Indian Heritage & Culture

Amravati as a Buddhist Site

For Prelims: Raja Vessareddy Nayudu, Amravati Stupa, Magadh, Emperor Ashoka, Buddhist council, Nagarjunakonda, Shaivism, Megalithic burials, Mahayana Buddhism, Acharya Nagarjuna, Amravati school of art

For Mains: Amravati School of Art, Indian Architecture

Why in News?

Recently, the Finance Minister announced Rs 15,000 crore in financial support for Andhra Pradesh to build its capital city, Amravati, and boost other development activities in the state.

- This has brought back focus on Amravati, a site of immense historical and spiritual significance in Andhra Pradesh that remains relatively unrecognised.

What are the Key Facts About Amravati and Andhra Buddhism?

- Historical Evolution:

- In the late 1700s, Raja Vessareddy Nayudu unknowingly discovered ancient limestone ruins in Andhra’s Dhanyakatakam village, which he and the locals used for construction, leading to the renaming of the village to Amravati.

- The systematic destruction of the ruins continued until 1816, when Colonel Colin Mackenzie's intensive survey, despite causing further damage, led to the rediscovery of the grand Amravati Stupa.

- In 2015, the Andhra Pradesh Chief Minister announced the new capital, Amaravati, inspired by the historic Buddhist site, aiming to develop it into a modern city akin to Singapore.

- Amravati and Andhra Buddhism:

- Buddhism, which emerged in the fifth century BCE in the ancient kingdom of Magadh (present-day Bihar), made its way to Andhra Pradesh mainly through trade routes in Andhra Pradesh.

- Buddhism was founded by Siddhartha Gautama, who attained enlightenment and became known as the Buddha.

- The first significant evidence of Buddhism in Andhra Pradesh dates back to the 3rd century BCE when Emperor Ashoka set up an inscription in the region, providing a major impetus to its spread.

- Monks from Andhra were present at the first Buddhist council held in 483 BCE at Rajgir, Bihar.

- Buddhism thrived in the region for nearly six centuries until the 3rd century CE, with isolated sites like Amravati, Nagarjunakonda, Jaggayapeta, Salihundam, and Sankaram continuing to practice the religion until the 14th century CE.

- Historians note that Buddhism's presence in Andhra coincided with its first urbanisation process, significantly aided by oceanic trade, which facilitated the religion's spread.

- Buddhism, which emerged in the fifth century BCE in the ancient kingdom of Magadh (present-day Bihar), made its way to Andhra Pradesh mainly through trade routes in Andhra Pradesh.

- Difference Between the Nature of Northern Buddhism and Andhra Buddhism:

- Merchant Patronage: In Andhra, merchants, craftsmen, and wandering monks played a crucial role in the spread of Buddhism, contrasting with the royal patronage (king Bimbisara or Ajatashatru) seen in North India.

- Influence on Political Rulers: Traders' success and their association with Buddhism influenced Andhra's political rulers, who issued inscriptions supporting the Buddhist sangha, suggesting a bottom-up spread of Buddhism.

- Integration of Local Practices: Buddhism in Andhra integrated local religious practices, such as megalithic burials, and Goddess and Naga (snake) worship, into its doctrines, reflecting a unique adaptation of Buddhism to regional traditions.

- Significance of Amravati in Buddhism:

- Amravati is renowned for being the birthplace of Mahayana Buddhism, one of the major branches of Buddhism that emphasizes the path of the Bodhisattva.

- Acharya Nagarjuna, a prominent Buddhist philosopher, lived in Amravati and developed the Madhyamika philosophy, focusing on the concept of emptiness and the middle way.

- From Amravati, Mahayana Buddhism spread across South Asia, China, Japan, Korea, and Southeast Asia..

- Factors Leading to the Decline of Buddhism in Andhra Pradesh:

- Rise of Shaivism: One of the primary factors contributing to the decline of Buddhism in Andhra Pradesh was the rise of Shaivism.

- By the seventh century CE, Chinese travellers noted the decline of Buddhist stupas and the thriving Shiva temples, which received patronage from aristocrats and royals.

- The growing influence of Shaivism offered a more structured and socially integrated religious framework that appealed to the local populace and rulers, drawing support away from Buddhist institutions.

- Decline of Urbanisation: During the third century BCE, the region experienced significant urbanisation and trade, which supported Buddhism's spread due to its emphasis on a casteless society.

- However, six centuries later, economic degradation led to a decline in patronage for Buddhist institutions.

- By the fourth century CE, Buddhist institutions found themselves without much patronage.

- Arrival of Islam: With the arrival of Islam, the Islamic rulers, who were generally more inclined towards supporting Islamic institutions, withdrew royal patronage from Buddhist establishments.

- Rise of Shaivism: One of the primary factors contributing to the decline of Buddhism in Andhra Pradesh was the rise of Shaivism.

What are the Key Features of the Amravati School of Art?

- About:

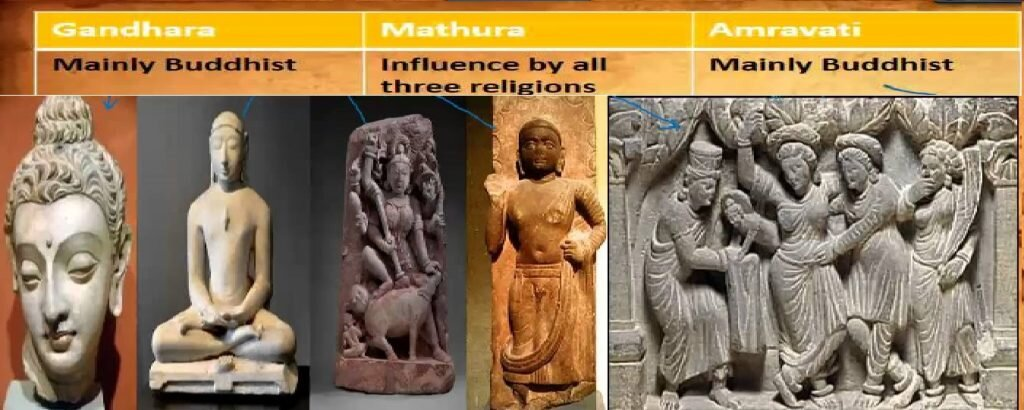

- During the post-Mauryan period, the Amravati school of art from the ancient Buddhist site of Amravati in Andhra Pradesh emerged as one of the three most significant styles of ancient Indian art, alongside the Mathura and Gandhara schools.

- Historical Context and Influences:

- Amravati Stupa:

- The Amravati Stupa, a grand Buddhist monument, was the centrepiece of the Amravati School of Art. This site became a hub of artistic and architectural activity, significantly contributing to the development of Buddhist art in India.

- In the early 19th century, government indifference to conserving ancient monuments led to local people and British officials using stupa materials for construction, causing further degradation.

- Excavations by officials like Walter Elliot in 1845 and the shipment of sculptures to Calcutta, London, and Madras also contributed to the site's decline.

- Amravati Stupa:

- Key Characteristics of Amravati School of Art:

- Major Centres: Amaravati and Nagarjunakonda.

- Patronage: This school was patronised by Satvahana rulers.

- Key Feature: Tribhanga posture, i.e. the body with three bends was used excessively by Amaravati school in its sculptures.

- The sculptures from Amravati are noted for their high aesthetic quality and intricate detailing, primarily crafted from palnad marble, a special kind of limestone that allows fine and intricate carvings.

- The art often features narrative panels depicting scenes from the life of the Buddha, Jataka tales, and various Buddhist rituals and practices.

- A particular depiction of the Buddha from Amravati, with the robe on the left shoulder and the other hand in abhaya (gesture of fearlessness), became iconic and was replicated in other parts of South and Southeast Asia.

- Unlike the Mathura and Gandhara schools, which show Graeco-Roman influences, the Amravati school developed a unique style with little external influence, emphasizing indigenous artistic traditions.

- Global Dispersion of Amravati Art:

- Today, sculptures from the Amravati Stupa are scattered across the world, with significant collections in the British Museum, the Art Institute of Chicago, Musee Guimet in Paris, and the Metropolitan Museum of Art in New York.

