Biodiversity & Environment

Protected Planet Report 2024

For Prelims: Protected Planet Report, International Union for Conservation of Nature, Kunming-Montreal Global Biodiversity Framework, Conference of the Parties (COP 15), United Nations Environment Programme, Aichi Biodiversity Targets

For Mains: National Biodiversity Strategy and Action Plan, Protected Areas and Biodiversity Conservation, Biodiversity and Climate Change

Why in News?

The Protected Planet Report 2024, produced by the UNEP– World Conservation Monitoring Centre (UNEP-WCMC) and the IUCN and its World Commission on Protected Areas (WCPA), is the first comprehensive evaluation of the global status of protected and conserved areas.

- It highlights both the progress made and the challenges ahead in achieving Target 3 of the Kunming-Montreal Global Biodiversity Framework(KM-GBF).

What is the Target 3 of the Kunming-Montreal GBF?

- The KM-GBF was adopted at the 15th COP of the UN Convention on Biological Diversity (CBD).

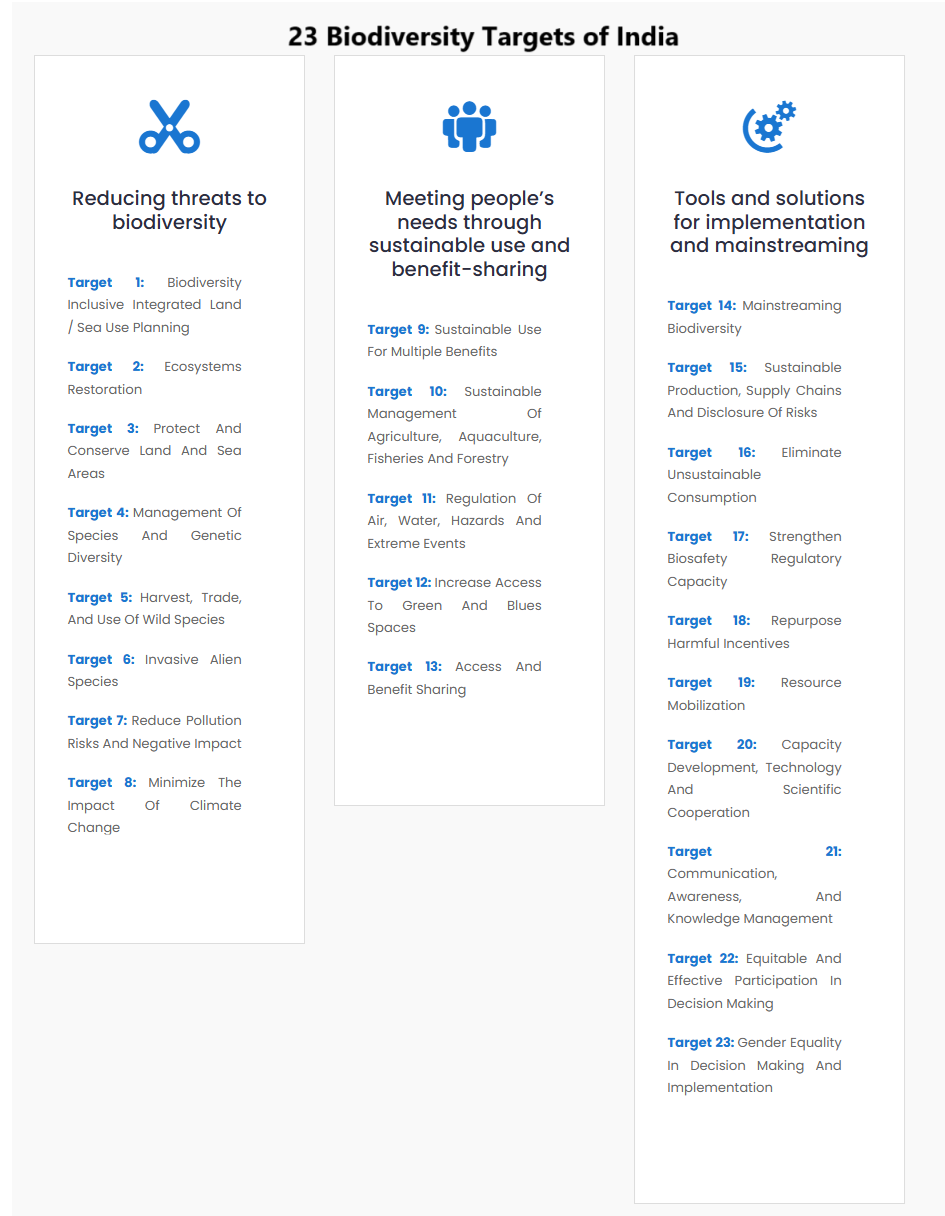

- This framework sets out an ambitious pathway to reach the global vision of a world living in harmony with nature by 2050, with 4 goals for 2050 and 23 targets for 2030.

- Target 3: Ensure and enable that by 2030 at least 30% terrestrial, inland water, coastal, and marine areas, especially those critical for biodiversity, are effectively conserved and managed through well-connected, ecologically representative, and equitably governed protected areas.

- This includes recognizing indigenous and traditional territories and integrating these areas into wider landscapes and seascapes, while ensuring sustainable use aligns with conservation goals and respects the rights of Indigenous peoples and local communities.

Key Terms

- Protected Area: Defined by the CBD as “a geographically defined area, which is designated or regulated and managed to achieve specific conservation objectives”.

- IUCN, along with the UNEP–WCMC, maintains a global database of protected and conserved areas.

- Indigenous and Traditional Territories: As per CBD, these are the areas with unique and significant biodiversity owned/occupied/managed by indigenous peoples and local communities.

What are the Key Highlights of the Protected Planet Report 2024?

- Global Coverage Progress: 17.6% of land and inland waters, and 8.4% of oceans and coastal areas are under protection. While progress has been made, the increase is minimal (less than 0.5% in both realms) since 2020.

- To meet the 30% target by 2030, additional protection is needed: 12.4% more land needs to be protected and 21.6% more ocean needs to be safeguarded.

- Progress in Ocean Conservation: Strongest progress since 2020 has been in the ocean, but most of this has been in national waters.

- In areas beyond national jurisdiction, coverage remains very low (<11% of the total area covered by marine and coastal protected areas).

- Challenges with Effectiveness and Governance: Less than 5% of land and 1.3% of marine areas have been assessed for management effectiveness. Only 8.5% of protected land is well-connected.

- Governance remains a challenge, with only 0.2% of land and 0.01% of marine areas assessed for equitable management.

- Underrepresentation of Biodiversity: Only one-fifth of areas identified as important for biodiversity are fully protected. Biodiversity is unevenly conserved.

- Though over two thirds of Key Biodiversity Areas (KBAs) are partially or fully covered by protected and conserved areas, the remaining one third (32%) of KBAs fall entirely outside these areas and lack formal protection.

- Indigenous Peoples' Role: Indigenous communities govern less than 4% of protected areas, despite holding 13.6% of global terrestrial areas outside formal protection.

- Governance data is lacking for these territories, and their contributions are often not fully recognized.

- Key Recommendations:

- Despite challenges, there is reason for optimism as 51 countries have already exceeded the 30% target on land, and 31 countries have done so at sea.

- With 6 years remaining, the report stresses that the 30% target is still achievable with accelerated efforts, global cooperation, and support for Indigenous Peoples.

- Insufficient availability of data is a long standing issue, especially regarding the positive biodiversity outcomes of protected and conserved areas, equitable governance for local people, and upholding the rights of women, Indigenous Peoples and local communities. Greater efforts are crucial in these areas.

- Indigenous People must be supported to act as stewards of their lands, their voices and knowledge must be heard and valued.

- Efforts must focus on not just increasing protected area coverage, but also ensuring these areas are well-connected and strategically located in biodiversity hotspots.

