Report on Currency and Finance (RCF) 2023-24

For Prelims: Digital India program, Unified Payments Interface (UPI), Payment and Settlement Systems Act, 2007, Reserve Bank of India (RBI).

For Mains: Impact of Digital Technology on Different Sectors in India, Positive and Negative Impacts of Digitization on Indian Economy

Why in News?

As per the 'Report on Currency and Finance (RCF) for the year 2023-24' released by the Reserve Bank of India (RBI), India's digital economy is set to constitute 20% of the country's GDP by 2026, doubling its current contribution of 10%.

- This significant growth projection underscores the transformative potential of digitalization in finance and its far-reaching impact on India's economy.

What is the Report on Currency and Finance?

- About:

- It is an annual publication of the RBI.

- The report covers various aspects of the Indian economy and financial system.

- Theme:

- The theme of the "Report is "India’s Digital Revolution."

- It focuses on the transformative impact of digitalization across various sectors in India, particularly in the financial sector.

- The theme of the "Report is "India’s Digital Revolution."

- Dimensions:

- It highlights how digital technologies are reshaping economic growth, financial inclusion, public infrastructure, and the regulatory landscape, while also addressing the associated opportunities and challenges.

What are the Key Highlights from the Report on Currency and Finance 2023-24?

- Expansion of Financial Services: The evolution and adoption of technological advancements have led to massive improvement in deepening of digital financial services.

- The potential for expanding financial inclusion in India by application of digital technologies is high in view of existing conditions.

- First, the progress of financial inclusion in India is evident in the Reserve Bank’s Financial Inclusion Index and narrowing account access gap between income groups.

- Second, in rural India, 46% of the population consists of wireless phone subscribers and 54% are active internet users.

- Third, given that more than half of FinTech consumers are from semi-urban and rural India and more than a third of digital payment users are from rural areas there is potential for furthering digital penetration and closing the rural-urban gap.

- Over two lakh gram panchayats have been connected through BharatNet in the last decade, enabling provision of services like e-health, e-education and e-governance in rural areas.

- The potential for expanding financial inclusion in India by application of digital technologies is high in view of existing conditions.

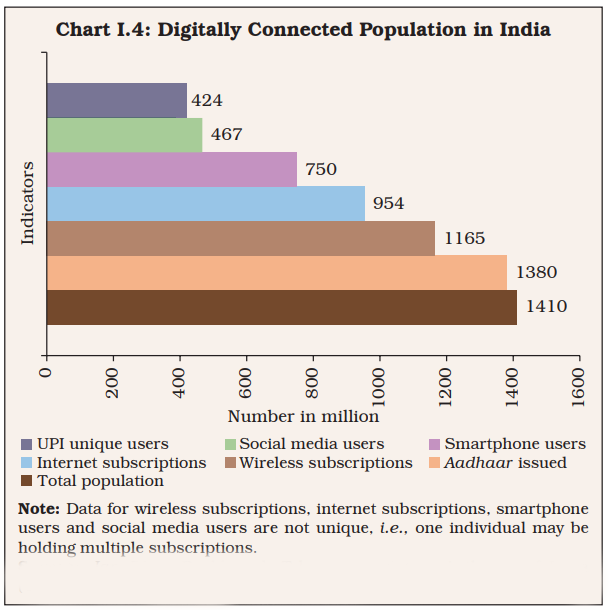

- Mobile Penetration: Although internet penetration in India was at 55% in 2023, the internet user base has grown by 199 million in the recent three years.

- India’s cost per gigabyte (GB) of data consumed is the lowest globally at an average of Rs. 13.32 per GB.

- India also has one of the highest mobile data consumption in the world, with an average per-user per-month consumption of 24.1 GB in 2023.

- There are about 750 million smartphone users, which is expected to reach about one billion by 2026.

- India is expected to be the second largest smartphone manufacturer in the next five years.

- Digital Economy: The digital economy currently accounts for 10% of India's GDP.

- By 2026, this figure is expected to double, contributing to 20% of GDP, driven by rapid advancements in digital infrastructure and financial technology.

- Digitization is strengthening banking infrastructure and public finance systems, optimizing direct benefit transfers and tax collections.

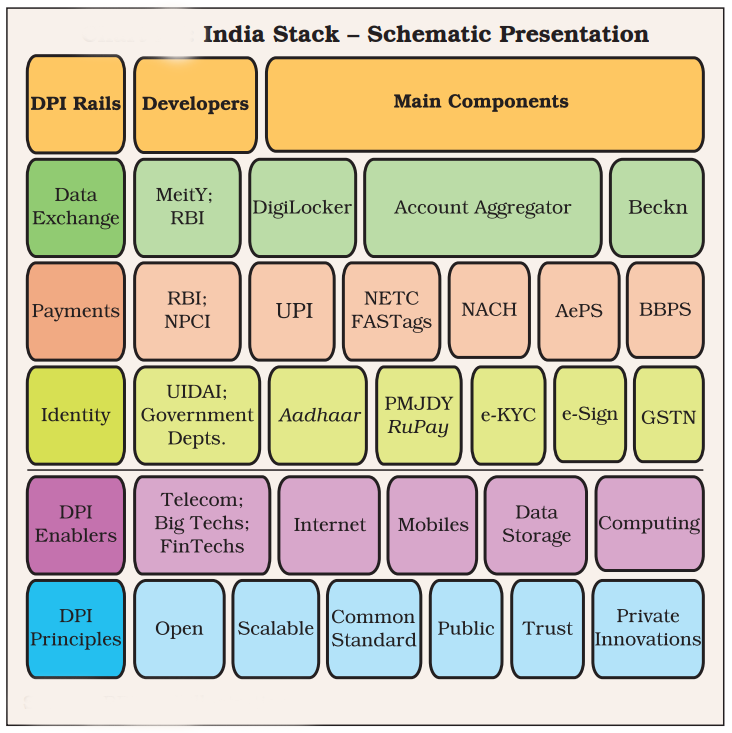

- India Stack: Key components such as Aadhaar, Unified Payments Interface (UPI), and DigiLocker have revolutionised service delivery. UPI has seen a tenfold increase in transactions over four years.

- Aadhaar: The world's largest biometric-based identification system, covering 1.38 billion ID holders.

- UPI: A real-time, low-cost transaction platform contributing significantly to financial inclusion.

- DigiLocker: Cloud-based storage providing secure document access.

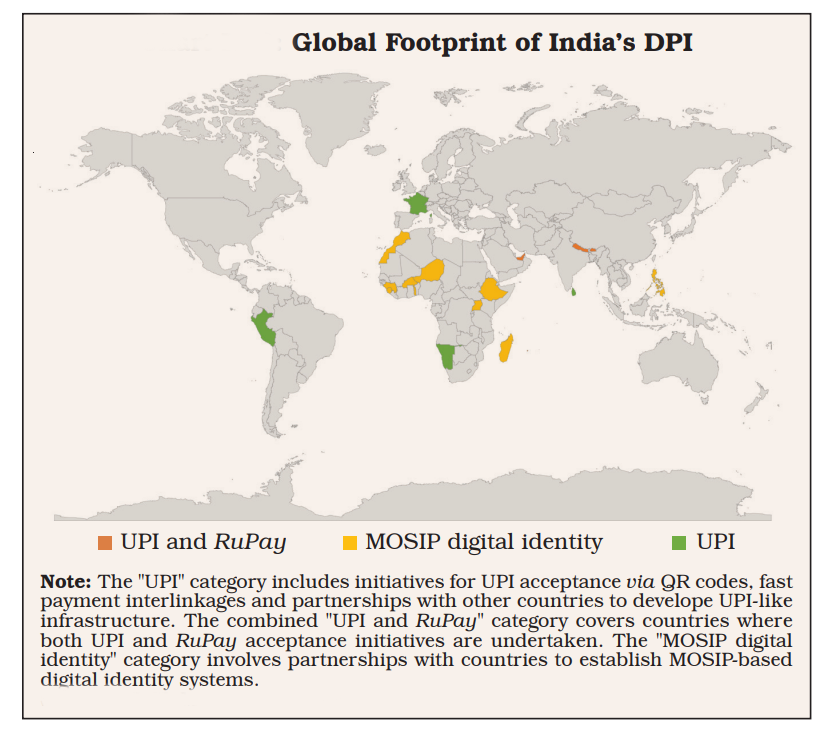

- Internationalisation of Digital Public Infrastructure: India’s DPI is going global by:

- Collaborating with other nations to develop digital identity solutions under the Modular Open Source Identity Platform (MOSIP) programme.

