Financial Literacy, Financial Inclusion and Digital Banking Initiatives | 11 Dec 2024

For Prelims: Financial literacy, Financial inclusion, poverty, inequality, Reserve Bank of India, Securities and Exchange Board of India, Insurance Regulatory and Development Authority of India, Pension Fund Regulatory and Development Authority, Atal Pension Yojana

For Mains: Significance of Financial Literacy, Financial Inclusion for India, Digital Banking Initiatives, Its Achievements and Challenges

What is Financial Literacy and Financial Inclusion?

- Financial Literacy:

- About:

- Financial literacy is the awareness, knowledge, attitude, behavior, and skill needed to understand and use financial tools to make informed financial decisions and achieve personal financial well-being.

- It can be developed through reading, listening to finance podcasts, following financial content, or consulting a financial expert.

- Key Components:

- Budgeting: Understanding how to create and maintain a budget.

- Saving and Investing: Knowing the importance of saving and the basics of investing.

- Credit Management: Understanding how credit works and how to manage debt.

- Financial Planning: Setting financial goals and developing plans to achieve them.

- State of Financial Literacy:

- According to the National Centre for Financial Education, only 27% of Indian adults are financially literate.

- Globally, less than a quarter of young adults feel confident in their financial understanding.

- About:

- Financial Inclusion:

- About:

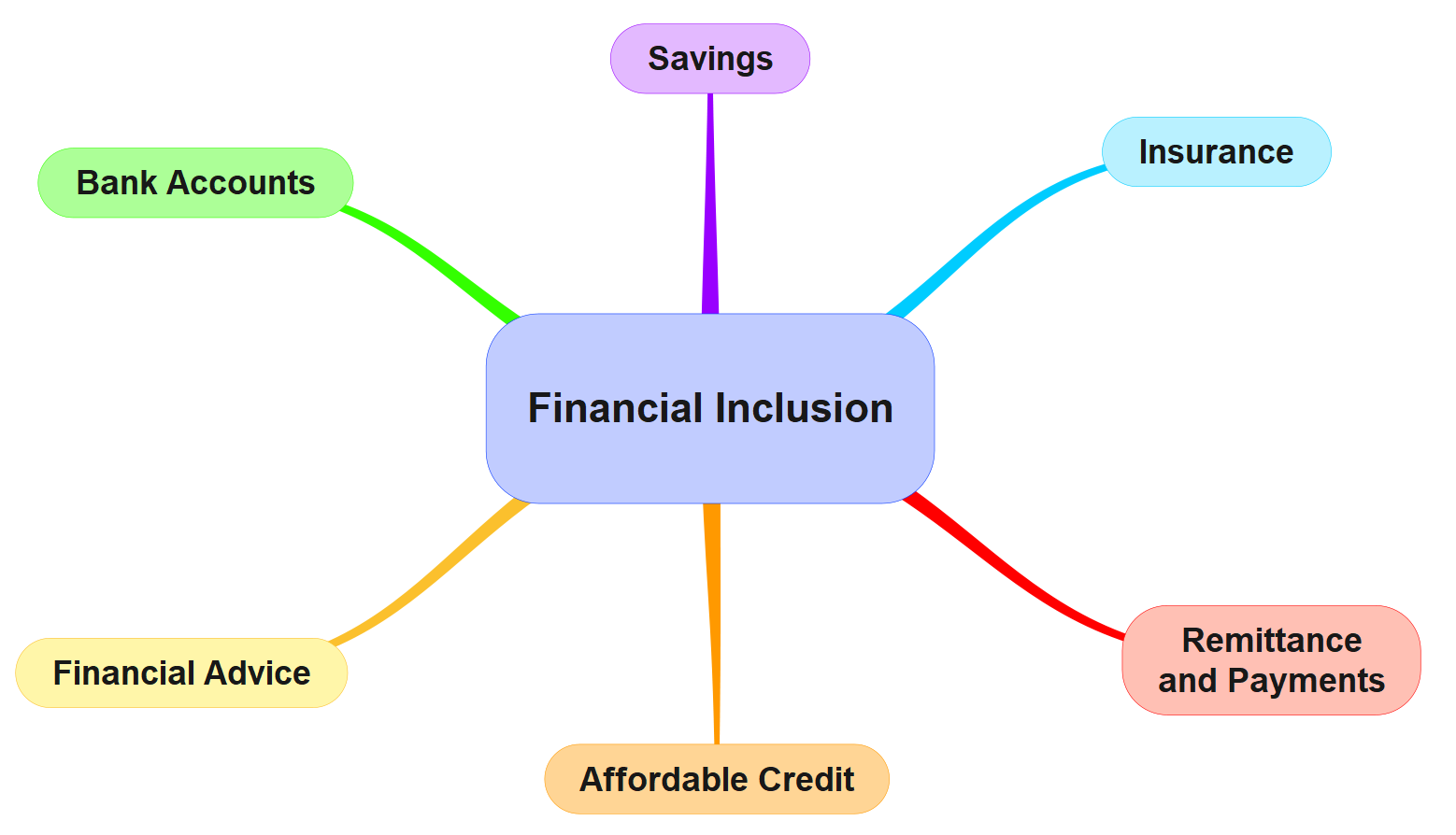

- Financial inclusion refers to efforts to make financial products and services (savings, credit, insurance, payments, etc.) accessible and affordable to all individuals and businesses, particularly marginalized and low-income groups.

- Key Components of Financial Inclusion:

- Access to Financial Services: Ensuring that financial services such as banking, insurance, and credit are available to everyone. This involves the establishment of physical banking outlets in underserved areas and the provision of digital financial services.

- Affordability: Financial products and services should be priced to be accessible for all segments of society. High costs can be a significant barrier, particularly for low-income groups.

- Financial Literacy: Educating individuals about financial products, services, and management is essential. Financial literacy empowers people to make informed decisions about their finances, including saving, investing, and managing credit.

- Usage: Beyond access, it's crucial that individuals actively use financial services to achieve financial stability and growth. This includes engaging with banking services, utilizing credit responsibly, and taking advantage of insurance products.

- About:

- Significance:

- Empowerment and Independence: Financially literate individuals are more capable of making sound financial decisions, reducing vulnerability to exploitation.

- Economic Growth: Financial inclusion boosts economic growth by mobilizing savings, generating employment, and enhancing productivity.

- Reduction of Inequality: By granting access to financial services, financial inclusion can address poverty and inequality.

- Financial Stability: A financially literate population can lead to greater financial stability, as individuals are better prepared to handle economic uncertainties.

What are the Initiatives for Financial Literacy and Financial Inclusion in India?

- RBI’s Initiatives:

- National Centre for Financial Education (NCFE):

- The National Centre for Financial Education (NCFE) was established in 2013 in collaboration with the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI), Pension Fund Regulatory and Development Authority (PFRDA).

- It promotes financial education through workshops, seminars, and campaigns with the aim to reach all sections of society, including children, youth, women, and senior citizens.

- NCFE reported a 17% increase in financial literacy among youth between 2016 and 2020 (NCFE Report 2020).

- Its National Strategy for Financial Education (NSFE) 2020-25 adopts a "5 C" approach- content, capacity, community-led model, communication, and collaboration, and outlines a comprehensive approach to improving financial literacy.

- This strategy targets 500 million Indians by 2025 and aims to develop a financially empowered and aware population.

- The strategy focuses on developing content, building capacity, fostering community-led financial literacy programs, and enhancing collaboration between various stakeholders.

- Financial Literacy Centres (FLCs):

- The RBI has established over 1,500 Financial Literacy Centres (FLCs) across India, particularly in rural and semi-urban areas. These centers offer free financial education, including debt management, savings, and investment advice.

- FLCs play a critical role in bridging the financial literacy gap, especially in underserved regions.

- Financial Literacy Week:

- Each year, the RBI organizes Financial Literacy Week to promote awareness about key financial concepts.

- This event includes workshops, seminars, and public outreach programs aimed at educating people on various aspects of personal finance, such as budgeting, insurance, and digital banking.

- RBI Kehta Hai Campaign:

- The initiative educates the public on topics such as digital banking, fraud prevention, and grievance redressal. By leveraging media platforms, this campaign has reached a broad audience, enhancing trust in the financial system and encouraging safe banking practices.

