Budgetary Dependence of CPSEs | 08 Mar 2025

For Prelims: Central Public Sector Enterprises, Capital expenditure, National Highways Authority of India, Foreign exchange reserves

For Mains: Role of CPSEs in Economic Development, Public Sector Enterprises: Issues and Challenges

Why in News?

Concerns arise as Central Public Sector Enterprises (CPSEs), shift their capital expenditure (capex) strategy, relying more on budgetary support than self-financing or private investment.

- This shift has sparked debate on the long-term financial sustainability and autonomy of CPSEs.

What are the Concerns Regarding CPSEs?

- Overdependence on Budgetary Support: CPSEs are increasingly relying on budgetary support (equity and loans from the government) rather than their own Internal and Extra Budgetary Resources (IEBR).

- Budgetary support for CPSEs has risen by over 150% in five years, from Rs 2.1 lakh crore in FY20 to Rs 5.48 lakh crore in FY25 (Revised Estimate).

- IEBR, which CPSEs use to finance their own capex, has declined significantly from Rs 6.42 lakh crore in FY20 to Rs 3.63 lakh crore in FY23 and estimated at Rs 3.82 lakh crore in FY25.

- The decline in IEBR restricts CPSEs’ financial flexibility and forces greater dependence on government funding.

- Reduced Private Sector Participation: CPSEs' reliance on budgetary support has deterred private investment.

- National Highways Authority of India (NHAI) was expected to raise 38% of its funding from private capital, but its IEBR fell to nil in FY23-FY24 due to rising debt (Rs 3.48 lakh crore in 2022) and policy instability, discouraging private investment.

- High debt limits CPSEs' ability to raise capital independently and weakens their financial health.

- Policy Concerns: The Standing Committee on Transport (FY22) noted that high budgetary support alone may not meet CPSE investment needs, urging private sector engagement.

- If CPSEs continue relying on government support, it could strain fiscal resources, reducing funds available for social and developmental programs.

- Pay High Dividends: The government's pressure on CPSEs to prioritize dividend payments over reinvestment limits their ability to expand, modernize, and make independent long-term growth decisions.

- Limited Financial Autonomy: CPSEs, unlike private firms, lack the flexibility to respond to market changes, leading to slow decision-making.

- Past mergers and acquisitions (e.g., acquisition of Hindustan Petroleum Corporation Limited (HPCL) by Oil and Natural Gas Corporation (ONGC)) reduced CPSE cash reserves, further restricting capex capabilities.

What are the Key Facts About CPSEs?

- About: CPSEs are companies where the Central Government or other CPSEs hold at least 51% stake.

- The Department of Public Enterprises (DPE) oversees CPSEs' performance, finance, and policies under various ministries.

- Post-independence, India's socialist model led to CPSEs in heavy industries, banking, oil & gas, steel, and power. The 1991 economic reforms ushered in corporatization, heightened competition, and a sharper focus on profitability and efficiency in CPSEs.

- Significance: CPSEs play a crucial role in India’s economic development, infrastructure creation, employment generation, and industrial growth.

