Reviewing Free Trade Agreements | 20 Dec 2024

For Prelims: Free Trade Agreement, MSMEs, Trade Deficit, Non-Tariff Barriers, Rules of Origin, ASEAN, FDI, Intellectual Property Rights, UPOV 1991, International Union for the Protection of New Varieties of Plants, TRIPS, EU, Economic Cooperation and Trade Agreement, Production-Linked Incentive (PLI) Scheme.

For Mains: Concerns related to India's FTAs and way forward.

Why in News?

Recently, India's External Affairs Minister stated that the government has adopted a cautious approach to free trade agreements (FTAs) to protect the interests of MSMEs or farmers.

- The decision has been taken weighing the unfavourable outcomes of past agreements and ensuring that FTAs do not adversely impact MSMEs or farmers.

How FTAs Proved Unfavorable for India?

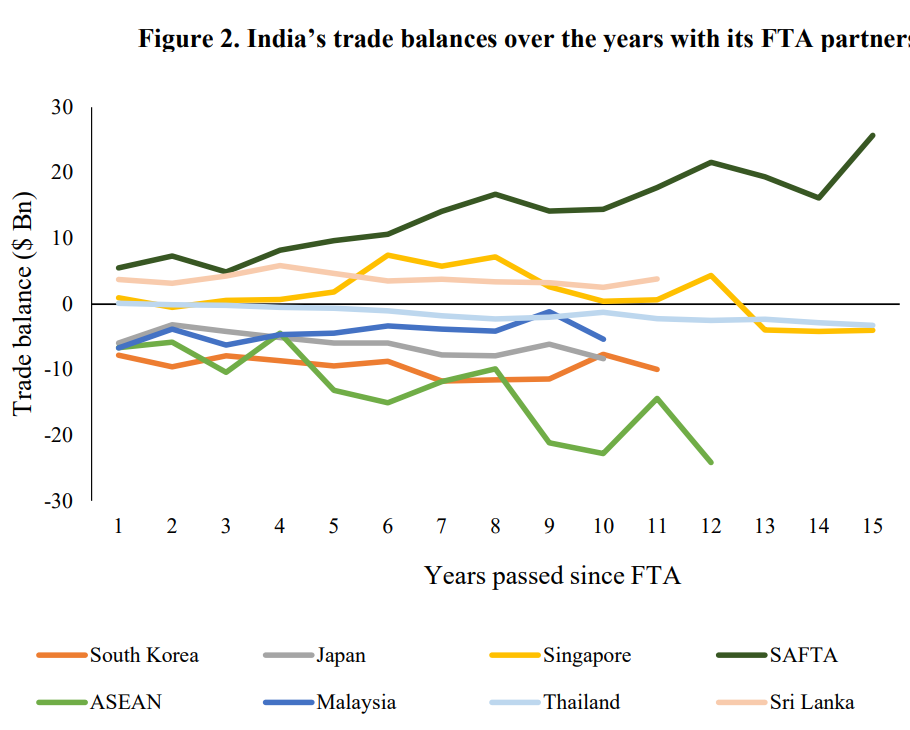

- Worsening Trade Deficits: Between 2017 and 2022, while India’s exports to FTA partners grew by 31%, its imports surged by 82% highlighting an unsustainable trade deficit.

- India has been opening its markets without gaining proportionate access to markets in return.

- Low FTA Utilisation: India's FTA utilisation remains alarmingly low at around 25%, far below the typical 70–80% utilisation rate seen in developed countries.

- It highlights India's failure to fully utilize the benefits of its bilateral and multilateral trade agreements.

- Poor Manufacturing Competitiveness: ASEAN's focus on research, innovation, government support, and value chain upgrades has boosted their global competitiveness by lowering production costs.

- South Korea and ASEAN outperformed India in sectors like electronics, automobiles, and textiles.

- It leads to a situation of inverted duty structure where import duties on raw materials goods are higher than on finished goods.

- E.g., higher GST rate paid on purchase of domestic raw materials compared to low import duty on imported goods.

- Lack of Stakeholder Consultation: Negotiators failed to involve representatives from relevant industries, businesses and associations, leading to a limited understanding of FTAs' impact and granting market access without considering domestic concerns.

- Non-Tariff Barriers: The FTAs led to a reduction in tariff rates, enabling partners to penetrate deeper into the Indian market.

- But non-tariff barriers by partner countries such as stringent standards, sanitary and phytosanitary measures and technical barriers to trade persisted, limiting Indian exporters' market access and export opportunities.