- Financial Education Microsite:

- The RBI has launched a dedicated financial education microsite that provides resources, tools, and information to help individuals improve their financial literacy. The site offers specific sections targeting women, children, and young adults, ensuring that financial education is accessible to diverse groups.

- Project Financial Literacy:

- The project targets various groups, including school children, women, and senior citizens, through workshops and campaigns. It seeks to enhance financial awareness and promote responsible financial behavior.

- National Centre for Financial Education (NCFE):

- Financial Inclusion Schemes by Government of India

- Pradhan Mantri Jan Dhan Yojana (PMJDY):

- This flagship scheme was launched to provide affordable access to financial services such as bank accounts, credit, insurance, and pensions for the unbanked population.

- The initiative has successfully opened over 40 crore bank accounts, significantly reducing the reliance on cash transactions and ensuring broader participation in the formal financial system.

- Atal Pension Yojana (APY):

- Atal Pension Yojana is a universal social security scheme launched in 2015 to provide a minimum guaranteed pension of Rs 1000-Rs 5000 to all Indians, especially the poor and unorganized sector workers.

- It is administered by PFRDA through NPS and covers citizens aged 18-40 years, with contribution levels varying based on age of joining.

- The scheme provides lifetime pension to the subscriber's spouse and entire corpus to the nominee in case of death of both.

- By encouraging people to save for their retirement, APY also promotes financial literacy, especially among low-income groups, and empowers them to plan for their financial future.

- National Pension System (NPS):

- NPS is a voluntary retirement savings scheme introduced by the Central Government in 2004 (except for armed forces) that encourages individuals to save for their retirement through regular contributions.

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY):

- PMJJBY is a life insurance scheme that provides coverage in case of death, irrespective of the cause.

- The scheme is available to individuals aged between 18 and 50 years, with a minimal annual premium of Rs 436.

- By offering affordable life insurance, it promotes financial protection among individuals who might otherwise not be able to afford such coverage.

- Pradhan Mantri Suraksha Bima Yojana (PMSBY):

- PMSBY provides two types of insurance coverage to individuals at a minimal premium of Rs 20 per year.

- It covers accidental death, complete disability, and partial disability, with coverage amounts up to Rs 2 lakh for death or complete disability, and Rs 1 lakh for partial disability.

- This scheme is designed to make insurance accessible to the masses, particularly those in the lower income groups.

- Pradhan Mantri Jan Dhan Yojana (PMJDY):

- Other Key Initiatives:

- Securities and Exchange Board of India (SEBI):

- SEBI has developed a mobile app called Saa₹thi to educate investors about the securities market.

- The app provides information on topics such as the KYC process, trading, mutual funds, and investor grievances redressal mechanisms. It is available in Hindi and English and aims to empower investors with knowledge about the stock market.

- Investor Education and Protection Fund Authority (IEPFA):

- The IEPFA, under the Ministry of Corporate Affairs, organizes Investor Awareness Programs (IAPs) to educate individuals about savings, investments, and the benefits of capital formation.

- The authority also offers educational resources to help people make informed investment decisions.

- School Curriculum Integration:

- Recognizing the importance of financial literacy as a life skill, the National Education Policy (NEP) 2020 emphasizes integrating financial education into school curricula.

- The Money Smart School Program (MSSP) by the National Centre for Financial Education (NCFE) aims to provide unbiased financial education in schools for improving financial literacy which is an important life skill for the holistic development of students.

- Securities and Exchange Board of India (SEBI):

What is the Significance of Financial Literacy in India?

- Promoting Financial Inclusion:

- Financial literacy bridges the gap between citizens and financial services, empowering people to participate in the formal economy.

- Understanding banking, insurance, and pension schemes enables people from diverse backgrounds to access and benefit from these essential services.

- Reducing Poverty and Inequality:

- Financially literate individuals make informed decisions about savings, investments, and borrowing, which can enhance economic security and reduce reliance on high-cost borrowing.

- This, in turn, narrows income inequality and helps lift economically disadvantaged groups out of poverty.

- Supporting Small Businesses:

- Micro, Small and Medium Enterprises (MSME), which contribute 30% to India's GDP and provide employment to over 11 crore people are crucial for India’s economic growth, yet they often face challenges due to financial mismanagement.

