Building a More Inclusive Financial System

This editorial is based on “PM Jan Dhan Yojana Has Accelerated Financial Inclusion, Reduced Inequalities” which was published in The India Express on 28/08/2024. This article highlights that the Pradhan Mantri Jan Dhan Yojana (PMJDY) has boosted financial inclusion in India with over 53 crore accounts and higher average balances, while reducing social issues and economic leakages. Future efforts should focus on enhancing the financial ecosystem, expanding products, and ensuring consumer protection.

For Prelims: Financial Inclusion, Pradhan Mantri Jan Dhan Yojana (PMJDY), Unified Payments Interface (UPI), Direct Benefit Transfers(DBT), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Atal Pension Yojana (APY), Payment banks, Small Finance Banks, Priority Sector Lending, Reserve Bank of India (RBI), Microfinance Institutions, Micro, Small, Medium Enterprises(MSMEs), BharatNet Project.

For Mains: Significance of Financial Inclusion for Inclusive Growth and Upliftment of Vulnerable Sections.

Financial inclusion has emerged as a crucial aspect of economic development, aiming to provide accessible, affordable, and effective financial services to all individuals, particularly those from marginalized and low-income backgrounds. In a country of over 1.3 billion people, with diverse geographic, economic, and social landscapes, ensuring universal access to financial services presents both immense challenges and opportunities.

