India to Become a Fintech Powerhouse | 12 Feb 2025

This editorial is based on “Lessons from India’s fintech revolution” which was published in The Hindustan Times on 07/05/2024. The article brings into picture India's fintech revolution, which has enabled a direct shift to mobile-first financial solutions, bypassing traditional banking. While this model serves as a blueprint for emerging economies, addressing key challenges is crucial for global leadership.

For Prelims: India's fintech revolution, Public-private-driven mode,Core banking solutions, Pradhan Mantri Jan Dhan Yojana, Unified Payments Interface, Account Aggregator Framework, Digital India, JAM Trinity (Jan Dhan-Aadhaar-Mobile), MSMEs, Paytm Payments Bank, India’s Digital Personal Data Protection Act .

For Mains: Key Drivers of Fintech Growth in India, Key Issues Related to the Fintech Sector in India.

India's fintech revolution has bypassed traditional banking, enabling millions to adopt mobile-first financial solutions. Since 2009, NPCI has standardized inter-bank transfers, facilitating a direct transition to digital payments—distinct from the West's gradual evolution. This public-private-driven model serves as a blueprint for emerging economies. However, to establish itself as a global fintech leader, India must address key challenges that lie ahead.

How the Fintech Sector Evolved in India?

- About: Fintech (Financial Technology) refers to the use of technology to deliver financial services efficiently.

- India’s fintech journey has been shaped by factors such as smartphone penetration, internet access, regulatory support, and digital payment innovations.

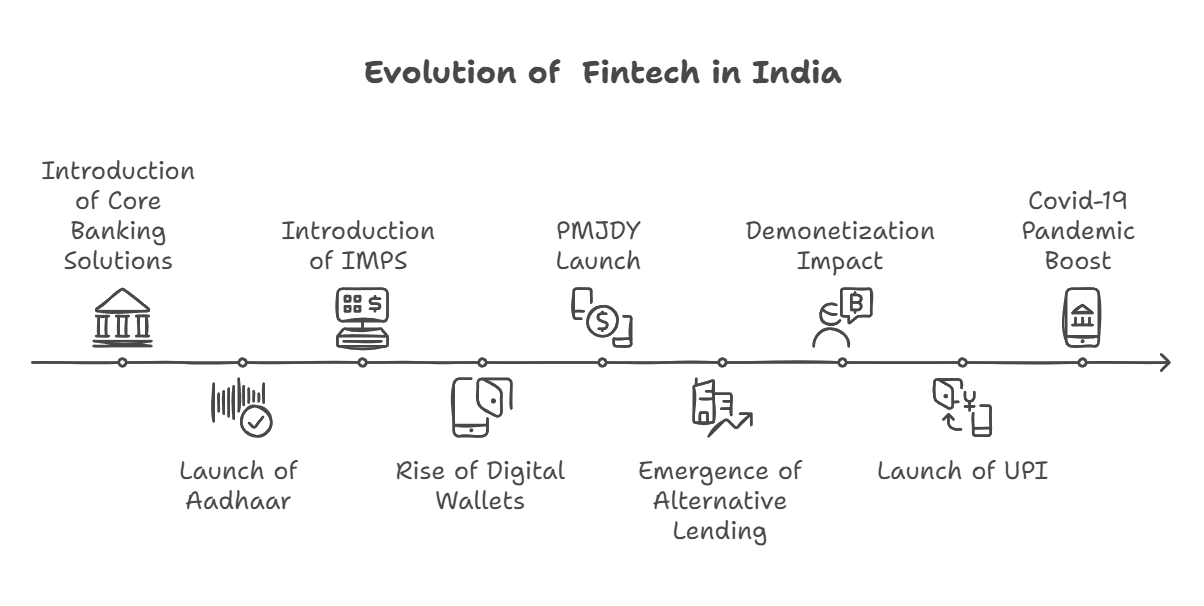

- Phases of Evolution

- Early Phase (Pre-2000s)

- The banking sector relied on core banking solutions (CBS) and IT-driven services.

- Introduction of ATMs, NEFT, RTGS, and electronic clearing services.

- Growth Phase (2000–2015)

- 2009: Launch of Aadhaar, enabling digital identity verification.

- 2010: Introduction of Immediate Payment Service (IMPS) by NPCI, facilitating real-time transactions.

- 2013: Rise of digital wallets (e.g., Paytm) due to increasing e-commerce.

- 2014: Pradhan Mantri Jan Dhan Yojana (PMJDY) launched, expanding financial inclusion.

