India's Push for Reducing Cross-Border Remittance Costs at WTO

For Prelims: World Trade Organization, International Monetary Fund, Sustainable Development Goals, G20, Unified Payments Interface, Free Trade Agreements , Agreement on Agriculture

For Mains: Cross-border remittances, International Collaborations for Economic Development

Why in News?

India’s proposal to lower the costs of cross-border remittances, presented at the World Trade Organization’s (WTO) 13th Ministerial Conference 2024 held earlier in Abu Dhabi, has gained backing from countries like Morocco and Vietnam.

- However, it has also faced resistance from some WTO members, highlighting the ongoing challenges in achieving global consensus on this critical issue.

Costs of Cross-border Remittances

- Remittance costs are the fees charged when someone sends money internationally. Fees can vary based on the amount sent and the method used.

- The current global average remittance cost is 6.25% of the amount sent, according to the International Monetary Fund (IMF).

- For smaller remittances under USD 200, remittance fees typically average 10% and can be as high as 15-20% of the principal in smaller migration corridors.

Note

- In 2016, the G20 integrated the UN’s 2030 Agenda by adopting the target of reducing remittance costs to below 3% (as outlined in SDG 10.c.) and eliminating remittance corridors with costs above 5% by 2030.

- In 2021, reaffirming this commitment, the G20 emphasised its dedication to SDG 10.c through the G20 Roadmap for Enhancing Cross-Border Payments, aiming to lower the average cost of remittances to less than 3%.

What is India's Proposal About Costs of Cross-border Remittances?

- Proposal: The draft proposal submitted by India in March 2024 at the WTO’s 13th Ministerial Conference, the proposal aims to reduce the global average cost for sending remittances which is currently more than double the Sustainable Development Goal (SDG) target of 3%.

- India suggests that digital remittances, with an average cost of 4.84%, are significantly cheaper and should be promoted.

- India has also proposed initiating a work programme to make concrete recommendations on reducing remittance costs.

- India’s Need for Remittance Cost Cut: India received the highest remittance inflows globally in 2023, amounting to USD 125 billion.

- Reducing remittance costs could further increase the inflow of funds. In 2023, India spent around USD 7-8 billion on remittance fees.

- As remittance costs decrease, making transfers cheaper and faster, the dependence on hawala will likely diminish as well.

- The hawala refers to an informal channel for transferring funds from one location to another through service providers (known as hawaladars) regardless of the nature of the transaction and the countries involved.

- Support and Challenges: Nations like Morocco and Vietnam have expressed strong support for India's proposal, recognizing the importance of reducing remittance costs.

- Countries such as the US and Switzerland have opposed the proposal, citing concerns about their own financial institutions’ revenue from remittance fees.

Remittance Inflow in India

- In 2023, India topped in remittances inflow list, followed by Mexico (USD 66 billion), China (USD 50 billion), the Philippines (USD 39 billion), and Pakistan (USD 27 billion).

- In FY23-24, Indians abroad sent a record USD 107 billion in remittances to India surpassing USD 100 billion for the second consecutive year.

- The net remittance amount nearly doubles the combined total of USD 54 billion from foreign direct investments (FDI) and portfolio investments during the same period.

- Gross remittances from the Indian diaspora reached USD 119 billion in FY24. After accounting for repatriation of income and related expenses, net private transfers amounted to USD 107 billion.

- According to a Reserve Bank of India (RBI) survey, the United States was the primary contributor, accounting for 23% of the total remittances. Most remittances are intended for familial support, with some allocated to investments such as deposits.

- Remittance volumes are influenced by migration levels, employment conditions in origin countries, and the cost of remitting funds.

What are the Benefits from a Remittance Cost Cut?

- Global Indian Diaspora: Lower costs ensure that more money goes to the sender’s family and less to intermediaries.

- Non-Resident Indians (NRI) community, and overseas travellers would find it easier and cheaper to transfer funds to and from India.

- Benefit to Indian MSMEs: Reduced foreign exchange costs would make Indian goods and services more competitive, leading to higher profit margins.

- Reduced remittance costs would make cross-border transactions more efficient, aligning with the Indian government’s goal to improve ease of doing business.

- Domestic Economy and UPI Transactions: Increased remittance inflows at lower costs could marginally strengthen the domestic currency and improve personal consumption patterns.

- The remittance cost cut could serve as a catalyst for expanding Unified Payments Interface (UPI) penetration in global markets.

- Financial Inclusion: Lower remittance costs can improve access to financial services for underserved populations, fostering greater financial inclusion.

- Since 78% of total remittance flows in 2023 went to Low and Middle-Income Countries (LMICs), reducing transaction costs is crucial for decreasing inequality both within and among countries.

- Bridging Socio-Economic Disparities: Lower transaction costs ensure that more of the remittance amount reaches those in need, helping to bridge economic disparities and support development in these regions.

- Lower costs mean that senders retain more of their money, which can lead to increased savings and investment in their home countries.

