Indian Economy

RBI to Discontinue I-CRR

For Prelims: RBI to discontinue I-CRR, Incremental Cash Reserve Ratio, Statutory Liquidity Ratio, Monetary Policy, Reserve Bank of India.

For Mains: RBI to Discontinue I-CRR, its Need and Implications.

Why in News?

Recently, the Reserve Bank of India (RBI) announced that it would discontinue the Incremental Cash Reserve Ratio (I-CRR) in a phased manner.

- The central bank will release the amount that banks have maintained under I-CRR in stages.

How Will the RBI Implement Discontinuation of I-CRR?

- The discontinuation of the I-CRR will be implemented in stages to ensure a smooth transition and prevent sudden shocks to the system's liquidity.

- In the first and second stages of the I-CRR reversal, 25 % of each of the Banks’ impounded funds will be released. The remaining 50% of the balance will be released in the third stage.

- This measured approach aims to ensure that banks have sufficient liquidity to meet increased credit demand during the upcoming festival season.

What is I-CRR?

- Background:

- On 10th August 2023, following the announcement of the monetary policy and the demonetization of Rs 2000 notes, the RBI declared that banks would be required to maintain an Incremental Cash Reserve Ratio (I-CRR) of 10% on the increase in their Net Demand and Time Liabilities (NDTL).

- NDTL is the difference between the sum of demand and time liabilities (deposits) of a bank (with the public or the other bank) and the deposits in the form of assets held by the other banks.

- Stated that it would review it in September 2023, or earlier.

- On 10th August 2023, following the announcement of the monetary policy and the demonetization of Rs 2000 notes, the RBI declared that banks would be required to maintain an Incremental Cash Reserve Ratio (I-CRR) of 10% on the increase in their Net Demand and Time Liabilities (NDTL).

- Purpose of Introducing I-CRR:

- The RBI introduced the I-CRR as a temporary measure to manage excess Liquidity in the banking system.

- Several factors contributed to the Surplus Liquidity, including the demonetisation of Rs 2,000 banknotes.

- RBI's surplus transfer to the government, increased government spending, and capital inflows.

- This liquidity surge had the potential to disrupt price stability and financial stability, necessitating efficient liquidity management.

- The RBI introduced the I-CRR as a temporary measure to manage excess Liquidity in the banking system.

- Impact of I-CRR on Liquidity Conditions:

- The I-CRR measure would absorb over Rs 1 lakh crore of excess liquidity from the banking system.

- As a result of the I-CRR mandate, the banking system's liquidity temporarily turned into a deficit on 21st August 2023, exacerbated by outflows related to Goods and Services Tax (GST) and central bank intervention to stabilize the rupee.

- However, liquidity conditions returned to Liquidity from the system.

What is the Cash Reserve Ratio (CRR)?

- About:

- The percentage of cash required to be kept in reserves as against the bank's total deposits, is called CRR.

- All banks in India (all Scheduled Commercial Banks (SCBs) (including RRBs), Small Finance Banks (SFBs), Payments Banks, Primary (Urban) Co-operative Banks (UCBs), State Co-operative Banks (StCBs) and District Central Co-operative Banks (DCCBs)) have to maintain CRR with RBI.

- Every co-operative bank (not being a scheduled co-operative bank) and Local Area Banks shall maintain CRR with itself or with the RBI.

- Banks can’t lend the CRR money to corporates or individual borrowers, banks can’t use that money for investment purposes, and Banks don’t earn any interest on that money.

Note

Primary Agricultural Credit Societies are not covered by the Banking Regulation Act of 1949 and are not regulated by the RBI.

- Need to Have Reserve cash with the RBI:

- Since a part of the bank’s deposits is with the RBI, it ensures the security of the amount in case of any emergencies.

- The cash is readily available when customers want their deposits back.

- CRR helps in keeping inflation under control. If there is a threat of high inflation in the economy, RBI increases the CRR, so that banks need to keep more money in reserves, effectively reducing the amount of money that is available to the banks.

- This curbs the excess flow of money in the economy.

- When there is a need to pump funds into the market, the RBI lowers the CRR rate, which in turn, helps the banks provide loans to a large number of businesses and industries for investment purposes. Lower CRR also boosts the growth rate of the economy.

- The CRR and other monetary tools require every commercial bank to maintain but not the NBFC.

Why is RBI using I-CRR in the Case of Demonetisation?

- RBI has chosen to implement I-CRR in the case of a sudden influx of liquidity, such as during demonetization.

- RBI used I-CRR in November 2016, after the demonetization of Rs 500 and Rs 1,000 banknotes.

- It allows the RBI to address the issue without affecting other aspects of monetary policy. This precision can be crucial, especially during unique situations like demonetization.

- The I-CRR can be implemented relatively quickly. When there is a sudden surge in liquidity due to a large-scale event like the return of demonetized currency notes, the central bank may need a tool that can be put into effect promptly.

- The I-CRR is typically intended to be a temporary measure. It can be introduced when there is a need to absorb excess liquidity temporarily and can be phased out once the liquidity situation stabilizes.

- But on the other hand Other tools such as Repo Rate, Statutory Liquidity Ratio (SLR) etc may have rather long term and slower impact on liquidity.

What are the Monetary Policy Instruments Available to the RBI?

- Qualitative:

- Moral Suasion: This is a non-binding technique where the RBI uses persuasion and communication to influence banks' lending and investment behavior.

- Direct Credit Controls: These are measures that involve regulating the flow of credit to specific sectors or industries. The RBI can issue directives on lending to certain sectors or set credit limits to achieve policy objectives.

- Selective Credit Controls: These are more specific than direct credit controls and target particular types of loans, such as consumer credit, to control demand in specific areas of the economy.

- Quantitative:

- Cash Reserve Ratio (CRR): CRR is the proportion of a bank's deposits that it must keep as reserves with the RBI in the form of cash. By adjusting the CRR, the RBI can control the amount of funds available for lending by banks.

- Repo Rate: The repo rate is the interest rate at which the RBI lends money to commercial banks for the short term. A change in the repo rate can influence banks' borrowing costs and, subsequently, their lending rates.

- Reverse Repo Rate: The reverse repo rate is the interest rate at which banks can park their excess funds with the RBI. It provides a floor for short-term interest rates and helps manage liquidity.

- Bank Rate: The bank rate is the rate at which the RBI provides long-term funds to banks and financial institutions. It influences interest rates in the long-term money market.

- Open Market Operations (OMOs): OMOs involve the buying or selling of government securities by the RBI in the open market. This action affects the money supply and liquidity in the banking system.