- Interlinkage of the UPI with fast payment systems of other nations like Singapore’s PayNow, the United Arab Emirates’ (UAE) Instant Pay Platform (IPP) and Nepal’s National Payments Interface (NPI) for cost-effective and fast remittances.

- Partnering with other central banks and foreign payment service providers to broaden UPI and RuPay acceptance beyond geographical borders, such as in countries like Bhutan, Mauritius, Singapore and the UAE.

- Sharing the Beckn protocol with nations to provide their public and private services through open, lightweight and decentralised specifications.

- Beckn Protocol enables the creation of open, peer-to-peer decentralized networks for pan-sector economic transactions.

- Vibrant Initiatives: The Open Credit Enablement Network, Open Network for Digital Commerce, and the Public Tech Platform for Frictionless Credit are driving the digital lending ecosystem.

- Fintech companies are partnering with banks and non-banking financial companies (NBFCs) to offer digital credit solutions and enhance financial inclusion.

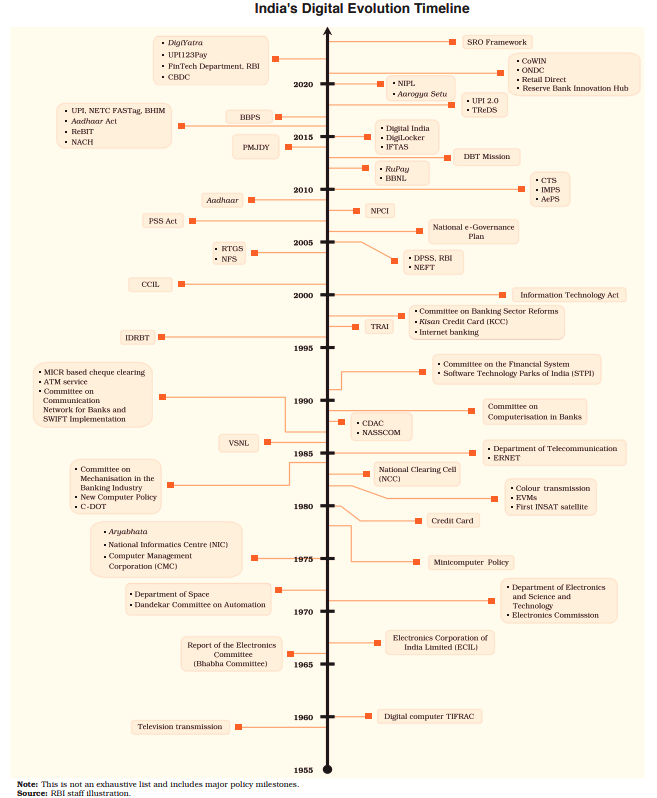

Evolution of Digital Revolution in India

- India’s digital revolution is a blend of government-led initiatives and enabling regulatory frameworks of financial market regulators (Reserve Bank of India and the Securities and Exchange Board of India (SEBI)). This journey traverses four phases since independence.

| Phase | Period | Description |

| Digital Awakening | 1950s-1980s | Early computers were introduced in banks. ATMs and credit cards were also introduced during this period. |

| Liberalisation & InfoTech Boom | 1990s | The internet became more widely available in the 1990s. This led to the dematerialization of stocks, which means that stocks were no longer represented by physical certificates. Internet banking also began to be offered by banks during this time. |

| Building Legal Framework | 2000-2016 | Laws were passed to regulate digital transactions. Digital payment systems, such as UPI, were launched during this period. |

| Digital Innovation | 2017 onwards | India has become a leader in digital payments. New features, such as offline payments, have been introduced. |

What are the Challenges Posed by Digitalisation?

- Impact on Financial Markets: Digitalisation has led to the introduction of complex financial products and services, significantly impacting market structure and financial stability.

- The emergence of digital players with unreliable funding models increases system vulnerabilities and poses challenges to financial stability.

- This hyper-diversification of financial services may result in a "barbell" financial structure, where a few dominant multi-product players coexist with numerous niche service providers.

- Fear of Monopolisation: In India's digital payment ecosystem, the proliferation of Unified Payments Interface (UPI) applications has expanded customer choices and increased transaction volumes. However, a significant share of transactions is dominated by a few applications, as indicated by the Herfindahl-Hirschman Index (HHI) (a common measure of market concentration of an industry used to determine market competitiveness).

- To address concentration risks, the National Payments Corporation of India (NPCI) has capped the market share of a single third-party application provider to 30% by December 2024.

- Cyber Security Challenges: Cybersecurity is a major concern due to the diverse nature of cyber threats targeting digital financial infrastructure.

- In India, security incidents handled by the Indian Computer Emergency Response Team (CERT-In) have skyrocketed from 53,117 in 2017 to over 1.32 million between January and October 2023.

- The majority of these incidents involve unauthorized network scanning, probing, and exploitation of vulnerable services.

- In India, the average cost of a data breach in 2023 was USD 2.18 million, which is less than the global average but still represents a significant increase.

- Consumer Protection Issues: Digitalisation has also led to "dark patterns," where consumers are tricked into making decisions against their interests. Additionally, extensive use of customer data by companies raises concerns about data protection and privacy, potentially compromising customer trust.

- Reshaping Labour Markets: Digital technologies are transforming workforce composition, job quality, skill requirements, and labour policies. The implementation of AI in financial services shifts roles towards higher-skilled tasks, automating routine functions and aiding decision-making.

- Between 2013 and 2019, support roles in the financial sector declined, while the number of professionals and technicians increased.

- In India, private sector banks reported high turnover rates in 2022-23, leading to significant risks such as loss of institutional knowledge and higher recruitment costs.

What Steps Have Been Taken to Deal With the Challenges?

- Financial and Digital Inclusion: India has established Digital Banking Units (DBUs) and improved UPI with offline and conversational payments in local languages.

- The Payment Infrastructure Development Fund (PIDF) has been launched to broaden payment infrastructure, and digitalisation of agricultural finance is underway.

- Customer Protection: To address regulatory and customer protection challenges in the digital lending ecosystem, the RBI issued the Guidelines on Digital Lending, focusing on loan servicing, disclosures, grievance redressal, credit assessment standards, and data privacy.

- The Reserve Bank-Integrated Ombudsman Scheme (RB-IOS) has improved grievance redress mechanisms, and public awareness campaigns like ‘RBI Kehta Hai’ and the e-BAAT programme educate the public on digital payment products and fraud prevention.

- Data Protection: The RBI has implemented data localisation for payments data and guidelines preventing digital lending applications from accessing private information without explicit user consent. Card-on-file tokenisation (CoFT) through card-issuing banks has been enabled to enhance the security of digital payments.

- Cyber Security: To promote the security of digital transactions, measures such as two-factor authentication, increased customer control over card usage, faster turnaround times for transaction failures, and augmented supervisory oversight have been implemented.

- The RBI has issued comprehensive guidelines for IT and Cyber Risk management.

- FinTech Regulation: The RBI has launched the Regulatory Sandbox scheme, the Reserve Bank Innovation Hub, and FinTech Hackathons to encourage FinTech innovations.

- Digital Technologies in Regulation and Supervision: Digital tools are being leveraged to enhance supervisory and monitoring frameworks. The DAKSH system help digitalise supervisory processes.

- Integrated Compliance Management and Tracking System (ICMTS) and Centralised Information Management System (CIMS) are also being implemented to enhance data management and analytics capabilities.

|

Drishti Mains Question: Discuss the major challenges associated with the digitalisation of the Indian economy. How can these challenges be effectively addressed to ensure inclusive and sustainable growth? |

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims:

Q. Consider the following statements: (2021)

- The Governor of the Reserve Bank of India (RBI) is appointed by the Central Government.

- Certain provisions in the Constitution of India give the Central Government the right to issue directions to the RBI in public interest.

- The Governor of the RBI draws his power from the RBI Act.

Which of the above statements are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains:

Q. Implementation of Information and Communication Technology (ICT) based Projects/Programmes usually suffers in terms of certain vital factors. Identify these factors, and suggest measures for their effective implementation. (2019)

4th Anniversary of NEP 2020

For Prelims: National Education Policy (NEP) 2020, Mid Day Meal Scheme, Sustainable Development Goal, PARAKH, NIPUN, Indian Sign Language (ISL), National Research Foundation

For Mains: Significance of Government Policies & Interventions in Education and Issues Related to Children.

Why in News?

Recently, the Union Ministry of Education celebrated the 4th anniversary of the National Education Policy (NEP) 2020 with a week-long campaign called "Shiksha Saptah."

- This campaign is designed to promote and celebrate the achievements and objectives of NEP 2020.

What are Initiatives under Shiksha Saptah?

