Farm Loan Waivers in India | 30 May 2024

For Prelims: Farm Loan Waiver, State Bank of India (SBI), Comptroller and Auditor General, NABARD, Reserve Bank of India, Inflation, Minimum support prices, Kisan Credit Card scheme

For Mains: Government Policies & Interventions, Growth & Development, Farm Loan Waivers and Related Issues.

Why in News?

Farm loan waivers have become a staple promise in Indian elections, particularly in agricultural states.

- These debt relief schemes, though providing temporary respite, fail to address the root causes of agrarian distress.

What are Farm Loan Waivers?

- About: Farm loan waivers are financial relief measures implemented by governments, where certain agricultural loans are forgiven, relieving farmers from the burden of repayment to reduce the distress among farmers.

- These waivers are often announced during election campaigns as promises to garner support from the farming community.

- Farm loan waivers involve the government absorbing the outstanding debt of farmers by providing a budgetary allocation to banks and financial institutions.

- Farmers face numerous challenges, including disputed land holdings, depleted groundwater reserves, poor soil quality, rising input costs, and low crop productivity.

- Due to a lack of assured remuneration for their produce, farmers often borrow funds from banks or private lenders at high-interest rates.

- Loan waivers provide temporary relief to indebted farmers, but they are not a long-term solution to agrarian distress.

- Implementation of Waivers:

- In times of crop failure or natural calamities, governments may waive penal interest, reschedule loans, or completely waive off outstanding loans.

- The government's budget absorbs the financial liability, not the banks.

- The waivers can be selective, based on factors like loan type (short-term, medium-term, long-term), categories of farmers, or loan sources.

Farm Loans: Scheduled banks offer loans to individual farmers or groups of farmers for agricultural or allied activities such as dairy, fishery, animal husbandry, poultry, bee-keeping and sericulture.

- Short-term (up to 18 months) loans are offered for raising crops during two seasons – Kharif and Rabi, while medium (more than 18 months up to 5 years) and long-term (beyond 5 years) loans are offered for purchasing agricultural machinery, irrigation and other developmental activities.

- Loans are also available for pre-harvest and post-harvest activities such as weeding, harvesting, sorting, and transporting farm produce.

- Most loans have a repayment period in installments up to five years, and interest rates vary depending on the nature of loans and the issuing banks.

Historical Instances of Farm Loan Waivers

- The first pan-India farm loan waiver was introduced in the 1990-91 through the Agricultural and Rural Debt Relief Scheme (ARDRS) providing relief to farmers for up to Rs 10,000 on select loans.

- The second major waiver was the Agricultural Debt Waiver and Debt Relief Scheme (ADWDRS) announced in 2008.

- The government allocated Rs 60,000 crores for farmer relief. Small farmers with less than 2 hectares of land had their entire eligible amount waived off.

- Other farmers with more than 2 hectares of land were offered a one-time settlement (OTS) of 25% of the eligible amount as a rebate, if they pay the remaining 75%.

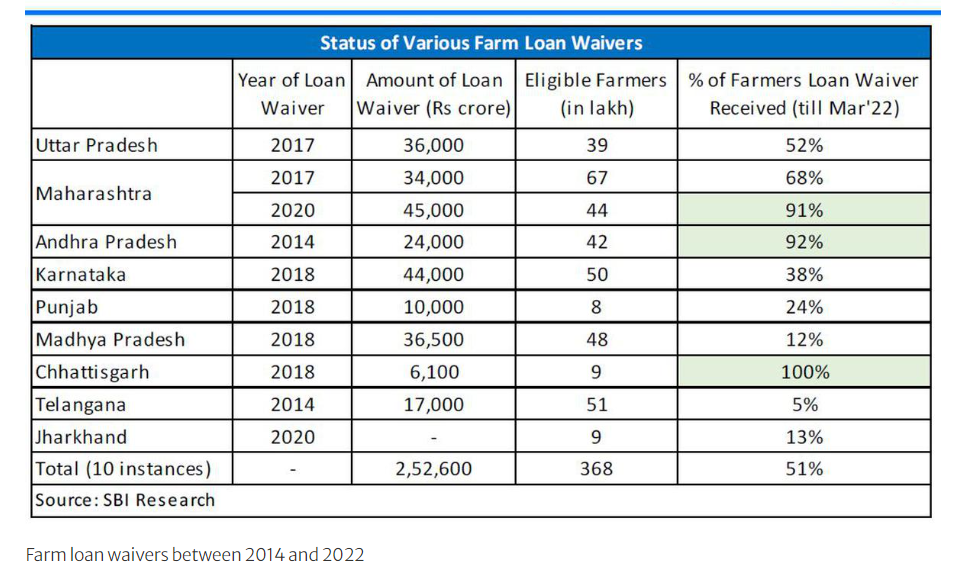

- According to a study by State Bank of India (SBI), since 2014, various state governments, including Andhra Pradesh, Telangana, Uttar Pradesh, Maharashtra, Karnataka, Punjab, Madhya Pradesh, Chhattisgarh, Jharkhand, and Tamil Nadu, have announced loan waivers amounting to Rs 2.52 lakh crores.

