Indian Economy

Funding Winter Impact on Start-ups

- 23 Jan 2024

- 9 min read

For Prelims: Funding Winter, Stand-Up India Scheme, Pradhan Mantri Mudra Yojana, Startup India Action Plan

For Mains: Indian Startup Ecosystem, Government’s Initiatives for Startups

Why in News?

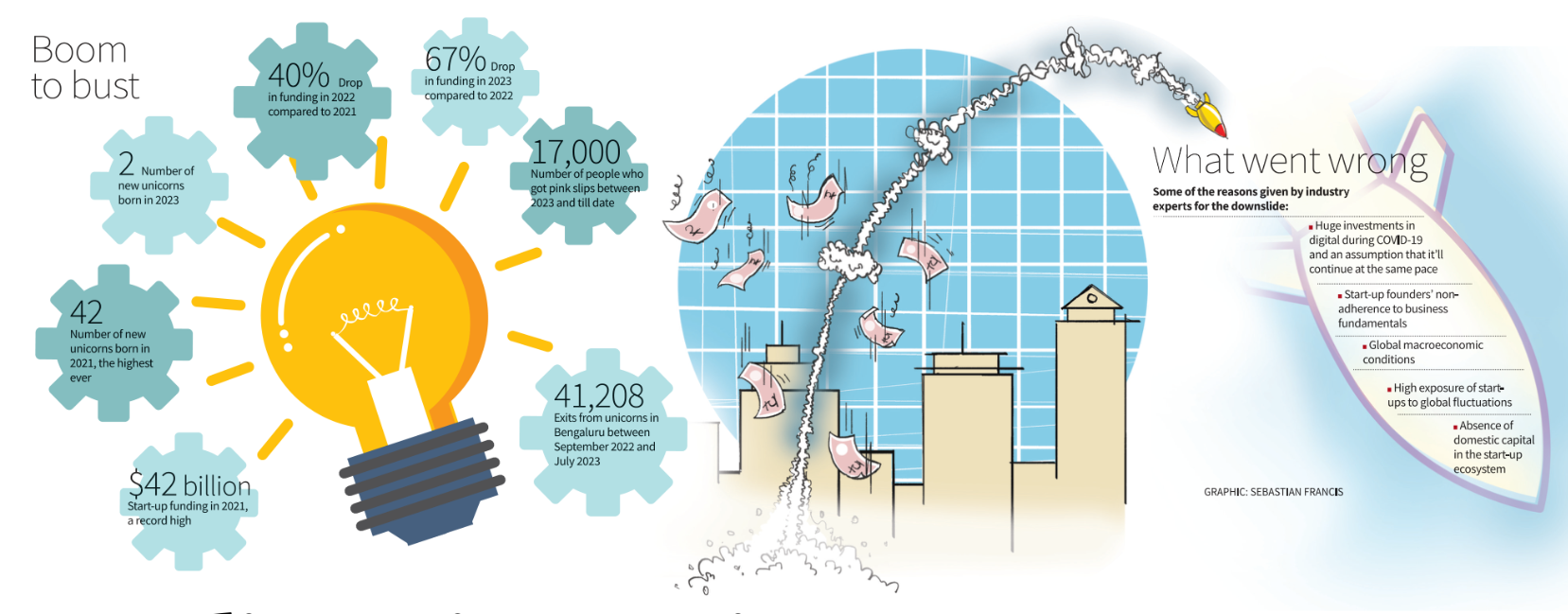

Bengaluru, often hailed as the Silicon Valley of India, has faced a significant setback in its vibrant start-up ecosystem due to a funding crunch triggered by global events. The aftermath of the funding winter has left many regional start-ups grappling with challenges ranging from layoffs to cautious investor sentiment.

What is Funding Winter?

- About:

- Funding winter is a term used to describe a period of reduced capital inflows to startups.

- During a funding winter, investors and lenders become more cautious and selective in providing financial support, leading to a decrease in the overall funding available in the market.

- Funding winters can significantly impact businesses and entrepreneurs, particularly those in the early stages of development or those seeking to expand their operations.

- Reasons for Funding Winter in India:

- Fluctuations in Indian Start-up Funding:

- In 2021, Indian start-up funding surged to a record USD 42 billion, creating 42 new unicorns. However, 2022 witnessed a 40% funding drop, marking a shift from pandemic-driven optimism.

- The initial boom was fueled by massive investments in digital ventures during the Covid-19 pandemic.

- There was an assumption that the digital trend would continue at the same pace, but as the world returned to normalcy, a reassessment of investments occurred.

- As per data, tech companies in India saw funding to the tune of USD 8.3 billion in 2023, a 67% drop from 2022.

- Global Macroeconomic Factors:

- Global events, including the Russia-Ukraine and Israel-Palestine conflicts, played a crucial role in triggering the funding winter.

- The resulting uncertainty in the global supply chain and trade outlook contributed to a bleak investment scenario for start-ups.

- The general slowdown in global economies had a cascading effect on investor confidence and capital flow.

