Science & Technology

Crypto-Currency Exchange

- 03 Jun 2020

- 6 min read

This article is based on “Regulating cryptocurrency exchanges” which was published in The Indian Express on 01/06/2020. It talks about the need for a legal and regulatory framework for establishing crypto-currency exchanges.

Recently, the Supreme court struck down the “April 6, 2018 circular” of the Reserve Bank of India. The circular has stopped crypto-currency traders and exchanges from accessing the banking system. The Supreme Court held that an outright ban on cryptocurrencies would be a disproportionate measure by the government.

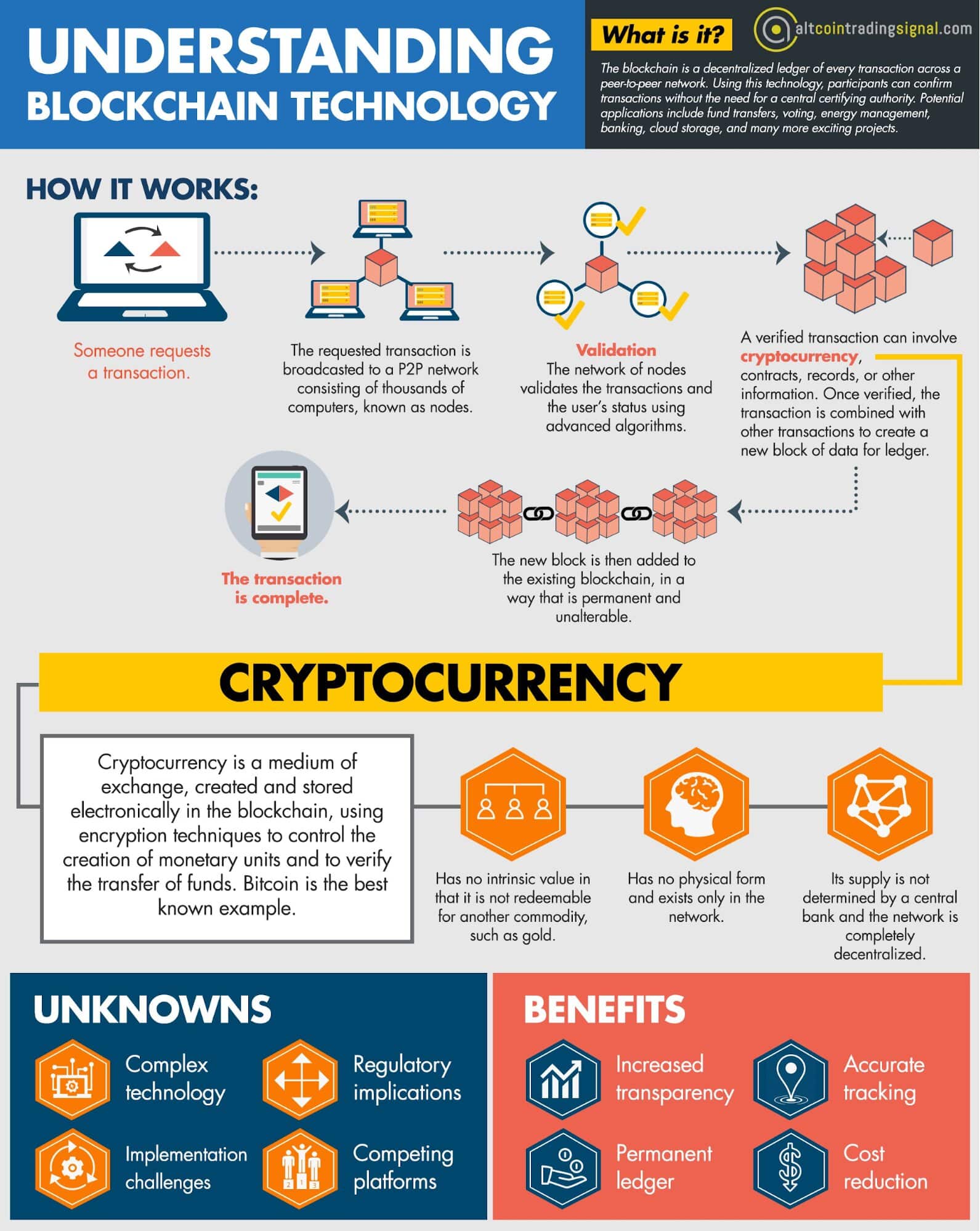

Thus, the judgement has certainly given a fillip to crypto-currency. The decentralised nature and lack of regulation make the management of cryptocurrencies challenging, owing to the anonymity of users and lack of central authority.