- Vidyanjali Program:

- Launched in 2021, it is an initiative by the Department of School Education and Literacy, that connects community members and volunteers with government and government-aided schools through an online portal.

- The Vidyanjali portal enables alumni, teachers, scientists, and others to contribute services, materials, or expertise to schools across India, enhancing the learning environment by integrating schools, volunteers, and the community in line with NEP 2020 objectives.

- Tithi Bhojan:

- Under this initiative, people from the community celebrate important days such as childbirth, marriage, birthdays etc. by contributing to the Mid Day Meal Scheme.

- Tithi Bhojan is not a substitute to Mid Day Meal but it supplements or complements Mid Day Meal.

- Cooking competitions at Block, District and State levels are organised to promote innovative menus.

What is National Education Policy 2020?

- About:

- The National Education Policy (NEP) 2020 aims to address India's evolving development needs by overhauling the education system to meet 21st century goals and Sustainable Development Goal 4 (SDG4), while preserving India's cultural heritage.

- It replaced the National Policy on Education, 1986, which was modified in 1992.

- Salient Features:

- Universal Access: Focuses on providing access to education from pre-school through secondary levels.

- Early Childhood Education: Transitions from the 10+2 to a 5+3+3+4 system, including children aged 3-6 in the school curriculum with an emphasis on Early Childhood Care and Education (ECCE).

- Multilingualism: Promotes using mother tongues or regional languages as the medium of instruction up to Grade 5, with options for Sanskrit and other languages. Indian Sign Language (ISL) will be standardised.

- Inclusive Education: Emphasises support for Socially and Economically Disadvantaged Groups (SEDGs), children with disabilities, and the establishment of "Bal Bhavans."

- Gross Enrolment Ratio (GER) Enhancement: Aim to raise the Gross Enrolment Ratio from 26.3% to 50% by 2035, adding 3.5 crore new seats.

- Research Focus: Establishes the National Research Foundation to enhance research culture and capacity.

- Language Preservation: Supports Indian languages through the Institute of Translation and Interpretation (IITI) and strengthens language departments.

- Internationalisation: Encourages international collaborations and the entry of top-ranked foreign universities.

- For example, in 2023 UGC released regulations to facilitate foreign universities to set up campuses in India.

- Funding: Targets increasing public investment in education to 6% of GDP.

- PARAKH Assessment Center: Introduces PARAKH (Performance Assessment, Review, and Analysis of Knowledge for Holistic Development) for competency-based and holistic assessments.

- Gender Inclusion Fund: Establishes a fund to promote gender equality in education and support initiatives for disadvantaged groups.

- Special Education Zones: Creates Special Education Zones to cater to the needs of disadvantaged regions and groups, reinforcing the commitment to equitable access to quality education.

What are the Achievements of the NIPUN Bharat Mission?

- About:

- A major recommendation of NEP 2020 was to ensure that children develop foundational literacy and numeracy skills by Grade 3.

- In pursuit of this goal, the Centre introduced the NIPUN (National Initiative for Proficiency in Reading with Understanding and Numeracy) Bharat Mission in 2021.

- Demographic Trends:

- Enrollment levels for children aged 6-14 have risen significantly, reaching over 90% in rural India by the early 2000s due to the Sarva Shiksha Abhiyan.

- Between 2010 and 2022, the percentage of mothers with children aged 4-8 who studied beyond Grade 5 increased from 35% to nearly 60%.

- The proportion of mothers with over 10 years of schooling also grew from under 10% to over 20%.

- Despite increased education, female labour force participation in India remains low at 37%, with younger women (15-29 years) showing even lower participation rates.

- Educated mothers can significantly support their children's learning, especially given the high workforce participation of young men in rural areas.

- The Covid-19 pandemic has increased parental involvement in education, setting a precedent for greater engagement.

- To achieve the goals of the NIPUN Bharat Mission, further encouragement of family, especially maternal involvement, is crucial for improving foundational literacy and numeracy in children.

|

Drishti Mains Question Discuss the measures proposed in NEP 2020 to promote inclusive education. How does the policy plan to support Socially and Economically Disadvantaged Groups (SEDGs)? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Which of the following can be said to be essentially the parts of ‘Inclusive Governance’? (2012)

- Permitting the Non-Banking Financial Companies to do banking

- Establishing effective District Planning Committees in all the districts

- Increasing the government spending on public health

- Strengthening the Mid-day Meal Scheme

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 3 and 4 only

(c) 2, 3 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Mains:

Q. National Education Policy 2020 is in conformity with the Sustainable Development Goal-4 (2030). It intends to restructure and reorient the education system in India. Critically examine the statement. (2020)

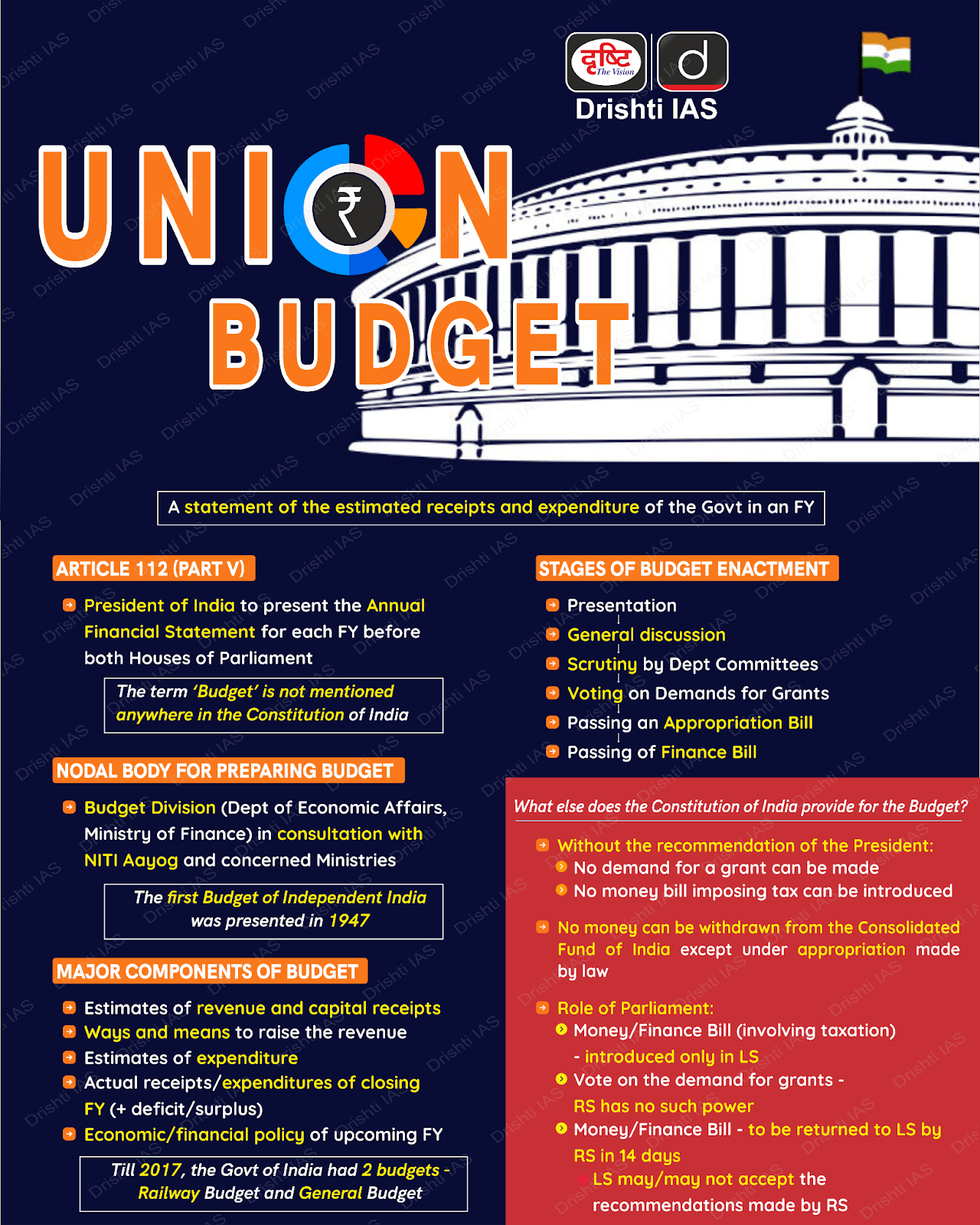

Schemes in Budget 2024 for Rural and Tribal Development

For Prelims: Union Budget, Parliament, Pradhan Mantri Gram SadakYojana (PMGSY), Interim Budget, Pradhan Mantri Gram Sadak Yojana (PMGSY), Jal Jeevan Mission, Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan (PM JANMAN)

For Mains: Significance of Parliament and Government Policies & Interventions for Indian Economy.

