Indian Economy

Measures on Atmanirbhar Bharat 3.0

- 13 Nov 2020

- 10 min read

Why in News

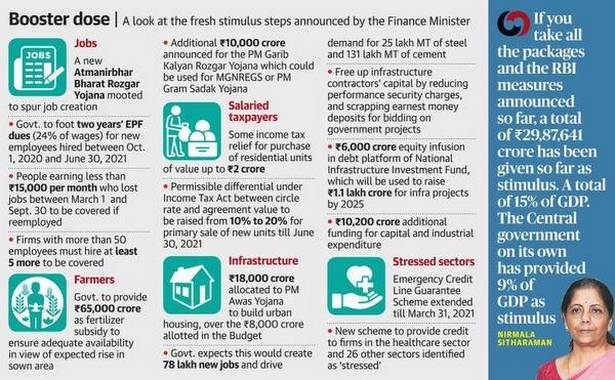

The government has announced a fresh set of measures, worth around Rs. 1.2 lakh crore, to boost job creation, provide liquidity support to stressed sectors and encourage economic activity in housing and infrastructure areas.

- An additional outlay of Rs. 65,000 crore is being provided as a fertiliser subsidy to support increasing demand on the back of a good monsoon and sharp increase in the crop-sown area.

- The measures have been announced under Aatmanirbhar Bharat 3.0. The recent announcement of Expansion of Production Linked Incentives (PLI) Scheme to 10 more sectors is also a part of Atmanirbhar Bharat 3.0.

Key Points

- Atmanirbhar Bharat Rozgar Yojana:

- Aim: It is aimed at incentivising the creation of new employment opportunities during the Covid-19 economic recovery phase.

- Government Contribution: It will provide subsidy for provident fund contribution for adding new employees to establishments registered with the Employees’ Provident Fund Organisation (EPFO).

- The organisations of up to 1000 employees would receive employee’s contribution (12% of wages) & employer’s contributions (12% of wages), totalling 24% of wages, for two years.

- Employers with over 1,000 employees will get employees’ contribution of 12%, for two years.

- The subsidy amount under the scheme will be credited upfront only in Aadhaar-seeded EPFO accounts (UAN) of new employees.

- Eligibility Criteria for Establishments: Establishments registered with EPFO will be eligible for the benefits if they add new employees compared to the reference base of employees as in September 2020.

- Establishments, with up to 50 employees, would have to add a minimum of two new employees.

- The organisations, with more than 50 employees, would have to add at least five employees.

- Target Beneficiaries:

- Any new employee joining employment in EPFO registered establishments on monthly wages less than Rs. 15,000.

- Those who left their job between 1st March to 30th September and are employed on or after 1st October.

- Time Period: The scheme will be effective from 1st October, 2020 and operational till 30th June 2021.

- ECLGS 2.0:

- Emergency Credit Line Guarantee Scheme (ECLGS) 2.0 is being launched for the Healthcare sector and 26 stressed sectors (as identified by the Kamath Committee) with credit outstanding of above Rs. 50 crore and up to Rs. 500 crore as on 29th February 2020 stressed due to Covid-19, among other criteria.

- Entities will get additional credit up to 20% of outstanding credit with a tenor of five years, including a 1 year moratorium on principal repayment.

- This scheme will be available till 31st March, 2021.

- Additional Outlay for PM Awas Yojana - Urban:

- A sum of Rs. 18000 crore is being provided for PMAY- Urban over and above Rs. 8000 Crore already allocated this year.

- This will help ground 12 Lakh houses and complete 18 Lakh houses, create additional 78 Lakh jobs and improve production and sale of steel and cement, resulting in a multiplier effect on the economy.

- PMAY - Urban Mission was launched in 2015 with an intention to provide housing for all in urban areas by year 2022.

- Relaxation of Earnest Deposit Money & Performance Security on Government Tenders:

- Performance security deposit on contracts has been reduced to 3% from around 5-10%, while Earnest Deposit Money (EMD) will not be required.

