India's Industrial Future: The Power of Clusters | 09 Nov 2024

This editorial is based on “Industrial cities, parks key to Viksit Bharat” which was published in The Hindu on 08/11/2024. The article brings into picture the emergence of industrial cities and corridors, backed by a ₹28,602 crore investment, as key drivers in India's ambition to become a USD 30-trillion economy by 2047. Projects like the Delhi-Mumbai Industrial Corridor aim to connect urban and rural centers, fostering innovation and growth.

For Prelims: Viksit Bharat@2047, Industrial Corridors, MSMEs , Production-Linked Incentives, PM Gati Shakti, Economic Survey 2022-23, European Union's Carbon Border Adjustment Mechanism, India's R&D spending, Industry 4.0.

For Mains: Role of Industrial Clusters in Driving India’s Development Journey, Major Challenges Limiting the Growth of India’s Industrial Sector.

As India envisions its transformation into a USD 30-trillion economy under Viksit Bharat@2047, industrial cities and corridors are emerging as the backbone of this ambitious journey. The recent approval of 12 new industrial cities under the National Industrial Corridor Development Programme, backed by a ₹28,602 crore investment, signals India's commitment to becoming a global manufacturing hub. These industrial corridors, exemplified by projects like the Delhi-Mumbai Industrial Corridor, are set to create a multiplier effect by connecting urban and rural centers while fostering innovation hubs.

What is the Role of Industrial Clusters in Driving India’s Development Journey?

- Economic Scale and Integration: Manufacturing clusters create powerful economies of scale through shared infrastructure and resources, significantly reducing operational costs for businesses of all sizes.

- The recent approval of 12 new industrial cities under NICDP demonstrates India's commitment to this model.

- These clusters are projected to generate 1 million direct and 3 million indirect jobs.

- Supply Chain Optimization and Cost Efficiency: Gujarat's Pharmaceutical cluster in Ahmedabad-Vadodara corridor exemplifies how clustering reduces logistics costs through shared infrastructure and proximate supplier networks.

- The cluster accounts for 28% of India's pharma exports, with 130 U.S. Food and Drug Administration certified drug manufacturing facilities.

- The integration of suppliers, manufacturers, and distributors in close proximity creates significant cost advantages and operational efficiencies.

- MSME Growth Catalyst: Industrial clusters serve as critical growth engines for MSMEs by providing them access to established supply chains, modern infrastructure, and market linkages.

- The ecosystem approach enables smaller businesses to benefit from proximity to larger anchor companies, as evidenced by Vedanta's recent announcement to establish two industrial parks for aluminum, zinc, and silver processing on a not-for-profit basis.

- Export Competitiveness: Industrial clusters significantly enhance India's export competitiveness by creating specialized manufacturing ecosystems that can compete globally.

- The focused development of sector-specific clusters, supported by initiatives like Production-Linked Incentives (PLI) and integrated infrastructure through PM Gati Shakti, is transforming India's export capabilities.

- The Surat diamond industry processes 85-90% of the world's rough diamonds and has a reputation for cutting-edge technology and skilled personnel, making it a vital player in the global diamond trade.

- Regional Development Catalyst: Industrial corridors are proving to be powerful drivers of balanced regional development by connecting urban and rural areas and creating new economic opportunities.

- This is exemplified by how the Chennai-Bengaluru Industrial Corridor has spurred development in smaller towns along its route, creating new growth centers.

- Recent data reveals that regions around industrial corridors have experienced a higher GDP growth rate compared to non-corridor regions.

- FDI Attraction Centers: Industrial clusters have emerged as powerful magnets for Foreign Direct Investment, offering ready-to-use infrastructure and clear policy frameworks.

- The success is evident in cases like Toyota's recent investment in Sambhajinagar and the growing interest from global manufacturers in sectors ranging from electronics to pharmaceuticals.