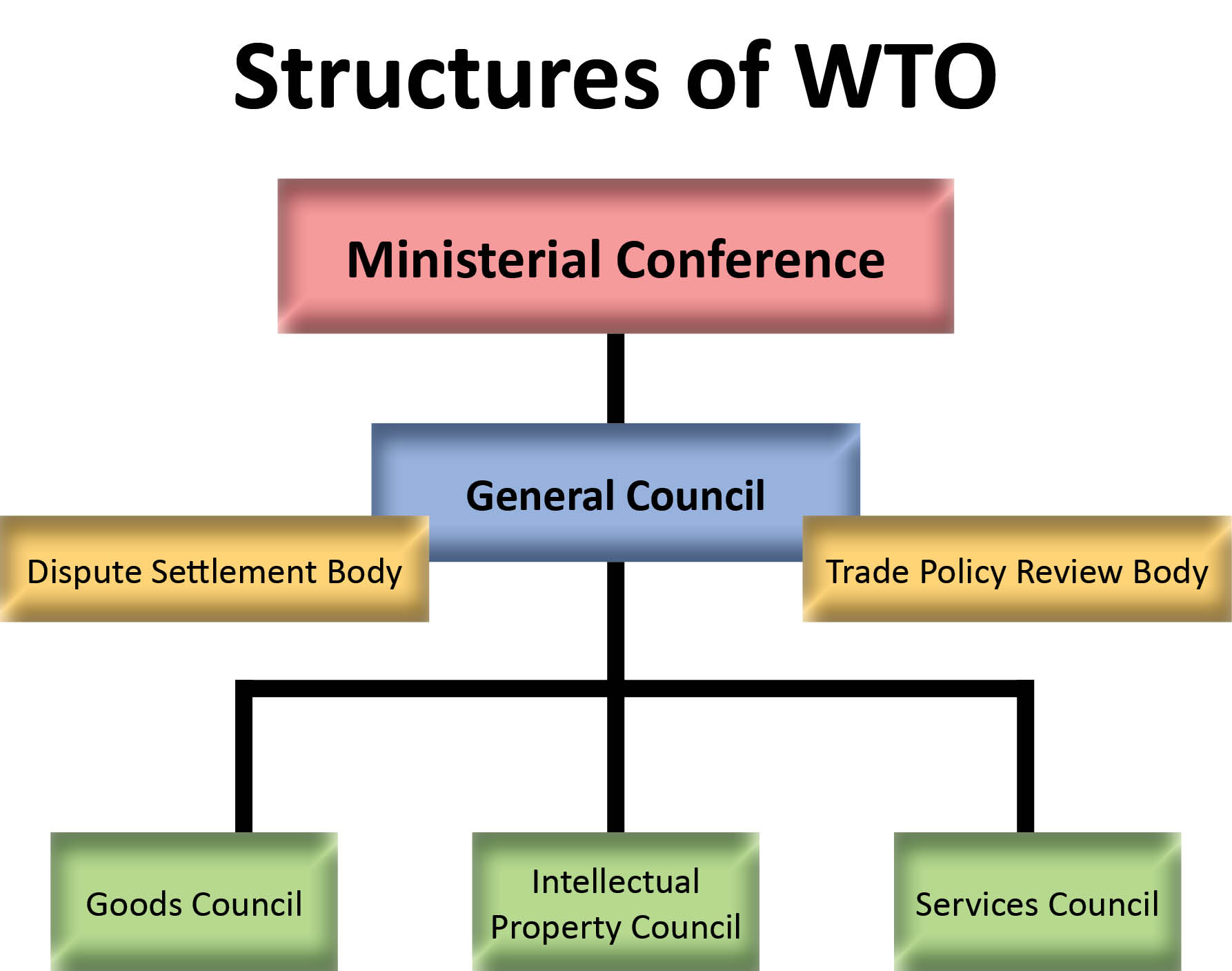

What are the Key Facts About the World Trade Organization?

- Origins: The Marrakesh Agreement, signed in 1994, established the WTO, which officially began on 1st January 1995.

- It succeeded the General Agreement on Tariffs and Trade (GATT) and was part of the Uruguay Round negotiations (1986-94) to create a more comprehensive global trade organisation.

- Members: WTO has 166 members, including India (since 1995 and a member of GATT since 1948), accounting for around 98% of world trade.

- WTO Secretariat: The WTO Secretariat, based in Geneva, Switzerland, supports the organisation's functions but does not itself have decision-making powers.

- The Secretariat is led by the Director-General, who oversees its operations

- Key WTO Principles:

- Most-Favoured-Nation (MFN): It requires that any favourable trading terms offered to one member must be extended to all other WTO members.

- National Treatment: This principle mandates that once a product, service, or intellectual property enters a market, it should receive non-discriminatory treatment compared to domestic products.

- Charging customs duty on an import is not a violation of national treatment.

- WTO Ministerial Conference: It is the organization's top decision-making body, meeting every two years with all members involved in decisions on matters covered under multilateral trade agreements.

- Important Agreements of the WTO:

Way Forward

- WTO Deputy Director General emphasised the need for increased awareness and outreach to garner broader support for reducing the remittance cost cut. Collaboration with international organisations such as the International Labour Organization (ILO) and the World Bank is crucial.

- Foster interoperability among different digital remittance platforms of countries to facilitate seamless cross-border transactions.

- Digital channels like UPI offer some cost savings, being cheaper than non-digital channels.

- Promote regulatory harmonisation among countries to reduce barriers and facilitate cross-border remittances.

|

Drishti Mains Question: Analyse the impact of remittance costs on developing economies. How does India's proposal to the World Trade Organization aim to address this issue? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. The terms ‘Agreement on Agriculture’, ‘Agreement on the Application of Sanitary and Phytosanitary Measures’ and ‘Peace Clause’ appear in the news frequently in the context of the affairs of the (2015)

(a) Food and Agriculture Organization

(b) United Nations Framework Conference on Climate Change

(c) World Trade Organization

(d) United Nations Environment Programme

Ans: c

Q2. In the context of which of the following do you sometimes find the terms ‘amber box, blue box and green box’ in the news? (2016)

(a) WTO affairs

(b) SAARC affairs

(c) UNFCCC affairs

(d) India-EU negotiations on FTA

Ans: a

Mains

Q1. What are the key areas of reform if the WTO has to survive in the present context of ‘Trade War’, especially keeping in mind the interest of India? (2018)

Q2. “The broader aims and objectives of WTO are to manage and promote international trade in the era of globalisation. But the Doha round of negotiations seem doomed due to differences between the developed and the developing countries.” Discuss in the Indian perspective. (2016)

Restatement of Values of Judicial Life

For Prelims: Chief Justice of India, Supreme Court, Bangalore Principles of Judicial Conduct, UN Basic Principles on the Independence of the Judiciary, United Nations Convention against Corruption

For Mains: Ethical Frameworks for Judiciary, Global Standards for Independence of the Judiciary

Why in News?

The recent visit of the Prime Minister of India to Chief Justice of India (CJI) residence has sparked controversy, particularly in the context of the "Restatement of Values of Judicial Life" adopted by the Supreme Court in 1997.

Note:

Socio-religious (personal) and administrative/judicial life of a public servant are distinct. The CJI (or any other public servant) cannot be questioned on personal life, as personal relationships fall outside the scope of judicial scrutiny. However, the judiciary must remain independent and free from undue influence, upholding the constitutional principle of separation of powers.

