US Federal Reserve's Rate Cut and Implications | 21 Sep 2024

For Prelims: Inflation, Russia-Ukraine Conflict, Unemployment, Recession, Carry trades, Foreign direct investment, Reserve Bank of India, Inflation target, Phillips Curve

For Mains: Impact of U.S. Federal Reserve Policies on Emerging Markets like India, Inflation vs. Employment, India's Monetary Policy Response to Global Economic Trends

Why in News?

Recently, the United States (US) Federal Reserve cut its benchmark interest rates by 50 basis points, marking its first significant reduction since the onset of the Covid-19 pandemic. This move signals a strategic approach to combat inflation while promoting economic growth.

Note

The US Federal Reserve conducts the nation's monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates in the US economy.

Why Did the US Federal Reserve Cut Interest Rates?

- Economic Recovery Post-Pandemic: Following the Covid-19 pandemic, the Federal Reserve initially slashed interest rates to stimulate the economy. However, as inflation surged due to various factors, including global supply chain disruptions (due to Russia-Ukraine Conflict), the Federal Reserve raised rates to combat rising prices.

- Moderation of Inflation: By mid-2023, inflation had started to stabilise, moving closer to the Federal Reserve's target of 2%.

- Recent jobs data showed that high interest rates were negatively impacting employment, with U.S. unemployment rising to 4.2% in August 2024. This raised concerns about a potential recession, prompting the Federal Reserve to prioritize job creation alongside price stability.

- Dual Mandate: The Federal Reserve operates under a dual mandate of maintaining stable prices and achieving maximum employment. As the economic landscape evolved, it became clear that a rate cut would help balance these objectives.

- Implications for US:

- By cutting rates, the US hopes to balance inflationary pressures. Although inflation has moderated, the central bank is focused on maintaining its target rate of around 2%, seeking a “soft landing” for the economy.

- Lower interest rates typically make loans cheaper for both individuals and businesses. With unemployment rising, the Fed is prioritising job creation alongside price stability.

- The rate cut could help reduce borrowing costs for businesses, potentially leading to increased hiring and economic expansion.

- By cutting rates, the US hopes to balance inflationary pressures. Although inflation has moderated, the central bank is focused on maintaining its target rate of around 2%, seeking a “soft landing” for the economy.

How Inflation and Unemployment are Related?

- Inverse Correlation: Generally, inflation and unemployment are inversely related—when one rises, the other falls.

- During periods of low unemployment, wage inflation tends to rise as employers offer higher wages to attract workers, eventually pushing prices higher.

- Conversely, in times of high unemployment, wage growth remains stagnant, leading to lower inflation.

- During periods of low unemployment, wage inflation tends to rise as employers offer higher wages to attract workers, eventually pushing prices higher.

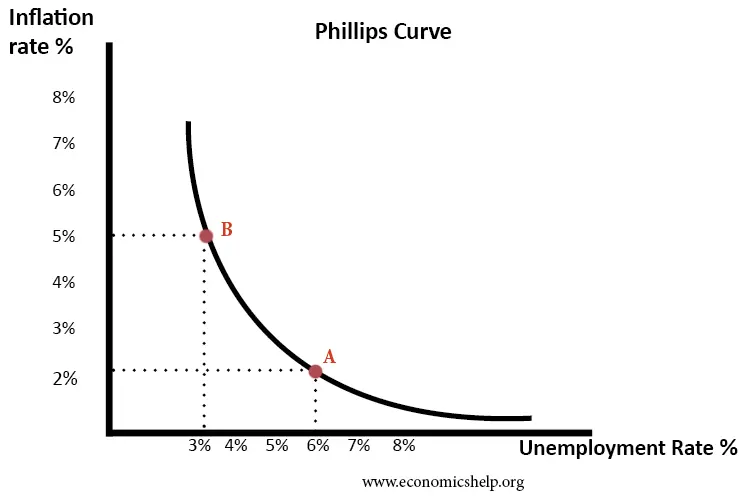

- Phillips Curve: The Phillips Curve is an economic theory that explains the inverse relationship between an economy's unemployment rate and inflation rate, as initially suggested by A.W. Phillips in the 1950s.

- The Phillips curve suggests that higher demand for labour during low unemployment periods leads to higher wages, which, in turn, drives inflation.

- This model has been widely used in monetary policy, particularly in balancing inflation and employment levels.

- The Phillips curve suggests that higher demand for labour during low unemployment periods leads to higher wages, which, in turn, drives inflation.

How will India be Affected by the Federal Reserve Rate Cut?

- Impact on Emerging Markets: The US plays a significant role in the global economy. A lower US interest rate makes investing in countries like India more appealing through carry trades.

- Carry trade is a strategy where investors(Foreign Institutional investors) borrow money in the US (where rates are low) and invest it where rates are higher, making a profit on the difference.

- Limited Impact: Chief Economic Adviser of India noted that while the rate cut could lower the dollar cost of capital and increase liquidity, it cannot be viewed as a standalone solution for boosting the global economy.

- Increased Foreign Investment: Lower US interest rates may incentivize global investors to borrow in the US and invest in India. This influx could take the form of Foreign Direct Investment (FDI), or debt from the US, providing much-needed capital for the Indian economy.

- Stock Market Sentiment: The rate cut has attracted considerable investor interest in the Indian stock market, indicating a positive sentiment among investors despite global uncertainties.

- Crude Oil Prices: When the US dollar weakens, oil becomes cheaper for holders of other currencies, leading to increased demand and potentially higher prices.

- Increased oil prices may increase India's energy import costs and potentially reigniting inflation in India.

- Impact on Currency Exchange Rates: A weakening US dollar against other currencies, including the Indian rupee, could adversely affect Indian exporters while benefiting importers.

- RBI’s Response: The Reserve Bank of India (RBI) faces pressure to cut interest rates, but it operates under different inflation targets and economic mandates compared to the Federal Reserve.

- The RBI is more focused on Gross Domestic Product (GDP) growth and is not as heavily influenced by US unemployment data.

Federal Tapering

- Federal tapering refers to the process by which the Federal Reserve gradually reduces its large-scale asset purchases, a monetary policy tool often employed during economic crises.

- This strategy, commonly associated with quantitative easing (QE), aims to stimulate the economy by lowering interest rates and increasing liquidity in financial markets.

- Tapering is intended to withdraw some of the economic stimulus provided during crises, transitioning towards a more normalised monetary policy.

India’s Repo Rate

- The RBI, at the 50th Monetary Policy Committee (MPC) meeting, decided to keep the policy repo rate unchanged at 6.50%.

- This decision reflects the committee's approach to managing inflation while supporting economic growth.

- The MPC's primary objective is to align inflation with the target rate of 4.0% with a tolerance band of +/- 2% points.

|

Drishti Mains Question: Analyze the implications of the US Federal Reserve’s interest rate cut on emerging economies like India. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Indian Government Bond Yields are influenced by which of the following? (2021)

- Actions of the United States Federal Reserve

- Actions of the Reserve Bank of India

- Inflation and short-term interest rates

Select the correct answer using the code given below.

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)