- Indian museums such as the Government Museum in Chennai and the National Museum in New Delhi also house pieces of Amravati art.

- Australia remains the only country to have returned a stolen Amravati-style sculpture.

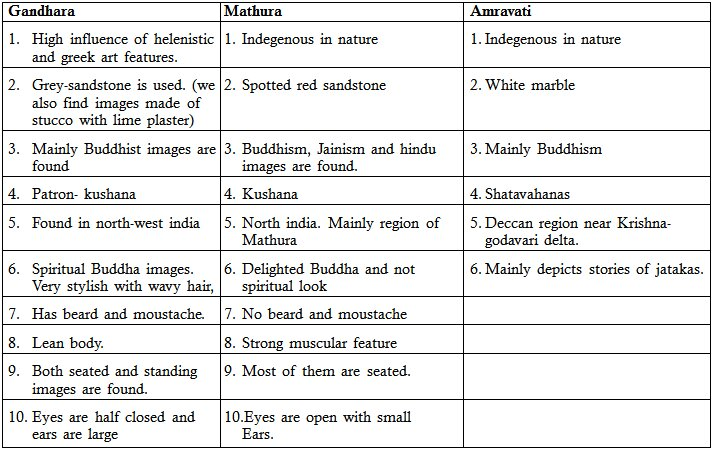

- Difference Between Amravati, Mathura, and Gandhara Schools of Art:

|

Drishti Mains Question: Discuss the key features of the Amaravati school of art and analyse its significance in the context of ancient Indian art. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Which one of the following statements is correct?(2021)

(a) Ajanta Caves lie in the gorge of Waghora river.

(b) Sanchi Stupa lies in the gorge of Chambal river.

(c) Pandu-lena Cave Shrines lie in the gorge of Narmada river.

(d) Amaravati Stupa lies in the gorge of Godavari river

Ans: (a)

Q. Which of the following kingdoms were associated with the life of the Buddha? (2015)

- Avanti

- Gandhara

- Kosala

- Magadha

Select the correct answer using the code given below:

(a) 1, 2 and 3

(b) 2 and 3 only

(c) 1, 3 and 4

(d) 3 and 4 only

Ans: (d)

Mains:

Q. Highlight the Central Asian and Greco-Bactrian elements in Gandhara art. (2019)

Q. Gandhara sculpture owed as much to the Romans as to the Greeks. Explain. (2014)

Science & Technology

SC Verdict on GM Mustard Approval

For Prelims: Genetically Modified (GM) crops, Herbicide Resistance, Bt cotton, Genetic Engineering Appraisal Committee (GEAC), Dhara Mustard Hybrid-11 (DMH-11), ‘Early Heera-2’ mustard, Bacillus amyloliquefaciens,

For Mains: Significance of Genetically Modified Crops Challenges and Mitigation.

Recently, the Supreme Court (SC) delivered a split verdict on the validity of the Centre’s decision to grant conditional approval for the environmental release of Genetically Modified (GM) mustard crops. Now, the case will be referred to a Supreme Court’s three-judge Bench.

