Rolling out Central Bank Digital Currency in India | 26 Dec 2024

This editorial is based on “Rupee-backed stablecoins could complement RBI’s digital currency” which was published in Mint on 26/12/2024. The article brings into focus the transformative impact of stablecoins on digital currencies, offering cryptocurrency advantages while maintaining value stability through traditional asset backing. It highlights how the emergence of the RBI's Central Bank Digital Currency (e-rupee) and rupee-backed stablecoins in India could shape a more inclusive and efficient digital financial ecosystem, provided there is adequate regulatory oversight.

For Prelims: Digital currencies, RBI's Central Bank Digital Currency, Rupee-backed stablecoins, Reserve Bank of India, Financial Action Task Force, Bank for International Settlements, Internationalize the rupee, India's G20 push on digital public infrastructure, Bank for International Settlements, E-commerce sector, Fintech, El Salvador’s experience with Bitcoin adoption.

For Mains: Key Benefits of Central Bank Digital Currency, Key Concerns Associated with CBDC.

The evolution of digital currencies has taken a significant turn with the emergence of stablecoins, which offer the benefits of cryptocurrencies while maintaining value stability by being pegged to traditional assets. In India, the landscape of digital finance is being transformed by two parallel developments: the RBI's Central Bank Digital Currency (e-rupee) and rupee-backed stablecoins. According to the Bank for International Settlements, digital currencies can cut transaction costs by up to 50%, making them an attractive option for both businesses and individuals. As India stands at this crucial juncture, the coexistence of e-rupee and rupee-backed stablecoins could potentially create a more inclusive and efficient digital financial ecosystem, provided there's proper regulatory oversight.

What is Central Bank Digital Currency?

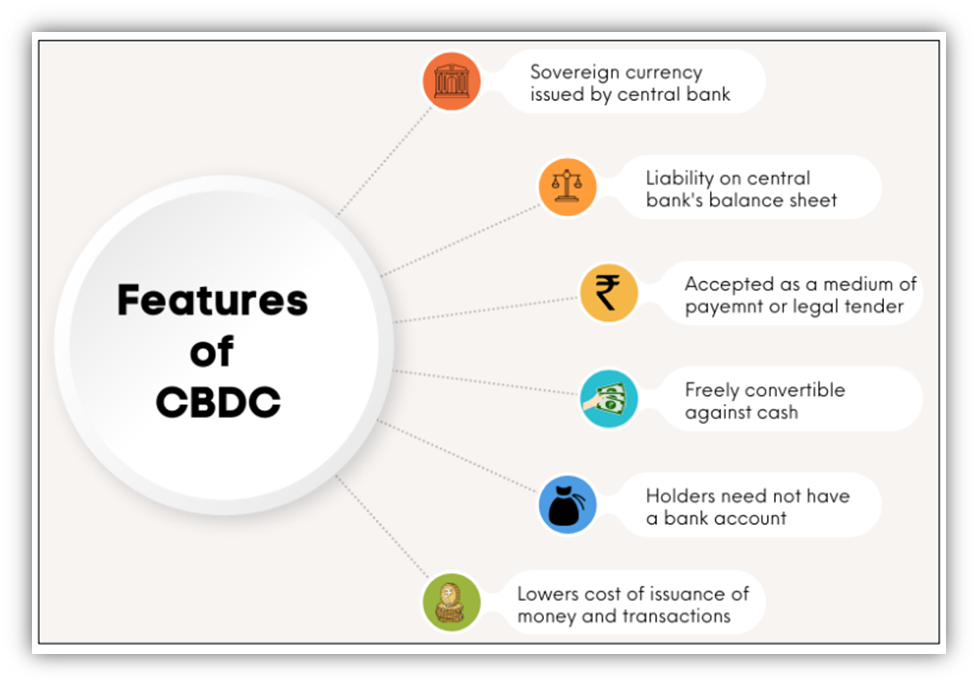

- About: Central Bank Digital Currency (CBDC) is a digital form of a country's fiat currency, issued and regulated by the central bank.

- It serves as a secure, seamless, and efficient alternative to cash, reducing costs associated with printing, distribution, and storage, while addressing risks like counterfeiting and theft.

- CBDCs can enhance financial inclusion, streamline cross-border payments, and support the shift towards a digital economy, with their design tailored to minimize disruptions to the financial system.

- Types of CBDC (e-Rupee):

- Retail CBDC: Designed for private sector users, including non-financial consumers and businesses.

- Acts as an electronic version of cash for retail transactions.

- Features:

- Functions as a direct liability of the central bank.

