International Relations

BRICS Nations Explore Alternative Currencies

- 05 Dec 2024

- 12 min read

For Prelims: 16th BRICS summit, Global South, SWIFT Network, Central Bank Digital Currency, Unified Payments Interface, Reserve Bank of India, India-UAE Local Currency Settlement System

For Mains: Impact of de-dollarization on global trade and finance, Internationalization of Indian Currency, Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

Why in News?

At the 16th BRICS summit in October 2024, BRICS countries discussed increasing the use of local currencies in trade or to create a new BRICS currency, to reduce reliance on the US dollar.

- In response, US President-elect Donald Trump stated that BRICS nations could face 100% import tariffs if they support a currency to replace the US dollar as the global reserve currency.

- India reaffirmed its commitment to strong economic ties with the US, emphasizing no intention to weaken the US dollar.

Why are BRICS Nations Exploring Alternative Currencies?

- Reducing Transaction Costs: Trading in local currencies eliminates the need for intermediary foreign currencies, which can lower transaction costs and make trade more efficient between BRICS countries.

- Dominance of the Dollar: The US dollar currently dominates over 90% of global trade and is central to international reserves. Relying heavily on the US dollar means that countries are significantly affected by US monetary policies.

- This can lead to economic instability in their own economies, prompting them to seek more control by using their own or other currencies.

- Many BRICS countries, particularly from the Global South, struggle to access major currencies like the dollar, hindering their ability to import goods, repay debts, and trade internationally.

- Using local currencies can bypass these challenges, fostering growth in local markets and boosting trade within the bloc.

- Political Motivations: One of the primary reasons for exploring local currencies is to escape the influence of financial sanctions by the US.

- For example, the US blocked Russia and Iran from the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network, a vital system for international financial transactions, which left these countries searching for alternatives to maintain trade.

- Avoiding the reliance on the US dollar also grants these countries more sovereignty in global trade and reduces vulnerability to external economic pressures.

- Geopolitical Reasons: Nations like Brazil, Russia are seeking greater autonomy from US influence by promoting currencies like the yuan and ruble, or even considering a unified BRICS currency, to reduce vulnerabilities tied to dollar dependency.

- As emerging economies like China grow, they are becoming major trading partners for many countries. This shift encourages the use of alternative currencies for trade settlements.

Trade in Local Currencies

- China’s Approach: China has promoted the use of its currency through bilateral currency swap agreements as seen in China’s trade with Ethiopia.

- A bilateral currency swap agreement is a financial contract between two central banks to exchange a specific amount of one currency for the same amount of another currency.

- China's barter trade model bypasses traditional currencies by exchanging goods with African countries for local currencies.

- These currencies are then used to buy goods from those countries, which are exported back to China and converted into renminbi, supporting its currency internationalization efforts.

- Southern Africa: The currency of South Africa (South African Rand) is essential for cross-border trade in the Southern African Customs Union, where Namibia, Botswana, Lesotho, and Eswatini use it alongside their own currencies, promoting economic integration and reducing reliance on the US dollar or euro.

- India-Russia: In response to US sanctions, India and Russia have been trading in their local currencies (rupee and rouble), with 90% of bilateral trade now conducted in these currencies or alternate currencies.

What are the Potential Risks of Moving Away from the US Dollar?

- Chinese Domination: Reducing reliance on the US dollar raises concerns about increasing Chinese economic dominance. China is pushing for greater use of the yuan in international trade, especially with Russia and other BRICS nations.

- Within BRICS, China's dominant economy could lead to disproportionate influence, potentially overshadowing the interests of other members like India, Brazil, and South Africa, who seek a multipolar financial system.

- Implementation Challenges: The adoption of a BRICS currency or local currencies faces challenges, as seen in India-Russia trade, where banking concerns over US sanctions hinder large-scale implementation.

- Many of the BRICS currencies are not widely used internationally, limiting the effectiveness of trading with local currencies.

- Countries that primarily export more than they import face the challenge of accumulating foreign currencies for trade, making the use of local currencies difficult.

- Liquidity Issues: The US dollar is highly liquid and widely accepted. Alternatives may not offer the same level of liquidity, complicating international transactions.

- Volatility and Exchange Rate Risks: During the transition away from the dollar, countries may experience increased exchange rate volatility.

- This is especially true for nations with less established financial markets. Such volatility can disrupt commerce, investment, and capital movements, creating further economic uncertainty.

What are the Potential Impacts of a 100% US Tariff on BRICS Imports?

- Impact on Global Trade: Such tariffs could force BRICS countries to deepen intra-bloc trade, accelerating de-dollarization.

- Import diversification to non-US markets could reduce US influence over global trade systems.

- This can lead to a rise in non-traditional reserve currencies like the Australian dollar, Chinese renminbi, and others reflecting a gradual move towards a multipolar global financial system.

- This transition reduces US financial leverage but increases competition among emerging currencies.

- Impact on US: A blanket 100% tariff on imports from BRICS countries would likely hurt the US economy by driving up the cost of imports.

- The US may see shifts in trade routes, with imports potentially moving to third-party countries. This could lead to higher costs for American consumers without significantly boosting domestic manufacturing.

- BRICS countries might retaliate with their own tariffs on US goods, further escalating trade tensions and impacting global trade dynamics.

- US economic dominance stems from the dollar's central role in trade. Growing adoption of alternatives could dilute its financial influence, pushing the US to adapt to a diversified global system.

What are India's Initiatives to Improve Trade in Local Currencies?

- Internationalizing the Rupee: In 2022, the Reserve Bank of India (RBI) allowed invoicing and payments for international trade in Indian rupees, especially with countries like Russia.

- This move was in response to US sanctions and aimed at reducing the dependence on the dollar.

