International Relations

India's Push for Reducing Cross-Border Remittance Costs at WTO

- 14 Sep 2024

- 12 min read

For Prelims: World Trade Organization, International Monetary Fund, Sustainable Development Goals, G20, Unified Payments Interface, Free Trade Agreements , Agreement on Agriculture

For Mains: Cross-border remittances, International Collaborations for Economic Development

Why in News?

India’s proposal to lower the costs of cross-border remittances, presented at the World Trade Organization’s (WTO) 13th Ministerial Conference 2024 held earlier in Abu Dhabi, has gained backing from countries like Morocco and Vietnam.

- However, it has also faced resistance from some WTO members, highlighting the ongoing challenges in achieving global consensus on this critical issue.

Costs of Cross-border Remittances

- Remittance costs are the fees charged when someone sends money internationally. Fees can vary based on the amount sent and the method used.

- The current global average remittance cost is 6.25% of the amount sent, according to the International Monetary Fund (IMF).

- For smaller remittances under USD 200, remittance fees typically average 10% and can be as high as 15-20% of the principal in smaller migration corridors.

Note

- In 2016, the G20 integrated the UN’s 2030 Agenda by adopting the target of reducing remittance costs to below 3% (as outlined in SDG 10.c.) and eliminating remittance corridors with costs above 5% by 2030.

- In 2021, reaffirming this commitment, the G20 emphasised its dedication to SDG 10.c through the G20 Roadmap for Enhancing Cross-Border Payments, aiming to lower the average cost of remittances to less than 3%.

What is India's Proposal About Costs of Cross-border Remittances?

- Proposal: The draft proposal submitted by India in March 2024 at the WTO’s 13th Ministerial Conference, the proposal aims to reduce the global average cost for sending remittances which is currently more than double the Sustainable Development Goal (SDG) target of 3%.

- India suggests that digital remittances, with an average cost of 4.84%, are significantly cheaper and should be promoted.

- India has also proposed initiating a work programme to make concrete recommendations on reducing remittance costs.

- India’s Need for Remittance Cost Cut: India received the highest remittance inflows globally in 2023, amounting to USD 125 billion.

- Reducing remittance costs could further increase the inflow of funds. In 2023, India spent around USD 7-8 billion on remittance fees.

- As remittance costs decrease, making transfers cheaper and faster, the dependence on hawala will likely diminish as well.

- The hawala refers to an informal channel for transferring funds from one location to another through service providers (known as hawaladars) regardless of the nature of the transaction and the countries involved.

- Support and Challenges: Nations like Morocco and Vietnam have expressed strong support for India's proposal, recognizing the importance of reducing remittance costs.

- Countries such as the US and Switzerland have opposed the proposal, citing concerns about their own financial institutions’ revenue from remittance fees.

Remittance Inflow in India

- In 2023, India topped in remittances inflow list, followed by Mexico (USD 66 billion), China (USD 50 billion), the Philippines (USD 39 billion), and Pakistan (USD 27 billion).

- In FY23-24, Indians abroad sent a record USD 107 billion in remittances to India surpassing USD 100 billion for the second consecutive year.

- The net remittance amount nearly doubles the combined total of USD 54 billion from foreign direct investments (FDI) and portfolio investments during the same period.

- Gross remittances from the Indian diaspora reached USD 119 billion in FY24. After accounting for repatriation of income and related expenses, net private transfers amounted to USD 107 billion.

- According to a Reserve Bank of India (RBI) survey, the United States was the primary contributor, accounting for 23% of the total remittances. Most remittances are intended for familial support, with some allocated to investments such as deposits.

- Remittance volumes are influenced by migration levels, employment conditions in origin countries, and the cost of remitting funds.

What are the Benefits from a Remittance Cost Cut?

- Global Indian Diaspora: Lower costs ensure that more money goes to the sender’s family and less to intermediaries.

