Indian Economy

Highlights of Economic Survey 2021

- 01 Feb 2021

- 21 min read

Why in News

Recently, the Union Minister of Finance presented the Economic Survey that details the state of the economy ahead of the government's budget for the fiscal year beginning 1st April, 2021.

- The foundational theme of the survey is "Saving Lives and Livelihoods".

Economic Survey

- The Economic Survey of India is an annual document released by the Ministry of Finance, Government of India.

- It contains the most authoritative and updated source of data on India’s economy.

- It is a report that the government presents on the state of the economy in the past one year, the key challenges it anticipates, and their possible solutions.

- The Economic Survey document is prepared by the Economics Division of the Department of Economic Affairs (DEA) under the guidance of the Chief Economic Advisor.

- It is usually presented a day before the Union Budget is presented in the Parliament.

- The first Economic Survey in India was presented in the year 1950-51. Up to 1964, it was presented along with the Union Budget. From 1964 onwards, it has been delinked from the Budget.

Key Points

- Indian Economy and Covid:

- Strategy to face the pandemic:

- Response stemmed from the humane principle that:

- Human lives lost cannot be brought back.

- Gross Domestic Product (GDP) growth will recover from the temporary shock caused by the Covid-19 pandemic.

- India’s policy response also derived from extensive research on epidemiology, especially that looked at Spanish Flu of 1918.

- One of the key insights was that pandemic spreads faster in higher and denser population and intensity of lockdown matters most at the beginning of the pandemic.

- Response stemmed from the humane principle that:

- Four Pillar Strategy:

- India adopted a unique four-pillar strategy of containment, fiscal, financial, and long-term structural reforms.

- Calibrated fiscal and monetary support was provided given the evolving economic situation.

- A favorable monetary policy ensured abundant liquidity and immediate relief to debtors via temporary moratoria, while facilitating monetary policy transmission.

- Cushioning the vulnerable in the lockdown and boosting consumption and investment while unlocking, mindful of fiscal repercussions and entailing debt sustainability.

- Covid pandemic affected both demand and supply:

- India was the only country to announce structural reforms to expand supply in the medium-long term and avoid long-term damage to productive capacities.

- The Rs. 1.46-lakh crore Production Linked Incentive (PLI) scheme is expected to make India an integral part of the global supply chain and create huge employment opportunities

- Demand-side measures have been announced in a calibrated manner.

- A public investment programme centered around the National Infrastructure Pipeline to accelerate the demand push and further the recovery.

- India was the only country to announce structural reforms to expand supply in the medium-long term and avoid long-term damage to productive capacities.

- Strategy to face the pandemic:

- Economic Recovery:

- V-shaped Economic Recovery after Lockdown:

- Starting July 2020, a resilient V-shaped recovery is underway.

- V-shaped recovery is a type of economic recession and recovery that resembles a "V" shape in charting.

- Specifically, a V-shaped recovery represents the shape of a chart of economic measures economists create when examining recessions and recoveries.

- A V-shaped recovery is characterized by a quick and sustained recovery in measures of economic performance after a sharp economic decline.

- Reasons:

- It is supported by the initiation of a mega vaccination drive with hopes of a robust recovery in the services sector and prospects for robust growth in consumption and investment.

- V-shaped recovery is due to resurgence in high frequency indicators such as power demand, rail freight, E-Way bills, Goods and Services Tax (GST) collection, steel consumption, etc.

- The fundamentals of the economy remain strong as gradual scaling back of lockdowns along with the support of Aatmanirbhar Bharat Mission have placed the economy firmly on the path of revival.

- Significance:

- This path would entail a growth in real Gross Domestic Product (GDP) by 2.4% over the absolute level of 2019-20 - implying that the economy would take two years to reach and go past the pre-pandemic level.

- GDP’s Estimation:

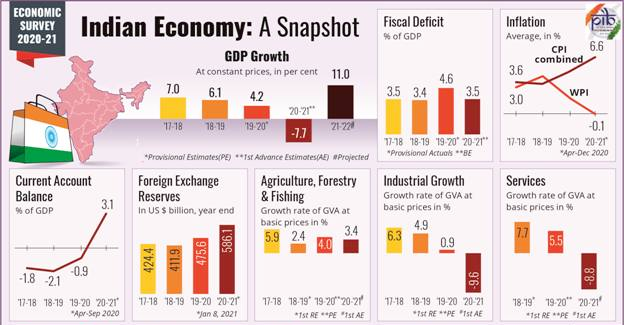

- India’s real GDP to record a growth of 11% in 2021-22 and nominal GDP by 15.4% - the highest since independence.

