Indian Economy

RBI allows Trade Settlements in Rupee

- 14 Jul 2022

- 8 min read

For Prelims: Foreign Trade, Currency Depreciation & Appreciation, Global Sanctions, Balance of Payments

For Mains: Effect of global sanctions on economy of India, Benefits and challenges of settling trade in Rupee, Intervention of government in economy

Why in News?

Recently, the Reserve Bank of India (RBI) has put in place a mechanism to facilitate International Trade in Rupees (INR), with immediate effect.

- However, banks acting as authorised dealers for such transactions would have to take prior approval from the regulator to facilitate this.

- As per the broad framework for cross-border trade transactions in INR under Foreign Exchange Management Act, 1999 (FEMA), all exports and imports under this arrangement may be denominated and invoiced in rupee (INR) and the exchange rate between the currencies of the two trading partner countries may be market determined.

What is Rupee Payment Mechanism?

- About:

- Authorised Dealer Banks in India had been permitted to open Rupee Vostro Accounts (an account that a correspondent bank holds on behalf of another bank).

- Indian importers undertaking imports via this mechanism will make payment in INR which will be credited into the Special Vostro account of the correspondent bank of the partner country, against the invoices for the supply of goods or services from the overseas seller.

- Indian exporters using the mechanism will be paid the export proceeds in INR from the balances in the designated Special Vostro account of the correspondent bank of the partner country.

- Indian exporters may receive advance payment against exports from overseas importers in Indian rupees through the above Rupee Payment Mechanism.

- Before allowing any such receipt of advance payment against exports, Indian banks need to ensure that available funds in these accounts are first used towards payment obligations arising out of already executed export orders/export payments in the pipeline.

- Balance in Special Vostro Accounts can be used for: payments for projects and investments, export/ import advance flow management, and investment in Government Treasury Bills, Government securities, etc.

- Authorised Dealer Banks in India had been permitted to open Rupee Vostro Accounts (an account that a correspondent bank holds on behalf of another bank).

- Existing Mechanism:

- If a company exports or imports, transactions are always in a foreign currency (excluding with countries like Nepal and Bhutan).

- So, in case of imports, the Indian company has to pay in a foreign currency (mainly dollars and could also include currencies like pounds, Euro, yen etc.).

- The Indian company gets paid in foreign currency in case of exports and the company converts that foreign currency to rupee since it needs rupee for its needs, in most of the cases.

What are the Benefits of this Mechanism?

- Promote Growth:

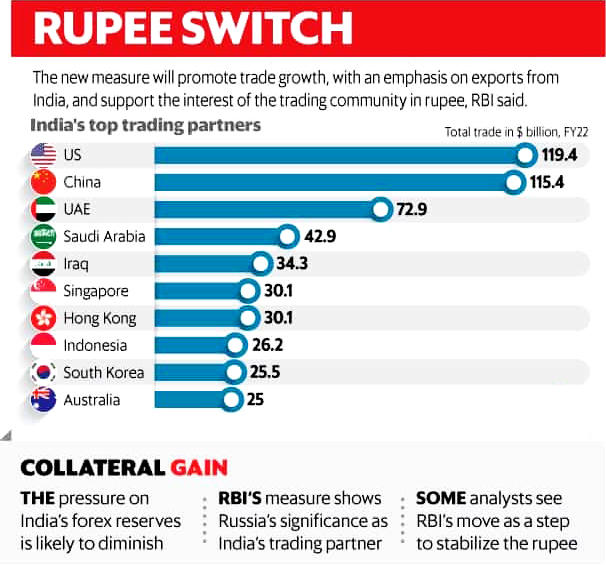

- It will promote growth of global trade and will support the increasing interest of the global trading community in INR.

- Trade with Sanctioned Countries:

- Ever since sanctions were imposed on Russia, trade has been virtually at standstill with the country due to payment problems.

- As a result of the trade facilitation mechanism introduced by the RBI we see the payment issues with Russia easing.

- Ever since sanctions were imposed on Russia, trade has been virtually at standstill with the country due to payment problems.

- Forex Fluctuation:

- The move would also reduce the risk of forex fluctuation, especially looking at the Euro-Rupee parity.

- Arrest Fall of Rupee:

- Amid ongoing rupee weakness, this mechanism aims at reducing demand for foreign exchange, by promoting rupee settlement of trade flows.

What Initiatives has India taken for International Trade?

- Rupee Rouble Agreement:

- The Rupee-Rouble trade arrangement is an alternative payment mechanism to settle dues in Rupees instead of Dollars or Euros.

- The State Bank of the U.S.S.R. will maintain one or more accounts with one or more commercial banks in India, authorised to deal in foreign exchange. In addition, the State Bank of the USSR will, if that Bank considers necessary, maintain another account with the Reserve Bank of India.

- Payments made to and by Indian residents and USSR residents will be done only in those specified accounts by debiting/crediting.

- The State Bank of the U.S.S.R. will maintain one or more accounts with one or more commercial banks in India, authorised to deal in foreign exchange. In addition, the State Bank of the USSR will, if that Bank considers necessary, maintain another account with the Reserve Bank of India.

- The Rupee-Rouble trade arrangement is an alternative payment mechanism to settle dues in Rupees instead of Dollars or Euros.

- Free Trade Agreements:

- India has recently signed a Free Trade Agreement with Australia & UAE.

- FTA is a pact between two or more nations to reduce barriers to imports and exports among them.

- Under a free trade policy, goods and services can be bought and sold across international borders with little or no government tariffs, quotas, subsidies, or prohibitions to inhibit their exchange.

- The concept of free trade is the opposite of trade protectionism or economic isolationism.

- India has recently signed a Free Trade Agreement with Australia & UAE.

- Indo-Pacific Economic Framework:

- India has joined a US-led initiative to set up an Indo-Pacific Economic Framework (IPEF) and this move would help boost economic ties further.

- The US has consistently been India’s largest market for services exports, but the recent overseas sales of merchandise goods to that country overtook China, making it the largest bilateral trading nation of India.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. With reference to Balance of Payments, which of the following constitutes/constitute the Current Account? (2014)

- Balance of trade

- Foreign assets

- Balance of invisibles

- Special Drawing Rights

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3

(c) 1 and 3

(d) 1, 2 and 4

Ans: C

Explanation:

- The Balance of Payments (BoP) is composed of two main aspects: Current Account and Capital Account.

- The Current Account of BoP measures the inflow and outflow of goods, services, investment incomes and transfer payments. Trade in services (invisibles), trade in goods (visibles), unilateral transfers, remittances from abroad, and international aid are some of the main components of the Current Account. When all the goods and services are combined, together they make up the Balance of Trade (BoT) of a country. Hence, 1 and 3 are correct.

- Capital Account of BoP records all those transactions, between the residents of a country and the rest of the world, which cause a change in the assets or liabilities of the residents of the country or its government.

- Loans and borrowing by private or public sectors, investments, and changes in the forex reserves are some of the examples of the components of the Capital Account. Hence, 2 and 4 are not correct.

- Therefore, option (c) is the correct answer.