate (accounting for about two-thirds) and machinery and equipment (owned by producers within the HH sector).

- HH NFS is arrived at after deducting financial liabilities (known as annual borrowing) from gross financial savings (GFS).

- Household Savings to GDP Ratio: It is the sum of its net financial savings to GDP ratio, physical savings to GDP ratio and gold and ornaments.

- Trends in Household Savings: There is a growing trend towards investing in riskier financial assets like stocks and debentures.

- A growing proportion of savings is being allocated to physical assets (real estate) rather than financial instruments.

- Pandemic and Impact on Household Savings: During the Covid-19 pandemic, households saved more due to limited spending opportunities. This resulted in a high financial savings rate (Rs 23.3 lakh crore in 2020-21).

- However, as restrictions eased, spending surged, reducing savings. Post-pandemic, many households have shifted their savings from financial assets to physical assets such as real estate and gold. This shift has reduced net financial savings.

- Net financial savings of households fell to Rs 14.2 lakh crore in 2022-23 from Rs 17.1 lakh crore in 2021-22. This is a notable drop from Rs 23.3 lakh crore in 2020-21.

- Savings in real estate and gold have surged, with physical asset savings reaching Rs 34.8 lakh crore and gold savings hitting Rs 63,397 crore in 2022-23.

- Many households overextended financially to purchase homes, often with high Equated Monthly Instalment (EMI) payments and reduced liquidity.

- Increasing expenses for healthcare and education have further squeezed household savings.

- The younger generation prioritises lifestyle and experiences over savings, encouraged by easy online shopping and borrowing options led to further decline in Household Savings and contributed to increase in household debt.

- Household Debt: It is defined as all liabilities of households (including non-profit institutions serving households) that require payments of interest or principal by households to the creditors at a fixed date in the future.

What are the Initiatives Related to Household Savings?

- Sukanya Samriddhi Account Scheme

- Senior Citizens’ Savings Scheme

- Kisan Vikas Patra Scheme

- Mahila Samman Savings Certificate

- Employees Provident Fund (EPF)

- National Pension System (NPS)

- Public Provident Fund (PPF) and National Savings Certificate (NSC)

- Post Office Monthly Income Scheme (POMIS): It is a Government of India-backed small savings scheme that allows residents of India above 10 years of age to invest a specific amount monthly.

- There is a 5-year lock-in period, and premature withdrawal is allowed after one year with a penalty. Income from the scheme is not subject to Tax Deduction at Source (TDS).

|

Drishti Mains Question: Q. Discuss the changing trends in household savings in India and their implications for the Indian economy. |

Read more: Rising Debt Strained Household Savings

UPSC Civil Services Examination, Previous Year Question

Mains

Q. As per the NSSO 70th Round “Situation Assessment Survey of Agricultural Households”, consider the following statements: (2018)

- Rajasthan has the highest percentage share of agricultural households among its rural households.

- Out of the total agricultural households in the country, a little over 60 percent belong to OBCs.

- In Kerala, a little over 60 percent of agricultural households reported to have received maximum income from sources other than agricultural activities.

Which of the statements given above is/are correct?

(a) 2 and 3 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: c

Indian Economy

Central Trade Unions (CTUs) Demand for Labour Welfare

For Prelims: Central Trade Unions (CTUs), Indian Labour Conference, Labour Codes, National Monetisation Pipeline (NMP), Privatization, Disinvestment, Raptakos case 1991, Fixed-term Employment, International Labour Organization, Gig Workers.

For Mains: Issues Surrounding Labour Reforms and Labour Welfare.

Why in News?

Recently, the Union government held a round table meeting with Central Trade Unions (CTUs) and has agreed to hold further discussions on the implementation of the four Labour Codes.

- Additionally, the CTUs called for the restoration of the old pension scheme requested the convening of the Indian Labour Conference (ILC), and sought increased support for the informal sector.

What are the Key Demands of Central Trade Unions (CTUs)?

- Reinstatement of the Indian Labour Conference (ILC): The CTUs demand the immediate convening of the Indian Labour Conference (ILC), a tripartite body that has not met since 2015.

- They argue that significant changes in labour laws, including the codification of 29 central laws and the passage of four labour codes occurred without proper consultation with the ILC.

