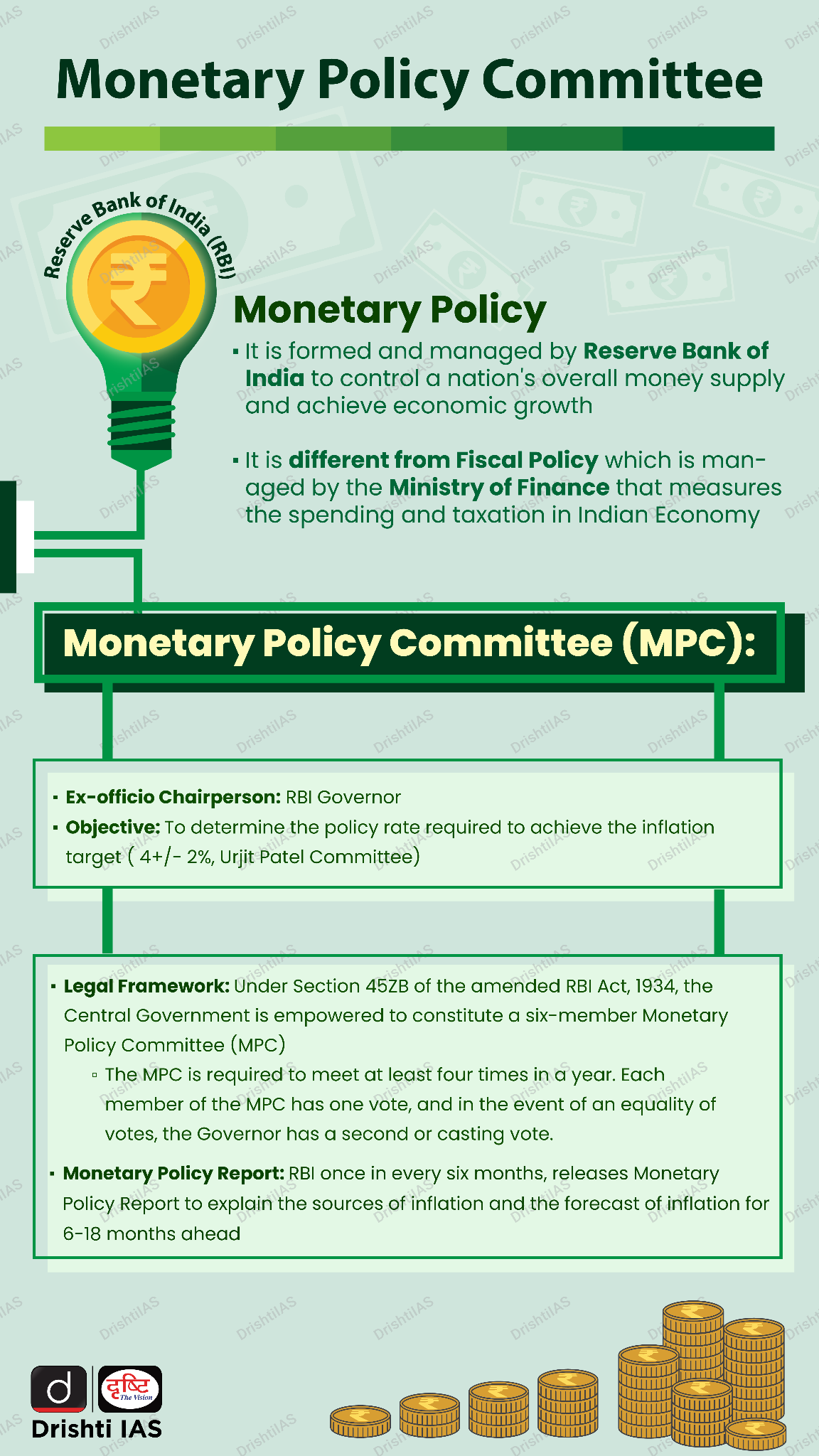

RBI's 50th Monetary Policy Committee Meeting

For Prelims: Reserve Bank of India, Monetary Policy Committee, Flexible inflation targeting, Repo rate, Artificial intelligence, Index of Industrial Production, Digital lending apps, Unified Payments Interface

For Mains: Monetary Policy Committee Decisions, Indian Economy and issues relating to planning, mobilisation of resources, growth, development and employment.

Why in News?

- The Reserve Bank of India's 50th Monetary Policy Committee (MPC) meeting has brought notable updates on interest rates and economic policies.

- This meeting highlights eight years of the flexible inflation targeting (FIT) framework and introduces measures to manage inflation and boost economic efficiency.

What are the Key Highlights of the 50th MPC Meeting?

- Rate Decisions of the MPC:

- The MPC decided to keep the policy repo rate unchanged at 6.50%. This decision reflects the committee's current approach to managing inflation and supporting economic growth.

- Standing Deposit Facility (SDF) Rate remains at 6.25%, aligning with the unchanged repo rate.

- Marginal Standing Facility (MSF) Rate and Bank Rate both rates are set at 6.75%. These rates are used to manage liquidity and borrowing costs within the economy.

- The MPC's primary objective is to withdraw accommodation to gradually align inflation with the target of 4.0%. Despite the strong economic growth, the committee emphasizes the need to control inflation to ensure price stability while supporting economic expansion.

- Assessment of Growth:

- Global Economic Conditions: MPC stated that the global economy is showing steady but uneven growth. Manufacturing sectors are experiencing a slowdown, while service industries continue to perform well.

- Major economies are witnessing a gradual reduction in inflation rates, although services prices remain sticky.

- Different countries are adopting varied monetary policies, with some central banks cutting rates while others tighten their policies.

- Challenges: Key global challenges include demographic shifts, climate change, geopolitical tensions, rising public debt, and advancements in technology such as artificial intelligence. These factors contribute to uncertainties in the medium-term global growth outlook.

- Domestic Economic Conditions: MPC highlighted India’s economic activity remains resilient with a positive outlook driven by steady monsoon progress, higher kharif sowing, and improved reservoir levels.

- Manufacturing and services sectors are robust, with the Index of Industrial Production (IIP) showing accelerated growth.

- Household consumption is supported by rising rural demand and steady urban discretionary spending.

- Global Economic Conditions: MPC stated that the global economy is showing steady but uneven growth. Manufacturing sectors are experiencing a slowdown, while service industries continue to perform well.