- Return on Investments (ROI) Focus:

- Investors began scrutinizing the sustainability and profitability of start-ups, leading to a correction in the market.

- Investors exhibit decreased confidence in unicorns and late-stage start-ups that prioritise growth over profitability.

- Investor interest and activity have shifted towards early-stage start-ups, emphasising caution and a focus on revenue models.

- The absence of mergers and acquisitions, coupled with poor performances of listed start-ups, left investors without viable exit options.

- The dearth of exit strategies contributed to a challenging environment for both investors and late-stage start-ups.

- Absence of Domestic Capital:

- Lack of domestic capital in the Indian start-up ecosystem worsens the funding crisis.

- Domestic Pension Funds are not investing in technology, venture, and start-ups, which is a missed opportunity for the country.

- The Union Ministry of Finance and regulatory system are hostile to the tax issues of start-ups.

- The latest regulations by the Reserve Bank of India restrict banks and Non-Banking Financial Company (NBFC) from investing in Alternate Investment Funds (AIF), which is seen as authoritarian.

- Macro and Microeconomic Challenges:

- Both macroeconomic conditions and the failure of some start-up founders to adhere to fundamental business principles compounded the crisis.

- The crisis was not only a result of external factors but also internal decisions and strategies within the start-up ecosystem.

- Fluctuations in Indian Start-up Funding:

What is the Impact on Start-ups and Employees?

- Mass Layoffs:

- A major repercussion of the funding winter has been mass layoffs. According to data from the international layoffs.fyi (tracks tech startup layoffs), tech companies gave the pink slip to around 17,000 people in India from 2023 to January 2024.

- Silent Layoffs:

- Companies resort to 'silent layoffs' by giving lower ratings, nudging employees to leave, rather than explicit layoffs.

- Attrition Rates:

- Between September 2022 and July 2023, 111 Indian unicorns experienced an attrition rate (rate at which employees depart an organisation) of 4.72%, with 41,208 employees exiting in Bengaluru alone.

Startup Ecosystem in India

- India has emerged as the 3rd largest ecosystem for startups globally with over 1 Lakh Department for Promotion of Industry and Internal Trade (DPIIT)-recognized startups across 763 districts of the country as of 3rd October 2023.

- India ranks 2nd in innovation quality with top positions in the quality of scientific publications and the quality of its universities among middle-income economies.

- The innovation in India is not just limited to certain sectors it spans in 56 diverse industrial sectors with 13% from IT services, 9% healthcare and life sciences, 7% education, 5% agriculture and 5% food & beverages.

- Indian Startup Ecosystem has seen exponential growth in past few years (2015-2022):

- 15 times increase in the total funding of startups.

- 9 times increase in the number of investors.

- 7 times increase in the number of incubators.

- As of October 2023, India is home to 111 unicorns with a total valuation of USD 349.67 billion. Out of the total number of unicorns, 45 unicorns with a total valuation of USD 102.30 billion were born in 2021 and 22 unicorns with a total valuation of USD 29.20 billion were born in 2022.

- 2023 saw the emergence of Zepto as the latest and only unicorn in the year.

What are the Indian Government’s Initiatives for Startups?

- Pradhan Mantri Mudra Yojana.

- Stand-Up India Scheme.

- Atal New India Challenge 2.0.

- National Initiative for Developing and Harnessing Innovations (NIDHI).

- Startup India Action Plan (SIAP).

- Ranking of States on Support to Startup Ecosystems (RSSSE).

Way Forward

- The entire ecosystem must prioritize business fundamentals, maintaining the right ratios and balances, and planning for future cycles.

- There is a need for structural-level reforms in financing, including collateral-free loans for start-ups, to ensure sustained growth.

- Continued government support, like Karnataka's ELEVATE program can play a crucial role in preventing start-up failures and fostering a resilient ecosystem.

- Karnataka's ELEVATE program gives a one-time grant of up to ₹50 lakh to early-stage start-ups. Under preferential market access, the government aims to promote public procurement from start-ups.

- The government should implement policies to incentivize domestic investments, especially from pension funds.

- Start-ups need to adapt to market dynamics by embracing frugality, efficiency, and organic business leads.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. What does venture capital mean? (2014)

(a) A short-term capital provided to industries

(b) A long-term start-up capital provided to new entrepreneurs

(c) Funds provided to industries at times of incurring losses

(d) Funds provided for replacement and renovation of industries

Ans: (b)

Q2. Which of the following statements is/are correct regarding Smart India Hackathon 2017? (2017)

- It is a centrally sponsored scheme for developing every city of our country into Smart Cities in a decade.

- It is an initiative to identify new digital technology innovations for solving the many problems faced by our country.

- It is a programme aimed at making all the financial transactions in our country completely digital in a decade.

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 2 only

(c) 3 only

(d) 2 and 3 only

Ans: (b)

Mains

Q1: The nature of economic growth in India in recent times is often described as a jobless growth. Do you agree with this view? Give arguments in favour of your answer. (2015)

-min.jpg)