- Review and Revision of the Four Labour Codes: CTUs argue that the new Labour Codes favour large corporations and dilute workers' rights. such as, the new codes make it simpler for companies, especially those with fewer than 300 employees, to hire and fire workers without requiring government permission.

- They demand further discussions on these Codes to address their concerns regarding job security, collective bargaining, work hours, social security provisions, and compliance requirements.

- Halt to Privatization and Disinvestment of Public Sector Enterprises: They oppose the National Monetisation Pipeline (NMP) which is seen as a move to transfer national assets to private corporations.

- The CTUs demand an immediate halt to the privatization, disinvestment, and sale of Public Sector Undertakings (PSUs) and Public Sector Enterprises (PSEs), such as Indian Railways.

- Implementation of Fair Minimum Wages: The CTUs call for a minimum wage of at least Rs 26,000 per month, based on the 15th ILC (1957) recommendation and the Supreme Court’s ruling in the Raptakos case, 1991.

- They demand regular wage revisions every five years, indexed to inflation.

- Employment Generation and Job Security: To address growing unemployment, the CTUs demand the withdrawal of fixed-term employment policies, which create job insecurity particularly in migrant workers.

- They called for the abolition of the Agnipath scheme and adherence to the International Labour Organization (ILO) Convention No. 1 which mandates an 8-hour workday.

- Detailed discussions were held on the Employment Linked Incentive scheme (ELI) schemes, which are projected to create two crore jobs in the country.

- Restoration of Old Pension Scheme (OPS): The CTUs call for the restoration of the non-contributory Old Pension Scheme, which they believe provides better social security to retired workers.

- They demand a minimum pension of Rs 9,000 per month for those covered under the Employees’ Pension Scheme (EPS) 1995 and Rs 6,000 per month for those not covered under any scheme.

Registration Provision For Trade Union In India

- Registration Provisions : A registered trade union must have at least 10% or 100 workers, whichever is less, with a minimum of 7 members from the relevant establishment or industry.

- Exemption from Forming Trade Unions: There are certain organisations that are exempted from forming trade unions to ensure operational efficiency.

- Some of the organisations which cannot form trade unions are:

- Armed Forces: Employees of the Indian Armed Forces (Army, Navy, and Air Force) are not eligible to form trade unions.

- This is governed by the Armed Forces Act, 1950, which restricts the formation of trade unions within the armed forces.

- Police and Law Enforcement Agencies: The Police Forces (Restriction of Rights) Act, 1966 prohibits non-gazetted police employees below the rank of Inspector from forming any kind of union or group.

- Armed Forces: Employees of the Indian Armed Forces (Army, Navy, and Air Force) are not eligible to form trade unions.

- Some of the organisations which cannot form trade unions are:

What is the Indian Labour Conference (ILC)?

- ILC is the apex level tripartite consultative committee in the Ministry of Labour & Employment consisting of

- Central Trade Union Organisations: Representing the workers.

- Central Organisations of Employers: Representing the employers.

- Government Representatives: Including the Ministry of Labour & Employment, State Governments, Union Territories, and relevant Central Ministries/Departments.

- It advises the Government on the issues concerning the working class of the country.

- The first meeting of the Indian Labour Conference (then called the Tripartite National Labour Conference) was held in 1942.

What are the Four Labour Codes?

- Four Labour Codes: The government has amalgamated 29 labour laws and codified them into 4 Labour Codes namely:

- Code on Wages, 2019: It universalised the provisions of minimum wages and timely payment for all employees to ensure the "Right to Sustenance" for every worker.

- It mandates that monthly salaried employees be paid by the 7th of the following month, weekly wage workers by the week's end, and daily wage earners on the same day.

- Industrial Relations Code, 2020: It provides a framework to protect the rights of workers to form trade unions, reduce the friction between employers, and workers and provide regulations for the settlement of industrial disputes.

- The Code aims to achieve industrial peace and harmony by effectively resolving industrial disputes.

- Code on Social Security, 2020: It includes self-employed, home-based, wage, migrant, unorganised sector and gig workers under social security schemes, such as life and disability insurance, health and maternity benefits, and provident fund.

- Occupational Safety, Health and Working Conditions Code, 2020: It emphasises the health, safety, and welfare of workers employed in various sectors like industry, manufacturing, factory etc.