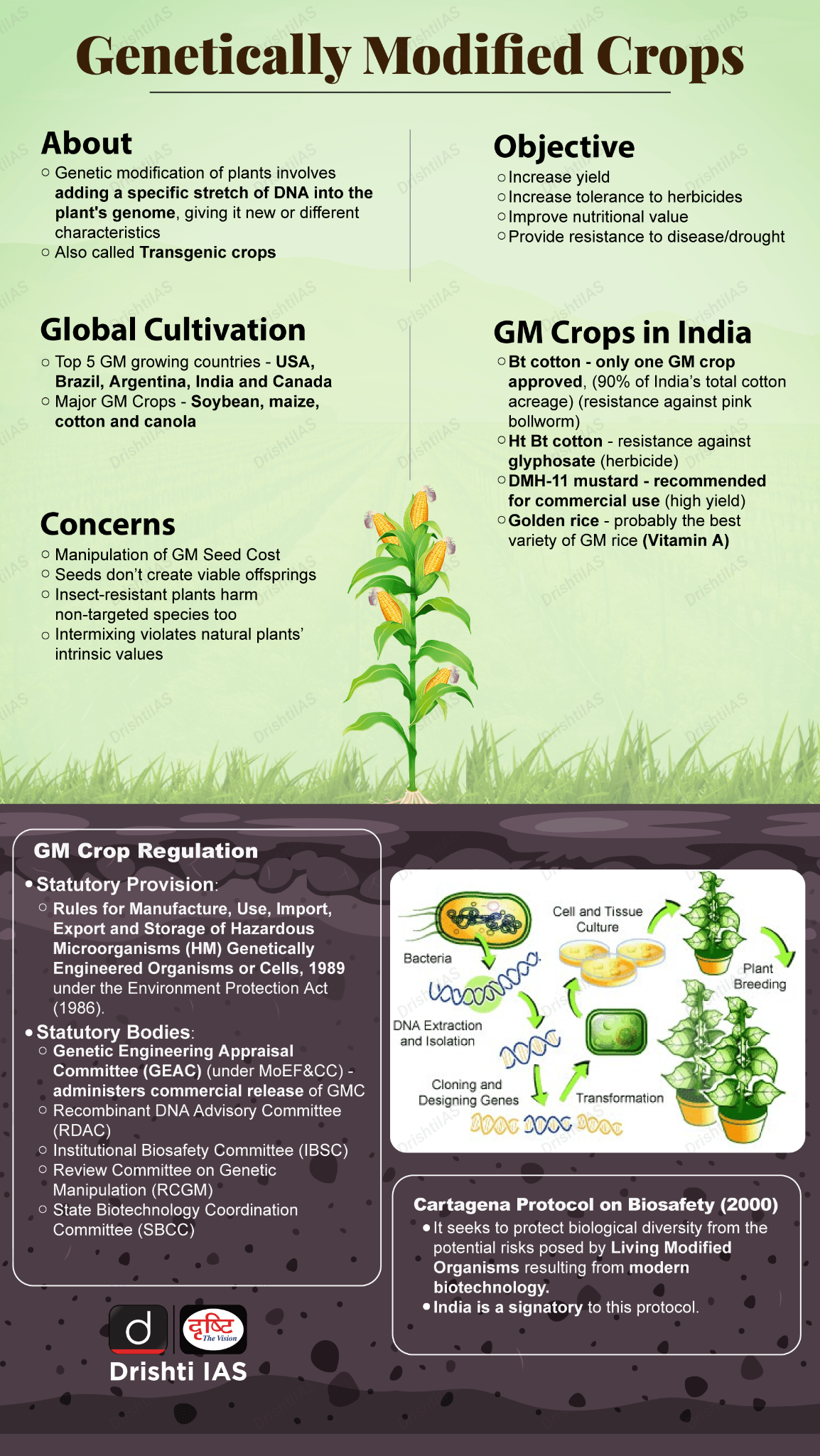

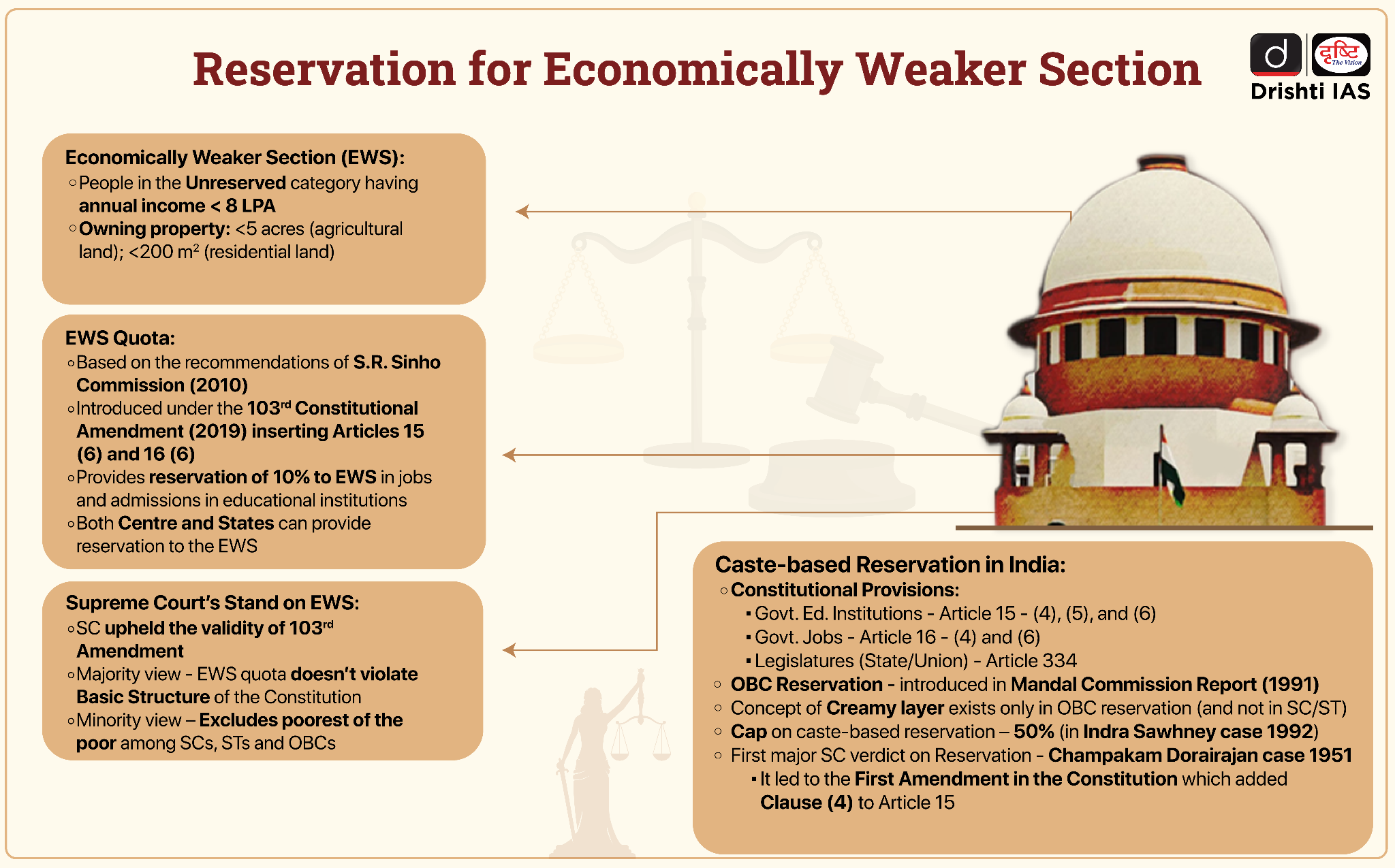

- Genetically Modified (GM) Crops are genetically engineered crops that undergo gene alteration and modification.

What are the Key Highlights of SC Verdict on GM Mustard?

- Reason Behind Split Judgement:

- Justice Nagarathna criticised the GEAC for clearing the project without relying on any indigenous studies on the crop’s effect in India and its possible environmental ramifications and only foreign research studies were considered while making the recommendation.

- In contrast, Justice Karol upheld the GEAC’s clearance for GM mustard’s commercial release

- However, both judges concurred on certain points raised during the arguments.

- They acknowledged that judicial review of decisions made by the GEAC was permissible and emphasised the need for the Centre to consider implementing a national policy.

- Directive for National Policy:

- The judges asked the Union Ministry of Environment and Forest to formulate such a policy, along with rules, within four months.

- This policy should cover research, cultivation, trade, and commerce, and be developed in consultation with stakeholders including agriculture experts, biotechnologists, state governments, and farmer representatives.

- GEAC's Role:

- The Genetic Engineering Appraisal Committee (GEAC) approved the environmental release of the transgenic mustard hybrid Dhara Mustard Hybrid-11 (DMH-11) in October 2022.

What is GM Mustard?

- About:

- Dhara Mustard Hybrid-11 (DMH-11) was developed in India by hybridising the Indian mustard variety ' Varuna' and 'Early Heera-2' (Eastern European variety).

- It contains two alien genes (‘barnase’ and ‘barstar’) isolated from a soil bacterium called Bacillus amyloliquefaciens that enable breeding of high-yielding commercial mustard hybrids.

- It is approved by the Genetic Engineering Appraisal Committee (GEAC) for cultivation.

- Characteristics:

- It is classified as a Herbicide Tolerant (HT) mustard variety and it is engineered to withstand specific herbicides, which can aid in weed control and enhance crop yield.

- Significance:

- Mustard Contribution in Oil Production and Imports: Despite producing 116.5 lakh tonnes of edible oils in 2021-22, India imported 141.93 lakh tonnes, highlighting a significant gap and there is a projected demand of 34 million tonnes by 2025-26.

- Mustard plays a pivotal role, constituting 40% of India's total edible oil production.

- Potential Yield Enhancement Of GM Mustard: GM Mustard demonstrates a yield increase of approximately 28% compared to the national standard and surpasses zonal benchmarks by around 37%, indicating superior performance in specific agricultural regions.

- Its varieties like DMH-11 have the capability to substantially increase yields to 3-3.5 tonnes per hectare.

- Improved Input Efficiency: GM mustard can optimise resource utilisation by requiring less water, fertilisers, and pesticides compared to traditional varieties. This efficiency is crucial for sustainable agriculture practices and mitigating environmental impact.

- Reduced Price Volatility: Enhanced production through GM mustard can stabilise edible oil prices in the domestic market, benefiting consumers and ensuring food security.

- Mustard Contribution in Oil Production and Imports: Despite producing 116.5 lakh tonnes of edible oils in 2021-22, India imported 141.93 lakh tonnes, highlighting a significant gap and there is a projected demand of 34 million tonnes by 2025-26.

What are Genetically Modified (GM) Crops?

- GM crops are plants whose genes are artificially modified, usually by inserting genetic material from another organism, in order to give it new properties, such as increased yield, tolerance to a herbicide, resistance to disease or drought, or improved nutritional value.

- Earlier, India approved the commercial cultivation of only one GM crop, Bt cotton, but Genetic Engineering Appraisal Committee (GEAC) has recommended GM Mustard for commercial use.

- Challenges Faced by BT Cotton (only Commercially cultivable GM Crop in India):

- Insect Resistance: The primary challenge with BT cotton has been the emergence of insect resistance to the Bt toxin. Overreliance on a single mode of pest control has accelerated this process.

- Secondary Pest Outbreaks: While effectively controlling bollworms, BT cotton has led to increased populations of sucking pests like aphids and whiteflies, necessitating additional pesticide applications.

- Environmental Impact: Concerns about the impact of Bt cotton on non-target organisms, such as beneficial insects, have been raised.

- Economic Implications: Despite initial yield gains, the long-term economic benefits of BT cotton have been debated, with some studies indicating diminishing returns.

What is the Genetic Engineering Appraisal Committee (GEAC)?

- The GEAC, under the Ministry of Environment (MoEF&CC), is responsible for the appraisal of activities involving large-scale use of hazardous microorganisms and recombinants in research and industrial production from an environmental angle.

- The committee is also responsible for the appraisal of proposals relating to the release of genetically engineered (GE) organisms and products into the environment including experimental field trials.

- GEAC is chaired by the Special Secretary/Additional Secretary of MoEF&CC and co-chaired by a representative from the Department of Biotechnology (DBT).

- Presently, it has 24 members and meets every month to review the applications in the areas indicated above.

What are the Concerns Associated with GM Mustard?

- Biodiversity Concern: Potential effects on honeybees due to altered flowering and pollen production.

-

Its altered genes could potentially affect other beneficial such as insects, soil microbes, and wildlife, and unintended harm to beneficial insect populations can disrupt ecological balances essential for agriculture.

-

- Food Security and Health Concerns: Monoculture cropping facilitated by GM varieties could increase vulnerability to crop diseases and climate change impacts, threatening long-term food security.

