Jammu & Kashmir Switch to Hindi

SC to Consider Plea for Restoring Jammu & Kashmir’s Statehood

Why in News?

Recently, the Supreme Court agreed to hear a petition regarding the restoration of Jammu & Kashmir’s statehood, following the 2019 bifurcation.

Key Points

- The bifurcation occurred after the abrogation of Article 370 in 2019, which led to the formation of two Union Territories (J&K and Ladakh).

- Article 3 of the Constitution: Formation of New States

- Parliament holds the power to enact legislation for the formation of new States.

- New States can be created by:

- Separating territory from an existing State.

- Uniting two or more States.

- Uniting parts of different States.

- Uniting any territory to a part of any State.

- Parliament also has the authority to:

- Increase or diminish the area of any State.

- Alter the boundaries or name of any State.

- Here, the word State includes a Union Territory also.

- Checks on Parliament’s Power:

- A bill for the formation of new States can only be introduced in either House of Parliament upon the recommendation of the President.

- If the bill affects the areas, boundaries, or name of a State, the President must refer the bill to the concerned State Legislature for its views.

- The views of the State Legislature must be communicated to Parliament, but Parliament is not bound by them.

- State Legislature’s Role:

- The State Legislature's only role is to express its views when requested by the President.

- Parliament is not obligated to adhere to the views of the State Legislature when forming new States.

- Laws enacted under Article 3 are not considered amendments to the Constitution, even if they modify provisions of the First Schedule (list of States and Union Territories) or the Fourth Schedule (allocation of seats in the Rajya Sabha).

- This means such laws can be passed by a simple majority in Parliament, not requiring the special procedure for constitutional amendments.

Madhya Pradesh Switch to Hindi

Madhya Pradesh Receives Rs. 14,000 Crore Tax Devolution

Why in News?

Recently, Madhya Pradesh received a Rs. 14,000 crore boost in tax devolution from the central government ahead of Diwali, improving fiscal space for the state.

Key Points

- How Tax is Devolved in India:

- The Finance Commission determines the division of central tax revenues between the Union and states, recommending how much each state should receive.

- Articles 270-275 of Indian Constitution outline how taxes are shared, ensuring states get a share of central taxes for financial stability.

- Current Status of Tax Devolution in India:

- Financial devolution refers to the transfer of financial resources and decision-making powers from the central government to the states.

- Article 270 of the Constitution outlines the distribution of net tax proceeds between the Union government and the States.

- The Finance Commission (FC), constituted every five years, provides recommendations for the vertical distribution of funds from the central government's divisible pool of taxes (excluding cess and surcharge).

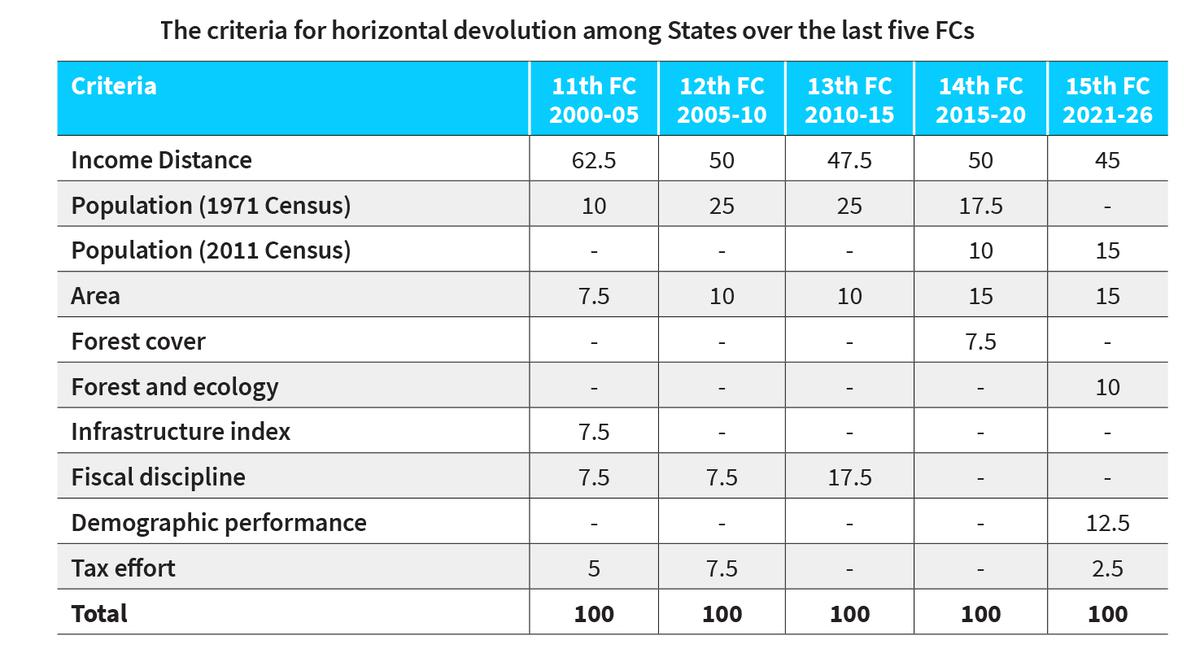

- Additionally, it offers a formula for the horizontal allocation of these funds among individual states.

- Apart from the share of taxes, States are also provided grants-in-aid as per the recommendation of the FC.

- The 16th Finance Commission, chaired by Dr Arvind Panagariya, has been tasked with making recommendations for the period 2026-31.

- Criteria for Devolution Among States: Currently, the share of States from the divisible pool (vertical devolution) stands at 41% as per the recommendation of the 15th FC.

Uttar Pradesh Switch to Hindi

Govt Plans Pre-Diwali Gifts for UP Employees

Why in News?

Recently, the Uttar Pradesh government is expected to offer multiple benefits to state employees ahead of Diwali.

Key Points

- Three Potential Benefits:

- Dearness Allowance (DA) Hike: A 4% increase in DA, bringing more financial relief to state employees by adjusting their income to match inflation.

- Bonus Announcement: The state government may provide a Diwali bonus to employees, offering additional financial support for the festive season.

- Retirement Age Review: Discussions are ongoing about possibly increasing the retirement age for specific government employees.

- Dearness Allowance (DA):

- It is the cost-of-living adjustment to offset inflation, provided to government employees and pensioners. It is calculated as a percentage of the basic salary.

- Impact on Economy:

- Increased Consumer Spending: The hike boosts disposable income, especially around festive periods, spurring consumer demand.

- Inflation Control: DA helps employees manage inflation, but an increase in demand could potentially raise inflation if supply doesn’t keep pace.

- Fiscal Pressure: For the government, DA hikes increase expenditure, which may strain the fiscal budget but stimulate economic growth through consumption.

Inflation

- Inflation, as defined by the International Monetary Fund, is the rate of increase in prices over a given period, encompassing a broad measure of overall price increases or for specific goods and services.

- It reflects the rising cost of living and indicates how much more expensive a set of goods and/or services has become over a specified period, usually a year.

- In India, inflation's impact is particularly significant due to economic disparities and a large population.

%20MPPCS%202025%20Desktop%20E.jpg)

%20MPPCS%202025%20Mobile%20E%20(1).jpg)

.png)

.png)

PCS Parikshan

PCS Parikshan