What is Restatement of Values of Judicial Life?

- The 'Restatement of Values of Judicial Life' is a code of judicial ethics adopted by the Supreme Court, serving as a guide for an independent and fair judiciary, ensuring the impartial administration of justice.

- The Code Comprises 16 Points:

- Justice must not merely be done but it must also be seen to be done. Judges must avoid any actions that erode public confidence in impartiality of the judiciary.

- Accordingly, any act of a judge of the Supreme Court or a high court, whether in official or personal capacity, which erodes the credibility of this perception, has to be avoided.

- A judge should not contest the election to any office of a club, society or other association, except in a society or association connected with the law.

- Close association with individual members of the bar, particularly those who practise in the same court, shall be avoided.

- A judge should not allow any member of their immediate family or a close relative who is a member of the Bar to appear before them or be involved in a case that they are handling.

- No member of a judge's family who is a member of the Bar shall be permitted to use the judge's residence or other facilities for professional work.

- A judge should practise a degree of aloofness (being distant) consistent with the dignity of his office.

- A judge shall not hear and decide a matter in which a member of his family, a close relation or a friend is concerned.

- A judge shall not engage in public debate or express political views on matters pending or likely to arise for judicial determination.

- A judge should let his judgments speak for themselves and not give media interviews.

- A judge shall not accept gifts or hospitality except from family, close relations and friends.

- A judge shall not hear and decide a matter in which a company in which he holds shares is concerned unless he has disclosed his interest and no objection to his hearing and deciding the matter is raised.

- A judge shall not speculate in shares, stocks or the like.

- Judges should not engage in trade or business, directly or indirectly, but publishing legal work or hobby activities are exceptions.

- A judge should not solicit, accept, or associate with fundraising for any purpose.

- A judge should not seek any financial benefit in the form of a perquisite or privilege attached to his office unless it is clearly available. Any doubt on this behalf must be resolved and clarified through the Chief Justice.

- Judges must always be aware they are under public scrutiny and avoid any act or omission unbecoming of their high office.

- Justice must not merely be done but it must also be seen to be done. Judges must avoid any actions that erode public confidence in impartiality of the judiciary.

Bangalore Principles of Judicial Conduct

- In July 2006, the United Nations Economic and Social Council (ECOSOC) adopted a resolution recognizing the Bangalore Principles of Judicial Conduct as an important advancement and complement to the 1985 United Nations Basic Principles on the Independence of the Judiciary.

- The Bangalore Principles of Judicial Conduct aim to set ethical standards for judges, providing a framework for regulating judicial behaviour and offering guidance on maintaining judicial ethics.

- The Principles recognize six core values: independence, impartiality, integrity, propriety, equality, and competence and diligence, which define the expected conduct for judges to effectively practise each value.

1985 UN Basic Principles on the Independence of the Judiciary

- It was adopted at the Seventh UN Congress on the Prevention of Crime and the Treatment of Offenders, 1985 and endorsed by General Assembly resolutions 40/32 and 40/146.

- These principles aim to bridge the gap between ideal judicial independence and real-world practices, ensuring justice is maintained, human rights are protected, and the judiciary operates free from discrimination.

- Key aspects include guaranteed independence, impartial decision-making, exclusive jurisdiction, non-interference, and the right to a fair trial.

What are the Other Major Concerns About Judicial Integrity in India?

- Political Ambitions of Judges: Judges publicly resigning from their positions to enter politics has raised concerns about their commitment to the Constitution of India and the impartiality of their judicial decisions.

- Former Supreme Court judges accepting lucrative political positions or government roles immediately after retirement has led to allegations of favouritism and quid pro quo.

- Instances where judges deliver decisions that benefit the ruling party and later receive high-profile government positions, suggesting potential quid pro quo arrangements.

- Transparency Issues: The opaque nature of how information is handled in significant cases compromises public confidence in the judicial process.

- Conflict of Interest: Judges are expected to avoid conflicts of interest and maintain the integrity of the judicial process.

- Judges' involvement in political activities, particularly after making controversial statements and rulings while on the bench, raises concerns about potential conflicts of interest.

- Public Trust and Confidence: The judiciary relies on public trust and confidence to fulfil its role. Judges' actions that undermine the perception of judicial integrity and impartiality erode public trust in the judicial system.

Way Forward

- Reinforce the adherence to the 'Restatement of Values of Judicial Life' and the Bangalore Principles of Judicial Conduct. This can be done through mandatory training and regular refresher courses for judges.

- Establish independent bodies to periodically audit and review judicial conduct and adherence to ethical standards.

- Leverage the Global Judicial Integrity Network which aims to assist judiciaries in strengthening judicial integrity and preventing corruption in the justice sector, in line with the United Nations Convention against Corruption.

- Foster public engagement by organising forums or discussions where citizens can interact with the judiciary to understand its functions and decisions better.

- Strengthen norms to ensure that judges who wish to enter politics must adhere to a cooling-off period and fully disclose any past judicial decisions that might be relevant.

- Establish clear guidelines for judges taking up post-retirement roles, ensuring they do not compromise the integrity of their judicial decisions or suggest favouritism.

|

Drishti Mains Question: Discuss the 'Restatement of Values of Judicial Life' adopted by the Supreme Court of India. How does it aim to maintain the integrity and independence of the judiciary? |

Inquiry Wing of Lokpal

For Prelims: Lokpal, Lokpal and Lokayuktas Act, 2013, Prevention of Corruption Act, 1988, Central Vigilance Commission (CVC), United Nations Convention Against Corruption (UNCAC), Central Bureau of Investigation (CBI), Second Administrative Reforms Commission (ARC), Transparency International, Public Accounts Committee (PAC), Enforcement Directorate (ED).

For Mains: Role and significance of Lokpal in anti-corruption framework, Strengthening of Lokpal.

Why in News?

Recently, the Lokpal has constituted an inquiry wing to conduct a preliminary probe into graft-related offences committed by public servants.

What are the Key Highlights of the Inquiry Wing of Lokpal?

- Legal Backing: Section 11 of the Lokpal and Lokayuktas Act, 2013, mandates the Lokpal to establish an inquiry wing.

