Budget 2024: Fiscal Prudence and Strategic Investments | 24 Jul 2024

This editorial is based on “Of prudence and plumbing: The Budget is fiscally and financially prudent and correctly focuses on fixing the economy’s plumbing ” which was published in The Financial Express on 24/07/2024. The article talks about the current budget's fiscal and financial strategies, praising its prudence amid challenging global economic conditions.

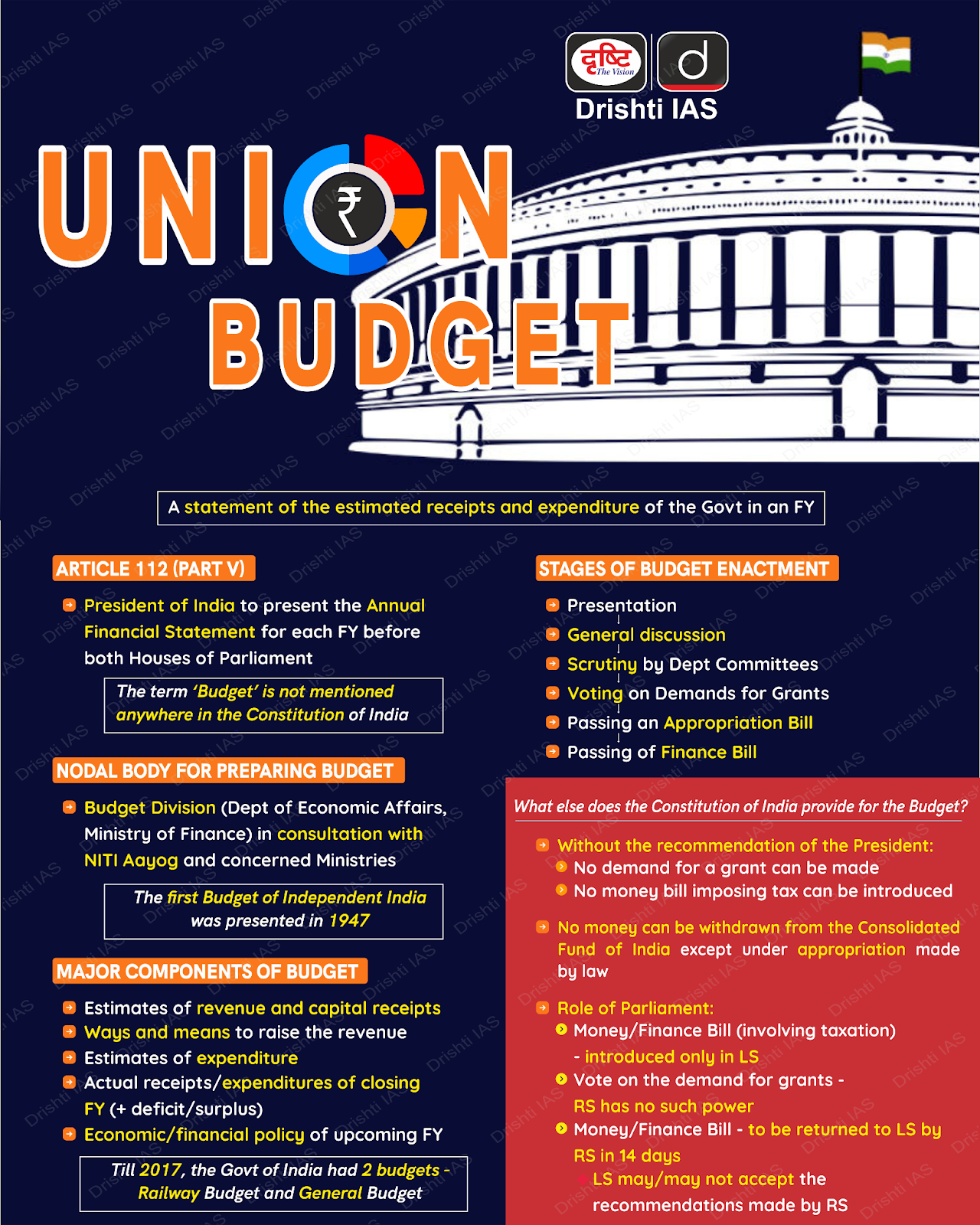

For Prelims: Union Budget, fiscal consolidation, Pradhan Mantri Gram SadakYojana (PMGSY), PM GatiShakti, public debt/ Gross Domestic Product(GDP)), customs duties Mudra loan, PM-KISAN, agri-tech innovations.