Why in News?

Recently, the Union Budget 2024-25 was presented in the Parliament. It was the first general budget of the 18th Lok Sabha.

- In this budget, the government has announced several measures for rural development (PMGSY) and tribal welfare like PM Janjatiya Vikas Mission (PMJVM).

What is Pradhan Mantri Gram Sadak Yojana (PMGSY) ?

- About: Launched on 25th December 2000, to provide all-weather road connectivity to unconnected habitations.

- Eligibility: Unconnected habitations with a population of 500+ in plain areas and 250+ in North-Eastern, Himalayan, Desert, and Tribal Areas (as per the 2001 census).

- Unconnected Habitation is a habitation located at least 500 metres (1.5 km in hills) from an all-weather road.

- Core Network: The essential network of roads required to provide basic access to social and economic services through at least one all-weather road.

- Funding Pattern: The Union Government covers 90% of project costs in North-Eastern and Himalayan States, and 60% in other states, with allocations based on sanctioned project values.

- Construction Standards: Rural roads are constructed according to the Indian Roads Congress (IRC) guidelines, which have been the apex body of highway engineers since 1934.

- Eligibility: Unconnected habitations with a population of 500+ in plain areas and 250+ in North-Eastern, Himalayan, Desert, and Tribal Areas (as per the 2001 census).

- PMGSY - Phase I:

- It was launched in 2000 as a 100% centrally sponsored scheme.

- Under the scheme, 1,35,436 habitations were targeted for providing road connectivity and 3.68 lakh km for the upgradation of existing rural roads to ensure full farm-to-market connectivity.

- PMGSY - Phase II:

- It was launched in 2013 for the upgradation of 50,000 km of the existing rural road network to improve its overall efficiency.

- While the ongoing PMGSY - I continued, under PMGSY phase II, the roads already built for village connectivity were to be upgraded to enhance rural infrastructure.

- The cost was shared between the centre and the states/UTs.

- Road Connectivity Project for Left Wing Extremism Affected Areas (RCPL WEA), was launched in 2016 for the construction of rural roads in LWE areas.

- PMGSY - Phase III:

- It was approved by the Cabinet in July 2019.

- It gives priorities to facilities like:

- Gramin Agricultural Markets (GrAMs): The retail agricultural markets close to the farm gate, that promote and service a more efficient transaction of the farmers’ produce.

- Higher Secondary Schools and

- Hospitals.

- Under this, it is proposed to consolidate 1,25,000 km of road length in the States. The duration of the scheme is 2019-20 to 2024-25.

- Progress of the Scheme: It has already completed over 7 lakh km of roads out of a sanctioned 8.25 lakh km with an investment of Rs. 2,70,000 crore. Additionally, a total of 1,61,561 unconnected habitations have been provided all-weather road connectivity under PMGSY.

- PMGSY - Phase IV:

- Phase IV of Pradhan Mantri Gram Sadak Yojana (PMGSY) has been announced in the Union Budget 2024-25 to connect 25,000 villages with all-weather roads.

- An amount of Rs 19,000 crore has been allocated for this for the FY 2024-25 (FY-25).

Indian Roads Congress (IRC)

- It was established in 1934 with the aim of advancing road infrastructure in India by uniting professionals and stakeholders in road development.

- Its key functions include setting standards, conducting research, and hosting knowledge-sharing events.

- Its membership spans government, private industry, and academia.

- It influences national road policies, supports bodies like the National Highway Authority of India (NHAI), and advocates for sustainable and environmentally friendly practices in road construction and maintenance.

What are the Key Highlights of the Union Budget 2024 Regarding Tribal Development?

- Launch of Pradhan Mantri Janjatiya Unnat Gram Abhiyan (PM JUGA):

- The launch of the PM JUGA Scheme marks a major effort to improve the living standards of tribal families in 63,000 villages.

- The scheme will emphasise "saturation coverage" in tribal-majority villages and aspirational districts. It is anticipated to benefit around 5 crore tribal individuals by improving their access to essential services and socio-economic opportunities.

- Budget Allocation for Different Schemes Related to Tribals:

- Eklavya Model Residential Schools (EMRS) aimed at providing quality education to ST students have been allocated Rs 6,399 crore, an increase of Rs 456 crore from FY 2023-24.

- EMRS is a scheme for model residential schools for STs across India, started in 1997-98 under the Ministry of Tribal Affairs.

- The aim is to build schools on par with Jawahar Navodaya Vidyalayas and Kendriya Vidyalayas, with a focus on preserving local art, culture, sports, and skill development.

- Post-Matric Scholarship for ST Students allocation has increased from Rs 1,970.77 crore to Rs 2,432.68 crore.

- The Prime Minister's Janjati Vikas Mission (PMJVM) has faced a budget reduction of Rs 136.17 crore this year.

- PMJVM aims to strengthen tribal entrepreneurship, facilitate livelihood opportunities, and promote efficient, equitable, self-managed, and optimal use of natural resources, Agri/Non-Timber Forest Products (NTFPs)/ Non-farm enterprises.

- The PM DAKSH scheme allocation has been raised from Rs 92.47 crore to Rs 130 crore.

- It is a central sector scheme by the Department of Social Justice and Empowerment aimed at providing skills training to individuals from SC and ST.

- The National Overseas Scholarship Scheme for Scheduled Castes allocation has been increased to Rs 95 crore from Rs 50 crore, enhancing financial support for higher education in foreign universities.

- The NAMASTE scheme received an increased allocation of Rs 116.94 crore in FY24, up from Rs 97.41 crore in FY23.

- NAMASTE stands for National Action for Mechanised Sanitation Ecosystem.

- Launched in 2022, the NAMASTE Scheme is a Central Sector initiative replacing the Self-Employment Scheme for the Rehabilitation of Manual Scavengers (SRMS) from 2007. It will be implemented across over 4,800 Urban Local Bodies (ULBs) until 2025-26.

- It has been launched to ensure the safety and dignity of sanitation workers in urban areas by eradicating manual scavenging through mechanised sewer cleaning in India as well as providing sustainable livelihood to these workers.

- Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan (PM JANMAN), launched in Union Budget 2023, has been continued with the allocation of Rs 25 crores in Union Budget 2024.

- It aims to provide essential amenities such as secure housing, clean drinking water, sanitation, improved access to education, health, and nutrition, as well as enhanced road and telecom connectivity, and sustainable livelihood opportunities to PVTGs households and habitats.

- Eklavya Model Residential Schools (EMRS) aimed at providing quality education to ST students have been allocated Rs 6,399 crore, an increase of Rs 456 crore from FY 2023-24.

What were the Other Schemes and their Allocations Announced in the Union Budget 2024-25?

- Pradhan Mantri Awas Yojana (PMAY):

- Objective of PMAY-G: To provide affordable housing to the underprivileged, with a total target of 2.95 crore rural houses since its launch in 2016. As of July 2024, nearly 2.94 crore houses have been sanctioned.

- Unit Cost Increase: The government has decided to increase the unit cost under PMAY-G from Rs 1.2 lakh to Rs 2 lakh in plain areas, and from Rs 1.3 lakh to Rs 2.20 lakh in Integrated Action Plan (IAP) districts, hilly regions, and difficult areas from 2024-25 onward.

- IAP is a government initiative in India aimed at promoting development in certain underserved areas.

- Target and Allocation: 3 crore additional houses under PMAY in rural and urban areas.

- Of these, 2 crore homes will be constructed in villages under PMAY-Gramin (PMAY-G) with an allocation of Rs 54,500 crore.