- Offers safe and secure money with 24/7 availability.

- Facilitates real-time or near real-time payment settlements.

- Wholesale CBDC: Primarily for interbank transfers and wholesale financial transactions.

- Used for activities like bond settlements and nostro transfers.

- Features:

- Restricted to select financial institutions.

- Enhances settlement systems by improving security and efficiency.

- Retail CBDC: Designed for private sector users, including non-financial consumers and businesses.

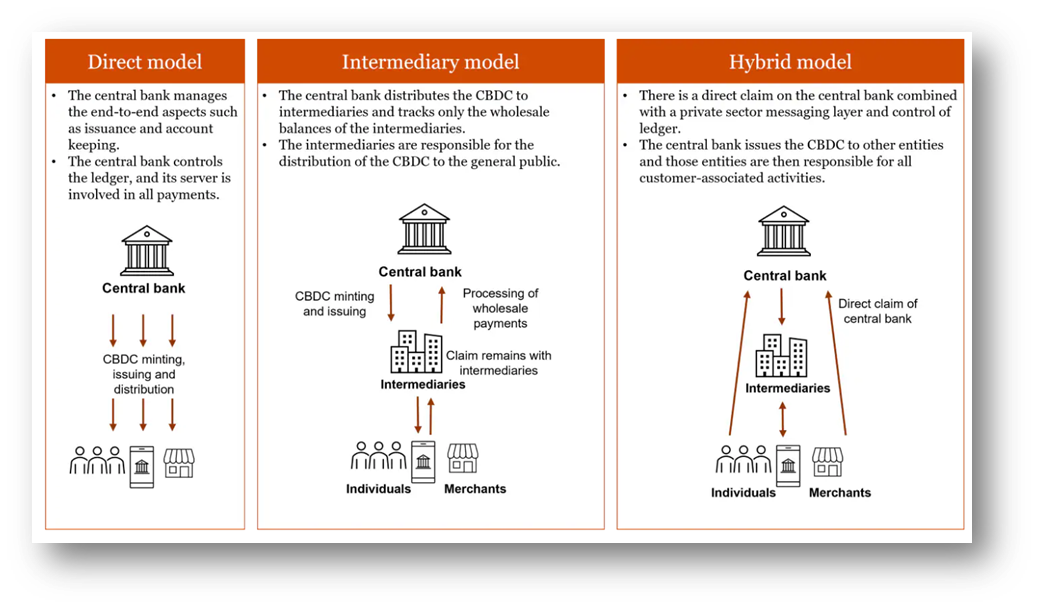

- Mode of Issuance:

What are the Key Benefits of Central Bank Digital Currency?

- Enhanced Financial Inclusion: CBDC can provide banking services to unbanked and underbanked populations by reducing reliance on physical bank branches.

- With mobile-based digital wallets, financial services can be accessed at fingertips.

- The RBI also proposed to introduce an offline functionality in CBDC-R for enabling transactions in areas with poor or limited internet connectivity.

- Reduction in Transaction Costs: CBDCs can significantly lower the cost of domestic cost of printing and transporting by eliminating intermediaries.

- Currently, for every Rs 100 note, the cost works out to be about Rs 15-17 rupee (15-17% on each tender) in its four-year life cycle, according to a market estimate. It can certainly be reduced with CBDC.

- Improved Monetary Policy Implementation: CBDCs allow central banks to monitor money flow in real time, enabling precise policy measures like targeted liquidity injections.

- This could mitigate issues like hoarding or black-market activities, ensuring better policy transmission.

- The Reserve Bank of India (RBI) in 2022 showcased its wholesale CBDC pilot (e₹-W) to better manage interbank settlements and boost liquidity management efficiency.

- Enhanced Transparency and Reduced Illicit Activities: With traceable transactions, CBDCs can curtail corruption, tax evasion, and financial crimes by enabling better oversight of funds.

- The Financial Action Task Force (FATF) estimates that money laundering amounts to trillions of dollars each year, with less than 1% of global illicit financial flows being seized or frozen.

- CBDCs can help recover a significant portion through greater transparency.

- India’s introduction of e-invoice systems aligns with this anti-evasion approach.

- Boost to Cross-Border Payments: CBDCs can modernize and streamline cross-border payment systems, enabling faster, cheaper, and more secure international transactions.

- The Bank for International Settlements (BIS) notes that CBDCs can reduce remittance costs.

- India's G20 push on digital public infrastructure underscores this goal, with a focus on reducing remittance costs globally by 2027.