- Complex Certification: The complexity of certification requirements and rules of origin under the FTAs have made it difficult for exporters to meet prescribed standards and increased compliance costs.

- Lack of Awareness: Many exporters do not know about the incentives and potential advantages available to them under the FTAs, hindering the FTAs’ effective implementation.

- Limited Services Trade: Despite India having a competitive edge in services, services trade has not grown as expected.

- Technology Transfer and Investment Challenges: The FDI inflows have not translated into significant advancements in technology or value-added linkages that could enhance India's industrial capacity.

Free Trade Agreements

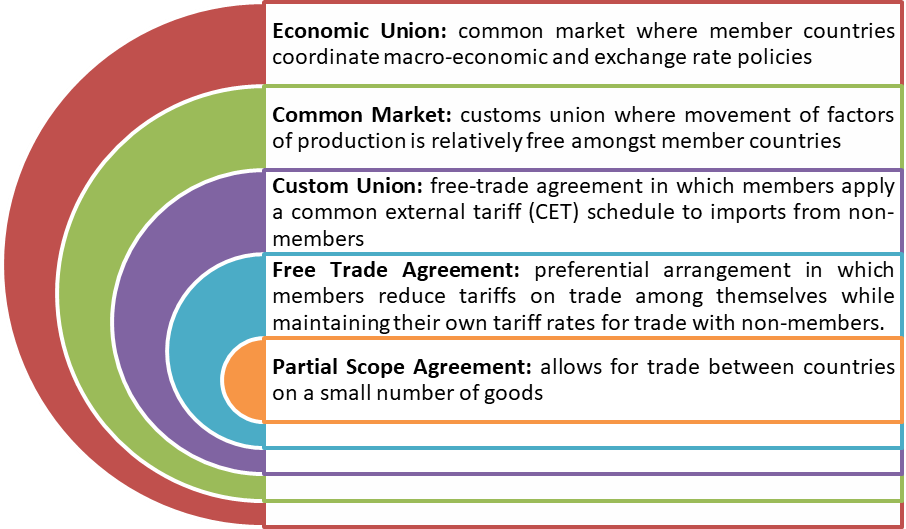

- About: FTAs are trade agreements between two countries (or blocs) which aim to give each other access to markets by lowering or removing border protection measures such as border taxes on exports and imports, and other barriers (such as standards, processes).

- Coverage: FTAs can cover trade in goods (such as agricultural or industrial products) or trade in services (such as banking, construction, trading etc).

- FTAs can also cover other areas such as intellectual property rights (IPRs), investment, government procurement and competition policy.

- Types of Trade Agreements:

- Major Trade Agreements of India:

Examples of the Use of Export Taxes to Maintain Competitiveness

- Kenya: Kenya got its leather industry back on its foot by imposing 40% export duty on raw hides and skins.

- This policy increased the number of tanneries in the country, created seven thousand new jobs, increased incomes for another 40,000 people and boosted earnings from the sector by almost Euros 8 million, with the potential for much more.

- Malaysia: Malaysia’s furniture sector is dependent on the export restrictions and taxes on raw timber which keep their inputs relatively cheap in order to remain competitive.

- Without these export restrictions and taxes, furniture SMEs are likely to be unable to compete.

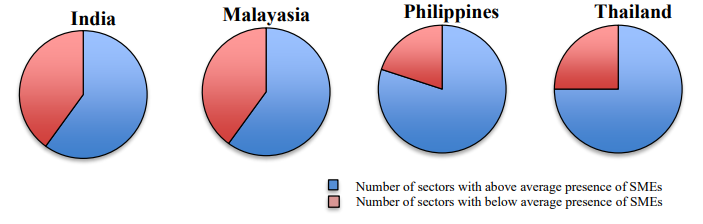

- Furniture SMEs are 6% of Malaysian SMEs in the manufacturing sector.

How FTAs Can Negatively Impact MSMEs?

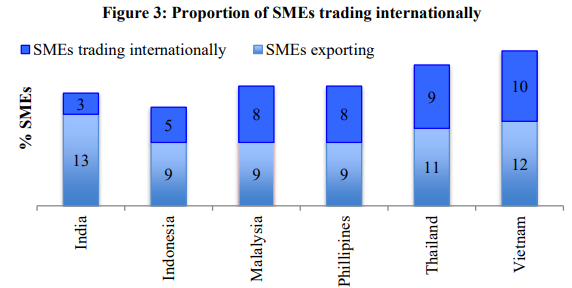

- Limited Global Reach: Only 16% of Indian SMEs engage in international trade, with 13% involved in exports. This is significantly lower than the international average of 19%.