- This Code is applicable in the following areas:

- Factories having 20 or more workers where the manufacturing process is being carried on with the aid of power.

- Factories having 40 or more workers where the manufacturing process is being carried on without the aid of power.

- This Code is applicable in the following areas:

- Code on Wages, 2019: It universalised the provisions of minimum wages and timely payment for all employees to ensure the "Right to Sustenance" for every worker.

What Steps are Needed to Fulfill the Demands of CTUs?

- Inclusive Consultation and Dialogue: The government should schedule and conduct the ILC to discuss ongoing and future labour reforms, maintaining a tripartite dialogue among government, employers, and labour unions regarding four labour code implementations.

- Job and Social Security: Reconsider fixed-term employment policies that contribute to job insecurity and assess the Agnipath scheme’s impact on job stability.

- National Policy for Migrant Workers: The unions demand the formulation of a comprehensive national policy for migrant workers should be considered along with the strengthening and effective implementation of the Interstate Migrant Workmen Act, 1979.

- Ratification of ILO Convention: The unions call for the ratification of the ILO Convention C177 on home-based workers to ensure their rights to fair wages, social security, and health coverage.

|

Drishti Mains Question: Q. Discuss the four labour codes and their features. What are the various concerns of labour trade unions regarding labour reforms? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q.Consider the following statements: (2017)

1. The Factories Act, 1881 was passed with a view to fix the wages of industrial workers and to allow the workers to form trade unions.

2. N.M. Lokhande was a pioneer in organizing the labour movement in British India.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Q.The Trade Disputes Act of 1929 provided for(2017)

(a) the participation of workers in the management of industries.

(b) arbitrary powers to the management to quell industrial disputes.

(c) an intervention by the British Court in the event of a trade dispute.

(d) a system of tribunals and a ban on strikes

Ans: (d)

Q.With reference to the guilds (Shreni) of ancient India that played a very important role in the country’s economy, which of the following statements is/are correct? (2012)

1. Every guild was registered with the central authority of the State and the king was the chief administrative authority on them.

2. The wages, rules of work, standards and prices were fixed by the guild.

3. The guild had judicial powers over its own members.

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains

Q.Since the decade of the 1920s, the national movement acquired various ideological strands and thereby expanded its social base. Discuss. (2020)

Q.Why indentured labour was taken by the British from India to other colonies? Have they been able to preserve their cultural identity over there? (2018)

Q.Discuss the changes in the trends of labour migration within and outside India in the last four decades. (2015)

Governance

Government Approved 12 New Industrial Smart Cities

For Prelims: Industrial Smart Cities, Smart Cities Mission, Centrally Sponsored Scheme, Sustainable development, Special Purpose Vehicle (SPV), Public-Private Partnership (PPP), Atal Mission for Urban, Rejuvenation and Urban Transformation (AMRUT), Pradhan Mantri Awas Yojana-Urban (PMAY-U)

For Mains: Challenges Associated with Industrial Smart Cities Development and Way Forward

Why in News?

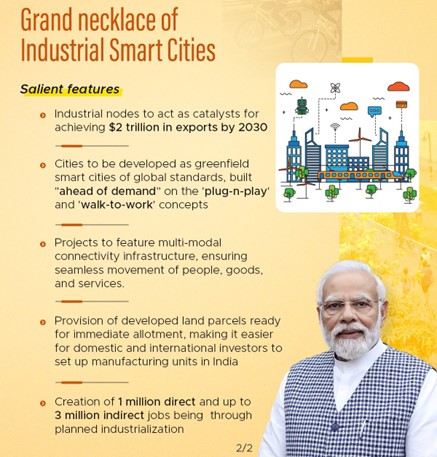

Recently, the Union Cabinet, under the leadership of Prime Minister has approved the establishment of 12 industrial smart cities across 6 major industrial corridors in 10 states under the National Industrial Corridor Development Programme.

- The chosen cities for the industrial projects are in Uttarakhand, Punjab, Maharashtra, Kerala, Uttar Pradesh, Bihar, Telangana, Andhra Pradesh, and Rajasthan.

What is an Industrial Smart City?

- About:

- An Industrial Smart City is an urban area that integrates advanced technologies and data analytics to enhance the efficiency of industrial operations and promote sustainable development.