- Inflation Trends and Implications:

- Headline Inflation increased to 5.1% in June 2024, largely due to higher food prices. Core inflation (excludes food and fuel price) moderated, with fuel prices in deflation.

- Food prices have a significant impact on overall inflation, given their substantial weight (around 46%) in the Consumer Price Index (CPI) basket. High food prices, particularly for vegetables, have driven up headline inflation.

- Future Outlook: While food inflation is expected to remain high in the short term, there may be some relief due to favourable base effects and improved monsoon conditions.

- Headline Inflation increased to 5.1% in June 2024, largely due to higher food prices. Core inflation (excludes food and fuel price) moderated, with fuel prices in deflation.

- Financial Market Conditions

- MPC noted that the global financial markets have experienced volatility due to concerns about economic slowdowns, geopolitical tensions, and changes in carry trade dynamics.

- Despite this, India’s financial markets are stable, supported by strong macroeconomic fundamentals.

- MPC noted that the global financial markets have experienced volatility due to concerns about economic slowdowns, geopolitical tensions, and changes in carry trade dynamics.

- Additional Measures Announced:

- Digital Lending Apps Repository:

- The RBI will establish a public repository of digital lending apps (DLAs) used by regulated entities (REs) like banks. This measure aims to help consumers identify unauthorised lending apps and ensure more transparency in the digital lending ecosystem.

- This development follows the RBI's September 2022 guidelines on digital lending, prompted by a report from an RBI Working Group revealing that approximately 600 of 1,100 lending apps available to Indian Android users are illegal.

- Unregulated digital lending has led to exploitation of consumers through predatory practices, highlighting the urgent need for stringent regulations and consumer protections in this rapidly evolving sector.

- The RBI asked REs to ensure Lending Service Providers (LSPs) and DLAs comply with guidelines. They must disclose interest rates upfront, inform borrowers of product details, and capture borrowers' economic profiles to promote responsible lending.

- The RBI will establish a public repository of digital lending apps (DLAs) used by regulated entities (REs) like banks. This measure aims to help consumers identify unauthorised lending apps and ensure more transparency in the digital lending ecosystem.

- UPI Transaction Limit:

- The transaction limit for tax payments through Unified Payments Interface (UPI) will be raised from Rs 1 lakh to Rs 5 lakh. This adjustment is designed to facilitate easier and more efficient tax payments for consumers.

- This change addresses the high value and frequency of direct and indirect tax payments, aiming to streamline and facilitate these transactions.

- The RBI also plans to introduce ‘Delegated Payments’ via UPI, allowing a secondary user (such as a spouse) to make payments using the primary user's bank account.

- Primary UPI users will be able to set specific payment limits for secondary users on their accounts.

- This feature is expected to expand the reach of digital payments and cater to UPI’s growing user base of 424 million individuals.

- Continuous Cheque Clearing:

- RBI has proposed continuous clearing of cheques with 'on-realisation-settlement' Cheque Truncation System, instead of the current clearing cycle of two working days to speed up payments and enhance efficiency.

- This system aims to clear cheques within hours on the day of presentation, improving efficiency, reducing settlement risk, and enhancing customer experience.

- RBI has proposed continuous clearing of cheques with 'on-realisation-settlement' Cheque Truncation System, instead of the current clearing cycle of two working days to speed up payments and enhance efficiency.

- Digital Lending Apps Repository:

Flexible Inflation Targeting Framework

- Introduced in February 2015, FIT aims to control inflation with a target of 4% (±2%) while allowing temporary deviations to support economic growth.

- This framework, established through an agreement between the RBI and the Finance Ministry (GoI), aims to manage inflation while accommodating growth. The framework builds on recommendations from the Urjit Patel Committee Report (UPCR).

- FIT aims to stabilise inflation expectations, which can enhance macroeconomic stability and foster growth.

- The RBI Act, 1934 was amended in 2016 to provide statutory basis for a monetary policy framework, the amendment provides for the inflation target to be set by the Government, in consultation with the RBI, once every five years.

- The framework is designed to make monetary policy more transparent and predictable, which can strengthen coordination between the RBI and the government.

|

Drishti Mains Question: Q. Discuss the impact of the recent monetary policy decisions on India's financial stability and economic efficiency. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)? (2017)

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: (a)

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do? (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (2019)

Transit-Oriented Urban Development

For Prelims: Transit Oriented Development (TOD), Growth Hubs, Peri-Urban Areas, Land Use, Market Potential Value, Public Transit, Greenhouse Gas Emissions, Disaster Resilience, National Transit Oriented Development (TOD) Policy, 2017, Urban Infrastructure Development Fund (UIDF)

For Mains: Role of Transit Oriented Development in Sustainable Functioning of Urban Areas.

Why in News?

The union government proposed a transit-oriented development (TOD) plan for 14 large cities with a population of over 30 lakh.

- Cities will be developed as "growth hubs" through economic and transit planning, and orderly development of peri-urban areas (areas immediately surrounding a city).

What is Transit-Oriented Development (TOD)?

- About:

- TOD is a planning strategy that aims to concentrate jobs, housing and services around public transport stations.

- It encourages development that is easy to walk or bike through, with jobs, homes, and services located close to transit options.

- TOD works on the idea that economic growth, urban transport and land use are more efficient when planned together.

- This approach has been successfully used in cities like Stockholm, Copenhagen, Hong Kong, Tokyo, and Singapore.

- TOD is a planning strategy that aims to concentrate jobs, housing and services around public transport stations.

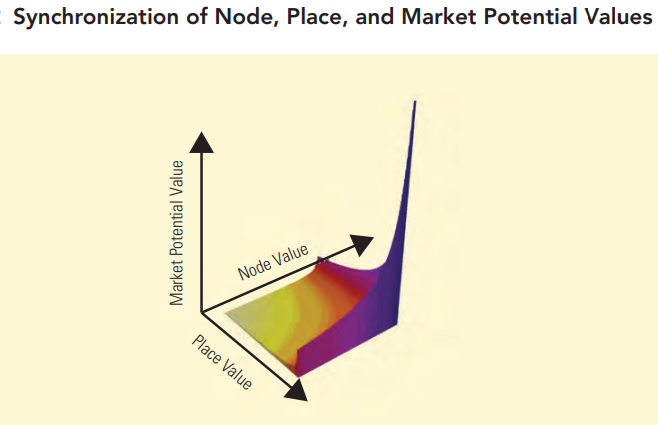

- World Bank 3V Framework Guiding TOD Plans:

- Node Value: It describes the importance of a station in the public transit network based on passenger traffic, connections with other transport modes, and centrality within the network.

