Governance

Ban on Cryptocurrency Trading Removed

- 05 Mar 2020

- 6 min read

Why in News

The Supreme Court has struck down a ban on trading of Virtual Currencies (VC) in India, which was imposed by the Reserve Bank of India (RBI) in April 2018.

- The RBI order prohibited banks and entities regulated by it from dealing in VCs or providing services for facilitating any person or entity in dealing with or settling VCs.

- Such services include maintaining accounts, registering, trading, settling, clearing, giving loans against virtual tokens, accepting them as collateral, opening accounts of exchanges dealing with them and transfer/receipt of money in accounts relating to purchase/ sale of VCs.

- There is no globally accepted definition of what exactly is virtual currency. Basically, virtual currency is the larger umbrella term for all forms of non-fiat currency being traded online.

- Fiat Money is a kind of currency, issued by the government and regulated by a central authority such as a central bank. Such currencies act like legal tender and are not necessarily backed by a physical commodity.

- Virtual currencies are mostly created, distributed and accepted in local virtual networks. Virtual Currencies also includes cryptocurrencies.

- Cryptocurrencies have an extra layer of security, in the form of encryption algorithms.

- Most cryptocurrencies now operate on the blockchain or distributed ledger technology, which allows everyone on the network to keep track of the transactions occurring globally.

- Popular forms of cryptocurrencies include Bitcoin, Ethereum, etc.

- Satoshi Nakamoto, widely regarded as the founder of the modern virtual currency bitcoin and the underlying technology called blockchain, defines bitcoins as “a new electronic cash system that’s fully peer-to-peer, with no trusted third party (central regulator)”.

Reasons Behind Banning Virtual Currencies

- Lack of any underlying fiat, episodes of excessive volatility in their value, and their anonymous nature which goes against global money-laundering rules.

- Risks and concerns about data security and consumer protection.

- Potential impact on the effectiveness of monetary policy.

Arguments in Support of Use of Virtual Currencies in India

- Digital/virtual currencies (both private or government backed) are integral part of digital economy and digital countries.

- 5 million Indians are engaged in virtual currency activities.

- India is the second largest user of Pundi X’s blockchain wallet.

- India is at the forefront of all things digital and an inspiration to the world. Its balanced approach between risk and innovation can become a role model for the world.

Highlights of the Judgement

- Test of Proportionality

- The ban did not pass the “proportionality” test. The test of proportionality of any action by the government must pass the test of Article 19(1)(g) of the Constitution, which states that all citizens of the country will have the right to practise any profession, or carry on any occupation or trade and business.

- Till date, the RBI has not come out with a stand that any of the entities regulated by it have suffered any loss or adverse effect directly or indirectly, on account of VC exchanges.

- Besides, the court found that the RBI did not consider the availability of alternatives before issuing the order i.e. achieving the same objective by imposing a less drastic restraint.

- Inconsistent with the RBI’s Stand: The RBI’s order was disproportionate” with an otherwise consistent stand taken by the central bank that VCs are not prohibited in the country.

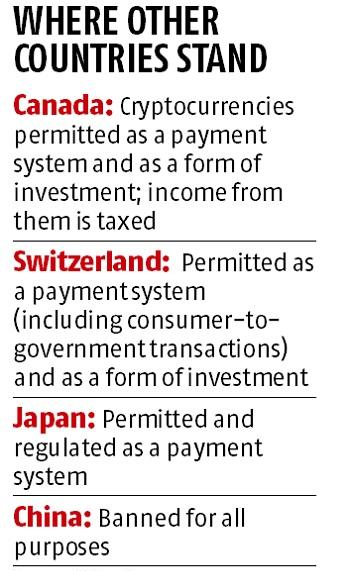

- Referred to the Global Approach: Organisations across the globe have called for caution while dealing with virtual currencies, while also warning that a blanket ban of any sort could push the entire system underground, which in turn would mean no regulation.

- On RBI’s Power: The Court held that the RBI has powers to regulate any currencies in the system.

Possible Impact of the Judgement

- With the order, resumption of operations at cryptocurrency exchanges and backward linkages with the banking sector are expected.

- Even as virtual currency investors and businesses will welcome the Supreme Court’s order on cryptocurrency, the relief for such players may be only temporary given that the Centre, in a draft law, has proposed to ban all private cryptocurrencies.

- The Supreme Court’s judgment could lead to the RBI rethinking its policies surrounding virtual currencies.