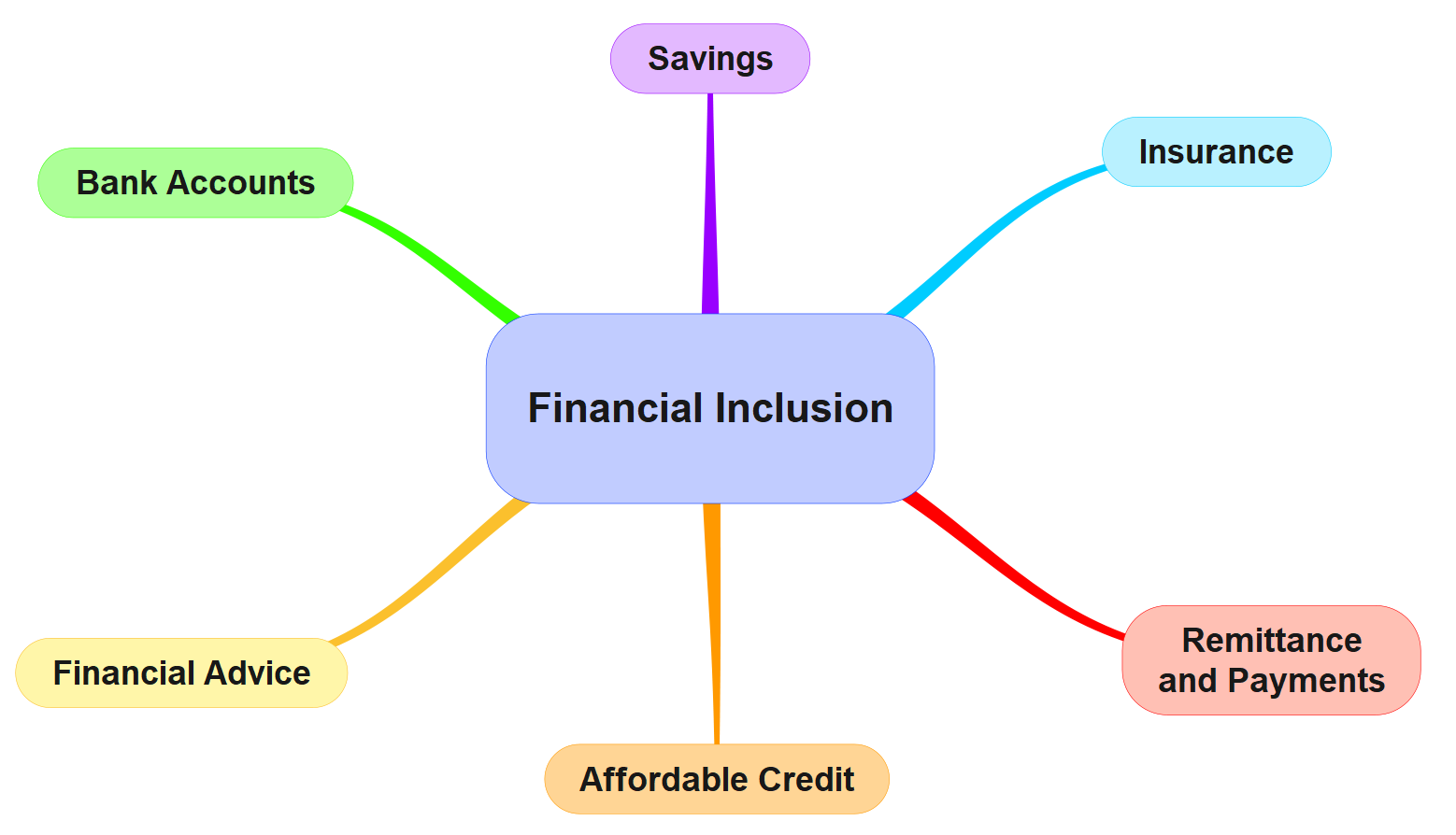

Financial inclusion goes beyond mere access to bank accounts; it encompasses a comprehensive suite of services including savings, credit, insurance, and digital payment solutions tailored to meet the needs of all segments of society.

The push for financial inclusion in India has gained significant momentum over the past decade, driven by a combination of government initiatives, technological advancements, and innovative business models. From the ambitious Pradhan Mantri Jan Dhan Yojana (PMJDY) to the revolutionary Unified Payments Interface (UPI), India has witnessed a transformative journey in its financial landscape. These efforts aim not only to provide basic financial services but also to empower individuals and businesses, reduce poverty, formalize the economy, and drive inclusive economic growth.

As India continues to navigate this path, understanding the multifaceted nature of financial inclusion, its progress, challenges, and future directions becomes crucial for policymakers, financial institutions, and citizens alike.

What is Financial Inclusion?

- Financial Inclusion: It is the process of ensuring access to appropriate financial products and services needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost in a fair and transparent manner by mainstream institutional players.

- Scope of Financial Inclusion: The scope of financial inclusion encompasses a wide range of financial services, including basic banking services (savings and checking accounts), credit facilities, insurance products, investment options, pension schemes, payment and remittance services and financial advisory services.

- Key Components of Financial Inclusion: The main components of financial inclusion are:

- Access to Financial Services: Ensuring that financial services such as banking, insurance, and credit are available to everyone. This involves the establishment of physical banking outlets in underserved areas and the provision of digital financial services.

- Affordability: Financial products and services should be priced to be accessible for all segments of society. High costs can be a significant barrier, particularly for low-income groups.

- Financial Literacy: Educating individuals about financial products, services, and management is essential. Financial literacy empowers people to make informed decisions about their finances, including saving, investing, and managing credit.

- Usage: Beyond access, it's crucial that individuals actively use financial services to achieve financial stability and growth. This includes engaging with banking services, utilizing credit responsibly, and taking advantage of insurance products.

What is the Importance of Financial Inclusion?

- Economic Empowerment: By providing access to formal financial services, individuals and small businesses gain the tools to manage their finances effectively, save for future needs, and access credit for growth opportunities.

- This empowerment can lead to increased economic activity and productivity at both micro and macro levels.

- Poverty Reduction: Access to financial services can serve as a powerful tool for poverty alleviation.

- Savings accounts provide a safe place to save money, reducing vulnerability to economic shocks while credit facilities can enable investments in education, healthcare, or small businesses, creating pathways out of poverty.

- Formalization of the Economy: Bringing more individuals and businesses into the formal financial system reduces the size of the shadow economy.

- This transition enhances transparency, improves tax collection, and enables more effective economic policy implementation.

- Enhanced Financial Stability: A broader base of depositors and borrowers can contribute to a more stable financial system by diversifying risks and reducing the impact of economic shocks on any single segment of the population.