- This wing is responsible for conducting preliminary inquiries into offences under the Prevention of Corruption Act, 1988, allegedly committed by specified public servants and functionaries.

- Organisational Structure: There will be a Director of Inquiry under the Lokpal chairperson. The director will be assisted by three Superintendents of Police (SPs) SP (general), SP (economic and banking) and SP (cyber).

- Each SP will be further assisted by inquiry officers and other staff.

- Preliminary Inquiry Timeline and Reporting: The Inquiry Wing must finalize its preliminary inquiry and submit a report to the Lokpal within 60 days.

- This report should include feedback from both the public servant and the designated competent authority for each category of public servant.

Note:

- The Lokpal and Lokayuktas Act, 2013 also has provision to constitute a prosecution wing headed by the “Director of Prosecution” for the purpose of prosecution of public servants, which is yet to be constituted.

What is the Need of the Inquiry Wing of Lokpal?

- Effective Preliminary Inquiries: The Central Vigilance Commission (CVC) emphasises the need for an independent authority like the Inquiry Wing of the Lokpal which is vital for conducting preliminary inquiries into corruption related allegations.

- Independence in Anti-Corruption Investigations: The Lokpal’s Inquiry Wing, being autonomous, can mitigate issues such as allegation of biases in politically sensitive cases investigated by Central Bureau of Investigation (CBI).

- The Inquiry Wing will work in conjunction with other agencies such as the CVC, CBI, and state-level Lokayuktas.

- Strengthening Accountability and Public Trust: It aligns with the recommendations of the Second Administrative Reforms Commission (ARC), which suggested strengthening anti-corruption institutions and enhancing coordination between different investigative and prosecuting agencies.

- Addressing Global Concerns on Corruption: Global corruption indices such as those by Transparency International have consistently highlighted the need for robust, independent institutions to tackle corruption.

- The Inquiry wing of Lokpal is seen as a response to international calls for reform by enhancing India’s mechanism for transparency and governance.

- Filling Gaps in the Current Anti-Corruption Framework: The 2011 Public Accounts Committee (PAC) Report on corruption highlighted the limitations of existing anti-corruption frameworks in India.

- The Inquiry Wing of the Lokpal addresses these gaps by providing a specialised mechanism for inquiry, separate from administrative and political influence.

What are the Key Facts About Lokpal?

- About : It is the first institution of its kind in independent India, created to combat corruption among public functionaries.

- It was established under the Lokpal and Lokayuktas Act, 2013, to investigate allegations of corruption against individuals within its scope.

- Composition of the Lokpal: The Lokpal consists of a Chairperson and eight Members, with at least 50% being Judicial Members.

- The Chairperson and Members are appointed by the President of India and serve for a term of five years or until the age of 70 years, whichever is earlier.

- The Chairperson's salary and allowances are equivalent to those of the Chief Justice of India, while the Members receive benefits similar to those of a Judge of the Supreme Court.

- Organisational Structure: The Lokpal operates through two main branches: the Administrative Branch and the Judicial Branch.

- Administrative branch is headed by an officer of the rank of Secretary to the Government of India.

- Judicial branch is headed by a Judicial Officer of an appropriate level.

- Jurisdiction: The Lokpal has the authority to investigate allegations of corruption against a wide range of public functionaries, including the Prime Minister, Union Ministers, Members of Parliament, and officials in Groups A, B, C, and D of the Union Government.

- It also covers chairpersons, members, officers, and directors of any board, corporation, society, trust, or autonomous body established by an Act of Parliament or funded by the Union or State Government.

- Proceeding of Lokpal: Upon receiving a complaint, the Lokpal may order a preliminary inquiry by its Inquiry Wing or refer the matter to agencies like the Central Bureau of Investigation (CBI) or CVC.

- The CVC sends a report back to the Lokpal for officials in Groups A and B, while it takes action under the CVC Act, 2003 for Groups C and D.

- Function of Lokpal: They perform the function of an "ombudsman” and inquire into allegations of corruption against certain public functionaries and for related matters.

- An ombudsman is an official who investigates complaints (usually lodged by private citizens) against businesses, public entities, or officials.

What are the Challenges in Functioning of Lokpal?

- Delay in Establishment of Supporting Infrastructure: The Lokpal and Lokayuktas Act, 2013 mandates separate Inquiry and Prosecution Wings for the Lokpal. While the Inquiry Wing has been established after a decade, the Prosecution Wing is yet to be constituted.

- Exclusion Clause: In terms of provisions of section 14 of the Lokpal and Lokayuktas Act, 2013 the employees of the State Government are not covered unless they have served in connection with the affairs of the Union.

- Lack of Clarity in Powers Over the CBI: While the Lokpal has the authority of superintendence over CBI for cases referred by it, there are ongoing ambiguities regarding the actual extent of this power, especially in relation to investigations involving high-level public officials.

- Shortage of Personnel: The Lokpal currently operates with vacancies in key positions. As of 2024, there are two vacant member positions—one judicial and one non-judicial. This shortage hampers its ability to effectively discharge its functions.

- Dependence on External Agencies: The Lokpal largely depends on external agencies like the CBI or the police for conducting investigations, which undermines its independence.

- No Comprehensive Oversight Mechanism: While the Lokpal is empowered to investigate high-level corruption, there is no dedicated oversight mechanism to monitor the functioning of the Lokpal itself.

Way Forward

- Expedite the Formation of Supporting Wings: The government must prioritise the complete constitution of the Inquiry and Prosecution Wings by promptly filling the vacancies, including the positions of Director of Inquiry and Director of Prosecution.

- Clearly Relations with CBI and Other Agencies: A clear delineation of Lokpal’s supervisory powers over the CBI and coordination mechanisms with the Enforcement Directorate (ED) and CVC should be established.

- Adopt Best Practices from Global Standards: India should adopt best practices from countries with robust whistleblower protection frameworks, in alignment with the United Nations Convention against Corruption (UNCAC), to encourage more individuals to report corruption without fear.