- 2015: Emergence of alternative lending platforms and digital NBFCs.

- Acceleration Phase (2016–2020)

- 2016: Demonetization accelerated digital transactions.

- 2016: Launch of Unified Payments Interface (UPI) revolutionized real-time fund transfers.

- Growth of fintech startups in lending, wealth management, and insurance (e.g., Zerodha, PolicyBazaar, PhonePe).

- Current Phase (2020–Present)

- Covid-19 Pandemic (2020): Boosted digital banking, contactless payments, and fintech adoption.

- 2021: Account Aggregator Framework launched for seamless financial data sharing.

- 2022: RBI introduced Digital Lending Guidelines to regulate online lending platforms.

- Rise of Buy Now, Pay Later (BNPL) models and embedded finance solutions.

- Growth of Rupay Credit Card linked UPI payments, cryptocurrency exchanges (regulated), and AI-driven financial services.

- Early Phase (Pre-2000s)

What are the Key Drivers of Fintech Growth in India?

- Rapid Digital Adoption, Smartphone Penetration and 5G: The widespread availability of affordable smartphones and cheap internet has driven digital financial services.

- With over 80 crore internet users, fintech solutions have become accessible even in rural areas, bridging the financial inclusion gap.

- According to a recent survey The percentage of households with smartphones, as well as internet connectivity, is around 88%

- 5G subscriptions in India are expected to account for nearly 65% of all mobile subscriptions by the end of 2029 reaching 840 million.

- Government Initiatives and Regulatory Support: The Indian government’s push for a cashless economy through Digital India, JAM Trinity (Jan Dhan-Aadhaar-Mobile), and financial inclusion schemes has significantly boosted fintech.

- Over 54.58 crore Jan Dhan accounts are opened as of 15th January, 2025, with 55.7% held by women.

- RBI and SEBI have introduced regulatory frameworks for digital lending, digital banking units, and account aggregators, ensuring a stable environment for fintech growth.

- UPI Revolution and Payment Innovations: India’s Unified Payments Interface (UPI) has transformed digital transactions, offering seamless interoperability and zero-cost transactions.

- The launch of UPI-linked credit card payments has further expanded its reach.

- UPI is projected to account for 90% of the total transaction volume in retail digital payments over the next 5 years.

- India is expanding UPI adoption in global markets, with partnerships in Singapore, UAE, and France (NPCI).

- Rise of Digital Lending and Alternative Credit Models: Fintech-driven lending has expanded access to credit, especially for MSMEs and gig workers, using AI-based risk assessment instead of traditional credit scores.

- Digital lenders and Buy Now, Pay Later (BNPL) models are reshaping consumer finance, offering instant, collateral-free credit.

- The size of the Indian digital lending companies is set to grow from USD 38.2 billion in 2021 to nearly USD 515 billion by 2030.

- Growth of InsurTech and WealthTech Platforms: The fintech sector has disrupted insurance (InsurTech) and wealth management (WealthTech), making financial products more accessible through digital channels.

- AI-powered advisory services, robo-advisors, and blockchain-driven insurance claims have enhanced efficiency and transparency in financial planning.

- The WealthTech market in India is projected to exceed $60 billion by 2025, growing at a 12–15% CAGR (NASSCOM).

- The Indian InsurTech sector has witnessed a 12-fold revenue growth over the past five years to $750 million in 2023, according to a report released by Boston Consulting Group

- Expansion of Embedded Finance and Open Banking: Embedded finance, where financial services are integrated into non-financial platforms (e.g., Amazon Pay, Ola Money), is driving seamless transactions.

- Open Banking, facilitated by the Account Aggregator framework, enables secure financial data sharing, improving credit access for individuals and businesses.

- Embedded finance can unlock $25 billion revenue opportunity for India's digital and financial services platforms by 2030.

- India’s Account Aggregator (AA) ecosystem has expanded significantly, with 1.1 billion AA-enabled accounts and 2.05 million users voluntarily sharing their financial data with banks and financial institutions to access loans and secure better, faster deals on financial products.

- Rise of Blockchain and CBDC (Digital Rupee): Blockchain technology is enhancing security, transparency, and efficiency in financial transactions.

- The RBI’s launch of the Central Bank Digital Currency (CBDC) or Digital Rupee aims to modernize the payment ecosystem, reducing dependency on cash.

- The latest Currency and Finance Report indicates that the number of retail e-rupee users reached 5 million by the end of June 2024.

