Indian Economy

Foreign Portfolio Investors (FPI) and Forex Reserve

- 13 May 2022

- 8 min read

For Prelims: Forex Reserve and its components, FPI, FDI, Special Drawing Rights (SDR)

For Mains: Objectives of holding forex reserves and its significance, significance of FPIand FDI

Why in News?

The Reserve Bank of India (RBI) added another 16.58 tonnes of gold to the country's foreign exchange reserves in the last six months, bringing the country's gold holdings to more than 700 tonnes (around 760.42).

- Gold was acquired by the RBI at a time when Foreign Portfolio Investors (FPIs) left India, and forex reserves dropped by USD44.73 billion from USD 642.45 billion in September 2021 to USD 597.72 billion on April 29, 2022.

- Now, India is the ninth-largest holder of gold reserves.

What are Foreign Portfolio Investors?

- Foreign portfolio investment (FPI) consists of securities and other financial assets passively held by foreign investors. It does not provide the investor with direct ownership of financial assets and is relatively liquid depending on the volatility of the market.

- Examples of FPIs include stocks, bonds, mutual funds, exchange traded funds, American Depositary Receipts (ADRs), and Global Depositary Receipts (GDRs).

- FPI is part of a country’s capital account and is shown on its Balance of Payments (BOP).

- The BOP measures the amount of money flowing from one country to other countries over one monetary year.

- The Securities and Exchange Board of India (SEBI) brought new FPI Regulations, 2019, replacing the erstwhile FPI Regulations of 2014.

- FPI is often referred to as “hot money” because of its tendency to flee at the first signs of trouble in an economy. FPI is more liquid, volatile and therefore riskier than FDI.

What are the Benefits of FPIs?

- Accessibility to International Credit:

- Investors may be able to reach an increased amount of credit in foreign countries, enabling the investor to utilize more leverage and generate a higher return on their equity investment.

- Increases the Liquidity of Domestic Capital Markets:

- As markets become more liquid, they become more profound and broader, and a more comprehensive range of investments can be financed.

- As a result, investors can invest with confidence knowing that they can promptly manage their portfolios or sell their financial securities if access to their savings is required.

- Promotes the Development of Equity Markets:

- Increased competition for financing leads to rewarding superior performance, prospects, and corporate governance.

- As the market's liquidity and functionality evolve, equity prices will become value-relevant for investors, ultimately driving market efficiency.

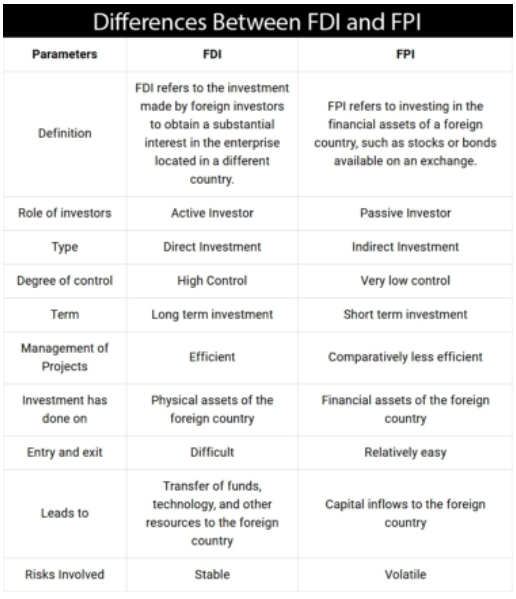

What is the Difference between FPI and FDI?

- FPI and FDI are both important sources of funding for most economies.

- A Foreign Direct Investment (FDI) is an investment made by a firm or individual in one country into business interests located in another country. FDI lets an investor purchase a direct business interest in a foreign country.

- Example: Investors can make FDI in a number of ways. Some common ones include establishing a subsidiary in another country, acquiring or merging with an existing foreign company, or starting a joint venture partnership with a foreign company.

What are Foreign Exchange Reserves?

- Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- It needs to be noted that most foreign exchange reserves are held in US dollars.

- India’s Forex Reserve include:

- Foreign Currency Assets

- Gold reserves

- Special Drawing Rights

- Reserve Tranche Position with the International Monetary Fund (IMF).

What is the Significance of Rising Forex Reserves?

- Comfortable Position for the Government:

- The rising forex reserves give comfort to the government and the RBI in managing India’s external and internal financial issues.

- Managing Crisis:

- It serves as a cushion in the event of a Balance of Payment (BoP) crisis on the economic front.

- Limits external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed.

- Rupee Appreciation:

- The rising reserves have also helped the rupee to strengthen against the dollar.

- Provides the capacity to intervene in support of the national or union currency.

- Confidence in Market:

- Reserves will provide a level of confidence to markets and investors that a country can meet its external obligations.

- Role in Policy Making:

- Supporting and maintaining confidence in the policies for monetary and exchange rate management.

UPSC Civil Services Examination, Previous Year Questions (PYQ)

Q. Which one of the following groups of items is included in India’s foreign-exchange reserves? (2013)

(a) Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries (b) Foreign-currency assets, gold holdings of the RBI and SDRs

(c) Foreign-currency assets, loans from the World Bank and SDRs

(d) Foreign-currency assets, gold holdings of the RBI and loans from the World Bank.

Ans: (b)

Q. With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic? (2020)

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt creating capital flow.

(c) It is the investment which involves debt-servicing.

(d) It is the investment made by foreign institutional investors in the Government securities.

Ans: (b)

- Foreign Direct Investment (FDI) is the investment through capital instruments by a person resident outside India in:

- An unlisted Indian company; or

- 10% or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

- Thus, FDI can be in a listed or unlisted company.

- The capital invested in India via FDI is non debt creating and not allowed to serve debt.

- An investment is called Foreign Portfolio Investment, if the investment made by a person (or institutional investors) resident outside India in capital instruments is:

- less than 10% of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company, or

- less than 10% of the paid up value of each series of capital instruments of a listed Indian company.

- Therefore, option (b) is the correct answer.