- Implement Recommendations from Committees: The government should actively consider and implement recommendations made by committees like the Second Administrative Reforms Commission to enhance Lokpal's accountability, streamline processes, and improve its operational efficiency.

|

Drishti Mains Question: Discuss the salient features of Lokpal and Lokayuktas Act, 2013. What are the challenges involved in functioning of Lokpal, suggest measures to tackle these challenges. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2019)

- The United Nations Convention against Corruption (UNCAC) has a ‘Protocol against the Smuggling of Migrants by Land, Sea and Air’.

- The UNCAC is the ever-first legally binding global anti-corruption instrument.

- A highlight of the United Nations Convention against Transnational Organized Crime (UNTOC) is the inclusion of a specific chapter aimed at returning assets to their rightful owners from whom they had been taken illicitly.

- The United Nations Office on Drugs and Crime (UNODC) is mandated by its member States to assist in the implementation of both UNCAC and UNTOC.

Which of the statements given above are correct?

(a) 1 and 3 only

(b) 2, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Mains

Q. In the integrity index of Transparency International, India stands very low. Discuss briefly the legal, political, social and cultural factors that have caused the decline of public morality in India. (2016)

Q. ‘A national Lokpal, however strong it may be, cannot resolve the problems of immorality in public affairs.’ Discuss (2013)

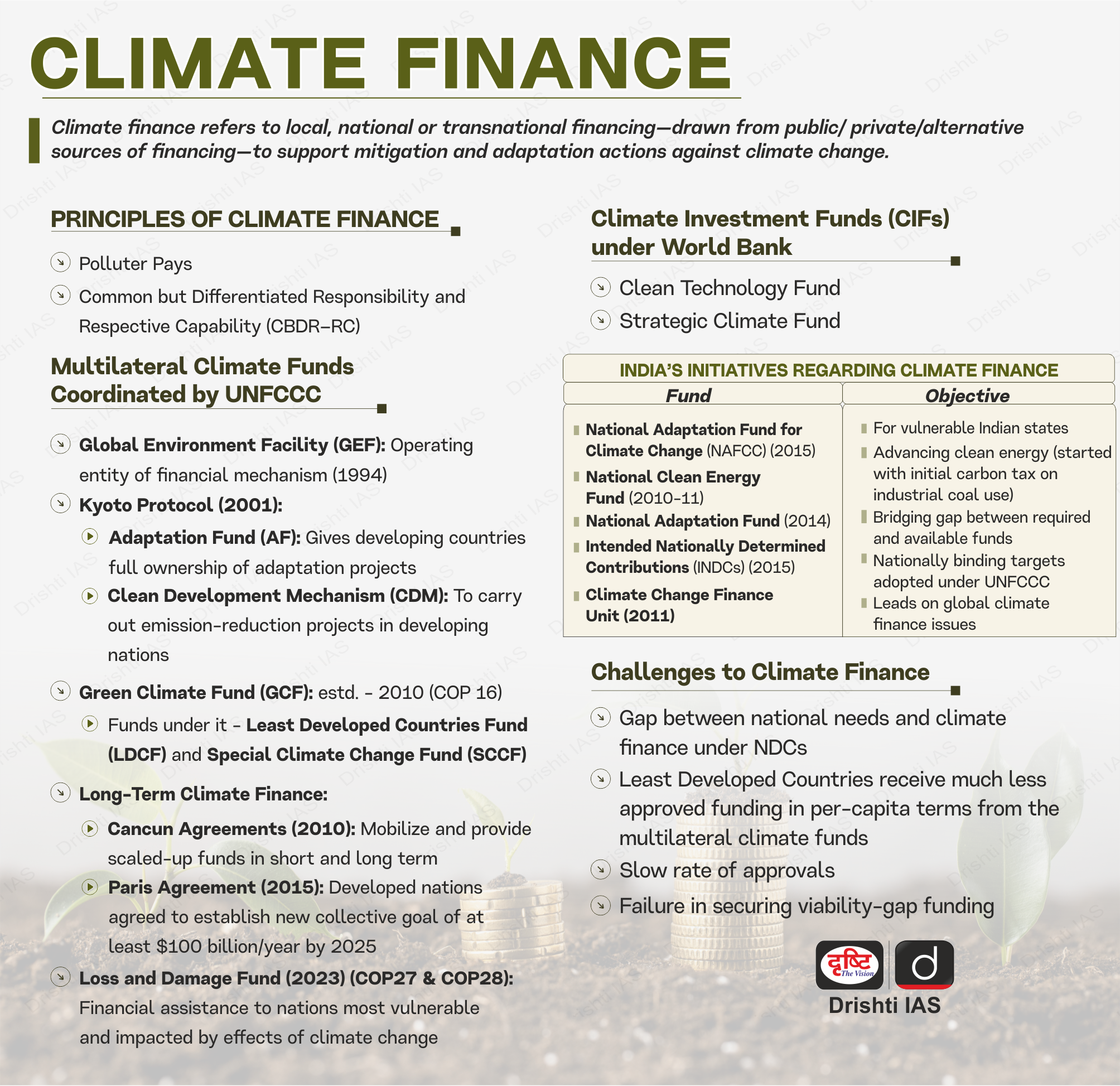

Loss and Damage Fund

Why in News?

- In the aftermath of the catastrophic landslides that recently impacted Kerala's Wayanad district, a critical discourse has arisen regarding the eligibility of subnational entities to claim compensation through the Loss and Damage Fund (LDF) under the United Nations Framework Convention on Climate Change (UNFCCC).

Note

- The Wayanad district of Kerala experienced a devastating landslide disaster in early July 2024 due to heavy rainfall and fragile ecological conditions.

- The landslides in Chooralmala and Mundakkai villages killed at least 144 people and injured 197, after the district received over 140 mm of rain in 24 hours, saturating the soil and weakening its binding to the underlying hard rocks.

What is the Loss and Damage Fund?

- Establishment and Goal: The Loss and Damage Fund (LDF) was established at the 27th UNFCCC Conference of Parties (COP27) held in 2022 in Egypt to provide financial support to regions suffering both economic and non-economic losses caused by climate change.

- In COP28, member countries reached an agreement to operationalize the Loss and Damage (L&D) fund.

- The Fund addresses losses resulting from extreme weather events and slow-onset processes, such as rising sea levels.