- Vulnerability to External Shocks: Indian SMEs are vulnerable to global disruptions, as seen during the Covid-19 lockdown, which severely impacted supply chains.

- Technical Barriers: Indian MSMEs often struggle with compliance to international standards, including sanitary and phytosanitary (SPS) measures and technical barriers to trade (TBTs).

- Limited Networking Opportunities: MSMEs in India often lack connections with potential buyers abroad, which limits their market access and visibility.

- Loss of Domestic Market Share: As cheaper imported goods flood the market due to lower tariffs under FTAs, domestic MSMEs may lose market share to foreign competitors, leading to a decrease in sales and revenue.

- Scaling Challenges: The lack of capital, technology, and access to skilled labor can hinder their ability to compete on price, quality, and efficiency against foreign goods entering the Indian market.

How FTAs Can Negatively Impact Farmers?

- UPOV 1991 Convention: EU is pushing India to join the UPOV 1991 (International Union for the Protection of New Varieties of Plants) which grants exclusive rights over new plant varieties to large corporations.

- By joining UPOV 1991, India could face restrictions on seed sovereignty, where farmers may be forced to buy seeds every season due to use of Terminator seeds (genetically engineered to be sterile after first harvest).

- TRIPS-Plus Demands: The EU's TRIPS-plus demands aim to expand the intellectual property (IP) rights of multinational companies (MNCs) over agrochemicals, such as pesticides and fertilizers.

- It would lead to the monopolization of agrochemical markets by large companies and increase in prices of essential inputs for farmers.

- Non-Tariff Barriers (NTBs): Applying the EU’s pesticide maximum residue limit (MRL) of 0.01 parts per million (ppm) for several pesticides and food commodities could lead to the rejection of India’s agricultural export consignments.

- Increased Competition: Under Economic Cooperation and Trade Agreement (ECTA), Australia is looking to expand the export of pulses, wines, sheep meat, wool and horticultural produce to India which may prove detrimental for subsistence based Indian small landholder farmers.

- Food Insecurity: India currently applies a 30% tariff to all Canadian lentil exports which will be eliminated after India-Canada FTA.

- It could lead to a 147% increase in Canada's exports over five years, threatening India's goal to boost domestic pulse production and reduce import dependency.

Way Forward

- Investment in Infrastructure: Streamlining logistics through digital tools and integrating transportation modes (road, rail, and ports) would reduce logistics costs and improve efficiency.

- Relaxation of Rules of Origin (ROO): To improve FTA utilization, India should work on making ROO requirements more flexible and commodity-specific rather than uniform across all sectors to lower transaction costs for exporters.

- Emphasis on Services: India should focus on designing FTAs with greater emphasis on market access for its strong services sectors, particularly in IT, business process outsourcing (BPO), and other knowledge-based services.

- Re-negotiating Existing FTAs: For FTAs already signed, India should seek to renegotiate terms to focus on diversifying into high-tech and value-added products like chemicals, automotive components, and electrical apparatus.

- Boosting R&D: Boosting R&D in Export-Oriented Industries to create high-value products that align with global demand.

- Integrated Policy Approach: India’s Production-Linked Incentive (PLI) scheme, aimed at boosting manufacturing in select sectors, should be aligned with future FTAs to ensure that sectors benefiting from the PLI scheme are also given preferential treatment in trade agreements.

|

Drishti Mains Question: Q. Critically analyze the impact of Free Trade Agreements (FTAs) on India's agricultural sector and small-scale industries. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following countries: (2018)

- Australia

- Canada

- China

- India

- Japan

- USA

Which of the above are among the ‘free-trade partners’ of ASEAN?

(a) 1, 2, 4 and 5

(b) 3, 4, 5 and 6

(c) 1, 3, 4 and 5

(d) 2, 3, 4 and 6

Ans: (c)

Q. The term ‘Regional Comprehensive Economic Partnership’ often appears in the news in the context of the affairs of a group of countries known as(2016)

(a) G20

(b) ASEAN

(c) SCO

(d) SAARC

Ans: (b)

Mains

Q. How would the recent phenomena of protectionism and currency manipulations in world trade affect macroeconomic stability of India? (2018)

Q. Evaluate the economic and strategic dimensions of India’s Look East Policy in the context of the post Cold War international scenario. (2016)