- Improved Government Service Delivery: Direct benefit transfers(DBT) and other government schemes can be more efficiently and transparently implemented through formal financial channels, reducing leakages and ensuring that benefits reach the intended recipients.

- Gender Equality: Financial inclusion can play a significant role in promoting gender equality by providing women with independent access to financial services, enhancing their economic autonomy and decision-making power within households and communities.

- Digital Transformation: The push for financial inclusion often goes hand-in-hand with digital innovation, driving the adoption of new technologies that can have spillover effects in other sectors of the economy.

- Social Inclusion: Access to financial services can enhance an individual's sense of dignity and social inclusion, particularly for marginalized groups who have historically been excluded from the formal economy.

What is the Current State of Financial Inclusion in India?

- Overall Progress: Since the introduction of the Pradhan Mantri Jan Dhan Yojana (PMJDY), India has made significant strides in financial inclusion.

- The percentage of adults with formal financial accounts has surged from approximately 50% in 2011 to over 80% in 2024.

- Account Statistics: As of August 2024, the total number of PMJDY accounts stands at 53.13 crore. This is a remarkable increase from the 14.7 crore accounts recorded in March 2015.

- Banking Sector Involvement: Public sector banks have played a crucial role in the PMJDY initiative, managing about 78% of the accounts opened under the scheme.

- Gender Distribution: Out of the total PMJDY accounts, 29.56 crore (55.6%) are held by women.

- Rural and Semi-Urban Areas: About 66.6% of PMJDY accounts are in rural and semi-urban regions, reflecting the scheme's focus on underserved areas.

- Digital Transaction: National Payments Corporation of India (NPCI) data shows that compared with June, the volume of UPI transactions grew by 3.95% in July, while the value of transactions increased by 2.84%.

What are Financial Inclusion Initiatives in India?

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Launched in 2014, Pradhan Mantri Jan Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, banking/savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner.

- Key features of the scheme include zero balance accounts that eliminate the need for a minimum deposit, accident insurance coverage of up to Rs 1 lakh for financial protection in case of accidental death or disability, and overdraft facilities up to Rs 10,000 to assist eligible account holders during emergencies.

- Micro-Insurance and Micro-Pension Schemes: The government has introduced low-cost insurance and pension schemes to reach underserved populations:

- Pradhan Mantri Suraksha Bima Yojana (PMSBY): It offers accidental death and disability insurance with an annual premium of Rs 20 for Rs 2 lakh coverage.

- Atal Pension Yojana (APY): A pension scheme for the unorganized sector, offering a guaranteed monthly pension of Rs 1,000 to Rs 5,000 after age 60.

- Other Financial Inclusion Initiatives:

- Pradhan Mantri Vaya Vandana Yojana (PMVVY): This pension scheme is designed for senior citizens aged 60 and above and guarantees return on investment for a fixed period.

- Pradhan Mantri Mudra Yojana (PMMY): PMMY facilitates easy access to credit for small and micro enterprises by providing loans up to Rs 20 lakh to non-corporate, non-farm small/micro enterprises, promoting entrepreneurship and job creation.

- Stand Up India Scheme: This initiative supports SC/ST and women entrepreneurs by providing loans between Rs 10 lakh and Rs 1 crore for setting up greenfield enterprises. It aims to foster inclusive growth and financial independence.

- Venture Capital Fund for Scheduled Castes (SCs): The fund provides financial assistance to SC entrepreneurs to help them start and grow businesses.

- Varishtha Pension Bima Yojana (VPBY): It is a scheme for the benefit of senior citizens aged 60 years and above.

- Sukanya Samriddhi Yojana: The Sukanya Samriddhi Scheme is a government savings program for parents of girl children, aimed at encouraging savings for their education and marriage expenses.

- JAM Trinity: The JAM Trinity, comprising Jan Dhan (bank accounts), Aadhaar (biometric ID), and Mobile (digital access), is a framework designed to enhance financial inclusion in India.