- Despite challenges, there is reason for optimism as 51 countries have already exceeded the 30% target on land, and 31 countries have done so at sea.

Key Institutions

- International Union for Conservation of Nature (IUCN): It was created in 1948 is a global membership organisation that includes governmental and civil society organisations. It serves as the authoritative body on the status of the natural world and the measures necessary to protect it.

- India became a State Member of IUCN in 1969, it provides invaluable scientific knowledge, policy guidance, and support for efforts aimed at conserving nature globally.

- UNEP-WCMC: It is a global leader in biodiversity, bridging science, policy, and practice to address nature’s crisis and promote a sustainable future. It operates as a collaboration between the United Nations Environment Programme (UNEP) and the UK charity WCMC.

- IUCN World Commission on Protected Areas (WCPA): It is a global network providing scientific, technical and policy advice, and advocating for effective area-based conservation measures that benefit biodiversity.

What are the Key Goals of India’s Biodiversity Strategy?

- NBSAP: The CBD mandates member countries including India, to develop a National Biodiversity Strategy and Action Plan (NBSAP) for conserving and sustainably using biodiversity.

- India recently updated its NBSAP to align with the KM-GBF, setting a goal to protect at least 30% of its natural areas by 2030.

- Originally created in 1999, India’s NBSAP was previously updated in 2008 and 2014 to meet the Aichi Biodiversity Targets, demonstrating India's ongoing commitment to addressing biodiversity threats.

- India recently updated its NBSAP to align with the KM-GBF, setting a goal to protect at least 30% of its natural areas by 2030.

- India’s Updated NBSAP: The updated NBSAP aims to protect 30% of terrestrial, inland water, coastal, and marine areas, aligning with the KM-GBF’s global goals.

- The plan emphasises the restoration of ecosystems such as forests and rivers, to ensure resources like clean water and air remain accessible.

|

Drishti Mains Question: Q. Evaluate India’s updated National Biodiversity Strategy and Action Plan (NBSAP) in the context of the Kunming-Montreal Global Biodiversity Framework. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Consider the following statements : (2023)

- In India, the Biodiversity Management Committees are key to the realization of the objectives of the Nagoya Protocol.

- The Biodiversity Management Committees have important functions in determining access benefit sharing, including the power to levy collection fees on the access of biological resources within its jurisdiction.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Answer: (c)

Q. With reference to ‘Global Environment Facility’, which of the following statements is/are correct? (2014)

(a) It serves as financial mechanism for ‘Convention on Biological Diversity’ and ‘United Nations Framework Convention on Climate Change’

(b) It undertakes scientific research on environmental issues at global level

(c) It is an agency under OECD to facilitate the transfer of technology and funds to underdeveloped countries with specific aim to protect their environment

(d) Both (a) and (b)

Ans: (a)

Q.“Momentum for Change: Climate Neutral Now” is an initiative launched by (2018)

(a) The Intergovernmental Panel on Climate Change

(b) The UNEP Secretariat

(c) The UNFCCC Secretariat

(d) The World Meteorological Organisation

Ans: (c)

Mains

Q. How does biodiversity vary in India? How is the Biological Diversity Act,2002 helpful in the conservation of flora and fauna? (2018)

Indian Polity

Limit on Private Property Acquisition

For Prelims: Articles 39(b) and 31C, Article 300A, Economic Democracy, Socialist, Fundamental Right, Zamindari System, Right to Property, Ninth Schedule, Articles 31A and 31B, Ryotwari, Directive Principles, Articles 14 and 19, 1st Amendment Act, 1951, Article 368, Constitutional Amendment, Parliament.

For Mains: Evolution of Right to property since independence. Role of judiciary in shaping the Right to property.

Why in News?

Recently, the Supreme Court in the Property Owners Association v State of Maharashtra Case 2024, set limits on the government’s power to take over privately owned resources for public distribution.

- The petitioners argued that private properties cannot be taken over by the state under the garb of constitutional schemes of Articles 39(b) and 31C of the Constitution.

Note:

- Article 39(b) provides that the State shall aim to ensure the distribution of material resources to serve the common good.

- As per Article 31C, Articles 39(b) and 39(c) cannot be challenged by invoking the right to equality (Article 14) or the rights under Article 19 (freedom of speech, right to assemble peacefully, etc).

What are the Key Highlights of the Supreme Court Verdict?

- Acquisition of Private Resources: Resources that are scarce or vital to community well-being should qualify for state acquisition and not all private properties.

- “Public trust doctrine” where the state holds certain resources in trust for the public, might guide this determination.

- Tests for Resource Qualification: The court laid down two key tests i.e., a resource must be both “material” and “belong to or serve the community.

- The materiality of a privately owned resource and its community element must be assessed on a case-by-case basis.

- Materiality refers to the impact of assets like land, minerals, or water on economic, social, and environmental dynamics.

- The materiality of a privately owned resource and its community element must be assessed on a case-by-case basis.

- Overturning Ranganath Reddy case 1977: The majority overturned the Sanjeev Coke ruling, 1982 which had upheld Ranganath Reddy case, 1977 argument in the Ranganath Reddy case that all private property could be deemed "material resources of the community" for redistribution.

- The lone dissenter Justice Sudhanshu Dhulia argued for broader legislative discretion in defining “material resources” of the community.

- Restriction on Article 39(b): The court cautioning against a wider interpretation of Article 39(b) that would undermine property rights under Article 300A.

- Article 300A: No person shall be deprived of his property save by authority of law.

- Private to Community Resources: SC outlined five ways of turning private resources into community material resources:

- Nationalisation, Acquisition, Operation of law, Purchase by the state and Donation by the owner.

What are the Constitutional Provisions Related to Right to Property?

- Article 31: The original Article 31 (a fundamental right) dealt with the right to property, but it was repealed (44th Amendment Act, 1978) and replaced by Article 300A (constitutional right).

- 1st Amendment Act, 1951: The 1st Amendment Act, 1951 incorporated Articles 31A and 31B into the Constitution, along with the Ninth Schedule.

- Articles 31A: It gave the state competence to acquire property or alter rights in property without it being challenged on grounds of inconsistency with fundamental rights.

- Article 31B: It ensured that laws included in the Ninth Schedule could not be struck down, even if they conflicted with fundamental rights.

- Ninth Schedule: It contains a list of central and state laws which cannot be challenged in courts. E.g., land reform laws.

- 25th Amendment Act, 1971: It inserted Article 31C to protect state laws aimed at resource distribution under Article 39(b) and (c) from constitutional challenges.

- The Amendment barred the courts from reviewing the State’s actions, even if they were arbitrary or irrational.

- 42nd Amendment Act, 1976: It expanded the scope of Article 31C to include all Directive Principles.

- This provision protects qualifying laws from being struck down under Articles 14 and 19 if they genuinely serve public welfare through resource redistribution.

- 44th Amendment Act, 1978: Article 19(1)(f) and Article 31, which protected the right to acquire, hold, and dispose of property, were abrogated meaning it removed the Right to Property from the list of fundamental rights.

- Property became a constitutional right under Article 300A in Chapter IV of Part XII.

What is Judicial Interpretation Related to Right to Property?

- Sankari Prasad Case, 1951: The Supreme Court upheld the 1st Amendment Act, 1951 affirming Parliament's exclusive authority to amend the Constitution under Article 368 and ruling that amendments affecting fundamental rights are not restricted by Article 13(2).

- Article 13(2) provides for judicial review which helps invalidate laws conflicting with fundamental rights.

- Bella Banerjee Case, 1954: The Supreme Court ruled that the government was required to pay just compensation in cases of compulsory property acquisition.

- Kesavananda Bharati case, 1973: SC clarified that constitutional amendments are not subject to the restrictions of Article 13(2) meaning that Parliament could amend the Constitution, including altering or removing provisions related to the right to property.