- India's blockchain technology market generated USD 321.5 million in revenue in 2022 and is projected to grow to USD 53,182.9 million by 2030

- Increasing Foreign Investments and Fintech Startups Boom: India’s fintech ecosystem is one of the world’s fastest-growing, attracting global investors.

- The combination of a vast consumer base, progressive regulations, and technological advancements makes India a fintech hub.

- India has over 2,500 fintech startups, second only to the US (Invest India).

- The combination of a vast consumer base, progressive regulations, and technological advancements makes India a fintech hub.

What are the Key Issues Related to the Fintech Sector in India?

- Regulatory Uncertainty and Compliance Challenges: The fintech sector in India operates in a rapidly evolving regulatory environment, leading to uncertainty for startups and investors.

- RBI banned Paytm Payments Bank (2024) from onboarding new customers due to regulatory violations, highlighting significant compliance challenges in the sector.

- Also, the lack of clear guidelines on AI-enabled fintech, cryptocurrency, and data protection makes compliance difficult.

- Cybersecurity Risks and Digital Fraud: With increasing digital transactions, cyber threats like phishing, identity theft, and financial fraud have surged.

- Many fintech firms lack robust cybersecurity frameworks, exposing customer data to breaches.

- India witnessed a 65% increase in payment fraud cases in 2023, with financial losses exceeding INR 1200 crore.

- UPI frauds constituted around 40% of these incidents with digital arrest led fraud being the prominent ones.

- Digital Lending and Predatory Practices: The rise of digital lending platforms has led to issues like high-interest rates, unethical recovery practices, and harassment of borrowers.

- Many loan apps operate without proper RBI registration, trapping low-income users in debt cycles.

- While RBI’s Digital Lending Guidelines aim to regulate the sector, enforcement challenges persist.

- The Indian government recently proposed a law to ban unregulated lending and impose a Rs 1 crore fine on offenders, but implementation remains a major concern.

- Many loan apps operate without proper RBI registration, trapping low-income users in debt cycles.

- Data Privacy and Consent Issues: Fintech companies collect vast amounts of user data but lack robust frameworks to ensure privacy and transparency.

- India ranked 5th in global data breaches in 2023, with 5.3 million leaked accounts.

- Many apps access sensitive information without user consent, leading to data misuse and security concerns.

- India’s Digital Personal Data Protection Act (2023) with its recently released rules, is still in its nascent stage.

- Digital Divide and Financial Inclusion Gaps: Despite fintech growth, rural and semi-urban India still faces challenges in accessing digital financial services.

- Limited internet penetration, lack of digital literacy, and language barriers prevent millions from benefiting from fintech solutions. T

- The JAM (Jan Dhan-Aadhaar-Mobile) framework has expanded access, but digital adoption remains slow.

- Only 38% of rural or semi urban Indians use digital financial services. Also, 11.30 crore Jan Dhan accounts remain inactive.

- Limited internet penetration, lack of digital literacy, and language barriers prevent millions from benefiting from fintech solutions. T

- High Customer Acquisition Costs and Profitability Concerns: Fintech startups struggle with high customer acquisition costs due to intense competition and heavy reliance on discounts and cashback offers.

- Many firms operate on thin margins, making long-term profitability a challenge. The lack of a sustainable revenue model has led to the shutdown of several startups.

- Fintechs in India raised just USD 2.1 billion in 2023, reflecting a nearly 300% drop from 2022.

- Monopoly Concerns and Lack of Market Competition: A few players dominate India’s fintech ecosystem, leading to concerns about monopolistic practices.

- Three firms control over 94% of UPI transactions – PhonePe, Google Pay , and Paytm.

- Lack of competition reduces innovation and creates dependency on a handful of platforms.

- NPCI introduced UPI market cap rules to limit the dominance of big players, but full implementation is delayed and deadlines keep getting extended.

- Three firms control over 94% of UPI transactions – PhonePe, Google Pay , and Paytm.

What Steps can India take to Revitalize its Fintech Sector and become a Global Model?

- Establishing a Comprehensive and Adaptive Regulatory Framework: India needs a unified and dynamic regulatory framework that balances innovation with consumer protection.

- Clear guidelines on digital lending, data privacy, cryptocurrency, and embedded finance will create stability for fintech players.

- A Regulatory Sandbox 2.0 can allow controlled testing of new financial products before full-scale implementation.

- Strengthening coordination between RBI, SEBI, and NPCI will ensure streamlined oversight.