- This combination aims to improve financial inclusion, enable direct benefit transfers, and enhance service delivery efficiency. JAM facilitates seamless authentication and digital transactions, reducing leakages in welfare programs.

- Elaborating Banking System: Payment banks, small finance banks, and priority sector lending, together they expand financial services reach, fostering broader economic participation and inclusion.

- Payment Banks: Specialized banks for small savings accounts and payments.

- Small Finance Banks: Banks focused on underserved segments.

- Priority Sector Lending: Mandated lending to specific sectors including agriculture and MSMEs.

- Banking Correspondents: The Reserve Bank of India’s (RBI) introduced the Banking Correspondent (BC) model in 2006 to extend banking services to areas where full bank branches are impractical.

- BCs provide basic services such as account opening, cash deposits, withdrawals, fund transfers, and balance inquiries using technology like micro-ATMs and point-of-sale devices.

- Digital Payments and Financial Technology (FinTech): Digital technology has revolutionized financial services in India, with both government-backed and private sector innovations driving financial inclusion.

- Unified Payments Interface (UPI):Introduced in 2016, UPI enables instant money transfers between bank accounts through a mobile app, supports multiple accounts in one app, and facilitates seamless transactions.

- According to the RBI annual report, in FY24, nearly 80% of digital payments in India were made through the UPI.

- Bharat Interface for Money (BHIM): A UPI-based app designed for basic smartphones and low connectivity areas.

- RuPay Cards: India’s domestic card network, reducing reliance on international schemes with lower transaction costs.

- Aadhaar Enabled Payment System (AEPS): Uses the Aadhaar biometric database to enable transactions through Aadhaar number and biometric authentication. This system is particularly beneficial for those lacking traditional banking infrastructure.

- Unified Payments Interface (UPI):Introduced in 2016, UPI enables instant money transfers between bank accounts through a mobile app, supports multiple accounts in one app, and facilitates seamless transactions.

- Microfinance Institutions (MFIs) and Self-Help Groups (SHGs): Microfinance institutions and Self-Help Groups (SHGs) play a vital role in reaching underserved communities, especially in rural and semi-urban areas.

- Microfinance Institutions (MFIs): Provide small loans to individuals who are unable to access traditional banking services, focusing on empowering economically weaker sections by offering credit without collateral.

- Self-Help Groups (SHGs): SHGs are community-based organizations where members pool savings and provide loans to one another, effectively fostering savings and offering credit based on mutual trust, especially in rural areas.

- India boasts of some 12 million SHGs, of which 88% are all-women-member ones. These groups have been crucial in promoting financial discipline and providing credit to underserved communities.

- Financial Literacy Programs: Financial literacy is essential for ensuring effective use of financial services. Several initiatives aim to improve financial literacy across various demographics.

- Financial Education Programme for Adults (FEPA): It is a financial literacy program aimed at spreading financial awareness among adults, including farmers, women’s groups, and various workers, aligning with the National Strategy for Financial Education.

- National Centre for Financial Education (NCFE): It enhances financial literacy through educational resources, workshops, and training programs, focusing on budgeting, saving, investing, and understanding financial products.

- Digital Financial Literacy Campaigns: Educate people about digital banking, online transactions, and cybersecurity, especially important as digital financial tools become more prevalent.

What are the Challenges Associated with Financial Inclusion?

- Digital Divide: India's vast and diverse geography poses significant challenges for delivering financial services to remote areas, where a substantial portion of the rural population lacks access to smartphones and internet connectivity.

- Inadequate road connectivity, unreliable electricity supply, and limited internet penetration in rural regions hinder the expansion of financial services.

- For instance, India's internet penetration rate is around 52%, which is below the global average of 66%.This digital divide limits the reach and effectiveness of digital financial services.

- Financial Literacy: Low levels of financial literacy, especially among rural and low-income populations, impede the effective use of financial services.

- Many individuals struggle to understand financial products and make informed financial decisions.

- Gender Gap: Women face additional barriers to financial inclusion due to social, economic, and cultural factors.