- Place Value: It reflects the quality and attractiveness of the area around the station.

- Key factors include diverse land use, access to essential services like schools and healthcare, the availability of amenities within walking or cycling distance, pedestrian-friendly design, and the size of urban blocks around the station.

- Market Potential Value: It refers to the potential market value of areas around stations.

- This is assessed by considering factors like the number of current and future jobs nearby, the number of jobs accessible by transit within 30 minutes, housing density, available land for development, possible zoning changes, and overall market activity.

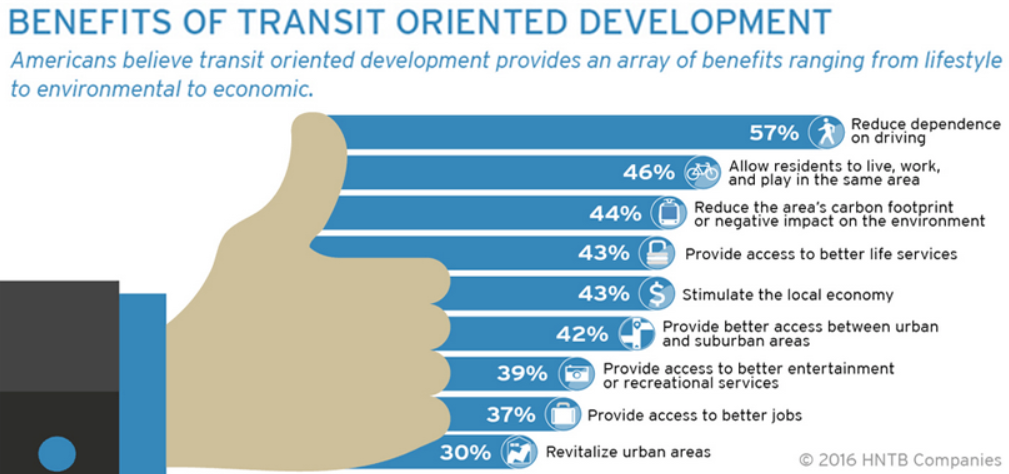

- Benefits of TOD:

- Boosting Economic Competitiveness: TOD encourages higher densities and clusters jobs in smaller areas, leading to benefits like increased city competitiveness.

- Research shows that doubling job density can boost economic productivity by 5 to 10%.

- Vibrant and Livable Communities: TOD brings jobs, housing, and amenities closer to transit stations, creating lively communities with great public spaces and shorter commutes, making cities more livable.

- Mutual Reinforcement of Compact Urban Development and Public Transit: Compact urban development and good public transit work together. High-density areas bring more passengers, making transit systems profitable, while the concentration of jobs and housing near stations supports these transport systems.

- Increasing Real Estate Value: Being close to mass transit makes TOD neighbourhoods more attractive, increasing real estate values.

- Cities can use this extra value to fund transit upgrades, affordable housing, and sustainable growth.

- In Hong Kong, this approach raised Hong Kong Dollar 140 billion and provided land for 600,000 public housing units between 1980 and 2005.

- Cities can use this extra value to fund transit upgrades, affordable housing, and sustainable growth.

- Promoting Inclusivity: While TOD can increase property prices, this can be mitigated by including affordable housing in new developments.

- An inclusive TOD approach ensures access to jobs and services for people of all income levels.

- Reducing Carbon Footprint: TOD reduces car use, shortens commutes, increases productivity, and lowers carbon emissions.

- E.g., in Stockholm, development along transit routes boosted economic value per person by 41% and cut greenhouse gas emissions per person by 35% from 1993 to 2010.

- Supporting Disaster Resilience: When implemented in areas less prone to natural hazards, TOD can enhance disaster resilience by encouraging high-density development in safer zones, reducing exposure to risks.

- Boosting Economic Competitiveness: TOD encourages higher densities and clusters jobs in smaller areas, leading to benefits like increased city competitiveness.

- Factors Driving Demand for TOD:

- Rapidly Growing Traffic Congestion: Nationwide traffic congestion is increasing rapidly and becoming overwhelming, prompting the need for more efficient urban planning.

- Dissatisfaction with Suburban areas: There is a growing discontent with suburban sprawl and strip development, leading people to seek alternatives.

- Desire for a Quality Urban Lifestyle: More people are seeking a higher quality urban lifestyle that offers better amenities and experiences.

- Preference for Walkable Environments: There is a growing desire for more walkable lifestyles that are free from heavy traffic, enhancing daily convenience and safety.

- Changes in Family Structures: The rise in single-person households and empty-nesters (people whose adult children have left home) is influencing the demand for urban living options.

- Support for Smart Growth: There is increasing national support for Smart Growth principles, which emphasize sustainable and efficient land use.

- Components of TOD:

- Walkable Design: It prioritises pedestrian-friendly design with walking as the main focus.

- Regional Node: A regional hub includes a mix of uses, such as office spaces, residential areas, retail, and civic facilities, all in close proximity.

- Collector Transit Systems: It includes supporting transit systems like streetcars, light rail, and buses.

- Designed for easy use of bicycles and scooters as daily transport options.

- Managed Parking: Parking is reduced and managed within the 10-minute walk circle around the town centre and train station.

- Specialised Retail: Stations feature specialised retail services for commuters and locals, such as cafes, grocery stores, and dry cleaners.

What are the Challenges Associated with TOD?

- Lack of Regional Coordination at the Metropolitan Level: India’s metropolitan areas often have multiple municipal and state authorities with differing agendas, leading to fragmented TOD planning.

- Not Inclusive: Separate planning processes for land use and transportation can result in mismatched goals and inefficient TOD development.

- Also, it does not take into account the requirements of other sectors of the economy like agriculture and allied services.

- Higher Population Density: Inadequate regulations may result in either an overconcentration of development in certain areas or underutilization in others.

- This can strain infrastructure in high-density areas while leaving other parts of the city underdeveloped and poorly connected.

- Neglected Urban Design: Many Indian cities lack well-designed sidewalks, crosswalks, and pedestrian zones, making it difficult for people to access transit stations safely and comfortably. It forces pedestrians to navigate dangerous and congested streets.

- May not Suit Indian Cities: In island cities like Hong Kong and Singapore, TOD maximises land use efficiency, allowing more people to live and work in proximity to transit, reducing the need for sprawling development. It may not be suitable for Indian cities like New Delhi or Bengaluru.

