International Relations

FATF’s Mutual Evaluation Report on India

- 03 Jul 2024

- 10 min read

For Prelims: FATF (Financial Action Task Force), Money Laundering (ML), Terrorist Financing (TF), G20, JAM (Jan Dhan, Aadhaar, Mobile) Trinity Terrorism, Gujarat International Finance Tec-City (GIFT City),foreign direct investment (FDI).

For Mains: Challenges, Initiatives, Problem of Money Laundering (ML), Terrorist Financing (TF) for India.

Why in News?

Recently, the Financial Action Task Force (FATF) issued a Mutual Evaluation Report (MER) on India, approved during their plenary session in Singapore. The MER report specifically assessed India's efforts in combating Money Laundering (ML), Terrorist Financing (TF) and proliferation financing.

What are the Highlights of the MER Report on India?

- Regular Follow-Up Category:

- India has been classified into the 'regular follow-up' category, joining Russia, France, Italy, and the UK, also designated in this category.

- Under the 'regular follow-up' category, India is required to submit a progress report on recommended actions by October 2027.

- FATF categorises member countries into four groups: regular follow-up, enhanced follow-up, grey list, and black list.

- Regular follow-up is the top category amongst 4 and only 5 countries in G20 including India have been placed in regular follow-up after the Mutual evaluation report.

- India has achieved strong results and a high level of technical compliance, yet it must address delays related to prosecutions for money laundering and terrorist financing.

- Digital Economy Through JAM Trinity:

- India's transition to a digital economy, facilitated by the JAM (Jan Dhan, Aadhaar, Mobile) Trinity and stricter cash transaction regulations, has successfully mitigated risks associated with ML, TF, and proceeds from crimes such as corruption and organised crime.

What is the Significance of the MER Report on the Indian Economy?

- Enhanced Global Financial Reputation:

- The positive FATF evaluation demonstrates India's robust financial system, boosting international confidence. This could support initiatives like the Gujarat International Finance Tec-City (GIFT City) in attracting more international financial institutions.

- This improved reputation can lead to better credit ratings, potentially lowering borrowing costs for Indian entities in global markets.

- Increased Foreign Investment:

- A trustworthy financial system is likely to attract more foreign direct investment (FDI). In sectors like fintech and e-commerce, where financial integrity is crucial, companies like Amazon and Walmart have already made significant investments in India.

- Expansion of Digital Payment Systems:

- The report's endorsement supports the global expansion of India's Unified Payments Interface (UPI). This could lead to wider acceptance of UPI in international markets as UPI is already operational in countries like Singapore and UAE, with plans for expansion to more nations.

- Boost to India's Fintech Industry:

- The positive evaluation could accelerate the growth of India's Fintech sector. Fintech companies like Paytm and PhonePe could find it easier to expand internationally. It may attract more venture capital and encourage innovation in areas like blockchain and digital currencies.

- Enhanced Remittance Flows:

- With improved financial systems, remittances from Non-Resident Indians (NRIs) could become more efficient and cost-effective and can increase the volume of remittances, which are a significant contributor to India's foreign exchange.

What is Money Laundering and Terrorism Financing (ML/TF)?