- Governance: The LDF is governed by a Governing Board, which is responsible for:

- Determining the allocation of the Fund’s resources.

- The World Bank serves as its interim trustee.

- The Governing Board is currently developing mechanisms to facilitate access to the Fund’s resources, including Direct access, Small grants, Rapid disbursement options.

- Concerns:

- Despite its intended purpose, there are ongoing concerns that:

- Climate funds, including the LDF, may be too slow to be immediately accessible following a disaster.

- This issue is particularly acute for local communities at the sub-national level.

- It is anticipated that the LDF may face similar challenges in ensuring timely access to its resources.

- Despite its intended purpose, there are ongoing concerns that:

India’s Role in Climate Finance

- India has incurred damages exceeding USD 56 billion due to weather-related disasters between 2019 and 2023.

- India's National Climate Action Policy and budgets have predominantly emphasised mitigation efforts rather than adaptation.

- As per Union Budget 2024, the Government will come up with a taxonomy for climate finance for enhancing the availability of capital for climate adaptation and mitigation.

- In the absence of clear guidelines for accessing loss and damage funds within India, frontline communities remain at risk.

- India’s Initiatives regarding Climate Finance include:

- National Adaptation Fund for Climate Change (NAFCC):

- National Clean Energy Fund: It was created to promote clean energy, and funded through an initial carbon tax on the use of coal by industries.

- National Adaptation Fund: It was established in 2014 with a corpus of Rs. 100 crores with the aim of bridging the gap between the need and the available funds.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. “Momentum for Change: Climate Neutral Now” is an initiative launched by (2018)

(a) The Intergovernmental Panel on Climate Change

(b) The UNEP Secretariat

(c) The UNFCCC Secretariat

(d) The World Meteorological Organisation

Ans: (c)

Q. With reference to the Agreement at the UNFCCC Meeting in Paris in 2015, which of the following statements is/are correct? (2016)

1. The Agreement was signed by all the member countries of the UN and it will go into effect in 2017.

2. The Agreement aims to limit the greenhouse gas emissions so that the rise in average global temperature by the end of this century does not exceed 2ºC or even 1.5ºC above pre-industrial levels.

3. Developed countries acknowledged their historical responsibility in global warming and committed to donate $ 1000 billion a year from 2020 to help developing countries to cope with climate change.

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

PAC to Review Regulatory Bodies Performance

Why in News?

Recently, the Public Accounts Committee (PAC) has taken suo-moto initiative to review the performance of regulatory bodies such as Securities and Exchange Board of India (SEBI) and Telecom Regulatory Authority of India (TRAI).

Why has the PAC Initiated the Review of Regulatory Bodies?

- The review aims to enhance the effective use of public funds and improve governmental oversight.

- The decision was made amid a political controversy over allegations of conflict of interest against the SEBI chief.

- The panel has chosen 5 subjects for suo-motu investigations, including "performance review of regulatory bodies established by Act of Parliament" and "levy and regulation of fees, tariffs, user charges etc. on public infrastructure and other public utilities".

What is the Public Accounts Committee (PAC)?

- About:

- The PAC is a committee of selected members of Parliament, constituted by the Parliament of India, for the purpose of auditing the revenue and the expenditure of the Government of India.

- Parliamentary committees draw their authority from Article 105 and Article 118 of the Constitution. PAC is one of the three Financial Parliamentary committees, the other two are the Estimates Committee and the Committee on Public Undertakings.

- None of the members of the CAG committee can hold positions as government ministers.

- Background:

- The PAC was introduced in 1921 after its first mention in the Government of India Act, 1919 also called Montford Reforms.

- It is constituted every year under Rule 308 of the Rules of Procedure and Conduct of Business in Lok Sabha.

- The PAC was introduced in 1921 after its first mention in the Government of India Act, 1919 also called Montford Reforms.

- Composition: It presently comprises 22 members (15 members elected by the Lok Sabha Speaker, and 7 members elected by the Rajya Sabha Chairman) with a term of 1 year only.

- The Chairman of the Committee is appointed by the Speaker of Lok Sabha.

- Powers and Functions:

- Examine accounts showing the appropriation of funds granted by the House for expenditure and the annual Finance Accounts of the government.

- Review other accounts presented to the House that the Committee deems appropriate, except those related to Public Undertakings assigned to the Committee on Public Undertakings.

- Committee reviews various CAG Audit Reports on revenue receipts, government expenditure by different Ministries/Departments, and accounts of autonomous bodies.

- The CAG assists the committee during the investigation.

- Recommendations:

- The PAC's recommendations are advisory and not binding on the government, as it is an executive body that cannot issue orders, and only Parliament can take a final decision on the committee's findings.

What are Regulatory Bodies in India?

- About:

- Regulatory bodies are independent government entities established to set and enforce standards in specific fields of activity or operations.

- These agencies may operate with or without direct executive supervision.

- Regulatory bodies are independent government entities established to set and enforce standards in specific fields of activity or operations.

- Functions:

- Creating regulations and guidelines

- Reviewing and assessing activities

- Issuing licences

- Conducting inspections

- Implementing corrective actions

- Enforcing standards

- Examples:

- Securities and Exchange Board of India (SEBI)

- Established: 1992

- Headquarters: Mumbai

- Role: Regulates securities markets, protects investors, and ensures market integrity.

- Structure: Board with Chairman, whole-time, and part-time members. Appeals handled by Securities Appellate Tribunal (SAT), with further appeals to the Supreme Court.

- Functions: Drafts regulations, conducts inquiries, imposes penalties. Overseas venture capital funds, mutual funds, and addresses fraudulent practices.

- Telecom Regulatory Authority of India (TRAI)

- Established: 1997

- Headquarters: New Delhi

- Role: Regulates telecom services, revises tariffs, ensures service quality, and advises the government on telecom policy.

- Structure: Chairperson, up to two whole-time and two part-time members.

- Appellate Authority: Telecommunications Dispute Settlement and Appellate Tribunal (TDSAT), established in 2000, handles disputes and appeals from TRAI’s decisions.

