Bihar Switch to Hindi

Bihar Business Connect 2024 Investment

Why in News?

In 'Bihar Business Connect-2024,' the state received investment proposals worth Rs 1.80 lakh crore.

- The State government announced that it will ensure the conversion of memorandums of understanding (MoUs) into tangible investments on the ground within a year.

Key Points

- Nodal Officers for Ease of Doing Business:

- The appointment of "one nodal officer for every five to ten MoUs" to facilitate ease of doing business was announced.

- These officers will assist investors in securing land and obtaining all required clearances across 11 sectors for which proposals have been received.

- Periodic Review of Progress:

- The State Investment Promotion Board will regularly review the progress of these initiatives to ensure timely implementation of investments.

- Investment Commitments in 2024:

- During the two-day global investors' summit in Patna, a total of 423 investment commitments were signed.

- In the 2023 edition of the investors' meet, Bihar had secured investment commitments worth Rs 50,300 crore.

Bihar Business Connect-2024

- Objective:

- The summit aimed to attract investments across sectors, including manufacturing, infrastructure, agriculture, and technology, showcasing Bihar's conducive environment for business growth.

- Government Initiatives:

- Key policies and reforms focused on improving ease of doing business, along with tax incentives, infrastructure upgrades, and skill development programs to create a favorable climate for investors.

- Networking Platform:

- The event provided a platform for networking among industry leaders, government officials, and global investors, enhancing collaboration opportunities in Bihar's economy.

- Sectoral Focus:

- Emphasis on sectors like renewable energy, IT, tourism, and agri-business aligns with the state’s plans to diversify its economic landscape.

Bihar Switch to Hindi

BPSC Rules Out Exam Cancellation

Why in News?

Recently, Bihar Public Service Commission (BPSC) Chairman ruled out cancellation of the 70th Integrated Combined Competitive Examination (CCE) 2024 which got mired in allegations of question paper leak.

Key Points

- Disruption in Exam Centre:

- The disruption was limited to one examination center, and the Commission is addressing the issue with a re-examination.

- The preliminary examination at the Bapu Pariksha Parisar center, canceled due to disruption caused by unruly aspirants, will be re-conducted on 4th January 2025 at another venue in Patna.

- Around 12,000 candidates are expected to participate in the re-examination.

- Show-Cause Notices:

- The BPSC has issued show-cause notices to 34 aspirants alleged to have been involved in the disruptions.

- These candidates must respond by 26th December 2024, failing which decisions will be made based on the available evidence.

- Protests Demanding Complete Cancellation:

- A group of aspirants continues to demand the cancellation of the entire exam conducted on 13th December 2024, citing concerns over fairness.

- Protesters have been sitting on dharna at Gardani Bagh for several days, arguing that re-examination for only one center violates the principle of a "level playing field."

Note:

- A Show Cause Notice is a formal communication issued by a court, government agency, or another authoritative body to an individual or entity, asking them to explain or justify their actions, decisions, or behavior. The purpose of a show cause notice is to give the recipient an opportunity to provide a response or clarification regarding specific concerns or alleged violations.

Chhattisgarh Switch to Hindi

Chhattisgarh Railway Station Renovated

Why in News?

Recently, the 136-year-old historic Bhilai railway station underwent renovation under the Amrit Bharat Station Yojna launched by the centre to modernise railway stations.

Key Points

- Historic Bhilai Railway Station Renovated:

- The 136-year-old Bhilai railway station in Durg district, built in 1888, has been renovated to enhance passenger experience.

- The station now features cleanliness improvements, an air-conditioned (AC) waiting hall, and covered sheds at new platforms to protect passengers from rain and sun.

- Additional amenities include raised ceilings for a spacious feel, improved lighting, and e-ATM machines for ticket purchases and train information.

- Entrances have been revamped, ensuring easier access, enhanced aesthetics, and better facilities for passengers.

Amrit Bharat Stations Scheme

- About:

- The Amrit Bharat Station Scheme aims to redevelop 1309 stations nationwide.

- The redevelopment will provide modern passenger amenities along with ensuring well-designed traffic circulation, inter-modal integration, and signage for the guidance of passengers.

- The Scheme was launched in February 2023 by the Ministry of Railways.

- Station-wise Plans:

- The station buildings' designs will be inspired by local culture, heritage, and architecture.

- For instance, the Jaipur Railway Station will feature elements resembling the Hawa Mahal and Amer Fort from Rajasthan.

- The station buildings' designs will be inspired by local culture, heritage, and architecture.