- These projections are in line with International Monetary Fund estimates.

- India’s GDP is estimated to contract by 7.7% in the Financial Year (FY) 2020-21, composed of a sharp 15.7% decline in the first half and a modest 0.1% fall in the second half.

- Sector-wise, agriculture has remained the silver lining while contact-based services, manufacturing, construction were hit hardest, and have been recovering steadily.

- The external sector provided an effective cushion to growth with India recording a Current Account Surplus of 3.1% of GDP in the first half of FY 2020-21.

- India’s real GDP to record a growth of 11% in 2021-22 and nominal GDP by 15.4% - the highest since independence.

- Foreign Investment:

- Net Foreign Direct Investment (FDI) inflows of USD 27.5 billion during April-October, 2020 - 14.8% higher as compared to the first seven months of FY 2019-20.

- Net Foreign Portfolio Investment (FPI) Inflows recorded an all-time monthly high of 9.8 Billion Dollars in November 2020.

- Debt Sustainability and Growth:

- Growth leads to debt sustainability in the Indian context but not necessarily vice-versa.

- Debt sustainability depends on the ‘Interest Rate Growth Rate Differential’ (IRGD), i.e., the difference between the interest rate and the growth rate.

- Negative IRGD in India – not due to lower interest rates but much higher growth rates – prompts a debate on fiscal policy, especially during growth slowdowns and economic crises.

- Fiscal policy that provides an impetus to growth will lead to lower debt-to-GDP ratio.

- Given India’s growth potential, debt sustainability is unlikely to be a problem even in the worst scenarios.

- Desirable to use counter-cyclical fiscal policy to enable growth during economic downturns.

- Counter-cyclical fiscal policy refers to the steps taken by the government that go against the direction of the economic or business cycle.

- Thus, in a recession or slowdown, the government increases expenditure and reduces taxes to create a demand that can drive an economic boom.

- V-shaped Economic Recovery after Lockdown:

- Services Sector:

- About:

- The services sector accounts for over 54% of India’s Gross Value Added (GVA) and nearly four-fifths of total Foreign Direct Investments (FDI) inflow into India.

- Services sector accounts for 48% of total exports, outperforming goods exports in recent years.

- Key indicators such as Services Purchasing Managers’ Index, rail freight traffic, and port traffic, are all displaying a V-shaped recovery after a sharp decline during the lockdown.

- Start Up: The Indian start-up ecosystem has been progressing well amidst the Covid-19 pandemic, being home to 38 unicorns - adding a record number of 12 start-ups to the unicorn list last year.

- Space Sector: India’s space sector has grown exponentially in the past six decades. Space ecosystem is undergoing several policy reforms to engage private players and attract innovation and investment.

- About:

- Agriculture:

- Growth:

- The Agriculture and Allied activities clocked a growth of 3.4%.

- As per the Provisional Estimates of National Income released by Central Statistical Organization in May, 2020, the share of Agriculture and Allied Sectors in Gross Value Added (GVA) of the country at current prices is 17.8% for the year 2019-20.

- Export:

- In 2019-20, the major agricultural and allied export destinations were the USA, Saudi Arabia, Iran, Nepal and Bangladesh.

- The top agriculture and related products exported from India were marine products, basmati rice, buffalo meat, spices, non-basmati rice, cotton raw, oil meals, sugar, castor oil and tea.

- Livestock:

- The contribution of Livestock in total agriculture and allied sector GVA (at Constant Prices) has increased from 24.32% (2014-15) to 28.63% (2018-19).

- Food Processing Industries (FPI):

- During the last 5 years ending 2018-19, FPI sector has been growing at an Average Annual Growth Rate (AAGR) of around 9.99% as compared to around 3.12% in Agriculture and 8.25% in Manufacturing at 2011-12 prices.

- Farm Laws:

- It strongly defended new farm laws, saying they herald a new era of market freedom which can go a long way in improving lives of small and marginal farmers in India.

- These legislations were designed "primarily" for the benefit of "small and marginal farmers", which constitute around 85% of the total number of farmers and are the biggest sufferer of the "regressive" Agricultural Produce Market Committee (APMC) -regulated market regime.