- Potential for creating novel proteins with unknown impacts on human health, as the genes used in GM mustard are not part of the human diet.

- Ethical Considerations: There are ethical concerns surrounding the commodification of genetic resources like self-terminating seed and exclusive patent regime are the implications for agricultural sovereignty.

- The introduction of GM mustard raises questions about equitable access to technologies and the rights of farmers to save and exchange seeds.

- Regulatory Challenges: Ensuring compliance with stringent bio-safety protocols and monitoring long-term environmental impacts requires robust institutional capacity and infrastructure and regulatory challenges.

Way Forward

- Biodiversity Mitigation: Conducting extensive research to understand the ecological impacts of GM mustard on non-target organisms and Implementing adaptive management strategies.

-

Food Safety and Human Health: Risk assessment of the allergenicity and toxicity of novel proteins introduced into the crop. Investing in long-term studies to monitor the impacts of GM mustard on food security, including its effects on crop diseases.

- For Example, the successful adoption of Bt cotton in India.

- Ethical Considerations: Equitable access to GM technologies, including the rights to save and exchange seeds to farmers. Implementing policies that protect traditional farming practices and promoting farmer autonomy in decision-making.

-

Capacity Building: Strengthening institutional capacity through training regulators, enhancing laboratory facilities for testing GM crops, and improving data collection and analysis capabilities.

- Establishing transparent regulatory frameworks that incorporate public consultation and stakeholder engagement.

Read more: Herbicide Tolerant (HT) Bt Cotton, BT Cotton in India - Problems and Solutions

|

Drishti Mains Question: Q. Genetically Modified (GM) Mustard crops hold potential benefits for agricultural productivity but also present significant challenges. Discuss the major challenges associated with the adoption of GM mustard crops in India. What measures can be taken to mitigate these challenges? |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Other than resistance to pests, what are the prospects for which genetically engineered plants have been created? (2012)

- To enable them to withstand drought

- To increase the nutritive value of the produce

- To enable them to grow and do photosynthesis in spaceships and space stations

- To increase their shelf life

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 3 and 4 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Mains:

Q. What are the present challenges before crop diversification? How do emerging technologies provide an opportunity for crop diversification? (2021)

Q. What are the research and developmental achievements in applied biotechnology? How will these achievements help to uplift the poorer sections of the society? (2021)

Economy

SC Upholds States' Taxation Power on Mineral Rights

For Prelims: Supreme Court of India, Union List, Royalty and Tax, Critical minerals, Foreign direct investment, Net-zero emissions

For Mains: Mining sector, Significance of India’s mining sector, Governance and Policy, Industrial Growth

Why in News?

The Supreme Court of India has recently addressed a crucial issue regarding the taxation of mineral rights, overturning its 1989 verdict and reaffirming the power of states in this context.

- This decision, delivered by a nine-judge Bench, clarifies the extent of authority both Parliament and states hold over mineral royalties.

What did the Supreme Court Decide?

- Background of the Case:

- In 1989, a seven-judge Bench ruled that the Centre has primary authority over mining regulation under the Mines and Minerals (Development and Regulation) Act, 1957, and Entry 54 of the Union List.

- States were permitted only to collect royalties and not impose additional taxes. The court classified royalties as taxes, making any cess on them beyond state authority.

- The 2004 five-judge Bench had later suggested a typographical error in the 1989 ruling, indicating that royalties were not a tax. This led to the current nine-judge review.

- In 1989, a seven-judge Bench ruled that the Centre has primary authority over mining regulation under the Mines and Minerals (Development and Regulation) Act, 1957, and Entry 54 of the Union List.

- Overturning 1989 Verdict: The Supreme Court's nine-judge Bench ruled that the 1989 verdict, which classified royalties on minerals as a tax under the MMDRA, 1957 was incorrect.

- State vs. Central Authority: The Court emphasised that the power to impose taxes on mineral rights resides solely with the states, while Parliament may only impose limitations to prevent hindrances to mineral development.

- The ruling clarifies that Parliament does not possess the power to tax mineral rights under Entry 50 of the List II of the Constitution, which governs state powers and is limited to imposing restrictions, not taxes.

- Parliament can set constraints on how states levy taxes on mineral rights, but it cannot impose taxes directly. This is to ensure that mineral development is not obstructed.

- The ruling clarifies that Parliament does not possess the power to tax mineral rights under Entry 50 of the List II of the Constitution, which governs state powers and is limited to imposing restrictions, not taxes.

- Dissenting Opinion: Warned that allowing states to levy taxes on mineral rights may also attempt to impose taxes on lands and buildings under Entry 49 of List II, leading to a breakdown of the federal system and lead to a breakdown in uniformity in mineral pricing and development.

- Consequently, states will start levying taxes on minerals again, leading to legal uncertainty and adverse economic consequences, including on metal development in India.

- Parliament will need to intervene to ensure uniformity in mineral pricing and development interests, and to prevent states from imposing taxes on mineral rights.

What is the Difference Between Royalty and Tax?

- Earlier in 2021, the Supreme Court of India had delineated the distinction between 'royalty' and 'tax.'

- Royalty: It originates from an agreement between parties. It is a compensation paid for the rights and privileges enjoyed by the grantee.

- The royalty payment has a direct relationship with the benefit or privilege conferred upon the grantee.

- It is specific to the agreement and is often linked to the exploitation of resources or usage of a privilege granted by the grantor.

- Precedents: The Court referenced several cases, including Hingir-Rampur Coal Co. Ltd. vs. State of Orissa (1961), State of West Bengal vs. Kesoram Industries Ltd. (2004), and others, to establish that royalties are contractual obligations with direct benefits.

- Tax: It is imposed under a statutory power without reference to any special benefit conferred on the payer. It is enforced by law and does not require the taxpayer's consent.

- Taxes are imposed for public purposes without any specific benefit to the payer. They are part of the common burden borne by all citizens.

- Unlike royalties, taxes do not involve a quid pro quo arrangement. The payment is mandatory and not linked to any specific privilege or benefit.

- Precedents: The Court referred to several cases, including the State of Himachal Pradesh vs. Gujarat Ambuja Cement Ltd. (2005) and Jindal Stainless Ltd. vs. the State of Haryana (2017), to highlight the characteristics of taxes.

What is the Mines and Minerals (Development and Regulation) Act, 1957?

- It is a pivotal legislation in India governing the mining sector. This Act has undergone multiple amendments to address emerging needs and challenges in the mineral sector, ensuring its alignment with national economic and security interests.

- The primary objectives were to develop the mining industry, ensure mineral conservation, and bring transparency and efficiency to mineral exploitation.

- 2015 Amendment: This comprehensive amendment introduced several key reforms.

- Auction Method: Mandated auctioning of mineral concessions to enhance transparency in allocation.

- District Mineral Foundation (DMF): Established DMF to benefit areas and people affected by mining.

- National Mineral Exploration Trust (NMET): Created NMET to boost mineral exploration activities.

- Penalties for Illegal Mining: Implemented stringent penalties to curb illegal mining activities.

- 2016 and 2020 Amendments: Addressed minor issues in the sector to ensure its smooth functioning.

- 2021 Amendment:

- Removed the distinction between Captive and Merchant Mines.

- Captive mines are operated by companies to produce minerals exclusively for their own use. The minerals extracted from captive mines may sell up to 50% of their annual mineral production in the open market after meeting the entire needs of the end-use plant for which the mineral block was originally allocated by the government.

- Merchant Mines are operated to produce minerals for sale in the open market. The extracted minerals are sold to various buyers, including industries that do not own their own mines.

- Auction-Only Concessions: Ensured that all private-sector mineral concessions were granted through auctions.

- Removed the distinction between Captive and Merchant Mines.

- 2023 Amendment:

- The Mines and Minerals (Development and Regulation) Amendment Act, 2023 aims to strengthen the exploration and extraction of critical minerals essential for India's economic development and national security.

- Key amendments include removing 6 minerals from the list of 12 atomic minerals limited to exploration by State agencies, empowering the government to exclusively auction mineral concessions for critical minerals.