- The m-CBDC Bridge Project, involving Thailand, Hong Kong, and the UAE, has shown how CBDCs can reduce these to near-instant settlements.

- Fostering Innovation in the Financial Sector: The introduction of CBDCs encourages fintech innovation by creating demand for new payment solutions and services.

- This ecosystem growth is visible in India, where the UPI system inspired advancements in the E-commerce sector and Fintech.

- For example, CBDCs could integrate with IoT for micropayments in smart cities, accelerating India's smart infrastructure goals.

- As of 2021, India has the highest finTech adoption rate of 87% in the world against the global average of 64% and CBDC could further amplify this trend.

- Economic Resilience and Crisis Management: CBDCs offer a robust alternative during crises, such as natural disasters or pandemics, when physical cash may be inaccessible.

- For instance, digital wallets powered by CBDCs could ensure seamless disbursement of welfare funds.

- During Covid-19, a significant number of global relief funds faced delays due to logistical cash issues. A fully functional CBDC system could have expedited these transfers in real time, aligning with India’s Humanitarian Aid Policies. .

- Support for De-Dollarization: CBDCs can reduce reliance on foreign currencies for trade and reserve management, strengthening economic sovereignty.

- For example, Russia’s introduction of its digital ruble is part of its strategy to mitigate dependency on the US dollar amidst sanctions.

- In India, the RBI’s pilot efforts with wholesale CBDCs for rupee-based cross-border trade support its aim to internationalize the rupee, in line with India’s rupee focused trade agreements (Rupee-Ruble Agreement)

What are the Key Concerns Associated with CBDC?

- Cybersecurity and Privacy Concerns: CBDCs increase the risk of cyberattacks on digital infrastructure, posing a threat to national financial security.

- Centralized systems are attractive targets for hackers, as seen in the 2020 SolarWinds cyberattack, which impacted critical financial systems.

- The increasing incidents of digital arrests and online theft further exacerbate the issue.

- High Implementation and Maintenance Costs: Developing and maintaining CBDC infrastructure requires significant financial investment and technical expertise.

- These costs could burden central banks, especially in developing countries with limited fiscal space and competing developmental priorities.

- For instance, the development and rollout of the eNaira reportedly cost the Central Bank of Nigeria (CBN) a huge chunk of money.

- Impact on Commercial Banking System: CBDCs could disintermediate traditional banks by diverting deposits to central bank accounts, reducing banks' ability to lend.

- The Bank of England highlighted that the introduction of CBDCs could lead to a reduction in bank deposits by 4% to 12%, creating liquidity shortfalls for banks.

- To address these challenges, banks might be compelled to borrow from wholesale markets, increasing their funding costs, or limit their lending activities, which could adversely impact economic growth.

- Limited Technological Readiness: The successful rollout of CBDCs requires robust technological infrastructure, which many countries lack.

- 45% of the Indian population, or about 665 million citizens, still do not access the internet as of 2023 and with only 25% digital literacy (NITI Aayog), CBDC adoption remains a major challenge.

- Cross-Border Regulatory Challenges: Integrating CBDCs into cross-border payment systems faces regulatory, technical, and geopolitical hurdles.

- The lack of uniform standards for CBDC interoperability complicates global trade.

- For example, the m-CBDC Bridge Project is completely different from digital Euro or Digital Rupee.

- Macroeconomic Risks and Dollarization: In developing countries, CBDCs could increase dollarization risks if foreign CBDCs dominate local economies.

- A recent study indicated that small economies may face this risk if neighboring countries adopt stronger CBDCs.

- This could undermine monetary sovereignty, as observed in El Salvador’s experience with Bitcoin adoption.

What is Rupee-Backed Stablecoins and How Can it Complement CBDC?

- Rupee-Backed Stablecoins: Rupee-backed stablecoins are digital tokens pegged 1:1 to the Indian rupee (INR), backed by equivalent reserves held in banks or financial institutions.

- These stablecoins operate on blockchain technology, enabling fast and low-cost transactions, both domestically and internationally.

- Unlike cryptocurrencies like Bitcoin, stablecoins aim to reduce price volatility while retaining the benefits of digital currencies, such as transparency and security. (Examples-TrueINR).

- Stablecoins Complementing CBDCs:

- Facilitating Cross-Border Trade and Payments: Rupee-backed stablecoins can address cross-border payment challenges by enabling seamless, low-cost, and faster settlements.

- Complementing CBDCs, stablecoins can bridge gaps in jurisdictions where CBDC interoperability or global standards are yet to develop.