- Financial literacy equips entrepreneurs with the skills to manage cash flow, plan investments, and use credit wisely, enhancing their competitiveness and longevity.

- Improving Economic Resilience:

- Financial literacy enables individuals and communities to handle financial setbacks better. When citizens understand the importance of savings, insurance, and emergency funds, they are better prepared for unforeseen circumstances.

- Encouraging Responsible Consumer Behavior:

- With a solid understanding of financial concepts, citizens become aware of their rights and responsibilities, reducing susceptibility to scams and mis-selling of financial products.

What are the Challenges to Financial Literacy and Inclusion in India?

- Financial Illiteracy: Financial literacy is a crucial skill in India, but only a small percentage of the population is financially literate.

- Digital Divide: India’s rural population faces limited access to digital financial services due to low smartphone penetration, internet connectivity, and infrastructure gaps like poor road access and electricity. This digital divide restricts financial inclusion in underserved areas, impacting economic empowerment.

- Non-Universal Access to Bank Accounts:

- As of 2024, approximately 22% of adults in India remain unbanked, despite the significant strides made under the Pradhan Mantri Jan Dhan Yojana (PMJDY). This translates to around 19 crore adults still lacking access to formal banking services.

- Gender Disparity: Social and cultural barriers limit women’s financial inclusion in India. Only 33% of women use the internet compared to 57% of men, reflecting lower digital access. Additionally, limited asset ownership and lower financial literacy rates among women widen this gap, hindering their economic empowerment and access to formal financial services.

- Informal Economy and Cash Dominance: A substantial portion of India's economy operates informally, with about 90% of workers engaged in informal sector jobs .

- The reliance on cash transactions, coupled with limited formal credit access, further inhibits the adoption of digital payments and financial services in this segment.

- According to an RBI, as of March 2024, cash accounts for 60% of consumer expenditure, but its share is rapidly declining, accelerated by the post-Covid-19 shift to digital payment.

- Lack of Credit Penetration: Providing affordable credit to low-income individuals and informal businesses still remains a challenge.

- Due to the lack of formal credit history and reliable data, lenders face difficulties in assessing creditworthiness. This results in high borrowing costs and limited credit availability for underserved segments .

- Implementation Challenges: Schemes like the Pradhan Mantri Jan Dhan Yojana (PMJDY) have achieved success in opening bank accounts, but many of these accounts remain dormant.

- Lack of meaningful usage due to limited financial literacy, low trust in formal banking systems, and the high cost of maintaining these accounts have undermined their intended benefits .

- Cybersecurity Concerns: The rapid expansion of digital financial services has heightened cybersecurity risks. Cybercrime reporting rose by 24.4% in 2022, with 65,893 cases reported compared to 52,974 in 2021 (NCRB). Increasing digital fraud and users' limited awareness of cybersecurity best practices remain major challenges to secure financial inclusion.

Way Forward

- Incorporate Financial Literacy in Education: There is a need to integrate financial literacy into the school curriculum to impart basic financial concepts at an early age. Subjects such as budgeting, saving, investing, and understanding credit should be introduced to build a financially aware youth population.

- Conduct Targeted Workshops and Awareness Campaigns: There should be conducted workshops and campaigns targeting different demographics- rural populations, urban youth, and senior citizens to improve outreach.

- Financial literacy programs should address the unique financial needs and comprehension levels of each group to ensure inclusivity.

- Leverage Digital Platforms for Financial Education: Digital platforms and mobile apps can disseminate financial education at scale.

- Interactive apps, online courses, and social media campaigns make learning financial concepts more engaging and accessible, particularly for the younger, tech-savvy generation.

- Enhance Financial Inclusion Efforts: Improving access to financial services remains a priority. Initiatives like Pradhan Mantri Jan Dhan Yojana (PMJDY) and the promotion of microfinance provide underserved communities with essential banking services, fostering financial inclusion and literacy simultaneously.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q. With reference to India, consider the following: (2010)

- Nationalization of Banks

- Formation of Regional Rural Banks

- Adoption of village by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. Pradhan Mantri Jan Dhan Yojana (PMJDY) is necessary for bringing unbanked to the institutional finance fold. Do you agree with this for financial inclusion of the poorer section of the Indian society? Give arguments to justify your opinion.