- These smart industrial cities aim to attract foreign investment, boost domestic manufacturing, and drive employment.

- Objective:

- The development of new industrial cities in India aims to strengthen the country's position in global value chains by providing investors with ready-to-allot land.

- It aims to integrate advanced urban concepts like 'plug-and-play' and 'walk-to-work'.

- Plug-and-play industrial parks offer ready-to-use infrastructure, enabling businesses to start operations immediately.

- "Walk-to-work" is an urban planning strategy that encourages people to live near their workplaces, reducing car use and promoting walking

- Road Map for Development:

- The cities will be developed under the National Industrial Corridor Development Programme (NICDP).

- NICDP aims to develop advanced industrial cities that can compete with the world’s top manufacturing and investment destinations.

- It is designed to foster a vibrant industrial ecosystem by facilitating investments from both large anchor industries and Micro, Small, and Medium Enterprises (MSMEs).

- The first industrial corridor, the Delhi Mumbai Industrial Corridor, was approved in 2007.

- The programme is implemented by the National Industrial Corridor Development and Implementation Trust (NICDIT) and the National Industrial Corridor Development Corporation Limited (NICDC).

- These industrial nodes will integrate residential and commercial setups, functioning as self-sustaining urban environments.

- The government plans to partner with Invest India (India's national Investment Promotion & Facilitation Agency) for marketing these projects.

- A Special Purpose Vehicle (SPV) will also be set up to implement the parks, with a 3-year completion timeline, depending on state cooperation.

- The cities will be developed under the National Industrial Corridor Development Programme (NICDP).

What are the Key Features of the Approved Industrial Smart Cities?

- Aligned with National Economic Goals & PM Gati-Shakti National Master Plan:

- The development of these smart cities aligns with the government’s goal of achieving USD 2 trillion in exports by 2030.

- The projects will be aligned with the PM’s GatiShakti National Master Plan, incorporating multi-modal connectivity infrastructure to enable seamless movement of people, goods, and services.

- This infrastructure is crucial for improving logistical efficiency and streamlining supply chains nationwide.

- The cities will be part of a ‘necklace of industrial cities’ along the Golden Quadrilateral, enhancing connectivity and industrial growth.

- Significance:

- These projects are designed to attract Foreign Direct Investment (FDI) from countries like Singapore and Switzerland.

- These cities are expected to generate around 10 lakh direct jobs and up to 30 lakh indirect jobs, with an investment potential of Rs 1.5 lakh crore.

- The cities developed under the NICDP will promote sustainability by integrating ICT-enabled utilities and green technologies to reduce environmental impact, while providing ready-to-allot land parcels to attract domestic and international investors, aiming to strengthen India's role in global value chains.

What are the Challenges Associated with Industrial Smart Cities Development?

- Technological Integration and Infrastructure: Upgrading outdated urban industrial infrastructure to support IoT devices, high-speed internet, and data centres demands significant investment and poses logistical challenges, especially in older cities.

- Data Privacy and Security: Ensuring the protection of vast amounts of data collected from smart devices against breaches requires robust security protocols and continuous monitoring.

- Funding and Investment: Securing substantial financial investment from public or private sources is challenging, requiring convincing stakeholders of the long-term benefits and Return on Investment (ROI).

- Public Acceptance and Awareness: Addressing citizens' concerns about privacy, job loss due to automation, and lifestyle changes through effective communication and education is crucial for the success of industrial smart city projects.

- Governance and Policy Issues: Navigating changes in local laws, regulations, and policies is time-consuming and politically sensitive, complicating the implementation of smart city initiatives.

Way Forward

- Regulatory Reforms: Simplify and digitise administrative processes, harmonise regulations across government levels, and enhance transparency in decision-making to improve efficiency, reduce business burdens, and build investor trust.

- Efficient Land Acquisition: There is a need to create land banks to streamline acquisition, ensure fair compensation to minimise disputes, and use innovative methods like land pooling to speed up the process.

- Sustainable Development: It is essential to conduct thorough environmental assessments, promote sustainable business practices, and invest in necessary infrastructure to support these efforts.