- Introduced exploration licences to attract foreign direct investment and engage junior mining companies in exploring deep-seated and critical minerals.

- The focus is on reducing dependence on imports and encouraging private sector involvement to expedite exploration and mining of these critical minerals.

- Recognised the importance of minerals like lithium, graphite, cobalt, titanium, and rare earth elements for future technologies and India's commitment to energy transition and net-zero emissions by 2070.

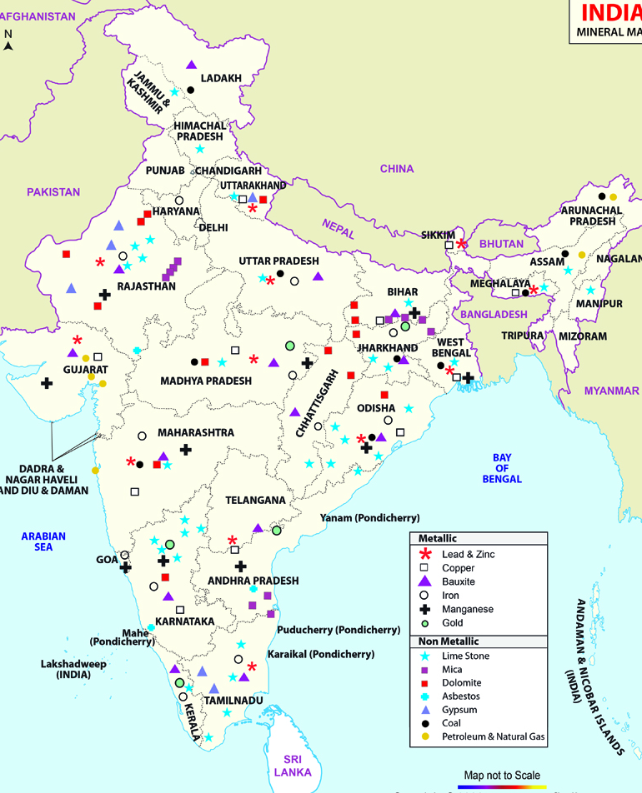

Scenario of the Mining Sector in India

- India's steel sector has experienced significant growth, making it the 2nd largest producer of steel in the world. The country's crude steel production was 144.04 million tonnes, finished steel production was 138.83 million tonnes, and finished steel consumption was 136.65 million tonnes in FY 2023-24.

- Finished steel production increased by over 12.68% compared to the previous year, while consumption grew by 13.9%

- India has a total coal reserve of 344.02 billion tonnes and is the second largest producer of coal in the world.

- In the coal sector, production during Jun 2024 was 84.63 million tonnes, showing a growth of 14.49% compared to Jun 2023.

- Cumulative coal production increased by 11.65% over the previous year.

- Manganese Ore (India) Limited achieved its highest production of 17.56 lakh tonnes of Manganese Ore in FY 2023-24, marking a 35% growth over the previous year. India's mineral production also saw a cumulative growth of 8.2% for the period Apr-Feb, 2023-24.

- The country's FDI policy allows 100% FDI through automatic routes in the steel and mining sectors, as well as for coal and lignite.

- The mineral production index (base 2011-12) for 2021-22 is 113.3, showing a growth of 12.17% compared to 2020-21.

- The total value of mineral production (excluding atomic and fuel minerals) for 2021-22 is estimated at approximately Rs. 220000 crore, with metallic minerals contributing approximately Rs. 120000 crore.

- The Indian mining industry has a large number of small operational mines. In 2021-22, there were 1319 reporting mines in India, with the highest number located in Madhya Pradesh (263), followed by Gujarat (147), Karnataka (132), Odisha (128), Chhattisgarh (114), Andhra Pradesh (108), Rajasthan (90), Tamil Nadu (88), Maharashtra (73), Jharkhand (45), and Telangana (39).

- These 11 states together accounted for 93% of the total number of mines in the country in 2021-22.

Read more: Industrial Alcohol Regulation

|

Drishti Mains Question: Q. Examine the division of powers between the Centre and states regarding mineral rights and royalties as clarified by the Supreme Court judgement. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. With reference to the management of minor minerals in India, consider the following statements: (2019)

- Sand is a ‘minor mineral’ according to the prevailing law in the country

- State Governments have the power to grant mining leases of minor minerals, but the powers regarding the formation of rules related to the grant of minor minerals lie with the Central Government.

- State Governments have the power to frame rules to prevent illegal mining of minor minerals.

Which of the statements given above is/are correct?

(a) 1 and 3 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Q. What is/are the purpose/purposes of ‘District Mineral Foundations’ in India? (2016)

- Promoting mineral exploration activities in mineral-rich districts

- Protecting the interests of the persons affected by mining operations

- Authorizing State Governments to issue licences for mineral exploration

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. Despite India being one of the countries of Gondwanaland, its mining industry contributes much less to its Gross Domestic Product (GDP) in percentage. Discuss. (2021)

Indian Economy

India's Garment Export Sector

For Prelims: Globalisation, Viscose Staple Fibre, Quality Control Orders, Production Linked Incentive (PLI) Scheme, Compound annual growth rate, Foreign Direct Investment (FDI), National Technical Textiles Mission,

For Mains: Textile Sector of India, Potential and Challenges, Related Government Policies and Initiatives

Why in News?

India’s garment export industry, a significant contributor to employment, has been facing a persistent decline. A recent report by the Global Trade Research Initiative (GTRI) , a research Group focused on Climate Change, technology and trade, sheds light on the reasons behind this downturn, pointing to self-inflicted barriers rather than external competition.

What are the Key Highlights of the GTRI Report?

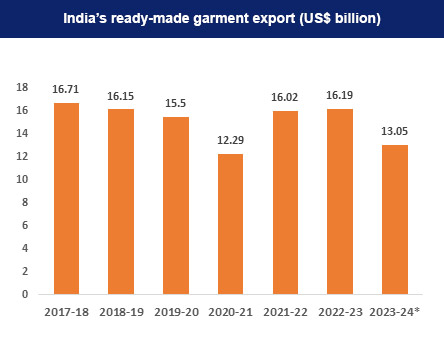

- Decline in Export Value: India's garment exports in 2023-24 were USD 14.5 billion, compared to USD 15 billion in 2013-14.

-

Vietnam and Bangladesh's garment exports grew significantly during the same period, reaching USD 33.4 billion and USD 43.8 billion, respectively.

-

Despite a decline, China still exported about USD 114 billion in garments.

- Globalisation has increased competition and shifted production to lower-cost labour countries, affecting India's market share.

-

- Trade Barriers: The sector faces substantial duties on importing essential raw materials, making production more expensive.

- Archaic customs and trade procedures add to the challenges, consuming time and resources that could be better utilised.

- The dominance of local suppliers for raw materials like Polyester Staple Fibre and Viscose Staple Fibre forces exporters to rely on more expensive domestic options.

- Recent Quality Control Orders (QCOs) for fabric imports have complicated the import process, pushing up costs for exporters.

- Exporters are forced to use pricier domestic supplies, making Indian garments less competitive globally. Exporters must meticulously account for every imported component, adding to the complexity and cost.

- Production Linked Incentive (PLI) Scheme: The PLI scheme launched in 2021 has not attracted sufficient investment and requires major modifications to be effective.

- Rising Imports: India's garment and textiles imports reached nearly USD 9.2 billion in 2023, with concerns that this could increase if export challenges remain unresolved.

- Synthetic Fabrics in Global Markets: Developed countries prefer clothing made from mixed synthetics, while only less than 40% of Indian exports consist of synthetic fabrics.

- Diversifying into synthetics can enable Indian manufacturers to operate year-round, meeting demands during autumn and winter as well.

- Indian exporters need to keep up with the fast-paced demands of the Fast Fashion Industry (FFI), which includes major players like Walmart, Zara, H&M, Gap, and online retailers like Amazon.

- Recommendations for Improving the Sector: Simplifying customs and trade procedures can reduce the time and cost burdens on exporters.

