Economy

China Plus One

- 17 Jul 2024

- 14 min read

For Prelims: China Plus One Strategy, PLI (Production Linked Incentive), Inflation, GDP, India’s trade agreements, GST, Foreign Direct Investment (FDI).

For Mains: China’s Economic Slowdown and Opportunities for India, Steps taken by India present itself as an alternative to China.

Why in News?

India has the opportunity to capitalise on the China Plus One strategy and attract global manufacturing investments.

- While China's exports remain strong, India's large domestic market, low-cost talent, and potential for growth make it an appealing alternative.

What is the China+1 Strategy?

- About:

- It refers to the global trend where companies diversify their manufacturing and supply chains by establishing operations in countries other than China.

- This approach aims to mitigate risks associated with over-reliance on a single country, especially in light of geopolitical tensions and supply chain disruptions.

- China's Dominance in Global Supply Chains:

- China has been the centre of global supply chains for the past few decades, earning the title of "World's Factory". This was due to favourable factors of production and a strong business ecosystem.

- Shift to China in the 1990s:

- In the 1990s, large manufacturing entities from the US and Europe shifted their production to China, attracted by the low manufacturing costs and access to a vast domestic market.

- Disruptions During the Pandemic:

- The Covid-19 pandemic led to significant disruptions in many economies. As the large economies emerged from the pandemic, there was a sudden surge in demand. However, China's zero-Covid policy resulted in industrial lockdowns, leading to inconsistent supply chain performance and container shortages.

- Evolution of the China+1 Strategy:

- The confluence of factors, including China's zero-Covid policy, supply chain disruptions, high freight rates, and longer lead times, has led many global companies to adopt a "China-Plus-One" strategy.

- This involves exploring alternative manufacturing locations in other developing Asian countries, such as India, Vietnam, Thailand, Bangladesh, and Malaysia, to diversify their supply chain dependencies.

- The confluence of factors, including China's zero-Covid policy, supply chain disruptions, high freight rates, and longer lead times, has led many global companies to adopt a "China-Plus-One" strategy.

What are the Opportunities for India to Attract the Foreign Investment?

- Demographic Dividend and Consumption Power:

-

India's youthful demographic, with 28.4% of the population under 30 in 2023, according to the World Bank's data, compared to China's 20.4%, is driving the workforce and consumer market. This boosts consumption, savings, and investments, positioning India as a potential multi-trillion dollar economy and attractive market for global companies.

-

-

Cost Competitiveness and Infrastructure Advantage:

-

India's lower labour and capital costs compared to competitors like Vietnam make its production sector highly competitive.

- A 2023 study by Deloitte stated that India's average manufacturing wage is 47% lower than China's.

- Additionally, the government's heavy investment in infrastructure through the National Infrastructure Pipeline (NIP) aims to reduce manufacturing costs and improve logistics by 20%, further enhancing India's attractiveness.

-

-

Business Environment and Policy Initiatives:

-

Recent policy interventions like the Production Linked Incentive (PLI) scheme, tax reforms, and relaxed FDI norms have created a conducive business environment.

-

The Make in India initiative, coupled with efforts to promote ease of doing business, is attracting foreign investments.

-

-

Digital Skilling and Technological Edge:

- As of January 2024, India has 870 million internet users, representing 61% of its population. This, combined with access to global tech giants like Google and Facebook, unavailable in China, gives Indian youth a digital advantage.

- Strategic Economic Partnerships:

-

India's focus on sub-regional partnerships and control over China's influence through initiatives like the CEPA trade agreement with the UAE demonstrates its strategic approach.

-

This diversification is expected to increase bilateral trade by 200% within 5 years, ensuring access to new markets while protecting domestic interests.

-

- Dynamic Diplomacy and Global Influence:

- India's active participation in groupings like QUAD and I2U2, along with bilateral agreements with key countries, strengthens its economic ties and opens doors for technology transfer, finance, and market access.

-

As India assumes leadership roles in G20 and SCO, it can leverage its position to shape global trade trends.

-

Large Domestic Market:

-

India's massive domestic market of 1.3 billion people with rising incomes offers a compelling alternative to China.