- Skill Development and Workforce Training: To address skill shortages in industrial parks, it is crucial to establish vocational training centers, collaborate with industries for tailored training programs, and provide incentives to encourage businesses to invest in employee development.

- Public-Private Partnerships: To maximise the benefits of industrial smart cities development, it is essential to foster public-private partnerships that share risks and rewards equitably while ensuring transparency and accountability in governance.

|

Drishti Mains Question: Q. What are industrial smart cities? Examine their relevance in urban development of India and enlist the challenges faced by them. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains:

Q. With a brief background of quality of urban life in India, introduce the objectives and strategy of the ‘Smart City Programme.’ (2016)

Important Facts For Prelims

Reusable Launch Vehicle, RHUMI-1

Why in News?

India recently launched its first reusable hybrid rocket, RHUMI-1, developed by the Tamil Nadu-based start-up Space Zone India, to collect data for research purposes on global warming and climate change.

- The rocket, carrying 3 Cube Satellites and 50 PICO Satellites, was launched into a suborbital trajectory using a mobile launcher.

Note:

- Cube satellites are nano satellites that weigh between 1 to 10 kg.

- Pico satellites are smaller satellites, with weights ranging from 0.1 to 1 kg.

What are the Key Features of RHUMI-1?

- Hybrid Propulsion System: The RHUMI-1 integrates both solid and liquid propellants, enhancing efficiency and lowering operational costs.

- Adjustable Launch Angle: The engine allows for precise trajectory control with adjustable angles ranging from 0 to 120 degrees.

- Electrically Triggered Parachute System: It has advanced and eco-friendly descent mechanism that ensures safe recovery of rocket components, offering both cost-effectiveness and environmental benefits.

- Environmentally Friendly: It is entirely free of pyrotechnics (fireworks) and TNT (Trinitrotoluene), an odourless yellow solid used in explosives, highlighting its commitment to sustainability.

Note:

- Dr. A.P.J Abdul Kalam Students Satellite Launch Mission: In 2023, this mission involved over 2,500 students from government, tribal, and public schools across India who contributed to designing and constructing a student satellite launch vehicle capable of carrying a payload of 150 Pico Satellites research experiment cubes.

What are Reusable Launch Vehicles (RLVs)?

- About:

- Reusable Launch Vehicles (RLVs) are spacecraft designed to be launched, recovered, and launched again multiple times.

- Advantages:

- Cost Savings: Up to 65% cheaper than building a new rocket for every launch.

- Reduce Space Debris: By minimising discarded rocket components.

- Increased Launch Frequency: Lesser turnaround time enables the rocket to be used more frequently.

- Different from Multi-Stage Rocket:

- In a typical multi-stage rocket, the first stage is discarded after its fuel is exhausted to reduce weight, allowing the remaining stages to continue propelling the payload into orbit.

- However, RLVs recover and reuse the first stage. After separating from the upper stages, the first stage descends back to Earth using engines or parachutes for a controlled landing.

UPSC Civil Services Examination, Previous Year Question (PYQ)

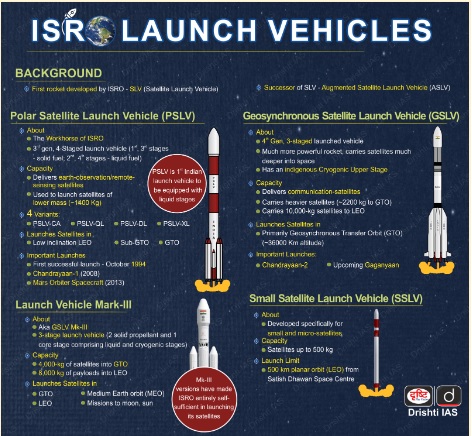

Q. With reference to India’s satellite launch vehicles, consider the following statements: (2018)

- PSLVs launch the satellites useful for Earth resources monitoring whereas GSLVs are designed mainly to launch communication satellites.

- Satellites launched by PSLV appear to remain permanently fixed in the same position in the sky, as viewed from a particular location on Earth.

- GSLV Mk III is a four-staged launch vehicle with the first and third stages using solid rocket motors, and the second and fourth stages using liquid rocket engines.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3

(c) 1 and 2

(d) 3 only

Ans: (a)

Important Facts For Prelims

Teachers’ Day 2024

Why in News?