For Mains: Significance of Fiscal Prudence and Government Policies & Interventions for Indian Economy.

In times of global economic turbulence and domestic fiscal challenges, the budget 2024 stands as a beacon of fiscal prudence and strategic foresight, aiming to mend the economic foundations of India.

The budget's strategy is multifaceted aiming for fiscal consolidation with a deficit pegged at 4.9% of GDP, lower than previous expectations, while maintaining conservative revenue assumptions amidst economic buoyancy.

Despite robust domestic growth, India's rising public debt/Gross Domestic Product(GDP) ratio underscores the imperative for cautious fiscal management, limiting the room for expansive policies.

With public sector investments reaching their limits due to fiscal and debt constraints, the private sector is poised to take up the mantle of driving economic expansion, buoyed by healthy corporate balance sheets but requiring enhanced demand visibility.

Thus, swift implementation is crucial for India's economy to effectively navigate global challenges and capitalize on emerging opportunities.

What are the Key Highlights of the Budget 2024 For the Indian Economy?

- Inflation Management: India’s inflation remains low, and stable, and is moving towards the 4% target, indicating macroeconomic stability.

- Export Competitiveness: Reduction in customs duties across sectors aims to enhance export competitiveness. The budget aligns with trade theory, emphasizing that lowering import tariffs can effectively serve as an export promotion strategy.

- Agriculture and Rural Development: Introduction of 109 high-yielding and climate-resilient varieties of crops, and ₹1.52 lakh crore provision for agriculture and allied sectors this year.

- Employment and Skilling: PM’s package of 5 schemes with ₹2 lakh crore outlay to facilitate employment, skilling, and opportunities for 4.1 crore youth over 5 years.

- Human Resource Development: Investment in education, skill development, and healthcare to empower the workforce.

- Urban Development Initiatives: Launch of PM Awas Yojana Urban 2.0 with ₹10 lakh crore investment to address housing needs of urban poor and middle-class families.

- Ensuring Energy Security: Policies focused on energy conservation, renewable sources, and sustainable energy practices.

- Women Empowerment: Allocation of more than ₹3 lakh crore for schemes benefiting women and girls.