- India's GDP per capita has grown at an average of 6.9% between 2018 and 2023 leading to a vast consumer base that provides a strong foundation for sustained economic growth and increased global trade.

-

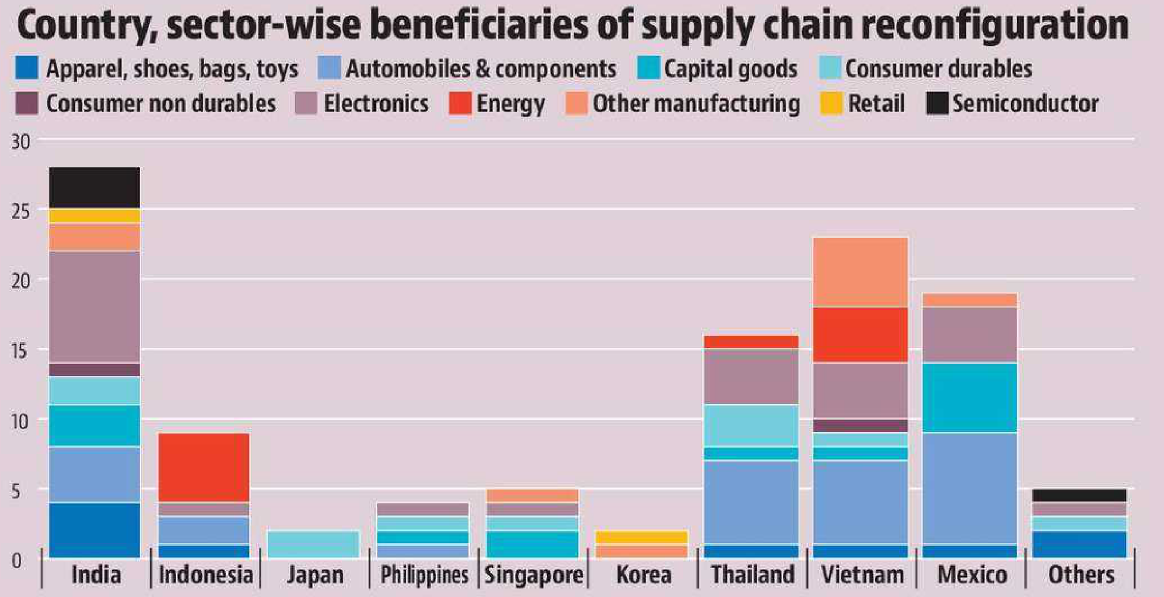

Which Sectors will Benefit from the China+1 Strategy in India?

- Information Technology/Information Technology Enabled Services (IT/ITeS): In a 2024 NASSCOM report, India is recognized as a key player in IT services exports, bolstered by initiatives like "Make in India," which aims to establish the country as a manufacturing hub for IT hardware. This effort has attracted major global technology firms.

- Pharmaceuticals: India's pharmaceutical industry, valued at Rs 3.5 lakh crore in 2024, is the world's third-largest by volume.

- India has emerged as a "pharmacy of the world," supplying nearly 70% of WHO's vaccine needs and offering 33% lower manufacturing costs than the US.

- Metals and Steel: India's rich natural resources and the PLI scheme for specialty steel, expected to attract Rs 40,000 crore in investments by 2029, position it as a major steel exporter. China's withdrawal of export rebates and imposition of duties on processed steel products enhance India's attractiveness.

What is India's Performance in the C+1 Landscape?

- Import Growth:

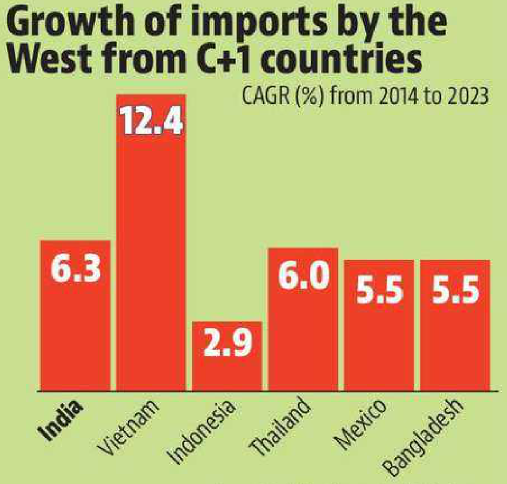

- India’s imports from Western countries have shown the second-highest growth among analysed countries, with a compound annual growth rate (CAGR) of 6.3% from 2014 to 2023.

