Bitcoins | 19 Dec 2020

Why in News

Recently, Bitcoin, the cryptocurrency, has crossed 20,000 US dollars in value.

- Bitcoin's price has always been volatile, and there is no clear explanation for its current rise.

- Cryptocurrency is a specific type of virtual currency, which is decentralised and protected by cryptographic encryption techniques.

- Bitcoin, Ethereum, Ripple are a few notable examples of cryptocurrencies.

Key Points

- Introduction:

- Bitcoin is a type of digital currency that enables instant payments to anyone. Bitcoin was introduced in 2009. Bitcoin is based on an open-source protocol and is not issued by any central authority.

- History:

- The origin of Bitcoin is unclear, as is who founded it. A person, or a group of people, who went by the identity of Satoshi Nakamoto are said to have conceptualised an accounting system in the aftermath of the 2008 financial crisis.

- Use:

- Originally, Bitcoin was intended to provide an alternative to fiat money and become a universally accepted medium of exchange directly between two involved parties.

- Fiat money is a government-issued currency that is not backed by a commodity such as gold.

- It gives central banks greater control over the economy because they can control how much money is printed.

- Most modern paper currencies, such as the US dollar and Indian Rupee are fiat currencies.

- Fiat money is a government-issued currency that is not backed by a commodity such as gold.

- Originally, Bitcoin was intended to provide an alternative to fiat money and become a universally accepted medium of exchange directly between two involved parties.

- Record of Bitcoins (Blockchain):