- Growth:

- Regulatory Forbearance:

- Regulatory forbearance for banks after the Global Financial Crisis involved relaxing the norms for restructuring assets, where restructured assets were no longer required to be classified as Non-Performing Assets (NPAs henceforth) and therefore did not require the levels of provisioning that NPAs attract.

- However, the survey points out that regulatory forbearance is an emergency medicine, not staple diet and suggests :

- Instead of continuing regulatory forbearance for years, policymakers should lay out thresholds of economic recovery at which such measures will be withdrawn.

- An Asset Quality Review exercise must be conducted by banks immediately after the forbearance is withdrawn.

- Legal infrastructure for the recovery of loans needs to be strengthened de facto.

- To promote judgement amidst uncertainty, ex-post inquests must recognize the role of hindsight bias and not equate unfavourable outcomes to bad judgement or malafide intent.

- India and Innovation:

- India entered the top-50 innovating countries for the first time in 2020 since the inception of the Global Innovation Index in 2007, ranking first in Central and South Asia, and third amongst lower middle-income group economies

- India’s Gross Domestic Expenditure on Research and Development (GERD) is lowest amongst top ten economies.

- India’s aspiration must be to compete on innovation with the top ten economies.

- Process Reforms:

- The survey highlighted excessive regulation in the country.

- India over-regulates the economy resulting in regulations being ineffective even with relatively good compliance with process.

- The root cause of the problem of overregulation is an approach that attempts to account for every possible outcome. Increase in complexity of regulations, intended to reduce discretion, results in even more non-transparent discretion.

- The solution is to simplify regulations and invest in greater supervision which, by definition, implies greater discretion.

