Local Currency Trade between India-Indonesia | 12 Mar 2024

For Prelims: Reserve Bank of India, Look East Policy, Non-Aligned Movement, G20, East Asia Summit

For Mains: Internationalisation of Indian Currency, Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

Why in News?

The Reserve Bank of India (RBI) and the Bank Indonesia (BI) signed a Memorandum of Understanding (MoU) for establishing a framework to promote the use of local currencies (the Indian Rupee (INR) and the Indonesian Rupiah (IDR)) for cross-border transactions.

- Earlier in 2023 India and Malaysia announced that they will settle trade in INR in addition to other currencies.

What are the Key Highlights of the MoU between RBI and Bank Indonesia?

- The primary objective of the MoU is to facilitate bilateral transactions in INR and IDR, covering all current account transactions, permissible capital account transactions, and other economic and financial transactions as mutually agreed upon by both countries.

- The framework enables exporters and importers to invoice and pay in their respective domestic currencies, thereby fostering the development of an INR-IDR foreign exchange market. This approach optimizes costs and settlement time for transactions.

- It is expected to promote trade between India and Indonesia, deepen financial integration, and enhance the historical, cultural, and economic relations between the two nations.

India-Indonesia Relations

- Commercial Relations:

- Indonesia has emerged as the second largest trading partner of India in the ASEAN region.

- Bilateral trade has increased from USD 4.3 billion in 2005-06 to USD 38.84 billion in 2022-23.

- Indonesia has emerged as the second largest trading partner of India in the ASEAN region.

- Political Relations:

- Both countries were chief supporters of independence for Asian and African countries, leading to the Bandung Conference of 1955 and the formation of the Non-Aligned Movement in 1961.

- Since India adopted the 'Look East Policy' in 1991, there has been rapid development in bilateral relations.

- Both countries are members of G20, East Asia Summit and the United Nations.

- Cultural Relations:

- The Hindu, Buddhist and later Muslim faiths travelled to Indonesia from the shores of India. The stories from the great epics of Ramayana and Mahabharata form a source of Indonesian folk art and dramas.

- There are approximately 100,000 people of Indian origin in Indonesia, mainly located in Greater Jakarta, Medan, Surabaya, and Bandung.