- Promoting Innovation in the Private Sector: Stablecoins can spur fintech innovation by enabling programmable money solutions for decentralized finance (DeFi) and e-commerce platforms.

- This complements CBDCs by serving niche use cases such as micropayments or blockchain-based trade finance, leaving central banks to focus on systemic stability.

- A dual system ensures flexibility and scalability in digital payments.

- Bridging the Digital Asset Ecosystem: Stablecoins can act as a bridge between traditional financial systems, CBDCs, and the growing digital asset economy.

- In India, where blockchain adoption is rising, rupee-backed stablecoins could facilitate tokenized asset trading while CBDCs handle mainstream retail and wholesale transactions.

- Providing Contingency in the Initial CBDC Rollout: As CBDCs are still in the pilot phase, stablecoins can serve as a stopgap solution for digital payments.

- They can complement CBDCs by providing functionalities not yet covered, such as greater anonymity or integration with global decentralized platforms.

- Facilitating Cross-Border Trade and Payments: Rupee-backed stablecoins can address cross-border payment challenges by enabling seamless, low-cost, and faster settlements.

What Measures can be Adopted to Effectively Implement CBDC in India?

- Building Robust Digital Infrastructure: Strengthening digital infrastructure, especially in rural areas, is critical for CBDC adoption.

- Initiatives like BharatNet should be accelerated to improve broadband connectivity.

- With only 25% of rural India digitally literate, targeted training and infrastructure investments through Common Service Centres can bridge this gap.

- Collaboration with private telecom operators can further boost last-mile connectivity.

- Ensuring Cybersecurity and Data Privacy: Developing a comprehensive cybersecurity framework is essential to protect CBDC systems from threats.

- Advanced encryption technologies and AI-based monitoring systems should be implemented to safeguard digital transactions.

- The RBI can collaborate with CERT-In to establish real-time threat detection mechanisms.

- Integrating with Existing Financial Ecosystems: CBDCs should complement, not disrupt, the current banking and payments systems.

- A tiered CBDC model can be introduced, with commercial banks acting as intermediaries for distribution and account management.

- The RBI’s current pilot, leveraging UPI for retail CBDC transactions, demonstrates how existing platforms can ensure seamless integration.

- For instance, linking CBDCs with Aadhaar and Jan Dhan accounts can enhance financial inclusion. Such integration reduces redundancy and optimizes resource utilization.

- Promoting Public Awareness and Education: A comprehensive awareness campaign is necessary to educate citizens about CBDC benefits and usage.

- The RBI and National Payments Corporation of India (NPCI) can collaborate on workshops, online modules, and community programs to enhance understanding.

- For instance, India’s successful campaign for digital payment adoption through DigiDhan Melas can be replicated.

- Creating Offline CBDC Capabilities: Developing robust offline functionality for CBDCs can ensure access in areas with poor or no internet connectivity.

- Technologies such as NFC-enabled smart cards or mobile wallets can facilitate offline transactions.

- The RBI’s offline retail CBDC trials are a step in the right direction. This measure will ensure inclusivity and resilience in the CBDC ecosystem.

- Establishing Interoperability Standards: CBDCs must be designed to be flexible and interoperable with existing payment systems across the globe and potential international CBDC frameworks.

- The G20’s roadmap on cross-border payments emphasizes the need for global standards; India can lead efforts in aligning its CBDC with these standards.

- Developing a Transparent Legal and Regulatory Framework: A clear legal framework is necessary to address issues like liability, taxation, and consumer protection in CBDC transactions.

- A common “CBDC Design Principles” by World Bank or BIS can serve as benchmarks for regulatory policies.

- India’s Personal Data Protection Act 2023 should be integrated into the CBDC framework to safeguard privacy.

- Such clarity will provide legal certainty and enhance stakeholder confidence.

- Leveraging Public-Private Partnerships (PPPs): Engaging private players in CBDC development and implementation can foster innovation and reduce costs.

- For instance, fintech companies can help design user-friendly applications and payment solutions.

- Collaboration with blockchain startups can also enhance security and operational efficiency. PPPs ensure scalability and keep implementation aligned with market needs.

|

Drisht Mains Question: Critically examine the potential benefits and challenges of implementing a Central Bank Digital Currency (CBDC) in India. Discuss its implications for financial inclusion, monetary policy, and the stability of the commercial banking system |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. With reference to Central Bank digital currencies, consider the following statements : (2023)

- It is possible to make payments in a digital currency without using US dollar or SWIFT system.

- A digital currency can be distributed with condition programmed into it such as a time-frame for spending it.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)