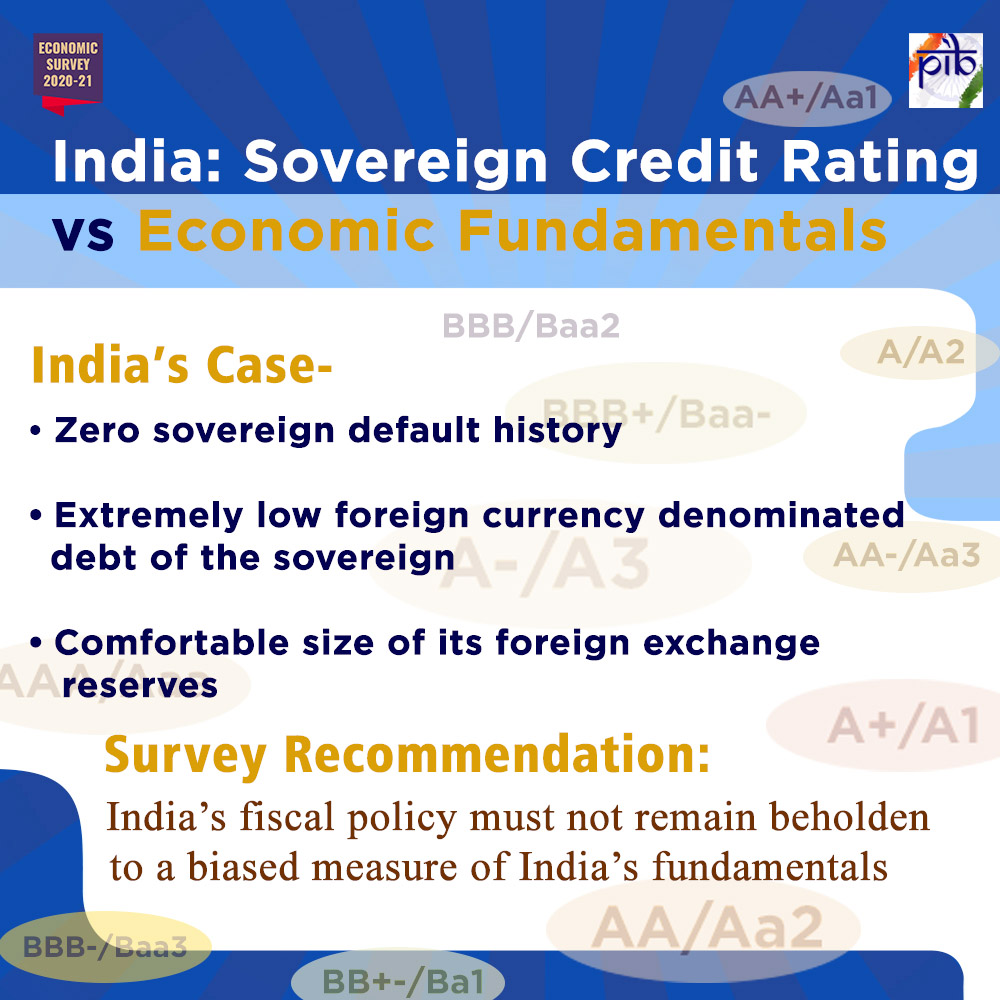

- India and Sovereign Credit Ratings:

- India's sovereign credit ratings do not reflect the economy's fundamentals and the global agencies should become more transparent and less subjective in their ratings.

- Defence Sector:

- The allocated capital budget for defence has been fully utilised since 2016-17, reversing the previous trends of surrender of funds.

- Healthcare:

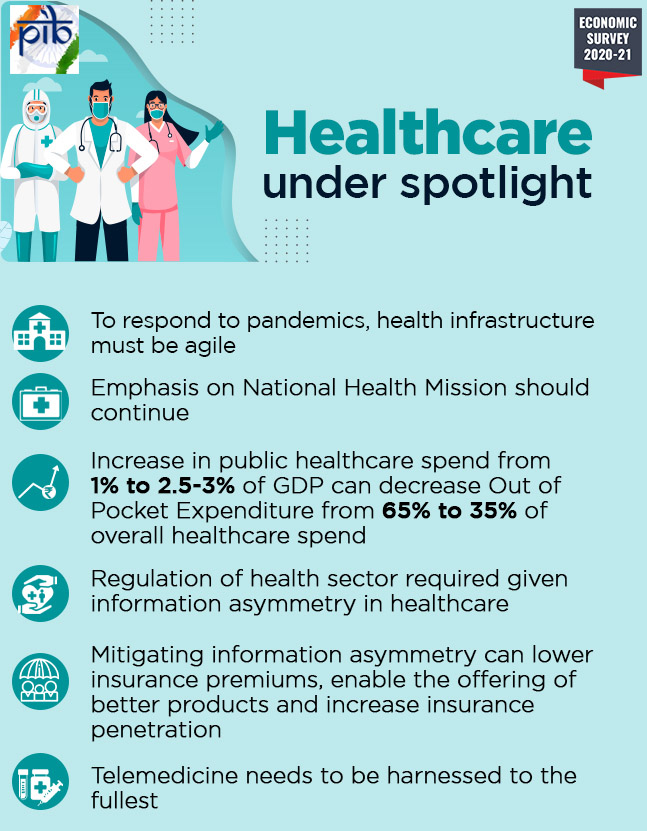

- Pradhan Mantri Jan Arogya Yojana (PM-JAY):

- PM-JAY contributed to improvement in many health outcomes in States that implemented the ambitious programme the Centre had launched more than two years ago to provide healthcare access to most vulnerable sections.

- National Health Mission (NHM):

- NHM played a critical role in mitigating inequity as the access of the poorest to pre-natal/post-natal care and institutional deliveries increased significantly.

- The scheme should be given prominence under Ayushman Bharat.

- Government Spending:

- An increase in government spending on the healthcare sector – from the current 1% to 2.5-3% of GDP – as envisaged in the National Health Policy 2017 could reduce out-of-pocket expenditures.

- Pradhan Mantri Jan Arogya Yojana (PM-JAY):

- Education:

- Literacy:

- India has attained a literacy level of almost 96% at the elementary school level.

- As per National Sample Survey (NSS), the literacy rate of persons of age 7 years and above at the All India level stood at 77.7% but the differences in literacy rate attainment among social-religious groups, as well as gender still persists.

- Female literacy remained below the national average among social groups of SC, ST, OBC, including religious groups of Hinduism and Islam.

- Rural Enrolment:

- The percentage of enrolled children from government and private schools owning a smartphone increased enormously from 36.5% in 2018 to 61.8% in 2020 in rural India.

- PM eVIDYA:

- PM eVIDYA is a comprehensive initiative to unify all efforts related to digital/online/on-air education to enable multi-mode and equitable access to education for students and teachers.