- Vietnam and Thailand have outperformed India, with a CAGR of 12.4% in imports by the US, UK, and EU.

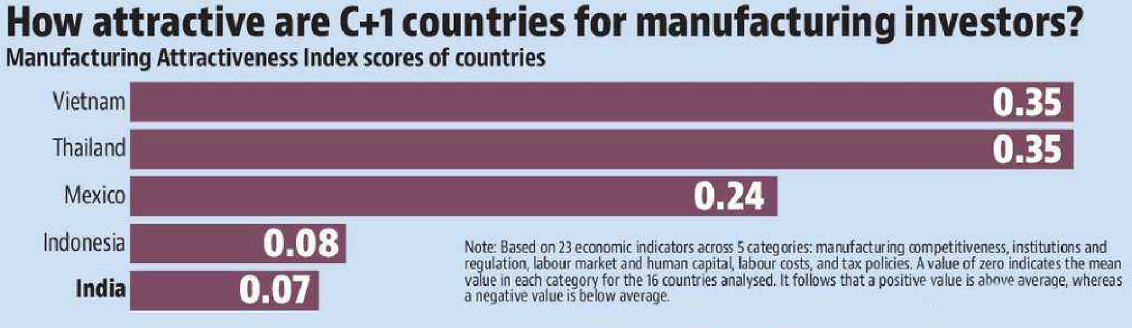

- Business Perception:

- Despite having abundant resources and strategic planning, India has struggled to create a positive impression among businesses relocating from China.

- Vietnam and Thailand have emerged as more attractive destinations.

-

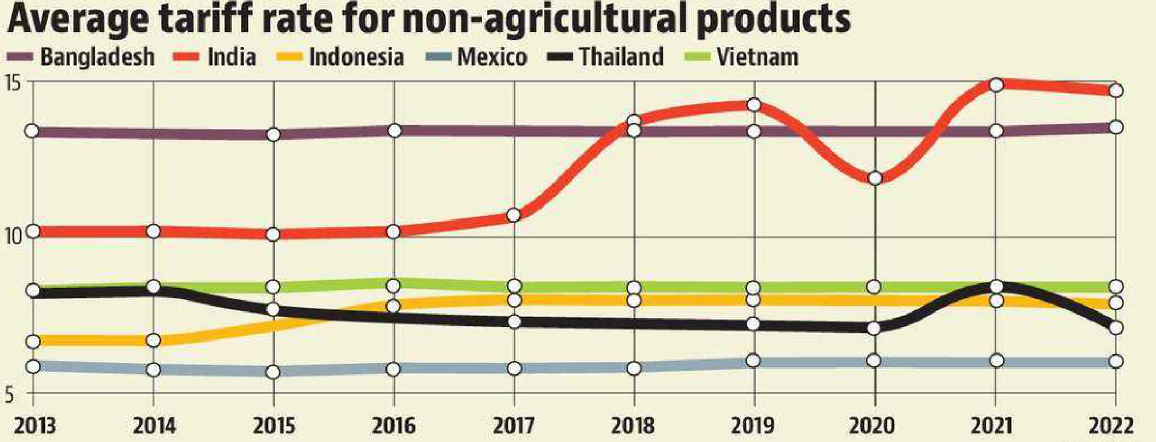

Tariff Rates:

- India's higher tariff rates, averaging 14.7% for non-agricultural products, have deterred Western investors. This is the highest among the countries analysed.

- The inverted duty structure in India, where taxes on imported raw materials are higher than those on final products, reduces the competitiveness of Indian exports.

- India's higher tariff rates, averaging 14.7% for non-agricultural products, have deterred Western investors. This is the highest among the countries analysed.