- Strengthening Data Protection and Cybersecurity Infrastructure: Digital Personal Data Protection Law should be complemented with clear provisions on consent, data portability, and security, that will safeguard user privacy.

- Mandating zero-trust security architecture and AI-driven fraud detection will enhance cybersecurity resilience.

- Stricter penalties for data breaches and compliance mandates for fintech firms will build consumer trust.

- Promoting indigenous cybersecurity startups can reduce reliance on foreign security solutions.

- Also, India can lead global fintech security standards by integrating blockchain for secure transactions.

- Financial Inclusion through Regional Language Fintech Solutions: To bridge the digital divide, fintech platforms must provide multilingual, voice-enabled, and AI-driven interfaces.

- Leveraging UPI Lite, offline payments, and feature-phone banking will improve accessibility for low-income groups.

- Encouraging Indian fintech startups to develop vernacular financial literacy programs will enhance adoption in rural areas.

- Special financial products tailored for MSMEs, gig workers, and women entrepreneurs will promote inclusive growth. India can showcase fintech as a tool for mass financial empowerment to the world.

- Encouraging Open Banking and Interoperability for Seamless Transactions: A well-structured Open Banking ecosystem, supported by the Account Aggregator framework, will enable secure and seamless financial data sharing.

- Mandating universal API standards will improve interoperability among fintech firms, banks, and NBFCs.

- Expanding UPI-like models for global remittances and cross-border transactions (as initiated by India with UAE)will enhance India’s global fintech footprint.

- Ensuring fair access to financial data while preventing monopolistic control will promote healthy competition. Open banking can position India as a model for democratic digital finance.

- Scaling Embedded Finance and BNPL with Responsible Lending Guidelines: Embedded finance (fintech within non-financial platforms) and Buy Now, Pay Later (BNPL) models must be regulated with consumer protection safeguards.

- Mandatory risk assessment algorithms will prevent over-lending and debt traps.

- Introducing a Central Digital Credit Bureau can monitor alternative credit lending in real time.

- Encouraging ethical lending practices through interest rate transparency and responsible debt collection policies will reduce predatory lending.

- Mandatory risk assessment algorithms will prevent over-lending and debt traps.

- Strengthening Fintech Funding: To sustain fintech innovation, Fintech Venture Funds backed by government-private partnerships should provide early-stage capital.

- Tax incentives for startups in AI-driven finance, blockchain, and cybersecurity will attract more fintech entrepreneurs.

- Expanding co-lending models between fintech firms and traditional banks can create hybrid financial solutions.

- Ensuring fintech startups have a clear path to profitability instead of over-reliance on cashbacks and discounts will make the sector more resilient.

- A balanced funding ecosystem will establish India as a global fintech hub.

- Tax incentives for startups in AI-driven finance, blockchain, and cybersecurity will attract more fintech entrepreneurs.

- Leveraging AI, Blockchain, and Quantum Computing for Next-Gen Fintech: Encouraging AI-driven wealth management, fraud detection, and automated lending can enhance financial efficiency.

- Blockchain-powered smart contracts for trade finance and asset tokenization will drive financial innovation.

- Exploring quantum computing for ultra-secure transactions will place India at the forefront of fintech security research.

- Promoting decentralized finance (DeFi) regulations will enable India to lead in Web3-driven financial systems.

- Adopting deep-tech-driven fintech models will position India as a next-generation financial powerhouse.

- Institutionalizing Global Fintech Standards and Thought Leadership: India should lead international fintech standardization efforts through the G20, BIS, and IMF to influence global regulations.

- Establishing an India Global Fintech Institute to conduct research, policymaking, and regulatory innovation will strengthen thought leadership.

- India can emerge as the Silicon Valley of Fintech by driving regulatory and technological best practices.

Conclusion:

India’s fintech revolution has redefined financial inclusion through digital payments, AI-driven lending, and blockchain innovations. Strengthening data protection, fostering competition, and enhancing global fintech partnerships will be key to leadership in the sector. A balanced approach—promoting innovation while ensuring consumer protection—can position India as a global fintech powerhouse.

|

Drishti Mains Question: India's fintech revolution is reshaping financial intermediation, often bypassing traditional banking structures. In this context, critically examine whether fintech is democratizing finance or deepening digital and economic divides. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. With reference to India, consider the following: (2010)

- Nationalisation of Banks

- Formation of Regional Rural Banks

- Adoption of village by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)