Regional Economic Outlook for Asia And Pacific Report: IMF | 17 May 2024

For Prelims: IMF, Special Drawing Rights, World Economic Outlook, International Monetary Fund (IMF), Inflation, World Bank (WB).

For Mains: Important International Institutions, Reports, Agencies and Further Structure, Mandate etc.

Why in News?

Recently, the International Monetary Fund (IMF) has released its Regional Economic Outlook for Asia And Pacific Report April 2024, which stated that India was the source of repeated positive growth surprises, supported by resilient domestic demand. Also, Public Investment is a significant factor in driving India’s economy.

What are the Key Highlights of the Report?

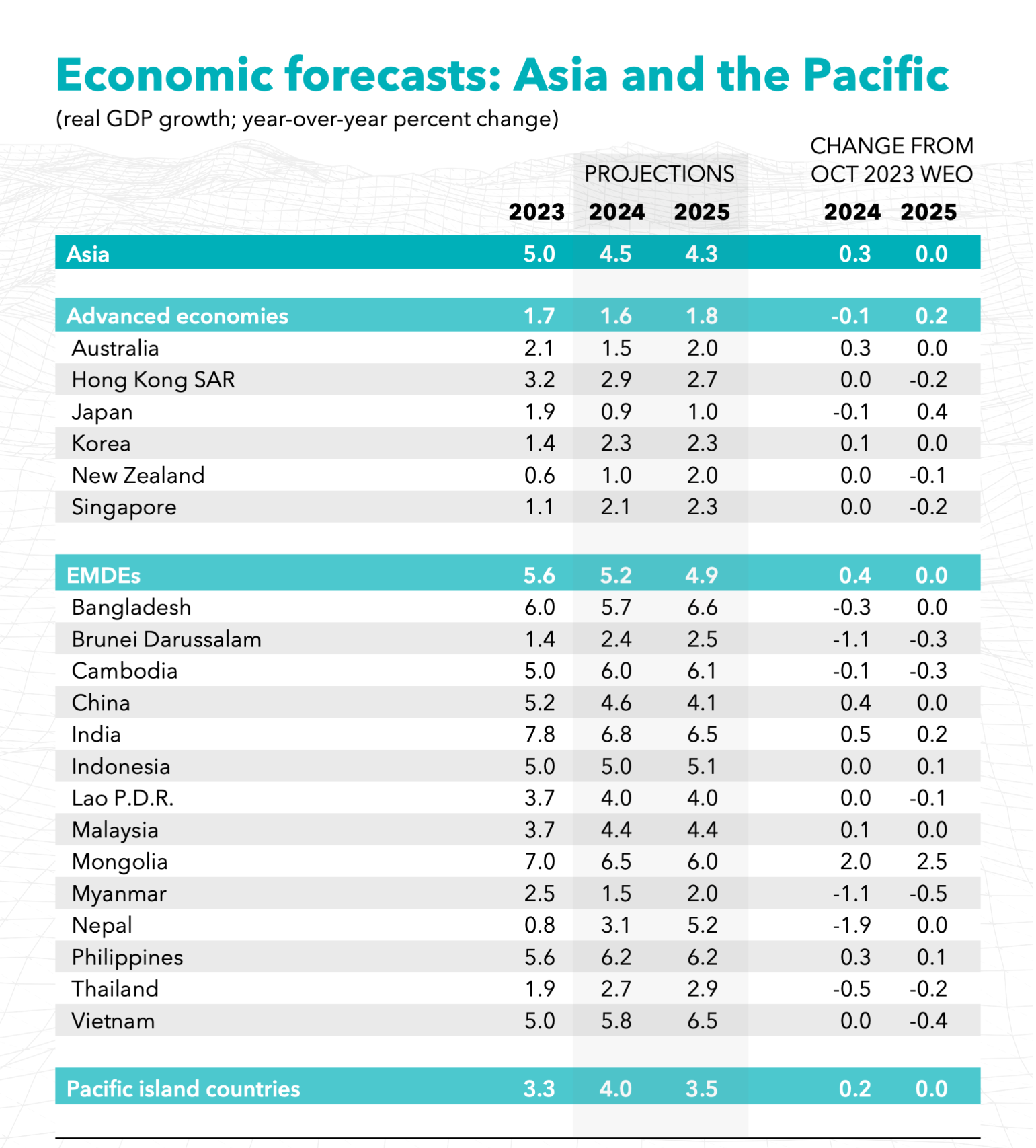

- Growth in Asia-Pacific: Asia-Pacific's growth in late 2023 surpassed expectations at 5.0%, with varying inflation rates across economies.

- Projections for 2024 suggest a slight growth slowdown to 4.5%, balancing near-term risks.