Recently, India celebrated Teachers' Day on 5th September 2024 marking the birth anniversary of Dr. Sarvepalli Radhakrishnan (1888-1975).

- On this day, the President of India confers the National Teachers’ Award (NTA) to honour teachers and recognise their contributions in empowering and educating society.

What are Key Facts About Dr. Sarvepalli Radhakrishnan?

- Birth: He was born into a Telugu family in Tiruttani town of Tamil Nadu, on 5th September 1888.

- Academic Achievements: He held several prestigious positions, including the King George V Chair at Calcutta University from 1921 to 1932, the second Vice-Chancellor of Andhra University from 1931 to 1936, and the fourth Vice-Chancellor of Banaras Hindu University from 1939 to 1948.

- Moreover, he was Professor of Eastern Religion and Ethics at the University of Oxford from 1936 to 1952.

- Political Career: He became the first Vice President of India (1952-62) and later the second President of India (1962-67).

- Philosopher: He is widely acknowledged in philosophical circles as a “bridge-builder” between India and the West.

- He defended Hinduism against what he perceived as “uninformed Western criticism,” helping to establish a more nuanced understanding of the religion on a global scale.

- Recognition: In 1954, he was awarded the country's highest civilian award, Bharat Ratna.

- In 1931, he was awarded with knighthood by King George V, former King of Britain, for his remarkable academics.

What is the National Teachers’ Award?

- About NTA: It was instituted to celebrate the unique contribution of teachers and to honour them who have improved the quality of education and enriched the lives of students.

- It carries a certificate of merit, a cash award of Rs. 50,000 and a silver medal.

- It is given by the Ministry of Education. In 2024, 82 teachers were selected for NTA.

- Eligibility of Teachers for NTA: School teachers and Heads of Schools working in recognized primary/middle/high/higher secondary schools are eligible for selection. E.g., Schools run by State Govt./UTs Administration, Schools affiliated to CBSE etc.

- Only regular teachers and heads of schools with a minimum ten years of services are eligible.

- Non-Eligibility for NTA: Teacher/Headmaster should not have been involved in providing private tuition.

- Contractual teachers and Shiksha Mitras are not eligible.

- Educational Administrators, Inspectors of Education, and the staff of training Institutes are not eligible for these awards.

- Evaluation Criteria: Teachers are evaluated based on the evaluation matrix which contains two types of criteria for evaluation.

- Objective Criteria: Under this the teachers are awarded marks against each of the objective criteria. It is given the weightage of 10 out of 100.

- Criteria Based on Performance: Under this, teachers are awarded marks on criteria based on performance e.g., initiatives to improve learning outcomes, innovative experiments undertaken etc. These criteria are given the weightage of 90 out of 100.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q.With reference to the scholars/litterateurs of ancient India, consider the following statements: (2020)

1. Panini is associated with Pushyamitra Shunga

2. Amarasimha is associated with Harshavardhana

3. Kalidasa is associated with Chandra Gupta-II

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (c)

Q.Consider the following statements: (2018)

1. As per the Right to Education (RTE) Act, to be eligible for appointment as a teacher in a State, a person would be required to possess the minimum qualification laid down by the concerned State Council of Teacher Education.

2. As per the RTE Act, for teaching primary classes, a candidate is required to pass a Teacher Eligibility Test conducted in accordance with the National Council of Teacher Education guidelines.

3. In India, more than 90% of teacher education institutions are directly under the State Governments.

Which of the statements given above is/are correct?

(a) 1 and 2

(b) 2 only

(c) 1 and 3

(d) 3 only

Ans: (b)

Q.Who among the following Gandhian followers was a teacher by profession? (2008)

(a) A. N. Sinha

(b) Braj Kishore Prasad

(c) J. B. Kriplani

(d) Rajendra Prasad

Ans: (c)

Rapid Fire

1866 Orissa famine and Renaming of Ravenshaw University

The Union Education Minister has proposed changing the name of Ravenshaw University in Cuttack, citing the association with Thomas Edward Ravenshaw a British administrator, who oversaw the 1866 Orissa famine that resulted in over a million deaths.

- The 1866 Orissa famine, known locally as “Na Anka Durbhikshya,” ravaged coastal Odisha. Historians attribute the famine to a combination of failed paddy harvests, inadequate rice import infrastructure, and supply chain failures.