- Promising Future Prospects:

- As per analysis, India has emerged as the most favoured destination for companies planning to relocate production or invest in new facilities in Asia, with 28 companies showing interest, compared to 23 for Vietnam.

- Notably, a significant portion of these interested firms (8 out of 28) are from the electronics sector, an area where India has previously lagged behind Vietnam.

What are the Factors Hindering India's Competitiveness?

- Ease of Doing Business: India's regulatory environment is complex, characterized by bureaucratic hurdles and inconsistent policy implementation, which deter both domestic and foreign investors.

- Manufacturing Competitiveness: India faces significant challenges in manufacturing competitiveness due to high input costs, inadequate infrastructure, and a shortage of skilled labour.

- The CME Group's ranking highlights this issue, placing India behind several Southeast Asian nations.

- Infrastructure Deficiencies: Poor transportation, logistics, and energy infrastructure increase operational costs and reduce business efficiency.

- Labour Market Rigidities: Restrictive labour laws hinder flexibility and job creation, particularly in the organised sector.

- Tax Structure: The complex tax regime, including multiple indirect taxes, adds to the cost of doing business.

- Land Acquisition Challenges: The cumbersome process of land acquisition for industrial projects delays investments and raises costs.

- Skill Mismatch: The education system often fails to produce graduates with the skills demanded by the modern economy.

- Corruption: The prevalence of corruption erodes investor confidence and increases transaction costs.

Way Forward

- Targeted Incentives and Subsidies: India should offer attractive incentives and subsidies, particularly in sectors like electronics, automotive, and pharmaceuticals, to set up manufacturing facilities in India, including tax benefits, land subsidies, and infrastructure support.

- Improve Ease of Doing Business: The focus should be made on streamlining regulatory processes, reducing bureaucratic hurdles, simplifying labour laws, land acquisition procedures, and environmental clearances to enhance the overall ease of doing business in India.

-

Develop Specialised Industrial Clusters: There is a need to create dedicated industrial clusters or manufacturing hubs for specific sectors with world-class infrastructure and support services, including plug-and-play facilities, common testing and certification centres, and shared logistics infrastructure.

-

Invest in Skill Development: India should also focus on strengthening vocational training programs and collaborate with industry to develop a skilled workforce aligned with the needs of the manufacturing sector, promote STEM education, and upskill the existing workforce to meet the demands of high-tech manufacturing.

- Enhance Infrastructure and Logistics: Invest in modern, efficient, and well-connected transportation networks, including roads, railways, ports, and airports, and improve the reliability and availability of power supply, water, and other essential utilities.

- Streamline Trade Policies and Agreements: Negotiate and sign free trade agreements (FTAs) with key trading partners to improve market access for Indian exports, simplify import-export procedures and reduce tariffs to enhance global competitiveness.

-

Promote Research and Innovation: The government should encourage public-private partnerships in research and development (R&D) to foster innovation in manufacturing technologies and processes and provide incentives for companies to establish R&D centres and collaborate with academic institutions in India.

Conclusion

The C+1 opportunity presents a crucial chance for India to address its longstanding manufacturing sector challenges and emerge as a global manufacturing powerhouse. By addressing the key bottlenecks and implementing a comprehensive strategy, India can leverage this trend to drive sustainable economic growth and job creation. The time is ripe for India to seize the C+1 opportunity and cement its position as a preferred manufacturing destination.

|

Drishti Mains Question: What is the China Plus One Strategy? Discuss the challenges and opportunities for India to fully utilise this strategy. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. What is the importance of developing Chabahar Port by India? (2017)

(a) India’s trade with African countries will enormously increase.

(b) India’s relations with oil-producing Arab countries will be strengthened.

(c) India will not depend on Pakistan for access to Afghanistan and Central Asia.

(d) Pakistan will facilitate and protect the installation of a gas pipeline between Iraq and India.

Ans: (c)

Mains

Q. A number of outside powers have entrenched themselves in Central Asia, which is a zone of interest to India. Discuss the implications, in this context, of India’s joining the Ashgabat Agreement. (2018)