- Non-Resident Indians (NRI) community, and overseas travellers would find it easier and cheaper to transfer funds to and from India.

- Benefit to Indian MSMEs: Reduced foreign exchange costs would make Indian goods and services more competitive, leading to higher profit margins.

- Reduced remittance costs would make cross-border transactions more efficient, aligning with the Indian government’s goal to improve ease of doing business.

- Domestic Economy and UPI Transactions: Increased remittance inflows at lower costs could marginally strengthen the domestic currency and improve personal consumption patterns.

- The remittance cost cut could serve as a catalyst for expanding Unified Payments Interface (UPI) penetration in global markets.

- Financial Inclusion: Lower remittance costs can improve access to financial services for underserved populations, fostering greater financial inclusion.

- Since 78% of total remittance flows in 2023 went to Low and Middle-Income Countries (LMICs), reducing transaction costs is crucial for decreasing inequality both within and among countries.

- Bridging Socio-Economic Disparities: Lower transaction costs ensure that more of the remittance amount reaches those in need, helping to bridge economic disparities and support development in these regions.

- Lower costs mean that senders retain more of their money, which can lead to increased savings and investment in their home countries.

What are the Key Facts About the World Trade Organization?

- Origins: The Marrakesh Agreement, signed in 1994, established the WTO, which officially began on 1st January 1995.

- It succeeded the General Agreement on Tariffs and Trade (GATT) and was part of the Uruguay Round negotiations (1986-94) to create a more comprehensive global trade organisation.

- Members: WTO has 166 members, including India (since 1995 and a member of GATT since 1948), accounting for around 98% of world trade.

- WTO Secretariat: The WTO Secretariat, based in Geneva, Switzerland, supports the organisation's functions but does not itself have decision-making powers.

- The Secretariat is led by the Director-General, who oversees its operations

- Key WTO Principles:

- Most-Favoured-Nation (MFN): It requires that any favourable trading terms offered to one member must be extended to all other WTO members.

- National Treatment: This principle mandates that once a product, service, or intellectual property enters a market, it should receive non-discriminatory treatment compared to domestic products.

- Charging customs duty on an import is not a violation of national treatment.