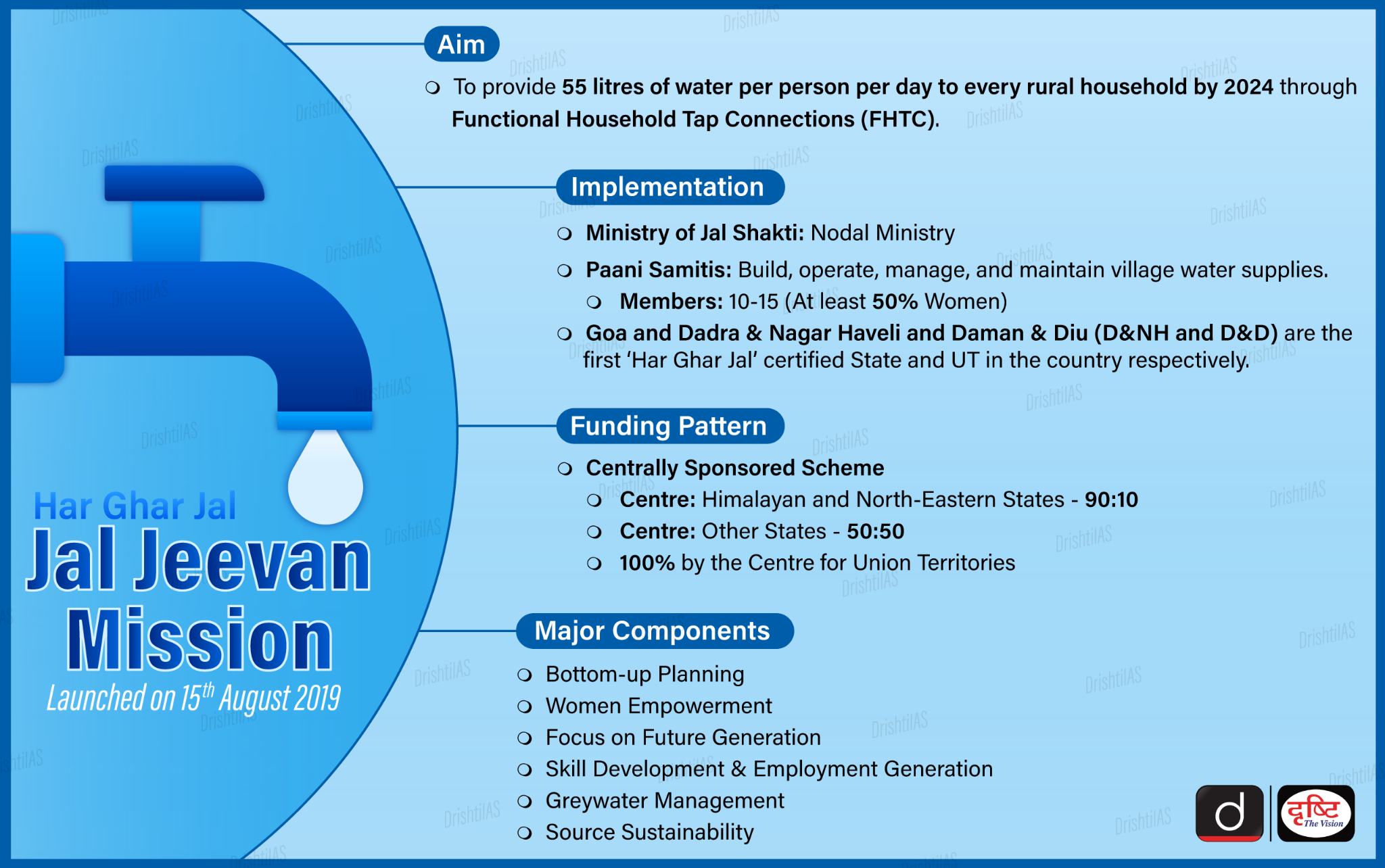

- Jal Jeevan Mission (JJM) (Rural): Allocation: Rs 69,926.65 crore.

- Objective: To provide a safe and adequate drinking water supply to all rural households, enhancing public health and sanitation.

- About JJM: Launched in 2019, it envisages a supply of 55 litres of water per person per day to every rural household through Functional Household Tap Connections (FHTC) by 2024.

- Achievement: It has provided tap water connections to 15 crore rural households nationwide. It has rapidly increased rural tap connection coverage from 3 crore to 15 crore between 2019 and 2024. 8 states and 3 Union Territories have achieved 100% coverage, with others like Bihar, Uttarakhand, Ladakh, and Nagaland making substantial progress.

- Rural Land Reforms:

-

Objective: These reforms aim to facilitate credit flow and improve land management, thereby enhancing agricultural productivity.

-

Reforms:

- Assignment of Unique Land Parcel Identification Numbers (Bhu-Aadhaar).

- Digitization of cadastral maps.

- Survey of map subdivisions based on current ownership.

- Establishment of a land registry.

- Linking land records to a farmers' registry.

-

What is the Jal Jeevan Mission (Urban)?

- In the Budget 2021-22, Jal Jeevan Mission (Urban) was announced under the MInistry of Housing of Urban Affairs to provide universal coverage of water supply to all households in urban areas through functional taps in all statutory towns in accordance with Sustainable Development Goal- 6.

- It complements the Jal Jeevan Mission (Rural).

- Objectives of Jal Jeevan Mission (Urban):

- Securing tap and sewer connections.

- Rejuvenation of water bodies.

- Creating a circular water economy.

|

Drishti Mains Question What are the Initiatives taken by the Union Government for Tribal and Rural Development? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (2020)

(a) Long standing parliamentary convention

(b) Article 112 and Article 110(1) of the Constitution of India

(c) Article 113 of the Constitution of India

(d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

Ans: (d)

Mains:

Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)

Surge in Tax Concessions on Political Donations

For Prelims: Tax concessions, Income Tax Act, 1961, Political party, Companies Act, 2013, Electoral Bond Scheme

For Mains: Impacts of Tax concessions for political donations in India, Regulating political donations

Why in News?

The latest financial data reveals a significant increase in tax concessions provided for donations to political parties, with the government granting nearly Rs 4,000 crore in fiscal year 2022-23.

- This rise highlights the growing trend of electoral funding through tax deductions and surge in tax concessions reflects broader shifts in political finance and its implications for fiscal policy.

What are the Tax Concessions on Political Donations?

- About: A tax concession is a reduction in the amount of tax that a particular group or organisation has to pay, or a change in the tax system that benefits them.

- In India, tax concessions on political donations are provided under the Income Tax Act, 1961.

- Section 80GGB, of Income Tax Act, 1961 allows Indian companies to claim deductions for contributions made to political parties or electoral trusts. However, donations made in cash are not eligible for deductions.

- Section 80GGC, of Income Tax Act, 1961 applies to individuals, firms, and other non-corporate entities. Similar to Section 80GGB, it allows deductions for contributions to political parties or electoral trusts, excluding cash donations.

- Deductions apply to donations made via cheques, account transfers, or electoral bonds.

- The Income Tax Act defines a political party as one registered under Section 29A of the Representation of the People Act, 1951.

- Total Tax Concessions: In FY 2022-23, the total tax concessions for donations to political parties amounted to approximately Rs 3,967.54 crore.

- In 2021-22, the tax concessions were Rs 3,516.47 crore, indicating a 13% increase from the previous fiscal year.

- Revenue Impact of These Deductions: Since 2014-15, the total revenue impact of tax concessions on political donations has reached approximately Rs 12,270.19 crore.

- In 2022-23, Rs 2,003.43 crore of the tax concessions came from donations by corporate taxpayers under Section 80GGB.

- Deductions claimed by individuals under Section 80GGC amounted to Rs 1,862.38 crore.

What are the Implications of Surge in Tax Concessions?

- Rising Electoral Funding: The increasing tax concessions for political donations highlight a growing trend in electoral financing, suggesting that political parties are relying more heavily on contributions from corporations and individuals.

- This could potentially alter the balance of power and influence in political decision-making.

- Need for Transparency: With the surge in political donations, there is a pressing need for greater transparency in political financing to ensure accountability and prevent undue influence on the political process.

- The sharp increase in concessions raises questions about the impact on public finances and the need for potential reforms in political funding policies.

- Revenue Loss: Increased tax concessions can lead to a significant reduction in government revenue. This can affect the government’s ability to fund public services and infrastructure projects.

- Market Distortions: Excessive concessions might create market distortions, favouring certain sectors or companies over others, which can lead to inefficiencies.

- Sustainable Growth: While tax concessions can boost short-term growth, they need to be balanced with long-term fiscal sustainability. Over-reliance on concessions can undermine the tax base and fiscal health.

What are the Regulations on Political Donations in India?

- Representation of People Act, 1951: Section 29B in RPA, 1951 allows political parties to accept voluntary contributions from any person or company, except government companies and foreign sources.

-

Companies Act, 2013: Section 182 of the Companies Act, 2013 allows Indian companies to contribute any amount to a political party, with conditions such as authorisation by the Board, non-cash payment, and disclosure in the company's profit and loss (P&L) account.

- Income Tax Act, 1961: Indian companies and individuals are eligible for tax deductions on donations made to political parties or electoral trusts under Section 80GGB and 80GGC.

- Foreign Contributions (Regulations) Act, 2010 (FCRA): The Representation of People Act, 1951 and the FCRA bar political parties from accepting donations from a 'foreign source', but Indian companies with foreign investment up to the permitted limits are no longer treated as a 'foreign source' and can now make political contributions under the Companies Act, 2013.