- Minerva Mills Case, 1980: Expansion of the scope of Article 31C to include all Directive Principles was struck down by the Supreme Court.

- SC also struck down provisions that prevented judicial scrutiny of Article 31C, reinforcing the principle of constitutional checks and balances.

- Waman Rao Case, 1981: It was held that constitutional amendments and laws in the Ninth Schedule before the Kesavananda Bharati case remain protected from judicial challenge.

- However, amendments added after the case are subject to judicial review based on the basic structure doctrine.

- Vidya Devi Case, 2020: SC held that forcibly dispossessing a person of private property without due process violates both human rights and the constitutional right under Article 300A.

What is the Significance of the SC Judgment?

- State and Individual Rights: It preserves the potential for state intervention while acknowledging that the indiscriminate acquisition of private resources is not permissible.

- Economic Democracy: The judgement aligns with Dr. B.R. Ambedkar’s vision of "economic democracy," ensuring that the Constitution does not dictate a rigid economic structure, thus preserving people's liberty to decide their social and economic organisation.

- Flexible Interpretation: It emphasises that Directive Principles like Article 39(b) should be implemented in a way that reflects evolving societal and economic realities and not a single rigid economic doctrine.

- Legislative Framework: The judgement reinforces the role of elected governments and the democratic process in shaping economic and welfare policies.

- Welfare: Future welfare policies will likely focus on scarce, critical resources essential for public welfare. The state may adopt more targeted welfare strategies, such as progressive taxation and public schemes.

What is the Impact of State Control over Property?

- Positive Impacts:

- Equitable Redistribution: Promotes social justice by redistributing resources to marginalised groups, reducing wealth inequality.

- Resource Management: Ensures resources like land, water, and minerals are used sustainably and for public benefit.

- Public Welfare Projects: Facilitates infrastructure development, healthcare, and education by acquiring land or property for public purposes.

- Protection of Vulnerable Groups: Provides safeguards for disadvantaged communities from exploitation.

- Negative Impacts:

- Limitations on Private Ownership: Reduces individual property rights, potentially discouraging private investment and entrepreneurship.

- Reduced Incentives: Private owners may lack motivation to improve or invest in properties due to state restrictions.

- Economic Stagnation: Overregulation or excessive control can stifle market-driven growth and innovation.

Conclusion

The Supreme Court's verdict in the Property Owners Association v. State of Maharashtra (2024) sets important precedents regarding the state’s power to acquire private property. It emphasises the need for public purpose, compensation, and case-by-case assessments, balancing individual property rights with the common good.

|

Drishti Mains Question: Q. Discuss judicial interpretation of the right to property in various landmark cases. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. What is the position of the Right to Property in India? (2021)

(a) Legal right available to citizens only

(b) Legal right available to any person

(c) Fundamental Right available to citizens only

(d) Neither Fundamental Right nor legal right

Ans: (b)

Q. ‘Economic Justice’ as one of the objectives of the Indian Constitution has been provided in (2013)

(a) the Preamble and the Fundamental Rights

(b) the Preamble and the Directive Principles of State Policy

(c) the Fundamental Rights and the Directive Principles of State Policy

(d) None of the above

Ans: (b)

Mains

Q. What was held in the Coelho case? In this context, can you say that judicial review is of key importance amongst the basic features of the Constitution? (2016)

Q. Discuss the role of land reforms in agriculture development. Identify the factors that were responsible for the success of land reforms in India. (2016)

Q. The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 has come into effect from I st January, 2014. What are the key issues which would get addressed with the Act in place? What implications would it have on industrialization and agriculture in India? (2014)

Social Justice

Inheritance Norms in Hindu Succession Act, 1956

For Prelims: Supreme Court, Hindu Succession Act, 1956, Inheritance Laws, Law Commission, National Commission for Women, Virashaivas, Lingayats, Brahmo Sabha, Prarthna Samaj, Arya Samaj, Scheduled Tribes, Article 366, Mitakshara and Dayabhaga School.

For Mains: Gender Equality and Issues Related to Women

Why in News?

Recently, the Supreme Court upheld the inheritance provisions under the Hindu Succession Act, 1956 (HSA) emphasising on cultural norms and legislative consistency rather than viewing inheritance as a matter of gender inequality.

- Several petitions challenged the validity of the provisions, arguing for equitable treatment of men and women in inheritance matters.

What are the Supreme Court’s Observations on Inheritance?

- Not About Gender Justice: The SC judgment highlighted that after marriage, a woman becomes part of her husband’s family, with corresponding rights to inheritance in that family.

- The court clarified that the inheritance laws should not be framed solely as a gender equality issue.

- Cultural Context: The court stressed that Hindu inheritance practices reflect deeply rooted cultural values.

- Traditional sentiments often do not permit a married woman’s parents to interfere in her inherited properties.

- Scientific and Logical Lineage: The court upheld the Act’s “scientific and logical” framework, wherein property acquired by the woman from her parents or in-laws is returned to the source family in the absence of direct heirs, maintaining an ancestral lineage-based approach.

- Need for Legislative Change: The court reiterated modifications to inheritance laws should be initiated and enacted by Parliament, the legislative body, rather than through judicial decisions.

- This is because inheritance laws affect the entire society, and any changes must reflect a broad societal agreement and collective values, rather than being influenced by the concerns of a few individuals or specific disputes.

- Role of Wills: The court underscored that a woman is free to distribute her property as she wishes through a will, emphasising individual autonomy within existing legal norms.

- Previous Recommendations: While certain bodies, including the 174th Law Commission (2000) and the National Commission for Women, have recommended equal inheritance rights for men and women, these reforms depend on the views of the states and Union Territories.

