Rapid Fire

India's Foreign Direct Investment Trends

- 28 Mar 2024

- 1 min read

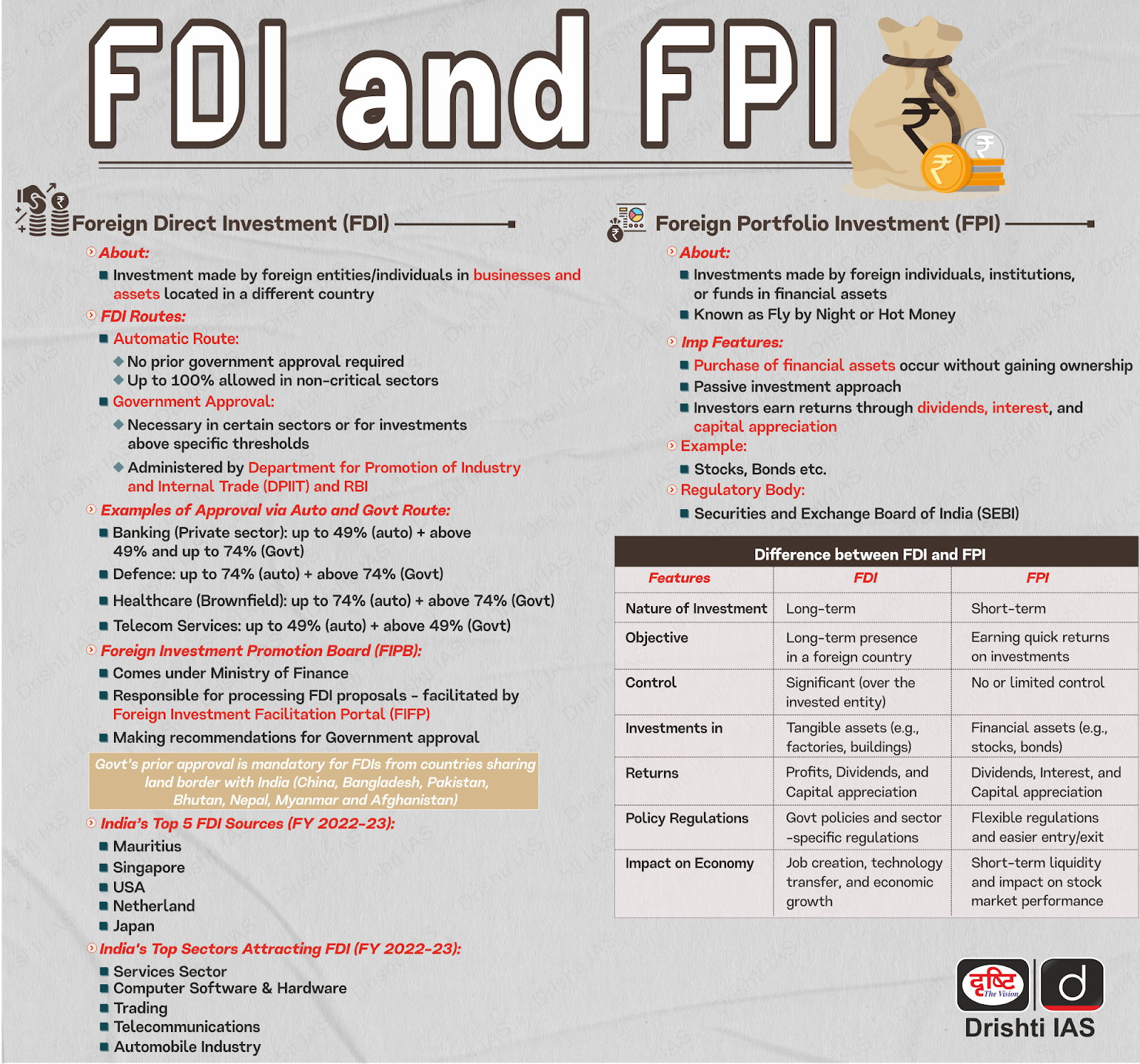

The Finance Ministry has released a comprehensive review shedding light on India's foreign direct investment (FDI) landscape, revealing both declines and hopeful prospects.

- India's net FDI inflows dropped by almost 31% to USD 25.5 billion over the first ten months of 2023-24.

- Overall global FDI flows rose by 3% to an estimated USD 1.4 trillion in 2023, but flows to developing countries fell by 9% due to economic uncertainty and higher interest rates.

- While a modest increase in global FDI flows is anticipated in 2024, significant risks remain, including geopolitical tensions, high debt levels, and global economic uncertainties.

- Around 65% of India's FDI equity inflows were observed in services, drugs and pharmaceuticals, construction (infrastructure activities), and non-conventional energy sectors.

- The Netherlands, Singapore, Japan, the USA, and Mauritius accounted for approximately 70% of the total FDI equity inflows into India.

Read more: Foreign Direct Investment