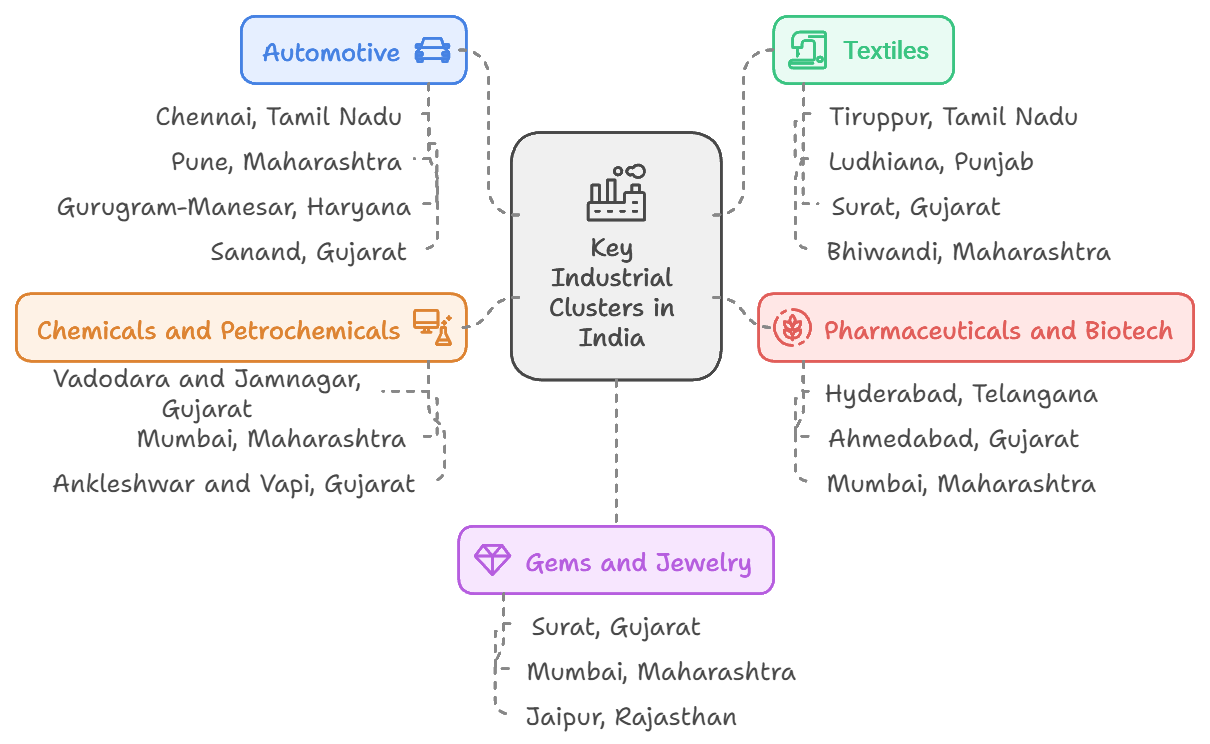

What are the Key Industrial Clusters in India?

- Automotive:

- Chennai, Tamil Nadu: Known as the "Detroit of India," hosts major manufacturers like Ford, Hyundai, and BMW.

- Pune, Maharashtra: Focuses on passenger and commercial vehicles, with Tata Motors, Mercedes-Benz, and Bajaj Auto.

- Gurugram-Manesar, Haryana: Home to Maruti Suzuki and Hero MotoCorp.

- Sanand, Gujarat: Notable for Tata Motors and previously Ford.

- Textiles:

- Tiruppur, Tamil Nadu: "Knitwear Capital of India," specializing in cotton garments for export.

- Ludhiana, Punjab: Known for woolen apparel and knitwear.

- Surat, Gujarat: Synthetic textile hub and major polyester producer.

- Bhiwandi, Maharashtra: Power loom industry for synthetic and cotton fabrics.

- Pharmaceuticals and Biotech:

- Hyderabad, Telangana ("Genome Valley"): Center for pharmaceutical and biotech research with Dr. Reddy’s Laboratories.

- Ahmedabad, Gujarat: Houses Zydus Cadila and Torrent Pharma for bulk drug manufacturing.

- Mumbai, Maharashtra: Home to Lupin, Sun Pharmaceuticals, and other formulation developers.

- Chemicals and Petrochemicals:

- Vadodara and Jamnagar, Gujarat: Leading hubs, with Jamnagar hosting Reliance's oil refinery.