- Electoral Bonds Scheme: Introduced in 2018, electoral bonds allow donors to contribute to political parties anonymously. The bonds are purchased via authorised banks and are valid for 15 days.

- In February 2024, the Supreme Court of India unanimously struck down the Electoral Bond Scheme and associated amendments as unconstitutional, ruling that the scheme violated the right to information.

Way Forward

- Reviewing Tax Concessions: Revisiting the framework for tax concessions on political donations can help ensure they align with broader fiscal policies and do not unduly impact government revenues.

- Setting reasonable limits on deductions and exploring alternative mechanisms for political funding could enhance the sustainability of the financing system.

- Public Financing: It refers to government financial support for political parties and candidates to facilitate their participation in the electoral process, reducing reliance on private donations and the potential influence of vested interests.

- Many countries provide public funding for political parties based on various criteria, such as past election performance, membership fees, and private donations. Some places, like Seattle, have experimented with "democracy vouchers" where eligible voters receive vouchers to donate to their chosen candidates.

- Enhanced Transparency: Mandating comprehensive disclosure of all political donations, including those made through electoral bonds. And establish an independent commission with strong oversight over political finance.

|

Drishti Mains Question: Q. Discuss the trends in tax concessions for political donations in India. How do these trends impact the political finance landscape and fiscal policy? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which one of the following effects of creation of black money in India has been the main cause of worry to the Government of India? (2021)

(a) Diversion of resources to the purchase of real estate and investment in luxury housing.

(b) Investment in unproductive activities and purchase of precious stones, jewellery, gold, etc.

(c) Large donations to political parties and growth of regionalism.

(d) Loss of revenue to the State Exchequer due to tax evasion.

Ans: (d)

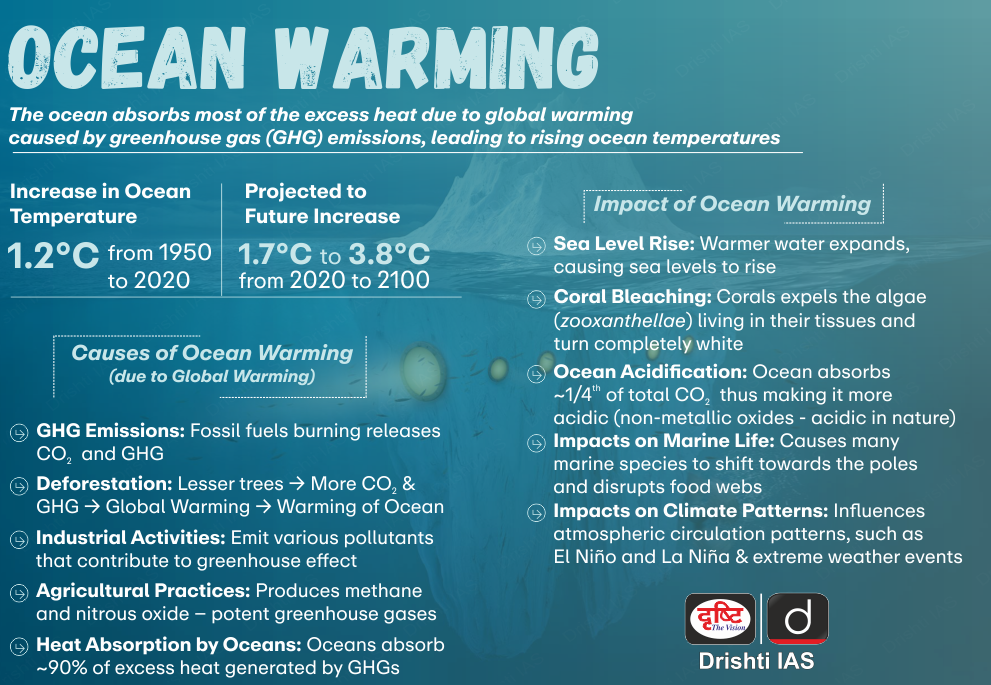

Ocean Circulation and Climate Change

Why in News?

Recently, a study published in Nature Communications has gained attention for its unexpected findings about the ocean's role in climate change.

- The study reveals that a weaker ocean circulation might increase atmospheric CO2 levels, contrary to previous assumptions.

What is the Relation Between Climate Change and Ocean Circulation?

- The Role of Overturning Circulation: Ocean overturning circulation acts as a global conveyor belt, moving water and nutrients across the ocean. It is a two-fold process.

- As surface waters absorb CO2 and cool, they become denser and sink into the deep ocean, transporting carbon away from the atmosphere.

- Deep waters upwell, bring nutrients and carbon back to the surface, where they support marine life and help regulate atmospheric CO2 levels.

- Traditional Views on Ocean Circulation and Climate Change: As climate change progresses, scientists predict a weakening of ocean overturning circulation due to various factors.

- Melting Ice Sheets: Particularly around Antarctica, melting ice sheets add freshwater to the ocean, disrupting circulation patterns.

- Temperature Changes: Global warming affects ocean temperature gradients, further impacting circulation.

- The traditional view is that weaker circulation would mean less carbon is stored in the deep ocean, but the ocean's carbon sink effect would stay balanced due to less carbon coming back up.

- New Insights from Research: New research reveals a complex feedback mechanism involving ocean circulation, iron availability, microorganisms, and ligands, showing that weaker ocean circulation could increase atmospheric CO2 levels contrary to previous beliefs.

- Ligands are organic molecules that bind with iron to keep it soluble and accessible for phytoplankton growth, but their availability can limit the effectiveness of iron fertilization efforts globally.

- Implications for Climate Change Mitigation: The study highlights the need to reconsider the ocean’s role in climate change mitigation, as weaker ocean circulation could reduce carbon sink effectiveness, leading to higher atmospheric CO2 and exacerbating global warming.

What is Meridional Overturning Circulation (MOC)?

- Definition: The Meridional Overturning Circulation (MOC) is a crucial component of global ocean circulation, moving water, heat, salt, carbon, and nutrients primarily in the north-south direction within and between ocean basins. It plays a vital role in regulating the Earth's climate.

- Mechanism:

- Northward Flow: In the Atlantic Ocean, warm and salty surface water is transported from the South Atlantic towards the Nordic Seas (near Greenland, England, and Northern Canada). Here, it cools, becomes denser, and sinks to form deep water currents that flow southwards towards Antarctica.

- Antarctic Contribution: Near Antarctica, even denser waters are formed. These waters flow north along the seafloor into the North Atlantic, where they rise and mix with other waters before flowing back to the south.

- Significance:

- The MOC is responsible for about two-thirds of the oceanic northward heat transport, making it essential for climate regulation.

- Changes in the MOC influence regional and global heat distribution, affecting climate and weather patterns.

- Cycle Duration: The entire circulation cycle of the MOC, also known as the oceanic conveyor belt, is extremely slow. It takes approximately 1,000 years for a parcel (any given cubic meter) of water to complete its journey along the belt.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. At the national level, which ministry is the nodal agency to ensure effective implementation of the Scheduled Tribes and Other Traditional Forest Dwellers (Recognition of Forest Rights) Act,2006? (2021)

(a) Ministry of Environment, Forest and Climate Change

(b) Ministry of Panchayati Raj

(c) Ministry of Rural Development

(d) Ministry of Tribal Affairs

Ans: (d)

Q. Stiglitz Commission established by the President of the United Nations General Assembly was in the international news. The commission was supposed to deal with (2010)

(a) The challenges posed by the impending global climate change and prepare a road map

(b) The workings of the global financial systems and to explore ways and means to secure a more sustainable global order

(c) Global terrorism and prepare a global action plan for the mitigation of terrorism

(d) Expansion of the United Nations Security Council in the present global scenario

Ans: (b)

Mains:

Q. Assess the impact of global warming on the coral life system with examples. (2019)

Discovery of Dark Oxygen

Why in News?

Recently, scientists reported an unknown process is producing oxygen deep in the world’s oceans, where photosynthesis can’t occur due to the lack of sunlight.

- This discovery is significant because oxygen supports marine life and suggests that there may be previously unknown ecosystems.

What is Dark Oxygen?

- About:

- Scientists observed an unexpected increase in oxygen concentration in some areas of the abyssal zone (where sunlight is extremely low and insufficient for photosynthesis).

- Researchers noted that this finding represents a new source of oxygen where photosynthesis does not occur, and termed it as ‘dark oxygen’.

- Possible Cause of Generation of Dark Oxygen:

- Typically oxygen is provided by the ‘Great Conveyor Belt’, a global circulation system which should decrease without local production, as small animals consume it.

- One hypothesis for oxygen production is that polymetallic nodules are transporting electric charges that split water molecules, releasing oxygen.

