Governance

India's Leather Industry

- 22 Apr 2025

- 11 min read

For Prelims: National Green Tribunal, Indian Footwear and Leather Development Program, Production Linked Initiative Scheme, Goods and Services Tax, Viability Gap Funding

For Mains: Leather industry in India’s economy and employment, Sustainable industrialisation

Why in News?

The Centre has proposed a mega leather cluster in Ramaipur, Kanpur. This project seeks to rejuvenate the leather sector, which was once central to the city’s identity and economy, but now plagued by pollution curbs, declining business, and poor labour conditions.

What Led to the Decline of the Leather Industry in Kanpur?

- Legacy: Kanpur earned the title “Leather City of India” due to its flourishing British-era tanning industry, its proximity to the Ganga river, and abundant labor.

- The post-1857 boom created employment for over 1 lakh workers across 600 tanneries.

- Impact of Demonetisation and Pollution Control (2016–17): Demonetisation in 2016 hit Kanpur's leather industry hard, as cash shortages and limited digital financial inclusion halted payments and raw material purchases, drastically reducing production.

- Later, a 2017 directive from the UP Pollution Control Board (UPPCB) mandated a 50% infrastructure reduction, with a penalty of Rs 12,500 per day for non-compliance.

- Resulted in factories operating at half capacity or shutting down intermittently.

- Additionally, the National Green Tribunal (NGT) has raised concerns over tannery effluents polluting the Ganga and soil with heavy metals like chromium and mercury, which were also found at high levels in blood samples of residents in Kanpur and nearby areas.

- Rising Operational Costs: Tannery effluent treatment costs surged from Rs 2 to over Rs 100 per hide, shifting the pollution control burden onto tannery owners.

- Due to stricter compliance rules, the cost of wastewater treatment was shifted to businesses, significantly reducing profit margins.

- As a result, tanneries in Kanpur have reduced their operations from around 600 to just over 200, leading to widespread job cuts and a substantial loss of income for workers.

What is the Significance of India's Leather Industry?

- Leather Sub-sectors: India's Leather Industry comprises four verticals Tanning, Footwear, Leather Garments, and Accessories.

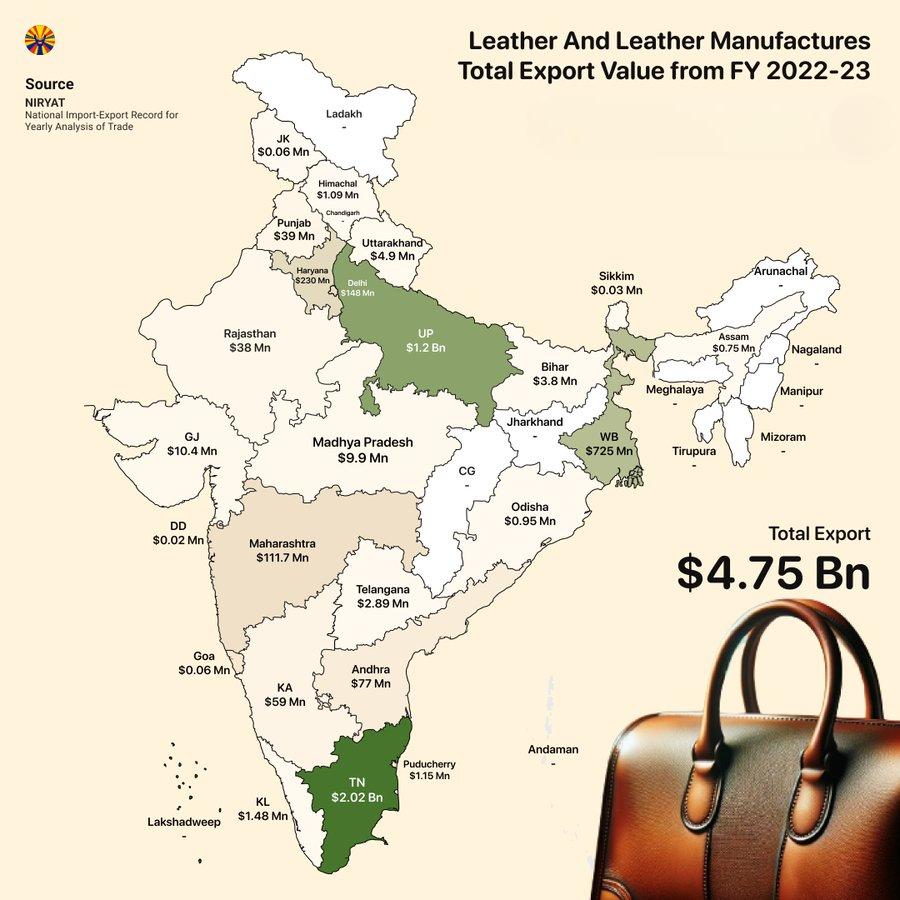

- States like Tamil Nadu, Uttar Pradesh, West Bengal, Maharashtra, and Punjab are leading producers.

- Global Leadership: India is the 2nd largest producer and consumer of leather footwear globally, after China.

- India is the 2nd largest exporter of leather garments after China, and the 4th largest exporter of leather goods in the world.

- It accounts for 13% of the world’s leather production, making it a major export contributor.