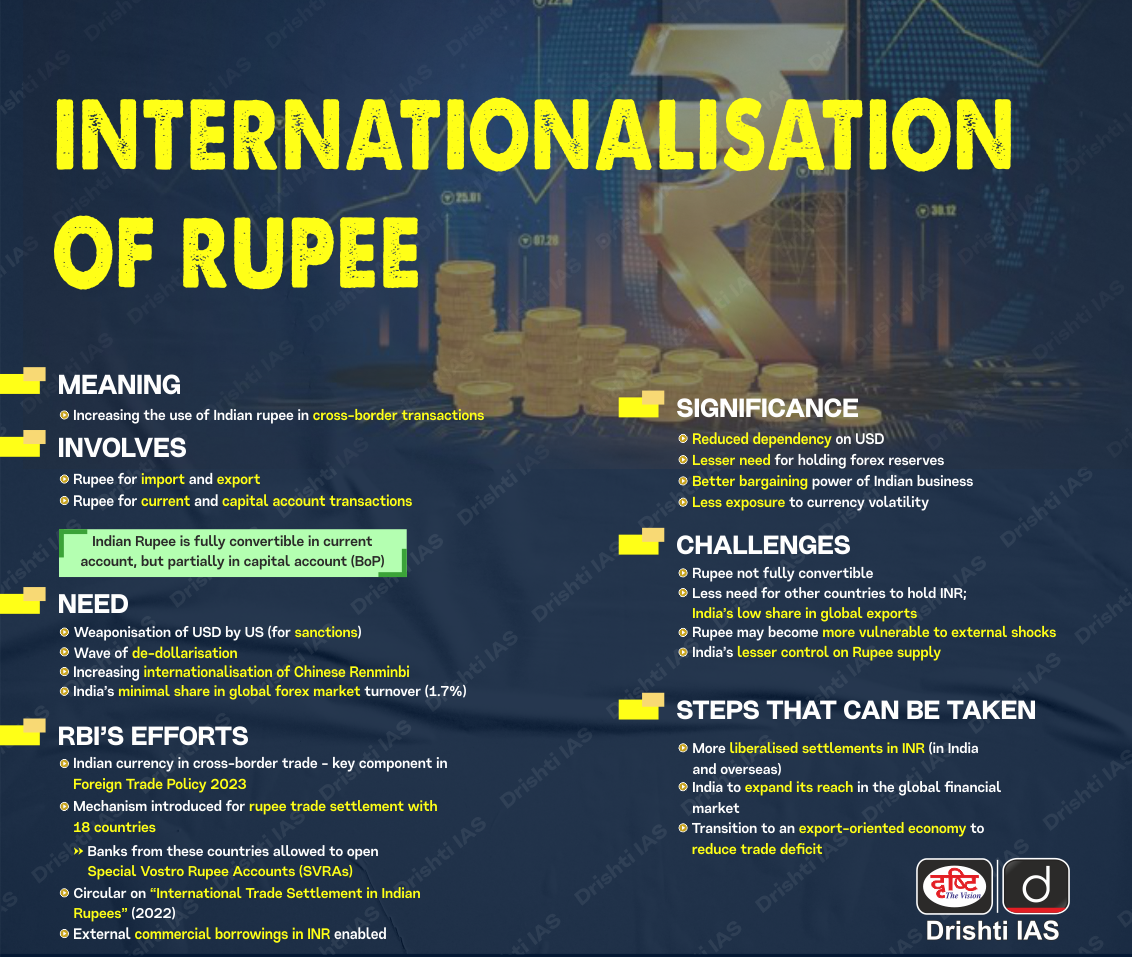

What are Efforts for the Internationalisation of the Rupee?

- Liberalisation of Capital Markets:

- India increased the availability of rupee-denominated financial instruments, such as bonds (Masala Bond) and derivatives, to enhance the rupee's appeal.

- Promotion of Digital Payment Systems:

- Initiatives like the Unified Payments Interface (UPI) have facilitated digital transactions in rupees.

- Recently, Sri Lanka and Mauritius have adopted UPI.

- Special Vostro Rupee Accounts (SVRAs):

- India permitted authorized banks from 18 countries (Ex. Russia and Malaysia) to open Special Vostro Rupee Accounts (SVRAs) for settling payments in rupees at market-determined exchange rates.

- Objectives of the Mechanism are lower transaction costs, greater price transparency, faster settlement time, and overall promotion of international trade.

- Currency Swap Agreements:

- Signed by the RBI with several countries (Ex. Japan, Sri Lanka and SAARC members) enables the exchange of rupee and foreign currency between respective central banks, bolstering the international usage of the rupee.

- Bilateral Trade Agreements:

- The government's signing of bilateral trade agreements with other countries has facilitated greater cross-border trade and investment, promoting the use of the rupee in international transactions.

Balance of Payments (BoP)

- The Balance of Payments (BoP) is a crucial indicator of a country's economic health, summarising its international transactions with the rest of the world.

- Those transactions that happen between Indian residents and Foreigners or nonresident Indians (NRIs) are recorded in India’s balance of payment.

- Structure: The BoP is broadly divided into two main accounts:

- Current Account: This account reflects the flow of goods, services, income, and current transfers.

- It deals with transactions that do not change the overall assets or liabilities of Indian residents abroad or foreign residents in India. It includes:

- Exports and Imports of goods and services

- Investment income (interest, dividends) and compensation of employees

- Current transfers (gifts, aid, Remittances)

- It deals with transactions that do not change the overall assets or liabilities of Indian residents abroad or foreign residents in India. It includes:

- Capital Account: This account captures transactions involving capital assets.

- It records transactions that directly impact a country's foreign assets and liabilities.

- Acquisition or disposal of non-produced non-financial assets (land, intellectual property)

- Includes Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI), Investing in businesses abroad, borrowing from foreign entities, and deposits made by NRIs in Indian banks are examples of capital account transactions.

- Current Account: This account reflects the flow of goods, services, income, and current transfers.

- Forex Reserves:

- Indian forex reserves are vital assets held by the RBI in foreign currencies.

- They serve as a financial cushion, ensuring liquidity to meet external obligations and stabilize the nation's currency and economy.

- Components of Indian Forex Reserves:

- Foreign Currencies:

- The Indian forex reserves mainly consist of foreign currencies such as the US Dollar, Euro, and British Pound. These currencies provide liquidity and facilitate international trade transactions.

- Gold Reserves:

- It is an essential hedge against inflation and a safety net during economic uncertainties.

- India has 800.78 tonnes of gold reserves.

- It is an essential hedge against inflation and a safety net during economic uncertainties.

- Special Drawing Rights (SDRs):

- SDRs are international reserve assets the IMF has created. They supplement the foreign exchange reserves of the member countries.

- The SDR is based on a basket of international currencies comprising the USD, Japanese yen, euro, pound sterling and Chinese Renminbi.

- SDRs are international reserve assets the IMF has created. They supplement the foreign exchange reserves of the member countries.

- Reserve Portion in IMF:

- The reserve portion in the IMF represents India's quota in the International Monetary Fund. It reflects India's position and voting power within this global financial institution.

- Impact on Indian Forex Reserves: Strengthens international standing.

- Foreign Currencies:

- Indian forex reserves are vital assets held by the RBI in foreign currencies.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. Convertibility of rupee implies (2015)

(a) being able to convert rupee notes into gold

(b) allowing the value of rupee to be fixed by market forces

(c) freely permitting the conversion of rupee to other currencies and vice versa

(d) developing an international market for currencies in India

Ans: (c)

.png)