Indian Economy

Union Budget 2020-21: Economy

- 03 Feb 2020

- 5 min read

Why in News

The Union Minister of Finance has presented the Budget 2020-21. Given below are the important macroeconomic indicators and proposed changes in taxation in India.

- Macroeconomic Indicators

- Nominal growth of GDP - 10% (2020-21). Nominal GDP is an assessment of economic production in an economy that includes current prices in its calculation.

- Fiscal deficit - 3.8% of GDP (2019-20), 3.5% of GDP (2020-21).

- The estimation for the FY20 was at 3.3%, thereby deviating from the target set in the fiscal path.

- The Government has made use of Section 4 of the FRBM (Fiscal Responsibility and Budget Management) Act which provides a trigger mechanism for a deviation from the estimated fiscal deficit on account of structural reforms in the economy with unanticipated fiscal implications.

- Reasons: The increase in deficit estimate is mainly on account of the shortfall in revenue collection. The government on its part has lowered its expenditure on many of the heads. For example, food subsidy in the budget estimate 2019-20 was over ₹1.84 lakh crore, which has been lowered to ₹1.08 lakh crore in the revised estimate

- Fiscal deficit, by definition, is the difference between a government's revenue receipts plus non-debt capital receipts (NDCR) and its total expenditure.

- Fiscal deficit occurs when a government collects lesser money - in terms of personal and corporate taxes, GST, market loans and NDCR (money received from sale of old assets) etc. - than it spends, on items such as central sector schemes, salaries of employees, subsidies, payments to states and so on.

- According to the Fiscal Responsibility and Budget Management Act in India, the recommended fiscal deficit should be 3% of GDP.

- Revenue deficit- 2.7% of GDP (2020-21). By definition, revenue deficit is the excess of revenue expenditure over revenue receipts.

- Size of Economy: India is now the fifth largest economy of the world in terms of GDP.

- Growth and Inflation: 7.4% average growth clocked during 2014-19 with inflation averaging around 4.5%.

- Poverty alleviation: 271 million people raised out of poverty during 2006-16.

- FDI: India’s Foreign Direct Investment elevated to US$ 284 billion during 2014-19 from US$ 190 billion during 2009-14.

- Central Government debt reduced to 48.7% of GDP (March 2019) from 52.2% (March 2014).

- Two cross-cutting developments:

- Proliferation of technologies (Analytics, Machine Learning, robotics, Bioinformatics and Artificial Intelligence).

- Highest ever number of people in the productive age group (15-65 years) in India.

- 15th Finance Commission has cut state share of central taxes to the states by one percentage point to 41%.

- This is due to the newly formed Union Territories of Jammu and Kashmir, and Ladakh, which will get funds from the Centre’s share, which means devolution will be for 28 states compared to 29 earlier.

- 42% was recommended by the 14th Finance Commission

Changes in Taxation

- Dividend Distribution Tax (DDT) removed. Instead of companies paying DDT on the dividend they give out, the dividend income will now be added to the taxable income of the recipient, and taxed at the applicable rate.

- Income Tax

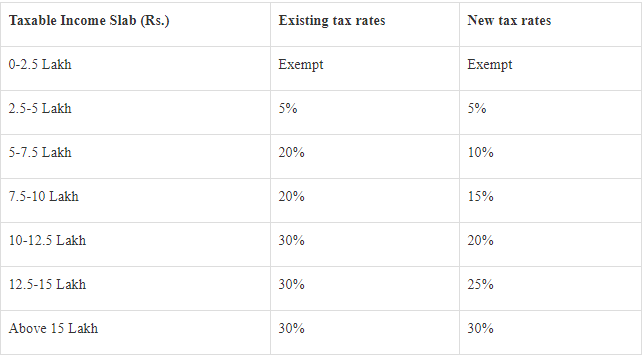

- New tax slabs and lower income tax rates. Around 70 of the existing exemptions and deductions to be removed in the new simplified regime.

- New tax regime to be optional - an individual may continue to pay tax as per the old regime and avail deductions and exemptions.

- Corporate Tax: Concessional corporate tax rate of 15% to new domestic companies in manufacturing and power sector.

- 5% health cess to be imposed on imports of medical equipment given these are made significantly in India.

- Issuance of Unique Registration Number to all charity institutions for easy tax compliance.

- ‘Vivad Se Vishwas’ scheme, with a deadline of 30th June, 2020, to reduce litigations in direct taxes.

- 100% tax exemption to the interest, dividend and capital gains income on investment made in infrastructure and priority sectors before 31st March, 2024 with a minimum lock-in period of 3 years by the Sovereign Wealth Fund of foreign governments.