- Lowering duties on essential raw materials can help reduce production costs.

- Ensuring fair competition in the domestic market for raw materials can lower costs for exporters.

What are the Key Facts About India's Garment Industry?

- The garment industry in India is highly fragmented, with a large number of small-scale manufacturers and fabricators dominating the scene. There are around 27,000 domestic manufacturers, 48,000 fabricators, and 100 manufacturer-exporters. Most of the firms are either proprietorship or partnership-owned.

- The industry benefits from a large pool of skilled workers and consistent growth across different sectors, making it a key potential sector in India.

- The textiles and apparel industry in India is the 2nd largest employer in the country after agriculture, providing direct employment to 4.5 crore people and 10 crore people in allied industries.

- Key Producers and Products: India is one of the largest producers of cotton and jute in the world. India is also the 2nd largest producer of silk in the world and 95% of the world’s hand-woven fabric comes from India.

- Tamil Nadu is a major cotton textile centre, contributing over 25% to the country's export of cotton yarn and fabrics.

- Market Growth: Total textile exports are expected to reach USD 65 Bn by FY26 and is expected to grow at a 10% Compound annual growth rate (CAGR) from 2019-20 to reach USD 190 billion by 2025-26.

- Export Trends: India is a significant exporter of textiles and apparel, with a large manufacturing base. In 2022-23, textile and apparel exports accounted for 8.0% of India's total exports, with a 5% share in global trade. The government aims to achieve USD 250 billion in textiles production in exports by 2030.

- India's textile and apparel products, including handlooms and handicrafts, are exported to over 100 countries worldwide, with key export destinations including the USA, Bangladesh, the UK, UAE, and Germany.

- The USA is the largest importer, accounting for about one-fourth of India's total exports.

- India signed a Free Trade Agreement (FTA) with the UAE in May 2022 and is in the process of negotiating FTAs with the EU, Australia, the UK, Canada, Israel, and other countries/regions to boost textile and apparel exports.

- Additionally, India's Foreign Direct Investment (FDI) policy allows for 100% FDI in single-brand product retail trading and up to 51% FDI in multi-brand retail trading, attracting international retailers to source from India and driving interest from new export destinations.

- India's textile and apparel products, including handlooms and handicrafts, are exported to over 100 countries worldwide, with key export destinations including the USA, Bangladesh, the UK, UAE, and Germany.

- Government Initiatives:

-

Union Budget 2024-25:

- The budget allocation for the textiles sector has been increased by USD 974 crore to USD 4,417.09 crore in the Budget 2024.

- The Union Budget proposes to reduce customs duty on wet white, crust, and finished leather for making garments, footwear, and other leather products for exports from 10% to 0%.

- Additionally, the duty on real down-filling material from duck or goose for use in manufacturing garments for exports will be reduced to 10% from the current 30%.

- Apparel Export Promotion Council (AEPC): AEPC, sponsored by the Ministry of Textiles, was incorporated in 1978. It is a nodal agency to promote exports of readymade garments from India.

-

The primary objective of the council is to promote, advance, increase, and develop the export of all types of ready-made garments in India.

-

AEPC supports the apparel industry by providing research and inputs on FTA, Foreign Trade Policy (FTP), and bilateral agreements.

-

-

PM Mega Integrated Textile Region and Apparel (PM MITRA) parks

-

Rebate of State and Central Taxes and Levies on the Export of Garments and Made-ups (RoSCTL scheme)

-

Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme

-

What are the Strategies to Boost India's Garment Industry?

- Align Exports with Global Market Demand: Focus on manufacturing apparel products and sustainable fashion that are in high demand globally.

- Market-Specific Strategies:

- Identify top imported commodities by each country where India has a low share.

- Address compliance issues and conduct cost comparisons with competing countries. Implement targeted interventions at the micro level to minimise the supply-demand gap.

- Market-Specific Strategies:

- Enhance Brand Building: Enhance the perceived value of Indian garments through effective branding.

- Obtain certifications such as Global Organic Textile Standard (GOTS) to improve brand image and compliance with international quality standards.

- Meeting the apparel exports of USD 40 billion by the year 2030 as highlighted by the Commerce and Industry Ministry requires at least 1,200 additional manufacturing units by 2030, compared to the projected addition of only 200 units.

- Proper branding of Indian apparel products can increase Unit Value Realisation (UVR), making exports more competitive.

- Capacity Creation: Invest in scaling up and modernising these segments to match spinning capacity. Encourage major domestic players to reinvest profits in capacity creation.

- Invest in weaving, fabric processing, and garmenting to strengthen the value chain and achieve cost competitiveness.

- Diversify Markets and Products: Reduce dependence on traditional markets like the US, EU, and UK. Explore new markets such as Mauritius through FTA.

- Increase production of man-made fibre (MMF) garments to tap into their growing global demand.

- MMFs are mainly of two types: synthetic (made from crude oil) and cellulosic (made from wood pulp). The main varieties of synthetic staple fibres are polyester, acrylic, and polypropylene, while cellulosic fibres include viscose and modal.

- Increase production of man-made fibre (MMF) garments to tap into their growing global demand.

- Leverage E-commerce Opportunities: Global e-commerce exports are expected to grow from USD 800 billion to USD 2 trillion by 2030.

- India aims to achieve a merchandise export target of USD 1 trillion by 2030, with USD 200 billion coming from e-commerce. The country's high internet penetration and demand from the Indian diaspora are expected to fuel this growth.

- E-commerce is important for MSMEs as it can greatly increase apparel exports. To achieve this, regulatory compliances should be simplified, and separate customs codes created for e-commerce shipments.

- It is important to take a quick, bold, and targeted approach to harness e-commerce for export expansion.

|

Drishti Mains Question: Q. Evaluate the impact of globalization on India's garment industry. How has it influenced the sector’s competitive position in the global market? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2020)

- The value of Indo-Sri Lanka trade has consistently increased in the last decade.

- “Textile and textile articles” constitute an important item of trade between India and Bangladesh.

- In the last five years, Nepal has been the largest trading partner of India in South Asia.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q. Analyse the factors for highly decentralised cotton textile industry in India. (2013)

Important Facts For Prelims

Humayun Tomb World Heritage Site Museum

Why in News?

The Humayun’s Tomb World Heritage Site Museum is set to open for visitors. Nestled between Sunder Nursery and Humayun’s Tomb in Nizamuddin, Delhi, this museum promises to offer visitors a unique insight into the life and times of the second Mughal Emperor, Humayun.

What are the Key Highlights of Humayun's Tomb Site Museum?

- Underground Design: The museum is designed like a baoli (stepwell) and includes a 100-seat auditorium, temporary galleries, cafés, meeting rooms, and a library.

- Unique Personal Items: Artefacts such as a pear-shaped water vessel belonging to Jauhar Aftabchi, a biographer of Humayun, and a helmet used by Humayun as a cooking vessel during his travels to Persia.

- The artefacts displayed in the museum are on loan from the National Museum for 10 years, ensuring a rich and varied display for visitors.

- Mughal Coins and Throne: Exhibits include coins from the reigns of 18 Mughal-era kings and the throne of Bahadur Shah Zafar, the last Mughal emperor.

- Highlights include: Coins from Akbar’s era with ‘Allah’ on one side and ‘Ram’ on the other. Expensive coins from Jahangir’s era. Rare coins minted by Bahadur Shah Zafar.

- Architecture and Personality: Focuses on the architecture of Humayun’s Mausoleum and the emperor’s personality. Exhibits convey stories of Humayun’s travels, administration, interest in reading, astrology, the arts, and his patronage of architecture.

- Cultural Figures: Highlights four cultural figures associated with the Nizamuddin area from the 14th century: Sufi Saint Hazrat Nizamuddin Auliya, Poet Amir Khusrau Dehalvi, Rahim, a commander-in-chief of Akbar’s army and poet, and Dara Shukoh, known for translating the Upanishads into Persian.

- Conservation Efforts: Managed by the Archaeological Survey of India (ASI), the museum is part of a larger conservation effort encompassing the 300-acre Humayun’s Tomb-Sunder Nursery-Nizamuddin Basti area.