- No Impact on People's Behaviour: Behavioural change is a key factor in reducing the use of private vehicles for lowering greenhouse gas (GHG) emissions. TOD may not motivate people to reduce private vehicle use despite heavy investment in inefficient public transit systems.

- Higher Vulnerabilities to Disaster: The concentration of people in a small area increases the likelihood of casualties and injuries during a disaster. Due to overburdened infrastructure, such as roads, utilities, and emergency services, it can quickly become overwhelmed during a disaster.

- Urban Sprawl: Rapid urbanisation leads to sprawling cities, making it challenging to create compact, walkable neighbourhoods. For example, cities like Ahmedabad experience significant sprawl, complicating the implementation of TOD principles.

- Socioeconomic Disparities: Ensuring that TOD benefits all socioeconomic groups is crucial but challenging. There is a risk that new developments may cater primarily to affluent populations, excluding lower-income residents.

- Other Issues: Regulatory, community and financial challenges hinder TOD in Indian cities like Bengaluru, Chennai, and Kolkata. Zoning laws, community resistance and budget constraints limit mixed-use development and transit improvements.

National Transit Oriented Development (TOD) Policy, 2017

- The Ministry of Housing and Urban Affairs (MoHUA) launched the National Transit-Oriented Development policy 2017. It is designed to assist states and cities in using Transit Oriented Development (TOD) for urban growth.

- Vision:

- Transformation: Shift from private vehicle dependence to public transport-oriented development.

- Accessibility: Promote public transport use, green mobility, and reduce pollution.

- Walkable Communities: Develop compact, affordable, and walkable neighbourhoods.

- Public Transport: Increase transit and walk trips, reduce pollution and congestion.

- Dense Infrastructure: Create dense road networks and reduce private vehicle ownership.

- Inclusive Housing: Incorporate affordable and economically weaker sections housing.

- Recreation and Safety: Ensure recreational spaces and safety, particularly for vulnerable groups.

- Environmental Impact: Reduce carbon footprints by promoting eco-friendly travel options.

Initiatives Taken for Transit Oriented Urban Development in india

Conclusion

Transit-Oriented Development (TOD) is a modern urban planning approach that integrates land use with transit infrastructure to foster high-density, mixed-use environments. It aims to reduce vehicle dependence, alleviate congestion, and enhance sustainability. Successful TOD relies on coordination, vertical development, and improved connectivity, with growing adoption in India.

|

Drishti Mains Question: Q. Discuss how Transit-Oriented Development (TOD) can prove to be a game changer in the sustainable development of cities. What challenges come along with TOD for Indian cities? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q. How is efficient and affordable urban mass transport key to the rapid economic development in India? (2019)

Q. With a brief background of quality of urban life in India, introduce the objectives and strategy of the ‘Smart City Programme.” (2016)

NARCL Aims to Acquire Rs 2 Trillion Stressed Assets by FY26

For Prelims: National Asset Reconstruction Company Ltd, Bad Bank, Non-performing assets, Reserve Bank of India, Asset Reconstruction Companies, India Debt Resolution Co. Ltd

For Mains: Significance of Bad Bank and Associated Challenges, Bad loans.

Why in News?

The National Asset Reconstruction Company Ltd (NARCL), the government-backed bad bank, has set an ambitious target to acquire Rs 2 trillion in stressed assets by FY26.

- This follows its significant achievement of acquiring Rs 1 trillion worth of distressed assets in FY24, demonstrating a proactive approach to address the issue of non-performing assets (NPAs) in the Indian banking system.

What is a Bad Bank?

- About: Bad banks are asset reconstruction companies that buy, manage, and recover bad loans and manage NPAs from commercial banks to liquidate the transferred assets.

- It provides a safety net for banks, allowing them to offload bad loans and focus on healthier lending activities.

- Evolution: The concept of bad banks emerged in the 1980s with institutions like Grant Street National Bank, which acquired bad assets from Mellon Bank.

- The concept gained prominence during the 2008 financial crisis. Countries like Sweden, Germany, and France have implemented similar models to manage bad assets.

- India’s first bad bank, NARCL, was established in 2021 to manage bad assets in public sector banks. Although the concept was proposed in an Economic Survey 2016.

- This move aligns with the global trend of using bad banks to stabilize financial systems burdened by distressed loans.

- Advantages: Bad banks centralize the management of NPAs, which can streamline efforts and increase efficiency in asset resolution.

- By transferring NPAs to a bad bank, originating banks can free up capital currently held as provisions against these assets. This can potentially lead to an increase in lending to more creditworthy customers.

- Government backing of bad banks can enhance confidence in the originating banks, thereby improving their overall capital buffers and financial stability.

- Disadvantages: Transferring bad assets to a government-backed entity can merely shift the burden within the public sector, potentially leading to taxpayer liabilities for any losses incurred.

- Government bailouts might discourage banks from exercising caution in their lending practices, potentially leading to a repeat of the same issues in the future.

- Current Challenges for Bad Banks:

- Price Discovery: Bad banks often face difficulties in pricing bad loans and determining future liabilities.

- Finding Buyers: Selling portfolios of distressed assets can be challenging, especially without established market mechanisms or precedents.

- Weak economic conditions can further depress asset values and reduce the pool of potential buyers.

What is NARCL?

- About: Designed as a "bad bank," NARCL aims to cleanse the financial system of distressed loans, thereby stabilizing banks and fostering a healthier economic environment.

- NARCL was announced in the Union Budget 2021-22 to handle large loans of over Rs 500 crore. Initial delays occurred due to the Reserve Bank of India's dissatisfaction with the proposed structure, leading to a revised plan.

- Under the new structure NARCL acquires and aggregates bad loan accounts from banks. India Debt Resolution Co. Ltd (IDRCL) handles the resolution process, operating under an exclusive arrangement with NARCL.

- NARCL was announced in the Union Budget 2021-22 to handle large loans of over Rs 500 crore. Initial delays occurred due to the Reserve Bank of India's dissatisfaction with the proposed structure, leading to a revised plan.

- Role of NARCL: Purchase bad loans from commercial banks. Manage these distressed assets.

- Sell them in the market through bidding methods like Swiss Challenge to recover funds and liquidate the transferred assets.

- Funding and Ownership: NARCL's acquisition strategy involves paying 15% of the agreed loan value in cash and the remaining 85% in government-backed security receipts.

- State-owned banks hold a 51% stake in NARCL, with the remaining stake owned by private banks.