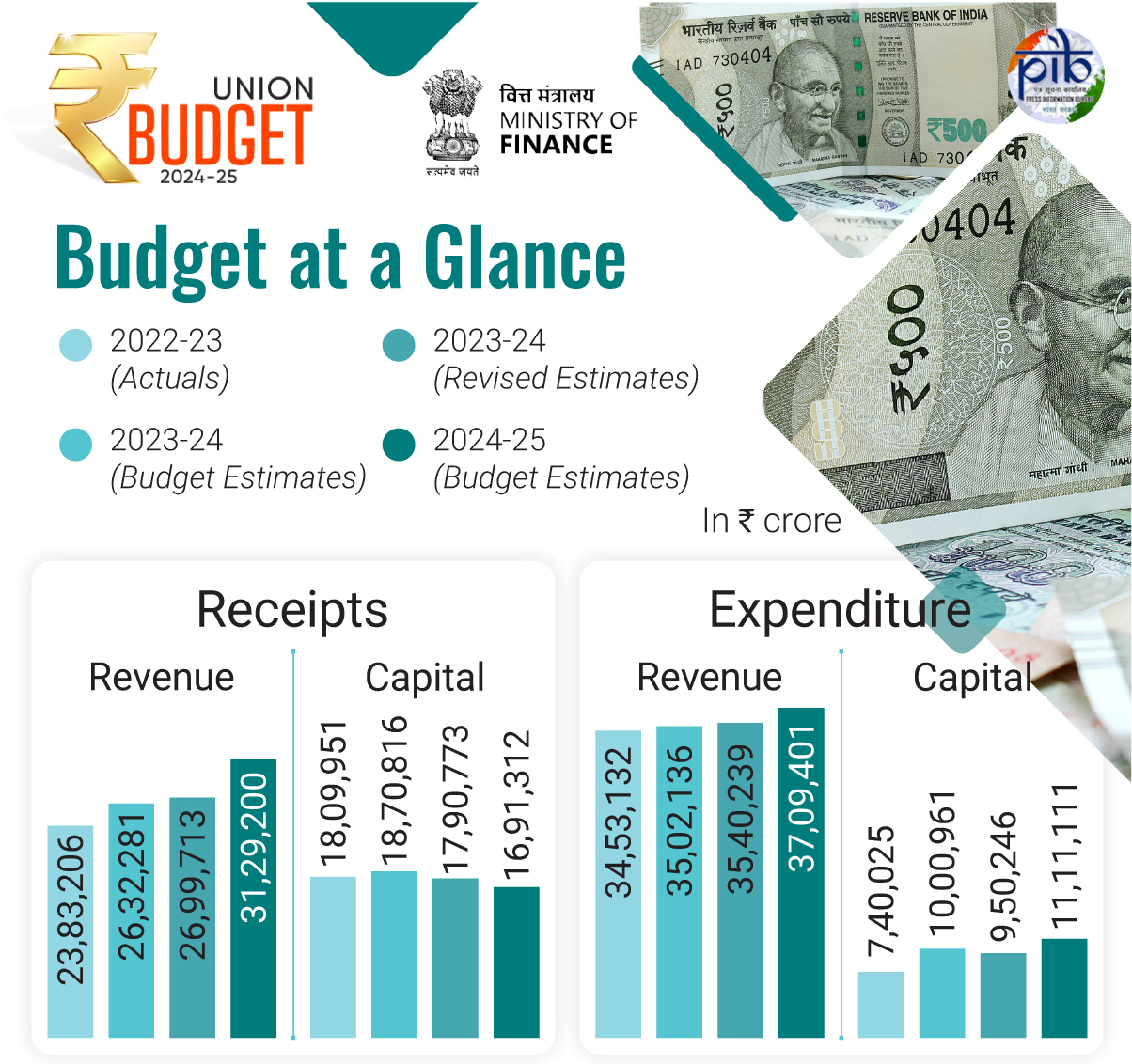

|

|

What is Fiscal Prudence?

- Fiscal prudence refers to the careful management of government finances aimed at maintaining fiscal discipline, sustainability, and stability.

- It involves making responsible decisions regarding public spending, revenue generation, borrowing, and debt management to achieve macroeconomic stability and long-term economic health.

What is the Significance of Fiscal Prudence in the Context of Budget 2024?

- Macro-level Impact:

- Debt Sustainability: India's fiscal deficit for FY 2023-24 is targeted at 4.9% of GDP, lower than previous estimates, indicating a commitment to reducing the deficit. This reduction is crucial for maintaining fiscal health and debt sustainability.

- Measures may include refinancing debt, extending debt maturities, and minimizing reliance on costly forms of financing.

- Investor Confidence: Prudent fiscal management enhances investor confidence by signaling the government's commitment to financial stability and sustainable growth.

- Credit Rating: A lower fiscal deficit and disciplined fiscal policies can potentially lead to improved credit ratings, reducing borrowing costs for the government and private sector alike.

- Debt Sustainability: India's fiscal deficit for FY 2023-24 is targeted at 4.9% of GDP, lower than previous estimates, indicating a commitment to reducing the deficit. This reduction is crucial for maintaining fiscal health and debt sustainability.

- Economic Stability:

- Inflation Control: By managing deficits, the government can mitigate inflationary pressures that arise from excessive public spending.

- Stimulus Effectiveness: Prudent fiscal policies ensure that any fiscal stimulus provided during economic downturns is effective and does not lead to long-term fiscal imbalances.

- Balanced Budgets: It Strives to achieve a balance between government revenues and expenditures over the economic cycle.

- This may involve running a budget deficit during economic downturns to stimulate growth and employment, balanced by surpluses during periods of economic expansion to reduce debt.

- Transparency and Accountability: Fiscal prudence maintains transparency in fiscal policies and practices to build trust among citizens and investors.