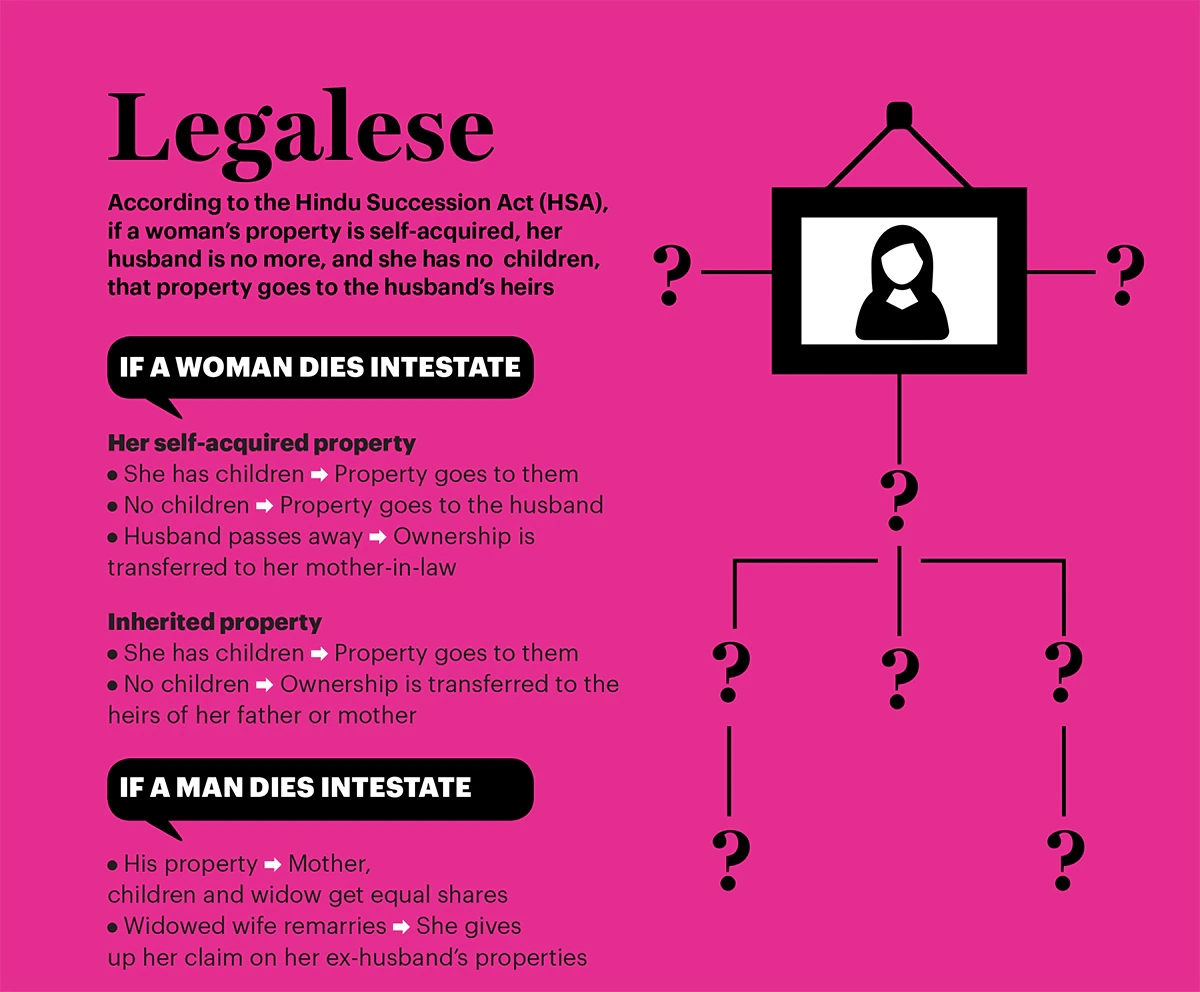

What are Key Provisions for Intestate (Without a Will) Succession Under HSA, 1956?

- For Hindu Women: If a Hindu woman dies without a will, her properties, including self-acquired assets are inherited first by her children and husband.

- If no husband or children exist, the property devolves upon the husband's heirs. Only in cases where there are no heirs of the husband does the property pass to the woman’s parents or their heirs.

- When property is inherited from a source (e.g., parents, in-laws), it returns to that source family if she dies intestate without direct heirs.

- For Hindu Men: When a Hindu man dies intestate, his property is divided equally among his wife, children, and mother. If none of these successors exist, the property devolves to the father.

What is the Hindu Succession Act, 1956?

- About: It lays down a legal framework for the distribution of property when a Hindu individual dies intestate.

- The Act establishes rules for determining heirs, their rights, and the division of property based on their relationships with the deceased.

- Applicability of Act:

- Hindus by religion, including Virashaivas, Lingayats, Brahmos, Prarthna Samajists, and Arya Samaj followers.

- Buddhists, Sikhs, and Jains by religion.

- Persons who are not Muslim, Christian, Parsi, or Jewish unless it is proved that Hindu law or custom does not govern them.

- The Act extends across India but does not automatically apply to Scheduled Tribes as per Article 366 of the Constitution unless notified by the Central Government.

- Schools of Hindu Law: It makes a uniform system of inheritance and devolution of property that is equally applicable to areas of Mitakshara and Dayabhaga school.

- The Mitakshara Law applies to the whole of India except West Bengal and Assam while Dayabhaga Law applies to West Bengal and Assam.

- Under Dayabhaga law, inheritance rights arise only after the forefathers' death, while Mitakshara grants property rights from birth.

- In the Dayabhaga system, both male and female family members can be coparceners, while the Mitakshara system restricts coparcenary rights to male members only.

- A coparcener is a person who can claim a right over ancestral property by birth.

- The Mitakshara Law applies to the whole of India except West Bengal and Assam while Dayabhaga Law applies to West Bengal and Assam.

- Distribution of Property:

- Class I Heirs: A widow is entitled to one share of the property.

- Sons, daughters, and mothers each receive an equal share.

- Class II Heirs: The property is divided equally if no Class I heirs exist.

- Agnates and Cognates: If no Class I or II heirs, property passes to paternal relatives (agnates) and other relatives (cognates).

- Class I Heirs: A widow is entitled to one share of the property.

- Hindu Succession (Amendment) Act, 2005: The 2005 amendment to Section 6 of the Act grants daughters coparcenary rights by birth, equal to sons, in property partitions arising from 2005.

Note:

- Heirs in Class I include son, daughter, widow, mother, son of predeceased son, and daughter of a predeceased son among others.

- Heirs in Class II include father, son’s daughter’s son, son’s daughter’s daughter, brother and sister among others.

Inheritance Laws in Other Communities

- Muslim: It is governed by Muslim Personal Law (Shariat) Application Act, 1973.

- Christian, Parsi and Jews: In case of Christians, Parsis and Jews, the Indian Succession Act, 1925 is applicable.

Conclusion

The Supreme Court's observations on inheritance provisions under the HSA highlight the interplay between cultural traditions and legislative frameworks, emphasizing lineage-based inheritance. The court stressed the importance of gender justice and societal values in Hindu inheritance laws while acknowledging the need to respect individual autonomy and consider potential legislative reforms. It is well established that a law's purpose cannot be undermined solely due to the hardship it may cause.

|

Drishti Mains Question: Examine the inheritance rights under the Hindu Succession Act, 1956. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the history of ancient India, which of the following statements is/are correct?

- Mitakshara was the civil law for upper castes and Dayabhaga was the civil law for lower castes.

- In the Mitakshara system, the sons can claim right to the property during the lifetime of the father, whereas in the Dayabhaga system, it is only after the death of the father that the sons can claim right to the property.

- The Mitakshara system deals with the matters related to the property held by male members only of a family, whereas the Dayabhaga system deals with the matters related to the property held by both male and female members of a family.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 3 only

Ans: (b)

Mains

Q. How does patriarchy impact the position of middle class working women in India? (2014)

Q. “Though women in post-Independent India have excelled in various fields, the social attitude towards women and feminist movement has been patriarchal.” Apart from women education and women empowerment schemes, what interventions can help change this milieu? (2021)

International Relations

Reassessing India's Stance on RCEP

For Prelims: World Bank, Regional Comprehensive Economic Partnership (RCEP), Global Value Chains (GVCs), National Logistics Policy 2022, FDI, Free Trade Agreements (FTAs), Production Linked Incentives (PLI) scheme 2020, ASEAN, Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), NITI Aayog.

For Mains: Regional Grouping and Its Impact on India, India’s Concerns with RCEP

Why in News?

B. V. R. Subrahmanyam, the CEO of NITI Aayog, has recently voiced support for India's inclusion in the Regional Comprehensive Economic Partnership (RCEP) and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

- His remarks reflect a shift from India’s current stance on RCEP, aligning with recommendations from the Economic Survey 2024, which advocates India’s integration into the regional supply chain networks.

What is RCEP?

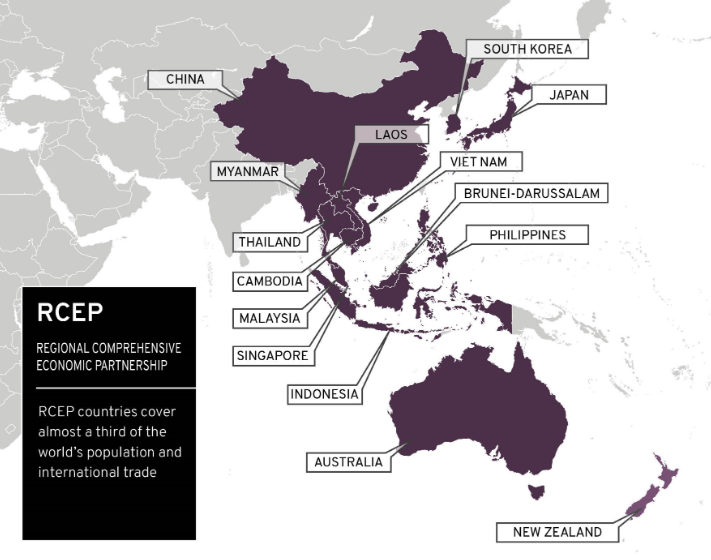

- About:

- The Regional Comprehensive Economic Partnership (RCEP) is a major economic agreement formed between the Association of Southeast Asian Nations (ASEAN) and their Free Trade Agreement (FTA) partners.