- Challenges Facing by NARCL:

- Dual Structure Issues: The duality of NARCL and IDRCL has led to operational inefficiencies. NARCL retains decision-making authority, but IDRCL handles resolution, creating a complex and costly structure.

- Pricing Discrepancies: Significant differences in pricing expectations between NARCL and banks have deterred transactions, as banks find NARCL's offers inadequate.

- High Operational Costs: The need for both NARCL and IDRCL has resulted in higher operational costs, which are exacerbated by NARCL’s reliance on external consultants and a slower due diligence process.

- Potential Solutions for NARCL’s Challenges:

- Combining IDRCL and NARCL could streamline operations, reduce costs, and enhance efficiency by eliminating duplicative functions.

- Implementing performance-linked incentives could attract skilled professionals and improve the effectiveness of asset resolution.

- Investor-friendly policies to facilitate domestic and foreign investor participation in asset resolution.

- Foster a secondary market for distressed assets to improve liquidity and price discovery.

Swiss Challenge Method

- The Swiss challenge method is a public procurement process that allows private companies to bid on government contracts. The method is used for projects such as roads, ports, and railways, or for services provided to the government.

- The RBI allowed banks to use Swiss Challenge technique for the selling of NPA accounts in September 2016 it involves:

- Initial Offer: A buyer submits an offer to purchase an NPA account.

- Invitation for Counter-Bids: If the initial offer is in cash and exceeds the bank’s minimum threshold, the bank invites counter-bids.

- Preference Order:

- Asset Reconstruction Companies (ARCs): ARCs with the largest stakes in the bank are given priority.

- First Bidder: If no ARCs participate, the initial bidder is preferred.

- Highest Bidder: During the counter-bid process, the highest bid is selected.

|

Drishti Mains Question: Q. What is a 'bad bank,' and what role does it play in managing non-performing assets (NPAs) within the banking sector? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the governance of public sector banking in India, consider the following statements:(2018)

- Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

- To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Exp:

- The government has done capital infusion in state owned banks to support credit expansion and to help them tide over losses resulting from the provisions that are to be made for non-performing assets (NPAs). But the capital infusion trend in state-owned banks

- has not been specific in a direction, like increasing or decreasing trend. While it has increased in some years, it has also decreased in a few years. Hence, statement 1 is not correct.

- Union Government in February 2017 had approved the merger of five associate banks along with the Bharatiya Mahila Bank with SBI. The purposes of the merger were rationalisation of public bank resources, reduction of costs, better profitability, and lower cost of funds leading to a better rate of interest to the public at large and improve productivity and customer service of the public sector banks. Parliament passed the State Banks (Repeal and Amendment) Bill, 2017 to merge six subsidiary banks with State Bank of India to affect rationalisation of public bank. Hence, statement 2 is correct.

GST on Health and Life Insurance in India

For Prelims: National Health Policy (NHP), Ayushman Bharat PMJAY, Insurance Regulatory and Development Authority of India, Health Insurance, World Health Organisation, Goods and Services Tax (GST)

For Mains: GST on Health and Life Insurance in India, Issues and Challenges with High Taxes on Insurances, India Health Infrastructure- Challenges and Way Forward, Challenges associated with ensuring the effective use of increased Healthcare funds in India.

Why in News?

Recently, the debate surrounding the Goods and Services Tax (GST) on health and life insurance has gained momentum, particularly following protests led by opposition leaders demanding the withdrawal of the 18% GST on insurance premiums.

- The rising cost of premiums, exacerbated by this tax, has made insurance increasingly unaffordable for many citizens, prompting discussions in Parliament and among industry stakeholders.