How Do Farm Loan Waivers Affect Farmers and Governments?

- Effects on Farmers:

- Waivers provide short-term relief to farmers struggling with debt, especially in the wake of poor harvests due to natural calamities.

- Critics argue that waivers can lead to a culture of non-repayment, expecting future waivers, which can undermine the credit discipline among the farming community.

- Post-waiver periods often see a tightening of credit as banks become wary of lending, potentially affecting the farmers’ ability to invest in the next crop cycle.

- A report by the Comptroller and Auditor General (CAG) found that the 2008 scheme benefitted several ineligible farmers while leaving out many deserving small and marginal farmers.

- Implementation Challenges: A recent SBI study in 2022 revealed that only half of the beneficiaries of the nine farm loan waivers announced by State governments since 2014 have actually received write-offs.

- Maharashtra had a relatively high implementation rate. In contrast, Telangana had the poorest implementation.

- Effects on Governments:

- Negative Impacts:

- The most immediate impact is the strain on government finances. Waiving loans means forgoing a significant amount of revenue that could be used for other social programs or infrastructure development.

- Large-scale loan waivers can increase government borrowing, leading to higher interest rates and inflation, undermining economic stability.

- Additionally, waivers often fail to tackle core agricultural issues like low crop prices and inadequate infrastructure, offering only short-term relief.

- Positive Impacts:

- Farm loan waivers can redirect funds from debt repayment to other areas. This allows farmers to reinvest in agriculture by purchasing better inputs to increase productivity, and diversify into other agricultural activities like poultry, dairy, or horticulture to generate additional income.

- Governments that implement loan waivers can gain political capital among the large farming population. A NABARD study from 1987 to 2020 found that out of 21 State governments that announced waivers before State polls, only four lost.

- Negative Impacts:

What are the Alternatives to Farm Loan Waivers?

- Increased Public Investment in Agriculture: Allocate a higher share of budgetary resources towards agricultural development as a proportion of total expenditure or GDP, which has been falling each year. Focus on irrigation, electricity, storage, and transportation.

- Ensure easy access to quality, affordable agricultural inputs like seeds, fertilizers, and pesticides. Strengthen the supply chain and distribution for these inputs.

- Enhance investment in agricultural research to develop drought-resistant and high-yielding crop varieties, improve farming techniques, and promote sustainable agriculture.

- Strengthen and expand agricultural extension services to disseminate modern farming practices, new technologies, and research findings to farmers, especially in remote areas.

- Incentivize Crop Diversification: Farmers focus mainly on crops like wheat and rice due to government minimum support prices (MSPs) and procurement assurance.

- Expanding price support and procurement to include oilseeds, pulses, fruits, and vegetables will incentivize crop diversification.

- Implementing supportive policies and promoting water-efficient crops suited to local conditions will enhance sustainability.

- For example: Punjab is facing severe depletion of groundwater reserves and soil degradation due to overuse of urea. The State’s farmers primarily grow wheat and rice, as these are the only viable crops due to government procurement.

- Direct Income Support Schemes: Implement direct income support schemes like PM-KISAN and Kisan Credit Card scheme as alternatives to loan waivers, ensuring efficient fund disbursement via direct benefit transfers (DBT) and Aadhaar-based identification.

- Market Reforms and Access: Improving the functioning of Agricultural Produce Marketing Committees (APMCs) can reduce exploitation by middlemen and ensure farmers get a fair share of the consumer rupee.

- Encouraging wider adoption of the Electronic National Agriculture Market (e-NAM) platform can facilitate online trading and connect farmers directly to consumers, eliminating unnecessary intermediaries.

- Farmer Producer Organizations (FPOs): Farmers forming cooperative societies can benefit from bulk buying seeds, fertilizers, and equipment, reducing costs and getting better deals.

- They can also collaborate on marketing and selling their produce to fetch fairer prices.

- Risk Mitigation Strategies: Offering affordable and accessible crop insurance schemes can protect farmers from financial losses due to natural calamities or unforeseen events.

- Crop insurance based on weather parameters helps mitigate risks from unpredictable weather patterns.

|

Drishti Mains Question: Q. Assess the efficacy of farm loan waivers in addressing long-term agrarian distress. Q. Analyze the impact of recurring farm loan waivers on the financial health of the Governments and the overall economy. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Q1. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes? (2020)

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Post-harvest expenses

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Mains

Q. Given the vulnerability of Indian agriculture to vagaries of nature, discuss the need for crop insurance and bring out the salient features of the Pradhan Mantri Fasal Bima Yojana (PMFBY). (2016)