Rapid Fire

Gold’s Rising Share in India’s Forex Reserve

- 22 Apr 2025

- 2 min read

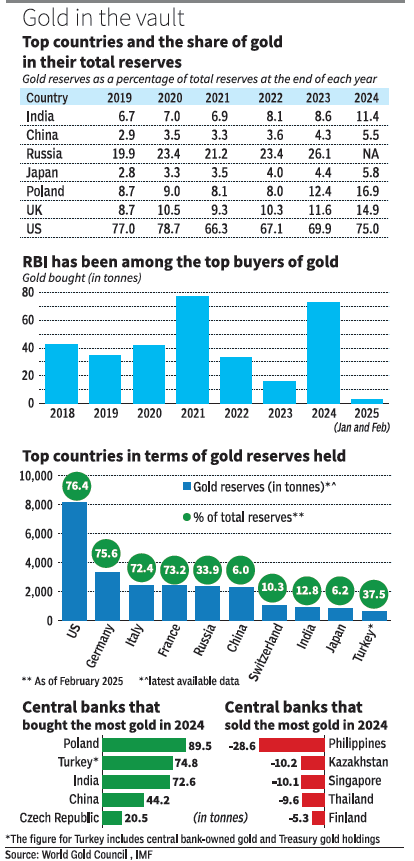

As per the World Gold Council (WGC), India's gold share in foreign exchange reserves has nearly doubled from 6.7% in 2019 to 12% by February 2025.

- India’s forex reserves rose to USD 677.84 billion in April 2025, led by an increase of USD 892 million in FCA and a USD 638 million rise in gold reserves, while SDRs fell by USD 6 million.

Foreign Exchange Reserves (Forex Reserves):

- About: Forex are reserve assets held by a central bank in foreign currencies. It may include foreign currencies, bonds, treasury bills and other government securities, typically denominated in US dollars.

- They are an important component of the Balance of Payment (BoP)

- The RBI is the custodian of India's foreign exchange reserves, deriving its authority from the provisions of the RBI Act, 1934.

- Purpose: It helps meet external payment needs and stabilize the national currency.

- They also serve as a buffer during global financial shocks and ensure confidence in monetary policies.

- Components of India’s Forex Reserves:

- Foreign Currency Assets (FCA) (largest contributor)

- Gold reserves (second largest contributor)

- Special Drawing Rights

- It is not a currency but its value is determined by a basket of 5 major currencies: the US dollar, euro, Chinese renminbi, Japanese yen, and British pound sterling.

- Reserve Tranche Position (RTP) with the IMF

- RTP is a country's quota-based access to IMF resources, available for borrowing without strict conditions, used for BoPs or financial stability.

| Read More: Rise in Forex Reserves |

-min.jpg)