Indian Economy

Monetary Policy Review: RBI

- 10 Aug 2022

- 12 min read

For Prelims: RBI, Monetary Policy Committee (MPC), Instruments of Monetary Policy, Various Policy Stances of RBI

For Mains: Monetary Policy, Growth & Development, Monetary policy and its instruments

Why in News?

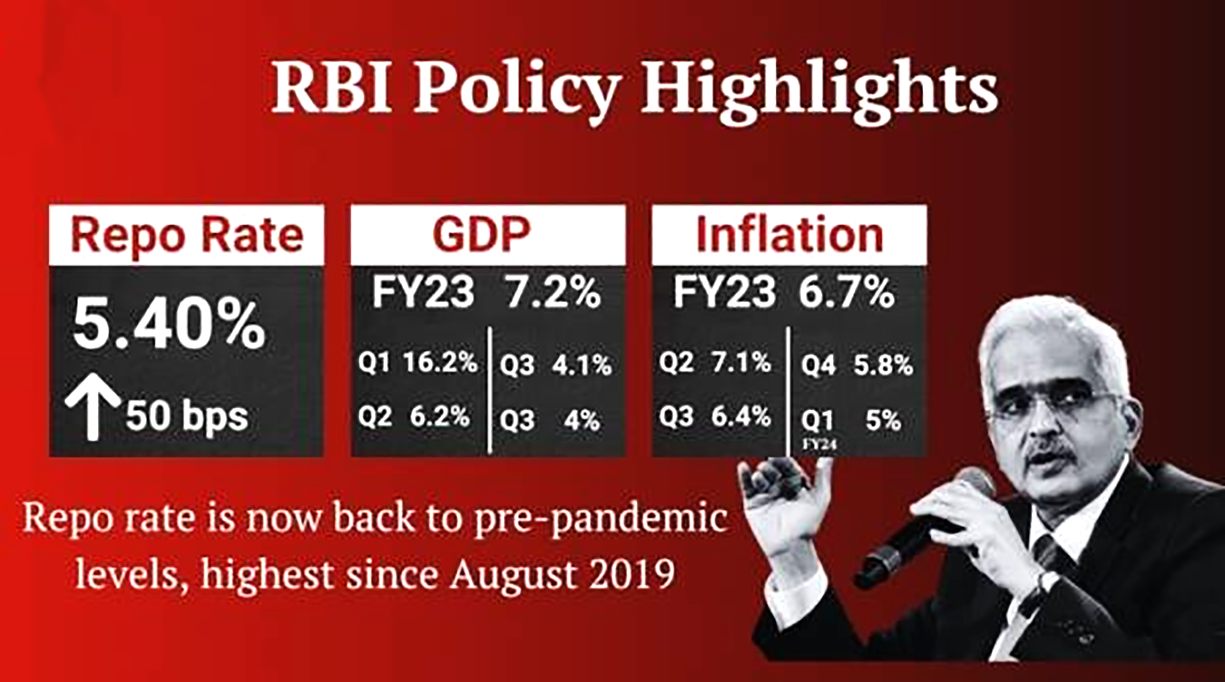

Recently, the Reserve Bank of India (RBI) in its Monetary Policy Committee (MPC) Review announced a 50-basis point hike in the repo rates thereby taking the cumulative rate hike over the last three months to 140 basis points.

What are the Highlights?

- Key Rates:

- Policy Repo Rate: 5.40%

- Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. Here, the central bank purchases the security.

- Standing Deposit Facility (SDF): 5.15%

- The SDF is a liquidity window through which the RBI will give banks an option to park excess liquidity with it.

- It is different from the reverse repo facility in that it does not require banks to provide collateral while parking funds.

- Marginal Standing Facility Rate: 5.65%

- MSF is a window for scheduled banks to borrow overnight from the RBI in an emergency situation when interbank liquidity dries up completely.

- Under interbank lending, banks lend funds to one another for a specified term.

- MSF is a window for scheduled banks to borrow overnight from the RBI in an emergency situation when interbank liquidity dries up completely.

- Bank Rate: 5.65%

- It is the rate charged by the RBI for lending funds to commercial banks.

- Cash Reserve Ratio (CRR): 4.50%

- Under CRR, the commercial banks have to hold a certain minimum amount of deposit (NDTL) as reserves with the central bank.

- Statutory Liquidity Ratio (SLR): 18.00%

- SLR is the minimum percentage of deposits that a commercial bank has to maintain in the form of liquid cash, gold or other securities.

- Policy Repo Rate: 5.40%

- Projections:

- GDP Growth for 2022-23: 7.2%

- Gross Domestic Product (GDP) gives the economic output from the consumers’ side. It is the sum of private consumption, gross investment in the economy, government investment, government spending and net foreign trade (the difference between exports and imports).

- Inflation Projection for 2022-23: 6.7%

- Inflation is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country.

- GDP Growth for 2022-23: 7.2%

Why a Hike in the Repo Rate?

- Even as the consumer price inflation has eased from its surge in April 2022, it is expected to remain uncomfortably high and above the upper threshold (6%) of the target.

- These elevated levels of inflation remained the key concern for the MPC as the inflation target of Government of India according to RBI is (4%+/- 2%)

- It is expected that Inflation would remain above the Upper Threshold (6 %), in Q2 and Q3 (FY 2022-23).

- This sustained high inflation may destabilise inflation expectations and harm growth in the medium term.