Humayun’s Tomb

- Built in 1570, Humayun's Tomb is the first major garden tomb in the Indian subcontinent, setting a precedent for Mughal architecture, which culminated in the Taj Mahal. It was commissioned by his first wife, Empress Bega Begum, in 1569-70 and designed by Persian architects.

- It includes other 16th-century Mughal tombs like Nila Gumbad and Isa Khan Niyazi, an Afghan noble.

- The tomb features a charbagh garden, a high-terraced platform, and a marble-clad dome. The mausoleum, known as the 'dormitory of the Mughals,' houses over 150 Mughal family members.

- The tomb is centred around the Shrine of the 14th century Sufi Saint, Hazrat Nizamuddin Auliya. Due to the belief that it is fortunate to be buried near a saint's grave.

- It was declared a UNESCO World Heritage Site in 1993 and has undergone extensive restoration work.

- The ASI and Aga Khan Trust for Culture manage the site, ensuring its preservation and protection under various legislations.

Humayun

- Early Reign: Humayun, the eldest son of Babur, faced immediate challenges upon his succession. His governance was marked by administrative and financial instability.

- Major Battles: Siege of Chunar (1532) Humayun achieved victory against the Afghans and besieged Chunar fort. Battle of Chausa (1539) Humayun faced defeat by Sher Shah Suri, narrowly escaping the battlefield. Battle of Kannauj (1540) also known as Battle of Bilgram Sher Shah Suri’s complete victory forced Humayun into exile.

- Internal conflicts, including a rebellion by Humayun’s brother Hindal and Kamran’s schemes, further weakened his position.

- Humayun became an exile for fifteen years. During this time, he married Hamida Banu Begum and had a son named Akbar.

- Humayun sought help from the Shah of Persia, who agreed to support him in exchange for certain conditions. With Persian assistance, Humayun captured Kandahar and Kabul in 1545.

- Persian Influences: Humayun introduced Persian administrative practices, improving revenue systems and promoting Persian arts and culture.

- Architectural Achievements: He founded Dinapanah, built the Jamali mosque, and initiated the construction of Humayun’s Tomb, which was completed by his wife, Hamida Banu Begum.

- Cultural Impact: Humayun played a key role in the development of Mughal painting by bringing Persian artists like Mir Sayyid Ali and Abdal Samad to India.

- He established the Nigaar Khana (painting workshop) and began the project of illustrating the Hamza Nama, which his successor Akbar continued.

- Literary Contributions: His sister, Gul Badan Begum, authored the "Humayun-Nama," documenting his reign and legacy.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q) With reference to Mughal India, what is/are the difference/differences between Jagirdar and Zamindar? (2022)

- Jagirdars were holders of land assignments in lieu of judicial and police duties, whereas Zamindars were holders of revenue rights without obligation to perform any duty other than revenue collection.

- Land assignments to Jagirdars were hereditary and revenue rights of Zamindars were not hereditary.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Important Facts For Prelims

Panchamasali Lingayats' Quota Demand

Why in News?

Recently, the Panchamasali Lingayats, a sub-caste within Karnataka's dominant Lingayat community, have been demanding inclusion in Category 2A of the Other Backward Classes (OBC).

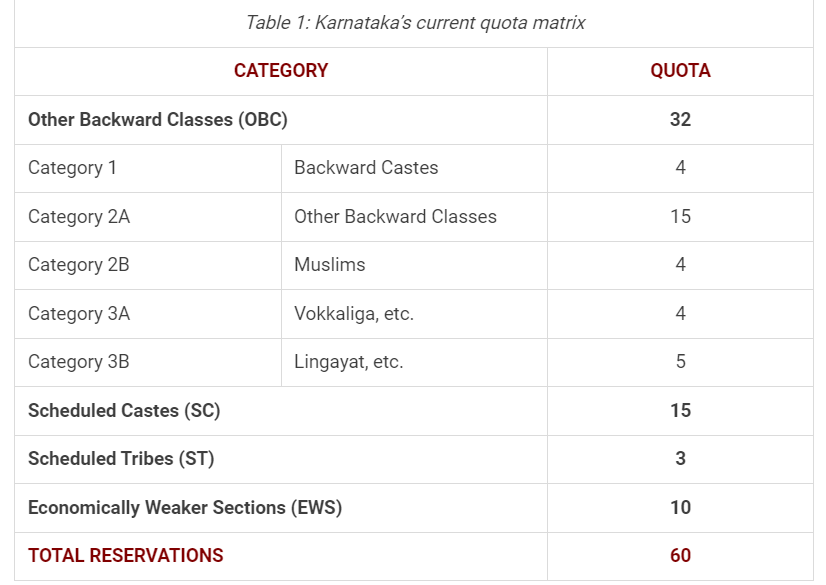

- This move aims to secure a 15% quota in government jobs and educational admissions, in contrast to the current 5% quota under Category 3B of Karnataka’s OBC quota matrix.

What is the Panchamasali Lingayats' Quota Demand?

- Panchamasali Lingayats: The Lingayats, officially classified as the Hindu sub-caste 'Veerashaiva Lingayats,' are followers of the 12th-century philosopher-saint Basavanna.

- Basavanna initiated a radical anti-caste movement, advocating for a personal, affective relationship with God, specifically Lord Shiva, rejecting orthodox Hindu practices.

- The Lingayat community consists of various sub-castes, with the agriculturalist Panchamasalis being the largest, making up nearly 70% of the Lingayat population and approximately 14% of Karnataka’s total population.

- Current OBC Quota Categories in Karnataka:

- The demand for inclusion in Category 2A emerged prominently in 2020.

- Karnataka's 32% OBC reservation in government jobs and educational institutions is divided among five categories.

- The Category 2A, which the Panchamasalis seek to join, includes 102 castes.

- The complex categorization aims to prevent dominant OBC groups from monopolising the quota benefits, ensuring equitable distribution based on relative marginalisation.

- Earlier Steps By Government:

- The previous state government attempted to placate the Panchamasalis by reallocating the 4% Muslim quota under Category 2B to the Vokkaligas and Lingayats, creating new Categories 2C and 2D.

- This increased the Lingayat quota from 5% to 7% and the Vokkaliga quota from 4% to 6%.

- However, the Panchamasalis insisted on inclusion in Category 2A, and the reallocation faced legal challenges.

- Current Situation and Government's Stance:

- The government has been awaiting a legal resolution from the Supreme Court. The findings of the Karnataka Social, Economic, and Caste Survey, expected to impact future quota plans, are also pending.

- The state government might consider including all Lingayats in the central OBC list as a balancing act.

- Currently, only 16 Lingayat sub-castes who are considered “very backward” are provided reservations under the OBC quota for central government jobs and college administrations.

Read more: Vokkaligas, Lingayats share in Reservation

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to ‘Changpa’ community of India, consider the following statements: (2014)

- They live mainly in the State of Uttarakhand.

- They rear the Pashmina goats that yield a fine wool.