- For instance, the National Family Health Survey (NFHS-5) in India reveals that 33% of women use the internet, while the figure is 57% for men.

- Limited asset ownership and lower financial literacy rates among women contribute to this gap.

- Difficult KYC Norms: Despite improvements, many individuals still struggle with providing necessary documentation for accessing financial services.

- This is particularly challenging for migrant workers and those in the informal sector.

- Last-Mile Connectivity: Ensuring consistent availability of banking services in remote areas remains a challenge.

- Issues such as irregular visits by banking correspondents and non-functional ATMs affect service quality.

- Credit Access for MSMEs: Micro, Small, and Medium Enterprises(MSMEs) often face difficulties in accessing formal credit due to lack of collateral, credit history, and complex loan application processes.

- Cybersecurity Concerns: The growth of digital financial services has led to increased cybersecurity risks.

- For instance, as per National Crime Records Bureau (NCRB) 2022, cybercrime reporting surged by 24.4%, totalling 65,893 cases, a significant surge from 52,974 cases in 2021.

- Rising incidents of digital fraud and limited awareness of cybersecurity best practices among users pose significant challenges.

What Should be the Way Forward?

- Strengthen Digital Infrastructure: Expanding internet connectivity through the BharatNet project and public Wi-Fi in rural areas while encouraging private investment in telecom infrastructure would strengthen digital infrastructure.

- Enhance Financial Literacy Programs: Enhance financial literacy programs to improve understanding of digital financial services and cybersecurity. This is crucial for empowering users to navigate online transactions securely, bridging gaps in access, and reducing vulnerabilities in remote and underserved areas.

- Leverage Technology for Last-Mile Connectivity: Use blockchain for secure transactions, artificial intelligence (AI) for credit scoring, and voice-based interfaces to overcome literacy barriers.

- Focus on Women and Rural Populations: Tailor financial products and services to meet the needs of women, the poor, and those living in rural areas. This can include creating gender-sensitive financial products, providing microcredit, and offering savings schemes that cater specifically to these groups.

- Implement targeted policies to address the persistent gender gap in financial inclusion. This could include promoting women-focused financial services, encouraging women’s entrepreneurship through microfinance, and ensuring that financial literacy programs are accessible to women.

- Simplify KYC Norms: Implement video KYC for remote account opening, create a unified KYC system, and develop alternative methods for those without traditional documents.

- Strengthen the Banking Correspondent Model: Improve Banking Correspondent training and incentives, expand service offerings, and enhance monitoring. This will enhance last-mile banking access, particularly in remote areas.

- Credit Histories and Data Sharing: Enhance online credit history systems such as CIBIL.

- Providing people with the ability to build and access their credit histories can encourage financial institutions to extend credit and other financial services to first-time users and those in underserved areas.

Conclusion

The journey towards comprehensive financial inclusion in India is ongoing, marked by significant progress and persistent challenges. The convergence of government initiatives, technological innovation, and collaborative efforts across sectors has laid a strong foundation for a more inclusive financial ecosystem. However, bridging the remaining gaps requires sustained focus on addressing infrastructure limitations, enhancing financial literacy, and developing tailored solutions for underserved segments.

As India moves forward, the emphasis must be on ensuring that financial inclusion translates into meaningful financial empowerment and improved economic outcomes for all citizens. This involves not just expanding access but also fostering usage, building trust in the formal financial system, and continuously innovating to meet evolving needs. Ultimately, achieving true financial inclusion will be pivotal in realizing India's aspirations for equitable and sustainable economic growth.

|

Drishti Mains Question Evaluate the challenges faced by India in achieving comprehensive financial inclusion and propose measures to address issues related to digital divide, financial literacy, and infrastructure. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q. With reference to India, consider the following: (2010)

1. Nationalization of Banks

2. Formation of Regional Rural Banks

3. Adoption of village by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. Pradhan Mantri Jan Dhan Yojana (PMJDY) is necessary for bringing unbanked to the institutional finance fold. Do you agree with this for financial inclusion of the poorer section of the Indian society? Give arguments to justify your opinion.