- Mumbai, Maharashtra: Major port city for chemical and petrochemical industries.

- Ankleshwar and Vapi, Gujarat: Key regions for chemicals and dye production.

- Gems and Jewelry:

- Surat, Gujarat: World leader in diamond cutting and polishing.

- Mumbai, Maharashtra: Major center for gold jewelry manufacturing and diamond trade.

- Jaipur, Rajasthan: Renowned for colored gemstones, including cutting and polishing of precious stones.

What are the Major Challenges Limiting the Growth of India’s Industrial Sector?

- Infrastructure Bottlenecks: India's logistics costs account for 14-18% of GDP (Economic Survey 2022-23) compared to 8-10% in developed economies, significantly impacting industrial competitiveness.

- For several years now, electricity distribution companies (discoms), which are mostly state-owned, have witnessed steep financial losses.

- Between 2017-18 and 2022-23, losses accumulated to over 3 lakh crore rupees.

- For several years now, electricity distribution companies (discoms), which are mostly state-owned, have witnessed steep financial losses.

- Land Acquisition Challenges: Complex land laws and lengthy legal procedures delay projects, making acquisition difficult.

- Bengaluru Peripheral Ring Road project has been delayed for years due to land acquisition issues

- Cost overruns and delays plague over 1,800 infrastructure projects (Ministry of Statistics and Programme Implementation).

- Surging land prices are also triggering increased legal disputes over ownership conflicts, prolonging already stalled projects.

- Additionally, land is a state subject, and the discrepancies in pricing and measurement standards between states add further complexity.

- Rigid Labor Laws and Skill Gaps: The industrial sector in India faces challenges with labor reforms due to the slow implementation of recent labor codes. This issue has been highlighted by recent strikes, such as the one at Samsung’s facility in Bangalore.

- If the skill gap in India continues on its current trajectory, most industries will be plagued by about 75-80% skill gap issues

- Unemployment rate in India rose sharply to 9.2% in June 2024. The formal sector employment remains at 10% of the workforce, indicating structural rigidities.

- Limited Access to Credit: India is one of the fastest-growing economies in the world but there exists a significant gap in accessing formal credit, especially when compared to other developed nations.

- According to a BizFund report, only 16% of MSMEs in India receive formal credit leaving more than 80% of these companies under-financed or financed through informal sources.

- As of March, 2024, the share of industry in bank credit shrunk to 23.1%

- Technology Adoption Barriers: Lack of scale and skill in MSMEs restricts Indian manufacturing industries from investing, modernizing and thereby adopting Industry 4.0.

- The digital infrastructure gap requires investments of $23 billion by 2025 for competitive modernization.

- India ranks 72 out of 174 countries, with an AI Preparedness Index rating of 0.49.

- Technology adoption costs are higher for Indian industries due to import dependencies.

- Environmental Compliance Challenges: Industrial units face high compliance costs of operational expenses due to environmental regulations.

- Also, a 2020 report stated that 18% of highly polluting industries that were required to install online continuous emissions monitoring systems (CEMS), have not complied with the norms.

- This is partly because bureaucratic delays in obtaining environmental approvals and other clearances increase a developer's overall project expense by as much as 10-12%.

- Also, a 2020 report stated that 18% of highly polluting industries that were required to install online continuous emissions monitoring systems (CEMS), have not complied with the norms.

- Global Competition and Trade Barriers: Recent WTO data shows India's share in global exports at 1.8%, despite being the 5th largest economy.

- Non-tariff barriers in key export markets affect a large number of Indian industrial exports.

- Additionally, green trade barriers like the European Union's Carbon Border Adjustment Mechanism could impact key sectors like steel, potentially affecting Indian exports to the EU.

- Non-tariff barriers in key export markets affect a large number of Indian industrial exports.

- Research and Innovation Gap: India's R&D spending at 0.7% of GDP is significantly lower than China's 2.4% and USA's 3.1%.

- In the past two years, India’s patent filing process has seen marked improvements. However, India's global share in patent filings remains just over 2%, indicating a continued need for targeted initiatives

What Strategies Could India Implement to Accelerate the Development of Industrial Clusters?