- Polymetallic nodules are lumps of iron, manganese hydroxides, and rock found on the ocean floor.

- However, the exact energy source for the nodules’ ability to produce oxygen remains unclear.

- Place of Study:

- The study was conducted in the Clarion-Clipperton Zone Region off Mexico's west coast.

- The Zone is noted for having the highest concentration of polymetallic nodules in the world.

- The study was conducted in the Clarion-Clipperton Zone Region off Mexico's west coast.

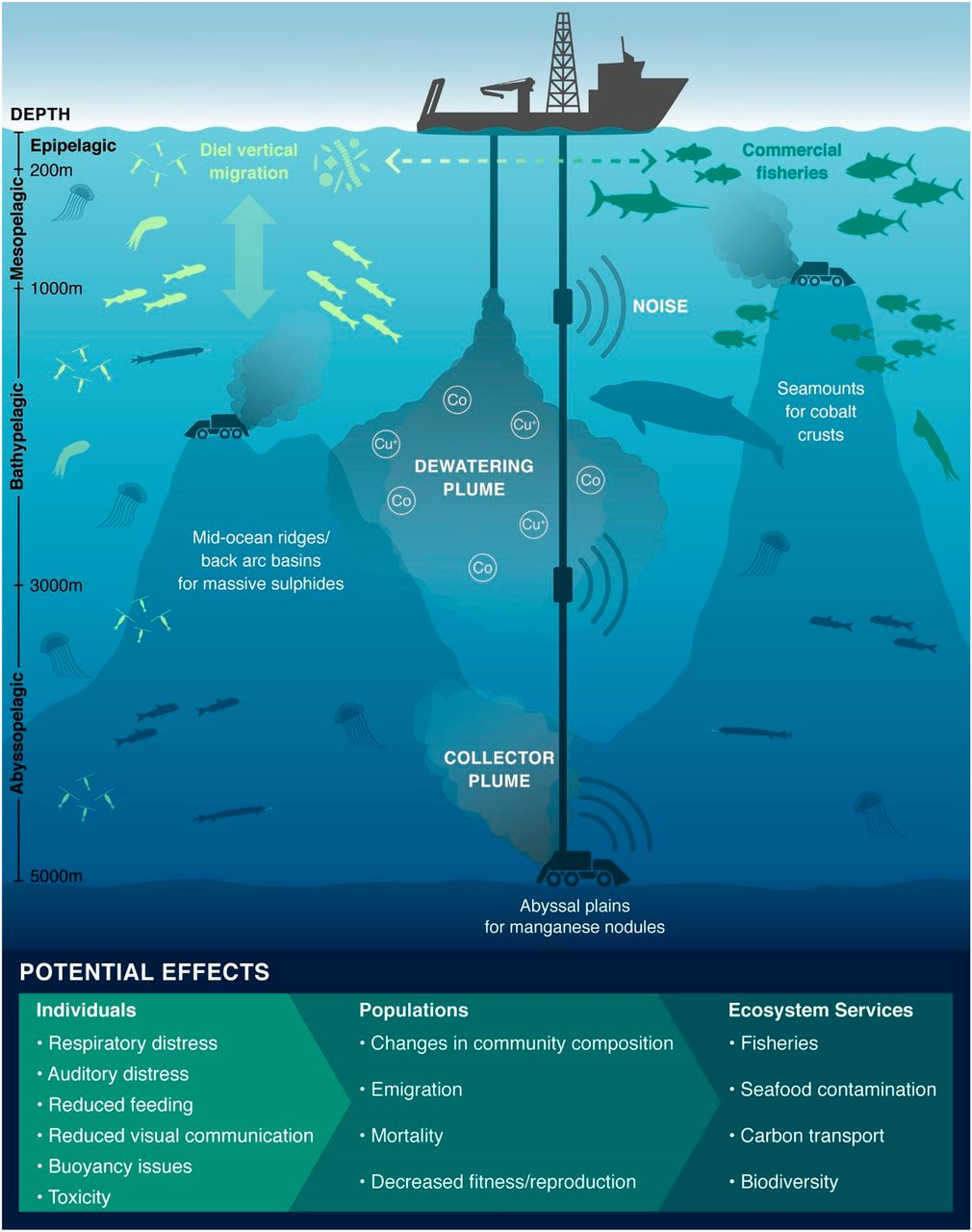

What is Deep-Sea Mining?

- About:

- Deep-sea mining involves extracting mineral deposits and metals from the ocean floor. There are three main types of Deep-sea mining.

- Removing polymetallic nodules rich in deposits from the seabed.

- Mining massive deposits of seafloor sulfides.

- Extracting cobalt crusts from rock formations.

- These nodules, deposits, and crusts contain valuable materials like nickel, rare earth elements, and cobalt, which are essential for batteries, renewable energy technologies, and everyday devices such as cell phones and computers.

- The deep-sea mining is anticipated to become a major marine resource extraction activity in the coming decades due to availability of polymetallic nodules.

- Deep-sea mining involves extracting mineral deposits and metals from the ocean floor. There are three main types of Deep-sea mining.

- Environmental Concerns:

- The discovery of ‘dark oxygen’ raises concerns about potential damage to ecosystems that rely on this oxygen source. Experts worry that deep-sea mining (that removes polymetallic nodules) could be harmful to these marine environments.

- In November 2023, a study indicated that deep-sea mining could harm deep-sea jellyfish (by creating mud plumes in ocean water which interfere with the nutrient and reproductive cycle of marine species).

- Limited scientific knowledge of abyssal zone ecosystems compared to those aboveground, may complicate efforts to gauge the potential impact of deep-sea mining on these ecosystems and their role in global climate processes.

- Indian Context:

- India intends to apply for licenses to explore deep-sea minerals in the Pacific Ocean.

- Also, India was the first country to receive the status of a ‘Pioneer Investor’ in 1987 and was given an area of about 1.5 lakh sq. km in the Central Indian Ocean Basin (CIOB) for nodule exploration.

- India’s exclusive rights to explore polymetallic nodules from seabed in the Central Indian Ocean Basin was extended in 2017 for five years.

- India in 2024, applied for Rights to Explore the Indian Ocean Seabed beyond its jurisdiction, including Cobalt-Rich Afanasy Nikitin Seamount (AN Seamount)

- India’s Ministry of Earth Sciences is developing a submersible vehicle (Samudrayaan Misssion) as part of its ‘Deep Ocean Mission’ to search for and mine similar resources in the Indian Ocean.

- India intends to apply for licenses to explore deep-sea minerals in the Pacific Ocean.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Consider the following statements:

1. The Global Ocean Commission grants licences for seabed exploration and mining in international waters.

2. India has received licences for seabed mineral exploration in international waters.

3. ‘Rare earth minerals’ are present on the seafloor in international waters.

Which of the statements given above are correct?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Ek Ped Maa Ke Naam Campaign

The Ministry of Defence will undertake a massive 15 lakh trees plantation drive across the country on the occasion of 78th Independence Day ceremony on 15th August 2024.

- The plantation drive is part of the 'Ek Ped Maa Ke Naam' campaign, to be conducted through the three Services, Defence Research and Development Organisation (DRDO), Defence PSUs, Controller General Defence Accounts (CGDA), National Cadet Corps (NCC), Sainik Schools, and Ordnance factories.

- The Prime Minister launched the 'Ek Ped Maa Ke Naam' campaign on World Environment Day 2024, urging all to plant a tree as a tribute to mothers.

