Indian Economy

Increased Foreign Portfolio Investments

- 16 Feb 2021

- 5 min read

Why in News

The Sensex has risen 11.36%, post Union Budget 2021-22 presentation, due to increased Foreign Portfolio Investments (FPIs).

- Sensex, otherwise known as the S&P BSE Sensex index, is the benchmark index of the Bombay Stock Exchange (BSE) in India. It comprises 30 of the largest and most actively-traded stocks on the BSE, and is the oldest stock index in India.

- A stock is an investment that represents a share, or partial ownership, of a company. Corporations issue (sell) stock to raise funds to operate their businesses.

Key Points

- Reasons for Inflow:

- Increased Liquidity:

- Stock market is responding to the Budget 2021-22 that has infused liquidity (money supply in market) in the Indian economy and been pro-growth with privatisation gaining ground.

- Several reforms aimed at protecting shareholder rights and improving the ease of doing business have also been a contributing factor.

- Post Covid Recovery:

- India, with a recovering economy, is moving back to a higher nominal growth trajectory versus the western world (which continues to struggle with the second wave of Covid and related lockdowns) and looks as a credible destination for growth seeking developed world investors.

- Increased Liquidity:

- Sectors Wise Investments:

- Performing Sectors:

- Sectors like private banks, Fast-Moving Consumer Goods (FMCG) and Information Technology (IT) have seen foreign flows as Indian companies have exhibited resilience and demonstrated growth post lifting of the lockdown restrictions.

- In 2020, the pharma sector was a preferred choice and the sector did very well.

- The Banking stocks underperformed due to potential Non-Performing Asset (NPA) concerns. Now, the banking stocks are again sought after by the FPIs.

- Performing Sectors:

- Benefit:

- Build Forex Reserve:

- Increased inflow of investments will conservatively allow to build forex reserves so that India has a buffer to maintain resilience in case of any future contagion from excessive liquidity and rising fiscal deficits.

- Build Forex Reserve:

Foreign Portfolio Investment

- Foreign Capital:

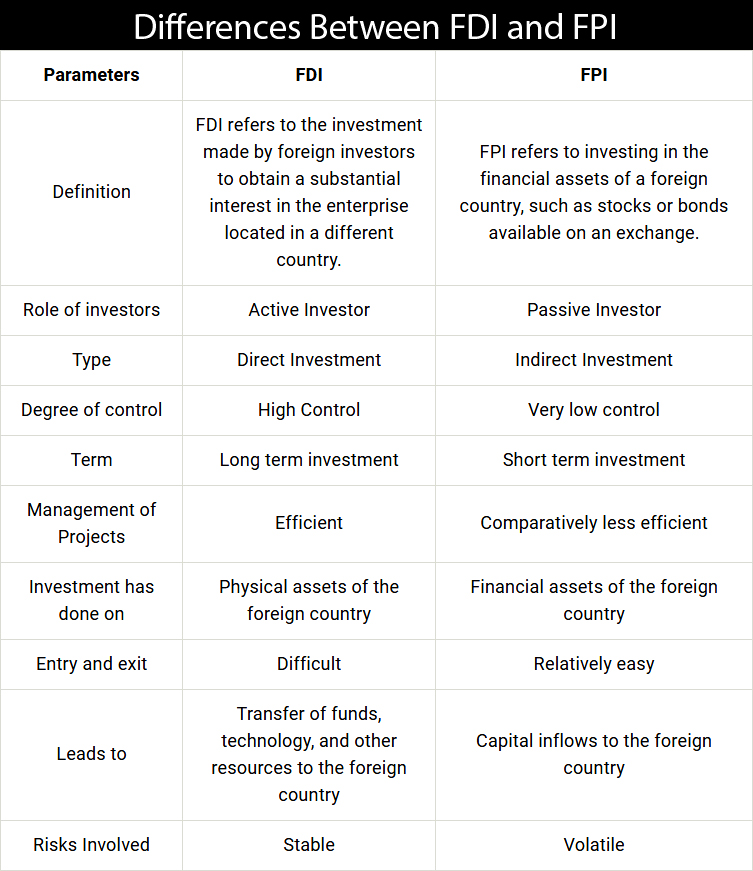

- FPI and FDI are both important sources of funding for most economies.

- A Foreign Direct Investment (FDI) is an investment made by a firm or individual in one country into business interests located in another country. FDI lets an investor purchase a direct business interest in a foreign country.

- Example: Investors can make FDI in a number of ways. Some common ones include establishing a subsidiary in another country, acquiring or merging with an existing foreign company, or starting a joint venture partnership with a foreign company.

- Foreign portfolio investment (FPI) consists of securities and other financial assets passively held by foreign investors. It does not provide the investor with direct ownership of financial assets and is relatively liquid depending on the volatility of the market.

- Examples of FPIs include stocks, bonds, mutual funds, exchange traded funds, American Depositary Receipts (ADRs), and Global Depositary Receipts (GDRs).

- Other Details Related to FPI:

- FPI is part of a country’s capital account and is shown on its Balance of Payments (BOP).

- The BOP measures the amount of money flowing from one country to other countries over one monetary year.

- The Securities and Exchange Board of India (SEBI) brought new FPI Regulations, 2019, replacing the erstwhile FPI Regulations of 2014.

- FPI is often referred to as “hot money” because of its tendency to flee at the first signs of trouble in an economy. FPI is more liquid, volatile and therefore riskier than FDI.

- FPI is part of a country’s capital account and is shown on its Balance of Payments (BOP).