- The relaxations provided till 31st December, 2021 will be a major relief to the construction sector as it will free up the capital of the contractors and will enhance their financial ability to carry out the project.

- Security Deposit: The contractor is required to deposit with the owner a sum stated as a percentage of the cost of the work in order to safeguard the interests of the owner in the event of improper performance of the contract.

- Earnest money: It is assurance or guarantee in the form of cash on the part of the contractor to keep open the offer for consideration and to confirm his intentions to take up the work accepted in his favour for execution as per terms and conditions in the tender.

- Income Tax relief for Developers & Home Buyers:

- Developers have been allowed to sell their housing units at 20% lower than the circle rate by increasing the permissible differential from 10% to 20% (Section 43 CA of IT Act).

- Circle rates, also known as ready-reckoner rates, are official area-wise prices set by state governments and are considered by the Income-Tax Department to assume purchase prices.

- The government has allowed a differential of 20% between actual prices and circle rates, up from 10% earlier.

- The benefit will, however, be available only on primary sale of residential units with price value up to Rs. 2 crore until 30th June, 2021.

- Developers have been allowed to sell their housing units at 20% lower than the circle rate by increasing the permissible differential from 10% to 20% (Section 43 CA of IT Act).

- Infra Debt Financing:

- Government will make Rs. 6,000 Crore equity investment in debt platform of National Investment and Infrastructure Fund (NIIF), which will help NIIF provide a debt of Rs. 1.1 Lakh Crore for infrastructure projects by 2025.

- Boost for Rural Employment:

- Additional outlay of Rs. 10,000 Crore is being provided for PM Garib Kalyan Rozgar Yojana to provide rural employment. This will help accelerate the rural economy.

- Boost for Project Exports:

- Rs. 3,000 Crore boost is being provided to EXIM Bank for promoting project exports under Indian Development and Economic Assistance Scheme (IDEAS Scheme).

- Under the IDEAS Scheme, most recipient countries get Indian firms executing projects such as railway lines, transmission lines and so on.

- Capital and Industrial Stimulus:

- Rs. 10,200 Crore additional budget stimulus is being provided for capital and industrial expenditure on domestic defence equipment, industrial infrastructure and green energy.

- R&D grant for Covid Vaccine:

- Rs. 900 Crore is being provided to the Department of Biotechnology for Research and Development of Indian Covid Vaccine.

Analysis

- The latest announcement reinforces the ‘fiscal conservatism’ ideology of the government, i.e. rather than large cash transfers, the growth philosophy centres around creating an ecosystem that aids domestic demand, incentivises companies to generate jobs and boost production, and simultaneously extends benefits to those in severe distress, be it firms or individuals.

- The measures follow a multi-pronged approach, aimed at generating employment and encouraging formalisation of the workforce in urban areas, expanding the scope of distress employment provided in rural areas, easing the flow of credit to stressed parts of the economy, expanding the incentives offered to boost domestic manufacturing, and kickstarting the real estate cycle, among others.

- Put together, all Covid-19 relief measures would increase the Centre’s actual fiscal outgo by under 2% of GDP in 2020-21.

- As per the government, the total stimulus announced by the Government and Reserve Bank of India (RBI) till date (including Atmanirbhar 1.0 and Atmanirbhar 2.0), to help the nation tide over the Covid-19 pandemic, works out to Rs. 29.87 lakh crore, which is 15% of national GDP.

- Out of this, the stimulus worth 9% of GDP has been provided by the government.

Way Forward

- The government’s announcements focus on job creation, easing credit flow, but actual spending remains limited. More support is needed.

- The finance ministry’s view of the state of the economy suggests that it believes a strong and durable recovery is taking hold. This is partly in line with the results of a study carried out by economists at the RBI, who now expect the economy to contract at a slower pace in the second quarter than what was expected before.

- As the RBI noted in its ‘State of the Economy’ report, while it is possible that the third quarter (October-December) may not see a contraction in GDP growth, there are significant risks — relentless pressure of inflation, poor global growth following a second wave of Covid-19, and intensifying stress among households and firms both. Thus, the government needs to take steps accordingly.