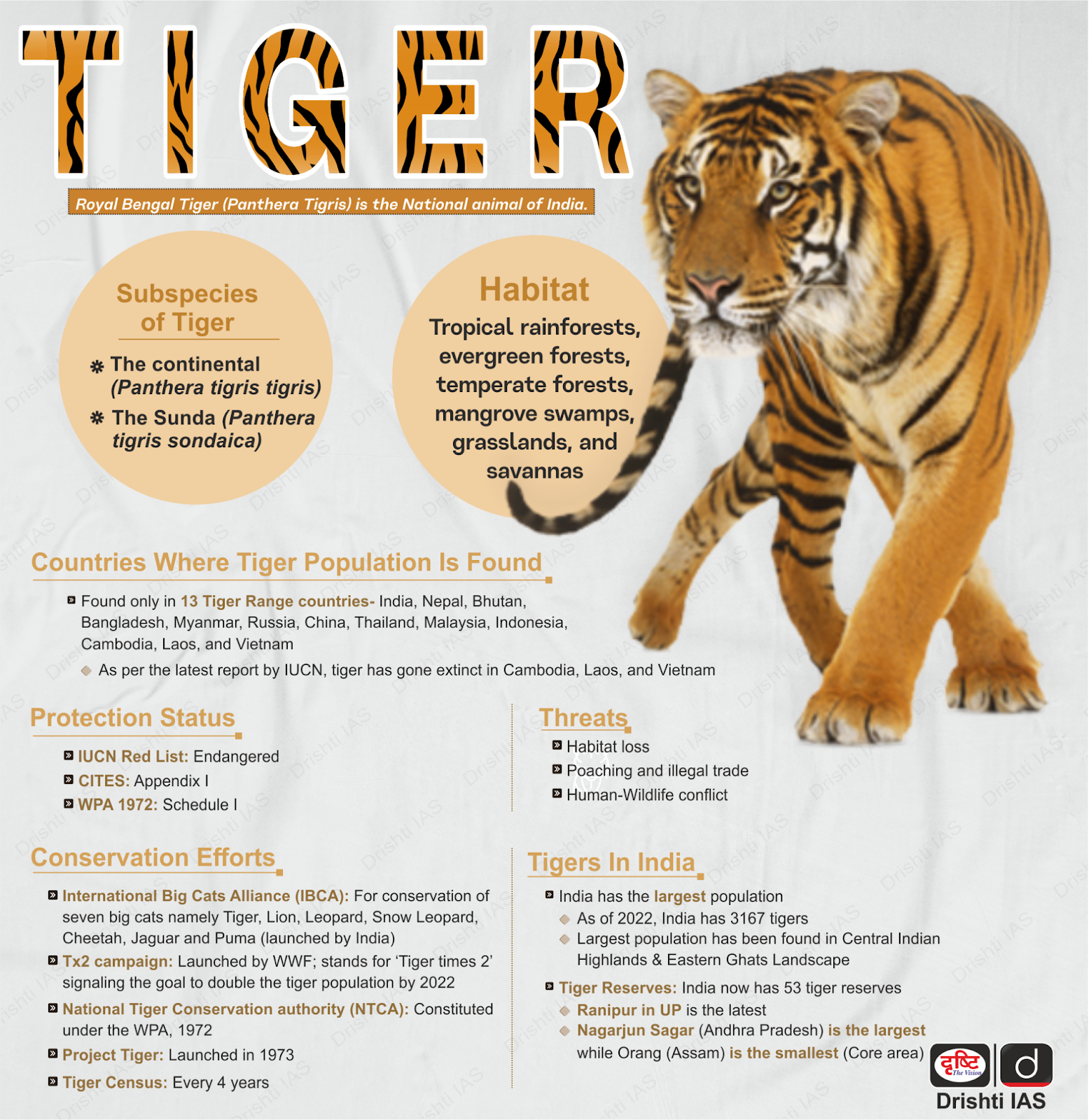

International Tiger Day 2024

International Tiger Day is celebrated every year on 29th July, to raise awareness about the magnificent yet endangered animal.

- The day is a reminder of the collective effort of 13 tiger range countries to double the wild tigers' population by 2022 through the TX2 global goal.

- The TX2 goal is a global commitment to double the world's wild tigers by 2022.

- The goal has been set by the World Wildlife Fund (WWF) through the Global Tiger Initiative, Global Tiger Forum and other critical platforms.

- The day was first established in 2010 at the Saint Petersburg Tiger Summit.

- The main aim is to urge the international community to intensify efforts for wildlife protection through expanding protected areas, promoting sustainable livelihoods, and maintaining sufficient forest area in tiger roaming nations.

Employment Data Collection Mechanism

The Union government is set to create an Employment Data Collection Mechanism (EDCM) in collaboration with all Ministries to address concerns over the lack of comprehensive data on employment trends, following concerns highlighted in the Economic Survey for 2023-24.

- The EDCM aims to improve employment data and address gaps in employment, unemployment, wage loss, and job loss data.

- The government is making reforms in sectors like labour, logistics, infrastructure, and manufacturing to boost employment. Initiatives such as PM Gati Shakti, Production Linked Incentive schemes, Bharatmala, and Sagarmala, and the Employment-linked Incentive package are aimed at generating employment.

- The country's working-age population is expected to grow by 9.7 million per year from 2021-31 and 4.2 million per year from 2031-41.

- The Union Budget 2024-2025 allocates Rs 2 lakh crore for employment and skilling schemes, including three "employment-linked incentive" schemes under the Prime Minister's package.

- The schemes focus on enrolling in the Employees’ Provident Fund Organisation (EPFO) and provide incentives for new employees and their employers. These schemes are expected to benefit a total of 290 lakh youth entering employment.

- The Central and State governments have various programmes and projects to create direct and indirect employment, but so far, they have not been effectively utilised to estimate employment generation.

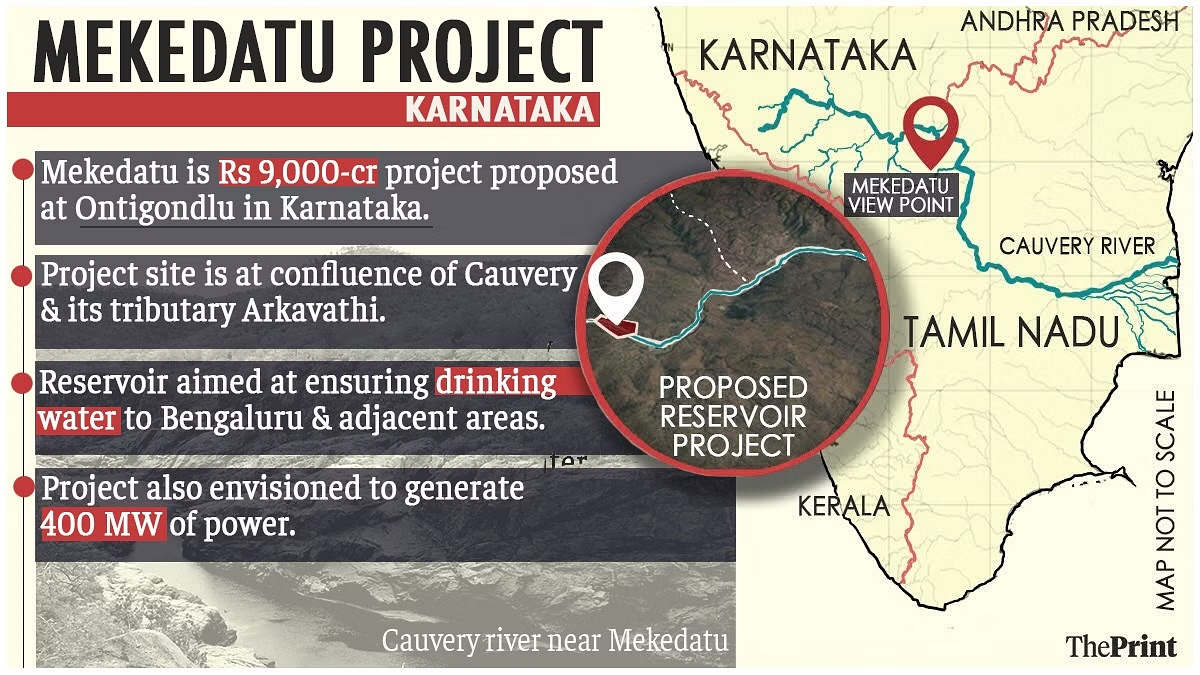

Mekedatu Project

Karnataka Chief Minister(CM) has highlighted the Mekedatu balancing reservoir project as a key solution to address water-sharing issues with Tamil Nadu during monsoon distress years, asserting that the project would benefit both states, particularly in times of water scarcity.

- The Mekedatu multi-purpose project aims to build a balancing reservoir near Kanakapura to provide drinking water to Bengaluru and generate 400 MW of power.

- Mekedatu is a deep gorge at the confluence of the Cauvery and Arkavathi rivers.

- The Supreme Court, has settled the sharing of Cauvery water, with Karnataka required to release 177.25 thousand million cubic (tmc) feet, but only during a normal year, not in a year of deficit rainfall. Tamil Nadu has a right to 177.25 tmc ft, but only during a normal monsoon.

- Karnataka Chief Minister(CM) emphasises that the Mekedatu reservoir will help meet Bengaluru's drinking water needs and enable Karnataka to release water to Tamil Nadu during a distress year, as 65 tmc ft of water can be impounded, which would otherwise end up in the sea.

- However, Tamil Nadu, the lower riparian state, opposes the project as it argues that the Mekadatu dam would significantly reduce the water flow downstream, negatively impacting the state's agricultural activities and water supply, and the Cauvery tribunal and Supreme Court order require the lower riparian state's no-objection for any project on the Cauvery river.

Read more: Mekedatu Project

.png)