- Liquidity Adjustment Facility (LAF): The LAF includes the repo rate and the reverse repo rate and is used by banks for their short-term liquidity needs. It helps the RBI manage daily liquidity conditions.

- Marginal Standing Facility (MSF): MSF is the rate at which banks can borrow overnight funds from the RBI against the collateral of government securities. It serves as a secondary source of funding for banks.

- Statutory Liquidity Ratio (SLR): SLR is the percentage of a bank's net demand and time liabilities (NDTL) that it must maintain in the form of approved securities.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. When the Reserve Bank of India announces an increase of the Cash Reserve Ratio, what does it mean? (2010)

(a) The commercial banks will have less money to lend

(b) The Reserve Bank of India will have less money to lend

(c) The Union Government will have less money to lend

(d) The commercial banks will have more money to lend

Ans: (a)

Q2. Which of the following terms indicate a mechanism used by commercial banks for providing credit to the government? (2010)

(a) Cash Credit Ratio

(b) Debt Service Obligation

(c) Liquidity Adjustment Facility

(d) Statutory Liquidity Ratio

Ans: (d)

Q3. With reference to Indian economy, consider the following: (2015)

- Bank rate

- Open market operations

- Public debt

- Public revenue

Which of the above is/are component/ components of Monetary Policy?

(a) 1 only

(b) 2, 3 and 4

(c) 1 and 2

(d) 1, 3 and 4

Ans: C

Q4. In the context of Indian economy, ‘Open Market Operations’ refers to (2013)

(a) borrowing by scheduled banks from the RBI

(b) lending by commercial banks to industry and trade

(c) purchase and sale of government securities by the RBI

(d) None of the above

Ans: C

Q5. In the context of Indian economy, which of the following is/are the purpose/purposes of ‘Statutory Reserve Requirements’? (2014)

- To enable the Central Bank to control the amount of advances the banks can create

- To make the people’s deposits with banks safe and liquid

- To prevent the commercial banks from making excessive profits

- To force the banks to have sufficient vault cash to meet their day-to-day requirements

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

Ans: (a)

Mains

Q. Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (2019)

Biodiversity & Environment

Global Stocktake Report

For Prelims: Global Stocktake Report, United Nations Climate Secretariat, Climate Change, Paris Agreement 2015, Greenhouse Gas (GHG), Nationally Determined Contribution.

For Mains: Global Stocktake Report and its Recommendations.

Why in News?

Recently, the synthesis report of the first Global Stocktake released by the United Nations Framework Convention on Climate Change (UNFCCC) ahead of the 18thG-20 summit in New Delhi.

- The synthesis report presents 17 key findings, painting a concerning picture of the world's progress towards Paris Agreement targets. While there is a limited window for corrective action, the report echoes previous warnings that global efforts are falling short.

What is Global Stocktake?

- The Global Stocktake is a periodic review mechanism established under the Paris Agreement in 2015.

- The stocktake takes place every five years, with the first-ever stocktake scheduled to conclude at the UN Climate Change Conference (COP28) at the end of 2023.

- Its primary objectives are to assess individual countries' efforts to reduce Greenhouse Gas (GHG) emissions and transition to renewable energy sources.

- The stocktake is designed to keep countries accountable and encourage them to increase their climate ambitions over time.

- In 2015, when countries committed in Paris to keep global temperatures from rising beyond 2 degrees Celsius by the end of the century and “as far as possible” below 1.5 degrees Celsius, they also agreed to periodically review, or take stock of efforts, made by individual countries in containing greenhouse gasses.

- While countries have laid out their Nationally Determined Contributions (NDC), they are expected to — but not obliged to — increase their ambitions every five years.

- While the latest NDC were submitted in 2020, a stocktake also aims to push countries to set higher targets before the next NDCs are published in 2025.

What are the Key Recommendations of the Report?

- Galvanizing Effect of Paris Agreement:

- The Paris Agreement has galvanised countries into setting goals and signalling the urgency of the climate crisis.

- Governments need to support ways to transition their economies away from fossil fuel businesses and that states and communities must strengthen efforts.

- Equitable Economic Transition:

- While rapid change could be “disruptive,” countries should work on ensuring that the economic transition is equitable and inclusive.

- Much more ambition is needed to reduce global GHG emissions by 43% by 2030 and further by 60% in 2035 and reach net zero CO2 emissions by 2050 globally.

- Rapid change should prioritize equitable and inclusive economic transitions.

- Scaling Up Renewable Energy and Halting Deforestation:

- Renewable energy has to be scaled up and all ‘unabated fossil fuels are to be rapidly eliminated.

- Deforestation and land-degradation have to be halted and reversed and agricultural practices critical to reducing emissions and conserving and enhancing carbon sinks have to be encouraged.

- Fragmented Adaptation Efforts:

- While the world, as a whole, has committed to scale up steps to help adapt to the unfolding and future impacts of climate change, most efforts were “fragmented, incremental, sector-specific and unequally distributed across regions.”

- Transparent reporting on adaptation could facilitate and enhance understanding, implementation and international cooperation.

- Addressing Loss and Damage:

- Averting, minimising and addressing ‘loss and damage,’ requires urgent action across climate and development policies to manage risks comprehensively and provide support to impacted communities.

- Support for adaptation and funding arrangements for averting, minimising and addressing loss and damage, from the impact of climate change, needed to be rapidly scaled up from expanded and innovative sources.

- Enhancing Climate Finance Access:

- Financial flows needed to be made consistent with climate-resilient development to meet urgent and increasing needs.

- A substantial shift in financial flows is essential to support low greenhouse gas emissions and climate-resilient development.

What is the Impact of Global Stocktake Report?

- The global stocktake report influenced the G20 Leaders Declaration, a significant outcome of the summit. For the first time, the declaration formally recognized the substantial financial requirements for transitioning to renewable energy.

- It noted the need for USD 5.8-5.9 trillion in the pre-2030 period for developing countries and USD 4 trillion per year for clean energy technologies by 2030 to achieve Net-Zero emissions by 2050.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q.1 With reference to the Agreement at the UNFCCC Meeting in Paris in 2015, which of the following statements is/are correct? (2016)

- The Agreement was signed by all the member countries of the UN and it will go into effect in 2017.

- The Agreement aims to limit the greenhouse gas emissions so that the rise in average global temperature by the end of this century does not exceed 2ºC or even 1.5ºC above pre-industrial levels.

- Developed countries acknowledged their historical responsibility in global warming and committed to donate $ 1000 billion a year from 2020 to help developing countries to cope with climate change.