- Integrated Infrastructure Development: Create dedicated infrastructure SPVs (Special Purpose Vehicles) for each major industrial cluster with targeted funding.

- Implement time-bound development of plug-and-play infrastructure facilities including 24x7 power, water supply, and waste management systems.

- Develop more multi-modal logistics parks under Gati Shakti within clusters with direct connectivity to ports, airports, and freight corridors.

- Set up common facility centers housing testing labs, design centers, and R&D facilities shared by cluster members.

- Technology Innovation Centers: Establish cluster-specific Centers of Excellence in partnership with premier technical institutions (IITs/NITs) and industry leaders.

- Create shared prototyping and testing facilities equipped with advanced manufacturing technologies like 3D printing and robotics.

- Implement cloud-based common platforms for design, simulation, and virtual manufacturing capabilities.

- Provide subsidized access to Industry 4.0 technologies for MSMEs within clusters.

- The recent success of Pune's Auto Cluster Development and Research Institute, demonstrates this approach's effectiveness.

- Financial Support Framework: Create dedicated cluster development funds with participation from government, industry, and financial institutions.

- Implement credit guarantee schemes specifically designed for cluster MSMEs.

- Develop supply chain financing programs leveraging the strength of anchor companies.

- Set up fintech platforms for invoice discounting and peer-to-peer lending within clusters.

- Environmental Sustainability Initiatives: Develop common effluent treatment plants and waste management facilities with modern technologies.

- Implement cluster-wide renewable energy projects including solar parks and waste-to-energy plants.

- Create circular economy networks within clusters for resource optimization and waste reduction.

- Establish green rating systems with incentives for environmentally conscious units.

- Market Linkage Programs: Establish digital B2B platforms connecting cluster members with domestic and international buyers.

- Develop export facilitation centers providing documentation and compliance support.

- Implement quality certification programs aligned with international standards. The successful example is Surat Diamond Bourse.

- Digital Infrastructure Development: Implement 5G networks and IoT infrastructure across industrial clusters.

- Create digital twins of cluster infrastructure for efficient management and maintenance.

- Develop blockchain-based platforms for supply chain transparency and traceability.

- Social Infrastructure Support: Develop integrated townships with housing, healthcare, and education facilities near clusters.

- Create public transportation networks connecting clusters with residential areas. Establish recreational facilities and social spaces within cluster areas.

- Implement daycare centers and women-friendly workplace facilities. The successful example is Sri City Industrial Cluster, where social infrastructure development improved worker retention.

- Also, Sri City management developed not only the industrial zone but trained manpower from neighboring villages to support industry needs.

- International Collaboration Programs: Establish twinning arrangements with successful international clusters for knowledge exchange.

- Develop international market intelligence cells within clusters. Implement global best practice sharing programs across cluster members.

Conclusion:

India's industrial clusters are poised to drive economic growth and innovation. By addressing infrastructure bottlenecks, improving access to finance, fostering technology adoption, and prioritizing sustainability, India can create world-class industrial hubs and progress towards SDG 9 (Industry, Innovation, and Infrastructure) and SDG 8 (Decent Work and Economic Growth). These clusters will not only generate employment and boost exports but also contribute to the country's goal of becoming a $30 trillion economy.

|

Drishti Mains Question: Discuss the role of industrial clusters in India's economic growth. What challenges hinder their development, and what measures can the government take to enhance their productivity, competitiveness, and sustainability? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. In the ‘Index of Eight Core Industries’, which one of the following is given the highest weight? (2015)

(a) Coal production

(b) Electricity generation

(c) Fertilizer production

(d) Steel production

Ans: (b)

Mains

Q.1 “Industrial growth rate has lagged behind in the overall growth of Gross-Domestic-Product(GDP) in the post-reform period” Give reasons. How far the recent changes is Industrial Policy are capable of increasing the industrial growth rate? (2017)

Q.2 Normally countries shift from agriculture to industry and then later to services, but India shifted directly from agriculture to services. What are the reasons for the huge growth of services vis-a-vis the industry in the country? Can India become a developed country without a strong industrial base? (2014)