Global Economic Prospects, 2024 | 19 Jul 2024

For Prelims: World Bank, Global Economic Prospects report 2024, Inflation, Supply Chain, Interest Rate, Monetary Policy, Investment, Red Sea, Panama Canal, Critical Routes, Middle East, Emerging Markets and Developing Economies (EMDEs), Financial Markets, Currency Fluctuations, Debt, Net Zero, Digital Divide, Multilateral Trading System, Learning Poverty, Malnutrition, Food Insecurity, Fiscal Consolidation, Manufacturing Sector, Services Sector, Remittances, Fiscal Deficit, Tax base.

For Mains: Situation of Global Economy and Contemporary Challenges to Economic System.

Why in News?

Recently, the World Bank has released its Global Economic Prospects report 2024.

- It highlights key trends and challenges facing the global economy, such as inflation, supply chain disruptions and geopolitical tensions.

What are the Key Highlights of the Report?

- Global Growth:

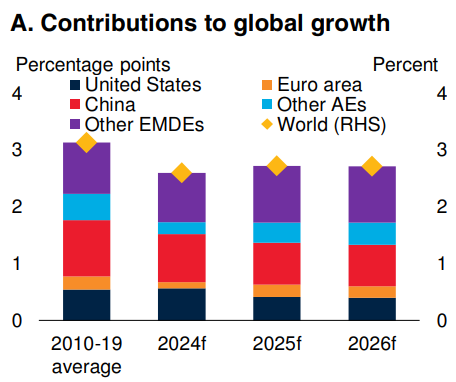

- Global growth is projected to hold steady at 2.6% in 2024-25, despite flaring geopolitical tensions and high interest rates, before edging up to 2.7% in 2025-26.

- The US economy has continued to grow despite the most aggressive monetary policy tightening in 40 years.

- India’s economy has been buoyed by strong domestic demand, with a surge in investment and robust services activity.

- Global Trade:

- The value of global services trade grew about 9% in 2023, driven primarily by a recovery in tourism flows.

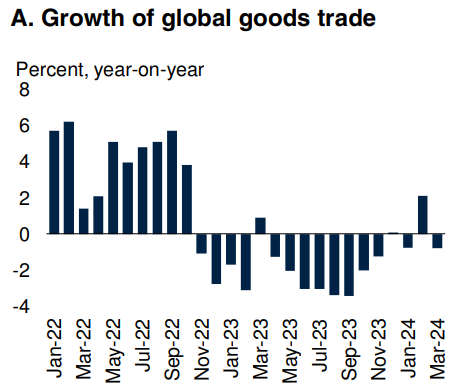

- Global trade in goods and services was nearly flat in 2023, the weakest performance outside of global recessions in the past 50 years.

- The volume of goods trade contracted for most of 2023 and fell by 1.9% for the year as a whole.

- Recent attacks on commercial vessels in the Red Sea, coupled with climate-related shipping disruptions in the Panama Canal, have affected maritime transit and freight rates along these critical routes.

- Commodity Markets:

- In 2024, aggregate commodity prices have generally risen against a backdrop of tight supply conditions and signs of firmer industrial activity.

- Oil prices have fluctuated this year, trending substantially higher in April 2024 in the context of escalating tensions in the Middle East.

- Natural gas prices fell nearly 28% in the first quarter of 2024 amid robust production, mild winter weather, and elevated inventories.

- Gold prices reached record highs, fueled by geopolitical concerns and central bank purchases.

- Food prices are forecast to dip by 6% in 2024 and 4% in 2025, mainly reflecting ample supplies for grains as well as oils and meals.

- Global Inflation:

- Global inflation has continued to decline, yet it remains above target in most advanced economies and in about one-fourth of inflation-targeting Emerging Markets and Developing Economies (EMDEs).

- Across most EMDEs in East Asia and Pacific (EAP), headline inflation broadly continued to trend near or below pre-pandemic averages.

- Global Financial Developments:

- Central banks across major advanced economies are expected to gradually lower policy rates in 2024.

- Policy rate projections derived from financial markets have been volatile since U.S. policy tightening started in 2022, with expectations repeatedly revised higher over time.

- Per Capita Income Growth:

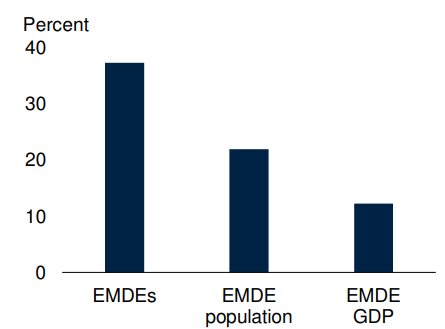

- EMDE GDP per capita growth is projected to fall from 3.2% in 2023 to 3% in 2024 and remain near that pace over 2025-26, well below the 2010-19 average of 3.8%.

- In EMDEs excluding China and India, the aggregate level of per capita income relative to advanced economies is expected to be lower in 2024 than in 2019, extending the stagnation that started in the 2010s.

- Decline in Welfare:

- Amid heightened conflict and violence, prospects remain especially lackluster in many vulnerable economies.

- Over half of fragile and conflict-affected economies will still be poorer in 2024 than on the eve of the pandemic.

- Volatility:

- Escalating geopolitical tensions can lead to volatile commodity prices due to supply disruptions, trade restrictions, market uncertainty and currency fluctuations.

- Trade Fragmentation:

- Trade fragmentation can disrupt trade networks through supply chain interruptions, trade diversion and reduced market access.