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q2. The term ‘Intended Nationally Determined Contributions’ is sometimes seen in the news in the context of (2016)

(a) pledges made by the European countries to rehabilitate refugees from the war-affected Middle East

(b) plan of action outlined by the countries of the world to combat climate change

(c) capital contributed by the member countries in the establishment of Asian Infrastructure Investment Bank

(d) plan of action outlined by the countries of the world regarding Sustainable Development Goals

Ans: (b)

International Relations

India's Socio Economic Performance in Comparison to G20 Nations

For Prelims: G20, GDP per Capita, Human Development Index (HDI)

For Mains: Impact of Socioeconomic Indicators on India's Global Standing

Why in News?

Recently, India hosted the 18th G20 Summit in New Delhi under the theme 'One Earth, One Family, One Future.'

- As India handed over the G20 Presidency of 2024 to Brazil, it was essential to evaluate its socioeconomic performance in comparison to fellow G20 nations. , Unfortunately, India's recent performance in key socioeconomic indicators lagged behind its G20 counterparts.

What is the Status of India's Progress on Various Metrics in Comparison to G20 Members?

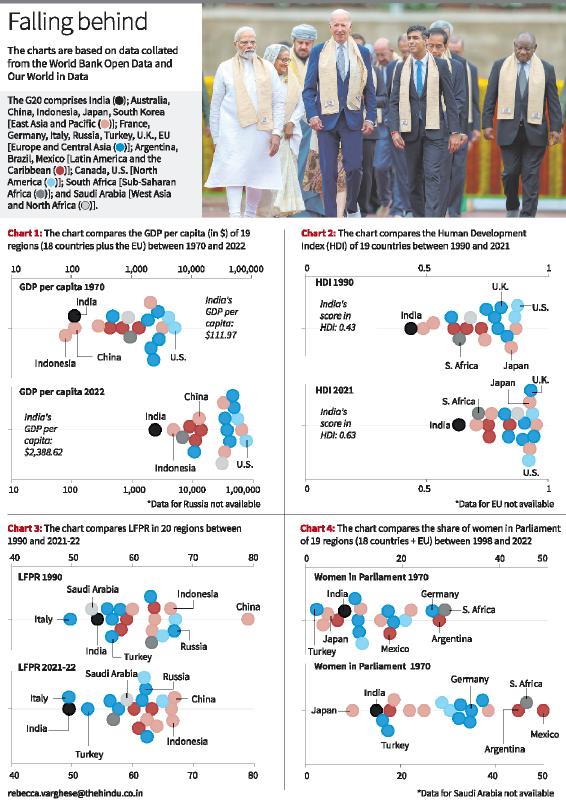

- Gross Domestic Product (GDP) per capita:

- GDP per capita is the sum of gross value added by all resident producers in the economy divided by mid-year population.

- In 1970, India ranked 18th out of 19 regions analysed (Russia excluded), with a GDP per capita of USD 111.97.

- By 2022, India's GDP per capita had increased to USD 2,388.62 but remained at the bottom among the 19 regions.

- Human Development Index (HDI):

- HDI is a composite index that measures average achievement in human development taking into account four indicators:

- Life expectancy at birth (Sustainable Development Goal 3),

- Expected years of schooling (Sustainable Development Goal 4.3),

- Mean years of schooling (Sustainable Development Goal 4.4),

- Gross national income (GNI) (Sustainable Development Goal 8.5).

- HDI is measured on a scale of 0 (worst) to 1 (best). The HDI of 19 countries (European Union(EU) excluded) between 1990 and 2021 is compared and India's HDI improved from 0.43 in 1990 to 0.63 in 2021, reflecting progress in life expectancy, education, and living standards.

- However, despite its progress in absolute terms, India ranked at the bottom of the list.

- HDI is a composite index that measures average achievement in human development taking into account four indicators:

- Health Metrics:

- Life Expectancy:

- India's average life expectancy increased from 45.22 years in 1990 to 67.24 years in 2021, surpassing South Africa but still lagging behind China.

- Infant Mortality:

- In 1990, India ranked last with an infant mortality rate of 88.8. By 2021, the rate improved to 25.5, but India ranked 19th out of 20 regions.

- Life Expectancy:

- Labour Force Participation Rate (LFPR):

- The (LFPR) above 15 years of age in the 20 regions was compared between 1990 and 2021-22.

- In 1990, with an LFPR of 54.2%, India ranked 18, above Italy (49.7%) and Saudi Arabia (53.3%).

- However, by 2021-22, India's LFPR slipped to 19th place, only ahead of Italy, with a reduced LFPR of 49.5%.

- The (LFPR) above 15 years of age in the 20 regions was compared between 1990 and 2021-22.

- Women in Parliament:

- The share of women in the Parliament of 19 regions (Saudi Arabia excluded) was compared between 1998 and 2022.

- India's share of women in Parliament increased from 8.1% in 1998 to 14.9% in 2022.

- However, compared to other G20 countries and the EU, India's rank declined from 15th in 1998 to 18th in 2022, just ahead of Japan.

- The share of women in the Parliament of 19 regions (Saudi Arabia excluded) was compared between 1998 and 2022.

- Environmental Performance:

- India has effectively curbed carbon emissions over the past three decades, consistently ranking as the lowest emitter among the 20 regions.

- However, India's progress in adopting eco-friendly energy sources has been relatively slow, with just 5.36% of electricity generated from renewables in 2015, ranking 13th among the 20 regions.

- India has effectively curbed carbon emissions over the past three decades, consistently ranking as the lowest emitter among the 20 regions.

Way Forward

- India should focus on policies that ensure economic growth reaches all segments of society. Targeted interventions for marginalized communities, rural development, and skill enhancement programs can help bridge income disparities.

- Policies should focus on creating more job opportunities, especially for the youth. Encouraging entrepreneurship can reduce unemployment, fostering inclusive development.

- India should focus on reducing infant mortality through targeted healthcare interventions, including maternal and child healthcare, immunisation, and sanitation infrastructure investments.

- Implement policies and programs that promote gender equality, including women's participation in the workforce and leadership roles.

- Accelerate the adoption of eco-friendly energy sources and increase renewable energy generation.

- Encouraging more women to enter politics and leadership roles is essential.

- Strengthen anti-corruption measures and promote ethical governance at all levels.

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Consider the following statements about G-20 :(2023)

- The G-20 group was originally established as a platform for the Finance Ministers and Central Bank Governors to discuss the international economic and financial issues.

- Digital public infrastructure is one of India's G-20 priorities.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

The G20:

- It was founded in 1999 after the Asian financial crisis as a forum for the Finance Ministers and Central Bank Governors to discuss global economic and financial issues. Hence statement 1 is correct.