- India has 20% of the world’s cattle and buffalo population, and 11% of goat and sheep population, ensuring ample raw material supply.

- Employment: India's Leather Industry employs 4.42 million people, with 30% female workforce, particularly in rural regions.

- India’s Leather Export Profile: The garments sector accounted for 7.62% of the country’s total leather exports in FY25 (April-December).

- India exports leather to over 50 countries, with the US (21.82%), Germany (11.33%), and the UK (9.17%) as the top importers.

- India’s Initiatives: Council for Leather Exports (CLE), the apex export promotion council under the Ministry of Commerce, facilitates market access, buyer-seller meets, and provides a bridge between policy and industry.

- The Indian Footwear and Leather Development Program (IFLDP), with a budget of Rs 1,700 crore till 2026, aims to boost manufacturing competitiveness and employment generation in the leather sector.

- Proposed Production Linked Initiative (PLI) Scheme (Union Budget 2025–26) envisions a Rs 2,600 crore incentive scheme to increase turnover to Rs 4 lakh crore, generate 2.2 million jobs, and boost domestic value addition.

What are the Challenges Facing India's Leather Industry?

- Decline in Exports: Leather and leather goods exports dropped nearly 10% in FY24 due to weak demand from major markets like the US and Europe.

- Tamil Nadu, the largest leather exporter, saw an 18% decline, significantly affecting the national figures.

- The Russia-Ukraine war has disrupted the Eurozone economy, reducing international demand.

- Threat from Synthetic Leather Substitutes & Innovation Gap: The rise of eco-friendly alternatives like faux leather, cork leather, ocean leather, microfiber, and vegan leather is eroding leather’s niche market.

- These substitutes are cheaper, cruelty-free, and increasingly accepted in global markets, especially in environmentally conscious economies.

- While India's Leather Industry’s slow innovation and lack of R&D hinder its competitiveness.

- Environmental Regulations and Compliance Burden: Tanning is inherently polluting as it generates high chemical and organic waste, including hazardous materials like hexavalent chromium.

- Many tanneries lack capacity for effluent treatment and operate in unhygienic conditions, exposing workers to serious health risks.

- Workers are exposed to hazardous chemicals without adequate protection or awareness, leading to occupational health risks and poor labor welfare.

- Regulatory Challenges: Ban on slaughterhouses and restrictions on cattle trade have severely impacted raw material availability.

- The Goods and Services Tax (GST) regime increased costs by 6–7%, especially hurting Micro, Small and Medium Enterprises (MSMEs).

- Stricter norms by the NGT and UPPCB have led to closure of units, especially in hubs like Kanpur and Unnao.

- Labour Issues and Skill Gaps: A large section of the workforce is untrained and illiterate, leading to low productivity, Poor awareness of health and safety practices and Limited adaptation to new technologies

How Can India Revive its Leather Industry?

- Transform CETPs to CIRCLES: Transform Common Effluent Treatment Plants (CETPs) into CIRCLES (Clean Integrated Resource-Conserving Leather Ecosystems).

- Fund decentralised Zero Liquid Discharge (ZLD) micro-treatment plants through Viability Gap Funding (VGF).

- Mandate digital effluent metering and traceability, linked to a central Green Leather Compliance Dashboard (similar to the PARIVESH portal for environment clearances).

- Position India ‘China Plus One’: India can strategically position itself as a “China Plus One” hub in the global leather value chain amid rising US-China trade tensions.

- India can attract global buyers seeking reliable alternatives. Strengthening eco-compliance and design innovation will make India a preferred sourcing destination.

- Addressing the Innovation Gap: A National Leather Tech Hub can be established under the Council of Scientific and Industrial Research – Central Leather Research Institute (CSIR-CLRI) and the Atal Innovation Mission to foster innovation in the leather sector.

- This hub can collaborate with startups and MSMEs to co-develop biodegradable tanning agents, chrome-free alternatives, and smart wearable leather composites.

- Unlock Ethical Luxury Branding for Indian Leather: Introduce a “Bharat Leather Mark”, backed by sustainable sourcing and ethical labour audits.

- Launch a ‘100 Indian Leather Stories’ global branding campaign showcasing heritage artisanship from Kanpur, Ambur, Tamil Nadu and Kolkata.

- Encourage luxury collaboration with global fashion houses under Make in India.

- Formalise the Informal: Provide Digital Udyog Cards for every tannery worker to ensure access to skilling,health benefits, and accident insurance.

- Skill the Sector, Heal the Worker: A dedicated Worker Wellness Mission should provide mobile health labs in leather clusters.

- By integrating PM Vishwakarma Yojana artisans can be upskilled in modern, sustainable techniques. This will reduce attrition and boost productivity by 30–35%, securing a healthier and more resilient workforce.

Conclusion

India’s leather industry doesn’t need an incremental fix, it needs a strategic leap. If approached as an eco-creative and culturally rooted export engine, it can become the global benchmark for ethical leather craftsmanship. The Ramaipur cluster is not just a policy project, it could be the nucleus of a new leather revolution powered by tech, tradition, and trust.

|

Drishti Mains Question: India’s leather sector is facing the dual burden of global competition and domestic regulation. Critically analyse the causes of its decline and suggest a comprehensive revival strategy. |

-min.jpg)