- Accountability mechanisms, such as regular audits and reporting of government finances, are essential to ensure that public funds are used efficiently and effectively.

What are the Government Strategies for Fiscal Prudence and Economic Growth in Budget 2024?

- Revenue Assumptions and Expenditure Management:

- Revenue Projections: The government projected a tax revenue growth rate of 10.8% against a nominal GDP growth rate of 10.5% for FY 2023-24.

- This cautious estimation aims to ensure realistic revenue targets amid economic uncertainties.

- Quality of Spending: There is a focus on increasing capital expenditure relative to revenue expenditure. This shift aims to enhance productivity, create long-term assets, and stimulate growth in key infrastructure sectors.

- Revenue Projections: The government projected a tax revenue growth rate of 10.8% against a nominal GDP growth rate of 10.5% for FY 2023-24.

- Structural Reforms and Sectoral Focus:

- Sectoral Investments: Budget 2024 emphasizes strategic investments in sectors such as infrastructure, healthcare, education, and technology.

- These investments are crucial for enhancing productivity, competitiveness, and overall economic growth.

- Export Promotion: Reduction in customs duties across various sectors aims to boost export competitiveness and integrate Indian products more effectively into global markets.

- Sectoral Investments: Budget 2024 emphasizes strategic investments in sectors such as infrastructure, healthcare, education, and technology.

- Financial Prudence and Market Stability:

- Financial Sector Reforms: The budget outlines reforms in the financial sector to strengthen regulatory frameworks, enhance transparency, and mitigate risks associated with financial markets.

- Market-oriented Policies: Policies aimed at rationalizing tariffs and enhancing ease of doing business contribute to a conducive environment for private sector investments and economic growth.

- Long-term Economic Strategy:

- Competitiveness and Equity: The budget underscores the importance of enhancing India's global competitiveness through structural reforms in factor markets (land, labour, and capital). This strategy aims to foster equitable growth and reduce regional disparities.

- Land reforms such as land Acquisition Laws, land Titling and Registration and Leasing Laws, labour reforms include codification of labour laws, and Social Security Nets and capital reforms such as Financial Sector Reforms, tax reforms, and easing the Investment Climate.

What Are the Current Economic Challenges In the Indian Economy?

- Global Economic Uncertainty:

- Trade Impact: Global trade tensions, geopolitical uncertainties, and shifts in the economic policies of major economies affect India's export performance. For instance, trade tensions between major economies like the US and China, and the Russia-Ukraine war, disrupt global supply chains, affecting India's export-driven sectors.

- Investment Flows: Foreign direct investment (FDI) inflows into India are influenced by global economic conditions. Uncertainties in global markets can lead to volatility in FDI inflows, impacting sectors dependent on foreign investments.

- Commodity Prices: Fluctuations in global commodity prices, especially crude oil and metals, impact India's import bills and inflation rates. This affects domestic consumption patterns and overall economic stability.

- Domestic Growth Slowdown:

- Structural Bottlenecks: Infrastructure constraints, bureaucratic inefficiencies, and regulatory complexities hinder economic growth. Delays in project implementation and inadequate logistics infrastructure affect manufacturing and export competitiveness.

- Despite reforms, agriculture remains vulnerable to weather fluctuations, inadequate infrastructure, and market access issues.

- Unemployment and Employment Quality:

- Youth Unemployment: As per the ILO report, the proportion of educated youth, who are unemployed, has nearly doubled to 65.7 percent in 2022 from 35.2 percent in 2000.

- This unemployment rate among India's youth population remains high, exacerbated by skill mismatches and inadequate job creation in formal sectors.

- Informal Sector Dominance: Almost 90 % of India's workforce operates in the unorganised sector, lacking job security, social security benefits, and access to skill development opportunities.

- Youth Unemployment: As per the ILO report, the proportion of educated youth, who are unemployed, has nearly doubled to 65.7 percent in 2022 from 35.2 percent in 2000.

- Fiscal Constraints:

- Fiscal Deficit: The fiscal deficit target for FY 2023-24 is projected at 6.8% of GDP, reflecting the government's efforts to manage expenditures amidst revenue constraints.