- Founded in 1868 as a small school, Ravenshaw College became a full-fledged college in 1876 and was renamed in honour of T.E. Ravenshaw. It evolved into a university in 2006 and has been a key player in Odisha’s education and political spheres.

- Ravenshaw also advocated for women's education in Odisha, leading to the establishment of Cuttack Girl’s School, which was later renamed Ravenshaw Hindu Girls School.

Rapid Fire

Operation Kavach 5.0 Targets Drug Trafficking

Source: IE

Recently, the Delhi Police launched 'Operation Kavach–5.0' in a major crackdown against drug trafficking, resulting in significant arrests and seizures across the national capital.

- The operation has pushed many traffickers to operate underground, shifting from large-scale to smaller shipments transported via cars and trains. Traffickers are now using women and children as decoys and setting up storehouses outside city limits.

- Operation Kawach is a major anti-narcotics initiative launched by the Delhi Police, focusing on both street-level and high-level drug trafficking and apprehending individuals involved in narcotics trafficking and distribution.

- It aims to combat the harmful effects of drug addiction on youth and children.

- It was launched in coordination with all district units of the Delhi Police, the operation involves the Crime Branch, Anti-Narcotics Task Force (ANTF).

- Initiatives Taken by India to Drug Menace: Nasha Mukt Bharat Campaign (NMBA), National Action Plan for Drug Demand Reduction and Prevention of Illicit Traffic in Narcotic Drugs and Psychotropic Substances Act, 1988.

Rapid Fire

AgriSURE Scheme

Recently, the Union Minister for Agriculture and Farmers’ Welfare unveiled the AgriSURE (Agri Fund for Start-ups & Rural Enterprises) Scheme in New Delhi marking a significant step in transforming India’s agricultural landscape.

- The event also featured the AgriSURE Greenathon Awards, recognising top tech-driven agri-start-ups.

- AgriSURE is an innovative Rs 750 crore blended capital fund registered with Securities and Exchange Board of India as a Category II Alternative Investment Fund (AIF), with contributions from the Government of India (Rs 250 crore), National Bank for Agriculture and Rural Development (NABARD) (Rs 250 crore), and private investors (Rs 250 crore).

- It aims to fuel growth and foster innovation in the agricultural and rural start-up ecosystem, with a focus on technology-driven, high-risk, high-impact ventures.

- AgriSURE Greenathon Awards recognized the most innovative start-ups developing tech-centric solutions to address challenges faced by farmers across the agri-value chain.

- Winners include Greensapio (Winner), Krushikanti (Runner-Up), and Ambronics (Second Runner-Up) from a pool of 2000 start-ups with a total prize pool of Rs 6 lakhs.

- Initiatives Related to Agri-Tech: Digital Agriculture Mission (DAM), AgriStack, and Unified Farmer Service Platform.

Read more: 7 New Schemes to Boost Farmer Income

Rapid Fire

Prakash Purab of Sri Guru Granth Sahib

Recently, the Prime Minister extended greetings on the occasion of Prakash Purab (Illumination Day) of Sri Guru Granth Sahib.

- Prakash Purab: On this day in 1604, the Guru Granth Sahib was formally inaugurated and ceremoniously opened at Golden Temple in Amritsar, taking the form of the Adi Granth Sahib.

- Adi Granth Sahib: The Adi Granth, meaning "the first book," is the early compilation of Sikh scriptures by Guru Arjan Dev (5th of 10 Gurus) in 1604.

- The Adi Granth is the first version of the Guru Granth Sahib which serves as the holy scripture of the Sikhs.

- The 10th Sikh Guru, Guru Gobind Singh, added further sacred Shabads to the Granth between 1704 and 1706.

- In 1708, before his departure, he declared the Adi Granth as the eternal Guru, commanding all Sikhs to regard the Guru Granth Sahib as their next and everlasting Guru. It was then renamed Sri Guru Granth Sahib.

- The Adi Granth incorporated writings from 36 Hindu and Muslim authors, including Kabir, Ravi Das, Naam Dev, and Sheikh Farid.

Read More: Sikhism, Saroop of Guru Granth Sahib, Guru Tegh Bahadur