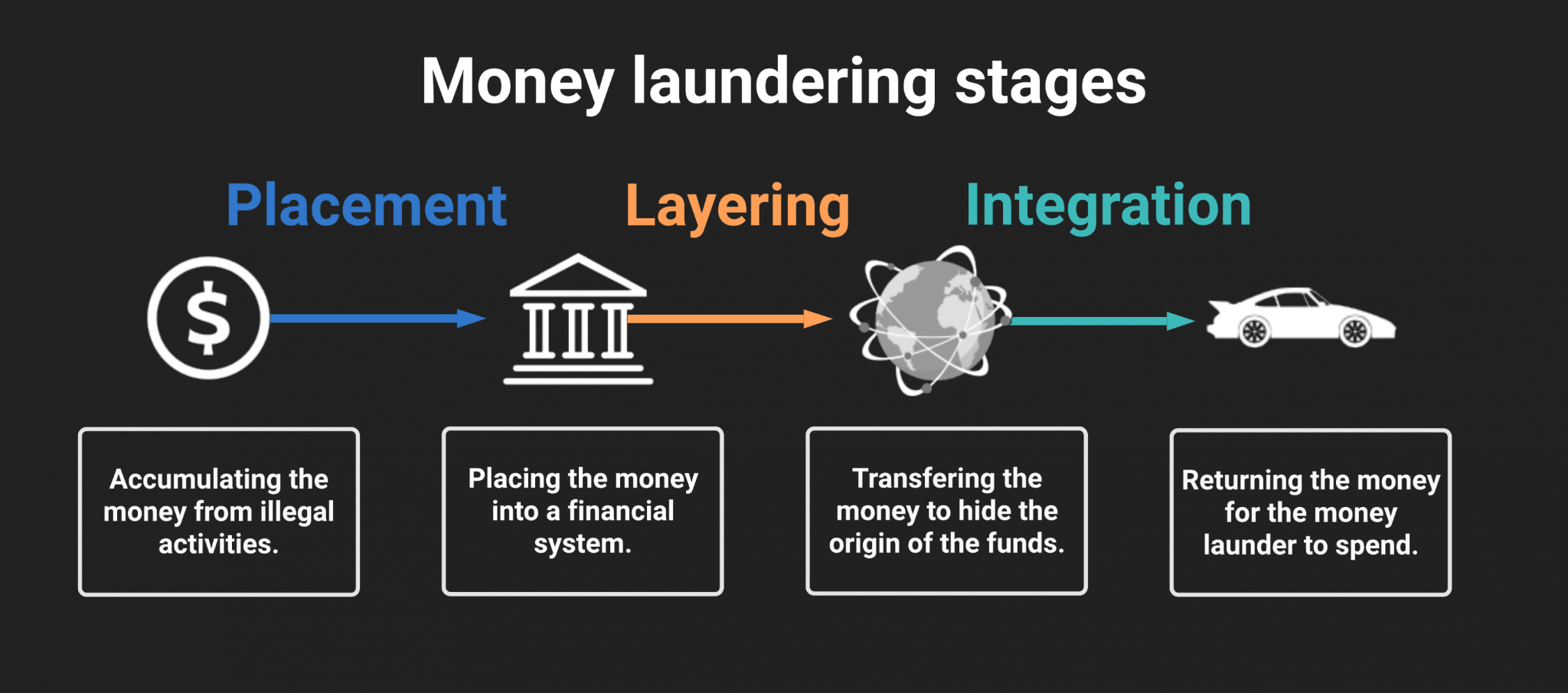

- Money Laundering (ML):

- Money laundering is concealing or disguising the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources.

- It is frequently a component of other, much more serious, crimes such as drug trafficking, robbery or extortion. According to the IMF, global Money Laundering is estimated between 2 to 5% of World GDP.

- Terrorism Financing (TF):

- Terrorism financing is the act of providing financial support to terrorists or terrorist organisations to enable them to carry out terrorist acts or to benefit any terrorist or terrorist organisation.

- While funds may come from criminal activities, they may also be derived from legitimate sources, for example, through salaries, revenue from legitimate business or donations including through non-profit organisations.

- There are generally three stages in terrorism financing: raising, moving and using funds.

What are the Concerns and Suggestions Suggested by FATF for India?

| Concerns | Suggestions |

|

|

|

|

|

|

What are India's Efforts to Combat ML/TF?

- Effort At National Level:

- Prevention of Money Laundering Act (PMLA): It was enacted in 2002 and provides a comprehensive legal framework to combat money laundering in India.

- Enforcement Directorate (ED): ED is the principal agency responsible for enforcing PMLA in India. It investigates and prosecutes cases of money laundering.

- Financial Intelligence Unit-India (FIU-IND): It was established in 2004, FIU-IND is the central national agency responsible for receiving, processing, analysing, and disseminating information relating to suspect financial transactions to enforcement agencies.

- Banking Regulations: The RBI and other financial regulators have implemented stringent guidelines for banks and financial institutions to prevent money laundering and ensure KYC (Know Your Customer) compliance.

- Effort At Global Level:

-

United Nations Conventions: India has ratified various UN Conventions related to combating terrorism and money laundering, such as the UN Convention against Transnational Organized Crime (UNTOC) and its protocols.

-

Bilateral and Multilateral Agreements: India engages with Interpol, and the United Nations Office on Drugs and Crime (UNODC) to align its efforts with global standards and participate in capacity-building programs to combat money laundering and terrorist financing.

-

|

Drishti Mains Questions: Assess India's progress in enhancing its anti-money laundering and counter-terrorist financing regime. What key challenges and measures should India prioritise to effectively address these identified issues? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to digital payments, consider the following statements: (2018)

- BHIM app allows the user to transfer money to anyone with a UPI-enabled bank account.

- While a chip-pin debit card has four factors of authentication, BHIM app has only two factors of authentication.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Mains

Q. Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (2021)