- RCEP is the world's largest trading bloc.

- It is designed to promote economic integration, trade liberalization, and cooperation among member nations.

- Its negotiations began in 2012 and it was officially signed in November 2020, marking a major milestone in regional trade. It was entered into force on 1st January 2022.

- Objectives:

- To facilitate trade and investment across member countries.

- To reduce or eliminate tariffs and non-tariff barriers to promote seamless trade.

- To strengthen economic cooperation and bolster regional supply chains.

- Member Countries:

- 15 countries signed RCEP in 2020: 10 ASEAN member countries (Brunei, Cambodia, Indonesia, Malaysia, Myanmar, Singapore, Thailand, the Philippines, Laos, and Vietnam) and their 5 free trade agreement (FTA) partners - China, Japan, South Korea, Australia, and New Zealand.

- Coverage Areas:

- The RCEP agreement covers several key areas, including: Trade in goods and services,Investment and economic cooperation, Technical cooperation, Intellectual property rights,Competition policies, Dispute resolution mechanisms, E-commerce and Support for small and medium enterprises(SMEs).

- Trade Volume:

- RCEP member countries collectively represent over 30% of the global Gross Domestic Product (GDP) in 2019 and cover about one-third of the world’s population.

- India and RCEP:

- India was initially a part of the RCEP negotiations but decided to withdraw in 2019.

Why did India Withdraw from RCEP?

- "China Plus One" Strategy:

- India’s decision aligns with the global trend of the "China Plus One" strategy, which aims to reduce over-reliance on China by diversifying supply chains and trade relationships.

- Growing Trade Deficits:

- Since the implementation of RCEP, trade deficits have risen significantly for several member nations.

- RCEP would have exacerbated India's trade deficit, as seen in other countries. For example, ASEAN’s trade deficit with China increased from USD 81.7 billion in 2020 to USD 135.6 billion in 2023.

- Dumping of Chinese Goods:

- India was concerned of an influx of cheap Chinese products, which could harm domestic industries. The country's trade deficit with China had already surged to USD 85 billion in 2023-24.

- Protection of Domestic Industry And Rules of Origin Norm:

- India's withdrawal from RCEP was partly due to concerns over protection of domestic industries, particularly in sectors like dairy and steel, where tariff reductions from 35% to zero would expose them to competition from Australia and New Zealand.

- Additionally, India was wary of the rules of origin provisions, fearing that products could bypass Indian tariffs by being routed through other countries, weakening safeguards for domestic industries.

What is CPTPP?

- About:

- The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is a free trade agreement (FTA) among 11 countries: Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, Peru, New Zealand, Singapore, and Vietnam.

- The CPTPP was officially signed on 8th March 2018, in Santiago, Chile, marking a significant step in regional trade cooperation.

- Significance:

- The CPTPP eliminates 99% of tariffs on goods and services, promoting economic integration. It includes strict environmental provisions to curb wildlife trafficking, protect vulnerable species, and regulate unsustainable logging and fishing, with penalties for non-compliance.

- All members are part of APEC, which fosters economic growth in the Asia-Pacific region.

- India's stand:

- India did not join the CPTPP due to concerns over stricter labor and environmental standards, narrowly defined investment protection clauses, and detailed transparency requirements that could limit India's regulatory autonomy.

What are the Major Benefits for India in Joining RCEP and CPTPP?

- Access to Expansive Markets:

- Joining RCEP and CPTPP would grant India access to larger markets, particularly in the Asia-Pacific region, boosting exports, especially from MSMEs that contribute 40% of India's exports.

- Reduced tariffs and trade barriers would enhance MSME competitiveness, while easier access to technology and resources would support scaling up production under initiatives like "Make in India."

- It would boost India’s supply chain integration, reduce logistics costs, and improve manufacturing efficiency.

- Utilizing the “China Plus One” Strategy:

- India, with its skilled workforce and growing industrial base, is well-placed to attract foreign investment as part of the "China Plus One" strategy. Countries like Vietnam, Indonesia, and Malaysia have benefited significantly from this shift.

- By joining RCEP, India can capitalize on the shift of multinational companies seeking alternatives to Chinese manufacturing, positioning itself as a key manufacturing hub in the region.

- Improved Trade Competitiveness and FDI:

- Joining RCEP would enhance India’s global trade competitiveness by reducing tariffs and non-tariff barriers, making its products more price-competitive, particularly in markets like Japan, South Korea, and Australia.

- It would also attract FDI by providing better market access and clearer trade terms, boosting investments in infrastructure, manufacturing, and technology, thereby driving economic growth and job creation.

- Strengthening Trade Negotiating Power:

- It would enhance India’s trade negotiating power, enabling it to influence trade rules and negotiate favorable terms in sectors like agriculture, technology, and services, while protecting domestic interests and boosting exports.

- Innovation and Knowledge Exchange:

- RCEP promotes intellectual property rights and technology exchange, offering India access to advanced technologies and fostering collaboration with countries like Japan and South Korea which would enhance innovation, boost competitiveness, and strengthen India’s technological capabilities

Impact of India's Current Tariff Structure on its Global Trade Competitiveness

- Average Applied Tariffs:

- India’s average applied tariff stands at around 13.8%, which is significantly higher than China’s 9.8% and the United States' 3.4%.

- Although it is lower than some other economies when considering trade-weighted averages, India's tariffs remain a constraint on its trade relations.

- High Bound Tariffs:

- India’s bound tariff rates, particularly on agricultural products, are among the highest globally, ranging from 100% to 300%.

- These high tariff rates create substantial barriers for foreign exporters, making Indian markets less attractive and limiting India’s integration into global supply chains.

Way Forward

- Bilateral Free Trade Agreements (FTAs): India should prioritize finalizing comprehensive FTAs with key partners like the United Kingdom and the European Union to expand market access.

- Strengthening Regional Groupings: India must continue advocating for regional integration within SAARC and enhance ties with BIMSTEC, which connects South and Southeast Asia.

- Trade Agreements with Gulf Countries and Africa: Active negotiations with Gulf Cooperation Council (GCC) countries and African nations should be pursued, with a focus on sectors such as energy, infrastructure, and digital cooperation.

- Indo-Pacific Economic Framework (IPEF): By participating actively in IPEF, India can further its "Act East Policy," promoting regional cooperation in trade, supply chain resilience, clean energy, and fair economic practices.

- Self-Reliant India: To boost exports and manufacturing, the government should focus on strengthening domestic capabilities through initiatives like Make in India 2.0 and Production Linked Incentive (PLI) Schemes.

|

Drishti Mains Question: Evaluate the potential benefits and challenges for India in joining the RCEP in the context of trade deficits and competition with China. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. Consider the following countries: (2018)

- Australia

- Canada

- China

- India

- Japan

- USA

Which of the above are among the ‘free-trade partners’ of ASEAN?

(a) 1, 2, 4 and 5

(b) 3, 4, 5 and 6

(c) 1, 3, 4 and 5

(d) 2, 3, 4 and 6

Ans: (c)

Q2. The term ‘Regional Comprehensive Economic Partnership’ often appears in the news in the context of the affairs of a group of countries known as(2016)

(a) G20

(b) ASEAN

(c) SCO

(d) SAARC

Ans: (b)

Q. With reference to the ‘Trans-Pacific Partnership’, consider the following statements: (2016)

- It is an agreement among all the Pacific Rim countries except China and Russia.