- It was upgraded to the level of Heads of State/Government in the wake of the global economic and financial crisis of 2007, and, in 2009.

- The G20 Summit is held annually, under the leadership of a rotating Presidency.

- It is initially focused largely on broad macroeconomic issues, but it has since expanded its agenda to include trade, sustainable development, health, agriculture, energy, environment, climate change, and anti-corruption.

Digital Public Infrastructure (DPI):

- It is a shared means to many ends. It is a critical enabler of digital transformation and is helping to improve public service delivery at scale.

- Designed and implemented well, it can help countries achieve their national priorities and accelerate the Sustainable Development Goals.

- The Ministry of Electronics & Information Technology (MeitY), Government of India has partnered with the United Nations Development Programme (UNDP) to drive collective action on digital public infrastructure during India’s G20 Presidency. Hence, statement 2 is correct.

Mains

Q. Despite Consistent experience of high growth, India still goes with the lowest indicators of human development. Examine the issues that make balanced and inclusive development elusive. (2016)

Indian Economy

Gresham's Law and Currency Exchange Rate

For Prelims: Fixed Exchange Rate, Floating and Managed Float Exchange Rate, Bretton Woods Conference, 2022 Sri Lankan Crisis, Inflation.

For Mains: Advantages and Disadvantages of Fixed Exchange Rates, Alternatives to Fixed Exchange Rates.

Why in News?

Gresham's law, attributed to English financier Thomas Gresham, was a significant factor in the 2022 economic crisis in Sri Lanka. The crisis was characterized by the Central Bank of Sri Lanka's implementation of a fixed exchange rate between the Sri Lankan Rupee and the U.S. Dollar.

What is Gresham’s Law?

- Gresham’s law is a monetary principle that states that “bad money drives out good”. Bad money is a currency with equal or less value than its face value. Good money has the potential for a greater value than its face value.

- This means that if there are two types of money in circulation, one with a higher intrinsic value and one with a lower intrinsic value, people will tend to hoard the more valuable money and spend the less valuable money.

- As a result, the less valuable money will dominate the market, while the more valuable money will disappear from circulation.

- This law comes into play when the government fixes the exchange rate between two currencies, creating a disparity between the official rate and the market rate.

- It applies not just to paper currencies but also to commodity currencies and other goods.

- This means that if there are two types of money in circulation, one with a higher intrinsic value and one with a lower intrinsic value, people will tend to hoard the more valuable money and spend the less valuable money.

- Instances of Gresham's Law in Action:

- Gresham's Law became noticeable during Sri Lanka's economic crisis when the country's Central Bank set a fixed exchange rate between the Sri Lankan rupee and the U.S. dollar.

- Despite unofficial market rates suggesting that the U.S. dollar was worth much more, the government insisted on a fixed rate of 200 Sri Lankan rupees for one U.S. dollar.

- This led to the Sri Lankan rupee being considered more valuable than it actually was and the U.S. dollar being undervalued according to market rates.

- As a result, fewer U.S. dollars were available in the official foreign exchange market, and people started to avoid using them in official transactions.

- Gresham's Law became noticeable during Sri Lanka's economic crisis when the country's Central Bank set a fixed exchange rate between the Sri Lankan rupee and the U.S. dollar.

- Contrast to Gresham's Law:

- In contrast to Gresham's Law, Thiers' Law highlights a phenomenon where "good money drives out bad." In a free exchange rate environment, people tend to favor higher-quality currencies and gradually discard those they perceive as inferior.

- The rise of private cryptocurrencies (Good Money) in recent years is often cited as an example of how well-regarded, private money producers can displace government-issued currencies (Bad Money).

- In contrast to Gresham's Law, Thiers' Law highlights a phenomenon where "good money drives out bad." In a free exchange rate environment, people tend to favor higher-quality currencies and gradually discard those they perceive as inferior.

What is a Fixed Exchange Rate?

- About:

- A fixed exchange rate, also called pegged exchange rate, is a regime applied by a government or central bank that ties the country's official currency exchange rate to another country's currency or the price of gold.

- The purpose of a fixed exchange rate system is to keep a currency's value within a narrow band.

- A fixed exchange rate, also called pegged exchange rate, is a regime applied by a government or central bank that ties the country's official currency exchange rate to another country's currency or the price of gold.

- History:

- The Bretton Woods Conference, which took place in 1944, established the international monetary system that was characterized by fixed exchange rates.

- At the conference, participating countries agreed to peg their currencies to the U.S. dollar, which was convertible into gold at a fixed rate of USD 35 per ounce.

- It aimed to promote stability and prevent competitive devaluations of currencies, which had contributed to economic instability during the Great Depression and World War II.

- The Bretton Woods Conference, which took place in 1944, established the international monetary system that was characterized by fixed exchange rates.

- Downfall:

- The downfall of the fixed exchange rate system, established at the Bretton Woods Conference, was due to persistent trade imbalances, inflation, speculative attacks, lack of exchange rate adjustability, and dwindling U.S. gold reserves.

- The "Nixon Shocks" in 1971, which included suspending the U.S. dollar's convertibility into gold, marked the system's collapse.

- This transitioned major currencies to floating exchange rates, allowing flexibility in response to economic conditions.

What are Some Advantages and Disadvantages of Fixed Exchange Rates?

- Advantages:

- Price Stability: Fixed exchange rates can provide price stability. This stability can be especially beneficial for countries with high inflation rates or volatile currencies.

- Reduced Transaction Costs: In a fixed exchange rate system, businesses engaged in international trade may face fewer currency-related transaction costs, such as currency conversion fees and exchange rate risk management expenses.

- Investor Confidence: Fixed exchange rates can boost investor confidence. Investors are more likely to commit capital to a country with a stable currency, reducing the cost of capital and potentially spurring economic growth.

- Disadvantages:

- Loss of Monetary Policy Autonomy: One significant drawback is that countries adopting fixed exchange rates give up control over their monetary policy.

- To maintain the peg, they may need to adjust interest rates and money supply according to the anchor currency's policies, which may not align with their domestic economic needs.

- Speculative Attacks: Fixed exchange rate systems can be vulnerable to speculative attacks.

- If investors believe a country's currency is overvalued, they may engage in massive sell-offs, forcing the central bank to deplete its foreign exchange reserves to maintain the peg.

- External Dependency: Fixed exchange rate systems tie a country's fortunes to the stability and policies of the anchor currency issuer.

- If the anchor currency faces problems, the pegged country may suffer without the ability to adjust its exchange rate.

- Loss of Monetary Policy Autonomy: One significant drawback is that countries adopting fixed exchange rates give up control over their monetary policy.