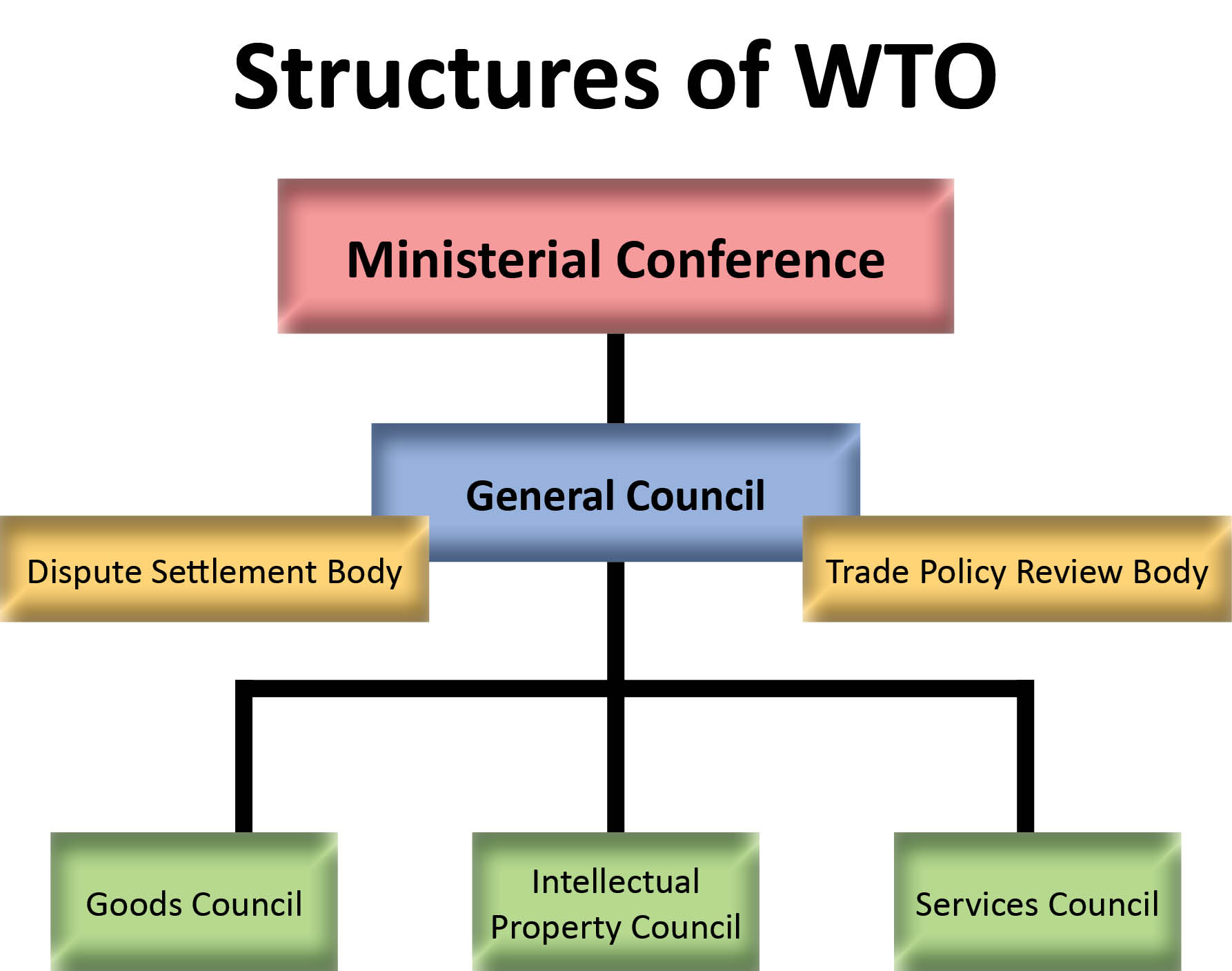

- WTO Ministerial Conference: It is the organization's top decision-making body, meeting every two years with all members involved in decisions on matters covered under multilateral trade agreements.

- Important Agreements of the WTO:

Way Forward

- WTO Deputy Director General emphasised the need for increased awareness and outreach to garner broader support for reducing the remittance cost cut. Collaboration with international organisations such as the International Labour Organization (ILO) and the World Bank is crucial.

- Foster interoperability among different digital remittance platforms of countries to facilitate seamless cross-border transactions.

- Digital channels like UPI offer some cost savings, being cheaper than non-digital channels.

- Promote regulatory harmonisation among countries to reduce barriers and facilitate cross-border remittances.

|

Drishti Mains Question: Analyse the impact of remittance costs on developing economies. How does India's proposal to the World Trade Organization aim to address this issue? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. The terms ‘Agreement on Agriculture’, ‘Agreement on the Application of Sanitary and Phytosanitary Measures’ and ‘Peace Clause’ appear in the news frequently in the context of the affairs of the (2015)

(a) Food and Agriculture Organization

(b) United Nations Framework Conference on Climate Change

(c) World Trade Organization

(d) United Nations Environment Programme

Ans: c

Q2. In the context of which of the following do you sometimes find the terms ‘amber box, blue box and green box’ in the news? (2016)

(a) WTO affairs

(b) SAARC affairs

(c) UNFCCC affairs

(d) India-EU negotiations on FTA

Ans: a

Mains

Q1. What are the key areas of reform if the WTO has to survive in the present context of ‘Trade War’, especially keeping in mind the interest of India? (2018)

Q2. “The broader aims and objectives of WTO are to manage and promote international trade in the era of globalisation. But the Doha round of negotiations seem doomed due to differences between the developed and the developing countries.” Discuss in the Indian perspective. (2016)