- It is a strategic alliance for the purpose of maritime security only.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Important Facts For Prelims

3rd Edition of the World Solar Report Series

Why in News?

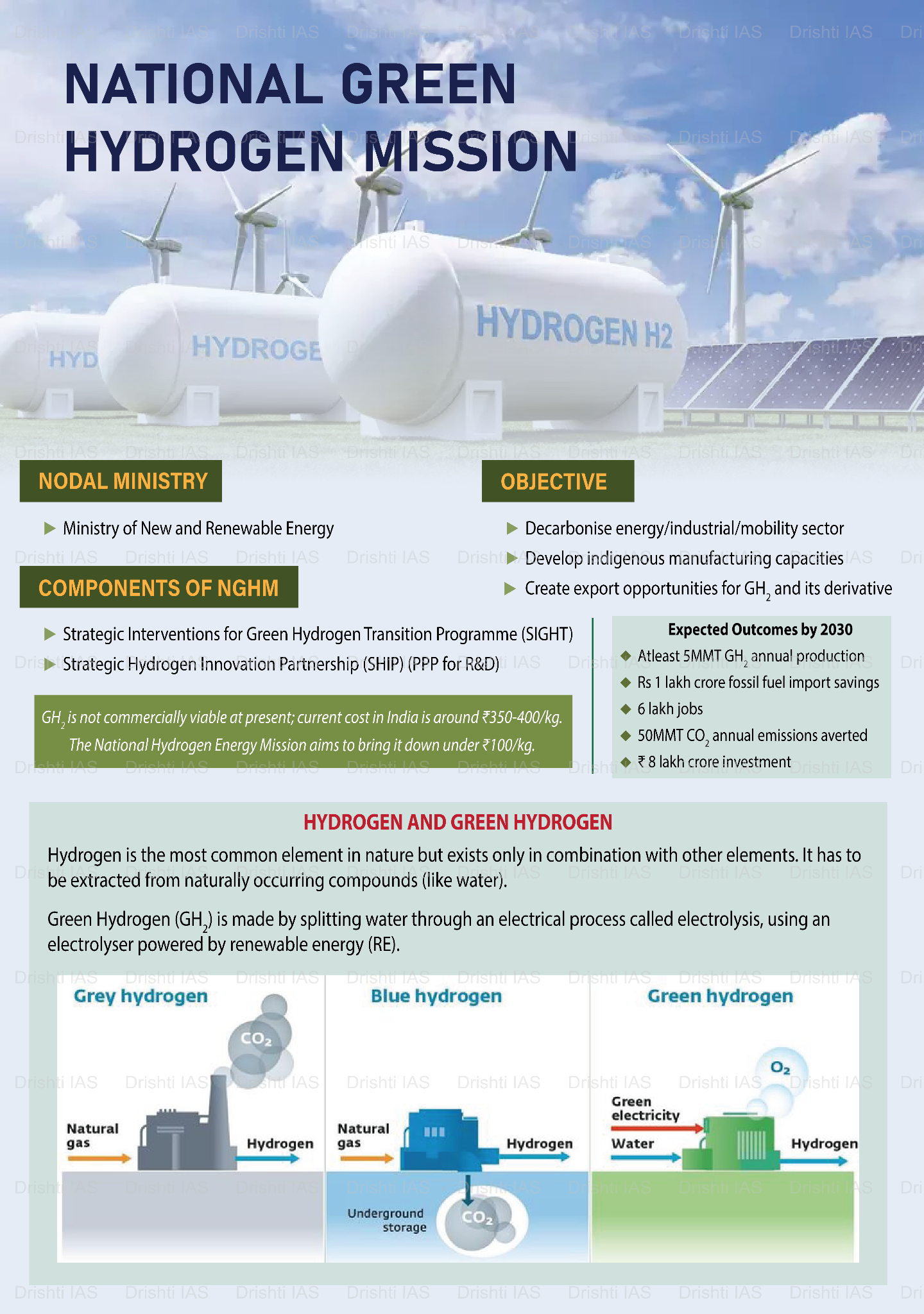

Recently, at the 7th Assembly of the International Solar Alliance (ISA), the 3rd edition of the World Solar Report Series was released. This year’s series comprises four key reports: the World Solar Market Report, the World Investment Report, the World Technology Report, and the Green Hydrogen Readiness Assessment for African Countries.

- Each report highlights advancements and challenges in the solar energy sector, underlining the growing role of renewable energy in addressing global climate targets.

Note:

- The World Solar Report series, launched by the ISA in 2022, offers a concise overview of global solar technology advancements, key challenges, and investment trends, providing valuable insights into the industry's growth.

What are the Key Highlights of the World Solar Report Series?

- World Solar Market Report: Global solar capacity has grown exponentially from just 1.22 GW in 2000 to an impressive 1,418.97 GW in 2023, reflecting a remarkable 40% annual growth rate.

- Global solar capacity is projected to reach 5, 457-7, 203 GW by 2030, driven by Paris Agreement goals, requiring a massive infrastructure push to meet climate targets.

- The clean energy industry now supports 16.2 million jobs, with solar accounting for 7.1 million.

- Global solar manufacturing is set to exceed 1,100 GW by 2024, double the demand, making solar more affordable.

- World Investment Report: Global energy investments to rise from USD 2.4 trillion in 2018 to USD 3.1 trillion by 2024, with clean energy investments nearly doubling that of fossil fuels.

- Solar investments accounted for 59% of total Renewable Energy investments, driven by lower panel costs. Asia–Pacific (APAC) leads in solar investments followed by Europe, the Middle East and Africa (EMEA).

- World Technology Report: Monocrystalline solar PV modules (solar panel) have achieved 24.9% efficiency, while multijunction perovskite cells (a type of solar cell) promise higher efficiency and lower costs, potentially outpacing traditional silicon panels.

- Solar manufacturing has reduced silicon usage by 88% in 2023 and a 90% drop in utility-scale solar PV costs, highlighting improvements in material efficiency and potential cost and environmental benefits.

- Green Hydrogen Readiness Assessment for African Countries: The report identifies Egypt, Morocco, Namibia, and South Africa as potential leaders for developing a green hydrogen economy due to their renewable energy resources.

- The report highlights the Green hydrogen, produced using renewable energy, is key for industries dependent on fossil fuels, such as steel and fertilisers.

International Solar Alliance (ISA)

- The ISA is an international organisation with 120 Member and Signatory countries. It works with governments to improve energy access and security worldwide and promote solar power as a sustainable transition to a carbon-neutral future.

- ISA’s mission is to unlock USD 1 trillion of investments in solar by 2030 while reducing the cost of the technology and its financing.

- ISA was formed at the 21st Conference of Parties (COP21) to the United Nations Framework Convention on Climate Change (UNFCCC) held in Paris in 2015 and partners with multilateral development banks (MDBs), development financial institutions (DFIs), public and private sectors, to deploy cost-effective solar energy solutions, especially in least Developed Countries (LDCs) and the Small Island Developing States (SIDS).

- ISA became the first international intergovernmental organization to be headquartered in India.

- ISA drives solar adoption through policies, investments, and new business models, providing clean energy and fostering sustainable growth.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Consider the following statements: (2016)

- The International Solar Alliance was launched at the United Nations Climate Change Conference in 2015.