- Public Debt Levels: India's public debt-to-GDP ratio has increased(81% in 2022), limiting fiscal space for public investments and social spending. High debt levels pose risks to macroeconomic stability and debt sustainability.

- Revenue Mobilization: Efforts to enhance tax collections and broaden the tax base are critical for reducing fiscal deficits and financing development priorities without compromising fiscal discipline.

What Are the Various Reforms Needed to Revamp the Indian Economy?

- Diversification of Trade Partnerships and Hedging Strategies: Expand export horizons to diverse markets like Africa, and Southeast Asia, to reduce reliance on any single region. Strengthen ties with Brazil and Vietnam for new export opportunities.

- Continue efforts to attract long-term FDI in sectors such as renewable energy and digital infrastructure by ensuring a stable business environment and predictable policies.

- Implement tools like strategic reserves and forward contracts to stabilize commodity prices and secure energy needs against global market fluctuations.

- Fiscal Reforms and Fiscal Discipline:

- Maintain fiscal discipline to ensure sustainable public finances. Budget 2024 targets a fiscal deficit of 4.9% of GDP, showcasing efforts towards fiscal consolidation.

- Enhance tax compliance and broaden the tax base to boost revenue. Initiatives such as digital taxation and GST reforms aim to streamline tax administration and increase collections.

- Infrastructure Development

- Increase public and private investment in transport, energy, and digital infrastructure. Budget 2024 allocates significant funds for infrastructure projects under initiatives like PM GatiShakti.

- Focus on smart cities, urban mobility, and affordable housing to support rapid urbanization and enhance living standards.

- Manufacturing and Industrial Growth:

- Strengthen manufacturing through production-linked incentives (PLI) and make-in-India initiatives across sectors like electronics, pharmaceuticals, and textiles.

- Ease of Doing Business: Simplify regulatory frameworks, reduce compliance burden, and promote MSMEs to foster entrepreneurship and job creation.

- Agricultural Reforms and Rural Development:

- Implement market reforms through e-Nam, improve agricultural infrastructure, and expand irrigation facilities. Budget 2024 focuses on enhancing farmer incomes through initiatives like PM-KISAN and promoting agri-tech innovations and the Agriculture Infrastructure Fund (AIF)

- AIF shall provide a medium - long-term debt financing facility for investment in viable projects for post-harvest management Infrastructure and community

- Develop rural roads, electrification, and connectivity under schemes like PM Gram Sadak Yojana (PMGSY) to uplift rural economies and reduce regional disparities.

- Implement market reforms through e-Nam, improve agricultural infrastructure, and expand irrigation facilities. Budget 2024 focuses on enhancing farmer incomes through initiatives like PM-KISAN and promoting agri-tech innovations and the Agriculture Infrastructure Fund (AIF)

- Employment-linked incentives: All these schemes announced in Budget 2024 need to be implemented earnestly to enhance employment generation. The Budget 2024 announced three employment-linked incentive schemes and will allocate Rs 2 lakh crore for job creation over the next five years.

- Scheme A includes a Direct Benefit Transfer of 1-month salary in 3 installments up to Rs 15,000 to first-time employees registered in EPFO.

- Scheme B revolves around job creation in manufacturing incentives that will be provided directly to both employees and employers as per their EPFO.

- Scheme C includes Support to Employers: Reimbursement to employers up to 3,000 per month for 2 years towards their EPFO contribution for each additional employee.

|

Drishti Mains Questions: Q. Discuss the strategic reforms and economic goals essential for revitalizing the Indian economy. How do these reforms aim to address current economic challenges and foster sustainable growth? |

UPSC Civil Services, Previous Year Questions (PYQ)

Prelims

Q1. In the context of governance, consider the following: (2010)

- Encouraging Foreign Direct Investment inflows

- Privatization of higher educational Institutions

- Down-sizing of bureaucracy

- Selling/offloading the shares of Public Sector Undertakings

Which of the above can be used as measures to control the fiscal deficit in India?

(a) 1, 2 and 3

(b) 2, 3 and 4

(c) 1, 2 and 4

(d) 3 and 4 only

Ans: D

Mains

Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)

Q. Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (2019)