- Integrated Approach to Urban Development:

- The redevelopment is planned with a holistic approach to urban development, treating the stations as "City Centres."

- This approach aims to integrate both sides of the city and create well-designed traffic circulation, inter-modal connectivity, and clear signage for passengers' guidance.

Madhya Pradesh Switch to Hindi

Van Vihar National Park

Why in News?

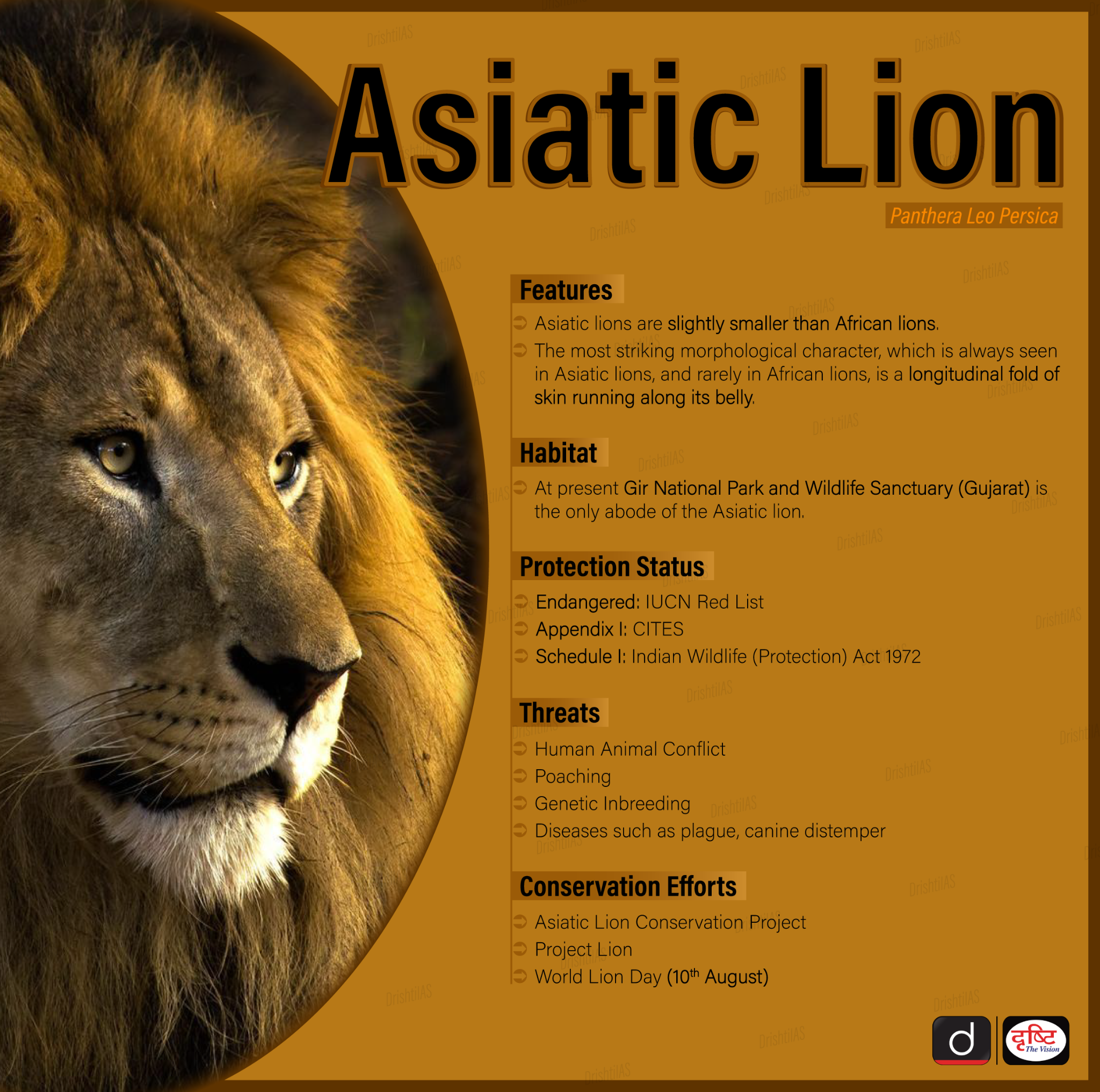

- According to the Madhya Pradesh Forest Department, the Van Vihar National Park in Bhopal will get two Asiatic lions from Gujarat in exchange for two Bengal tigers.