What are Alternatives to Fixed Exchange Rates?

- Floating Exchange Rate: A floating exchange rate, also known as a flexible exchange rate, is a system where a currency's value is determined by supply and demand in the foreign exchange market.

- In this system, exchange rates can fluctuate continuously and are not officially pegged or fixed to any other currency or commodity.

- Floating exchange rates allow currencies to adjust freely to economic conditions, trade imbalances, and market forces.

- Example: Canada and Australia.

- Managed float: A managed float exchange rate, also referred to as a dirty float, is a system where a country's central bank or government occasionally intervenes in the foreign exchange market to influence its currency's value.

- While the exchange rate is allowed to float to some extent, authorities may buy or sell their own currency to stabilize or manage its value in response to certain economic goals or to prevent excessive volatility.

- Example: India and China.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of the Indian rupee? (2019)

(a) Curbing imports of non-essential goods and promoting exports

(b) Encouraging Indian borrowers to issue rupee-denominated Masala Bonds

(c) Easing conditions relating to external commercial borrowing

(d) Following an expansionary monetary policy

Ans: (d)

Q2. Consider the following statements:

The effect of devaluation of a currency is that it necessarily

- improves the competitiveness of the domestic exports in the foreign markets

- increases the foreign value of domestic currency

- improves the trade balance

Which of the above statements is/are correct?

(a) 1 only

(b) 1 and 2

(c) 3 only

(d) 2 and 3

Ans: (a)

Mains

Q. How would the recent phenomena of protectionism and currency manipulations in world trade affect macroeconomic stability of India? (2018)

Biodiversity & Environment

Marine Light Pollution

For Prelims: Artificial lighting, corals and plankton

For Mains: Artificial Light at Night (ALAN) - significance and associated issues, Impact of artificial lightning on organisms, Light Pollution

Why in News?

The impact of artificial lighting on land-based life (humans, fireflies, and birds) has been known for quite some time.

- However, a recent US-based study has argued to consider light pollution’s influence on coastal marine organisms as well which affects everything from whales to fish, corals, and plankton.

What is Artificial Lighting in the Marine Environment?

- About:

- Artificial lighting refers to the light that is produced from artificial sources such as candles, fire, electricity, etc.

- Ecologists and biologists have long recognized that artificial light at night can have adverse effects on the health of humans and terrestrial wildlife.

- Recent research is showing that marine life is also sensitive to artificial light, including extremely low levels and certain wavelengths, particularly blue and green light.

- Artificial lighting refers to the light that is produced from artificial sources such as candles, fire, electricity, etc.

- Marine Light Pollution: When this artificial light is used excessively or poorly, it becomes light pollution and disrupts the natural patterns of wildlife, contributing to the increase in carbon dioxide (CO2) in the atmosphere.

- The scientists found that 1.9 million km2 of the ocean experience biologically significant amounts of artificial light pollution to a depth of 1 metre.

- This represents about 3% of the world’s Exclusive Economic Zones (EEZs).

- Significant areas of the ocean are seeing light exposures to depths of 10 metres, 20 metres, or more.

- In areas with very clear water, the light at night can reach depths of more than 40 metres.

- The scientists found that 1.9 million km2 of the ocean experience biologically significant amounts of artificial light pollution to a depth of 1 metre.

- Sources:

- Coastal development (e.g., buildings, streetlights, billboards, ports, piers, docks and, light house).

- Vessels (e.g., fishing and merchant marine vessels), harbours and offshore infrastructure such as oil rigs.

- Some of the common types of artificial lights in the marine environment are LED, fluorescent, metal halide, and plasma lamps.

- White LEDs produce broad spectrum light that is sensed by a wide range of organisms and have a peak at short wavelengths (blue and green light) to which many marine organisms are particularly sensitive.

Note:

- The Earth is getting artificially brighter, at a rate of 2.2% per year. As a result of these brighter nights, the impacts of artificial light at night (ALAN) have become an increasing focus in terrestrial ecology.

- As per studies, non-natural light increased the brightness of Skyglow, by 9.2-10% every year between 2011 and 2022

- Research has shown that ALAN is a major form of anthropogenic pollution that can affect a wide range of biotic processes, including physiology, behaviour, animal movements, species interactions, community structure and reproduction.

How does Artificial Lightning Affect the Marine Ecosystem?

- Disruption of Normal Cycles: As per the study, it already took marine organisms an evolution of over millions of years to adapt to natural light and now the threat of ever-increasing anthropogenic light pollution has been posing several threats to them.

- Artificial light can easily wash out the glow of moonlight and starlight consequently disrupting their hormonal cycles, inter-species behaviour, and reproduction cycles.

- Illustration: For instance, to lay their eggs, female sea turtles try to find a quiet, dark spot and avoid light. However, due to artificial lightning, they may end up not coming ashore at all.

- Moreover, their hatchlings head toward inland lights instead of moonlight on the water and then die of dehydration or starvation.

- LEDs Worsening the Impact: The ever-growing usage of LED lighting is also altering the very nature of artificial light.

- Suggestion:

- Encouraging land-based Lights Out efforts (local, state, and regional campaigns to darken skies) to help migrating birds that are drawn to light at night. It will also benefit marine systems near coastal cities.

- Increasing the usage of red light in coastal areas as much as possible and putting up barriers to shield the coastline from artificial light.

- Red light, having the longest wavelength in the visible spectrum, doesn’t penetrate as far into the water.