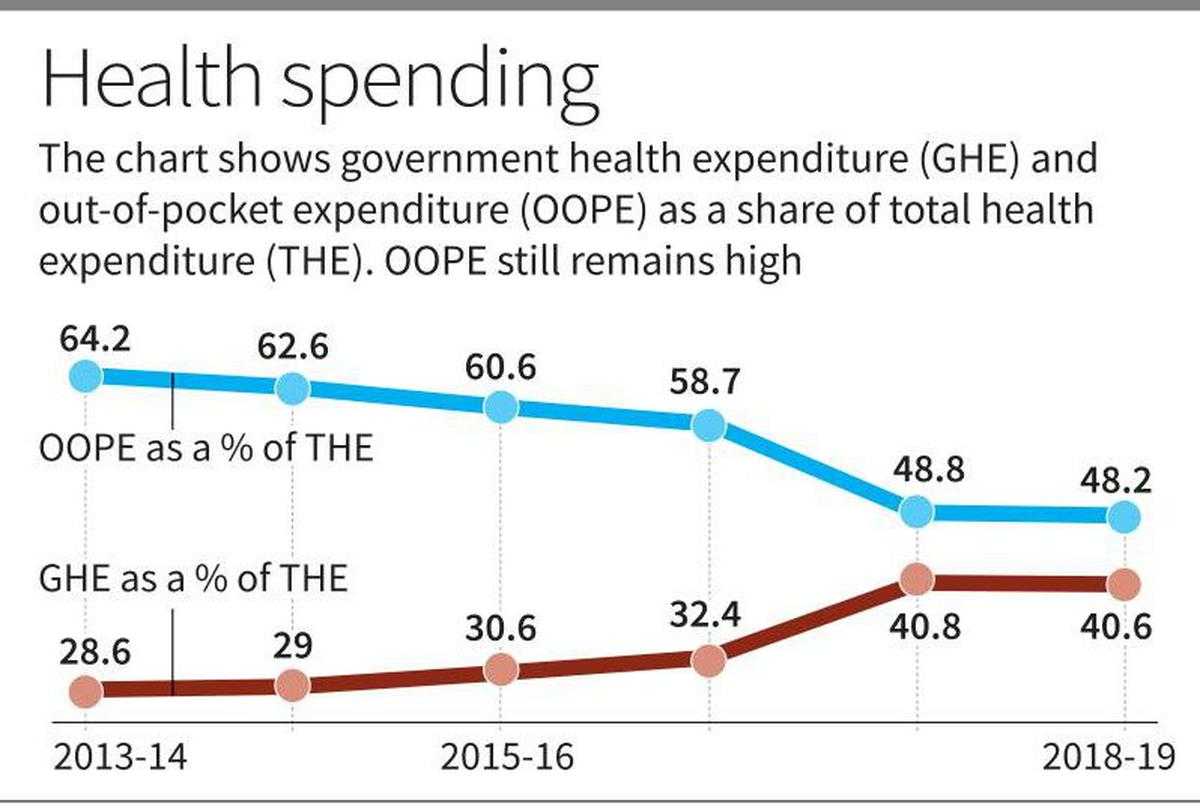

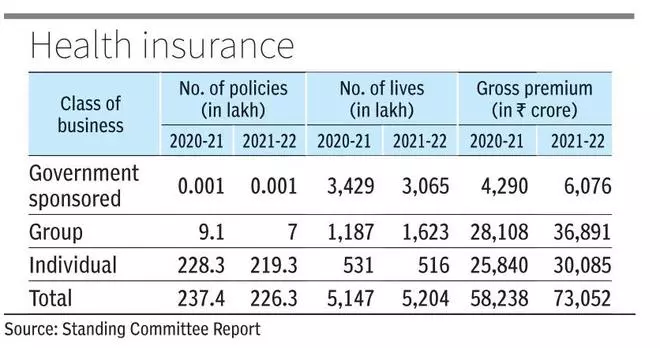

What is the Current State of Health Expenditure in India?

- Higher Medical Inflation:

- India's healthcare expenditure has been under scrutiny, with medical inflation estimated at around 14% towards the end of 2023.

- Higher Out-of-Pocket Expenditure (OOPE):

- Out-of-Pocket Expenditure (OOPE) is still around 39.4% of Total Health Expenditure (THE) in 2021-22 as per National Health Accounts (NHA) data.

- Although this has dropped significantly from 62.6% in 2014-15 to 39.4% in 2021-22.

- In states such as Uttar Pradesh, the OOPE were as high as 71.3%.

- Marginal Increase in Government Health Expenditure (GHE):

- The share of Government Health Expenditure (GHE) in Total Health Expenditure (THE) has risen from 28.6% in 2013-14 to just 40.6% in FY19.

- GHE as a percentage of GDP increased 63% between 2014-15 to 2021-22, rising from 1.13% of GDP in 2014-15 to 1.84% by 2021-22.

- Share of Health Expenditure in GDP: In the year 2019-20, India's Total Health Expenditure (THE) was estimated at Rs. 6,55,822 crores, which represents 3.27% of the GDP and amounts to Rs. 4,863 per capita.

- In comparison, countries like the US spend about 18% of their GDP on healthcare, while countries such as Germany and France spend around 11-12%.

Why is there Need to Reduce GST on Health and Life Insurance Premiums?

- Insurance a Basic Necessity: Insurance is a basic necessity as it provides financial protection against unexpected events, safeguarding family's financial interests and thus it should not be subjected to high taxes.

- Affordability: The 18% GST on insurance premiums significantly increases the cost for policyholders. With health insurance premiums having risen by up to 50% in some cases, many individuals are finding it increasingly difficult to maintain their policies.

- Global Comparison: The GST on insurance in India is among the highest in the world. Countries like Singapore and Hong Kong do not impose such taxes on insurance, making their insurance products more attractive and affordable.

- Impact on Insurance Penetration: The high GST rate contributes to low insurance penetration in India, which was only 4% in 2022-23, lower than the global average of around 7%.

- Lowering the GST could encourage more people to purchase insurance, aligning with the goal of "Insurance for All by 2047."

- Economic Growth: Taxing insurance premiums can restrict the growth of the insurance sector, which is vital for economic stability and individual financial security.

What can be the Downsides of Removing GST on Life and Health Insurance?

- Revenue Loss for Governments: GST from life and health insurance (@ 18%) generates significant revenue for federal and state governments. Removing it could lead to budget deficits, affecting funding for public health initiatives and services.

- Increased Burden on Other Taxpayers: To compensate for the lost revenue, governments may need to increase other taxes, placing a heavier burden on taxpayers.

- Potential for Increased Prices: While removing GST may seem to lower costs for consumers, healthcare providers might increase prices to maintain revenue levels, negating the intended benefits.

India's Insurance and Pension Sector: A Growth Opportunity

- Global Comparison and Opportunity for Growth:

- India's insurance and pension sectors lag behind global counterparts. While these sectors contribute 19% and 5% to India's GDP, respectively, developed economies like the US (52% and 122%) and the UK (112% and 80%) showcase significantly higher penetration.

- This gap presents a substantial opportunity for growth in India's insurance and pension markets.

- India's insurance and pension sectors lag behind global counterparts. While these sectors contribute 19% and 5% to India's GDP, respectively, developed economies like the US (52% and 122%) and the UK (112% and 80%) showcase significantly higher penetration.

- Industry Performance:

- The General Insurance sector collected Rs 1,09,000 crore in health premiums alone during FY 2023-24.

- The Life Insurance industry mobilised Rs 3,77,960 crore in premiums in FY 2024, with LIC contributing the majority at Rs 2,22,522 crore.

Way Forward

- GST Review: The government should consider reviewing the GST on health and life insurance premiums to make them more affordable and encourage higher penetration rates.

- A parliamentary committee, chaired by the former MoS Finance, has proposed reducing GST on health and term insurance to lower premiums and encourage policy uptake.

- Capital Support to Insurance Sector: Parliamentary committee suggests that the Reserve Bank of India issue 'on-tap' bonds to meet the insurance sector's capital requirements, estimated at Rs 40-50,000 crore.

- "On-tap bonds" refer to bonds that are available for purchase at any time, rather than being issued in a specific offering or auction.

- More Public Investments in Healthcare: Increased public investment in healthcare in developing countries shows that higher spending leads to greater utilisation of services. As healthcare becomes more affordable, latent demand is realised, enabling more people to access care.

- Investments in More Medical Colleges: To bring down costs beyond a few islands of excellence such as the AIIMS, investments in other medical colleges shall be encouraged to possibly bring down costs and ramp up quality of health services.

- Policy Reforms: Policy reforms to reduce medical inflation and control healthcare costs can enhance health insurance affordability. Additionally, offering incentives to insurers can promote competition and innovation, further lowering costs.

|

Drishti Mains Question: What are the challenges related to the healthcare sector in India? What steps can be taken to make health services more affordable? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains:

Q. “Besides being a moral imperative of a Welfare State, primary health structure is a necessary precondition for sustainable development.” Analyse. (2021)

Wildfires Triggering Pyrocumulonimbus Clouds

Why in News?

Recently wildfires raging in the United States and Canada are so intense that they have created pyrocumulonimbus clouds (pyroCbs), which have the potential to spit out thunder and spark more fires.