- Other Regulatory Bodies: Reserve Bank of India (RBI), National Bank for Agriculture and Rural Development (NABARD), Small Industries Development Bank of India (SIDBI), Food Safety and Standards Authority of India (FSSAI), Central Drugs Standard Control Organisation (CDSCO), and Competition Commission of India (CCI).

- Securities and Exchange Board of India (SEBI)

Read More: Securities and Exchange Board of India, Telecom Regulatory Authority of India Repealing Regulations, 2023

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which of the following is/are the aims/aims of the “Digital India” Plan of the Government of India? (2018)

- Formation of India’s own Internet companies like China did.

- Establish a policy framework to encourage overseas multinational corporations that collect Big Data to build their large data centres within our national geographical boundaries.

- Connect many of our villages to the Internet and bring Wi-Fi to many of our schools, public places and major tourist centres.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q. Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering themselves directly? (2019)

(a) Certificate of Deposit

(b) Commercial Paper

(c) Promissory Note

(d) Participatory Note

Ans: (d)

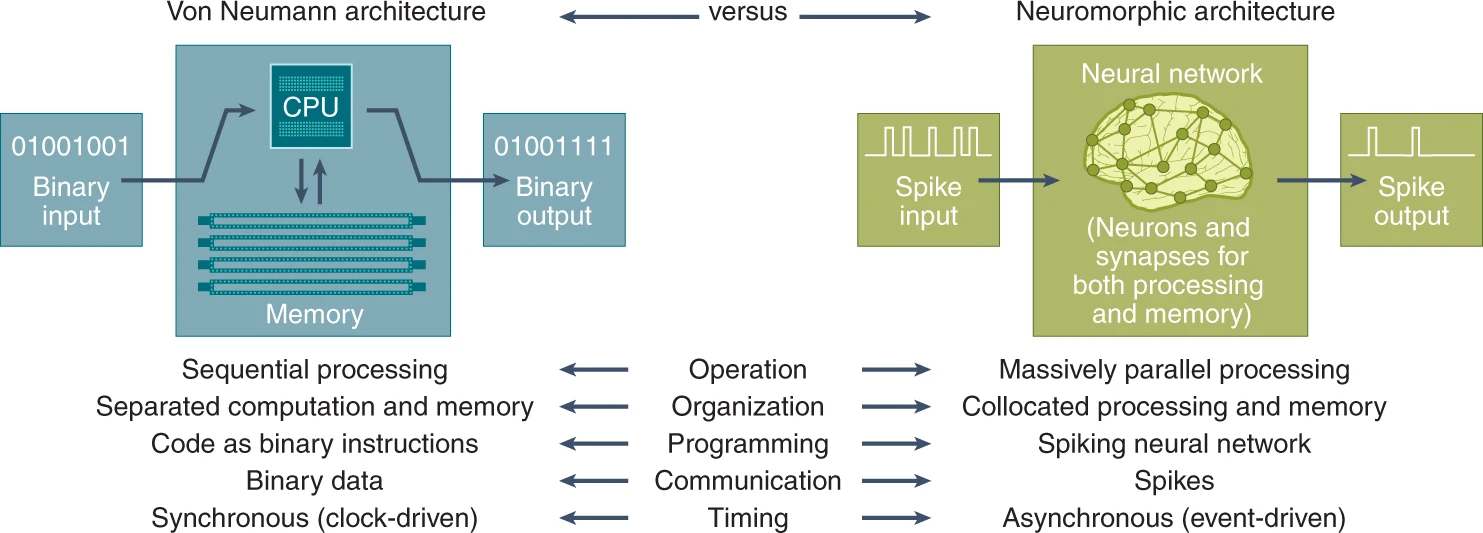

Neuromorphic Computing

Recently, the researchers at the Indian Institute of Science (IISc) have developed a neuromorphic or brain-inspired analog computing.

- This system is capable of storing and processing data in 16,500 states using molecular film.

What is Neuromorphic Computing?

- About:

- Neuromorphic computing is a process designed to mimic the structure and function of the human brain using artificial neurons and synapses.

- It represents a significant shift from traditional binary computing to neuromorphic computing, allowing systems to learn from the environment.

- Working Mechanism:

- It involves the use of Artificial Neural Networks (ANN) made up of millions of artificial neurons, similar to those in the human brain.

- These neurons pass signals to each other in layers, converting input into output through electric spikes or signals, based on the architecture of Spiking Neural Networks (SNN).

- This allows the machine to mimic the neuro-biological networks in the human brain and perform tasks efficiently and effectively, such as visual recognition and data interpretation.

- Key Features:

- Brain-Inspired Design: Neuromorphic systems replicate the brain's architecture, particularly the neocortex, which is responsible for higher cognitive functions such as sensory perception and motor commands.

- Spiking Neural Networks: These systems use spiking neurons that communicate through electrical signals, closely resembling biological neuronal behavior. This design allows for parallel processing and real-time learning.

- Integration of Memory and Processing: Unlike traditional von Neumann architecture, which separates memory from processing, neuromorphic systems integrate these functions, enhancing computational efficiency.

- Advantages:

- It allows computers to process information more efficiently, enabling faster problem-solving, pattern recognition, and decision-making compared to traditional computing systems.

- It has the ability to revolutionise AI hardware, enabling complex tasks like training Large Language Models (LLMs) on personal devices, addressing hardware limitations and energy inefficiencies.

- Current AI tools are restricted to resource-heavy data centers due to a lack of energy-efficient hardware.

- Integration with Molecular Film:

- Molecular films are ultrathin layers of molecules that can be engineered to exhibit specific electrical and optical properties, enabling the creation of brain-inspired data storage and processing devices.

- This film acts as a neuromorphic accelerator, simulating brain-like parallel processing to quickly handle complex tasks like matrix multiplication and improve computer performance when combined with silicon chips.

- The recent advancement involves a molecular film offering 16,500 possible states, surpassing traditional binary systems.

- This film utilizes molecular and ionic movements to represent memory states, mapped via precise electrical pulses, creating a "molecular diary" of states.

- Differences from Traditional Computing:

- Parallel Processing: Neuromorphic computers can process multiple streams of information simultaneously, unlike traditional computers that operate sequentially.

- Energy Efficiency: They consume less power by computing only when relevant events occur, making them ideal for applications requiring real-time data processing.