This issue can be resolved by setting up regulated crypto-currency exchanges. However, without a clear legal and regulatory framework governing these exchanges, the whole economic system may become vulnerable to the shortcomings of cryptocurrency.

In this context, there is a need for regulating crypto-currency exchanges, which will provide robust information sharing and coordination mechanisms between regulators and enforcement agencies within and outside the country.

Importance of Crypto-Currency Exchanges

- Similar to stock exchanges, crypto-currency exchanges provide an online platform or marketplace for the trade of crypto-currencies.

- They also enable trade or exchange of cryptocurrencies for fiat money, they connect the crypto and traditional financial systems.

- Further, crypto-currency exchanges are responsible for assessing the project’s credibility, intermediaries and also conducts KYC scrutiny of issuers.

- Moreover, unlike traditional securities markets, crypto exchanges perform additional functions like custody of assets or funds, clearing and settlement.

- Licensed crypto-currency exchanges can also help in the implementation of anti-money laundering (AML) and terrorism financing (CFT) laws.

- Crypto-currency exchanges have therefore emerged as a key market infrastructure within the crypto-ecosystem.

Associated Challenges

- Security Issue: Instances like Mt Gox bankruptcy highlight some of the key risks associated with crypto exchanges pertaining to the safety and security of cryptocurrencies.

- Crypto-currencies are prone to cyber frauds, hacking and other network-related issues.

Mt. Gox Bankruptcy Case Study

- Mt. Gox was a Tokyo-based cryptocurrency exchange that operated between 2010 and 2014. It was responsible for more than 70% of bitcoin transactions at its peak.

- However, its prominence made it a target for hackers, and Mt. Gox experienced security problems several times during its years of operation.

- In 2011, hackers used stolen credentials to transfer bitcoins. That same year, deficiencies in network protocols resulted in several thousand bitcoins being lost and investors’ claims are yet to be settled.

- Lack of Investor Protection: Due to the anonymous nature of crypto-currency transactions, there is a lack of investor/consumer protection in the form of recourse and quick and orderly access to their own funds/assets.

- Regulatory Mismanagement: On the contrary of the perceived role, sometimes crypto-currency exchanges are also known to enable circumvention of capital controls and commission of financial crime including money laundering and terrorism financing.

- Conflict of Interest: As the crypto-currency exchanges act as custodian as well as a regulator of crypto-currencies, this may lead to conflicts of interest, micro-prudential and consumer protection risks.

Way Forward

- Clarity on Crypto-currency definition: A legal and regulatory framework must first define crypto-currencies as securities or other financial instruments under the relevant national laws and identify the regulatory authority in charge.

- Ensuring Compliance: Licenses may be issued based on compliance with eligibility requirements and detailed scrutiny of operational policies and procedures on internal governance, risk management and financial resources.

- Need for Strong KYC: Regulations can also require the performance of stringent KYC checks and independent verification by exchanges before onboarding investors.

- Ensuring Transparency: Record keeping, inspections, independent audits, investor grievance redressal and dispute resolution may also be considered to address concerns around transparency, information availability and consumer protection.

Promoting crypto-currency and subsequent strengthening of crypto-currency exchanges is in synergy with the idea of a less-cash economy. In this context, India could emulate China's Digital Currency Electronic Payment (DCEP) system.

|

Drishti Mains Question Examine the significance of crypto-currency exchanges as they perform important functions but also carry significant risks. |

This editorial is based on “Far Out” which was published in The Indian Express on June 2nd, 2020. Now watch this on our Youtube channel.