- The withdrawal of Monetary Accommodation (Expanding money Supply) or increasing Rates can keep inflation expectations in range and contain the Second-Round Effects of Inflation.

- Second-round effects occur when inflation passes to impact the wage and price setting, leading to a wage-price spiral.

How will Hike in repo rate impact Borrowers and Depositors?

- It will hit the home loan customers and prospective borrowers, as it will result in a hike in lending rates.

- It will benefit the conservative investors, who like to park their funds in bank fixed deposits, since the deposit rates are expected to increase following the rate hike.

- The deposit rate hike will help fulfil the credit demand in the economy and also help banks raise additional funds.

What about Liquidity?

- While improving the availability of funds with the banks, Rates Hike will lead to a gradual decline in systemic liquidity.

- To maintain adequate liquidity in the system, RBI will conduct two-way fine-tuning operations in the form of Variable Rate Repo (VRR) and Variable Rate Reverse Repo (VRRR) operations of different maturities.

- The Variable Rate Operations are usually undertaken to reduce the money flow by taking out existing cash present in the system.

- The central bank has been rebalancing the surplus liquidity in the system by shifting it out of the fixed-rate overnight reverse repo window to VRRR auctions of longer maturity.

What is Monetary Policy Framework?

- About:

- In May 2016, the RBI Act was amended to provide a legislative mandate to the central bank to operate the country’s monetary policy framework.

- Objective:

- The framework aims at setting the policy (repo) rate based on an assessment of the current and evolving macroeconomic situation, and modulation of liquidity conditions to anchor money market rates at or around the repo rate.

- Reason for Repo Rate as Policy Rate: Repo rate changes transmit through the money market to the entire financial system, which, in turn, influences aggregate demand.

- Thus, it is a key determinant of inflation and growth.

What is the Monetary Policy Committee?

- Origin: Under Section 45ZB of the amended (in 2016) RBI Act, 1934, the central government is empowered to constitute a six-member Monetary Policy Committee (MPC).

- Objective: Further, Section 45ZB lays down that “the Monetary Policy Committee shall determine the Policy Rate required to achieve the inflation target”.

- The decision of the Monetary Policy Committee shall be binding on the Bank.

- Composition: Section 45ZB says the MPC shall consist of 6 members:

- RBI Governor as its ex officio chairperson,

- Deputy Governor in charge of monetary policy,

- An officer of the Bank to be nominated by the Central Board,

- Three persons to be appointed by the central government.

- This category of appointments must be from “persons of ability, integrity and standing, having knowledge and experience in the field of economics or banking or finance or monetary policy”.

What are the Instruments of Monetary Policy?

- Repo Rate

- Standing Deposit Facility (SDF) Rate

- Marginal Standing Facility (MSF) Rate

- Liquidity Adjustment Facility (LAF)

- LAF Corridor

- Main Liquidity Management Tool

- Fine Tuning Operations

- Reverse Repo Rate

- Bank Rate

- Cash Reserve Ratio (CRR)

- Statutory Liquidity Ratio (SLR)

- Open Market Operations (OMOs)

What is an Expansionary Monetary Policy?

- About:

- An expansionary monetary policy is focused on expanding (increasing) the money supply in an economy. This is also known as Easy Monetary Policy.

- It is implemented by lowering key interest rates thus increasing market liquidity (money supply). High market liquidity usually encourages more economic activity.

- When RBI adopts Expansionary Monetary Policy, it decreases Policy Rates (Interest Rates) like Repo, Reverse Repo, MSF, Bank Rate etc.

- Implications:

- Causes an increase in bond prices and a reduction in interest rates.

- Lower interest rates lead to higher levels of capital investment.

- The lower interest rates make domestic bonds less attractive, so the demand for domestic bonds falls and the demand for foreign bonds rises.

- The demand for domestic currency falls and the demand for foreign currency rises, causing a decrease in the exchange rate. (The value of the domestic currency is now lower relative to foreign currencies)

- A lower exchange rate causes exports to increase, imports to decrease and the balance of trade to increase.

What is Contractionary Monetary Policy?

- About:

- A contractionary monetary policy is focused on contracting (decreasing) the money supply in an economy. This is also known as Tight Monetary Policy.

- A contractionary monetary policy is implemented by increasing key interest rates thus reducing market liquidity (money supply). Low market liquidity usually negatively affects production and consumption. This may also have a negative effect on economic growth.

- When RBI adopts a contractionary monetary policy, it increases Policy Rates (Interest Rates) like Repo, Reverse Repo, MSF, Bank Rate etc.

- Implications:

- Contractionary monetary policy causes a decrease in bond prices and an increase in interest rates.

- Higher interest rates lead to lower levels of capital investment.

- The higher interest rates make domestic bonds more attractive, so the demand for domestic bonds rises and the demand for foreign bonds falls.

- The demand for domestic currency rises and the demand for foreign currency falls, causing an increase in the exchange rate. (The value of the domestic currency is now higher relative to foreign currencies)

- A higher exchange rate causes exports to decrease, imports to increase and the balance of trade to decrease.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q. With reference to Indian economy, consider the following: (2015)

- Bank rate

- Open market operations

- Public debt

- Public revenue

Which of the above is/are component/ components of Monetary Policy?

(a) 1 only

(b) 2, 3 and 4

(c) 1 and 2

(d) 1, 3 and 4

Ans: (c)

Mains

Q. Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (2019)