What are Pyrocumulonimbus Clouds?

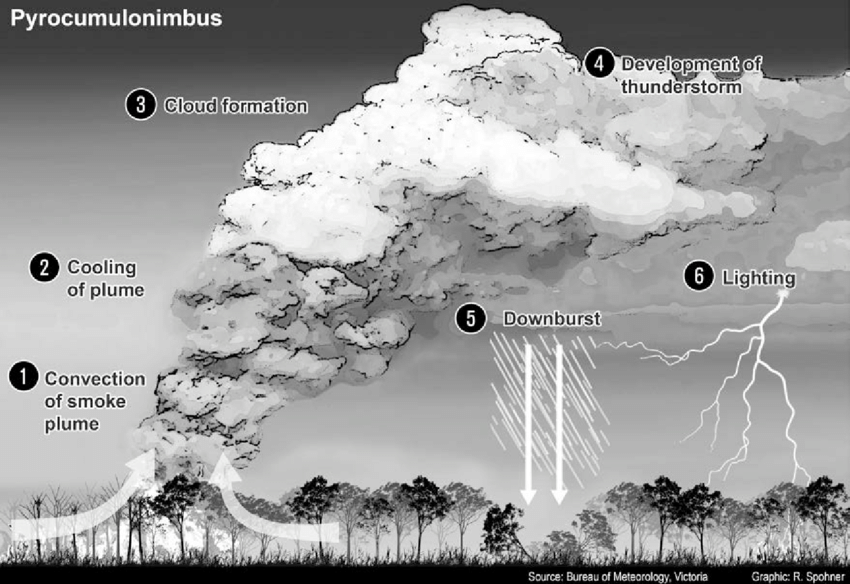

- Definition: Pyrocumulonimbus clouds are thunder clouds created by intense heat from the Earth’s surface. They are also called fire clouds.

- They are formed similarly to cumulonimbus clouds, but the intense heat that results in the vigorous updraft comes from fire, either large wildfires or volcanic eruptions.

- Conditions for its Formation:

- Pyrocumulonimbus clouds form under extreme heat (like wildfires).

- Not every wildfire produces these clouds, temperatures need to exceed 800°C, as seen in the 2019-2020 Australian bushfires.

- Intense heat from the fire causes hot air to rapidly rise, carrying water vapour, smoke, and ash that condense into pyrocumulus clouds as they cool.

- These clouds can reach up to 50,000 feet and form thunderstorm systems with lightning and strong winds.

- Pyrocumulonimbus clouds form under extreme heat (like wildfires).

- Impacts and Characteristics:

- Pyrocumulonimbus clouds can produce lightning that may ignite new wildfires several kilometres away.

- They generally generate minimal rain, aiding wildfire spread rather than suppression.

- These clouds can trigger strong winds, accelerating and complicating wildfire management.

Why are Pyrocumulonimbus Cloud Events Occurring More Often?

- Rising Temperatures and Extended Fire Seasons: Global warming leads to higher temperatures and longer dry periods, creating drier conditions that increase the frequency and intensity of wildfires and provide more opportunities for pyrocumulonimbus cloud formation.

- Increased vegetation and Drought Conditions: Warmer temperatures and changing precipitation patterns increase vegetation growth, which serves as fuel for wildfires.

- Additionally, persistent droughts dry out forests and grasslands, making them more susceptible to ignition.

- Extreme Weather Patterns: Intense and frequent heatwaves, along with altered wind patterns, can trigger and spread wildfires more rapidly, increasing the likelihood of pyrocumulonimbus clouds forming.

- Human Activities: Deforestation, land use changes, and urbanization exacerbate wildfire risks by increasing the likelihood of human-caused fires and indirectly contributing to pyrocumulonimbus cloud formation.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Consider the following: (2019)

- Carbon monoxide

- Methane

- Ozone

- Sulphur dioxide

Which of the above are released into atmosphere due to the burning of crop/biomass residue?

(a) 1 and 2 only

(b) 2, 3 and 4 only

(c) 1 and 4 only

(d) 1, 2, 3 and 4

Ans: (d)

Sucralose: A Promising Sweetener for Diabetics

Why in News?

A recent study from India has highlighted the potential benefits of using sucralose, a non-nutritive sweetener, as a substitute for sucrose (table sugar) among individuals with Type 2 Diabetes.

- The study contrasts with the WHO’s recent caution against Non-Nutritive Sweeteners (NNS) for weight control in non-diabetics.

What were the Key Findings of the Study?

- The study reported no significant changes in glucose or HbA1c levels, a key indicator of blood glucose control, between the intervention and control groups.

- Participants using sucralose showed slight improvements in body weight, waist circumference, and Body Mass Index (BMI).

- The judicious use of sucralose can help in reducing overall calorie and sugar intake, which is crucial for managing diabetes effectively.

- Significance: These findings are significant for India, where sweeteners are less commonly used. The study suggests that sucralose could improve dietary compliance and aid in weight management for diabetics in the country.

What are Sugar and Sugar Substitutes?

- Sugar: It is a form of carbohydrate, along with fibre and starch. While carbohydrates are important for our health, sugar itself is not essential.

- White table sugar, known as sucrose, is the most widely used sweetener.

- Other natural sugars include: fructose, galactose, glucose, lactose, maltose.

- Sugar Substitutes:

- Sugar substitutes offer a sweet taste without the calories associated with sugar, with some containing no calories at all.

- They are commonly found in products labelled as "sugar-free", "keto", "low carb" or "diet".

- Types of Sugar Substitutes:

- Artificial Sweeteners: Also known as Non-Nutritive Sweeteners (NNS), are primarily synthesised from chemicals in laboratories, or derived from natural herbs.They can be 200 to 700 times sweeter than table sugar.

- Examples: Acesulfame potassium (Ace-K), Advantame, Aspartame, Neotame, Saccharin, Sucralose etc.

- Sugar Alcohols: They are synthetically derived from sugars, and are used in many processed foods. They are less sweet than artificial sweeteners and add texture and taste to items like chewing gum and hard candies.

- Examples: Erythritol, isomalt, lactitol, maltitol, sorbitol, and xylitol etc.

- Novel Sweeteners: They are derived from natural sources, offer the benefits of both artificial and natural sweeteners. They are low in calories and sugar, preventing weight gain and blood sugar spikes, and are typically less processed, closely resembling their natural sources.