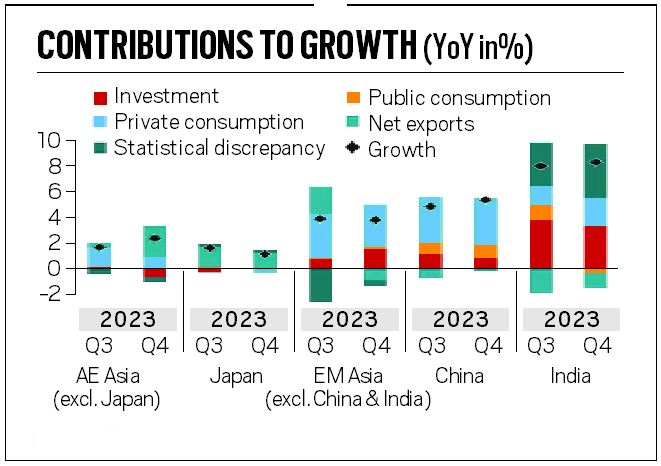

- In emerging markets, growth was supported primarily by strong private demand.

- India’s Growth Forecasts: It raised India’s growth forecast for the financial year 2024-25 to 6.8% from 6.5% earlier and retained the growth forecast for 2025-26 at 6.5%.

- It stated that India and the Philippines have been the source of repeated positive growth surprises, supported by resilient domestic demand.

- In China and, especially, India, public investment made an important contribution.

- Forecast for China: The Chinese Economy is expected to grow at the rate of 4.6% in 2024, slower from 5.2% in 2023 and expected to remain at 4.1% in 2025.

- The IMF sees China as a source of both upside and downside risks.

- Policies addressing stresses in the property sector and boosting domestic demand will benefit China and the region, as this sector is under stress due to concerns about a potential housing bubble (rapid rise in prices) and high levels of debt.

- However, sectoral policies leading to excess capacity in certain industries, such as steel and aluminium, will harm China and the region.

- The IMF sees China as a source of both upside and downside risks.

- Inflation Forecast: The IMF stated that inflation is currently at or near the desired level in emerging markets, but there are different factors contributing to inflation in the future.

- Core inflation is expected to stay low, but some economies may see a decrease in headline inflation due to lower energy prices.

- However, in countries like India, food prices, particularly for rice, can increase headline inflation.

- Inflation, as defined by the International Monetary Fund, is the rate of increase in prices over a given period, encompassing a broad measure of overall price increases or for specific goods and services.

- Headline Inflation: It considers the price changes of all the goods and services. This basket includes everything from food and energy to clothing, rent, and entertainment.

- Core Inflation: This is change in price of goods and services excluding food and energy sectors(as they are volatile).

- Core Inflation= Headline Inflation- Food and Fuel Items

- Inflation, as defined by the International Monetary Fund, is the rate of increase in prices over a given period, encompassing a broad measure of overall price increases or for specific goods and services.

- Geoeconomic Fragmentation: IMF has highlighted Geoeconomic fragmentation as a significant risk.

- Geoeconomic fragmentation refers to the risk of increasing economic and trade tensions between countries, which can have negative impacts on global economic growth and stability.

- Global disputes increase the trade risks, as shown by ships being redirected around Africa to bypass the Red Sea, leading to higher shipping expenses.

- IMF suggested that policymakers should be cautious to not aggravate trade frictions themselves.

How Public Investment is Key to Growth of India?

- About: Public investment refers to the allocation of government funds towards critical sectors such as infrastructure, education, healthcare, and technology.

- It plays a pivotal role in shaping a nation’s economic trajectory.

- Public Sector as Key to India’s Growth:

- Infrastructure Development: Public investment is vital for building and maintaining critical infrastructure, such as roads, highways, railways, ports, airports, and power plants, which are essential for economic growth and productivity.

- This sector will require estimated investments of USD4.5 trillion by 2030, which underscores the need for increased public investment in this sector.

- Job Creation and Poverty Alleviation: Public investment in infrastructure projects, social welfare schemes, and rural development initiatives can create employment opportunities and contribute to poverty alleviation.

- The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), for instance, has generated billions of person-days of employment since its inception.

- Human Capital Development: Public investment in education, healthcare, and skill development is crucial for building a skilled and productive workforce, which is essential for sustained economic growth.

- Also, public investment ensures balanced development across regions. It reduces disparities and promotes inclusive growth.

- Crowding-in Private Investment: Public investment in infrastructure and other productive sectors can create a favourable environment for private investment by reducing the cost of doing business and enhancing overall productivity.

- Infrastructure Development: Public investment is vital for building and maintaining critical infrastructure, such as roads, highways, railways, ports, airports, and power plants, which are essential for economic growth and productivity.

What is IMF?

- About: The International Monetary Fund (IMF) is an international organisation that provides financial assistance and advice to member countries.

- It was conceived during the Bretton Woods Conference in July 1944.

- Objectives:

- Foster global monetary cooperation and stability.