Key Points

- Exchange Between MP and Gujarat:

- Under an animal exchange programme two tigers have been relocated to the Junagadh zoo.

- Two pure-breed Asiatic (Gir) lions will be brought from Sakkarbaug Zoological Park in Junagadh to Van Vihar National Park in Bhopal as part of the exchange.

- Van Vihar National Park:

- It is located on the banks of the Upper Lake in Bhopal, and serves as a vital conservation area in the Madhya Pradesh capital.

- It has the unique distinction of being a combination of National Park, a Zoo, Rescue Centre for wild animals and Conservation Breeding Centre for selected vital species.

- It is the only place in central India where its rescue centre harbours a number of Lions and Tigers rescued from the circuses, Sloth Bears rescued from the madaris, Tigers, Panthers and Bears rescued from the zones of human-wildlife conflict.

- It is also a designated co-ordinating zoo and Conservation Breeding Centre for the Hard Ground Barasingha, the state animal of Madhya Pradesh and two species of Gyps Vultures.

- It is a natural habitat for a variety of herbivores and carnivores namely, tiger, white tiger, leopard, hyena and sloth bear, chital, sambhar, blackbuck, blue bull, chousingha, common langur, rhesus monkey, porcupine, etc.

Rajasthan Switch to Hindi

55th GST Council Meeting

Why in News?

Recently, the 55th Goods and Services Tax (GST) Council meeting was held under the Chairpersonship of the Union Minister for Finance & Corporate Affairs in Jaisalmer, Rajasthan.

Key Points

- Chief Ministers of Goa, Haryana, Jammu & Kashmir, Meghalaya, Odisha; Deputy Chief Ministers of Arunachal Pradesh, Bihar, Madhya Pradesh, and Telangana also participated.

- Recommendations by the GST Council:

- Used Electric Vehicle (EVs): GST council decided to raise the rate of tax to 18% from 12% on all used EV sales, just as in case of non-electric vehicles.

- GST will apply only to the margin value (difference between purchase and selling price, adjusted for depreciation if claimed) in case of business sales. No GST applies to individual-to-individual sales.

- Used Electric Vehicle (EVs): GST council decided to raise the rate of tax to 18% from 12% on all used EV sales, just as in case of non-electric vehicles.

- Bank's Penal Charges: No GST applies to penal charges by banks and non-banking financial companies (NBFCs) for loan term violations.

- Payment Aggregators: Payment aggregators handling payments of less than Rs 2,000 will be eligible for an exemption.

- This exemption does not extend to payment gateways or other fintech services unrelated to fund settlement.

- Aviation Turbine Fuel (ATF): GST council did not agree on bringing ATF under the ambit of GST because states refused to accept it.

- States see ATF as part of the crude petroleum diesel basket, saying that it alone cannot be taken out.

- 5 products i.e., crude oil, petrol, diesel, ATF and natural gas were kept out of purview of GST. The central government levies excise duty on them and states levy VAT.

- GST Exemption: Black pepper and raisins supplied directly by farmers will be exempt from GST.

- Gene therapy is fully exempt from GST, and Integrated GST exemption on surface-to-air missiles is extended.

- Compensation Cess: Reduced compensation cess rate to 0.1% on supplies to merchant exporters.

- This Cess is collected on the supply of select goods and or services to compensate the states for any revenue loss on account of implementation of GST.

- Popcorn: GST Council clarified (no new tax imposition) that caramelized popcorn is taxed at 18% GST. Ready-to-eat popcorn with salt and spices attracts 5% GST if not pre-packaged and labeled, and 12% if pre-packaged and labeled.

- Caramelised popcorn is classified as sugar confectionery, and attracts 18% GST while salted popcorn is a namkeen and subject to 5% GST.

GST Council

- About: The GST Council, a constitutional body under Article 279-A (101st Amendment, 2016), makes recommendations on GST implementation.

- GST is a value-added (Ad Valorem) and indirect tax system that is levied on the supply of goods and services in India.

- Members: The Council includes the Union Finance Minister (Chairperson), Union Minister of State (Finance), and a finance or any other minister from each state.

- Nature of Decisions: In the Mohit Minerals case, 2022, the Supreme Court ruled GST Council recommendations are not binding, as Parliament and states have simultaneous legislative powers on GST.

%20MPPCS%202025%20Desktop%20E.jpg)

%20MPPCS%202025%20Mobile%20E%20(1).jpg)

.png)

.png)

PCS Parikshan

PCS Parikshan