- Example: Allulose, Monk fruit, Stevia, Tagatose etc.

- Artificial Sweeteners: Also known as Non-Nutritive Sweeteners (NNS), are primarily synthesised from chemicals in laboratories, or derived from natural herbs.They can be 200 to 700 times sweeter than table sugar.

What is Diabetes?

- About:

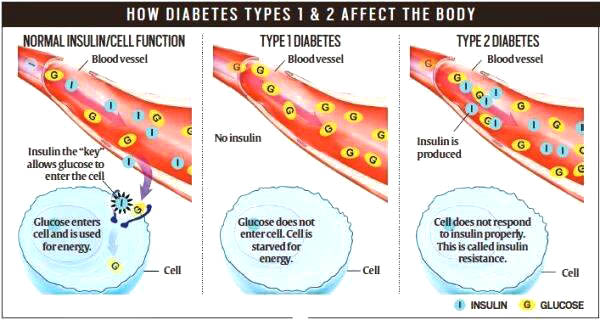

- Diabetes or Diabetes Mellitus (DM) is a medical disorder characterised by insufficient insulin production or an abnormal response to insulin, leading to elevated blood sugar (glucose) levels.

- While 70–110 mg/dL fasting blood glucose is considered normal, blood glucose levels between 100 and 125 mg/dL is considered prediabetes, and 126 mg/dL or higher is defined as diabetes.

| Types of Diabetes | ||

| Type 1 Diabetes | Type 2 Diabetes | |

| Causes | In this, the pancreas does not make insulin, because the body’s immune system attacks the islet cells in the pancreas that make insulin. | In this, the pancreas makes less insulin and the body becomes resistant to insulin |

| Prevalence | Type 1 diabetes affects about 5-10% of people with diabetes, typically developing before age 30, though it can occur later in life. | Type 2 diabetes is more common but typically begins after age 30 and increases with age |

| Prevention | Cannot be prevented. | Can be prevented with lifestyle changes. |

- Initiatives to Tackle Diabetes:

- National Programme for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases and Stroke (NPCDCS).

- World Diabetes Day

- Global Diabetes Compact

Jaisalmer Fort

The historic Jaisalmer Fort in Rajasthan, experienced a collapse of its walls following heavy rainfall, highlighting the need for better maintenance and preservation of this UNESCO World Heritage Site. The collapse is attributed to weakened walls due to a lack of proper maintenance.

- The Jaisalmer Fort is India’s only ‘living’ fort, with residents living within its walls, making its maintenance crucial for their safety.

- Built in 1156 AD by Raja Rawal Singh, the fort was strategically constructed to protect the kingdom from invasions. It was an important trade centre along the Silk Route, connecting India with Central Asia.

- Constructed from yellow sandstone that changes colour with sunlight, the fort appears golden, earning it the name "Sonar Quila" or "Golden Fort."

- The Raj Mahal (Royal Palace) is the largest palace within the fort, featuring ornate balconies and intricate carvings. It is a splendid example of medieval Rajasthani architecture, featuring a remarkable blend of Islamic and Rajput style influences.

- Built in 1156 AD by Raja Rawal Singh, the fort was strategically constructed to protect the kingdom from invasions. It was an important trade centre along the Silk Route, connecting India with Central Asia.

- The Archaeological Survey of India (ASI) is responsible for the fort's maintenance.

- The hill forts of Rajasthan, including Chittor, Kumbhalgarh, Ranthambore, Gagron, Amer, and Jaisalmer Forts, were designated as a UNESCO World Heritage Site in 2013.

- Jaisalmer Fort along with the Forts of Chittorgarh, Kumbhalgarh and Ranthambore are protected as Monuments of National Importance of India under the Ancient and Historical Monuments and Archaeological Sites and Remains (Declaration of National Importance) Act of 1951.

Discovery of Cult Temple in Italy

Recently, archaeologists discovered a 2,700-year-old Etruscan cult temple (or Oikos) related to the ancient Etruscan civilisation at the Sasso Pinzuto necropolis in Tuscany, Italy.

- They discovered more than 120 chamber tombs from the 7th century BCE to the Hellenistic period (323-31 BC).

Etruscan Civilisation:

- It flourished in central Italy (8th–3rd century BCE) between the Tiber and Arno rivers and west and south of the Apennine mountains.

- It was a federation of city-states with a shared language and culture, significantly influencing the Romans who later succeeded them.

Etruscan Temple:

- Etruscan temples, typically rectangular, were built on tuffaceous opus quadratum foundations (solid bases made from square-cut tuff, a soft volcanic rock).

- They were often positioned at elevation from ground for significant visibility and symbolic reasons, these temples were commonly near burial sites, linking them to funerary practices.

- Polychrome clay slabs with reliefs depicting religious and festive scenes were a common decorative feature.

Ban on SIMI Extended

A judicial tribunal has confirmed the five-year extension of the ban imposed on Students Islamic Movement of India (SIMI).

- It said the outfit has not abandoned its objective of 'Jehaad' for the cause of Islam and that it continues to work for the establishment of Islamic rule in India.

- The tribunal was constituted under the Unlawful Activities (Prevention) Act, 1967 (UAPA).

- UAPA aims to prevent and combat unlawful activities that threaten the sovereignty, integrity and security of India.

- As many as 10 state governments have recommended the declaration of SIMI as an "unlawful association" under the provisions of the UAPA.

- The SIMI was first declared outlawed in 2001 and since then the ban has been extended periodically.

- SIMI was founded on 25th April 1977, at Aligarh Muslim University as a youth group linked to Jamaat-e-Islami-Hind (JEIH). It became independent in 1993.

Kasturi Cotton Bharat Initiative

The Kasturi Cotton Bharat programme of the Ministry of Textiles is a pioneering effort in traceability, certification and branding of Indian cotton.

- It is a collaboration between the Government of India (Cotton Corporation of India), trade bodies, and industry to enhance cotton traceability and certification.

- A microsite with QR code verification and a blockchain platform has been developed for end-to-end traceability and transaction certification.

- The program is promoted at both national and international levels, with funds allocated at the national level rather than state-specific.

- Approximately 343 modernised ginning and pressing units are registered, including 15 units in Andhra Pradesh.

- Around 100 bales from Andhra Pradesh have been certified under the Kasturi Cotton Bharat brand.

- Cotton is a vital crop in India, contributing to 25% of global production and is known as "White-Gold" for its economic value. It thrives in hot, sunny climates and various soil types but is sensitive to waterlogging.