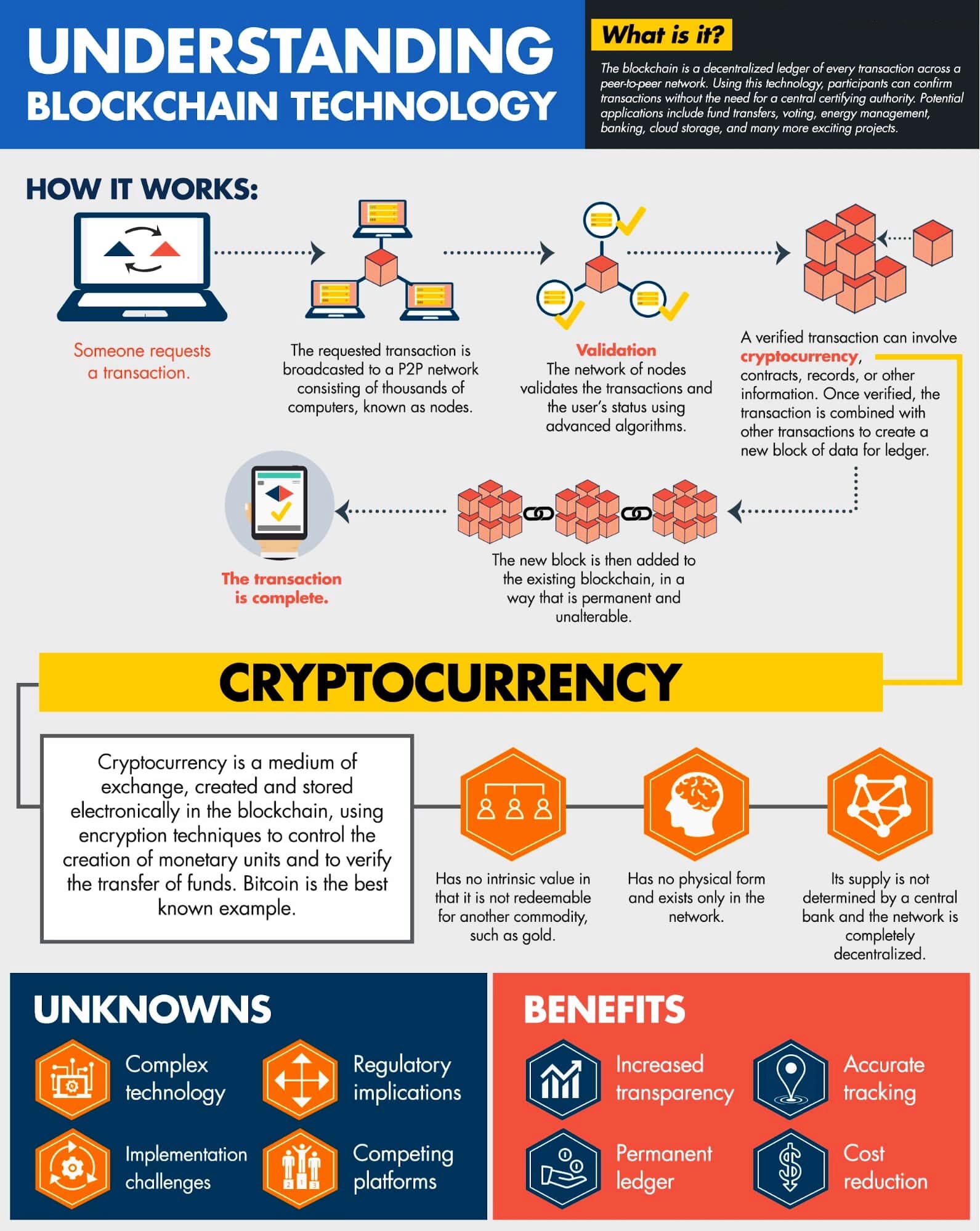

- All the transactions ever made are contained in a publicly available, open ledger, although in an anonymous and an encrypted form called a blockchain.

- Transactions can be denominated in sub-units of a Bitcoin.

- Satoshi is the smallest fraction of a Bitcoin.

- Transactions can be denominated in sub-units of a Bitcoin.

- Blockchain is a shared, immutable ledger that facilitates the process of recording transactions and tracking assets in a business network.

- An asset can be tangible (a house, car, cash, land) or intangible (intellectual property, patents, copyrights, branding).

- Virtually anything of value can be tracked and traded on a blockchain network, reducing risk and cutting costs for all involved.

- A simple analogy for understanding blockchain technology is a Google Doc.

- When one creates a document and shares it with a group of people, the document is distributed instead of copied or transferred.

- This creates a decentralized distribution chain that gives everyone access to the document at the same time.

- It needs to be noted that other usage and applications of Blockchain technology have emerged in the last few years.

- The government of Andhra Pradesh and Telangana have put the land records on the blockchain technology owing to its easy traceability feature.

- Election Commission (EC) officials are exploring the potential of using blockchain technology to enable remote voting.

- All the transactions ever made are contained in a publicly available, open ledger, although in an anonymous and an encrypted form called a blockchain.

- Acquiring Bitcoins:

- One can either mine a new Bitcoin if they have the computing capacity, purchase them via exchanges, or acquire them in over-the-counter, person-to-person transactions.

- Miners are the people who validate a Bitcoin transaction and secure the network with their hardware.

- The Bitcoin protocol is designed in such a way that new Bitcoins are created at a fixed rate.

- No developer has the power to manipulate the system to increase their profits.

- One unique aspect of Bitcoin is that only 21 million units will ever be created.

- A Bitcoin exchange functions like a bank where a person buys and sells Bitcoins with traditional currency. Depending on the demand and supply, the price of a Bitcoin keeps fluctuating.

- Bitcoin Regulation:

- The supply of bitcoins is regulated by software and the agreement of users of the system and cannot be manipulated by any government, bank, organisation or individual.

- Bitcoin was intended to come across as a global decentralised currency, any central authority regulating it would effectively defeat that purpose.

- It needs to be noted that multiple governments across the world are investing in developing Central Bank Digital Currencies (CBDCs), which are digital versions of national currencies.

- Legitimacy of Bitcoins (or cryptocurrencies) in India:

- In the 2018-19 budget speech, the Finance Minister announced that the government does not consider cryptocurrencies as legal tender and will take all measures to eliminate their use in financing illegitimate activities or as a part of the payment system.

- In April 2018, Reserve Bank of India (RBI) notified that entities regulated by it should not deal in virtual currencies or provide services for facilitating any person or entity in dealing with or settling virtual currencies.

- However, the Supreme Court struck down the ban on trading of virtual currencies (VC) in India, which was imposed by the RBI.

- The Supreme Court has held that cryptocurrencies are in the nature of commodities and hence they can not be banned.

- Possible Reasons for the Rise in the Value of the Bitcoin:

- Increased acceptance during the pandemic.

- Global legitimacy from large players like payments firm PayPal, and Indian lenders like State Bank of India, ICICI Bank, HDFC Bank and Yes Bank.

- Some pension funds and insurance funds are investing in Bitcoins.