Budget Vishesh: MSME Budget 2024-25 | 21 Aug 2024

For Prelims: Union Budget 2024-25, Micro, Small, and Medium Enterprise (MSME) sector, Mudra loan, Public sector banks, e-Commerce Export Hubs, National Policy on Skill Development and Entrepreneurship, GST, Raising and Accelerating MSME Performance (RAMP), The Trade Receivables Discounting System (TReDS), Scheme of Funds for Regeneration of Traditional Industries (SFURTI), The Special Credit Linked Capital Subsidy Scheme (SCLCSS), IPR (Intellectual Property Rights), A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship (ASPIRE), Non-Performing Assets (NPAs), Micro, Small, and Medium Enterprises Development Act, 2006.

For Mains: Significance of Micro, Small, and Medium Enterprise (MSME) Sector in Growth of Indian Economy and Inclusive Growth.

Why in News?

Recently, in Union Budget 2024-25 the government unveiled a series of initiatives to enhance the Micro, Small, and Medium Enterprise (MSME) sector.

- The Budget introduced a new MSME credit assessment model, boosted Mudra loan limits, expanded SIDBI branches, established e-commerce export hubs, and lowered The Trade Receivables Discounting System (TReDS) onboarding threshold.

What are MSMEs?

- About:

- MSME stands for Micro, Small and Medium Enterprises. These are businesses that produce, process, and preserve goods and commodities.

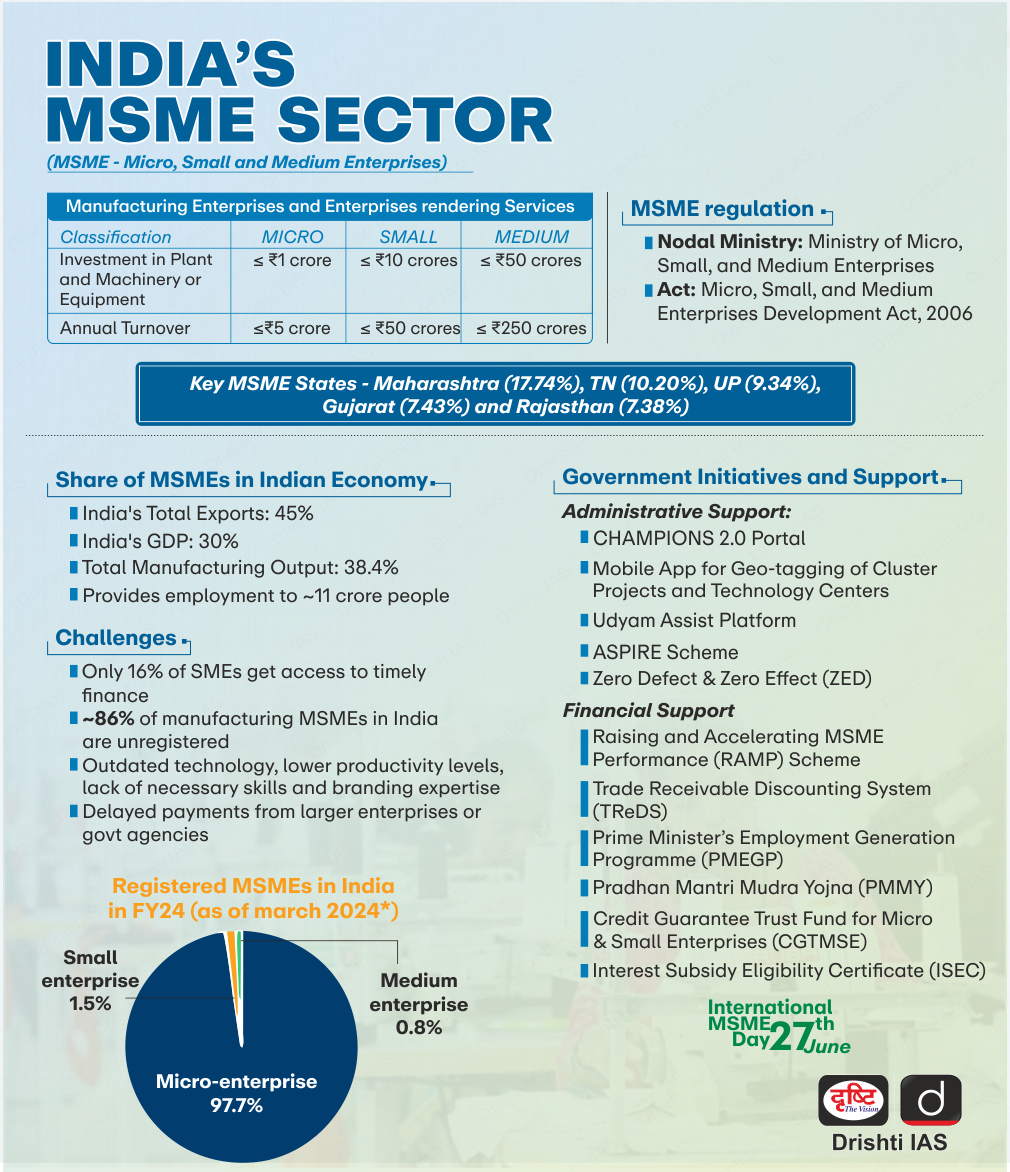

- These are broadly classified based on their investment in plant and machinery for manufacturing or equipment for service enterprises, as well as their annual turnover-

- Micro Enterprise: Investment in plant and machinery or equipment is up to Rs 1 crore, and turnover is up to Rs 5 crore.