What is the Scenario in the South Asia Region (SAR)?

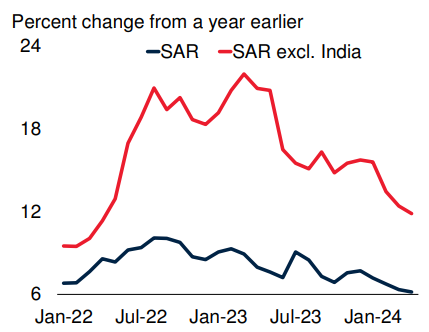

- Growth in the South Asia Region (SAR) is projected to slow from 6.6% in 2023 to 6.2% in 2024. It is mainly due to a moderation of growth in India from a high base in recent years.

- With steady growth in India, regional growth is forecast to stay at 6.2% in 2025-26.

- Growth is expected to remain robust in Bangladesh, though at a slower rate than in the past several years, and to strengthen in Pakistan and Sri Lanka.

- However, risks include disruptions in commodity markets caused by the escalation of armed conflicts, possible abrupt fiscal consolidations, financial instability stemming from the large exposure of banks to sovereign borrowers etc.

What are India Specific Developments?

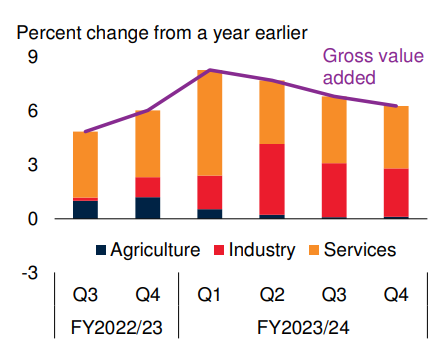

- Growth: It is projected to grow an average of 6.7% making South Asia the world’s fastest-growing region. Growth in India has been strong, fueled by the manufacturing and services sectors.

- Inflation: Inflation has remained generally stable in recent months, with rates in India being lower than in other parts of the region.

- Trade Deficits: Factors like increases in remittances and recoveries in tourism, as well as the effects of continued import restrictions contributed to reductions in external imbalances.

- Fiscal Deficit: In India, the fiscal deficit is projected to shrink relative to GDP, partly because of increased revenues generated by the authorities’ efforts to broaden the tax base.

- Forecast: India will remain the fastest-growing of the world’s largest economies, although its pace of expansion is expected to moderate. After a high growth rate in FY 2023-24, steady growth of 6.7% per year is projected for the three fiscal years beginning in FY 2024-25.

What are the Key Global Challenges?

- Elevated Debt:

- Many EMDEs are contending with high debt in an environment of weak growth, steep borrowing costs, and a multitude of downside risks.

- These challenges are particularly acute for the poorest countries, where many sources of financing are drying up or have become cost prohibitive.

- Climate Change:

- Reaching net zero by 2050 will require cutting greenhouse gas emissions by between one-fourth and one-half by 2030 relative to 2019.

- However, current global commitments are estimated to reduce emissions by only about 10% by the end of this decade.

- Digital Transition:

- The digital divide continues to widen. About one-third of the global population, or 2.6 billion people, remained offline in 2023.

- About 18% of the population in EMDEs lacked electricity while only about 63% had access to the internet, compared with over 90% in advanced economies.

- Trade Fragmentation:

- The proliferation of trade-restricting measures, disruptions to global value chains, and a further weakening of the multilateral trading system could lead to significant welfare losses globally, with particularly adverse impacts for EMDEs.

- Lifting Human Capital:

- The pandemic brought about considerable disruption to schooling and learning and is likely to have a lasting and unequal impact on learning levels.

- Since 2019, the learning poverty rate is estimated to have risen by 13 percentage points to 70%, on average, in low- and middle-income countries.

- Learning poverty rate is the share of children unable to read and understand a simple text by age 10.

- Food Insecurity:

- Major drivers of food insecurity and malnutrition are conflict, extreme weather patterns, economic downturns, and inequality which have intensified in recent years, often occurring in combination.

- The rise of trade-restrictive measures has further accentuated food insecurity exposing people to fluctuations in international food prices.

Way Forward

- Comprehensive Reforms: Decisive global and national policy efforts are needed to meet pressing challenges. At the global level, priorities include safeguarding trade, supporting green and digital transitions, delivering debt relief, and improving food security.

- Public Investment: Scaling up public investment by 1% of GDP can increase the level of GDP by more than 1.5% over the medium term. The impact on private investment is also significant as it grows by as much as 2% over five years.

- Revenue Mobilize: States should improve their ability to mobilize revenue from domestic sources, which constitute a more stable base than other alternatives. They should improve spending efficiency especially in health, education, and infrastructure.

- Debt Restructuring: Decisive action by the international community is needed to address developing risks to avoid the economic costs of debt crises. Debt restructuring and relief processes have so far delivered little relief.

- Climate Finance: Mobilizing public resources through subsidy reforms and carbon pricing can finance public investments and social transfers for low-emission and equitable development.

- Digital Infrastructure: Developing digital infrastructure can help raise investment growth and financial inclusion by enabling small firms and financial institutions to access financial markets and digital payments.

- Trade Growth: To guard against trade fragmentation, it is key to restore the rules based multilateral trade system, mitigate the adverse effects of geopolitical tensions on trade networks, foster a level playing field for international commerce, and reduce trade policy uncertainty.