- Traditional binary computing operates with bits in two states: 0 or 1, similar to a light switch being on or off. In contrast, analog computing uses continuous values, similar to a dimmer switch with a range of brightness levels.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. With the present state of development, Artificial Intelligence can effectively do which of the following? (2020)

- Bring down electricity consumption in industrial units

- Create meaningful short stories and songs

- Disease diagnosis

- Text-to-Speech Conversion

- Wireless transmission of electrical energy

Select the correct answer using the code given below:

(a) 1, 2, 3 and 5 only

(b) 1, 3 and 4 only

(c) 2, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Mission Mausam

Recently, the Union cabinet has approved 'Mission Mausam' with an outlay of Rs 2,000 crore over the next two years to enhance India’s ability to predict and respond to extreme weather events and the impacts of climate change.

- Focus Areas: It includes accuracy, modelling, radars, satellites, and accurate agromet forecasts.

- It will help equip stakeholders, including citizens, to better manage extreme weather events and climate change impacts, enhancing community resilience.

- Components of the Mission:

- Deployment of next-generation radars and satellite systems with advanced sensors

- Development of enhanced Earth system models

- A GIS-based automated decision support system for real-time data sharing

- Implementation and Support: The mission will be implemented by the India Meteorological Department (IMD), Indian Institute of Tropical Meteorology, and the National Centre for Medium-Range Weather Forecasting – three key institutions under the Ministry of Earth Sciences (MoES).

- The mission will be supported by other MoES bodies – Indian National Centre for Ocean Information Services, National Centre for Polar and Ocean Research and National Institute of Ocean Technology.

- Sectoral Benefits: It will improve monitoring and early warning systems in agriculture, disaster management, and defence, while optimising energy and water resource management. Also, it will support safer aviation and promote sustainable tourism.

Read More: India's Maritime History

National Bank for Financing Infrastructure and Development

Recently, the Government of India in consultation with the Reserve Bank of India (RBI) has notified the National Bank for Financing Infrastructure and Development (NaBFID) as a “public financial institution” under the Companies Act, 2013 aiming to boost infrastructure financing in the country.

- The Companies Act of 2013 regulates incorporation, responsibilities, directors, and dissolution of companies. It partially replaced the Companies Act, 1956.

- This notification enhances NaBFID's capacity to fund large-scale infrastructure projects, strengthening the national infrastructure finance system.

- NaBFID, established in 2021 by the National Bank for Financing Infrastructure and Development Act (2021) as India's fifth All India Financial Institution (AIFI) to support long-term infrastructure financing, including the development of bonds and derivatives markets.

- As of February 2024, NaBFID as a specialised Development Finance Institution (DFI) has sanctioned over Rs 86,804 crore for infrastructure projects across the country, with 50% of the sanctions having long tenures of 20 to 50 years. NaBFID plans to sanction over Rs 3 lakh crore by March 2026.

- Other Four AIFIs:

World Suicide Prevention Day

World Suicide Prevention Day (WSPD) is observed annually on 10th September to increase global awareness that suicide is preventable and to encourage open conversations about mental health.

- Suicide is a significant public health crisis, with over 700,000 deaths worldwide each year. It is also the third leading cause of death among 15-29-year-olds globally. This day serves as a platform to raise awareness, reduce stigma, and emphasize that suicide prevention is possible.

- The triennial theme for World Suicide Prevention Day from 2024 to 2026 is "Changing the Narrative on Suicide” which urges open discussions about suicide and mental health, replacing stigma with understanding and support.

- The first WSPD was launched in Stockholm on 10th September 2003, as an initiative by the International Association for Suicide Prevention (IASP) and the World Health Organization (WHO).

- Government Initiatives Related to Suicide Prevention:

Global Bio India 2024

The Global Bio India 2024 conference held recently in New Delhi showcased India’s expanding bio economy and launched the India Bio Economy Report (IBER) 2024, along with unveiling 30 groundbreaking startups, paving the way for the future of biotech.

- Global Bio-India 2024 is an annual event organised by the Biotechnology Industry Research Assistance Council (BIRAC), a Public Sector Undertaking under the Department of Biotechnology (DBT).

- It provides a unique venue for collaboration among governments, startups, research institutes, and international bodies.

- The recently approved BioE3 (Biotechnology for Economy, Employment, and Environment) policy by the Union Cabinet was highlighted at the event.

- BioE3 Policy aims to establish biomanufacturing facilities, bio foundry clusters, and Bio-AI hubs.

- IBER 2024 released by DBT and BIRAC, details the impressive progress of India's biotech industry.

- Key Highlights: India's bio-economy has grown from USD 10 billion in 2014 to USD 151 billion by 2023, and is expected to reach USD 300 billion by 2030, driven by increasing demand for vaccines and biopharmaceuticals, now accounting for 4.25% of India's GDP of USD 3.55 trillion in 2023.

- Initiatives Related to Biotech: National Biotechnology Development Strategy 2020-25, National Biopharma Mission, Biotech-KISAN Scheme, Atal Jai Anusandhan Biotech Mission, and Biotech Parks.

Read More: BioE3 Policy and Biotechnology in India

Public Health Emergency Management Act (PHEMA)

An expert group constituted by NITI Aayog has recommended a new Public Health Emergency Management Act (PHEMA) to deal with the public health crisis.

- PHEMA aims to create health cadres at national and state levels and also empower public health agencies to take urgent action.

- It would cover epidemics, non-communicable diseases, disasters, and bio-terrorism.

- Key Recommendations:

- Formation of an Empowered Group of Secretaries (EGoS): It will coordinate pandemic preparedness and emergency response efforts and is proposed to be chaired by the Cabinet Secretary.

- Implementation of a Scorecard Mechanism: A structured scorecard will track progress against key targets to ensure preparedness and responsiveness.

- Pandemic Preparedness and Emergency Response Fund: To finance activities like genomic surveillance, vaccine development, and shared infrastructure.

- Global Harmonisation: Advocates for aligning Indian regulatory norms with global standards to facilitate international acceptance of regulatory data.

- Development of a Clinical Trial Network: To accelerate access to globally developed practices and enhance India's participation in international research efforts.