- Around 92 courses have started and 1.5 crore students are enrolled under Swayam Massive Open Online Courses (MOOCs) which are online courses relating to the National Institute of Open Schooling.

- PRAGYATA:

- PRAGYATA guidelines on digital education have been developed with a focus on online/blended/digital education for students who are presently at home due to closure of schools.

- MANODARPAN:

- The MANODARPAN initiative for psychological support has been included in Atmanirbhar Bharat Abhiyan.

- Literacy:

- Vocational Courses and Skill Development:

- Vocational courses will be introduced phase-wise in schools for classes 9 to 12 to expose students to skill development avenues, as part of the Centre's flagship skilling scheme Pradhan Mantri Kaushal Vikas Yojana 3.0.

- Merely 2.4% of India's workforce in the age group of 15-59 years have received formal vocational or technical training, while another 8.9% obtained training through informal sources.

- Out of the 8.9% workforce who received non-formal training, the largest chunk is contributed by on-the-job training (3.3%), followed by self-learning (2.5%) and hereditary sources (2.1%) and other sources (1%).

- Among those who received formal training, the most opted training course is IT-ITeS among both males and females.

- The Unified Skill Regulator- National Council for Vocational Education and Training (NCVET) was operationalized recently.

- Vocational courses will be introduced phase-wise in schools for classes 9 to 12 to expose students to skill development avenues, as part of the Centre's flagship skilling scheme Pradhan Mantri Kaushal Vikas Yojana 3.0.

- Bare Necessities:

- Bare Necessities Index (BNI) :

- Bare Necessities Index (BNI) based on the large annual household survey data can be constructed using suitable indicators and methodology at district level for all/targeted districts to assess the progress on access to bare necessities.

- The BNI summarises 26 indicators on five dimensions viz., water, sanitation, housing, micro-environment, and other facilities.

- Bare Necessities Index (BNI) based on the large annual household survey data can be constructed using suitable indicators and methodology at district level for all/targeted districts to assess the progress on access to bare necessities.

- Improvement in Bare Necessities:

- Bare necessities have improved across all States in the country in 2018 as compared to 2012.

- Increase in equity is noteworthy as the rich can access private options for public goods.

- Bare Necessities Index (BNI) :

- Sustainable Development and Climate Change:

- India has taken several proactive steps to mainstream the Sustainable Development Goals (SDGs) into the policies, schemes and programmes.

- Voluntary National Review (VNR) presented to the United Nations High-Level Political Forum (HLPF) on Sustainable Development.

- Localisation of SDGs is crucial to any strategy aimed at achieving the goals under the 2030 Agenda.

- Sustainable development remains core to the development strategy despite the unprecedented Covid-19 pandemic crisis.

- Eight National Missions under the National Action Plan on Climate Change (NAPCC) focussed on the objectives of adaptation, mitigation and preparedness on climate risks.

- Nationally Determined Contributions (NDC) states that finance is a critical enabler of climate change action.

- The International Solar Alliance (ISA) launched two new initiatives – ‘World Solar Bank’ and ‘One Sun One World One Grid Initiative’ – poised to bring about a solar energy revolution globally.

- India has taken several proactive steps to mainstream the Sustainable Development Goals (SDGs) into the policies, schemes and programmes.

- Social Infrastructure, Employment and Human Development:

- The combined (Centre and States) social sector expenditure as % of GDP has increased in 2020-21 compared to last year.

- India’s rank in Human development Index (HDI) 2019 was recorded at 131, out of a total 189 countries.

- Government’s incentive to boost employment through Aatmanirbhar Bharat Rozgar Yojana and rationalization and simplification of existing labour codes into 4 codes.

- Low level of female Labour Force Participation Rate (LFPR) in India:

- Females spending disproportionately more time on unpaid domestic and caregiving services to household members as compared to their male counterparts (Time Use Survey, 2019).

- Need to promote non-discriminatory practices at the workplace like pay and career progression, improve work incentives, including other medical and social security benefits for female workers.

- Inequality and Growth:

- Both inequality and per-capita income (growth) have similar relationships with socio-economic indicators in India, unlike in advanced economies.

- Economic growth has a greater impact on poverty alleviation than inequality.

- India must continue to focus on economic growth to lift the poor out of poverty. Redistribution in a developing economy is feasible only if the size of the economic pie grows.