Functionality and Essentially Test for ITC | 05 Oct 2024

For Prelims: Supreme Court, Input Tax Credit (ITC), Goods and Services Tax (GST), Cascading Effect of Taxes, Excise Duty, VAT.

For Mains: Functioning of Input Tax Credit (ITC) mechanism under the GST system and its implications.

Why in News?

Recently, the Supreme Court laid down functionality and essentially test for Input Tax Credit (ITC) eligibility under the Goods and Services Tax (GST) regime.

- The verdict was delivered in the Chief Commissioner of Central Goods and Service Tax & Ors. Vs Safari Retreats Case, 2024.

What are the Key Highlights of the Supreme Court Ruling on ITC?

- ITC for Real Estate Sector: The Supreme Court (SC) ruled that the real estate sector can claim ITC on construction costs for commercial buildings used for renting or leasing purposes under the functionality and essentially test.

- Earlier ITC was not allowed on such immovable property construction.

- Clarification on 'Plant and Machinery' Category: The court clarified that if the construction of a building is essential for providing services like leasing or renting, the building may fall under the category of 'plant and machinery.'

- This is based on Section 17(5)(d) of the Central Goods and Services Tax (CGST) Act, 2017 which permits ITC claims on plant and machinery used in the business of supplying services.

- The court read down the scope of Sections 17(5)(c) and (d) of the CGST Act, 2017 which prohibit ITC claims for construction materials used for immovable property, except for plant or machinery.

- Case-Specific Determination: The SC emphasised that determining whether a building like a mall or warehouse qualifies as ‘plant’ under Section 17(5)(d) should be assessed on a case-by-case basis.

- The business nature and the role of the building in the registered person’s business are key factors in this determination.

What are Functionality and Essentially Tests?

- Functionality Test: It will evaluate whether the building plays a role in the supply of services, akin to the function of plant and machinery in a factory.

- Essentially Test: The SC held that procurement of goods or services must be directly essential to business operations.

- It means that only those goods and services that are directly needed for constructing or developing property can be claimed for tax benefits or input tax credit (ITC). E.g., cement, steel etc.

What is Goods and Services Tax?

- About GST: GST is a value-added tax system (ad valorem tax) that is levied on the supply of goods and services in India.

- It is a comprehensive indirect tax implemented in India on 1st July 2017, via the 101st Constitution Amendment Act, 2016, with the vision of ‘One Nation, One Tax.’

- Tax Slabs: The primary GST slabs for regular taxpayers are currently 0% (nil-rated), 5%, 12%, 18%, and 28%.

- GST Council: The GST Council is a constitutional body that recommends matters concerning GST implementation in India. According to Article 279A(1) of the Constitution, the President established the GST Council.

What is Input Tax Credit Under GST?

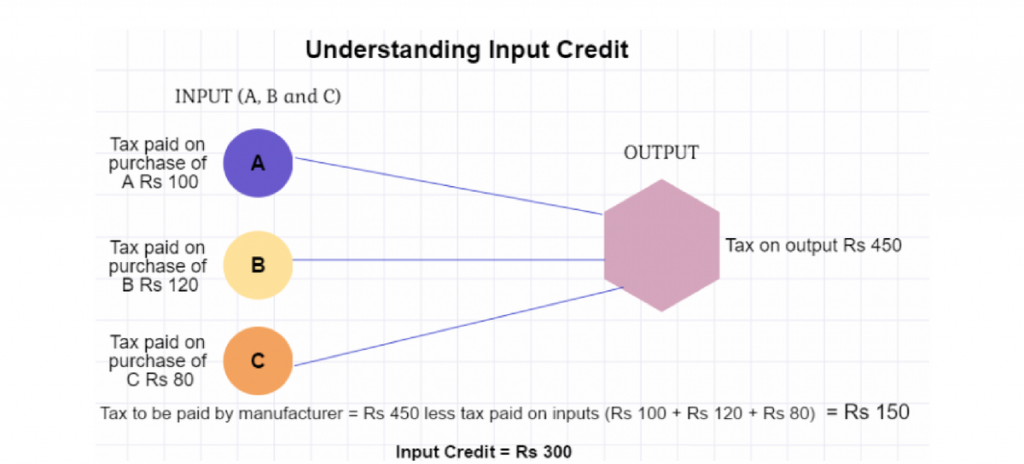

- About ITC: ITC is one of the foundational elements of the GST system that allows businesses to claim credit for taxes paid on inputs used in their business.

- It implies at the time of paying tax on output, one can reduce the tax he has already paid on inputs and pay the balance amount.

- It enables an uninterrupted and seamless credit flow across the supply chain.

- It eliminates the cascading effect of taxes by imposing tax only on the value addition to the input.

- ITC Working Mechanism: When someone buys a product/service, he pays taxes on the purchase and on selling, he collects the tax.

- He adjusts the taxes paid at the time of purchase with the amount of output tax (tax on sales) and balance liability of tax (tax on sales minus tax on purchase) has to be paid to the government.

- Avoiding Cascading of Taxes using ITC: Cascading of taxes occurs when a tax is levied on a product, and subsequent taxes are imposed on the taxed value of that product, thus leading to multiple layers of taxation.

- In the pre-GST tax system, taxes levied by the Central Government (like central excise duty) could not be used to offset taxes levied by the State Governments (like VAT). VAT was levied not just on the value of the product but also on the tax (excise duty) included in the price.

- Since GST subsumes most central and state indirect taxes into a single levy, the tax paid at one stage can be used to offset the tax payable at subsequent stages. This ensures that tax is only paid on the value added at each stage, not on the entire cost, including previous taxes.

- Impact of ITC: The introduction of ITC under GST has led to greater transparency and efficiency in the supply chain.

- Since the tax paid at each stage can be claimed as a credit, businesses are incentivised to ensure proper documentation and compliance.

- The ITC mechanism reduces the overall tax burden on businesses, making goods and services more competitively priced in the market.

What is Reversal of Input Tax Credit?

- About Reversal of ITC: Reversal of ITC means that the input tax credit one had claimed earlier is cancelled, and the amount is added to his tax liability.

- Conditions for ITC Reversal:

- Non-payment Of invoices within 180 days: ITC will be reversed for invoices that remain unpaid beyond 180 days from the date of issue.

- Credit note issued to ISD by seller: If a seller issues a credit note to the Input Service Distributor (ISD), it means that the amount of input tax credit (ITC) previously claimed will be reduced.

- Partially used business inputs: In cases where inputs are used for both business and non-business (personal) purposes, the portion of ITC used for personal purposes must be reversed proportionately.

Conclusion

The Supreme Court's ruling on ITC introduces the functionality and essentiality tests, offering clarity for businesses in the real estate sector on claiming ITC for construction used in renting and leasing. This decision promotes transparency and efficiency, while reducing the overall tax burden, fostering investment and growth in commercial real estate.

|

Drishti Mains Question: How does the Input Tax Credit (ITC) mechanism under the GST system mitigate the cascading effect of taxes? Illustrate with examples to support your explanation. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Consider the following items: (2018)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Good and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Q.What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’? (2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

Q. Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? (2020)

Q. Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (2019)

Q. Explain the salient features of the Constitution (One Hundred and First Amendment) Act, 2016. Do you think it is efficacious enough “to remove cascading effect of taxes and provide for the common national market for goods and services”? (2017)

Q. Discuss the rationale for introducing the Goods and Services Tax (GST) in India. Bring out critically the reasons for the delay in rollout for its regime. (2013)