Important Facts For Prelims

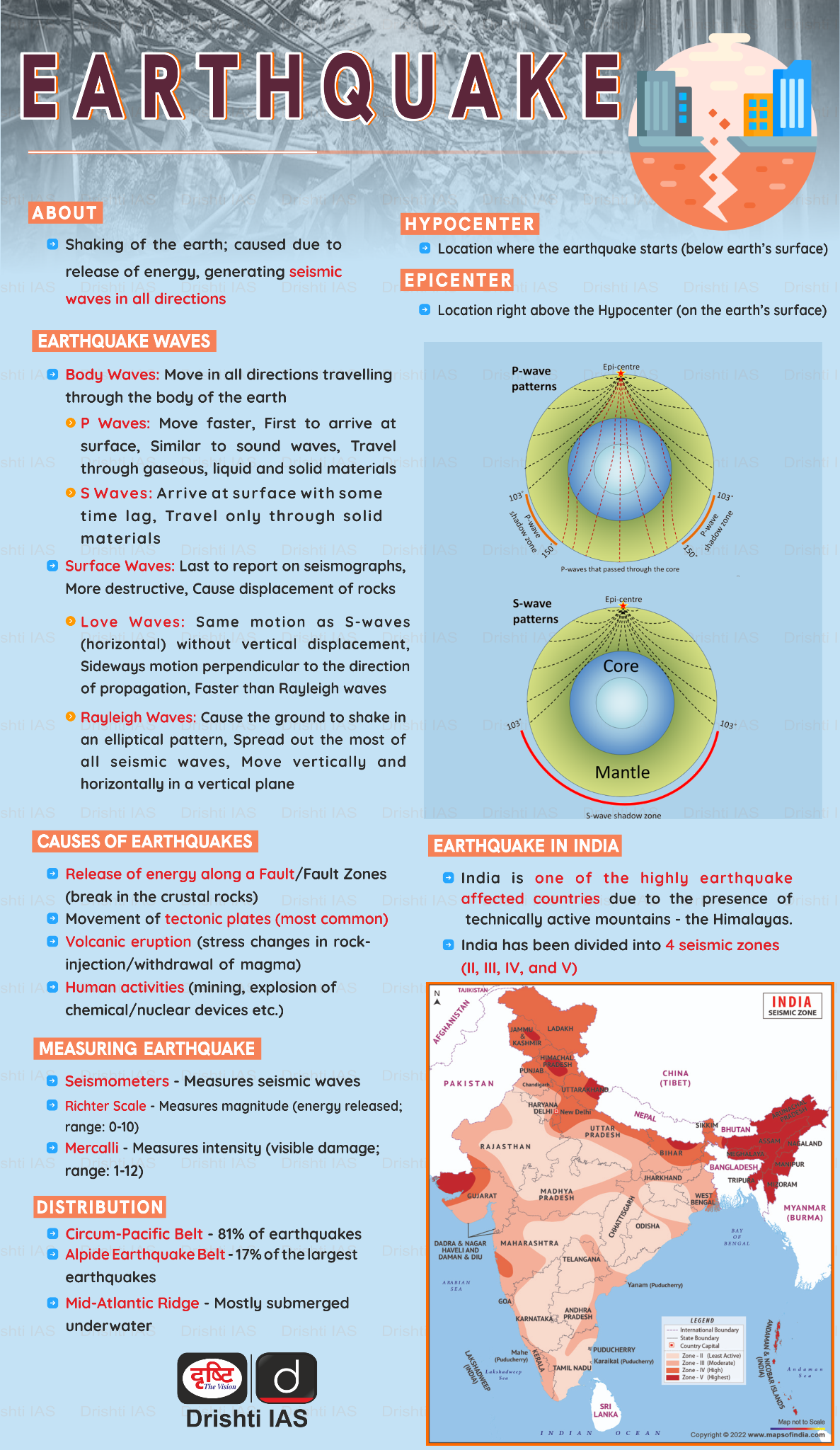

Strongest Earthquakes in History

Why in News?

- Recently, a powerful 6.8 magnitude earthquake struck Morocco killing over 2,900 people.

- According to the Significant Earthquake Events (SEE) database, this is the strongest quake to hit Morocco.

- The SEE database maintains some of the oldest earthquake records that fulfil certain criteria.

Note:

- The Significant Earthquake Database is maintained by the National Centers for Environmental Information (NCEI), a US government agency.

- It contains information on earthquakes from 2150 BCE to the present that meet at least one of the following criteria:

- Moderate damage (approximately USD 1 million or more)

- 10 or more deaths

- Magnitude of 7.5 or more

- An earthquake that generated a tsunami

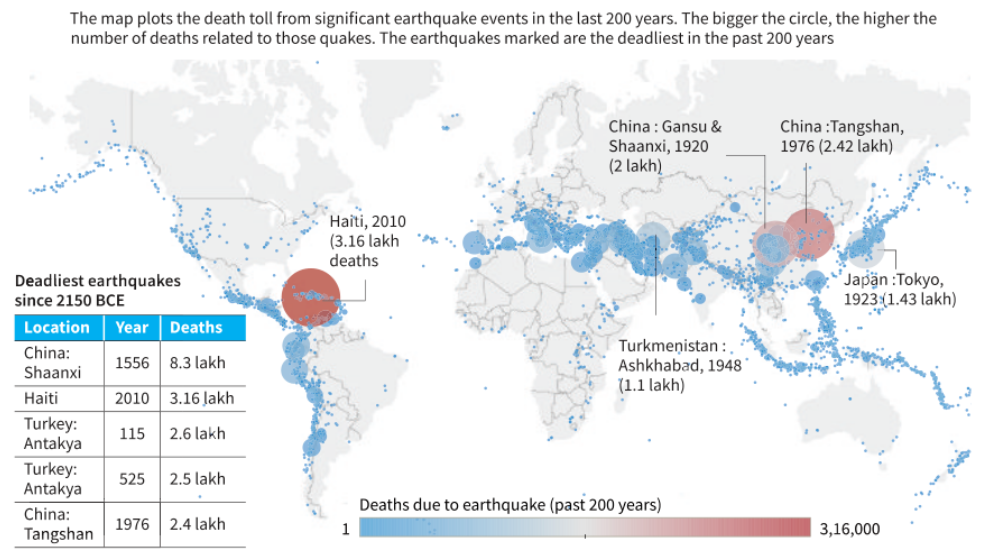

What is the NCEI’s Data on Earthquakes?

- Global Highest Earthquakes: As per NCEI, in the last 200 years, China has suffered the highest number of quakes — 428.

- It is followed by Indonesia (366 quakes), Iran (272), Japan (256), and Turkey (209).

- Most Severe Earthquakes: In the past 200 years, there have been four quakes with a magnitude of 9+.

- The most severe quake struck the Chilean city of Puerto Montt in 1960 (9.5).

- This is followed by Alaska in 1964 (9.2), Honshu (Japan) in 2011 (9.1), and Sumatra (Indonesia) in 2004 (9.1).

- Of the 10 most severe earthquakes since 2150 BCE, seven have occurred in the last 200 years.

- The most severe quake struck the Chilean city of Puerto Montt in 1960 (9.5).

- Morocco: The recent one that occurred is the strongest that hit Morocco. The deadliest ever to hit the country occurred in 1960 and killed about 13,100 people (Magnitude at 5.9).