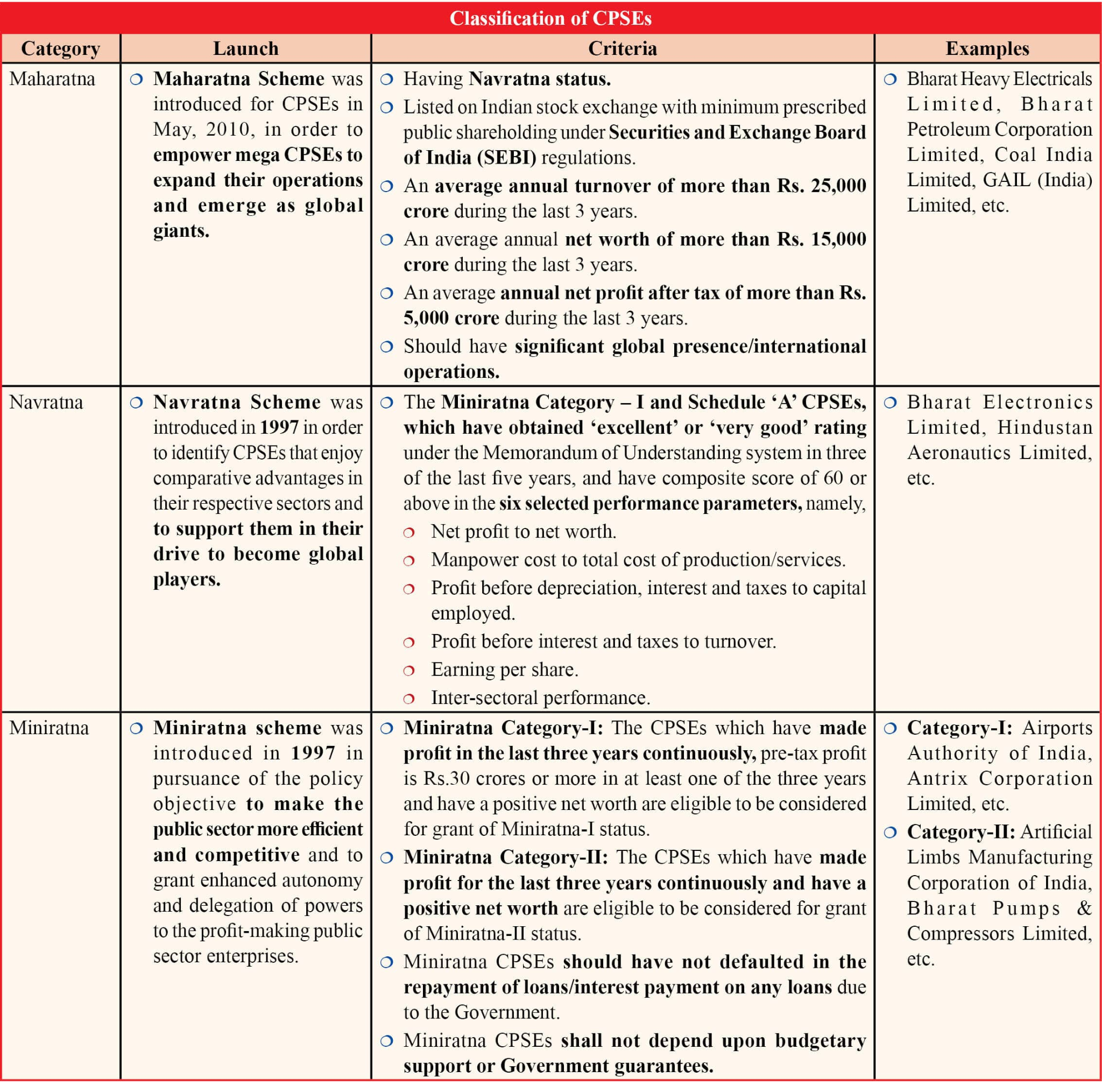

- Classification: CPSEs are categorized into Miniratna, Navratna, and Maharatna based on size, financial performance, and strategic importance.

- In February 2025, Indian Railway Catering and Tourism Corporation (IRCTC) and Indian Railway Finance Corporation (IRFC) as the country’s 25th and 26th Navratna companies respectively.

- Current Status of CPSEs: According to the Public Enterprises Survey 2023-24, as of March 2024, India has 448 CPSEs (only 272 operating in FY24).

- Financial Performance of CPSEs: Gross revenue of the operating CPSEs declined by 4.7% to Rs 36.08 lakh crore in FY24.

- Contributions to the Economy: CPSEs contributed Rs 4.85 lakh crore in FY 2023-24 to the Contribution to Central Exchequer (via taxes, duties, and dividends), marking a 5.96% increase from Rs 4.58 lakh crore in FY 2022-23.

- In FY 2023-24, all CSR eligible CPSEs spent around 4,900 crore on CSR activities, reflecting a 19.08% increase from FY 2022-23.

- CPSEs earned Rs 1.43 lakh crore in foreign exchange reserves in FY 2023-24, contributing to India’s trade balance and global business engagement.

Note: Other types of public enterprises include Public Sector Banks (PSBs), where the Central/State Government or other PSBs hold at least 51%, and State Level Public Enterprises (SLPEs), where the State Government or other SLPEs hold at least 51%.

What Measures Can Address CPSEs’ Concerns?

- Disinvestment: Under Department of Investment and Public Asset Management (DIPAM) and New Public Sector Enterprise Policy, 2021 non-strategic CPSEs can be prioritized for privatization to attract private investment and reduce the fiscal burden, while strategic ones are retained.

- Implement policy reforms to reduce regulatory bottlenecks and financial risks for private investors.

- Raise Capital Independently: Encourage CPSEs to revive IEBR financing through bonds, external commercial borrowings (ECBs), and partnerships with private players and reduce their dependence on budgetary support.

- Digital Transformation: CPSEs lag behind private companies in digital adoption, impacting operational efficiency. Integrating advanced digital infrastructure and automation in sectors like railways, power, and telecom can reduce operational costs.

- Limiting High Dividend Payout: As recommended by the 15th Finance Commission (2020-21), CPSEs should balance their dividend payments with reinvestment in infrastructure expansion.

- CPSE Performance Reviews: The 2005 Sengupta Committee recommended limiting CPSE performance reviews to twice a year for better efficiency.

|

Drishti Mains Question: Critically evaluate the financial health of CPSEs with a focus on their rising debt burden. What steps should be taken to ensure fiscal sustainability? |