- Small Enterprise: Investment in plant and machinery or equipment is up to Rs 10 crore, and turnover is up to Rs 50 crore.

- Medium Enterprise: Investment in plant and machinery or equipment is up to Rs 50 crore, and turnover is up to Rs 250 crore.

- Present Status of MSME Sector:

- According to the Ministry of Statistics & Programme Implementation, MSME manufacturing contributes 40.83% of India's total manufacturing Gross Value Added (GVA) and the MSME sector accounts for 45.56% of India's total exports.

- As per Annual Report 2023-24 of Ministry of Micro, Small & Medium Enterprises, Micro sector accounts for more than 99% of total estimated number of MSME while Small sector and Medium sector accounted for 0.52% and 0.01% of total estimated MSME, respectively.

- Out of 633.88 estimated numbers of MSME, 51.25% are in rural areas.

- The socially backward groups owned almost 66.27% of MSME.

- As per the National Sample Survey (NSS) 73rd round, MSME sector created 11.10 crore jobs.

What are New Provisions in Budget 2024-25 for MSME Sector?

- Credit Guarantee Scheme: Facilitates MSME term loans for machinery and equipment without requiring collateral or third-party guarantees.

- Expanded Credit Guarantee: A self-financing fund provides guarantees up to Rs 100 crore per borrower, with upfront and annual fees required from the borrower.

- New Assessment Model: Public sector banks will use a digital footprint-based credit assessment for MSMEs, moving away from traditional asset and turnover criteria.

- Stress Period Support: A new mechanism will provide continued credit to MSMEs in stress, including those in special mention accounts, with an increased Mudra loan limit to Rs 20 lakh from Rs 10 lakh for those who have previously repaid loans under the Tarun category.

- Lower Turnover Threshold for TReDS: The turnover threshold for mandatory onboarding on the TReDS platform will be reduced from Rs 500 crore to Rs 250 crore to facilitate greater MSME participation.

- SIDBI Branch Expansion: SIDBI will open new branches in MSME clusters over the next three years to improve its outreach and offer direct credit to these businesses. By establishing 24 branches this year, it will expand its service coverage to 168 of the 242 major clusters.

- Financial Support for Quality and Export: Funds to set up 50 irradiation units and 100 NAB-accredited testing labs, in addition to the creation of e-commerce export hubs to aid international sales for MSMEs and traditional artisans will be provided.

What are Major Initiatives and Schemes for MSME Sector?

- RAMP Scheme: Raising and Accelerating MSME Performance (RAMP) scheme aims at enhancing market and credit access, strengthening institutions and governance at both the Centre and State levels, improving Centre-State linkages and partnerships, and addressing issues of delayed payments and environmental sustainability for MSMEs.

- FIRST: The Forum for Internet Retailers, Sellers, and Traders (FIRST) aims to promote awareness and support for MSMEs across India to go digital and become self-reliant. It seeks to represent MSMEs engaged in online sales and support their growth by serving as advocates to government officials and policymakers.

- TReDs Scheme: The Trade Receivables Discounting System (TReDS) is an institutional mechanism designed to facilitate the financing of MSME trade receivables from corporate buyers, government departments, and public sector undertakings (PSUs) through multiple financiers.

- CHAMPIONS portal: Launched in 2020, this is a technology-driven platform to assist MSMEs in addressing their grievances, encouraging, supporting, and helping them grow. It provides single-window solutions to MSMEs.

- Udyam Registration: This is a simplified online registration process for MSMEs, replacing the earlier system of filing Udyog Aadhaar Memorandum. It aims to ease the process of MSME registration and provide them with various benefits.

- MSME Samadhan: This is a delayed payment monitoring system that enables MSME suppliers to directly register their cases relating to delayed payments by Central Ministries, Departments, CPSEs, or State Governments.

- SFURTI Scheme: Scheme of Funds for Regeneration of Traditional Industries (SFURTI) aims to make Traditional Industries more productive and competitive by organizing the Traditional Industries and artisans into clusters to provide support for their long-term sustainability and economies of scale.

- Credit Linked Capital Subsidy Scheme (CLCSS): This scheme aims to facilitate technology upgradation of MSMEs by providing an upfront capital subsidy of 15% on institutional finance up to Rs 1 crore for induction of well-established and improved technology.

- The Special Credit Linked Capital Subsidy Scheme (SCLCSS): SCLCSS under the National SC-ST Hub provides a 25% subsidy on plant and machinery for SC-ST MSEs, with a ceiling of Rs 25 lakh, to support new and expanding enterprises and enhance their participation in public procurement.

- MSME Innovative Scheme: This scheme promotes and supports untapped creativity of the MSME sector. It includes Incubation, Design, and IPR (Intellectual Property Rights) components to assist and protect innovators.