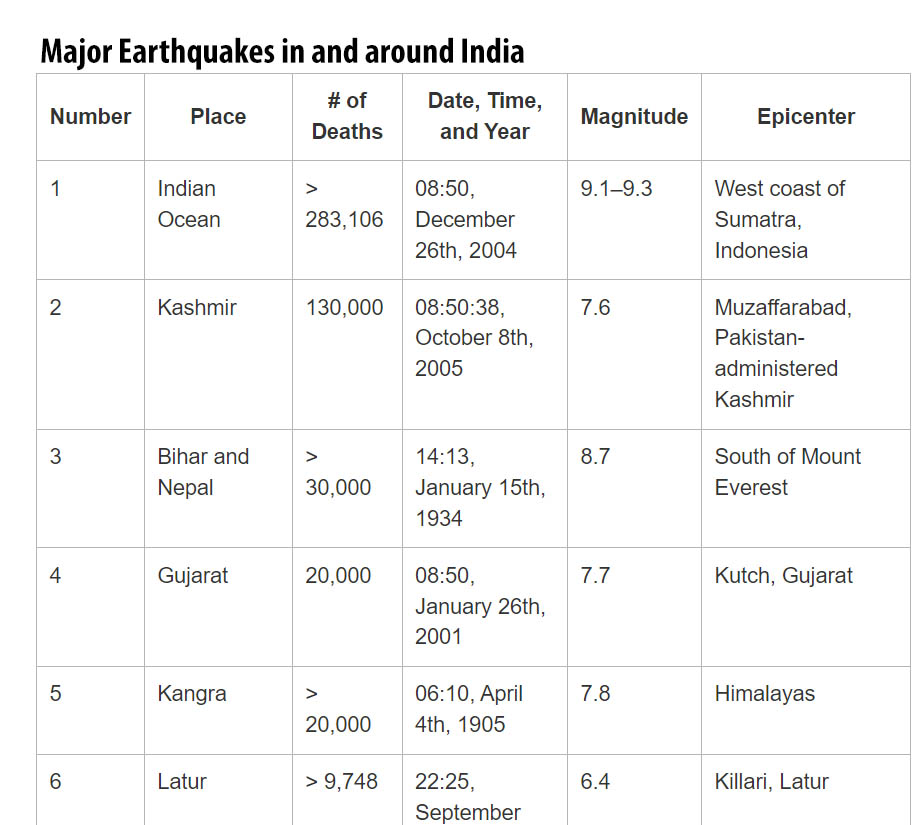

- India: As per NCEI, India has recorded 85 quakes in the last 200 years and ranks 16 on the list of countries with highest earthquakes.

- The deadliest earthquake to hit India (either in the last 200 years or since 2150 BCE), occurred in 2001 in Gujarat.

- The Bhuj earthquake (magnitude - 7.6), as it is commonly known, is considered to be the deadliest as it killed over 20,000 people.

- However, the Bhuj earthquake was not the strongest; the 1941 earthquake in Andaman (poorly recorded due to WW-II), and the 1897 earthquake in Assam, were both considered the strongest with a magnitude of 8.

- The deadliest earthquake to hit India (either in the last 200 years or since 2150 BCE), occurred in 2001 in Gujarat.

UPSC Civil Services Examination, Previous Year Questions

Prelims:

Q. Consider the following: (2013)

- Electromagnetic radiation

- Geothermal energy

- Gravitational force

- Plate movements

- Rotation of the earth

- Revolution of the earth

Which of the above are responsible for bringing dynamic changes on the surface of the earth?

(a) 1, 2, 3 and 4 only

(b) 1, 3, 5 and 6 only

(c) 2, 4, 5 and 6 only

(d) 1, 2, 3, 4, 5 and 6

Ans: (d)

Important Facts For Prelims

Leopard Sterilisation

Why in News?

Recently, the Maharashtra Government has decided to sterilize Leopards for the sustainable management of population for leopards in the State.

- Gujarat's forest department has also proposed sterilisation of leopards, especially in and around Gir National Park.

What is the Need for Sterilizing Leopards and Concerns?

- Need:

- In 2019-20 alone, Maharashtra saw 58 human deaths due to leopards—over half the 97 casualties in 2010-18.

- Maharashtra has decided to sterilize leopards as a response to the increasing leopard-human conflicts, rising leopard population, and the need to protect both leopards and human communities.

- The proposed sterilisation program aims to address these challenges while complying with environmental conservation laws and regulations.

- Concerns:

- Concerns about the sterilisation of leopards include doubts about its effectiveness, the need for comprehensive scientific research, veterinary skill development, potential stress on leopards, challenges with traditional methods, and alternative contraception options.

- There is also an emphasis on addressing conflicts and gaining community support for conservation efforts.

What are the Key Points Related to Leopards?

- Scientific Name: Panthera pardus

- About:

- The leopard is the smallest of the Big Cats (Of genus Panthera namely the Tiger, Lion, Jaguar, Leopard, and Snow Leopard), and known for its ability to adapt in a variety of habitats.

- A nocturnal animal, the leopard hunts by night.

- It feeds on smaller species of herbivores found in its range, such as the chital, hog deer and wild boar.

- Melanism is a common occurrence in leopards, wherein the entire skin of the animal is black in colour, including its spots.

- A melanistic leopard is often called black panther and mistakenly thought to be a different species.

- Habitat:

- It occurs in a wide range in sub-Saharan Africa, in small parts of Western and Central Asia, on the Indian subcontinent to Southeast and East Asia.

- The Indian leopard (Panthera pardus fusca) is a leopard widely distributed on the Indian subcontinent.

- It occurs in a wide range in sub-Saharan Africa, in small parts of Western and Central Asia, on the Indian subcontinent to Southeast and East Asia.

- Population in India:

- As per a recent report ‘Status of leopards in India, 2018’ released by the Ministry of Environment, Forest and Climate Change, there has been a “60% increase in the population count of leopards in India from 2014 estimates’’.

- The 2014 estimates placed the population of leopards at nearly 8,000 which has increased to 12,852.

- The largest number of leopards have been estimated in Madhya Pradesh (3,421) followed by Karnataka (1,783) and Maharashtra (1,690).

- As per a recent report ‘Status of leopards in India, 2018’ released by the Ministry of Environment, Forest and Climate Change, there has been a “60% increase in the population count of leopards in India from 2014 estimates’’.

- Threats:

- Poaching for the illegal trade of skins and body parts.

- Habitat loss and fragmentation

- Human-Leopard conflict

- Conservation Status:

- IUCN Red List: Vulnerable

- CITES: Appendix-I

- Indian Wildlife (Protection) Act, 1972: Schedule-I

UPSC Civil Services Exam, Previous Year Questions (PYQ)

Q. Consider the following: (2012)

- Black-necked crane

- Cheetah

- Flying squirrel

- Snow leopard

Which of the above are naturally found in India?

(a) 1, 2 and 3 only

(b) 1, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (b)

Rapid Fire

Rapid Fire Current Affairs

Bhoj Wetland

The National Green Tribunal (NGT) recently ordered the MP state govt to stop the operation of cruise vessels as well as other motor-propelled boats in the Bhoj wetland on account of the drastic damage being done to water bodies.