- Ensure financial stability and provide crisis assistance.

- Facilitate international trade with stable currencies.

- Promote sustainable growth and employment through effective policies.

- Board of Governors: The Board of Governors of the IMF includes one Governor and one Alternate Governor from each member country.

- In the case of India, the Finance Minister serves as the ex-officio Governor on the Board of Governors, and Governor of the Reserve Bank of India acting as India's Alternate Governor.

- Special Drawing Rights: The IMF issues an international reserve asset known as Special Drawing Rights, that can supplement the official reserves of member countries.

- Total global allocations are currently about USD 293 billion. IMF members can voluntarily exchange SDRs for currencies among themselves.

- Reports Published by IMF:

What is the Significance of the IMF for India?

- About: India joined the IMF as a founding member in December 1945, even before gaining independence.

- Currently, India holds a 2.75% Special Drawing Rights quota and 2.63% of votes in the IMF.

- SDR is one of the components of the Foreign Exchange Reserves (FER) of India

- IMF has made an allocation of Special Drawing Rights 12.57 billion to India. (approx USD 17.86 billion).

- Currently, India holds a 2.75% Special Drawing Rights quota and 2.63% of votes in the IMF.

- Significance:

- Independence of the Indian Rupee: Before the establishment of the IMF, the Indian rupee was linked with the British Pound Sterling.

- But the Indian rupee has become independent after the establishment of the IMF. Its value is expressed in terms of gold.

- It means that the Indian rupee is easily convertible into the currency of any other country.

- Availability of Foreign Currencies: The Government of India has been purchasing foreign currencies from the Fund from time to time to meet the requirements of development activities.

- From the inception of the IMF up to 31st March, 1971, India purchased foreign currencies of the value of Rs. 817.5 crores from the IMF, and the same have been fully repaid.

- Since 1970, the assistance that India, as other member countries of the IMF, can obtain from it has been increased through the setting up of the Special Drawing Rights (SDRs created in 1969).

- Help During Emergency: India has got a large amount of financial assistance from the Fund to solve its economic crisis arising due to natural calamities like flood, earthquakes, famines etc.

- In 1981 India was able to procure a massive loan of Rs. 5000 crores from IMF to overcome the balance of payments problem faced by it.

- Independence of the Indian Rupee: Before the establishment of the IMF, the Indian rupee was linked with the British Pound Sterling.

Which Sunrise Sectors in India are Seeking Substantial Public Investments?

- Carbon Capture, Utilization, and Storage (CCUS): CCUS technologies can play a crucial role in mitigating greenhouse gas emissions, particularly from industries like steel, cement, and power generation.

- However, public investment in research, development, and deployment of CCUS projects in India is currently limited.

- Cybersecurity and Data Protection: With the increasing digitalization of the economy and the rise of cyber threats, public investment is needed to enhance India's cybersecurity infrastructure, develop robust data protection frameworks, and build a skilled workforce in this domain.

- Biotechnology and Precision Medicine: Public investment in biotechnology research, particularly in areas like genomics, synthetic biology, and precision medicine, can help India develop cutting-edge healthcare solutions and position itself as a leader in this field.

- Circular Economy and Waste Management: While some initiatives have been taken, more public investment is required to develop a comprehensive circular economy framework, including infrastructure for waste collection, recycling, and resource recovery.

- Blue Economy and Marine Research: With India's vast coastline, public investment in marine research, sustainable ocean exploration, and the development of a blue economy focused on sectors like offshore wind energy, marine biotechnology, and coastal tourism could unlock significant economic opportunities.

|

Drishti Mains Question: Discuss the role of the International Monetary Fund (IMF) in promoting global economic stability and its impact on developing countries. Evaluate the criticisms against the IMF's policies and suggest potential reforms to address these concerns. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. "Rapid Financing Instrument" and "Rapid Credit Facility" are related to the provisions of lending by which one of the following? (2022)

(a) Asian Development Bank

(b) International Monetary Fund

(c) United Nations Environment Programme Finance Initiative

(d) World Bank

Ans: (b)

Q2. “Gold Tranche” (Reserve Tranche) refers to (2020)

(a) a loan system of the World Bank

(b) one of the operations of a Central Bank

(c) a credit system granted by WTO to its members

(d) a credit system granted by IMF to its members

Ans: (d)

Q3. ‘Global Financial Stability Report’ is prepared by the (2016)

(a) European Central Bank

(b) International Monetary Fund

(c) International Bank for Reconstruction and Development

(d) Organization for Economic Cooperation and Development

Ans: (b)

Mains

Q. The World Bank and the IMF, collectively known as the Bretton Woods Institutions, are the two inter-governmental pillars supporting the structure of the world’s economic and financial order. Superficially, the World Bank and the IMF exhibit many common characteristics, yet their role, functions and mandate are distinctly different. Elucidate. (2013)