- Initiatives like digital payment systems like UPI aim to internationalize the rupee.

- Bilateral Trade Agreements: India has been actively negotiating bilateral trade agreements that include provisions for using local currencies, such as with the India-UAE Local Currency Settlement System.

- This strategic move is part of broader efforts to enhance economic autonomy and reduce dependence on the US dollar.

- Foreign Exchange Reserves: The RBI has been diversifying its foreign exchange reserves by including other major currencies like the euro and yen, reducing the proportion held in US dollars.

Way Forward

- India’s Balanced Diplomacy: India has decided not to weaken the US dollar. However, at the same time, India should continue promoting initiatives like the adoption of Central Bank Digital Currency (CBDC) and the internationalization of the Unified Payments Interface (UPI).

- Additionally, India should collaborate with BRICS nations to ensure that financial reforms align with its long-term economic interests and work towards addressing trade imbalances by encouraging Indian exports to BRICS countries.

- Digital Payment Solutions: A reliable, digital payment system is essential to efficiently balance currency demand, reduce costs, and ensure the success of local currency trade.

- Incremental Progress: Given the complexities, a gradual approach seems most feasible. Countries should start by conducting some trade in local currencies, gradually building the infrastructure and confidence needed to expand the system.

|

Drishti Mains Question: Discuss the implications of de-dollarization, focusing on BRICS' role in reshaping global finance. Evaluate the challenges and opportunities for India. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Convertibility of rupee implies (2015)

(a) being able to convert rupee notes into gold

(b) allowing the value of rupee to be fixed by market forces

(c) freely permitting the conversion of rupee to other currencies and vice versa

(d) developing an international market for currencies in India

Ans: (c)

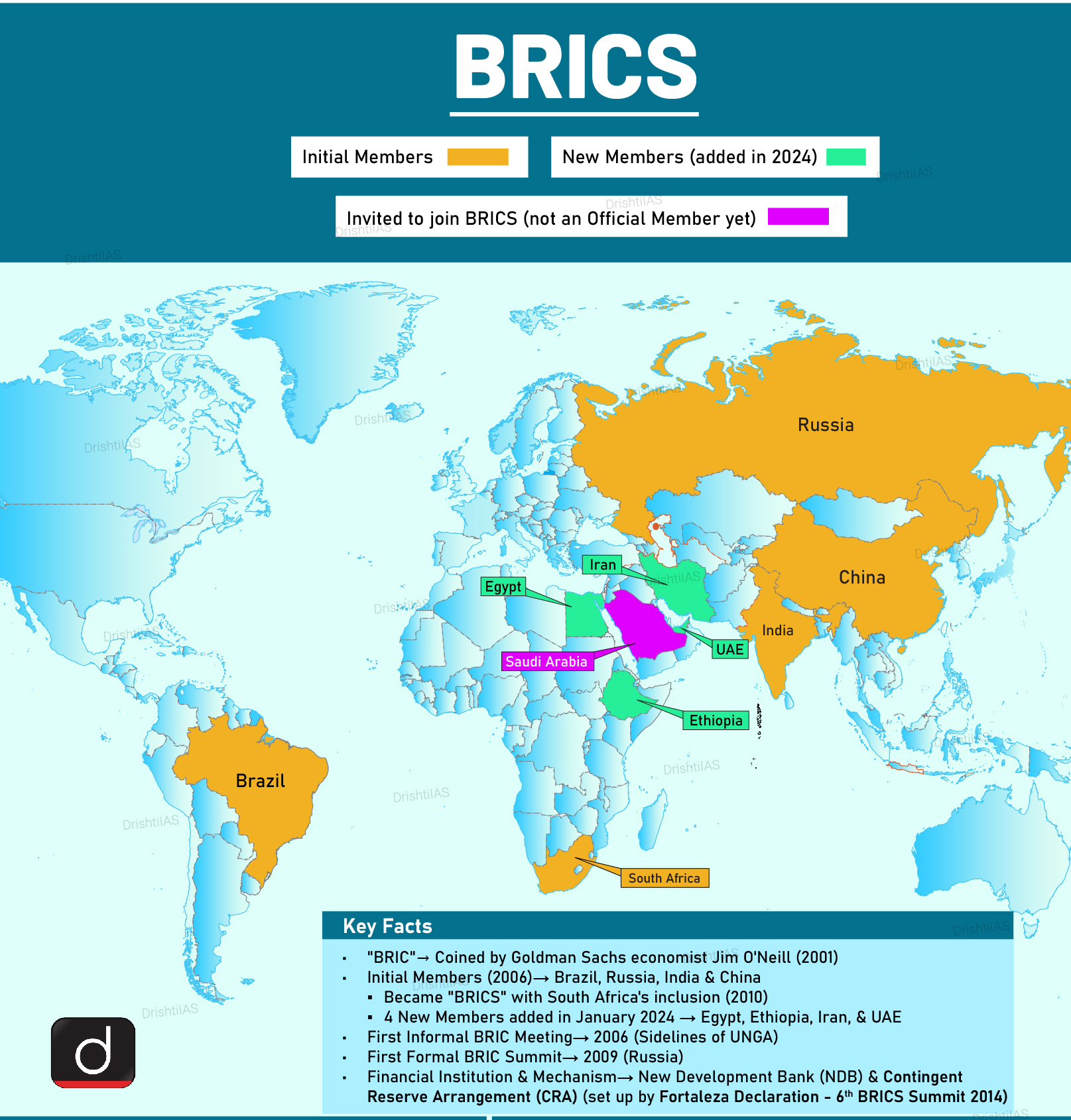

Q. With reference to a grouping of countries known as BRICS, consider the following statements: (2014)

- The First Summit of BRICS was held in Rio de Janeiro in 2009.

- South Africa was the last to join the BRICS grouping.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)