- The Alliance includes all the member countries of the United Nations.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Important Facts For Prelims

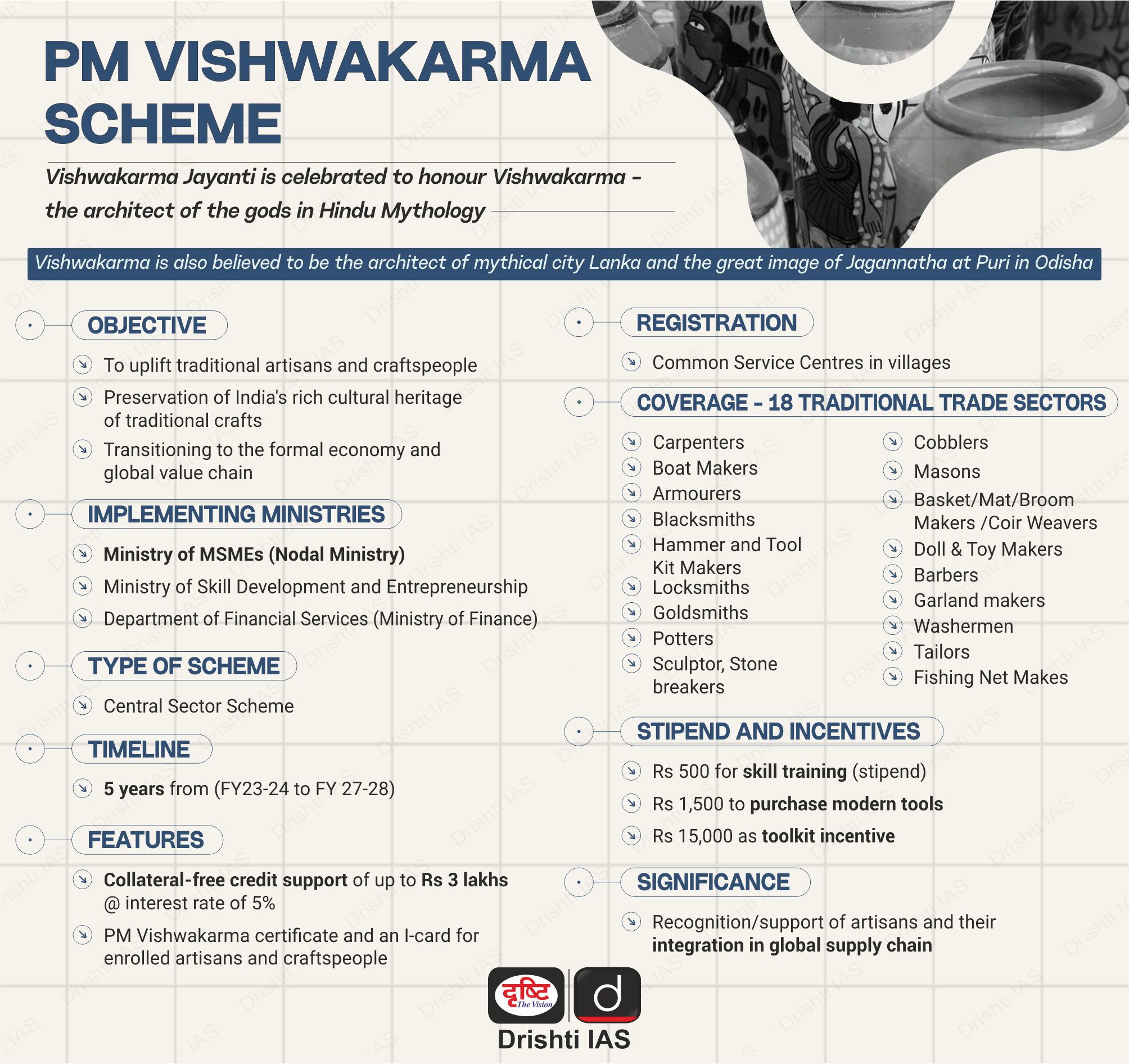

PM Vishwakarma Yojana

Why in News?

Since the launch of the PM Vishwakarma Yojana in 2023, it has made significant strides in supporting traditional craftspeople and artisans across the country. - a substantial number of applications, with a large portion successfully completing the multi-step registration process.

- Additionally, many registered beneficiaries have availed toolkit incentives to purchase modern tools suitable for their occupation.

What is the PM Vishwakarma Yojana?

- Objective: Uplift traditional artisans and craftspeople by enhancing the quality and market accessibility of their products and integrate them in both domestic and global value chains.

- Features:

- Budgetary allocation for scheme – Rs 13,000 crore for 5 financial years (2023-24 to 2027-28).

- Provides recognition to beneficiaries through a PM Vishwakarma Certificate and an ID Card.

- Stipend of Rs 500 for skill training per day and Rs 15,000 grant for the purchase of modern tools.

- Category: Central Sector Scheme

- Nodal Ministry: Ministry of Micro, Small and Medium Enterprises (MoMSME)

- Lending Institutions:

- Scheduled Commercial Banks

- Regional Rural Banks

- Small Finance Banks

- Cooperative Banks

- NBFCs and Micro Finance Institutions

- Lending Mechanism:

- Beneficiaries are eligible for collateral-free credit support of up to Rs 1 lakh (first tranche) and Rs 2 lakh (second tranche) at a low interest rate.

- Eligibility Beneficiaries:

- Industrial Units: Targeted specifically for the MSME sector.

- Training Program Eligibility: Open to individuals from school dropouts to those holding an M.Tech degree.

Other Government Initiatives for Artisans

- Ambedkar Hastshilp Vikas Yojana

- Mega Cluster Scheme

- National Handicraft Development Programme

- Comprehensive Handicrafts Cluster Development Scheme

- Export Promotion Council for Handicrafts

- One District One Product

- Atmanirbhar Hastshilpkar Scheme

UPSC Civil Services Examination, Previous Year Question:(PYQ)

Prelims:

Q1. Consider the following statements with reference to India : (2023)

- According to the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the ‘medium enterprises’ are those with investments in plant and machinery between `15 crore and `25 crore.

- All bank loans to the Micro, Small and Medium Enterprises qualify under the priority sector.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Rapid Fire

Adoption Awareness Month

Recently, Central Adoption Resource Authority (CARA) celebrated November as National Adoption Awareness Month to promote legal adoptions.

- About CARA: It is a statutory body established under the Juvenile Justice Act, 2015 and functions under the Ministry of Women & Child Development.

- It is the nodal body for adoption of Indian children and is mandated to monitor and regulate in-country and inter-country adoptions.

- Inter-country adoptions in India adhere to the Hague Convention on Intercountry Adoption, 1993, ratified by Government of India in 2003.

- It is the nodal body for adoption of Indian children and is mandated to monitor and regulate in-country and inter-country adoptions.

- Theme: Rehabilitation of Older Children through Foster Care and Foster Adoption.

- Hague Convention is an international treaty to ensure the prompt return of the child who has been “abducted” from the country of their “habitual residence”.

- The Convention shall cease to apply when the child attains the age of 16 years.

Read More: Adoption in India

Rapid Fire

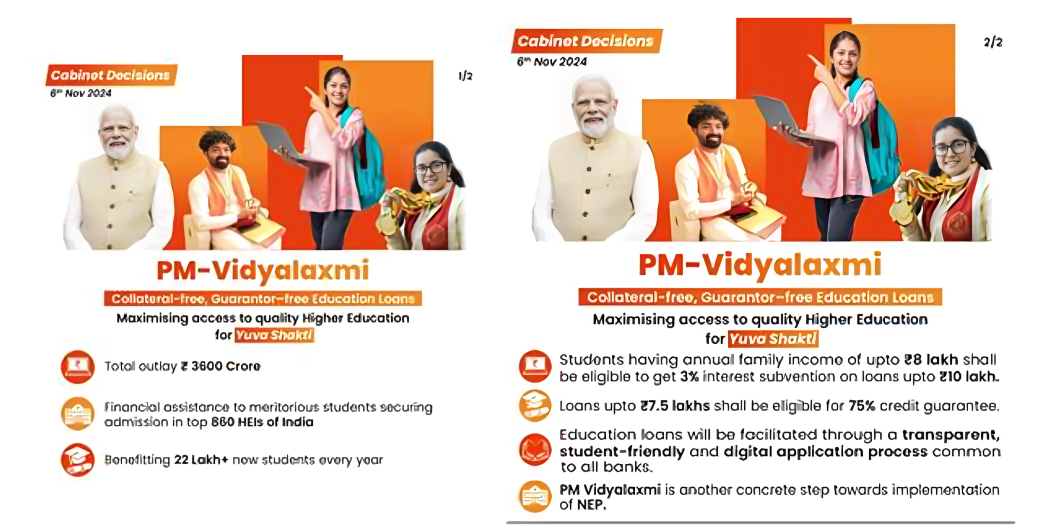

PM-Vidyalaxmi Scheme

The Union Cabinet has approved the Pradhan Mantri Vidyalaxmi scheme, designed to provide financial assistance to meritorious students for higher education.