- MSME SAMBANDH: This is a public procurement portal that monitors the implementation of the Public Procurement Policy for MSMEs and tracks the procurement by Central Public Sector Enterprises from MSMEs.

- ASPIRE Scheme: A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship (ASPIRE) scheme promotes innovation and rural entrepreneurship through rural Livelihood Business Incubators (LBI) and Technology Business Incubators (TBI).

- Prime Minister's Employment Generation Programme (PMEGP): This scheme provides credit-linked subsidies to set up new micro-enterprises and generate employment opportunities in rural and urban areas.

- General category beneficiaries receive a 25% margin money subsidy in rural areas and 15% in urban areas, while special category beneficiaries get 35% in rural areas and 25% in urban areas.

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE): This trust provides collateral-free credit to MSMEs. It offers credit guarantees to financial institutions to encourage them to extend loans to MSMEs without collateral security or third-party guarantees.

- Micro and Small Enterprises Cluster Development Programme (MSE-CDP): This scheme aims to support the sustainability and growth of MSMEs by addressing common issues such as improvement of technology, skills, quality, market access, and others through setting up of common facility centers.

- It is a demand driven Central Sector Scheme, wherein the State Government sends proposals for establishment of Common Facility Centers (CFCs) and establishment or up-gradation of infrastructure development projects as per requirements in clusters.

Other Initiatives for MSME Sector

- The Supreme Court Ruling (2024):

- The Supreme Court ruled that banks must identify early signs of stress in MSME accounts before classifying them as Non-Performing Assets (NPAs).

- This ruling is based on the May 2015 notification under the Micro, Small, and Medium Enterprises Development Act, 2006, which requires banks to follow the "Framework for Revival and Rehabilitation of MSMEs" before accounts become NPAs.

- This ruling seeks to safeguard MSMEs while ensuring financial institutions exercise due diligence.

- U.K. Sinha Committee:

- The U.K. Sinha Committee was formed by the Reserve Bank of India (RBI) to study the problems faced by MSMEs, and made several key recommendations.

- Some of the recommendations like raising the loan limit under Mudra Scheme and updating the definition of MSME have been implemented by the government.

What are the Challenges Associated with MSME Sector?

- Access to credit: Limited access to formal credit remains a major hurdle for MSMEs.

- Only about 16% of MSMEs have access to formal credit and as per the Standing Committee on Finance’s report on ‘Strengthening Credit Flows to the MSME Sector’ credit gap in the MSME sector is around Rs 20-25 lakh crore.

- Technology adoption: Many MSMEs struggle to adopt modern technologies due to lack of awareness and financial constraints.

- Many MSMEs, especially in rural areas, lack access to digital tools and platforms necessary for e-commerce and modern business practices.

- Skill development: There is a significant shortage of skilled labor within the MSME sector.

- As per the report on National Policy on Skill Development and Entrepreneurship only 4.7% of the total workforce in India had undergone formal skill training compared with 52% in the US, 80% in Japan, and 96% in South Korea.

- Also, MSMEs lack access to training programs that could help in upgrading the skills of their workforce.

- Market access: MSMEs face challenges in accessing domestic and international markets due to limited marketing resources and market knowledge.

- Tariffs, non-tariff barriers, and lack of export support infrastructure hinder the global expansion of MSMEs.

- Regulatory compliance: Complex regulations and frequent policy changes create difficulties for MSMEs.

- Frequent changes in tax laws (like changes in GST slabs) and regulations create uncertainty and increase the compliance burden for MSMEs.

- Infrastructure constraints: Inadequate infrastructure, including unreliable power supply and poor transportation facilities, hampers the productivity and growth of MSMEs.

- The infrastructure deficits lead to higher operational costs for MSMEs compared to larger enterprises.

- Although the government plans to develop industrial parks, many MSMEs still operate without access to well-established industrial zones.

- Delayed payments: Late payments from larger companies and government entities strain MSME finances.

- As per an estimate, the value of delayed payments from buyers to MSMEs is Rs 10.7 lakh crore annually.

Way Forward

- Enhancing Credit Access: Expand and streamline credit guarantee schemes and encourage banks to develop MSME-specific financial products.

- Accelerating Technology Adoption: Implement a comprehensive digital literacy program for MSMEs and offer financial incentives for technology acquisition.

- Addressing Skill Shortage: Develop sector-specific skill development programs and incentivize MSMEs to participate in apprenticeship schemes. Also align workforce skills with industry requirements.

- Improving Market Access: Promote market awareness and standardization of products to increase market access of MSMEs. Also, work on reducing tariff and non-tariff barriers through trade agreements.

- Tackling Delayed Payments: Section 43B(h) of the Micro, Small, and Medium Enterprises Development Act, 2006, provides that businesses that buy goods or services from MSMEs must pay their dues within 45 days. There is a need to enforce this provision on timely payments more strictly.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Which of the following can aid in furthering the Government’s objective of inclusive growth? (2011)

1. Promoting Self-Help Groups

2. Promoting Micro, Small and Medium Enterprises

3. Implementing the Right to Education Act

Select the correct answer using the codes given below:

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (d)