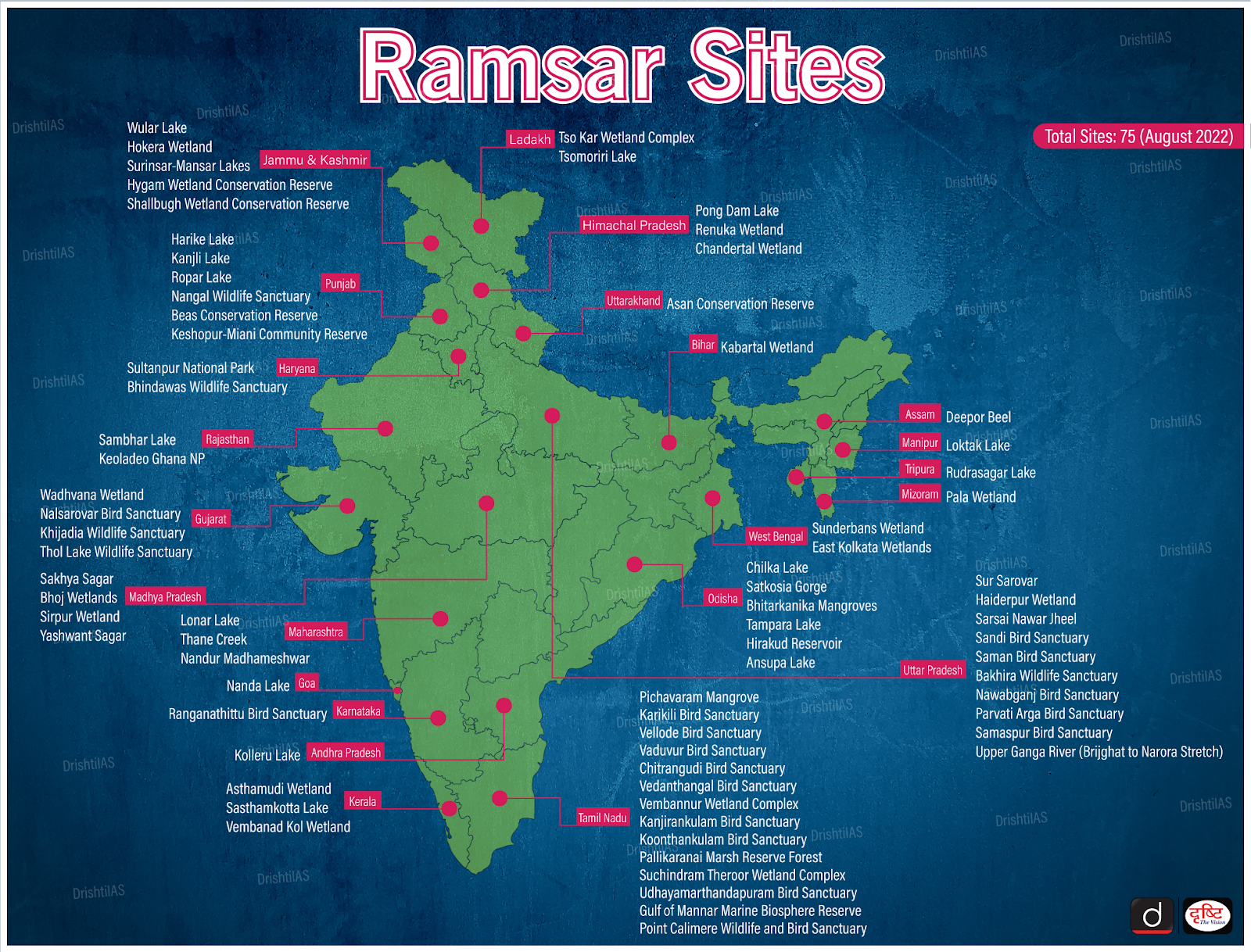

- The Bhoj Wetland, also known as Bhopal Lake is a designated Ramsar site and hence, a wetland of international importance (Ramsar Convention 1971).

- It consists of two contiguous human-made reservoirs -

- "Upper Lake" - created in the 11th century by construction of an earthen dam across the Kolans River.

- “Lower Lake” - constructed ~200 years ago, largely from leakage from the Upper lake. It is surrounded by the city of Bhopal.

Read More: National Green Tribunal (NGT), Wetlands in India, Ramsar Convention 1971 (Infographic)

Foreigners’ Tribunals

Recently, the Assam state government disclosed that since 2001, a total of 3,100 people have been declared and convicted as foreigners by tribunals in Assam and have been deported. These people were declared non-citizens by Foreigners’ Tribunals (FTs).

- Steps against people with doubtful citizenship are taken according to the Foreigners’ Act of 1946, the Foreigners (Tribunal) Order of 1964 and notifications issued by the Centre from time to time.

- FTs are quasi-judicial bodies to whom an individual can represent his/her case if their name does not figure in the final National Register of Citizens (NRC). Only FTs are empowered to declare a person as a foreigner.

- The FTs judge their citizenship on the basis of documents provided or the lack of them.

Read More: Foreigners Tribunals, Citizenship of India

South Korea and Quad

South Korea has expressed its will to join the Quad grouping and now the decision of expansion rests with the latter.

- Currently, Quad is a grouping of India, Australia, the US, and Japan formed on a common ground of democratic values of the countries. It aims to ensure and support a “free, open and prosperous” Indo-Pacific region.

- On the bilateral front, India and South Korea are negotiating expansion of the Comprehensive Economic Partnership Agreement (CEPA) (in place since 2010).

Read More: Quad, India-South Korea Relations

Expansion of PM Ujjawala Yojana

The Union Cabinet has recently approved the extension of Pradhan Mantri Ujjwala Yojana (PMUY) for release of 75 lakh LPG connections over 3 years from FY 23-24 to FY 25-26 increasing the total number of beneficiaries to 10.35 crore.

Initiatives to expand LPG coverage:

- PAHAL (Pratyaksh Hastantarit Labh): To reduce "ghost" accounts and illegal use of household cylinders for commercial purposes, the LPG cylinders were not sold at subsidised price and rather at market price.

- The applicable subsidy was directly transferred to the individual's bank account electronically.

- GIVE IT UP: Instead of removing subsidies forcefully, people were encouraged to voluntarily surrender their subsidies which helped redirect the funds to those who genuinely needed assistance in acquiring LPG cylinders.

Read More: Pradhan Mantri Ujjwala Yojana