- Objective: It aligns with the National Education Policy (NEP) 2020 and aims to provide collateral-free, guarantor-free loans to students.

- Eligibility Criteria: Students enrolled in institutions ranked within the top 100 by the National Institutional Ranking Framework (NIRF), and those in the 101-200 range from state government and all central government governed institutions.

- Beneficiaries: It can benefit over 22 lakh students, with the list updated annually based on the latest NIRF rankings.

- Procedure: The Department of Higher Education will launch the "PM-Vidyalaxmi" portal for students to apply for education loans and interest subvention, with payments made via E-voucher and Central Bank Digital Currency (CBDC) wallets.

- Supplementing Existing Schemes: The scheme supplements the two components, Credit Guarantee Fund for Education Loans (CGFSEL) and Central Sector Interest Subsidy (CSIS), under the existing PM-Uchchatar Shiksha Protsahan (PM-USP) scheme.

- PM-USP CSIS offers full interest subvention for loans up to Rs 10 lakh to students with family income up to Rs 4.5 lakh, pursuing technical courses.

Read more: Revamping India's Higher Education System

Rapid Fire

Brazil Declines Belt and Road Initiative

Despite having strong economic ties with China, Brazil has opted not to join China's Belt and Road Initiative (BRI), making it the second BRICS nation to make this choice after India.

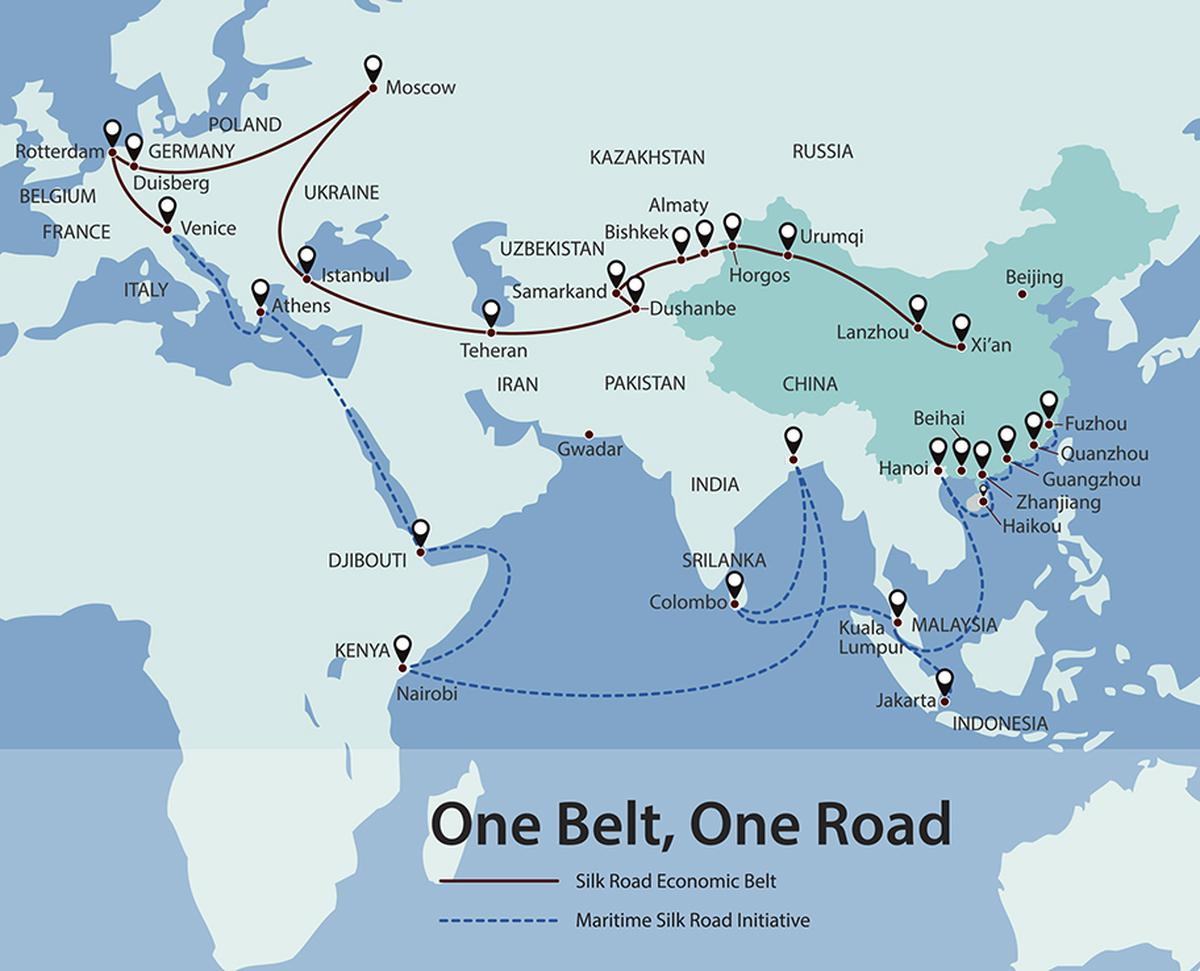

- About BRI

- BRI is China’s strategic initiative that aims to connect Asia with Africa and Europe via land and maritime networks with the aim of improving regional integration, increasing trade and stimulating economic growth.

- Components:

- Silk Road Economic Belt: This segment of the BRI is dedicated to improving connectivity, infrastructure, and trade links across Eurasia through a network of overland transportation routes.

- Maritime Silk Road: This component enhances maritime connections and cooperation starting in the South China Sea, extending to Indo-China, Southeast Asia, and across the Indian Ocean to Africa and Europe.

- Key Corridors for Development:

- China-Pakistan Economic Corridor (CPEC)

- New Eurasian Land Bridge Economic Corridor

- China-Indochina Peninsula Economic Corridor

- China-Mongolia-Russia Economic Corridor

- China-Central Asia-West Asia Economic Corridor

- China-Myanmar Economic Corridor

Read More: China’s Belt and Road Initiative

Rapid Fire

LMV Licence for Transport Vehicles

Recently, the Supreme Court ruled that a person holding a driving licence for a light motor vehicle (LMV) is also entitled to drive a transport vehicle with an unladen weight upto 7,500 kg.

- The SC upheld its 2017 verdict, which also permitted LMV licence holders to drive transport vehicles under 7,500 kg gross weight.

- The 2017 decision was accepted by the Central Government, leading to amendments in the Motor Vehicles Rules, 2017.

- As per Section 2(21) of The Motor Vehicles Act, 1988, a light motor vehicle is a transport vehicle, omnibus, motor car, tractor, or road-roller with a gross vehicle weight or unladen weight not exceeding 7,500 kilograms.

- The SC verdict challenged the practice of insurance companies rejecting claims in accidents involving transport vehicles driven by those with LMV licence.

Read More: The Motor Vehicles Bill for Road Safety