- They are kept in the category of Scheduled Tribes.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. Discuss the role of the National Commission for Backward Classes in the wake of its transformation from a statutory body to a constitutional body. (2022)

Q. Do government’s schemes for up-lifting vulnerable and backward communities by protecting required social resources for them, lead to their exclusion in establishing businesses in urban economies? (2014)

Rapid Fire

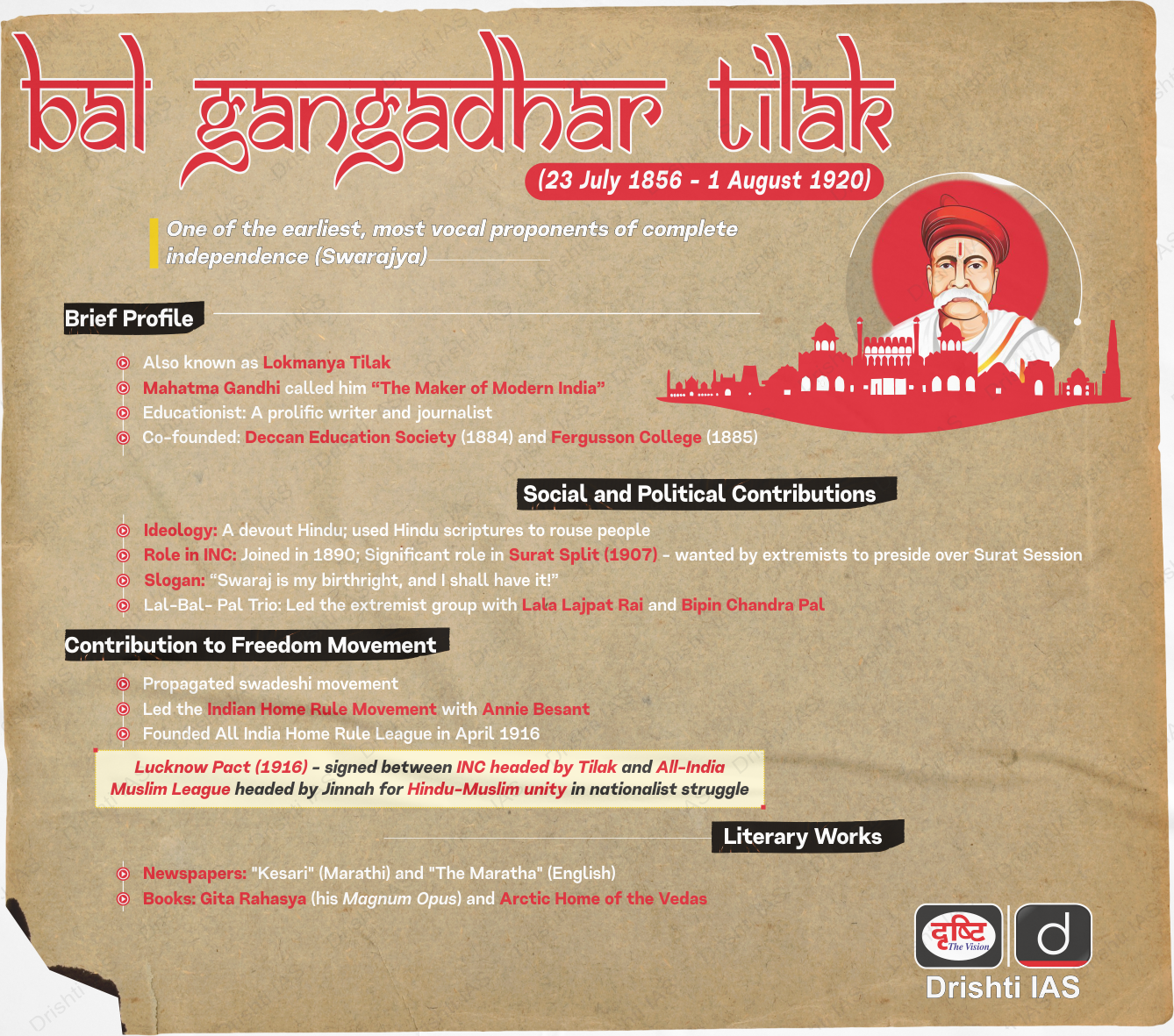

168th Birth Anniversary of Bal Gangadhar Tilak

On 23rd July, India commemorated the birth anniversary of Bal Gangadhar Tilak honouring his legacy as a freedom fighter and educationist.

- Personal Life And Ideology:

- Bal Gangadhar Tilak was born in July 1856 in Ratnagiri, Maharashtra, and revered as the father of Indian unrest.

- He was one of the earliest and the most vocal proponents of complete independence or swarajya (self-rule).

- Along with Lala Lajpat Rai and Bipin Chandra Pal, he was part of the Lal-Bal-Pal trio of leaders with extremist ideology.

- The Surat Split of 1907:

- The Surat Split of 1907 in the Indian National Congress (INC) marked a division into Extremist and Moderate factions. Extremists, primarily from the Bombay Presidency, supported Tilak or Lajpat Rai for the presidency.

- But the split took place when Rasbehari Ghose was elected.

- The Surat Split of 1907 in the Indian National Congress (INC) marked a division into Extremist and Moderate factions. Extremists, primarily from the Bombay Presidency, supported Tilak or Lajpat Rai for the presidency.

- Contribution In Education:

- Along with his associate Gopal Ganesh Agarkar and others, he co-founded the Deccan Education Society in 1884.

- Through this society, Tilak played a pivotal role in establishing Fergusson College in Pune in 1885.

Read More: Bal Gangadhar Tilak

Rapid Fire

NASA Sent Hollywood Song to Venus

Recently, NASA has transmitted Hollywood singer Missy Elliott's song "The Rain" to Venus via the Deep Space Network (DSN).

- The transmission was made using the (Deep Space Station) antenna located at the Goldstone Deep Space Communications Complex in California.

NASA’s Future Mission to Study Venus:

- The DAVINCI mission, which stands for Deep Atmosphere Venus Investigation of Noble gases, Chemistry, and Imaging, is set to be launched by the year 2029.

- The VERITAS, also known as Venus Emissivity, Radio Science, InSAR, Topography, and Spectroscopy, is expected to launch by 2031.

India’s Mission to Venus- Shukrayaan-1:

- Under the Venus Orbiter Mission, ISRO plans to launch Shukrayaan-1, a spacecraft destined to orbit Venus to study the atmosphere of Venus.

Venus:

- Venus is often called Earth's twin and is slightly smaller than Earth.

- It is the second planet from the Sun and the sixth largest planet.

- It is the hottest planet in our solar system.

- Venus spins from east to west, which is backward compared to most planets, and it has a day longer than its year.

Read More: Volcanism on Venus.

Rapid Fire

Neutrinos

Neutrinos play an important role in particle physics and astrophysics. It is a fundamental elementary particle, and atmospheric neutrinos can be studied when solar radiation hits the Earth’s atmosphere.

Neutrinos:

- Neutrinos are subatomic particles that have no electric charge, have a small mass, and are left-handed (the direction of its spin is opposite to the direction of its motion).

- They are the second-most abundant particles in the universe after photons and the most abundant among particles that make up matter.

- Neutrinos interact with matter very rarely, making them difficult to study.

- Neutrinos can change from one type (electron-neutrino, muon-neutrino, tau-neutrino) to another as they travel and interact with other particles, a phenomenon called neutrino oscillation.

- Neutrinos can carry information across large distances due to their low interaction rate with matter.

- They could potentially be used to transmit information, replacing electromagnetic waves in communication channels.

- Physicists have built large and sensitive detectors to study neutrinos and maximise the number of interactions between neutrinos and the detector's matter.

- India's Neutrino Observatory project is proposed to be set up at Pottipuram village in Theni (Tamil Nadu) in a 1,200-metre-deep cave.

Read more: Indian Neutrino Observatory

Rapid Fire

China to Raise Retirement Age

China is planning to gradually raise its statutory retirement age, which is currently among the lowest globally as it is facing pension budget deficits.

- In China, the current retirement age for men is 60 years, women (white-collar) is 55 years and women (factory workers) is 50 years.

- Demographic Changes:

- The life expectancy in China has risen significantly, from about 44 years in 1960 to 78 years in 2021, with projections to exceed 80 years by 2050.

- The population aged 60 and older is expected to rise from 280 million to over 400 million by 2035.

- The ratio of workers supporting each retiree is decreasing, projected to drop from 5-to-1 to 4-to-1 by 2030, and further to 2-to-1 by 2050.

- In India, the Central Government's pension expenditure is estimated to be around 2.40 lakh crore in the Budget 2024-25, representing 0.7% of the projected GDP.

- Additionally, India’s National Pension System is a low cost, tax-efficient retirement savings account under which the individual and his employer co-contribute to his retirement account for the social security/welfare of the individual.

- Similarly, the Atal Pension Yojana was launched in 2015, to create a universal social security system for the poor, the under-privileged and the workers in the unorganised sector.

Read More: National Pension System and Atal Pension Yojana